41d07a07794faf8104525499efd27be2.ppt

- Количество слайдов: 76

Chapter 10 An Overview of Stabilization Programs © Pierre-Richard Agénor and Peter J. Montiel 1

High inflation is more common among developing countries than in the industrial world. Table 10. 1: l Summarizes major inflation episodes in developing countries during the period 1980 -1996. l Instances of high inflation are found in Africa, Asia, and the Middle East, and in the Western Hemisphere. l Small group of countries appear to have suffered from “chronic” high inflation. l This group includes Argentina, Bolivia, Brazil, Chile, Ecuador, Ghana, Guyana, Israel, Mexico, Paraguay, Peru, Turkey, Uruguay, and Zaire. l 2

Variety of approaches have been used to stabilize high inflation: è populist; è orthodox (money-based and exchange-rate-based); è heterodox. l Populist programs focuses on direct intervention in the wage-price process through wage and price controls. Orthodox programs: l They feature an intended fiscal adjustment. Two varieties: l Money-based programs rely on restrictions on the rate of monetary expansion to provide a nominal anchor. l Exchange-rate-based programs rely on exchange-rate pegging to provide the nominal anchor. 3 l

Speed of implementation: l “Cold turkey” or “shock therapy”: desired fiscal adjustment is implemented in one-step fashion. l “Gradualist”: place the fiscal deficit on a declining path. Heterodox program: l Fiscal correction, an exchange-rate freeze or a preannounced exchange-rate path. l Incomes policies in the form of either explicit wage-price controls or a “social contract. ” 4

l l l l Populism. Orthodox Money-Based Stabilization. Exchange-Rate-Based (Southern Cone). Heterodox Programs. Argentina’s Convertibility Plan (1991 -1997). Brazil’s Real Plan (1994 -1997). Lessons of Stabilization. 5

Populism

l l Best-known instances of populism have been in Latin America. Populism did not evolve as an approach to the stabilization of high inflation. They were aimed at a broader range of macroeconomic problems, including è stagnant production, è unequal income distribution, è external crises, è high inflation. Populist programs to be discussed have attempted to è combine rapid growth with low inflation; è pursue stimulative aggregate demand policies; 7

restrain wage and price increases through administrative controls. Populist diagnosis is based on the view that the economy possesses unutilized productive capacity, due both è to deficient aggregate demand è to monopoly power in the manufacturing sector. Reasons for deficient demand: è restrictive aggregate demand policies; è unequal distribution of income. Remedy: expansionary fiscal policies and rising wages. Although profits may be depressed by the increase in labor costs, price increases are not necessary. è l l 8

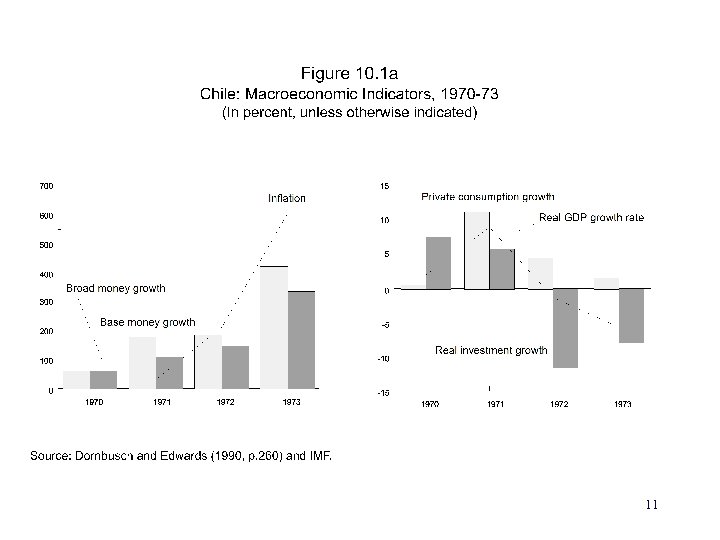

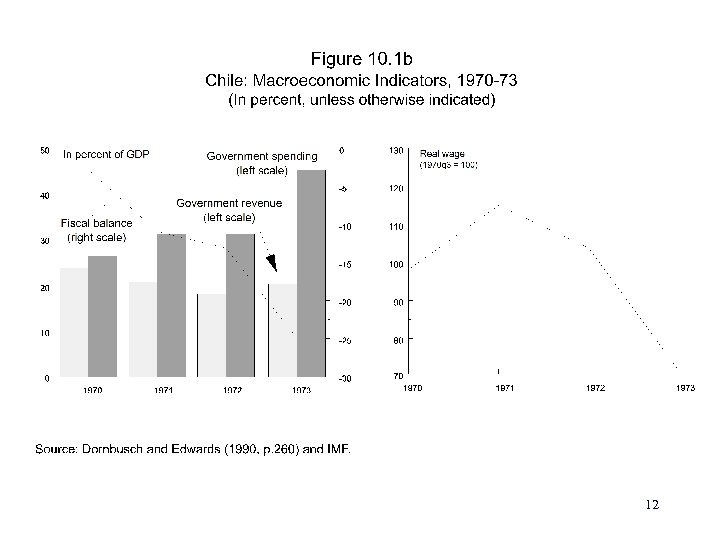

Reason: total profits would be increased by the expansion in output. l To ensure that prices do not rise, administrative controls are the favored policy tool. Two examples: l Chile under Allende (1970 -1973). l Peru under García (1986 -1990). l 9

Chile under Allende (1970 -1973) l Figure 10. 1. 10

11

12

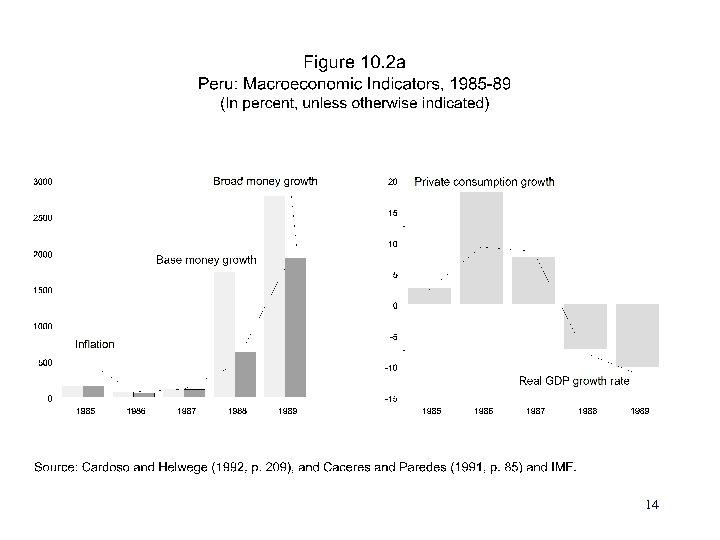

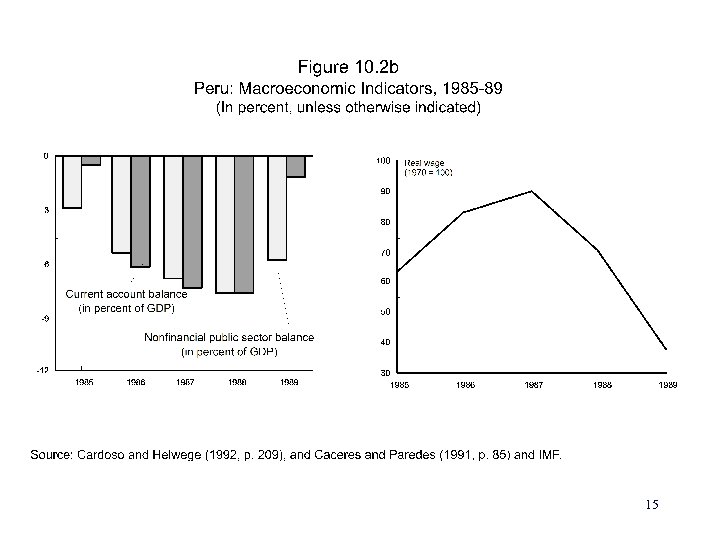

Peru under García (1986 -1990) l Figure 10. 2. 13

14

15

Orthodox Money-Based Stabilization

l l l This approach emphasize on demand management without using direct wage-price controls or guidelines. Sine qua non of orthodox stabilization is fiscal adjustment. Note that central bank credit to the public sector is the most important source of base money creation in developing countries. Balance of payments and credit extended to the private sector are alternative sources. Thus fiscal adjustment that limits the public sector's call on central bank resources does not necessarily imply that the money stock will stop growing. This means that fiscal adjustment does not, by itself, imply the use of money as a nominal anchor. 17

However, fiscal adjustment is necessary for the sustained achievement of money growth rates compatible with low inflation and public sector solvency. l Orthodox money-based programs rely on a money growth target as a nominal anchor feature fiscal adjustment. Two best-known applications: l Chile (September 1973). l Bolivia (August 29, 1985). l 18

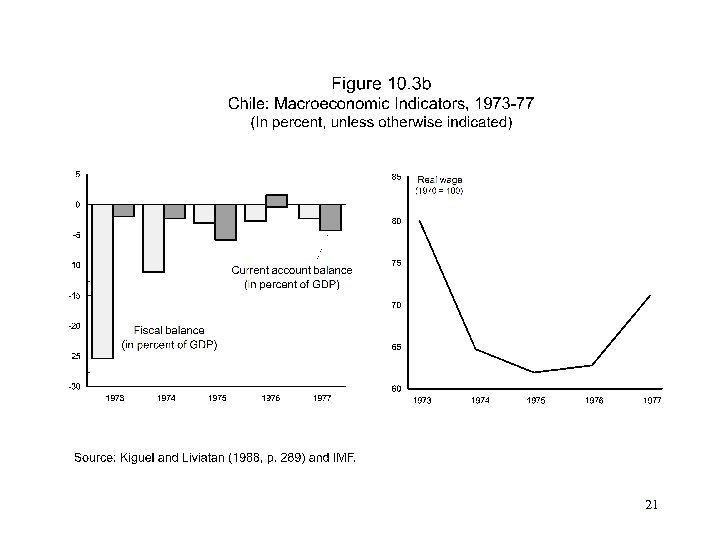

Chile (September 1973) l Figure 10. 3. 19

20

21

22

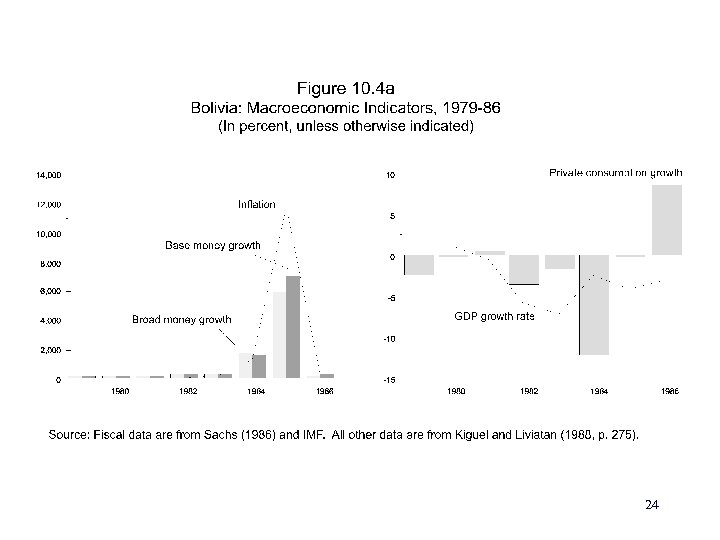

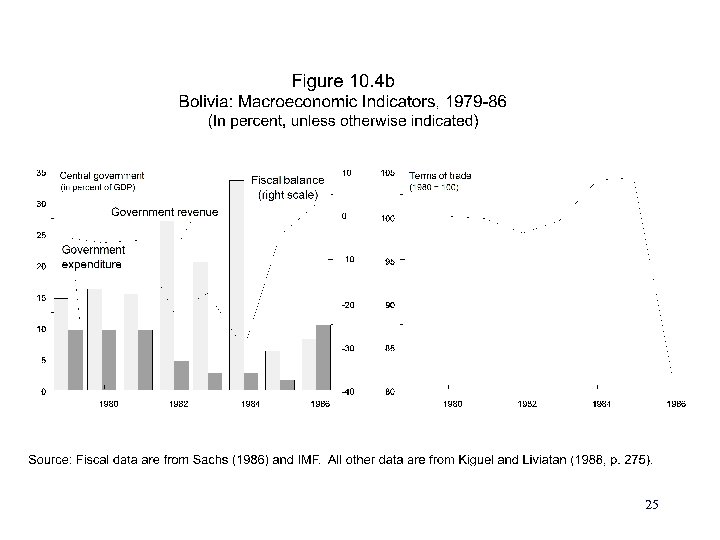

Bolivia (August 29, 1985) l Figure 10. 4. 23

24

25

Exchange-Rate-Based (Southern Cone) Stabilization Programs

l l l Failure of orthodox stabilization to reduce inflation in chronic high-inflation countries led to adoption of alternative approach in the Southern Cone countries during the late 1970 s. Intellectual foundation for this approach: monetary approach to the balance of payments (MABP). Important tenet of the monetary approach: belief that PPP held more or less continuously. Thus, domestic price level would be determined by the exchange rate. Thus, inflation stabilization required slowing the rate of depreciation of the exchange rate. Then external balance would be achieved by restrictive aggregate demand policy. 27

l l l Output growth was taken to depend on domestic supply conditions. It could therefore be promoted by undertaking marketoriented structural reforms. Complete package included è predetermined exchange-rate path; è fiscal and structural adjustment. Trade liberalization had an important role. Reason: adoption of low and uniform tariffs promotes economic growth, and supports the price stability objective through the influence of the law of one price. 28

Examples: l Chile (February 1978). l Uruguay (October 1978). l Argentina (December 1978). 29

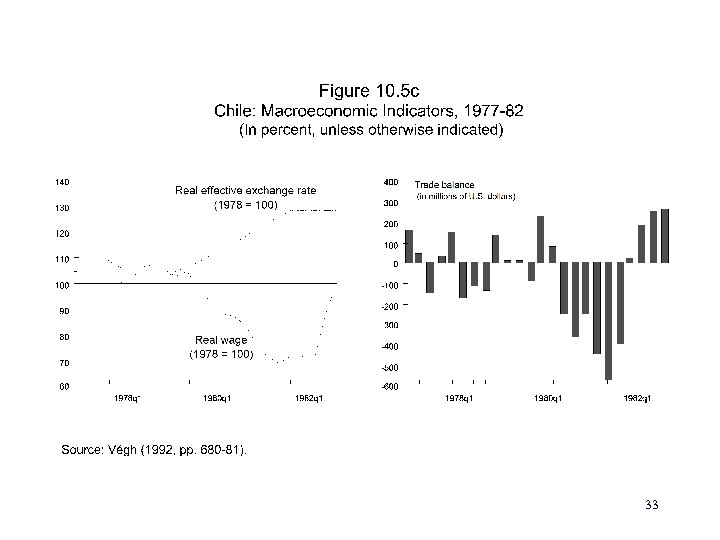

Chile (February 1978) l Figure 10. 5. 30

31

32

33

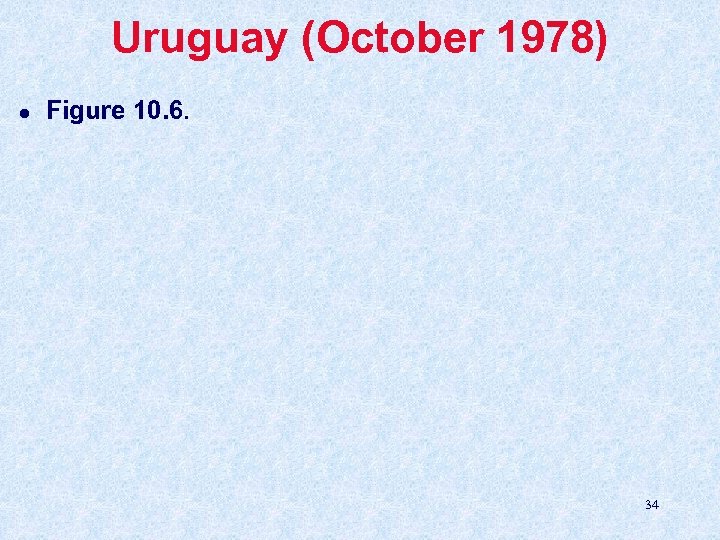

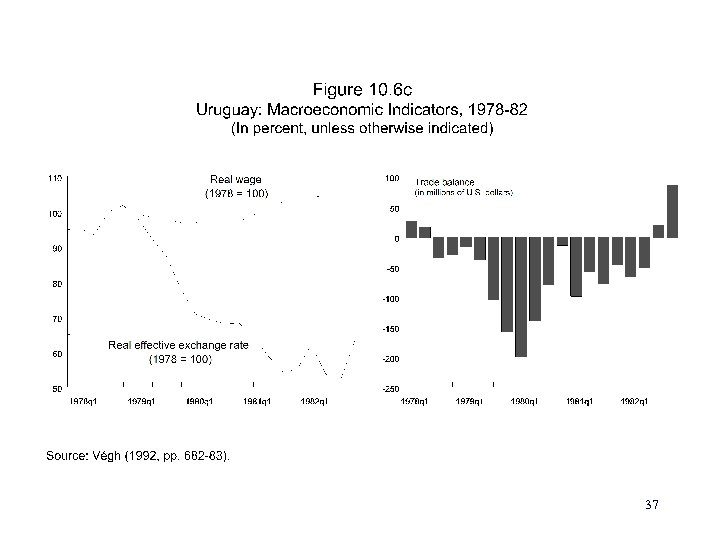

Uruguay (October 1978) l Figure 10. 6. 34

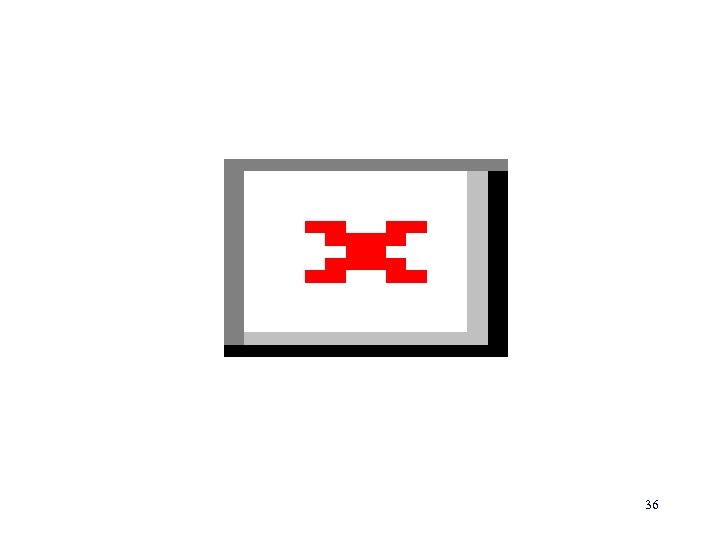

35

36

37

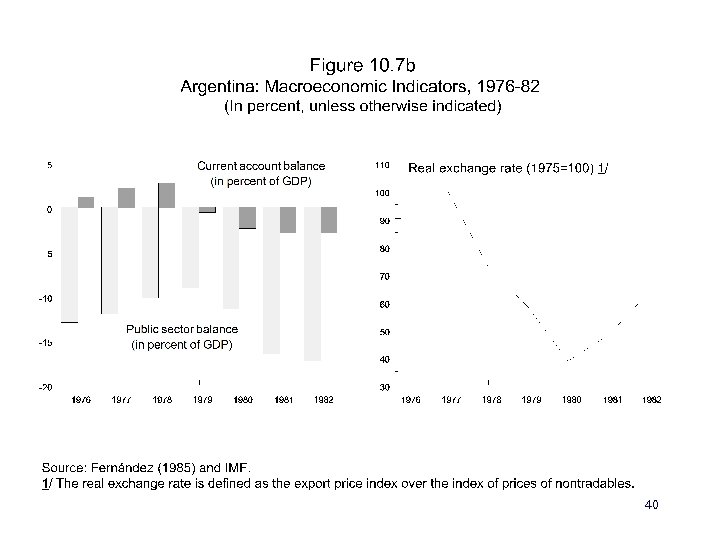

Argentina (December 1978) l Figure 10. 7. 38

39

40

Heterodox Programs

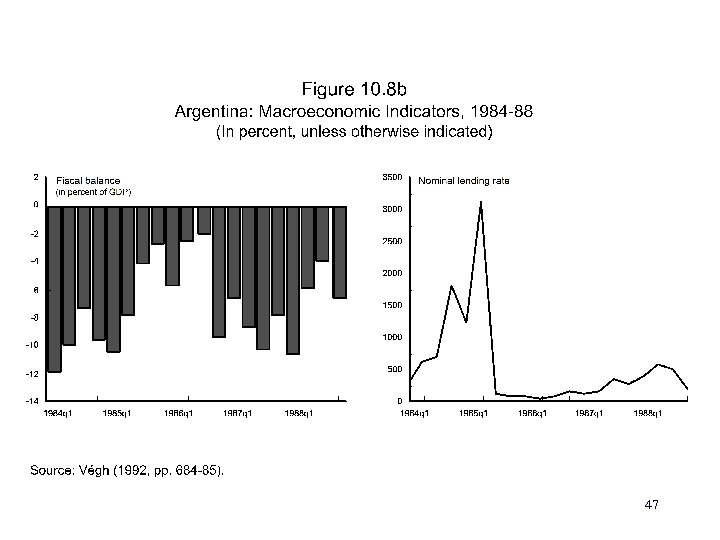

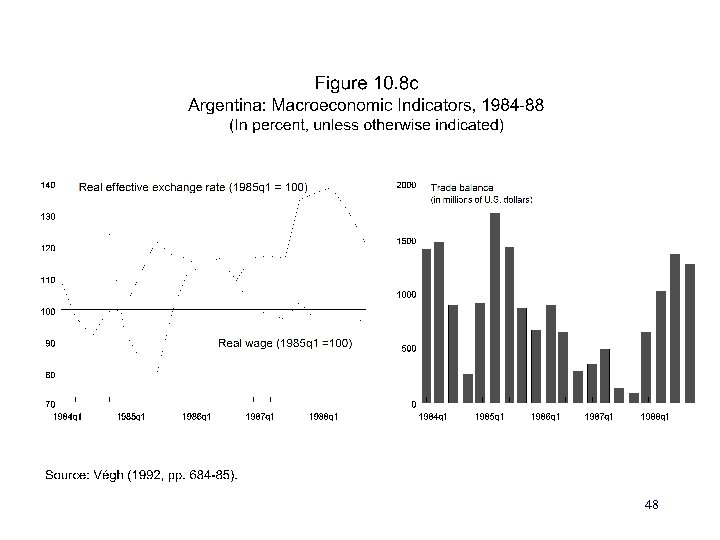

l l l Since inflation has a strong inertial component, even if “fundamentals” are corrected, inflation would continue at high rates. Thus, restrictive aggregate demand policies with correction of the fiscal and monetary fundamentals would result in a deep and prolonged recession. Such a recession would entail economic and political costs, and call into question the authorities' commitment to persevere in the anti-inflation effort. Inertia may arise from two sources: è existence of explicit or implicit backward-looking indexation in nominal variables; è initial lack of credibility. Heterodox programs were undertaken by several 42 developing nations in the mid- to late 1980 s.

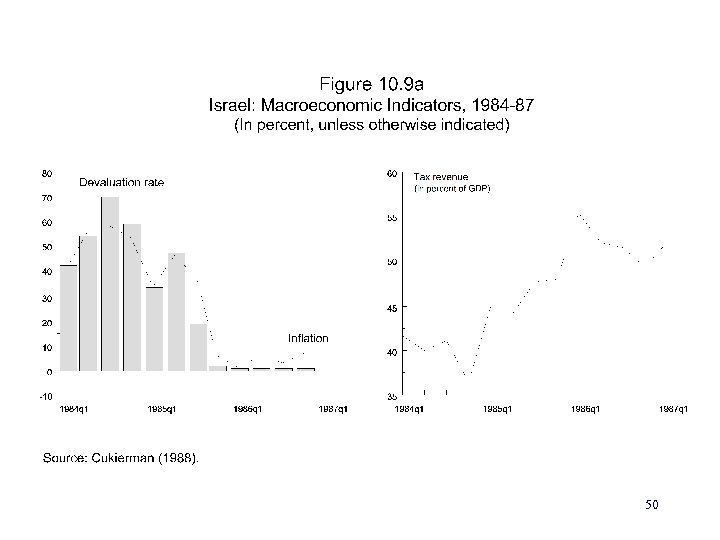

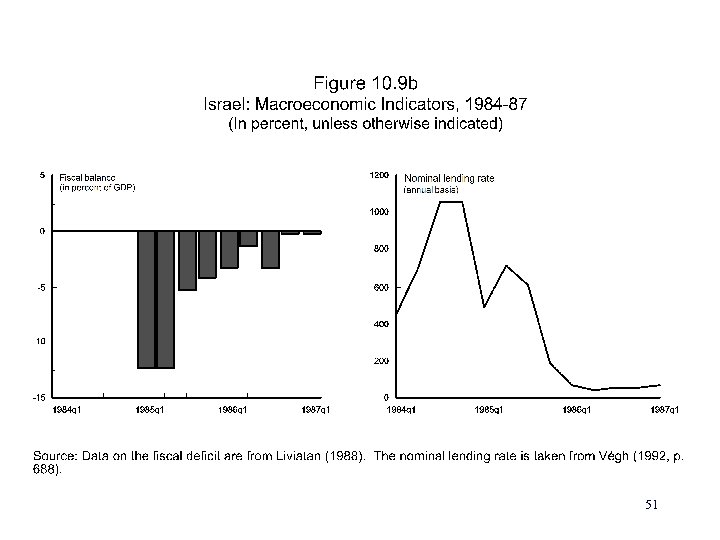

Examples: l Argentina (December 1978). l Israel (July 1, 1985). l Brazil (February 28, 1986). l Mexico (December 1987). Similarities: l These are all middle-income developing countries, except Argentina. l They had enjoyed considerable economic success during the 1960 s and 1970 s. l Stabilization effort was launched under what amounted to a new political regime that took power after a period of economic and political crisis. 43

l l l Inflation accelerated in the first half of the decade and had reached triple-digit levels by the time the attempted stabilization was undertaken. They had disappointing growth performance during the early 1980 s. They confronted severe external imbalances associated with the international debt crisis. They enjoyed initial success, in that they achieved a substantial reduction in inflation without severe costs in terms of reduced economic activity. Yet only the Israeli and Mexican programs are currently considered to have achieved enduring success. 44

Argentina (June 14, 1985) l Figure 10. 8. 45

46

47

48

Israel (July 1, 1985) l Figure 10. 9. 49

50

51

52

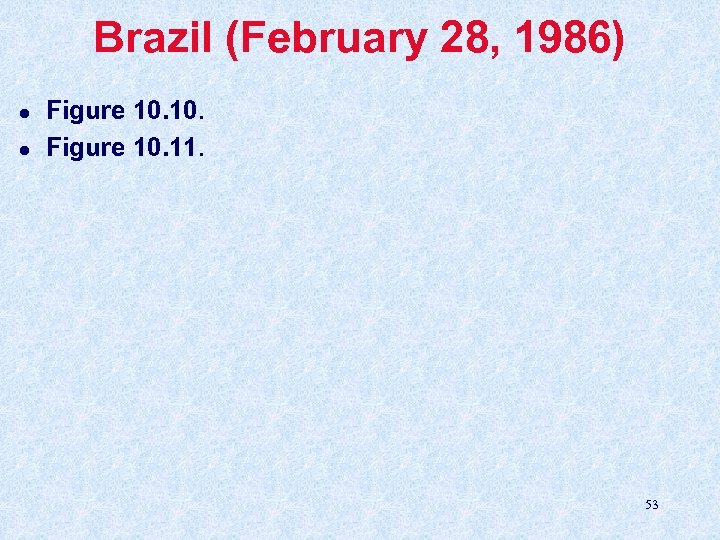

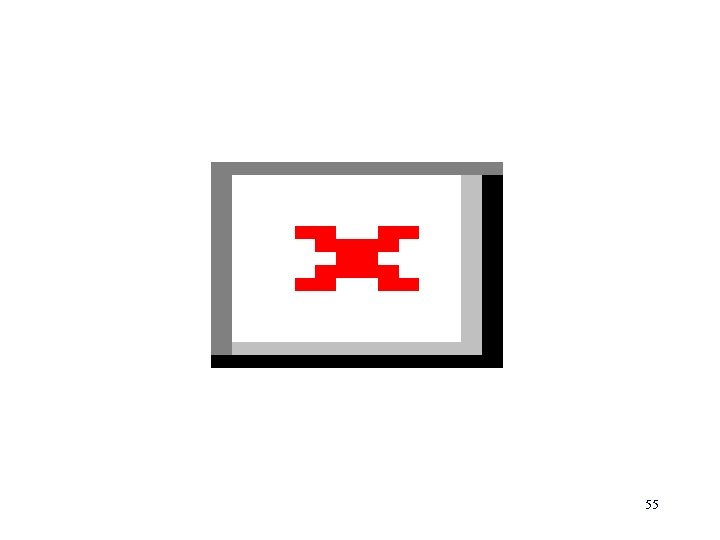

Brazil (February 28, 1986) l l Figure 10. 11. 53

54

55

56

57

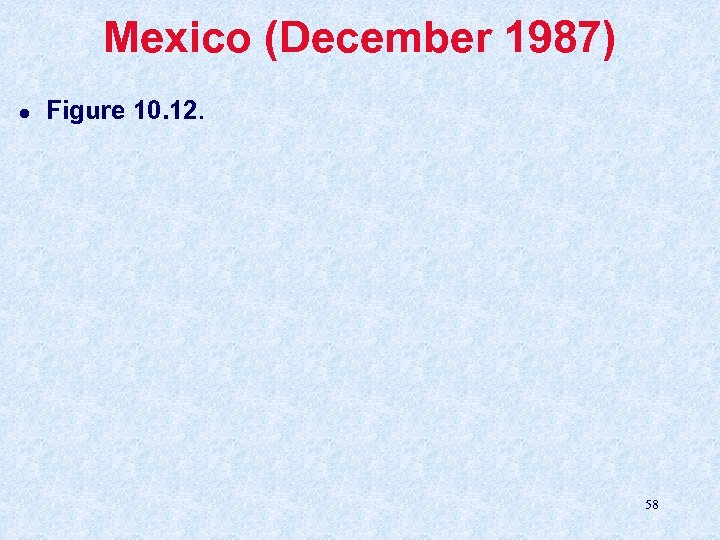

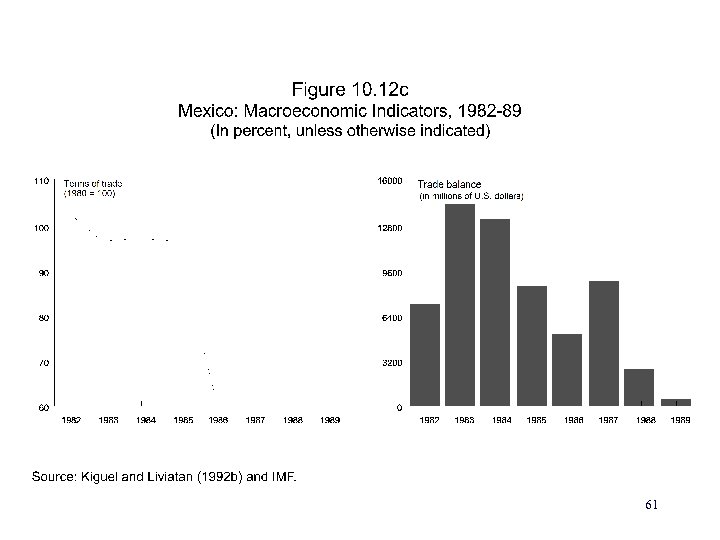

Mexico (December 1987) l Figure 10. 12. 58

59

60

61

Argentina’s Convertibility Plan (1991 -1997)

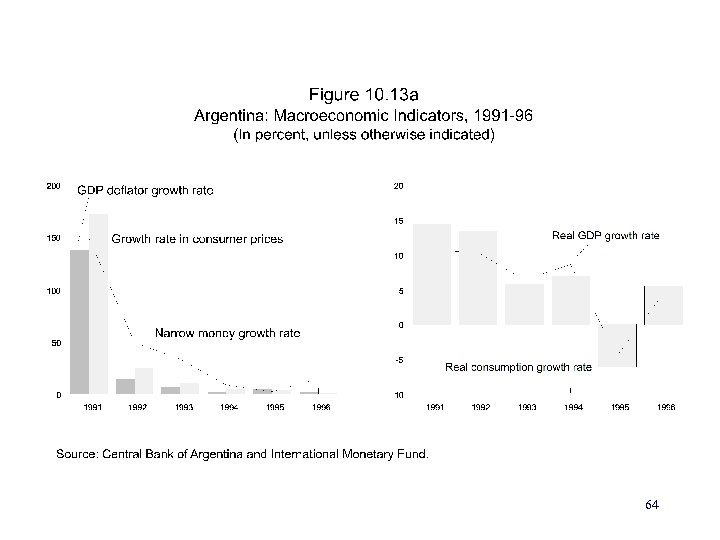

l Figure 10. 13. 63

64

65

66

Brazil’s Real Plan (1994 -1997)

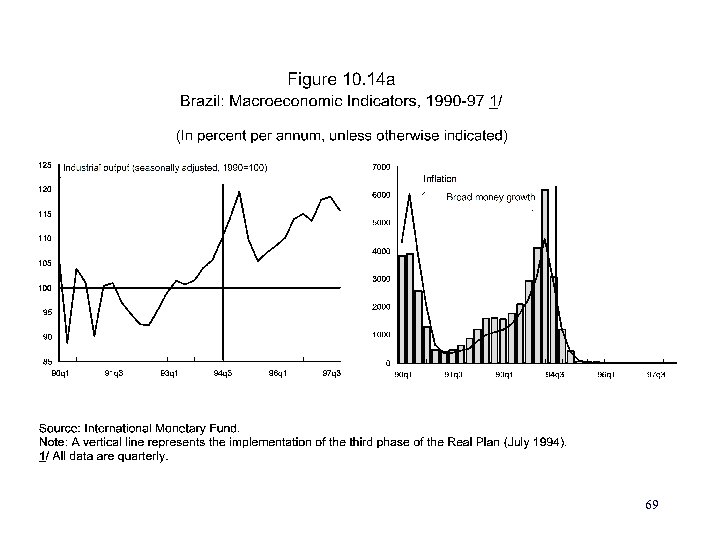

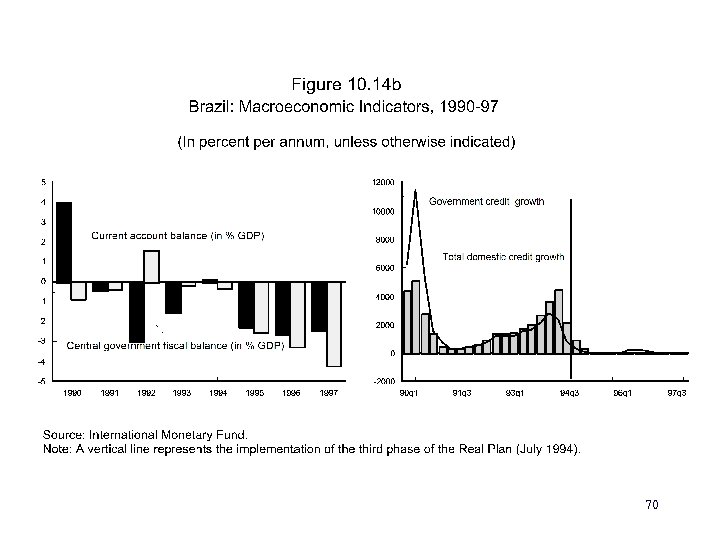

l Figure 10. 14. 68

69

70

71

Lessons of Stabilization

Fiscal adjustment is necessary. l In the absence of a permanent fiscal adjustment, inflation does not stay permanently low. l Setting price-based nominal anchors such as exchangerate freezes and wage and price controls is not sufficient for inflation stabilization. Costs of orthodox stabilization depend on the nature of ongoing inflation. Under chronic high inflation: l Nominal contracts continue to exist. l If such contracts possess a backward-looking element, or if the stabilization program lacks credibility, nominal contracts impart inertia to the wage-price process. 73

Under hyperinflation: l Such inertia will cease to exist, when domestic currency ceases to function as the unit of account and wages and prices are changed frequently due to freely determined exchange rate. In the presence of inertia: l Adherence to noninflationary fiscal targets under a money-based program generates è recession on impact; è improvement in the current account; è slow convergence of inflation to its targeted level. l Under an exchange-rate-based program: è real exchange rate appreciates; è current account may or may not improve; 74

inflation convergence continues to be slow. When inertia is absent (typical under hyperinflation): l Quick inflation convergence with minimal output costs may be possible with a credible fiscal program. Heterodox elements (exchange-rate freeze with income policies) can be useful for credible fiscal program in stabilizing chronic inflation, but they are dangerous to use. l With sufficient commitment to a permanent fiscal adjustment, a suspension of indexation and the adoption of incomes policies can help establish low inflation rapidly. l This may avoid short-run damage to economic activity associated with orthodox adjustment under these circumstances. 75 è

Danger: program's short-run success tempts policymakers to slide into populism by relaxing fiscal discipline while relying on wage and price controls for inflation abatement. l This path quickly runs into domestic capacity and foreign financing constraints, and is likely to leave the country in worse conditions than before. l Whether well-implemented heterodox adjustment can permanently avoid the output costs of stabilization is less obvious. Kiguel and Liviatan (1992 a) and Végh (1992): l Exchange-rate-based stabilization programs, whether orthodox or heterodox, tend to avoid real output costs on impact, only to undergo a recession later (“boomrecession” cycle). 76 l

41d07a07794faf8104525499efd27be2.ppt