26afc7b8bb23b9ba7ffee1fb7abb53da.ppt

- Количество слайдов: 25

Chapter 1 Overview • What is: • Finance? • Financial Management? • Financial Intermediary Function (the cycle of money)?

Chapter 1 Overview • What is: • Finance? • Financial Management? • Financial Intermediary Function (the cycle of money)?

Chapter 1 Overview • Areas of Finance 1. Corporate Finance 2. Investments 3. Financial Institutions and Markets 4. International Finance

Chapter 1 Overview • Areas of Finance 1. Corporate Finance 2. Investments 3. Financial Institutions and Markets 4. International Finance

Chapter 1 Overview • What are the Financial Markets? • How they are classified? 1. The Type of Asset Traded • • Equity markets Debt markets Derivatives markets Foreign exchange markets 2. The Maturity of the Financial Asset • Money market • Capital market

Chapter 1 Overview • What are the Financial Markets? • How they are classified? 1. The Type of Asset Traded • • Equity markets Debt markets Derivatives markets Foreign exchange markets 2. The Maturity of the Financial Asset • Money market • Capital market

Chapter 1 Overview 3. The Owner of the Financial Asset • primary market • secondary market 4. The Nature/Type of the Transaction • dealer markets • auction markets

Chapter 1 Overview 3. The Owner of the Financial Asset • primary market • secondary market 4. The Nature/Type of the Transaction • dealer markets • auction markets

Chapter 1 Overview • Categories of Financial management: ü Capital Budgeting ü Capital Structure ü Working Capital Management

Chapter 1 Overview • Categories of Financial management: ü Capital Budgeting ü Capital Structure ü Working Capital Management

Chapter 1 Overview • The main Objective of the Finance Manager: Øfor public companies its maximizing the current stock price. Øfor private companies its maximizing the current market value of the company’s equity.

Chapter 1 Overview • The main Objective of the Finance Manager: Øfor public companies its maximizing the current stock price. Øfor private companies its maximizing the current market value of the company’s equity.

Chapter 1 Overview • The three main legal categories of business organizations: ü Sole proprietorship ü Partnership ü Corporation What are the advantages and disadvantages of each one?

Chapter 1 Overview • The three main legal categories of business organizations: ü Sole proprietorship ü Partnership ü Corporation What are the advantages and disadvantages of each one?

Chapter 1 Overview • The Agency Model ü Agency relationship ü Principal agent problem ü Agency theory ü Agency costs • How to solve the agency theory problem?

Chapter 1 Overview • The Agency Model ü Agency relationship ü Principal agent problem ü Agency theory ü Agency costs • How to solve the agency theory problem?

Chapter 3 Overview • One Equation, Four Variables PV = FV x 1/ (1+r)n FV = PV x (1+r)n r = [FV/PV]1/n – 1 n =[ln(FV/PV)/ln(1+r)]

Chapter 3 Overview • One Equation, Four Variables PV = FV x 1/ (1+r)n FV = PV x (1+r)n r = [FV/PV]1/n – 1 n =[ln(FV/PV)/ln(1+r)]

Chapter 3 Overview • Example 1: A friend promises to pay you $600 two years from now if you loan him $500 today. What annual interest rate is your friend offering? • Example 2: Assume that you purchase a 6 year, 8 percent savings certificate for $1, 000. If interest is compounded an nually, what will be the value of the certificate when it matures?

Chapter 3 Overview • Example 1: A friend promises to pay you $600 two years from now if you loan him $500 today. What annual interest rate is your friend offering? • Example 2: Assume that you purchase a 6 year, 8 percent savings certificate for $1, 000. If interest is compounded an nually, what will be the value of the certificate when it matures?

Chapter 3 Overview • Example 3: You have purchased a Treasury bond that will pay $10, 000 to your newborn child in 15 years. If this bond is discounted at a rate of 3. 875% per year, what is today's price (present value) for this bond? • Example 4: You currently have $2, 500 invested at an annual rate of 8%. How long will it take for this investment to grow to a value of $3, 500?

Chapter 3 Overview • Example 3: You have purchased a Treasury bond that will pay $10, 000 to your newborn child in 15 years. If this bond is discounted at a rate of 3. 875% per year, what is today's price (present value) for this bond? • Example 4: You currently have $2, 500 invested at an annual rate of 8%. How long will it take for this investment to grow to a value of $3, 500?

Chapter 3 Overview • Relationships between TVM variables: FV FV PV + r + n +

Chapter 3 Overview • Relationships between TVM variables: FV FV PV + r + n +

Chapter 3 Overview q. The rule of 72 • Example: You are offered an investment opportunity with the “guar antee” that your investment will double in 5 years. Assuming annual compounding, what annual rate of return would this investment provide?

Chapter 3 Overview q. The rule of 72 • Example: You are offered an investment opportunity with the “guar antee” that your investment will double in 5 years. Assuming annual compounding, what annual rate of return would this investment provide?

Chapter 4 Overview • Future Value of an Uneven Cash Flow Stream With unequal periodic cash flows, treat each of the cash flows as a lump sum and calculate its future value over the relevant number of periods. Sum up the individual future values to get the future value of the multiple payment streams.

Chapter 4 Overview • Future Value of an Uneven Cash Flow Stream With unequal periodic cash flows, treat each of the cash flows as a lump sum and calculate its future value over the relevant number of periods. Sum up the individual future values to get the future value of the multiple payment streams.

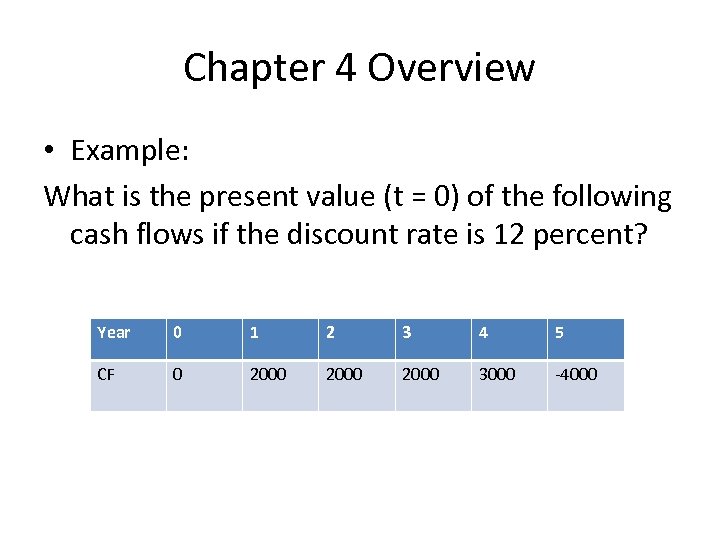

Chapter 4 Overview • Example: What is the present value (t = 0) of the following cash flows if the discount rate is 12 percent? Year 0 1 2 3 4 5 CF 0 2000 3000 4000

Chapter 4 Overview • Example: What is the present value (t = 0) of the following cash flows if the discount rate is 12 percent? Year 0 1 2 3 4 5 CF 0 2000 3000 4000

Chapter 4 Overview • Future Value of an Annuity Stream - Annuity due: at the start of each period as is true of rent and insurance payments. - Ordinary annuity: at the end of each period as in the case of mortgage and loan payments.

Chapter 4 Overview • Future Value of an Annuity Stream - Annuity due: at the start of each period as is true of rent and insurance payments. - Ordinary annuity: at the end of each period as in the case of mortgage and loan payments.

Chapter 4 Overview • PV ordinary annuity = PMT * PVIFA • FV ordinary annuity = PMT * FVIFA • PV annuity due = PMT * PVIFA* (1 + r) • FV annuity due = PMT * PVIFA * (1 + r)

Chapter 4 Overview • PV ordinary annuity = PMT * PVIFA • FV ordinary annuity = PMT * FVIFA • PV annuity due = PMT * PVIFA* (1 + r) • FV annuity due = PMT * PVIFA * (1 + r)

Chapter 4 Overview • Example: a. You decide to begin saving toward the purchase of a new car in 5 years. If you put $1, 000 at the end of each of the next 5 years in a savings account paying 6 percent compounded annually, how much will you accumulate after 5 years? b. What would be the ending amount if the payments were made at the beginning of each year?

Chapter 4 Overview • Example: a. You decide to begin saving toward the purchase of a new car in 5 years. If you put $1, 000 at the end of each of the next 5 years in a savings account paying 6 percent compounded annually, how much will you accumulate after 5 years? b. What would be the ending amount if the payments were made at the beginning of each year?

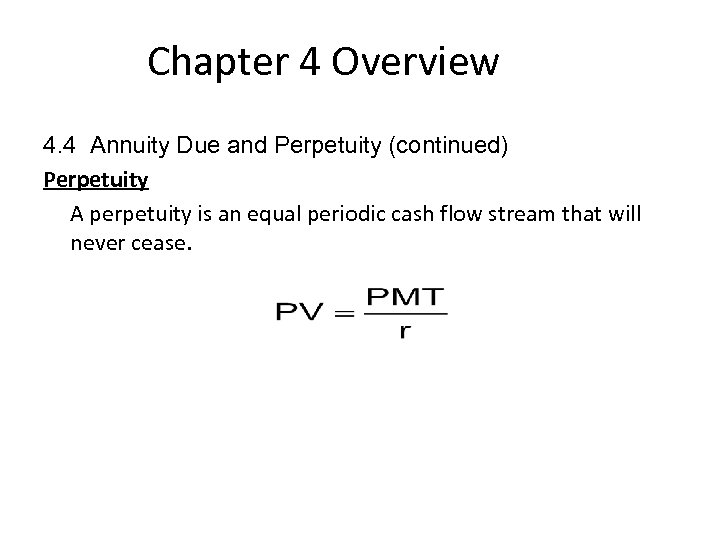

Chapter 4 Overview 4. 4 Annuity Due and Perpetuity (continued) Perpetuity A perpetuity is an equal periodic cash flow stream that will never cease.

Chapter 4 Overview 4. 4 Annuity Due and Perpetuity (continued) Perpetuity A perpetuity is an equal periodic cash flow stream that will never cease.

Chapter 4 Overview 4. 5 Three Payment Methods Loan payments can be structured in one of 3 ways: 1) Discount loan • Principal and interest is paid in lump sum at end 2) Interest only loan • Periodic interest only payments, with principal due at end 3) Amortized loan • Equal periodic payments of principal and interest

Chapter 4 Overview 4. 5 Three Payment Methods Loan payments can be structured in one of 3 ways: 1) Discount loan • Principal and interest is paid in lump sum at end 2) Interest only loan • Periodic interest only payments, with principal due at end 3) Amortized loan • Equal periodic payments of principal and interest

Chapter 4 Overview q Amortization Schedules • Example: Your company is planning to borrow $1, 000 on a 5 year, 15 percent, annual payment, fully amortized term loan. a. What amount of the payment made at the end of the second year will represent repayment of principal? b. what will be the amount of yearly payment? c. what will be the ending balance of the loan at year 2?

Chapter 4 Overview q Amortization Schedules • Example: Your company is planning to borrow $1, 000 on a 5 year, 15 percent, annual payment, fully amortized term loan. a. What amount of the payment made at the end of the second year will represent repayment of principal? b. what will be the amount of yearly payment? c. what will be the ending balance of the loan at year 2?

Chapter 5 Overview q The Effective Annual Rate (EAR) • Example 1: What is the effective annual percentage rate (EAR) of 12 percent compounded monthly?

Chapter 5 Overview q The Effective Annual Rate (EAR) • Example 1: What is the effective annual percentage rate (EAR) of 12 percent compounded monthly?

Chapter 5 Overview • Example 2: If you would like to accumulate $7, 500 over the next 5 years, how much must you deposit each six months, starting six months from now, given a 6 percent interest rate and semiannual compounding?

Chapter 5 Overview • Example 2: If you would like to accumulate $7, 500 over the next 5 years, how much must you deposit each six months, starting six months from now, given a 6 percent interest rate and semiannual compounding?

Chapter 5 Overview q Nominal and Real Interest Rates (1 + r) = (1 + r*) x (1 + h) • The nominal risk free rate of interest on a Treasury bill includes the real rate of interest and the inflation premium. Rf=r*+inf • The nominal rate of interest on a Treasury bond includes the real rate of interest, the inflation premium and maturity premium. Rf=r*+inf +mp • The rate of return on all other riskier investments (r) would have to include a default risk premium (dp) and a maturity risk premium (mp) r = r* + inf + dp + mp

Chapter 5 Overview q Nominal and Real Interest Rates (1 + r) = (1 + r*) x (1 + h) • The nominal risk free rate of interest on a Treasury bill includes the real rate of interest and the inflation premium. Rf=r*+inf • The nominal rate of interest on a Treasury bond includes the real rate of interest, the inflation premium and maturity premium. Rf=r*+inf +mp • The rate of return on all other riskier investments (r) would have to include a default risk premium (dp) and a maturity risk premium (mp) r = r* + inf + dp + mp

Chapter 5 Overview • Example 1: If the interest rate of a 10 years corporate bond is 12% and the interest rate of a 15 years corporate bond is 16%, given that both have the same credit rating (e. g. both have AA credit rating), what is the maturity risk premium? • Example 2: If the risk free rate on T bills is 2%, the interest rate on a 10 years Treasury bond is 6% and the interest rate on a BBB 10 years corporate bond is 9%, the maturity risk premium is …………. . and the default risk premium is ………….

Chapter 5 Overview • Example 1: If the interest rate of a 10 years corporate bond is 12% and the interest rate of a 15 years corporate bond is 16%, given that both have the same credit rating (e. g. both have AA credit rating), what is the maturity risk premium? • Example 2: If the risk free rate on T bills is 2%, the interest rate on a 10 years Treasury bond is 6% and the interest rate on a BBB 10 years corporate bond is 9%, the maturity risk premium is …………. . and the default risk premium is ………….