119fdd66e8aad1c4fb1906974fdaf338.ppt

- Количество слайдов: 36

Chapter 1 The Billing/Accounts Receivable/Cash Receipts (B/AR/CR) Process

Learning Objectives • • • Understand relationship between B/AR/CR and its environment Understand relationship between B/AR/CR and management problem solving at various levels of the organization Become familiar with some of the technology used in implementing the B/AR/CR process Achieve a reasonable level of understanding of the logical & physical characteristics of the process Gain a foundation level of understanding as to how enterprise systems impact the processing of information in the B/AR/CR process Recognize some plans commonly used to control the B/AR/CR process B/AR/CR Process

B/AR/CR Spoke on AIS Wheel • In this chapter we spotlight one business process, (B/AR/CR) process. • We will describe the various users of the (B/AR/CR) process, each having their own view of the enterprise system and enterprise database. • In addition, we will analyze the process controls related to the (B/AR/CR) process. 3

Introduction • The billing/accounts receivable/cash receipts (B/AR/CR) process is an interacting structure of people, equipment, methods, and controls designed to create information flows and records that accomplish the following: 1. Support the repetitive work routines of the credit department, the cashier, and the accounts receivable department 2. Support the problem-solving processes of financial managers 3. Assist in the preparation of internal and external reports 4

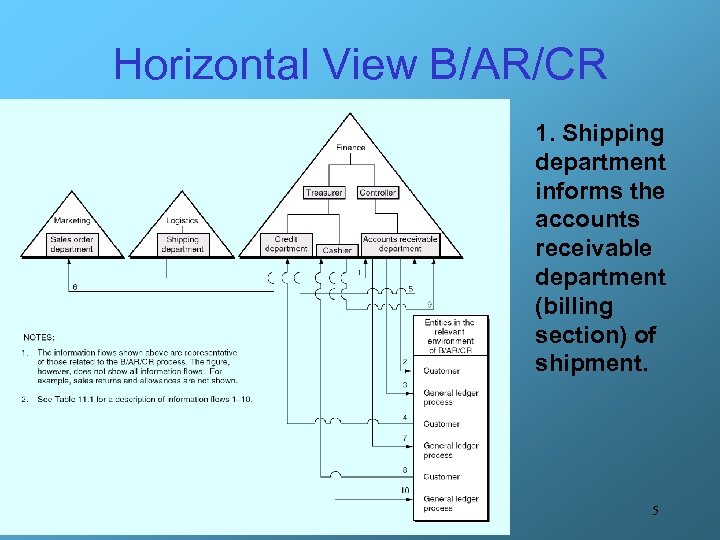

Horizontal View B/AR/CR 1. Shipping department informs the accounts receivable department (billing section) of shipment. 5

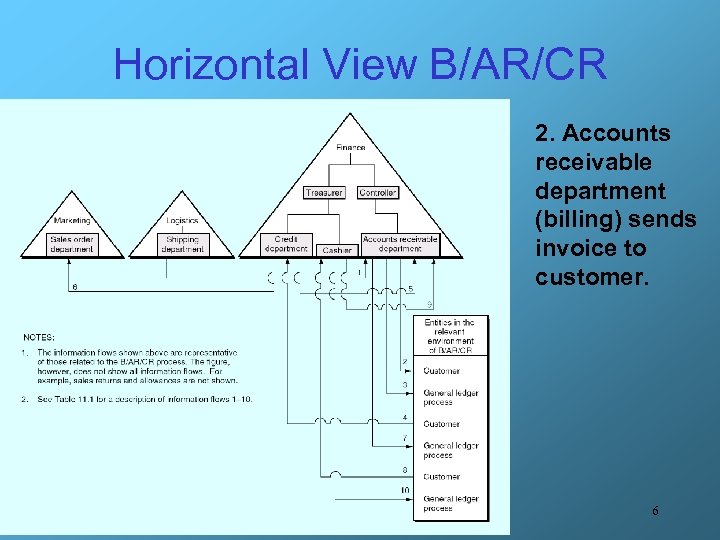

Horizontal View B/AR/CR 2. Accounts receivable department (billing) sends invoice to customer. 6

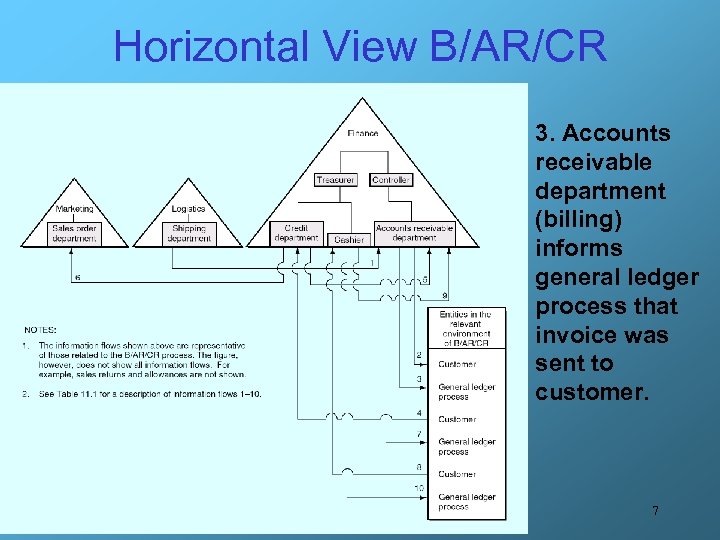

Horizontal View B/AR/CR 3. Accounts receivable department (billing) informs general ledger process that invoice was sent to customer. 7

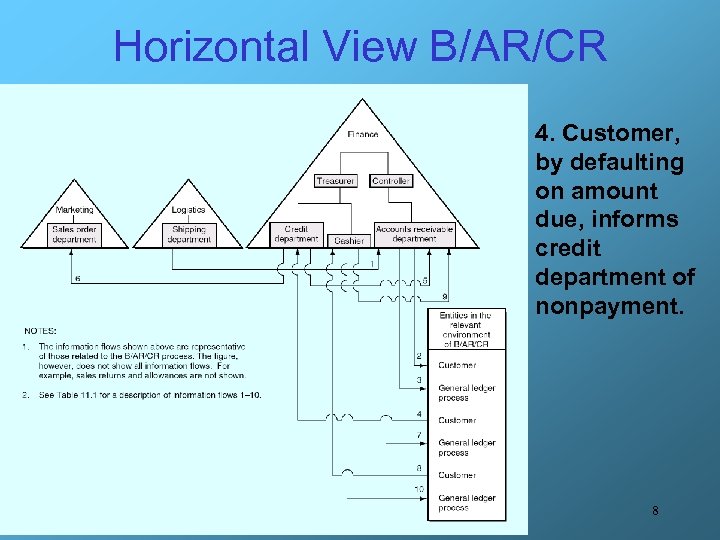

Horizontal View B/AR/CR 4. Customer, by defaulting on amount due, informs credit department of nonpayment. 8

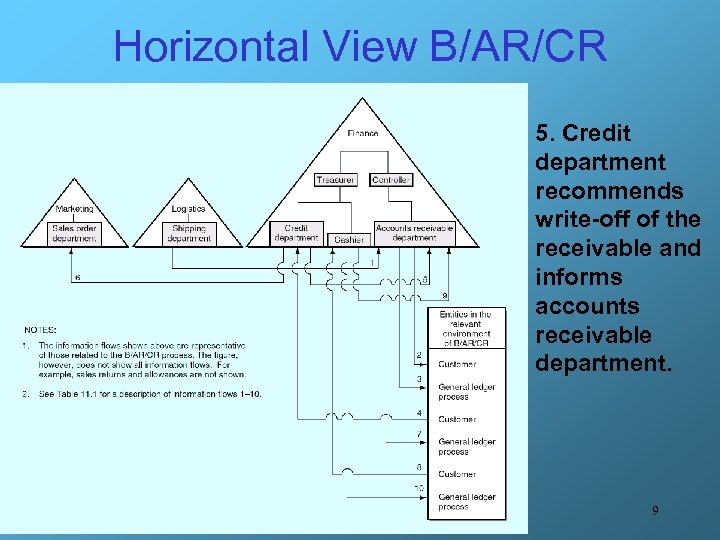

Horizontal View B/AR/CR 5. Credit department recommends write-off of the receivable and informs accounts receivable department. 9

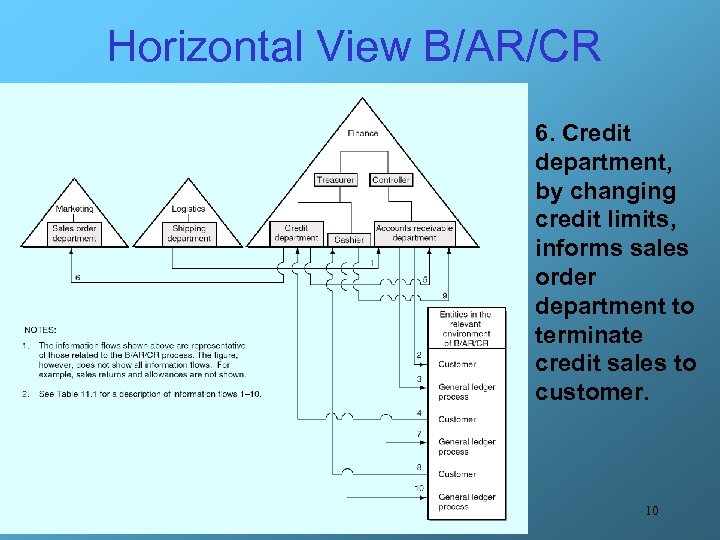

Horizontal View B/AR/CR 6. Credit department, by changing credit limits, informs sales order department to terminate credit sales to customer. 10

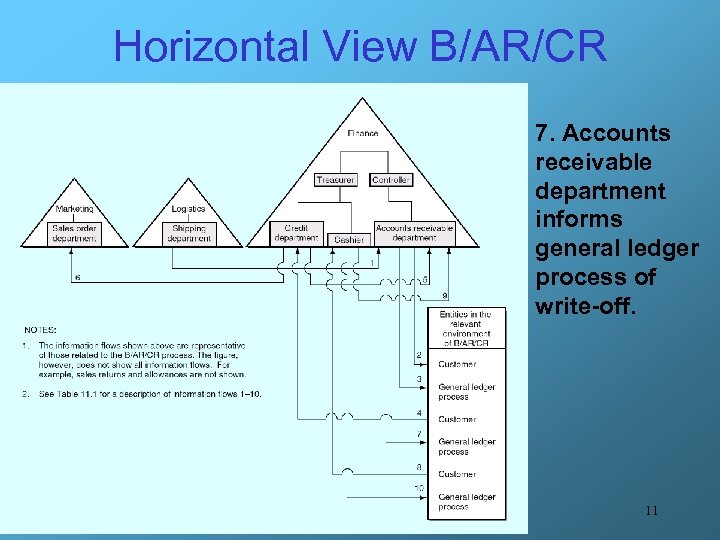

Horizontal View B/AR/CR 7. Accounts receivable department informs general ledger process of write-off. 11

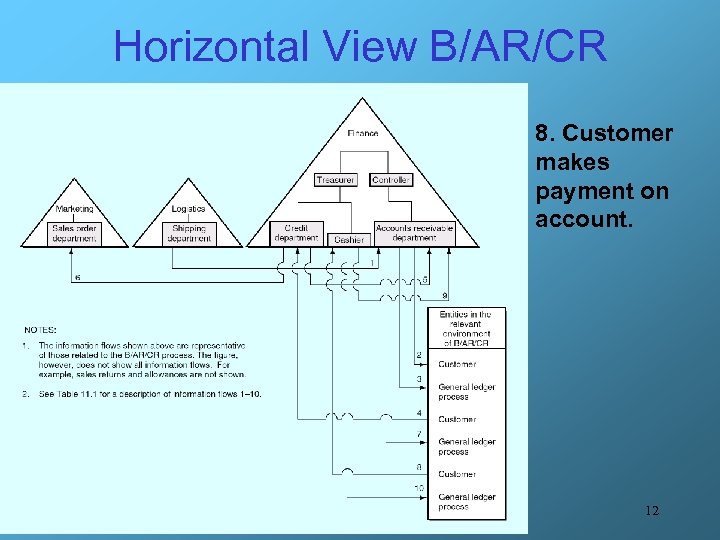

Horizontal View B/AR/CR 8. Customer makes payment on account. 12

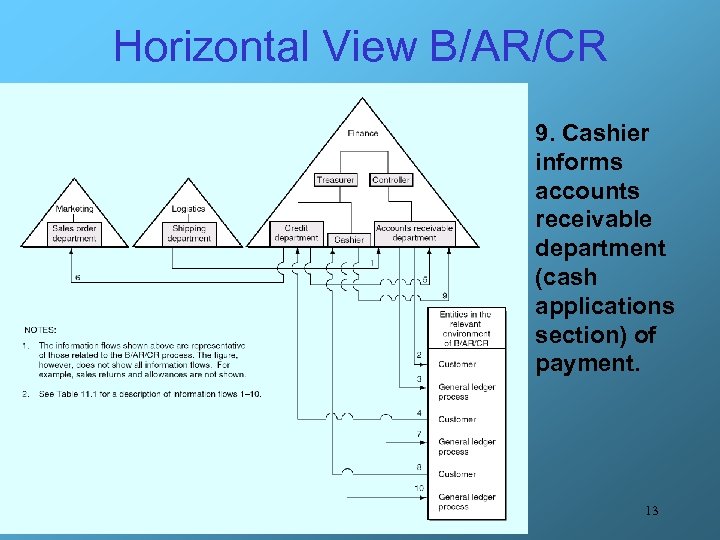

Horizontal View B/AR/CR 9. Cashier informs accounts receivable department (cash applications section) of payment. 13

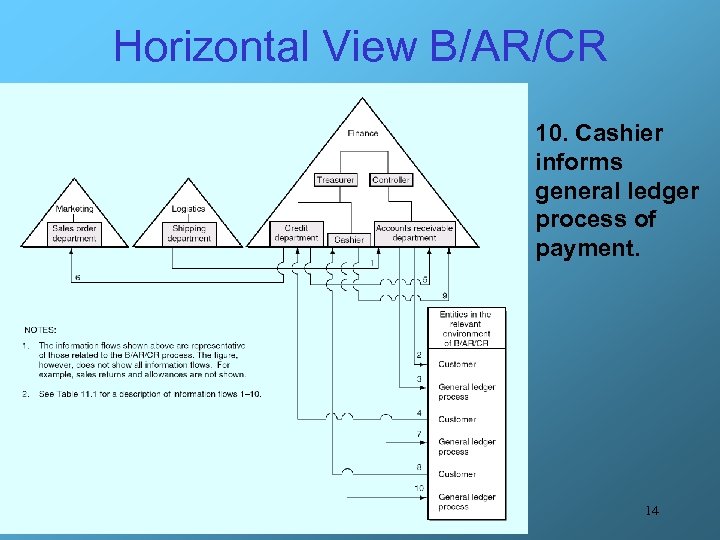

Horizontal View B/AR/CR 10. Cashier informs general ledger process of payment. 14

CSS: Customer Self-Service Systems • CSS is an extension of CRM that allows a customer to complete an inquiry or perform a task without the aid of the organization’s employees – ATMs, Speedpass, Automated telephone systems • A major extension: interconnection of CSS systems with enterprise systems – In some cases, customers can check their orders during the manufacturing process or check inventory before placing orders. – Some of the more advanced systems also allow customers to check production planning for future manufacturing to determine if goods will be available when they are needed. • Why are companies so interested in customer selfservice systems? – The payback on such systems is huge – Reduction of staffing needs for call centers is particularly beneficial 15

Digital Imaging Processing Systems • Because of the quantity of paper documents that typically flow through the B/AR/CR process, the ability to quickly scan, store, add information to, and retrieve documents can significantly reduce: – labor costs for filing – costs of physical storage space and structures necessary for storing paper-based files. 16

Cash Receipts Management • In the billing function, the goal is to get invoices to customers as quickly as possible; with the hope of reducing the time it then takes to obtain customer payments. • Having the B/AR/CR process produce invoices automatically helps ensure that invoices are sent to customers shortly after the goods have been shipped. • Float, when applied to cash receipts, is the time between the customer tendering payment and the availability of good funds. • Good funds are funds on deposit and available for use. 17

Cash Receipts Management • The following procedures are designed to reduce or eliminate the float associated with cash receipts: – Checks • High-speed electronic equipment is able to read the magnetic ink character recognition MICR code and sort checks at speeds approaching 100, 000 checks per hour – A charge card or credit card • A third party, for a fee, removes from the collector the risk of noncollection of the account receivable. • The retailer submits the charges to the credit card company for reimbursement. • The credit card company bills the consumer – A debit card • Authorizes the collector to transfer funds electronically from the payer’s to the collector’s balance. • Some retailers find the notion of direct debit attractive because it represents the elimination of float. 18

Other solutions to float problems • • • Electronic funds transfer Automated clearing house Lockbox and electronic lockbox services Electronic checks Electronic cash See Technology Summary 11. 1 19

The Fraud Connection • Many result from improper segregation of duties – Custody of cash – Recording of cash transactions • Lapping – Employee pockets cash/check received from customer A – So that customer A doesn’t complain about missing payment, employee credits customer B’s payment to A’s account – So that customer B doesn’t complain about missing payment, employee credits customer C’s payment to B’s account – This scheme comes unraveled when the employee runs out of hours in the day 20

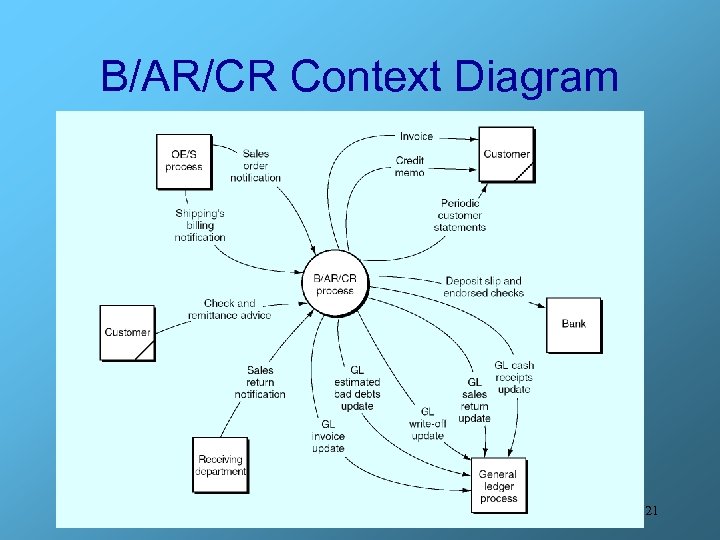

B/AR/CR Context Diagram 21

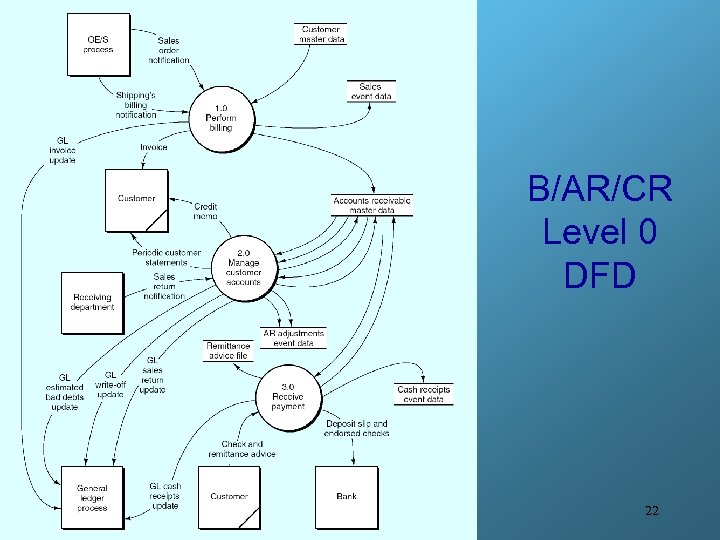

B/AR/CR Level 0 DFD 22

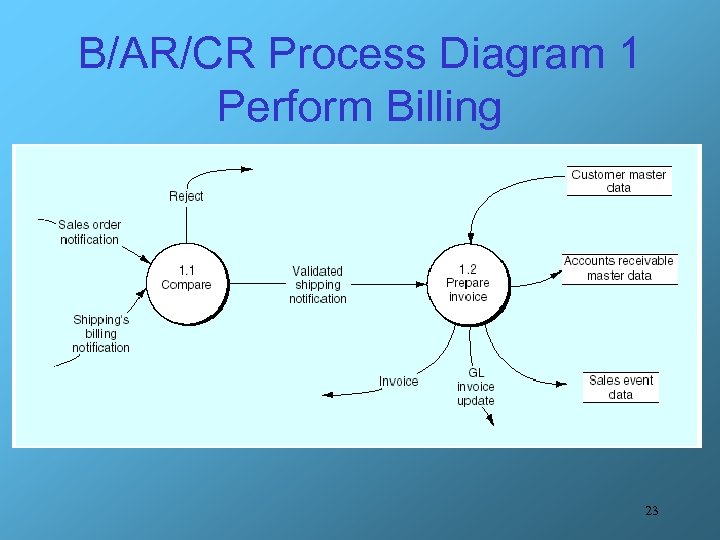

B/AR/CR Process Diagram 1 Perform Billing 23

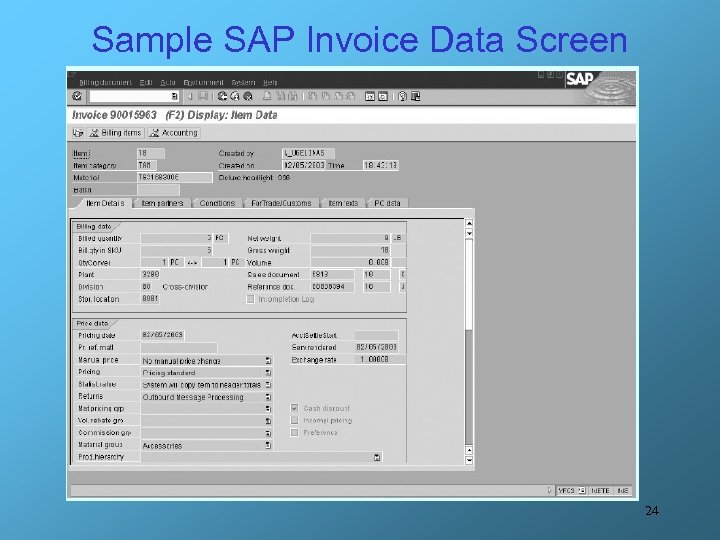

Sample SAP Invoice Data Screen 24

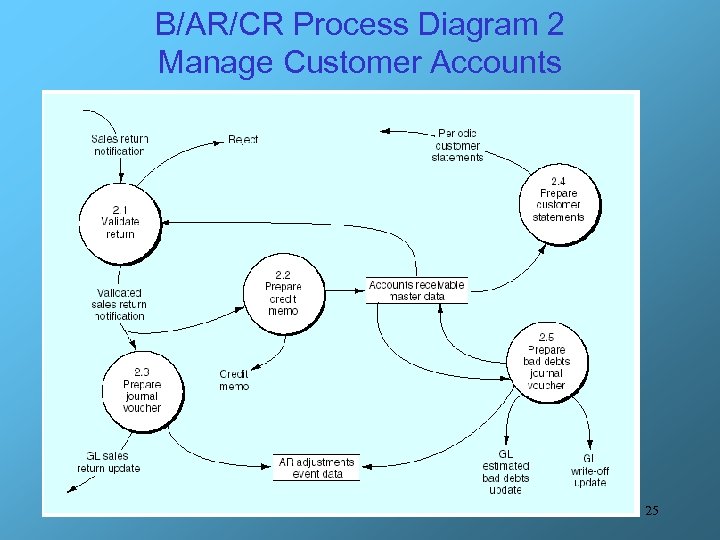

B/AR/CR Process Diagram 2 Manage Customer Accounts 25

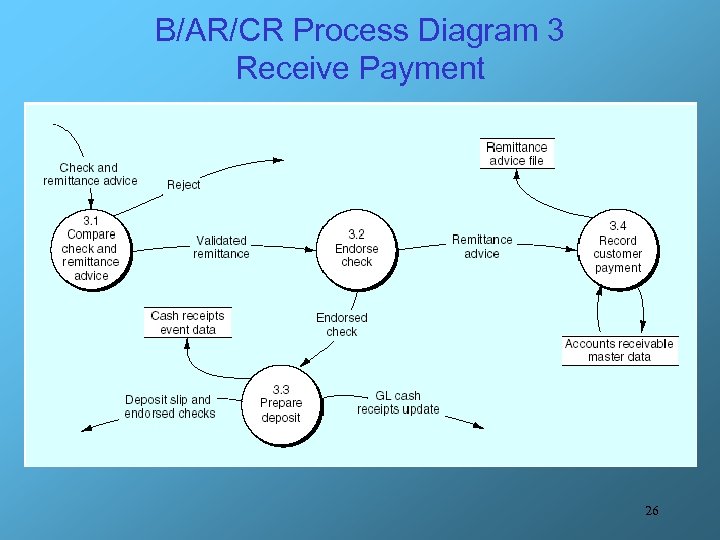

B/AR/CR Process Diagram 3 Receive Payment 26

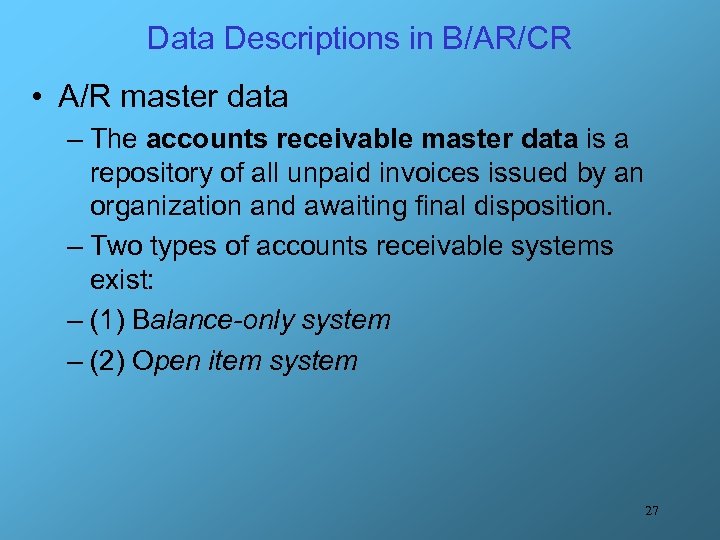

Data Descriptions in B/AR/CR • A/R master data – The accounts receivable master data is a repository of all unpaid invoices issued by an organization and awaiting final disposition. – Two types of accounts receivable systems exist: – (1) Balance-only system – (2) Open item system 27

Balance-only system • In a balance-only system, AR records show a customer’s current balance due, past-due balance, and the finance charges and payments related to the account. • Each month, unpaid current balances are rolled into the past-due balances. • Electric and gas utility companies typically use balance-only systems. 28

Open-item system • The open-item system appropriate in situations where the customer typically makes payments for specific invoices when those invoices are due. • In the AR master data, each record consists of individual open invoices, to which payments and adjustments are applied. • On the customer statement of account, a “lump sum” beginning balance is not shown. • Instead, all invoices that are yet to be settled continue to be listed, along with payment details. • Also, each open invoice is grouped by aging category and aged individually. • Monthly, or at specified times, the customer accounts are aged an aging schedule is printed. 29

Data Descriptions in B/AR/CR • Sales event data – one or more invoice records (details contained in invoice data) • A/R adjustments data – write-offs, estimated doubtful a/c, sales returns, etc. – Journal voucher #, trans. code, authorization • Cash receipts data – details of customer payments 30

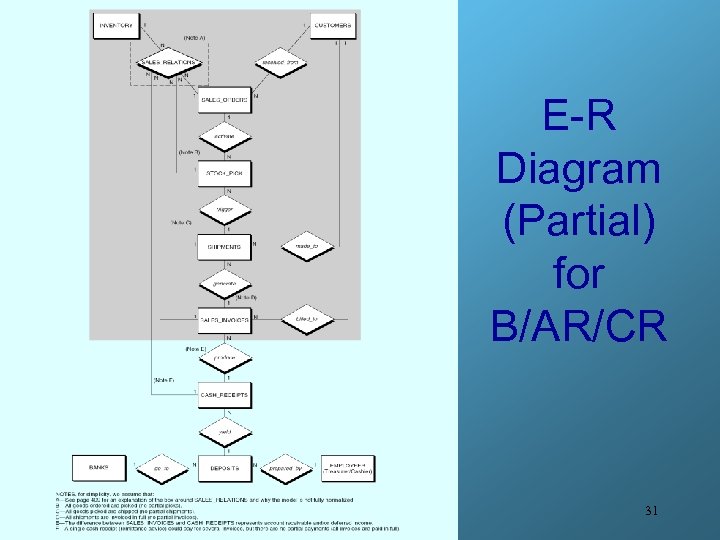

E-R Diagram (Partial) for B/AR/CR 31

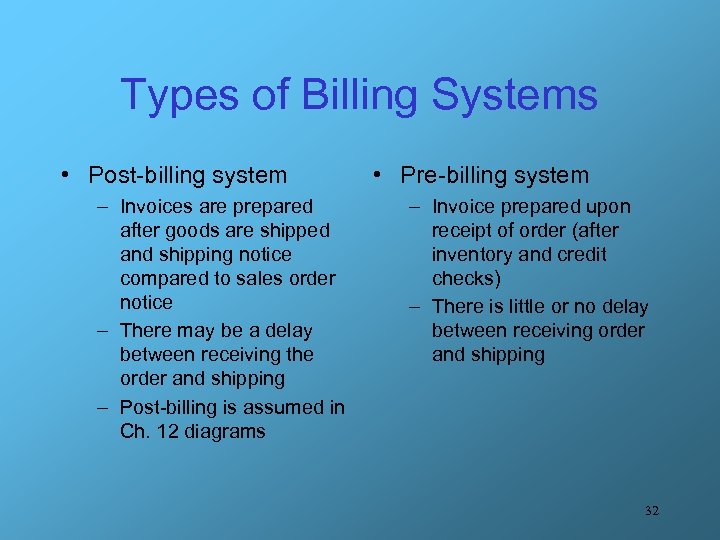

Types of Billing Systems • Post-billing system – Invoices are prepared after goods are shipped and shipping notice compared to sales order notice – There may be a delay between receiving the order and shipping – Post-billing is assumed in Ch. 12 diagrams • Pre-billing system – Invoice prepared upon receipt of order (after inventory and credit checks) – There is little or no delay between receiving order and shipping 32

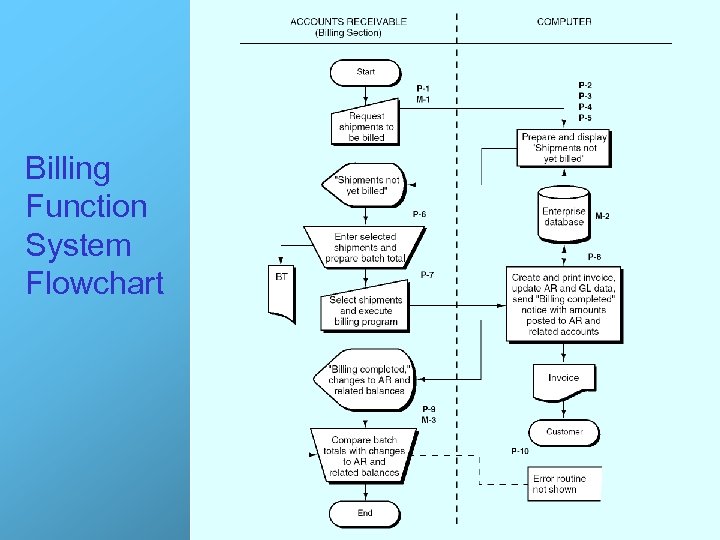

Billing Function System Flowchart

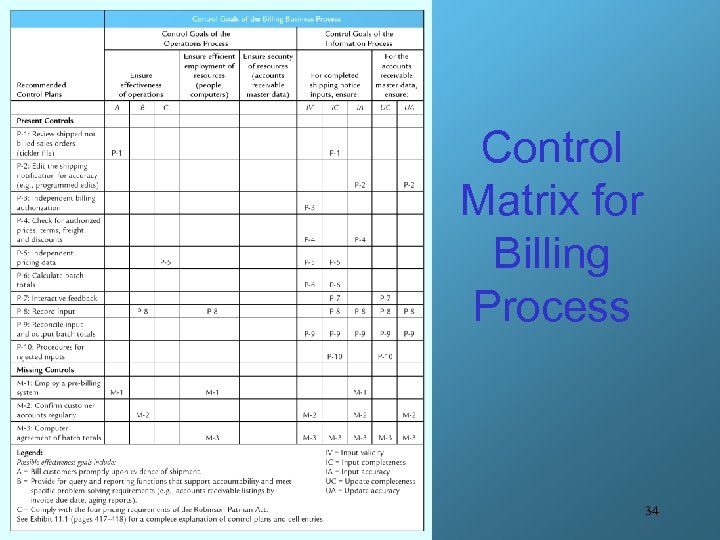

Control Matrix for Billing Process 34

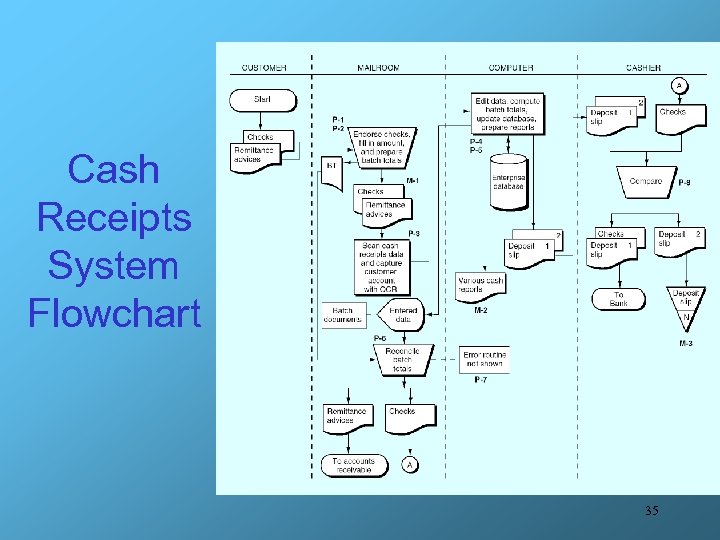

Cash Receipts System Flowchart 35

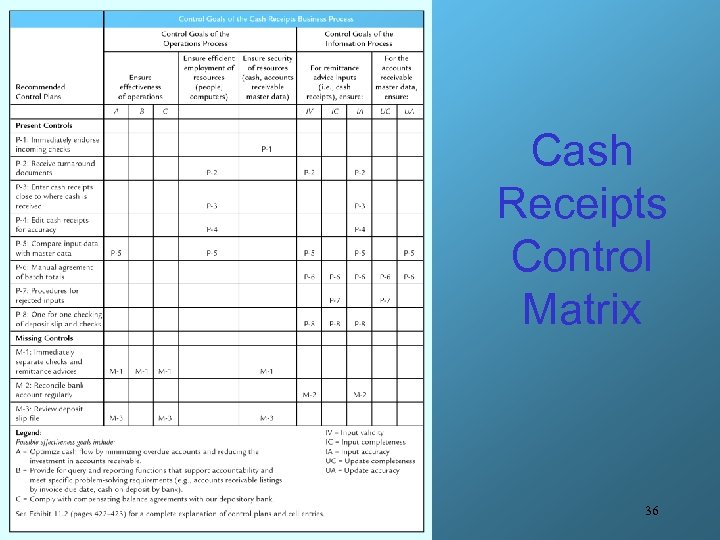

Cash Receipts Control Matrix 36

119fdd66e8aad1c4fb1906974fdaf338.ppt