cb974ba7ddbee25e0f25aaedd35b28a3.ppt

- Количество слайдов: 81

Chapter 1 Power Notes Introduction to Accounting and Business Learning Objectives 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. What is Business? Business Stakeholders What is Accounting? History of accounting The relationship between accounting and bookkeeping What is the role of Accounting in business? Why do the stakeholders need accounting information? Accounting – An information process Users of accounting information Generally Accepted Accounting Principles Types of business organization Types of business C 1 - 1

Chapter 1 Power Notes Introduction to Accounting and Business Learning Objectives 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. What is Business? Business Stakeholders What is Accounting? History of accounting The relationship between accounting and bookkeeping What is the role of Accounting in business? Why do the stakeholders need accounting information? Accounting – An information process Users of accounting information Generally Accepted Accounting Principles Types of business organization Types of business C 1 - 1

What is a business? • Celcom Axiata, TESCO, Mc. Donalds, Sime Darby • Provision shops, gift shops, beauty salons, restaurants, law firms, clinics • A business is an organisation in which basic resources (inputs) are assembled and processed to provide goods or services (outputs) to customers. Customers pay for these goods or services. C 1 - 2

What is a business? • Celcom Axiata, TESCO, Mc. Donalds, Sime Darby • Provision shops, gift shops, beauty salons, restaurants, law firms, clinics • A business is an organisation in which basic resources (inputs) are assembled and processed to provide goods or services (outputs) to customers. Customers pay for these goods or services. C 1 - 2

Business stakeholders • • • Owners Employees Customers Creditors Governments C 1 - 3

Business stakeholders • • • Owners Employees Customers Creditors Governments C 1 - 3

What is Accounting? • Accounting is the process of identifying, measuring, recording and communicating economic information to permit informed judgments and decisions by users of the communication C 1 - 4

What is Accounting? • Accounting is the process of identifying, measuring, recording and communicating economic information to permit informed judgments and decisions by users of the communication C 1 - 4

The history of Accounting began because people needed to : • Record business transactions • Know if they were being financially successful • Know how much they owned and how much they owed C 1 - 5

The history of Accounting began because people needed to : • Record business transactions • Know if they were being financially successful • Know how much they owned and how much they owed C 1 - 5

The relationship between Bookkeeping and Accounting • Until about 100 years ago all accounting data was kept by being recorded manually in books, so the part of accounting that is concerned with recording data if often known as BOOKKEEPING • Nowadays although handwritten books may be used (particularly by smaller organizations)most accounting data is recorded electronically and stored electronically using computers • Bookkeeping is the process of recording data relating to accounting transactions in the accounting books C 1 - 6

The relationship between Bookkeeping and Accounting • Until about 100 years ago all accounting data was kept by being recorded manually in books, so the part of accounting that is concerned with recording data if often known as BOOKKEEPING • Nowadays although handwritten books may be used (particularly by smaller organizations)most accounting data is recorded electronically and stored electronically using computers • Bookkeeping is the process of recording data relating to accounting transactions in the accounting books C 1 - 6

What is the role of accounting in business? • Accounting provides information. • To who? Owners, managers and other business stakeholders • What information? How the business is performing • Accounting is the language of business. C 1 - 7

What is the role of accounting in business? • Accounting provides information. • To who? Owners, managers and other business stakeholders • What information? How the business is performing • Accounting is the language of business. C 1 - 7

Why do the stakeholders need accounting information? • Manager – to decide whether to stop or continue a new product • Bank – to decide whether to lend money to the business • Suppliers – to decide whether to sell to the business on credit • Government – to determine the amount of tax on the business C 1 - 8

Why do the stakeholders need accounting information? • Manager – to decide whether to stop or continue a new product • Bank – to decide whether to lend money to the business • Suppliers – to decide whether to sell to the business on credit • Government – to determine the amount of tax on the business C 1 - 8

Accounting — An Information Process Identification of Users C 1 - 9

Accounting — An Information Process Identification of Users C 1 - 9

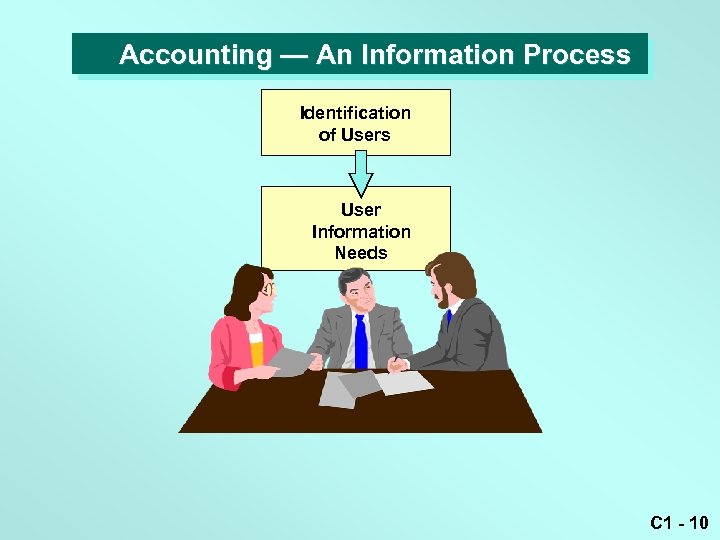

Accounting — An Information Process Identification of Users User Information Needs C 1 - 10

Accounting — An Information Process Identification of Users User Information Needs C 1 - 10

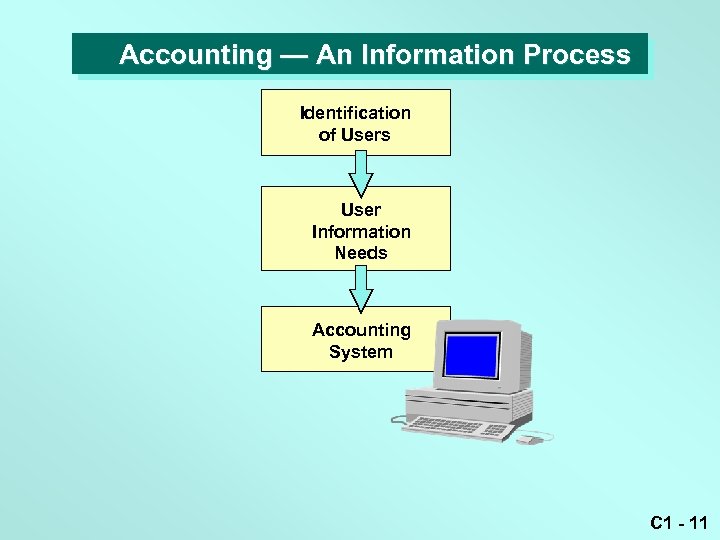

Accounting — An Information Process Identification of Users User Information Needs Accounting System C 1 - 11

Accounting — An Information Process Identification of Users User Information Needs Accounting System C 1 - 11

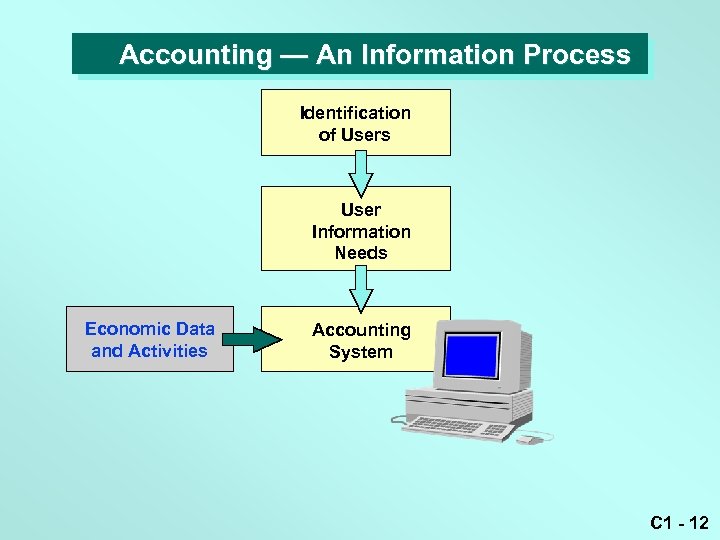

Accounting — An Information Process Identification of Users User Information Needs Economic Data and Activities Accounting System C 1 - 12

Accounting — An Information Process Identification of Users User Information Needs Economic Data and Activities Accounting System C 1 - 12

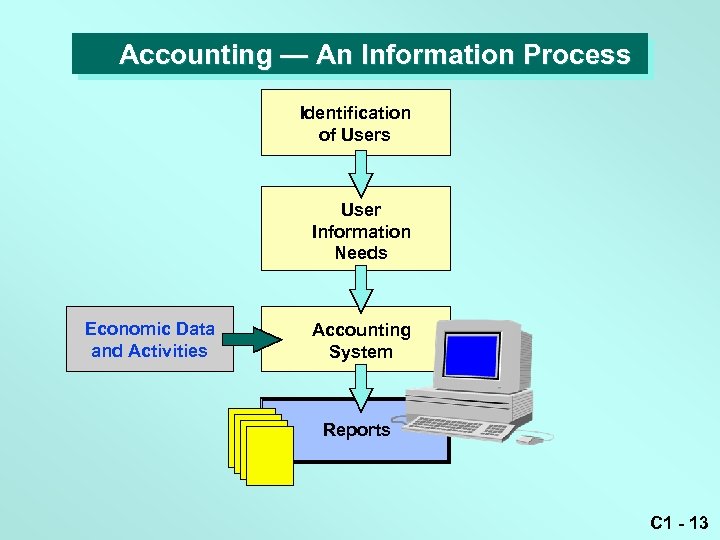

Accounting — An Information Process Identification of Users User Information Needs Economic Data and Activities Accounting System Reports C 1 - 13

Accounting — An Information Process Identification of Users User Information Needs Economic Data and Activities Accounting System Reports C 1 - 13

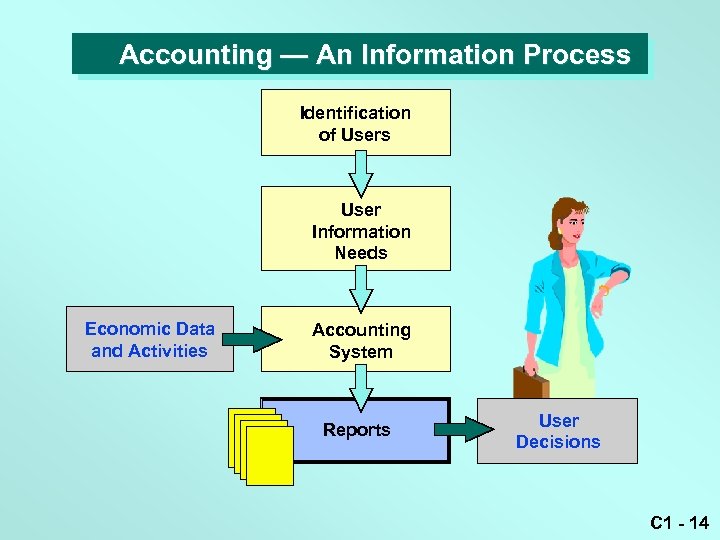

Accounting — An Information Process Identification of Users User Information Needs Economic Data and Activities Accounting System Reports User Decisions C 1 - 14

Accounting — An Information Process Identification of Users User Information Needs Economic Data and Activities Accounting System Reports User Decisions C 1 - 14

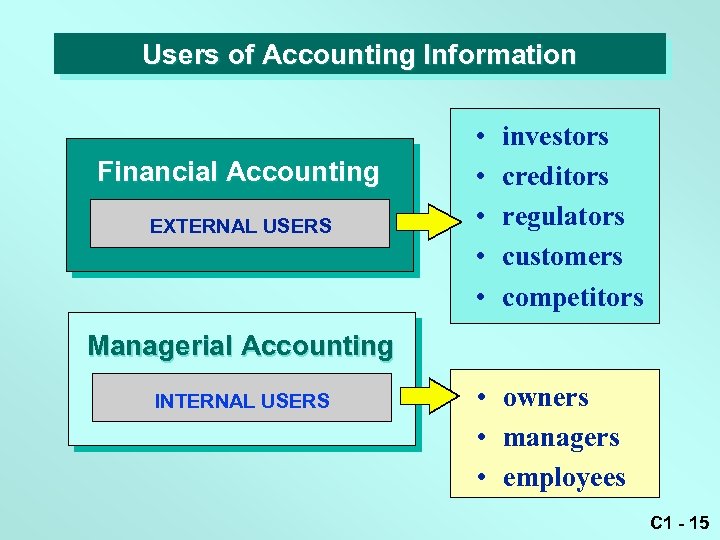

Users of Accounting Information Financial Accounting EXTERNAL USERS • • • investors creditors regulators customers competitors Managerial Accounting INTERNAL USERS • owners • managers • employees C 1 - 15

Users of Accounting Information Financial Accounting EXTERNAL USERS • • • investors creditors regulators customers competitors Managerial Accounting INTERNAL USERS • owners • managers • employees C 1 - 15

• Internal Users: Those individuals inside a company who plan, organize and run the business. Example: Owners interested in profits earned, financial stability and business growth Managers need accounting information to guide it in business planning, organizing and control Employees interested in business stabilities to know whether the owners can pay increased wages and benefits C 1 - 16

• Internal Users: Those individuals inside a company who plan, organize and run the business. Example: Owners interested in profits earned, financial stability and business growth Managers need accounting information to guide it in business planning, organizing and control Employees interested in business stabilities to know whether the owners can pay increased wages and benefits C 1 - 16

• External Users: Individuals and organization outside a company who wants financial information about the company. Direct financial interest: Investors who use accounting information to make decision to buy, hold or sell the stock Creditors (suppliers/bankers) use accounting information to evaluate the risk of granting credits or lending money Indirect financial interest: Government use accounting information for taxes and others regulatory requirements. Public (customers) interested in whether a company will continue to honor products warranties and support its product line C 1 - 17

• External Users: Individuals and organization outside a company who wants financial information about the company. Direct financial interest: Investors who use accounting information to make decision to buy, hold or sell the stock Creditors (suppliers/bankers) use accounting information to evaluate the risk of granting credits or lending money Indirect financial interest: Government use accounting information for taxes and others regulatory requirements. Public (customers) interested in whether a company will continue to honor products warranties and support its product line C 1 - 17

Generally Accepted Accounting Principles • • Business entity concept Historical cost concept Objectivity concept Unit of measure concept C 1 - 18

Generally Accepted Accounting Principles • • Business entity concept Historical cost concept Objectivity concept Unit of measure concept C 1 - 18

Business Entity Concept • Business is separate from the owner Business Owner Business’ cash Owner’s cash C 1 - 19

Business Entity Concept • Business is separate from the owner Business Owner Business’ cash Owner’s cash C 1 - 19

Historical Cost concept Historical Cost Concept • Transactions are recorded at the cost at the point of transaction 175, 000 130, 000 170, 000 $150, 000 C 1 - 20

Historical Cost concept Historical Cost Concept • Transactions are recorded at the cost at the point of transaction 175, 000 130, 000 170, 000 $150, 000 C 1 - 20

Historical Cost concept Objectivity Concept • Accounting records are based on objective evidence 175, 000 170, 000 130, 000 $150, 000 C 1 - 21

Historical Cost concept Objectivity Concept • Accounting records are based on objective evidence 175, 000 170, 000 130, 000 $150, 000 C 1 - 21

Objectivity Concept • Accounting records are based on objective evidence C 1 - 22

Objectivity Concept • Accounting records are based on objective evidence C 1 - 22

Unit of Measure concept Unit of measure Concept • For example kilogram is used to measure weight • Money is used for measurement in accounting C 1 - 23

Unit of Measure concept Unit of measure Concept • For example kilogram is used to measure weight • Money is used for measurement in accounting C 1 - 23

Types of business organisations • Sole proprietorship • Partnership • Company C 1 - 24

Types of business organisations • Sole proprietorship • Partnership • Company C 1 - 24

A business is normally organized as one of three different forms: 1. Sole proprietorship / Sole Trader – business is owned by a single or sole owner. The owner is responsible for all the losses and liabilities of the business. 2. Partnership – business is owned at lest (two) owners. The partnership is formed with a partnership agreement. 3. Company / Corporation – A company owned by many owners known as shareholders. A company is formed by statute. Company can divided into two type; limited liability and unlimited liability C 1 - 25

A business is normally organized as one of three different forms: 1. Sole proprietorship / Sole Trader – business is owned by a single or sole owner. The owner is responsible for all the losses and liabilities of the business. 2. Partnership – business is owned at lest (two) owners. The partnership is formed with a partnership agreement. 3. Company / Corporation – A company owned by many owners known as shareholders. A company is formed by statute. Company can divided into two type; limited liability and unlimited liability C 1 - 25

Types of businesses • Manufacturing business • Trading business • Service business C 1 - 26

Types of businesses • Manufacturing business • Trading business • Service business C 1 - 26

Chapter 2 Power Notes Accounting Classification and Equation Learning Objectives 1. 2. 3. 4. 5. 6. 7. The Accounting Equation The relationship between Accounting Equation and the layout of the Balance Sheet The meaning of the term Asset, Liabilities, Capital (Owner’s Equity), Accounts Receivables and Accounts Payable. How accounting transactions affect the items in the accounting equation. The meaning of the revenue and expenses Relationship of the profit to the accounting equation Financial Statement (will be discussed more in Chapter 6) C 2 C 1 - 27

Chapter 2 Power Notes Accounting Classification and Equation Learning Objectives 1. 2. 3. 4. 5. 6. 7. The Accounting Equation The relationship between Accounting Equation and the layout of the Balance Sheet The meaning of the term Asset, Liabilities, Capital (Owner’s Equity), Accounts Receivables and Accounts Payable. How accounting transactions affect the items in the accounting equation. The meaning of the revenue and expenses Relationship of the profit to the accounting equation Financial Statement (will be discussed more in Chapter 6) C 2 C 1 - 27

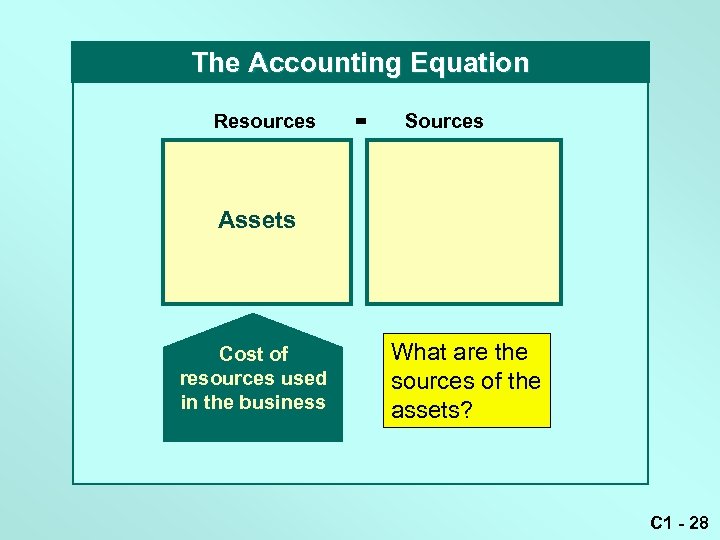

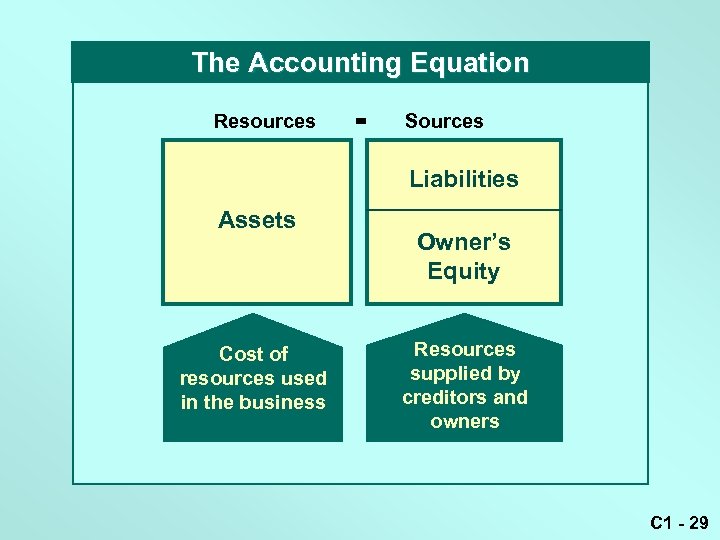

The Accounting Equation Resources = Sources Assets Cost of resources used in the business What are the sources of the assets? C 1 - 28

The Accounting Equation Resources = Sources Assets Cost of resources used in the business What are the sources of the assets? C 1 - 28

The Accounting Equation Resources = Sources Liabilities Assets Cost of resources used in the business Owner’s Equity Resources supplied by creditors and owners C 1 - 29

The Accounting Equation Resources = Sources Liabilities Assets Cost of resources used in the business Owner’s Equity Resources supplied by creditors and owners C 1 - 29

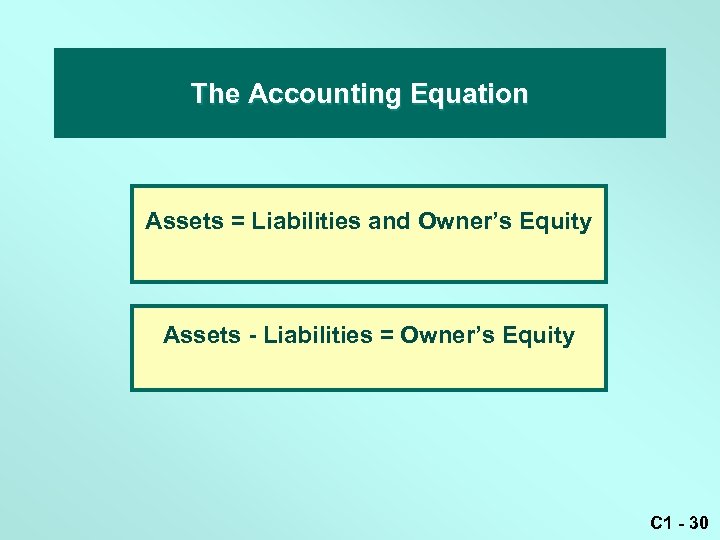

The Accounting Equation Assets = Liabilities and Owner’s Equity Assets - Liabilities = Owner’s Equity C 1 - 30

The Accounting Equation Assets = Liabilities and Owner’s Equity Assets - Liabilities = Owner’s Equity C 1 - 30

RESOURCE SUPPLIED BY THE OWNER = RESOURCES IN THE BUSINESS C 1 - 31

RESOURCE SUPPLIED BY THE OWNER = RESOURCES IN THE BUSINESS C 1 - 31

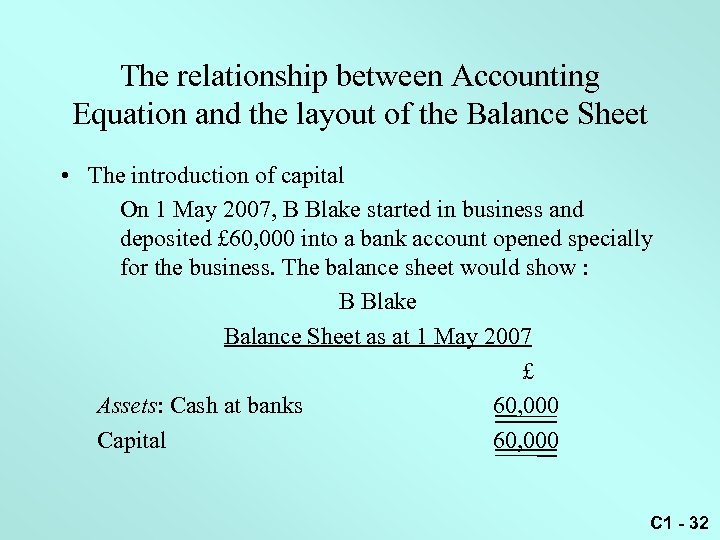

The relationship between Accounting Equation and the layout of the Balance Sheet • The introduction of capital On 1 May 2007, B Blake started in business and deposited £ 60, 000 into a bank account opened specially for the business. The balance sheet would show : B Blake Balance Sheet as at 1 May 2007 £ Assets: Cash at banks 60, 000 Capital 60, 000 C 1 - 32

The relationship between Accounting Equation and the layout of the Balance Sheet • The introduction of capital On 1 May 2007, B Blake started in business and deposited £ 60, 000 into a bank account opened specially for the business. The balance sheet would show : B Blake Balance Sheet as at 1 May 2007 £ Assets: Cash at banks 60, 000 Capital 60, 000 C 1 - 32

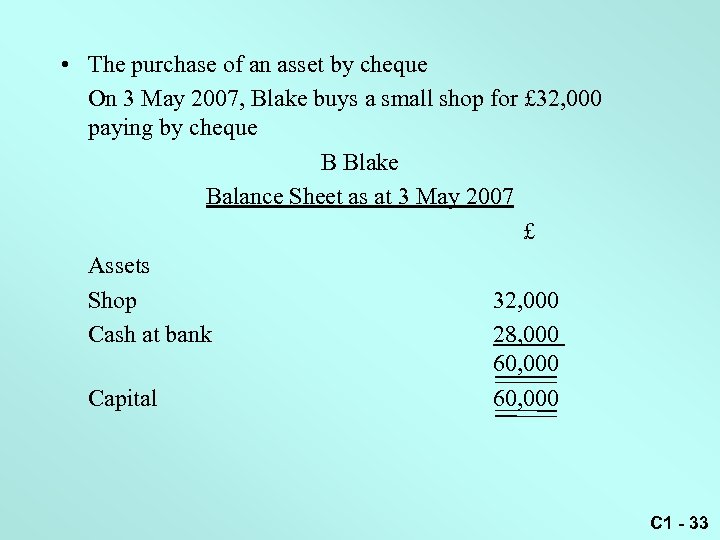

• The purchase of an asset by cheque On 3 May 2007, Blake buys a small shop for £ 32, 000 paying by cheque B Blake Balance Sheet as at 3 May 2007 £ Assets Shop 32, 000 Cash at bank 28, 000 60, 000 Capital 60, 000 C 1 - 33

• The purchase of an asset by cheque On 3 May 2007, Blake buys a small shop for £ 32, 000 paying by cheque B Blake Balance Sheet as at 3 May 2007 £ Assets Shop 32, 000 Cash at bank 28, 000 60, 000 Capital 60, 000 C 1 - 33

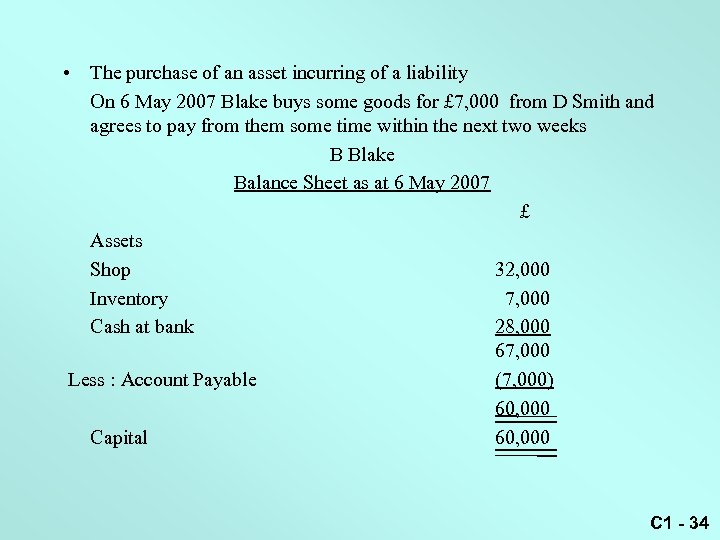

• The purchase of an asset incurring of a liability On 6 May 2007 Blake buys some goods for £ 7, 000 from D Smith and agrees to pay from them some time within the next two weeks B Blake Balance Sheet as at 6 May 2007 £ Assets Shop 32, 000 Inventory 7, 000 Cash at bank 28, 000 67, 000 Less : Account Payable (7, 000) 60, 000 Capital 60, 000 C 1 - 34

• The purchase of an asset incurring of a liability On 6 May 2007 Blake buys some goods for £ 7, 000 from D Smith and agrees to pay from them some time within the next two weeks B Blake Balance Sheet as at 6 May 2007 £ Assets Shop 32, 000 Inventory 7, 000 Cash at bank 28, 000 67, 000 Less : Account Payable (7, 000) 60, 000 Capital 60, 000 C 1 - 34

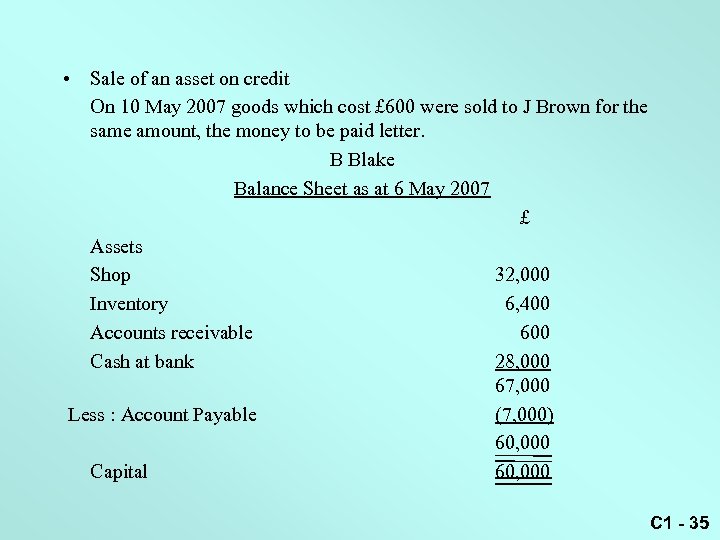

• Sale of an asset on credit On 10 May 2007 goods which cost £ 600 were sold to J Brown for the same amount, the money to be paid letter. B Blake Balance Sheet as at 6 May 2007 £ Assets Shop 32, 000 Inventory 6, 400 Accounts receivable 600 Cash at bank 28, 000 67, 000 Less : Account Payable (7, 000) 60, 000 Capital 60, 000 C 1 - 35

• Sale of an asset on credit On 10 May 2007 goods which cost £ 600 were sold to J Brown for the same amount, the money to be paid letter. B Blake Balance Sheet as at 6 May 2007 £ Assets Shop 32, 000 Inventory 6, 400 Accounts receivable 600 Cash at bank 28, 000 67, 000 Less : Account Payable (7, 000) 60, 000 Capital 60, 000 C 1 - 35

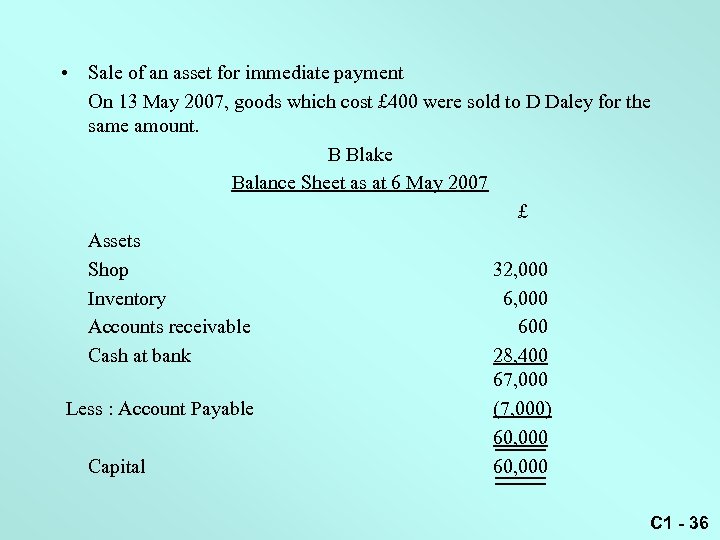

• Sale of an asset for immediate payment On 13 May 2007, goods which cost £ 400 were sold to D Daley for the same amount. B Blake Balance Sheet as at 6 May 2007 £ Assets Shop 32, 000 Inventory 6, 000 Accounts receivable 600 Cash at bank 28, 400 67, 000 Less : Account Payable (7, 000) 60, 000 Capital 60, 000 C 1 - 36

• Sale of an asset for immediate payment On 13 May 2007, goods which cost £ 400 were sold to D Daley for the same amount. B Blake Balance Sheet as at 6 May 2007 £ Assets Shop 32, 000 Inventory 6, 000 Accounts receivable 600 Cash at bank 28, 400 67, 000 Less : Account Payable (7, 000) 60, 000 Capital 60, 000 C 1 - 36

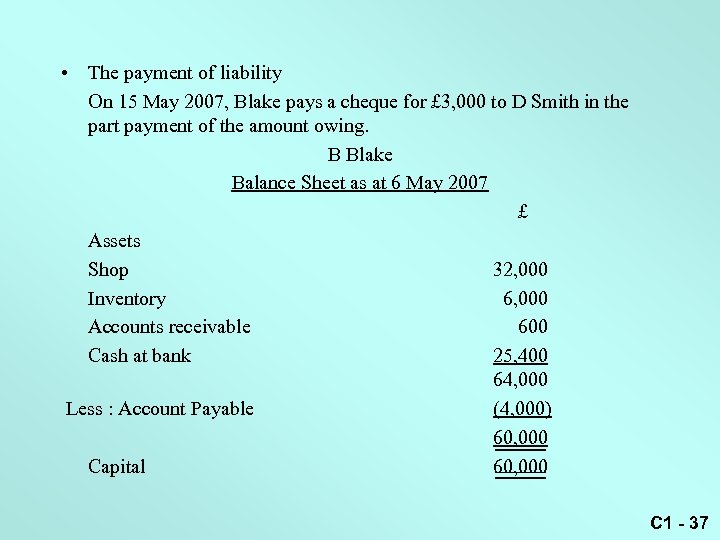

• The payment of liability On 15 May 2007, Blake pays a cheque for £ 3, 000 to D Smith in the part payment of the amount owing. B Blake Balance Sheet as at 6 May 2007 £ Assets Shop 32, 000 Inventory 6, 000 Accounts receivable 600 Cash at bank 25, 400 64, 000 Less : Account Payable (4, 000) 60, 000 Capital 60, 000 C 1 - 37

• The payment of liability On 15 May 2007, Blake pays a cheque for £ 3, 000 to D Smith in the part payment of the amount owing. B Blake Balance Sheet as at 6 May 2007 £ Assets Shop 32, 000 Inventory 6, 000 Accounts receivable 600 Cash at bank 25, 400 64, 000 Less : Account Payable (4, 000) 60, 000 Capital 60, 000 C 1 - 37

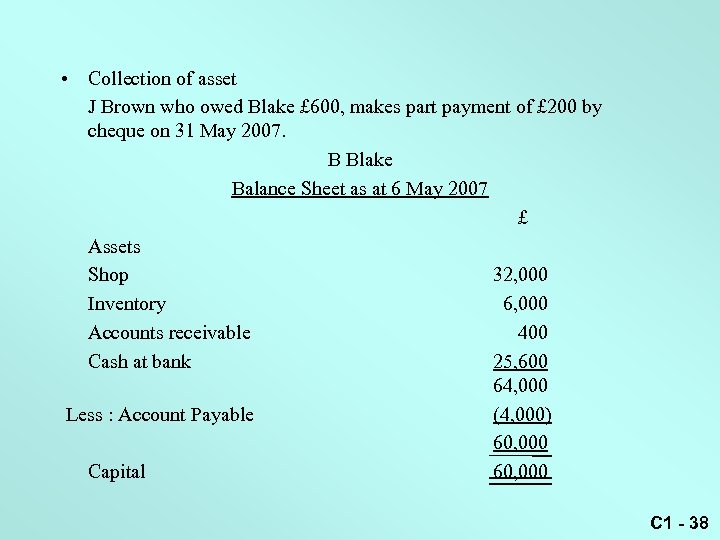

• Collection of asset J Brown who owed Blake £ 600, makes part payment of £ 200 by cheque on 31 May 2007. B Blake Balance Sheet as at 6 May 2007 £ Assets Shop 32, 000 Inventory 6, 000 Accounts receivable 400 Cash at bank 25, 600 64, 000 Less : Account Payable (4, 000) 60, 000 Capital 60, 000 C 1 - 38

• Collection of asset J Brown who owed Blake £ 600, makes part payment of £ 200 by cheque on 31 May 2007. B Blake Balance Sheet as at 6 May 2007 £ Assets Shop 32, 000 Inventory 6, 000 Accounts receivable 400 Cash at bank 25, 600 64, 000 Less : Account Payable (4, 000) 60, 000 Capital 60, 000 C 1 - 38

Assets • What are your assets? C 1 - 39

Assets • What are your assets? C 1 - 39

Assets • Resources owned by the business • Cash, land, buildings, equipment C 1 - 40

Assets • Resources owned by the business • Cash, land, buildings, equipment C 1 - 40

Assets are economic resources owned by a business that are expected to benefit future operations. Monetary items. Non-monetary physical things. C 1 - 41

Assets are economic resources owned by a business that are expected to benefit future operations. Monetary items. Non-monetary physical things. C 1 - 41

Liability Liabilities • Say you borrowed $5 from your friend for lunch. You have a liability or debt of $5. You friend is your creditor. You Liability- $5 Your friend Your creditor C 1 - 42

Liability Liabilities • Say you borrowed $5 from your friend for lunch. You have a liability or debt of $5. You friend is your creditor. You Liability- $5 Your friend Your creditor C 1 - 42

• Liabilities are amounts due or the present obligations of a business to pay cash, transfer assets, or provide services to other parties in the future. C 1 - 43

• Liabilities are amounts due or the present obligations of a business to pay cash, transfer assets, or provide services to other parties in the future. C 1 - 43

Owner’s equity Owner’s Equity • Amounts belonging to the owner. • Say Sally puts $10, 000 into the business. Therefore $10, 000 of the business belongs to Sally. Owner’s equity = $10, 000 C 1 - 44

Owner’s equity Owner’s Equity • Amounts belonging to the owner. • Say Sally puts $10, 000 into the business. Therefore $10, 000 of the business belongs to Sally. Owner’s equity = $10, 000 C 1 - 44

• Owners’ equity represents the claims by the owners of a business to the assets of the business. • Owners’ equity is the residual equity that remains after deducting liabilities from assets. • OE = Assets - Liabilities. • Assets = Liabilities + OE. • OE = Contributed Capital + Retained Earnings. C 1 - 45

• Owners’ equity represents the claims by the owners of a business to the assets of the business. • Owners’ equity is the residual equity that remains after deducting liabilities from assets. • OE = Assets - Liabilities. • Assets = Liabilities + OE. • OE = Contributed Capital + Retained Earnings. C 1 - 45

Account Receivable = Debtor • Money owed by customers (individuals or corporations) to another entity in exchange for goods or services that have been delivered or used, but not yet paid for. Receivables usually come in the form of operating lines of credit and are usually due within a relatively short time period, ranging from a few days to a year. On a public company's balance sheet, accounts receivable is often recorded as an asset because this represents a legal obligation for the customer to remit cash for its short-term debts C 1 - 46

Account Receivable = Debtor • Money owed by customers (individuals or corporations) to another entity in exchange for goods or services that have been delivered or used, but not yet paid for. Receivables usually come in the form of operating lines of credit and are usually due within a relatively short time period, ranging from a few days to a year. On a public company's balance sheet, accounts receivable is often recorded as an asset because this represents a legal obligation for the customer to remit cash for its short-term debts C 1 - 46

Account Payable = Creditor • An accounting entry that represents an entity's obligation to pay off a short-term debt to its creditors. The accounts payable entry is found on a balance sheet under the heading current liabilities. Accounts payable are often referred to as "payables". Another common usage of AP refers to a business department or division that is responsible for making payments owed by the company to suppliers and other creditors. C 1 - 47

Account Payable = Creditor • An accounting entry that represents an entity's obligation to pay off a short-term debt to its creditors. The accounts payable entry is found on a balance sheet under the heading current liabilities. Accounts payable are often referred to as "payables". Another common usage of AP refers to a business department or division that is responsible for making payments owed by the company to suppliers and other creditors. C 1 - 47

HOW ACCOUNTING TRANSACTIONS AFFECT THE ITEMS IN THE ACCOUNTING EQUATION C 1 - 48

HOW ACCOUNTING TRANSACTIONS AFFECT THE ITEMS IN THE ACCOUNTING EQUATION C 1 - 48

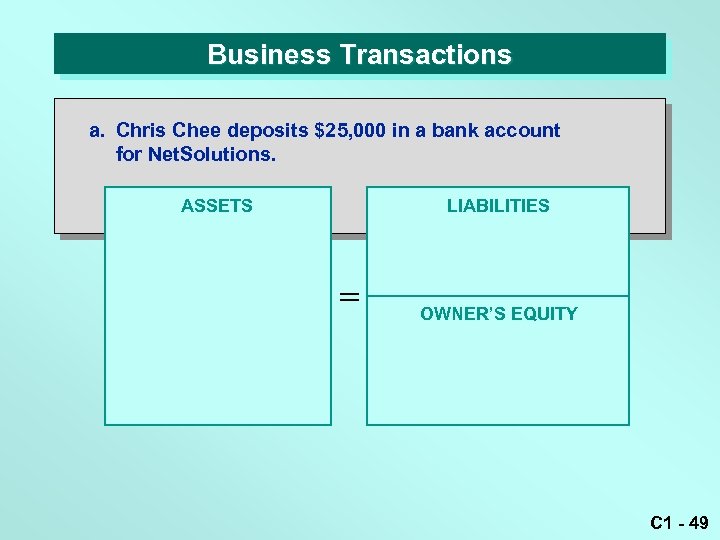

Business Transactions a. Chris Chee deposits $25, 000 in a bank account for Net. Solutions. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 49

Business Transactions a. Chris Chee deposits $25, 000 in a bank account for Net. Solutions. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 49

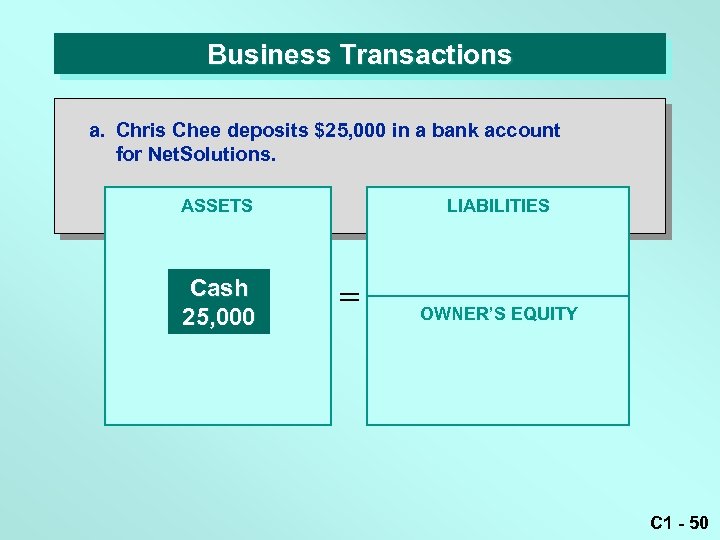

Business Transactions a. Chris Chee deposits $25, 000 in a bank account for Net. Solutions. LIABILITIES ASSETS Cash 25, 000 = OWNER’S EQUITY C 1 - 50

Business Transactions a. Chris Chee deposits $25, 000 in a bank account for Net. Solutions. LIABILITIES ASSETS Cash 25, 000 = OWNER’S EQUITY C 1 - 50

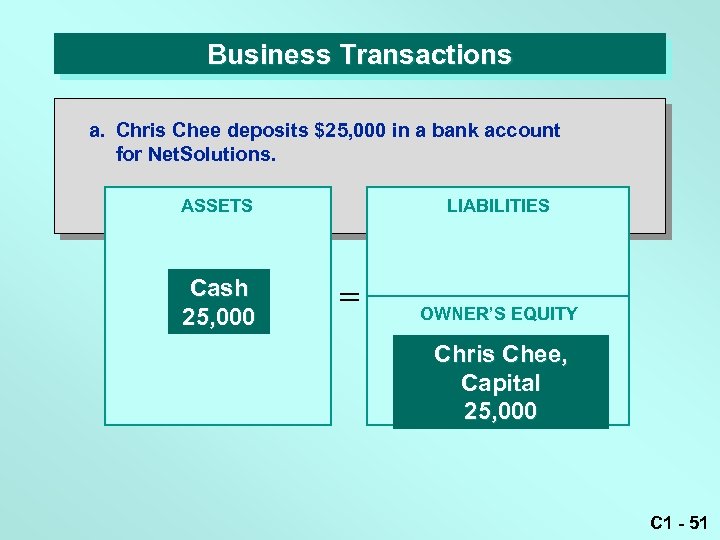

Business Transactions a. Chris Chee deposits $25, 000 in a bank account for Net. Solutions. LIABILITIES ASSETS Cash 25, 000 = OWNER’S EQUITY Chris Chee, Capital 25, 000 C 1 - 51

Business Transactions a. Chris Chee deposits $25, 000 in a bank account for Net. Solutions. LIABILITIES ASSETS Cash 25, 000 = OWNER’S EQUITY Chris Chee, Capital 25, 000 C 1 - 51

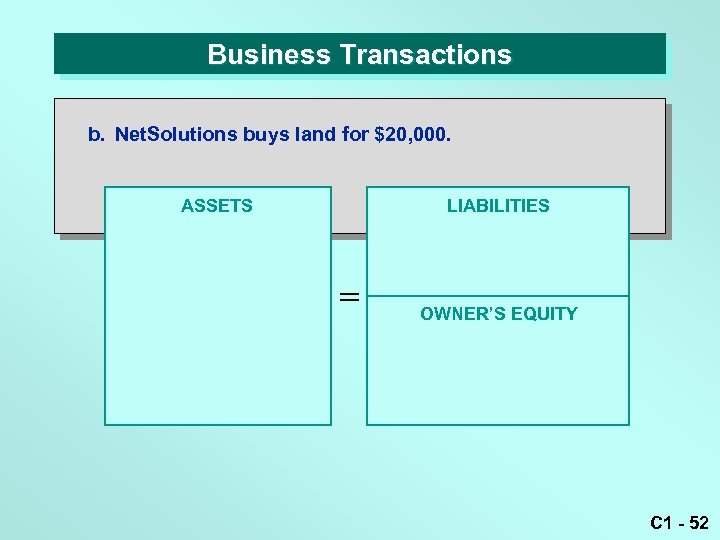

Business Transactions b. Net. Solutions buys land for $20, 000. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 52

Business Transactions b. Net. Solutions buys land for $20, 000. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 52

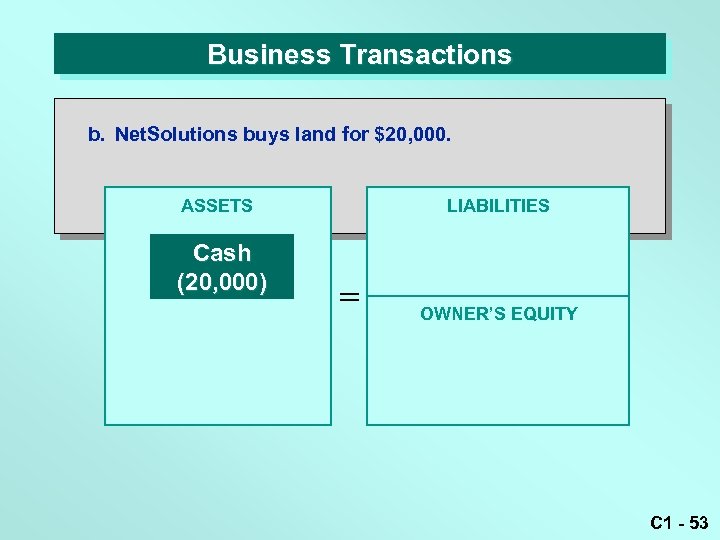

Business Transactions b. Net. Solutions buys land for $20, 000. LIABILITIES ASSETS Cash (20, 000) = OWNER’S EQUITY C 1 - 53

Business Transactions b. Net. Solutions buys land for $20, 000. LIABILITIES ASSETS Cash (20, 000) = OWNER’S EQUITY C 1 - 53

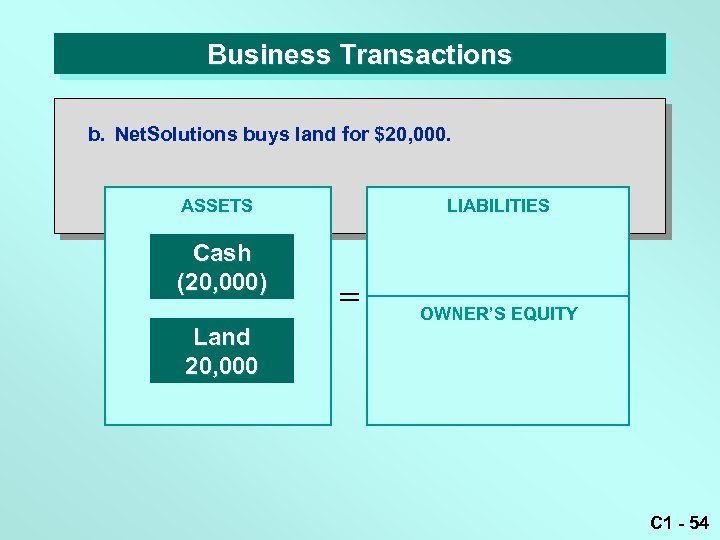

Business Transactions b. Net. Solutions buys land for $20, 000. LIABILITIES ASSETS Cash (20, 000) Land 20, 000 = OWNER’S EQUITY C 1 - 54

Business Transactions b. Net. Solutions buys land for $20, 000. LIABILITIES ASSETS Cash (20, 000) Land 20, 000 = OWNER’S EQUITY C 1 - 54

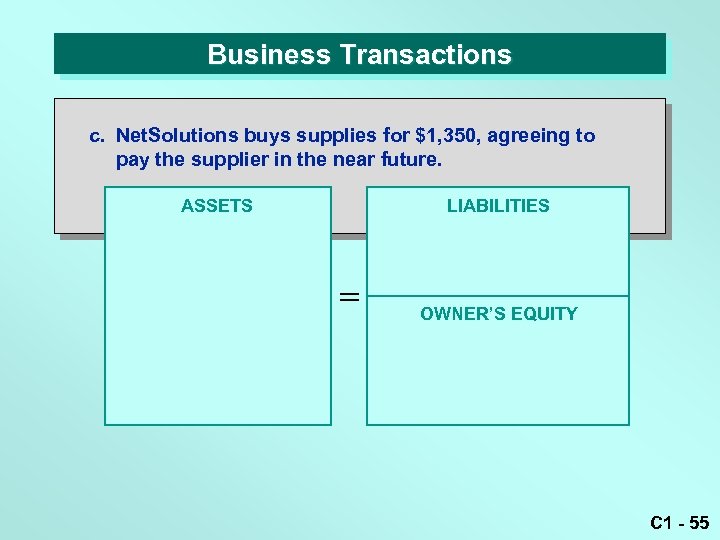

Business Transactions c. Net. Solutions buys supplies for $1, 350, agreeing to pay the supplier in the near future. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 55

Business Transactions c. Net. Solutions buys supplies for $1, 350, agreeing to pay the supplier in the near future. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 55

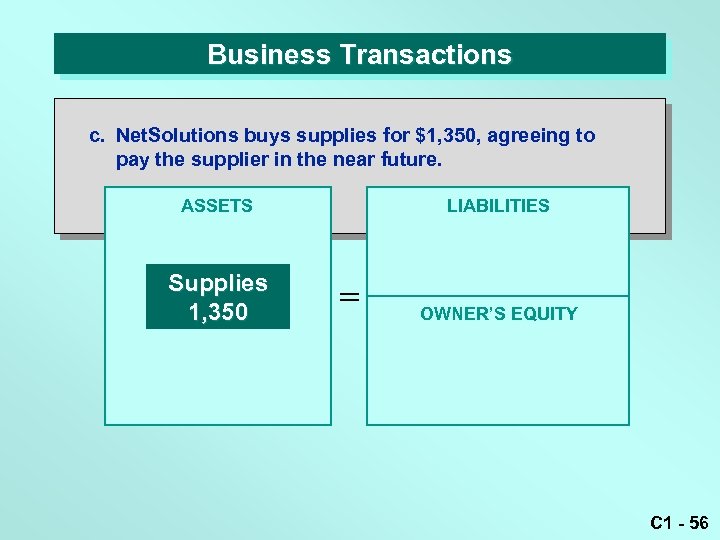

Business Transactions c. Net. Solutions buys supplies for $1, 350, agreeing to pay the supplier in the near future. LIABILITIES ASSETS Supplies 1, 350 = OWNER’S EQUITY C 1 - 56

Business Transactions c. Net. Solutions buys supplies for $1, 350, agreeing to pay the supplier in the near future. LIABILITIES ASSETS Supplies 1, 350 = OWNER’S EQUITY C 1 - 56

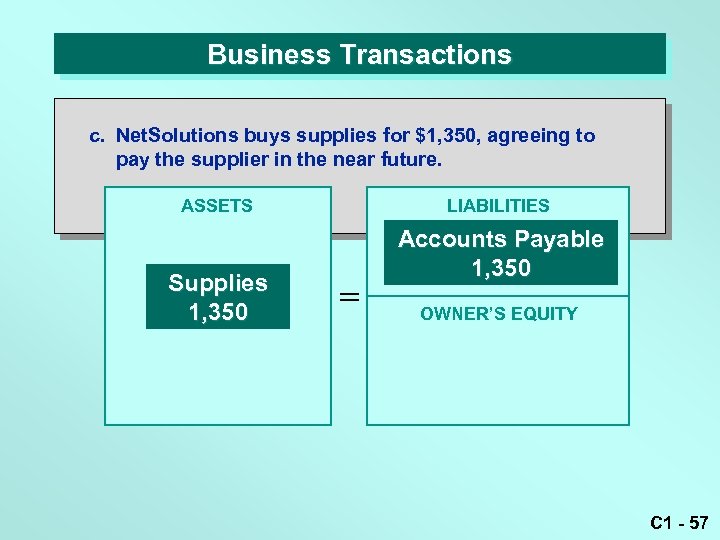

Business Transactions c. Net. Solutions buys supplies for $1, 350, agreeing to pay the supplier in the near future. LIABILITIES ASSETS Supplies 1, 350 = Accounts Payable 1, 350 OWNER’S EQUITY C 1 - 57

Business Transactions c. Net. Solutions buys supplies for $1, 350, agreeing to pay the supplier in the near future. LIABILITIES ASSETS Supplies 1, 350 = Accounts Payable 1, 350 OWNER’S EQUITY C 1 - 57

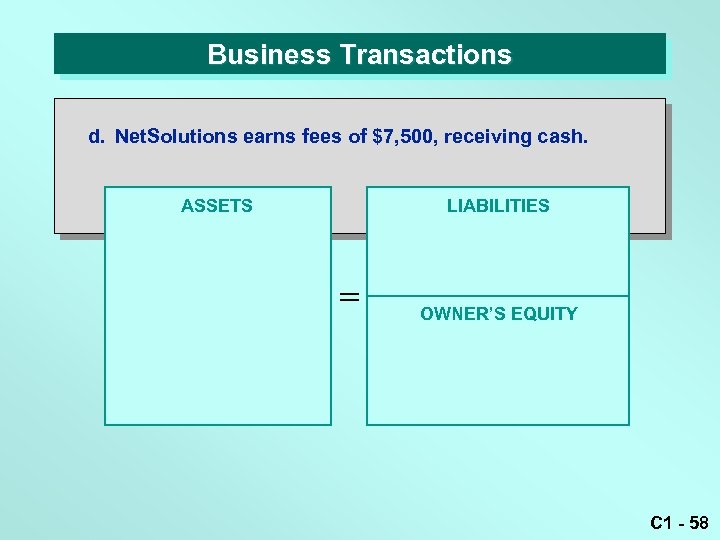

Business Transactions d. Net. Solutions earns fees of $7, 500, receiving cash. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 58

Business Transactions d. Net. Solutions earns fees of $7, 500, receiving cash. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 58

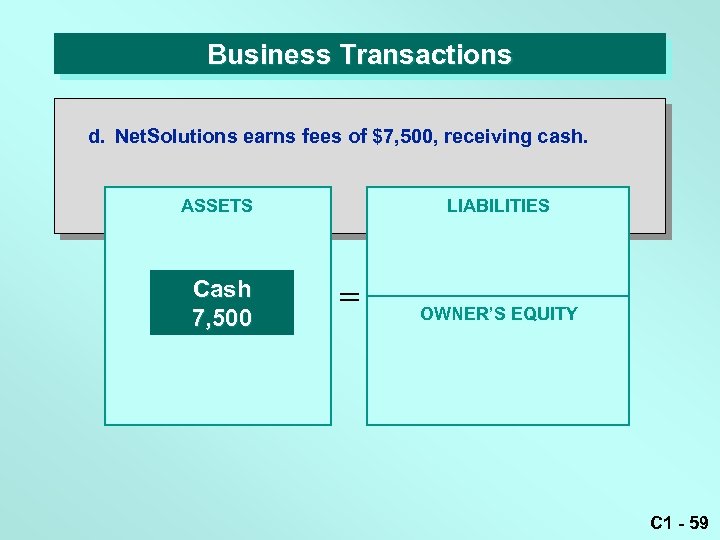

Business Transactions d. Net. Solutions earns fees of $7, 500, receiving cash. LIABILITIES ASSETS Cash 7, 500 = OWNER’S EQUITY C 1 - 59

Business Transactions d. Net. Solutions earns fees of $7, 500, receiving cash. LIABILITIES ASSETS Cash 7, 500 = OWNER’S EQUITY C 1 - 59

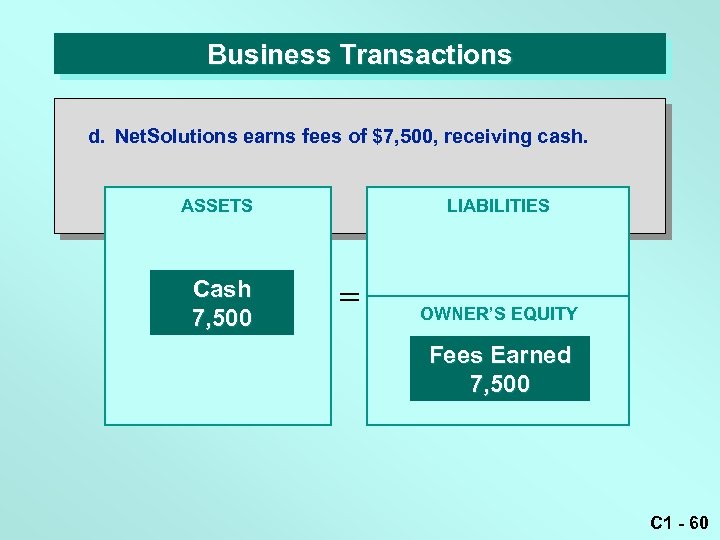

Business Transactions d. Net. Solutions earns fees of $7, 500, receiving cash. LIABILITIES ASSETS Cash 7, 500 = OWNER’S EQUITY Fees Earned 7, 500 C 1 - 60

Business Transactions d. Net. Solutions earns fees of $7, 500, receiving cash. LIABILITIES ASSETS Cash 7, 500 = OWNER’S EQUITY Fees Earned 7, 500 C 1 - 60

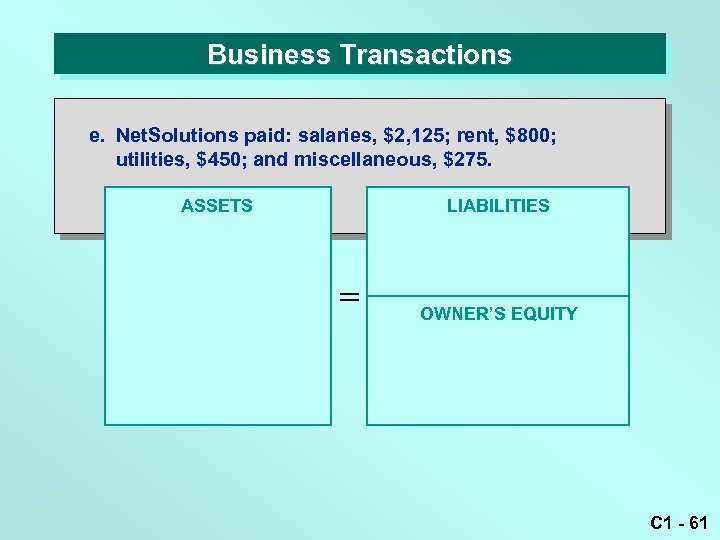

Business Transactions e. Net. Solutions paid: salaries, $2, 125; rent, $800; utilities, $450; and miscellaneous, $275. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 61

Business Transactions e. Net. Solutions paid: salaries, $2, 125; rent, $800; utilities, $450; and miscellaneous, $275. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 61

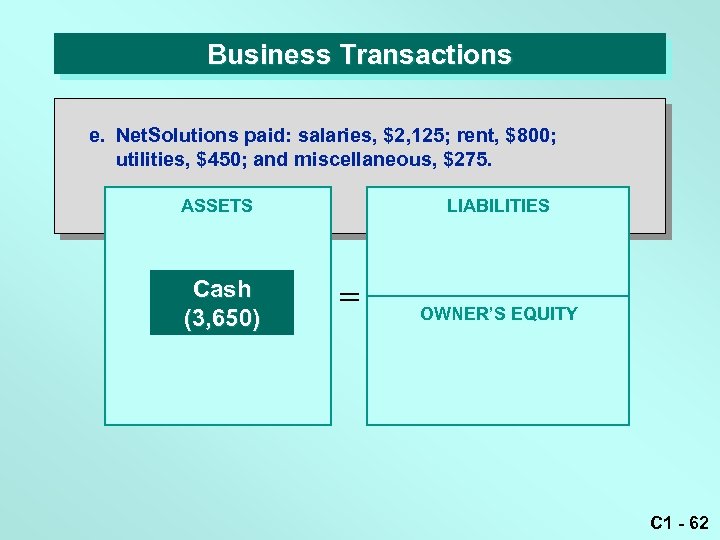

Business Transactions e. Net. Solutions paid: salaries, $2, 125; rent, $800; utilities, $450; and miscellaneous, $275. LIABILITIES ASSETS Cash (3, 650) = OWNER’S EQUITY C 1 - 62

Business Transactions e. Net. Solutions paid: salaries, $2, 125; rent, $800; utilities, $450; and miscellaneous, $275. LIABILITIES ASSETS Cash (3, 650) = OWNER’S EQUITY C 1 - 62

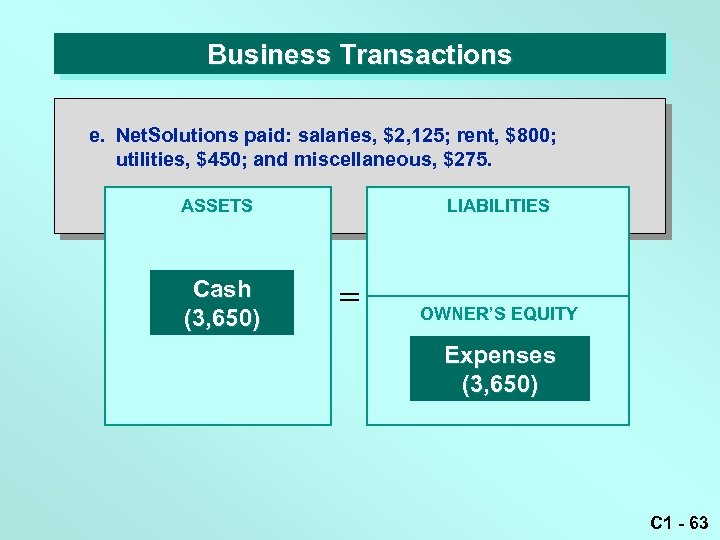

Business Transactions e. Net. Solutions paid: salaries, $2, 125; rent, $800; utilities, $450; and miscellaneous, $275. LIABILITIES ASSETS Cash (3, 650) = OWNER’S EQUITY Expenses (3, 650) C 1 - 63

Business Transactions e. Net. Solutions paid: salaries, $2, 125; rent, $800; utilities, $450; and miscellaneous, $275. LIABILITIES ASSETS Cash (3, 650) = OWNER’S EQUITY Expenses (3, 650) C 1 - 63

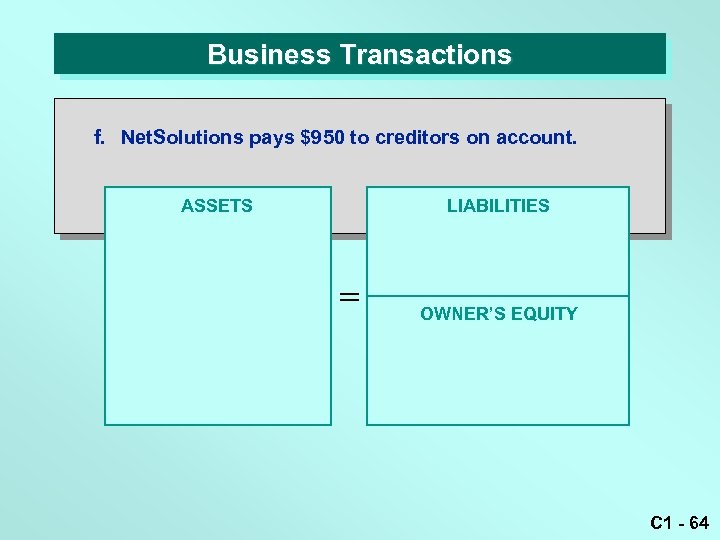

Business Transactions f. Net. Solutions pays $950 to creditors on account. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 64

Business Transactions f. Net. Solutions pays $950 to creditors on account. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 64

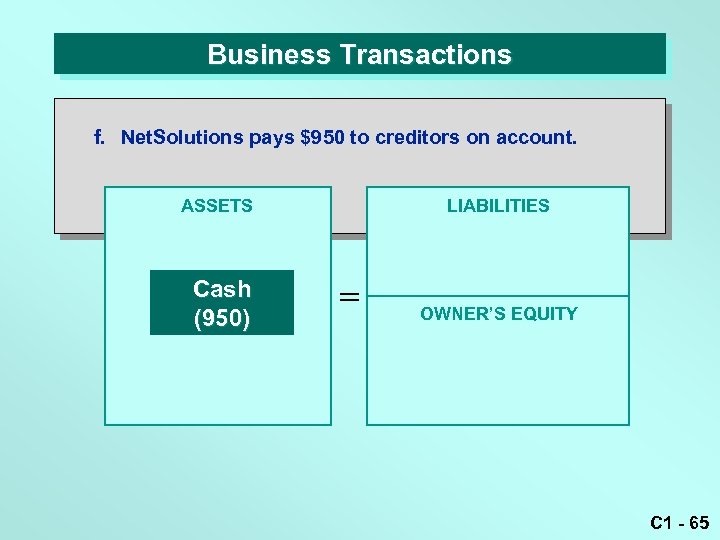

Business Transactions f. Net. Solutions pays $950 to creditors on account. LIABILITIES ASSETS Cash (950) = OWNER’S EQUITY C 1 - 65

Business Transactions f. Net. Solutions pays $950 to creditors on account. LIABILITIES ASSETS Cash (950) = OWNER’S EQUITY C 1 - 65

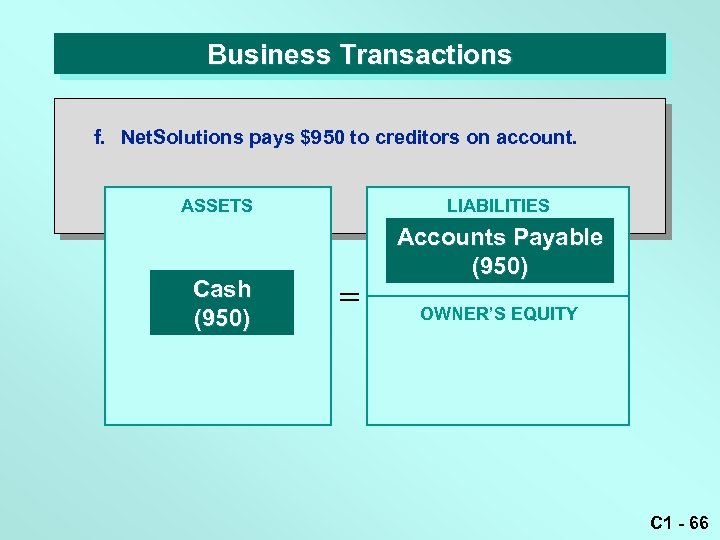

Business Transactions f. Net. Solutions pays $950 to creditors on account. LIABILITIES ASSETS Cash (950) = Accounts Payable (950) OWNER’S EQUITY C 1 - 66

Business Transactions f. Net. Solutions pays $950 to creditors on account. LIABILITIES ASSETS Cash (950) = Accounts Payable (950) OWNER’S EQUITY C 1 - 66

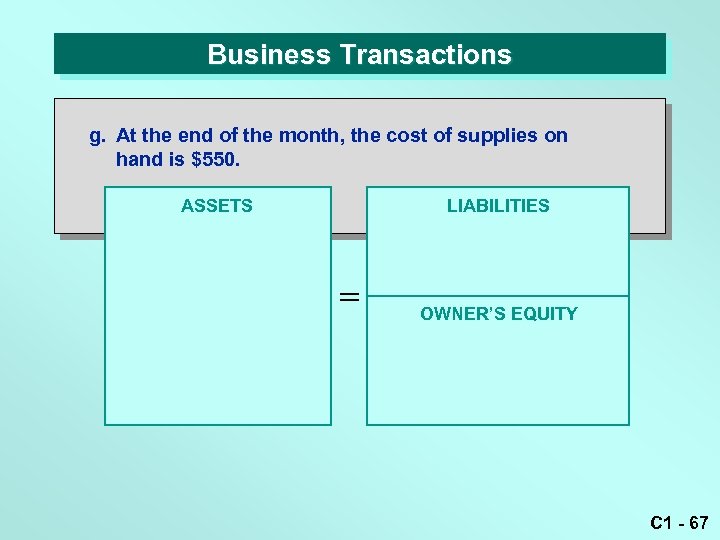

Business Transactions g. At the end of the month, the cost of supplies on hand is $550. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 67

Business Transactions g. At the end of the month, the cost of supplies on hand is $550. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 67

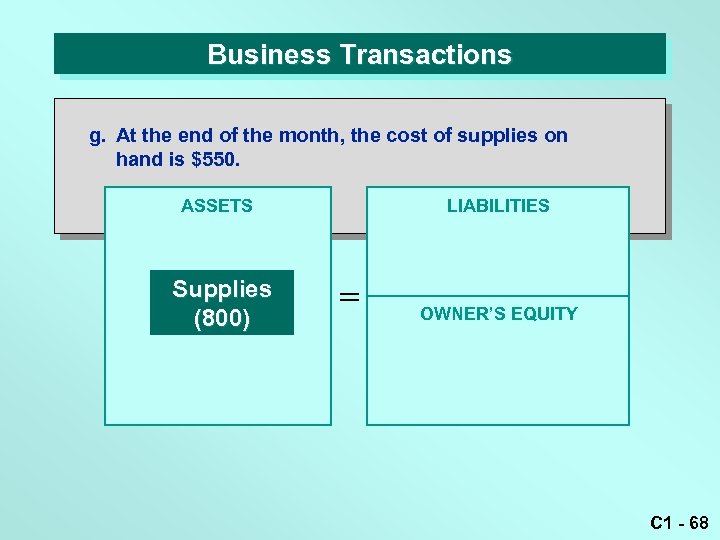

Business Transactions g. At the end of the month, the cost of supplies on hand is $550. LIABILITIES ASSETS Supplies (800) = OWNER’S EQUITY C 1 - 68

Business Transactions g. At the end of the month, the cost of supplies on hand is $550. LIABILITIES ASSETS Supplies (800) = OWNER’S EQUITY C 1 - 68

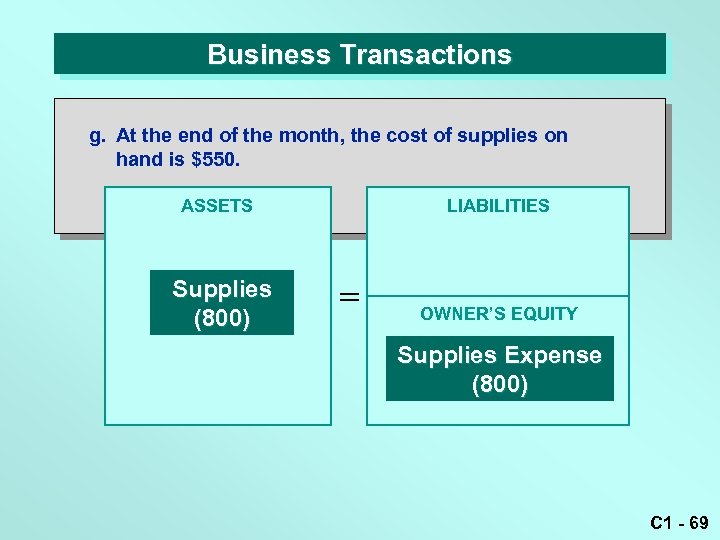

Business Transactions g. At the end of the month, the cost of supplies on hand is $550. LIABILITIES ASSETS Supplies (800) = OWNER’S EQUITY Supplies Expense (800) C 1 - 69

Business Transactions g. At the end of the month, the cost of supplies on hand is $550. LIABILITIES ASSETS Supplies (800) = OWNER’S EQUITY Supplies Expense (800) C 1 - 69

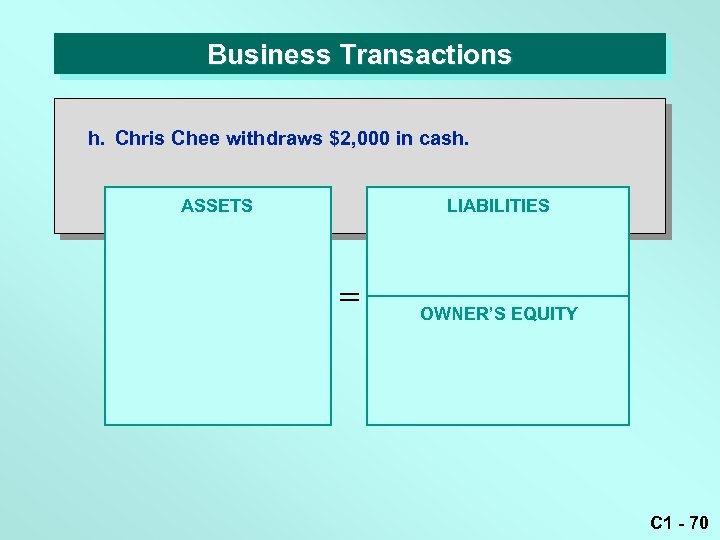

Business Transactions h. Chris Chee withdraws $2, 000 in cash. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 70

Business Transactions h. Chris Chee withdraws $2, 000 in cash. LIABILITIES ASSETS = OWNER’S EQUITY C 1 - 70

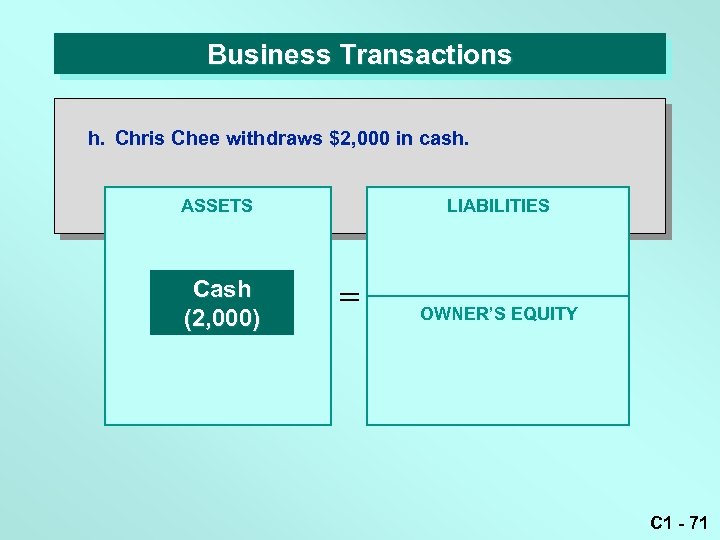

Business Transactions h. Chris Chee withdraws $2, 000 in cash. LIABILITIES ASSETS Cash (2, 000) = OWNER’S EQUITY C 1 - 71

Business Transactions h. Chris Chee withdraws $2, 000 in cash. LIABILITIES ASSETS Cash (2, 000) = OWNER’S EQUITY C 1 - 71

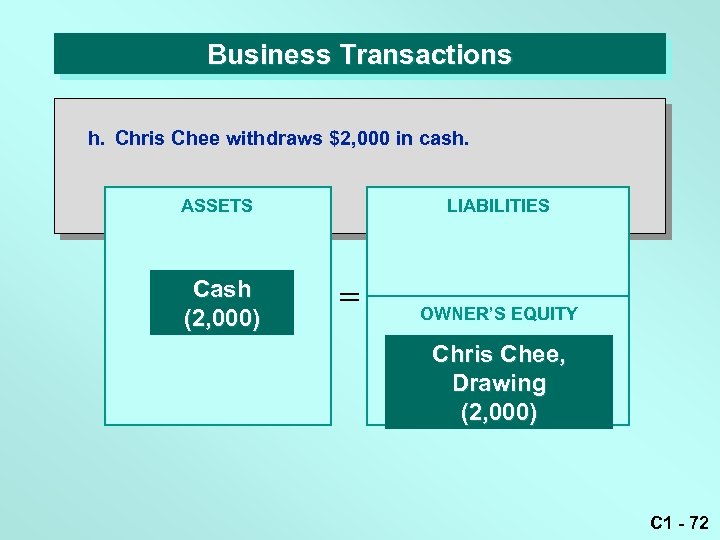

Business Transactions h. Chris Chee withdraws $2, 000 in cash. LIABILITIES ASSETS Cash (2, 000) = OWNER’S EQUITY Chris Chee, Drawing (2, 000) C 1 - 72

Business Transactions h. Chris Chee withdraws $2, 000 in cash. LIABILITIES ASSETS Cash (2, 000) = OWNER’S EQUITY Chris Chee, Drawing (2, 000) C 1 - 72

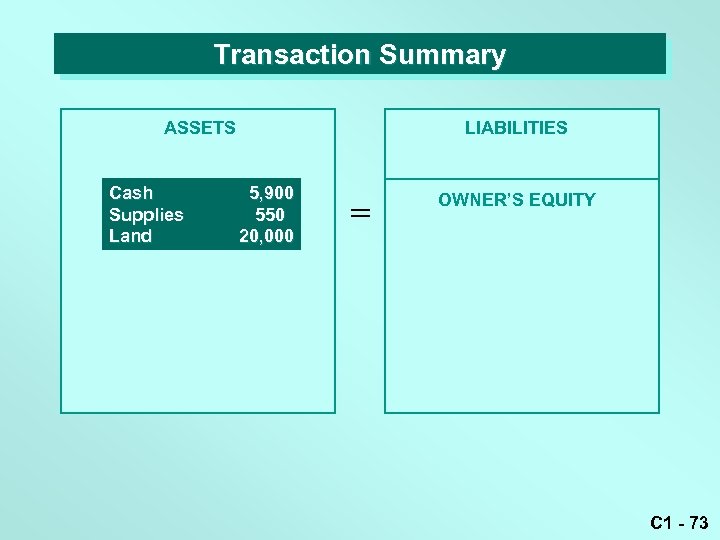

Transaction Summary LIABILITIES ASSETS Cash Supplies Land 5, 900 550 20, 000 = OWNER’S EQUITY C 1 - 73

Transaction Summary LIABILITIES ASSETS Cash Supplies Land 5, 900 550 20, 000 = OWNER’S EQUITY C 1 - 73

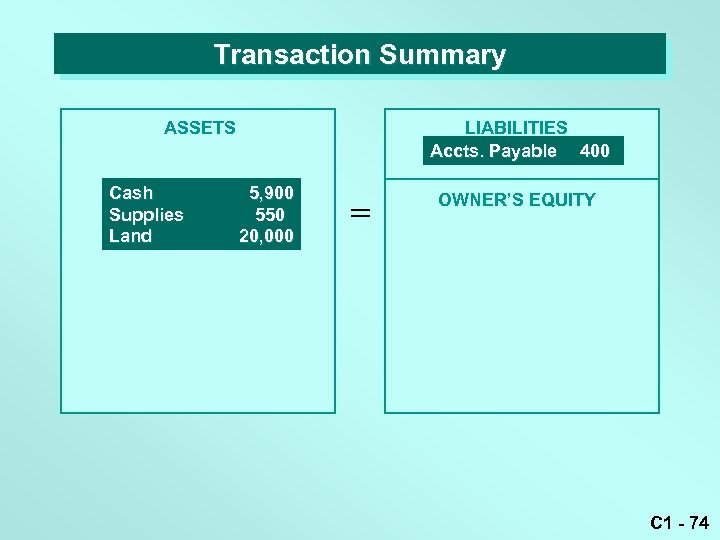

Transaction Summary LIABILITIES Accts. Payable 400 ASSETS Cash Supplies Land 5, 900 550 20, 000 = OWNER’S EQUITY C 1 - 74

Transaction Summary LIABILITIES Accts. Payable 400 ASSETS Cash Supplies Land 5, 900 550 20, 000 = OWNER’S EQUITY C 1 - 74

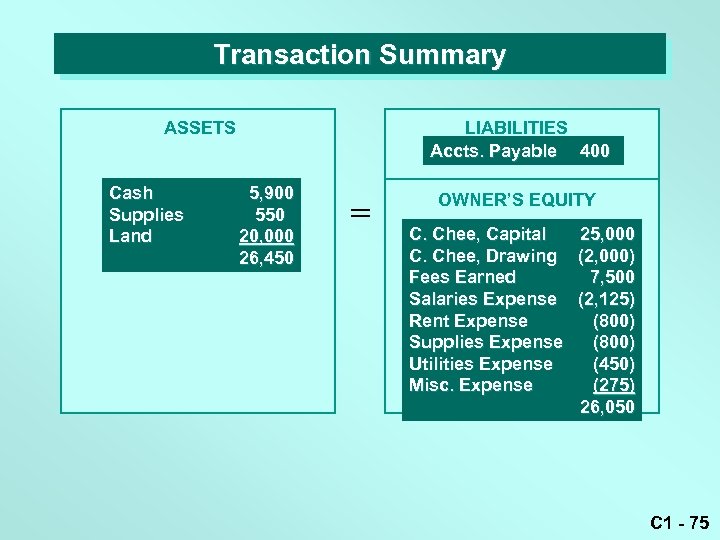

Transaction Summary LIABILITIES Accts. Payable 400 ASSETS Cash Supplies Land 5, 900 550 20, 000 26, 450 = OWNER’S EQUITY C. Chee, Capital 25, 000 C. Chee, Drawing (2, 000) Fees Earned 7, 500 Salaries Expense (2, 125) Rent Expense (800) Supplies Expense (800) Utilities Expense (450) Misc. Expense (275) 26, 050 C 1 - 75

Transaction Summary LIABILITIES Accts. Payable 400 ASSETS Cash Supplies Land 5, 900 550 20, 000 26, 450 = OWNER’S EQUITY C. Chee, Capital 25, 000 C. Chee, Drawing (2, 000) Fees Earned 7, 500 Salaries Expense (2, 125) Rent Expense (800) Supplies Expense (800) Utilities Expense (450) Misc. Expense (275) 26, 050 C 1 - 75

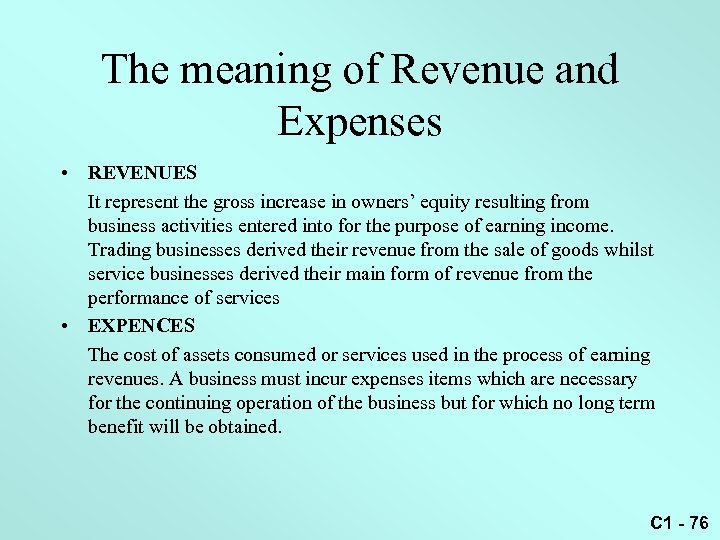

The meaning of Revenue and Expenses • REVENUES It represent the gross increase in owners’ equity resulting from business activities entered into for the purpose of earning income. Trading businesses derived their revenue from the sale of goods whilst service businesses derived their main form of revenue from the performance of services • EXPENCES The cost of assets consumed or services used in the process of earning revenues. A business must incur expenses items which are necessary for the continuing operation of the business but for which no long term benefit will be obtained. C 1 - 76

The meaning of Revenue and Expenses • REVENUES It represent the gross increase in owners’ equity resulting from business activities entered into for the purpose of earning income. Trading businesses derived their revenue from the sale of goods whilst service businesses derived their main form of revenue from the performance of services • EXPENCES The cost of assets consumed or services used in the process of earning revenues. A business must incur expenses items which are necessary for the continuing operation of the business but for which no long term benefit will be obtained. C 1 - 76

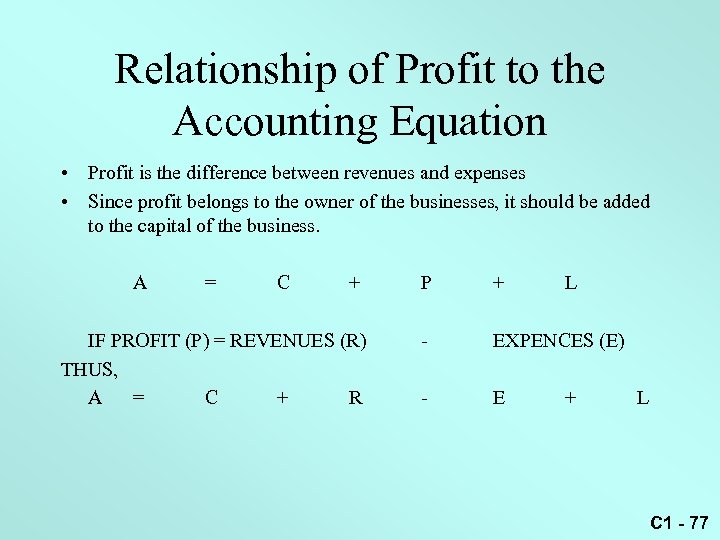

Relationship of Profit to the Accounting Equation • Profit is the difference between revenues and expenses • Since profit belongs to the owner of the businesses, it should be added to the capital of the business. A = C + IF PROFIT (P) = REVENUES (R) THUS, A = C + R P + L - EXPENCES (E) - E + L C 1 - 77

Relationship of Profit to the Accounting Equation • Profit is the difference between revenues and expenses • Since profit belongs to the owner of the businesses, it should be added to the capital of the business. A = C + IF PROFIT (P) = REVENUES (R) THUS, A = C + R P + L - EXPENCES (E) - E + L C 1 - 77

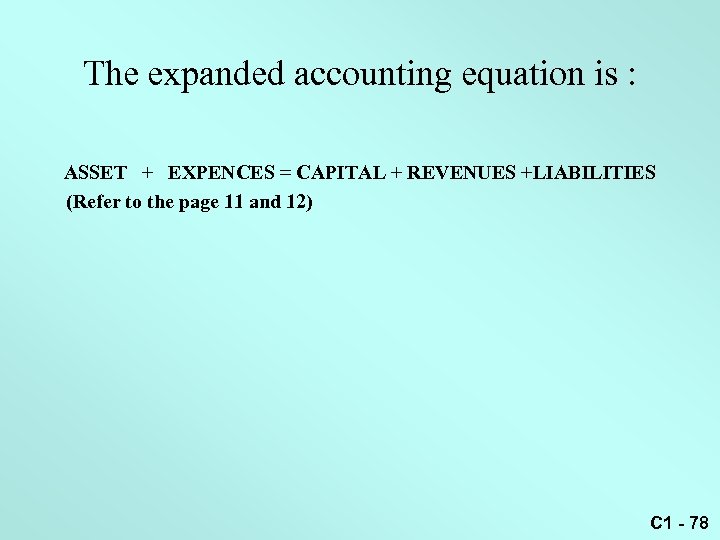

The expanded accounting equation is : ASSET + EXPENCES = CAPITAL + REVENUES +LIABILITIES (Refer to the page 11 and 12) C 1 - 78

The expanded accounting equation is : ASSET + EXPENCES = CAPITAL + REVENUES +LIABILITIES (Refer to the page 11 and 12) C 1 - 78

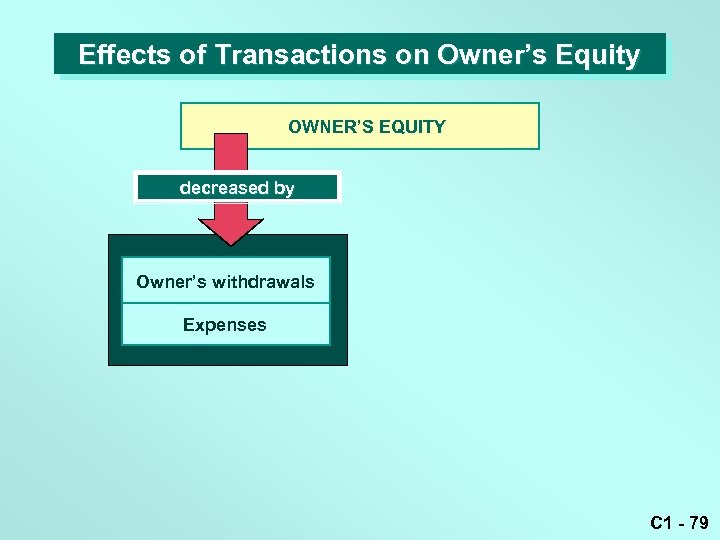

Effects of Transactions on Owner’s Equity OWNER’S EQUITY decreased by Owner’s withdrawals Expenses C 1 - 79

Effects of Transactions on Owner’s Equity OWNER’S EQUITY decreased by Owner’s withdrawals Expenses C 1 - 79

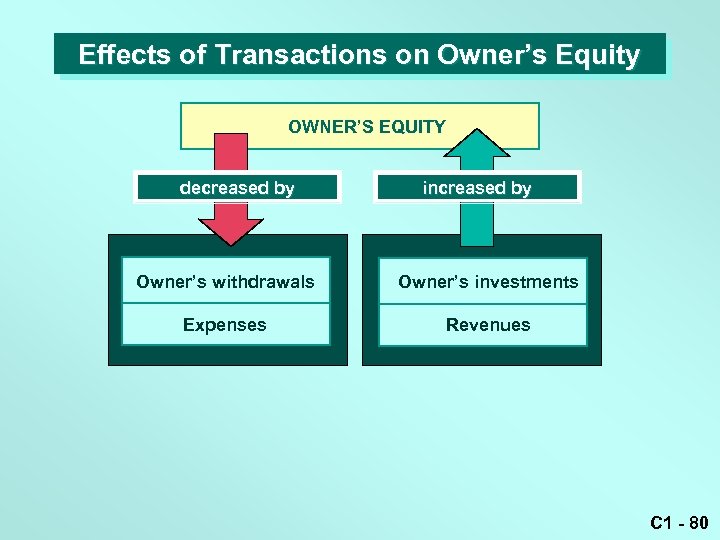

Effects of Transactions on Owner’s Equity OWNER’S EQUITY decreased by increased by Owner’s withdrawals Owner’s investments Expenses Revenues C 1 - 80

Effects of Transactions on Owner’s Equity OWNER’S EQUITY decreased by increased by Owner’s withdrawals Owner’s investments Expenses Revenues C 1 - 80

End of Chapter 1 and 2 C 1 - 81

End of Chapter 1 and 2 C 1 - 81