6993bddeb93fe84e8c0d50ce57c6e975.ppt

- Количество слайдов: 28

Chapter 1 Introduction

Chapter 1 Introduction

Types of Assets z. Tangible Assets y. Value is based on physical properties y. Examples include buildings, land, machinery z. Intangible Assets y. Claim to future income generated (ultimately) by tangible asset(s) y. Examples include financial assets

Types of Assets z. Tangible Assets y. Value is based on physical properties y. Examples include buildings, land, machinery z. Intangible Assets y. Claim to future income generated (ultimately) by tangible asset(s) y. Examples include financial assets

Types of Financial Assets z. Bank loans z. Common stock z. Government bonds z. Preferred stock z. Corporate bonds z. Foreign stock z. Municipal bonds z. Foreign bond

Types of Financial Assets z. Bank loans z. Common stock z. Government bonds z. Preferred stock z. Corporate bonds z. Foreign stock z. Municipal bonds z. Foreign bond

Debt vs. Equity z. Debt Instruments y. Fixed dollar payments (‘fixed income’) y. Examples include loans, bonds z. Equity Claims y. Dollar payment is based on earnings y. Residual (varying) claims y. Examples include common stock, partnership share

Debt vs. Equity z. Debt Instruments y. Fixed dollar payments (‘fixed income’) y. Examples include loans, bonds z. Equity Claims y. Dollar payment is based on earnings y. Residual (varying) claims y. Examples include common stock, partnership share

Price of Financial Asset and Risk z. The price or value of a financial asset is equal to the present value of all expected future cash flows. y. Expected rate of return y. Risk of expected cash flow

Price of Financial Asset and Risk z. The price or value of a financial asset is equal to the present value of all expected future cash flows. y. Expected rate of return y. Risk of expected cash flow

Types of Investment Risks z. Purchasing power risk = inflation risk z. Default risk = credit risk (special case of PP risk) z. Exchange rate risk = currency risk

Types of Investment Risks z. Purchasing power risk = inflation risk z. Default risk = credit risk (special case of PP risk) z. Exchange rate risk = currency risk

Role of Financial Assets z. Transfer funds from those with more money than projects to those with more projects than money. z. Share unavoidable risk associated with cash flows. y. Equity holders bear inflation risk y. Debt holders bear default risk y. Both may bear exchange rate risk

Role of Financial Assets z. Transfer funds from those with more money than projects to those with more projects than money. z. Share unavoidable risk associated with cash flows. y. Equity holders bear inflation risk y. Debt holders bear default risk y. Both may bear exchange rate risk

Role of (Financial) Markets z. Provide liquidity: buyers and sellers all in one ‘place’. zprice discovery efficient resource allocation z. Reduce transactions costs: ysearch costs yinformation costs (market efficiency)

Role of (Financial) Markets z. Provide liquidity: buyers and sellers all in one ‘place’. zprice discovery efficient resource allocation z. Reduce transactions costs: ysearch costs yinformation costs (market efficiency)

Classification of Financial Markets z. Nature of asset: debt vs. equity markets z. Maturity: money (short) vs. capital (long) markets z. Seasoning: primary vs. secondary markets z. Delivery: cash (= spot) vs. derivatives markets z. Structure: auction vs. over-the-counter (OTC) vs. intermediated markets

Classification of Financial Markets z. Nature of asset: debt vs. equity markets z. Maturity: money (short) vs. capital (long) markets z. Seasoning: primary vs. secondary markets z. Delivery: cash (= spot) vs. derivatives markets z. Structure: auction vs. over-the-counter (OTC) vs. intermediated markets

Financial Market Participants z. Households z. Business units z. Federal, state, and local governments z. Government agencies z. Supranationals (= multilaterals) z. Regulators (broader definition)

Financial Market Participants z. Households z. Business units z. Federal, state, and local governments z. Government agencies z. Supranationals (= multilaterals) z. Regulators (broader definition)

Globalization of Financial Markets z. In general, easier for investors to move capital internationally z. Causes: y. Deregulation (liberalization) of financial markets (e. g. currency controls) y. Technological advances y. Increased role of institutional investors (economies of scale), inc. Cal. PERS

Globalization of Financial Markets z. In general, easier for investors to move capital internationally z. Causes: y. Deregulation (liberalization) of financial markets (e. g. currency controls) y. Technological advances y. Increased role of institutional investors (economies of scale), inc. Cal. PERS

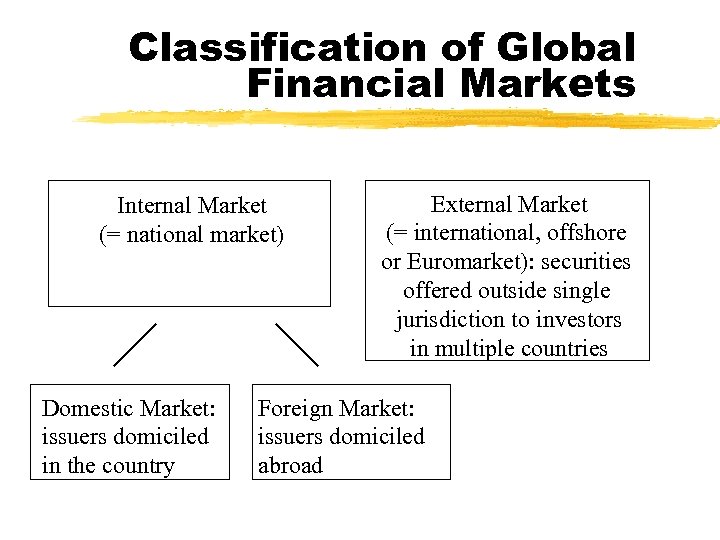

Classification of Global Financial Markets Internal Market (= national market) Domestic Market: issuers domiciled in the country External Market (= international, offshore or Euromarket): securities offered outside single jurisdiction to investors in multiple countries Foreign Market: issuers domiciled abroad

Classification of Global Financial Markets Internal Market (= national market) Domestic Market: issuers domiciled in the country External Market (= international, offshore or Euromarket): securities offered outside single jurisdiction to investors in multiple countries Foreign Market: issuers domiciled abroad

Motivation for Using Foreign Markets and Euromarkets z. Limited fund availability in internal market (esp. in poorer countries) z. Reduced cost of funds z. Diversifying funding sources (portfolio reduces risk)

Motivation for Using Foreign Markets and Euromarkets z. Limited fund availability in internal market (esp. in poorer countries) z. Reduced cost of funds z. Diversifying funding sources (portfolio reduces risk)

Derivatives Market z. Derivatives’ value depends on underlying (financial) asset z. Futures/forward contracts: parties agree to buy/sell at an agreed price and date. z. Options contracts: rights (not obligations) to buy (call) or sell (put) at an agreed price on/by an agreed date.

Derivatives Market z. Derivatives’ value depends on underlying (financial) asset z. Futures/forward contracts: parties agree to buy/sell at an agreed price and date. z. Options contracts: rights (not obligations) to buy (call) or sell (put) at an agreed price on/by an agreed date.

Role of Derivative Instruments z. Buy/sell risk (e. g. purchasing power risk, interest rate risk, exchange rate risk) z`Zero sum’ z. However, there are still advantages: y. May be lower transactions costs y. Can be faster to transact than cash market y. Greater liquidity y. Allows great scope for financial innovation…

Role of Derivative Instruments z. Buy/sell risk (e. g. purchasing power risk, interest rate risk, exchange rate risk) z`Zero sum’ z. However, there are still advantages: y. May be lower transactions costs y. Can be faster to transact than cash market y. Greater liquidity y. Allows great scope for financial innovation…

Chapter 2 Financial Intermediaries and Financial Innovation

Chapter 2 Financial Intermediaries and Financial Innovation

Services of Financial Institutions z. Financial intermediaries transform financial assets (then their liabilities): inc. deposits, insurance, pensions z. Help create, launch financial assets (underwriter) z. Trade financial assets for customers (broker) z. Trade their own financial assets (dealer) z. Provide investment advice

Services of Financial Institutions z. Financial intermediaries transform financial assets (then their liabilities): inc. deposits, insurance, pensions z. Help create, launch financial assets (underwriter) z. Trade financial assets for customers (broker) z. Trade their own financial assets (dealer) z. Provide investment advice

Role of Financial Intermediaries z. Obtain funds (their liabilities, e. g. deposits) & invest them (their assets, e. g. loans): transfer funds from savers to investors z. Direct investment ye. g. bank buys corporate stocks or bonds z Indirect investment ye. g. individual deposits money in a bank that buys…

Role of Financial Intermediaries z. Obtain funds (their liabilities, e. g. deposits) & invest them (their assets, e. g. loans): transfer funds from savers to investors z. Direct investment ye. g. bank buys corporate stocks or bonds z Indirect investment ye. g. individual deposits money in a bank that buys…

Intermediaries and asset transformation z. Maturity intermediation y. Many short term deposits = a long term loan y. Longer loan terms usually more expensive z. Reducing risk by diversification yportfolio, covariance, marriage [? ] z. Specialization reduces costs: contracting and information processing, etc. z. Enable non-cash payments (cheques, plastic)

Intermediaries and asset transformation z. Maturity intermediation y. Many short term deposits = a long term loan y. Longer loan terms usually more expensive z. Reducing risk by diversification yportfolio, covariance, marriage [? ] z. Specialization reduces costs: contracting and information processing, etc. z. Enable non-cash payments (cheques, plastic)

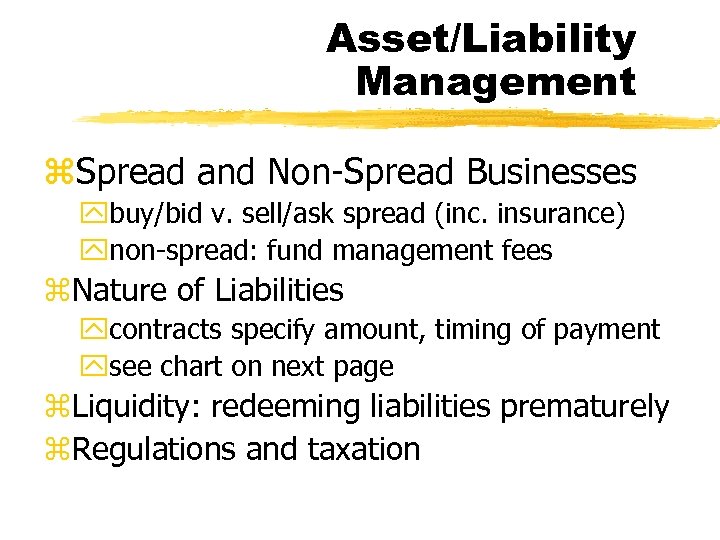

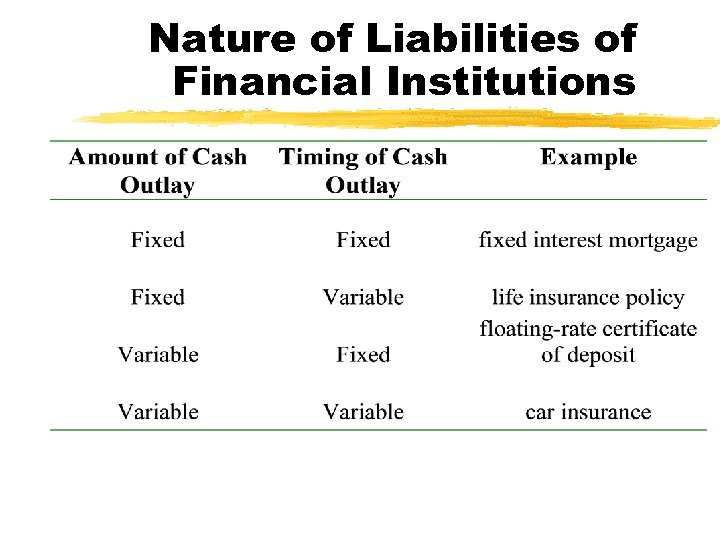

Asset/Liability Management z. Spread and Non-Spread Businesses ybuy/bid v. sell/ask spread (inc. insurance) ynon-spread: fund management fees z. Nature of Liabilities ycontracts specify amount, timing of payment ysee chart on next page z. Liquidity: redeeming liabilities prematurely z. Regulations and taxation

Asset/Liability Management z. Spread and Non-Spread Businesses ybuy/bid v. sell/ask spread (inc. insurance) ynon-spread: fund management fees z. Nature of Liabilities ycontracts specify amount, timing of payment ysee chart on next page z. Liquidity: redeeming liabilities prematurely z. Regulations and taxation

Nature of Liabilities of Financial Institutions

Nature of Liabilities of Financial Institutions

Categories of Financial Innovation (Economic Council of Canada) z. Market-broadening instruments yattract new investors z. Risk-management instruments yre-allocate risk z. Arbitraging instruments and processes yfacilitate arbitrage

Categories of Financial Innovation (Economic Council of Canada) z. Market-broadening instruments yattract new investors z. Risk-management instruments yre-allocate risk z. Arbitraging instruments and processes yfacilitate arbitrage

Categories of Financial Innovation (BIS) z Price-risk-transferring innovations yfor price/exchange rate risk z Credit-risk-transferring instruments z Liquidity-generating innovations yinc. by avoiding regulatory constraints z Credit-generating instruments (debt funds) z Equity-generating instruments (capital base)

Categories of Financial Innovation (BIS) z Price-risk-transferring innovations yfor price/exchange rate risk z Credit-risk-transferring instruments z Liquidity-generating innovations yinc. by avoiding regulatory constraints z Credit-generating instruments (debt funds) z Equity-generating instruments (capital base)

Causes of Financial Innovation z Financial innovation is a form of innovation z Reasons to innovate: yimprove products (e. g. cut costs, including taxes – v. ‘Rules in OECD Countries to Prevent Avoidance of Corporate Income Tax’, Thuronyi) ydifferentiate products z Explosion in financial products since 1980 s: ytheoretical developments (e. g. Black-Scholes) more sophisticated market participants ytechnical developments: computers, IT yderegulation greater competition by intermediaries yincreased risk [? ]: see chart on next page z Changing global patterns of financial wealth

Causes of Financial Innovation z Financial innovation is a form of innovation z Reasons to innovate: yimprove products (e. g. cut costs, including taxes – v. ‘Rules in OECD Countries to Prevent Avoidance of Corporate Income Tax’, Thuronyi) ydifferentiate products z Explosion in financial products since 1980 s: ytheoretical developments (e. g. Black-Scholes) more sophisticated market participants ytechnical developments: computers, IT yderegulation greater competition by intermediaries yincreased risk [? ]: see chart on next page z Changing global patterns of financial wealth

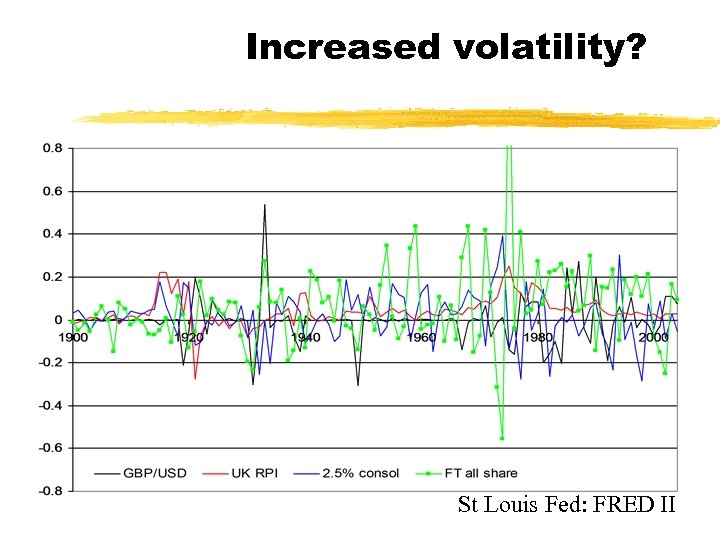

Increased volatility? St Louis Fed: FRED II

Increased volatility? St Louis Fed: FRED II

![Asset Securitization z Securitization: y“homogenizing and packaging financial instruments into a new fungible [interchangeable] Asset Securitization z Securitization: y“homogenizing and packaging financial instruments into a new fungible [interchangeable]](https://present5.com/presentation/6993bddeb93fe84e8c0d50ce57c6e975/image-26.jpg) Asset Securitization z Securitization: y“homogenizing and packaging financial instruments into a new fungible [interchangeable] one” (Barkley International Inc. ) z Many institutions instead of a single one: ybank A makes home mortgages ybank A hires bank B to issue securities backed by the mortgages ybank A buys credit risk insurance ybank A sells loan servicing right

Asset Securitization z Securitization: y“homogenizing and packaging financial instruments into a new fungible [interchangeable] one” (Barkley International Inc. ) z Many institutions instead of a single one: ybank A makes home mortgages ybank A hires bank B to issue securities backed by the mortgages ybank A buys credit risk insurance ybank A sells loan servicing right

Benefits to Issuers z. Specialization/out-source to focus on ‘core competences’: service fees (to collect & forward payments…)? z. Diversification reduces risks, hence costs z. Manage risk-based capital requirements z. Manage interest rate volatility

Benefits to Issuers z. Specialization/out-source to focus on ‘core competences’: service fees (to collect & forward payments…)? z. Diversification reduces risks, hence costs z. Manage risk-based capital requirements z. Manage interest rate volatility

Other Benefits z. To Investors (buyers of securities) ygreater liquidity yreduced credit risk z. To Borrowers ylower lending rate spreads z. Social Benefits ye. g. `viatical settlement’: trade life insurance benefits

Other Benefits z. To Investors (buyers of securities) ygreater liquidity yreduced credit risk z. To Borrowers ylower lending rate spreads z. Social Benefits ye. g. `viatical settlement’: trade life insurance benefits