8536c75a21e569f76e84ccc00183ca4b.ppt

- Количество слайдов: 13

Chapter 1 Introduction to Derivatives

Chapter 1 Introduction to Derivatives

What Is a Derivative? • Definition An agreement between two parties which has a value determined by the price of something else • Types Options, futures and swaps • Uses Risk management Speculation Reduce transaction costs Regulatory arbitrage Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 2

What Is a Derivative? • Definition An agreement between two parties which has a value determined by the price of something else • Types Options, futures and swaps • Uses Risk management Speculation Reduce transaction costs Regulatory arbitrage Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 2

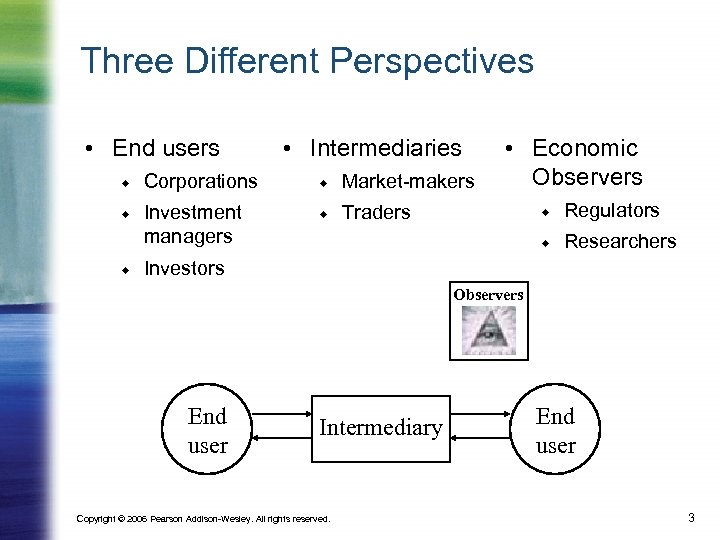

Three Different Perspectives • End users Corporations Investment managers • Intermediaries Market-makers • Economic Observers Traders Regulators Researchers Investors Observers End user Intermediary Copyright © 2006 Pearson Addison-Wesley. All rights reserved. End user 3

Three Different Perspectives • End users Corporations Investment managers • Intermediaries Market-makers • Economic Observers Traders Regulators Researchers Investors Observers End user Intermediary Copyright © 2006 Pearson Addison-Wesley. All rights reserved. End user 3

Financial Engineering • The construction of a financial product from other products • New securities can be designed by using existing securities • Financial engineering principles Facilitate hedging of existing positions Enable understanding of complex positions Allow for creation of customized products Render regulation less effective Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 4

Financial Engineering • The construction of a financial product from other products • New securities can be designed by using existing securities • Financial engineering principles Facilitate hedging of existing positions Enable understanding of complex positions Allow for creation of customized products Render regulation less effective Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 4

The Role of Financial Markets • Insurance companies and individual communities/families have traditionally helped each other to share risks • Markets make risk-sharing more efficient Diversifiable risks vanish Non-diversifiable risks are reallocated • Recent example: earthquake bonds by Walt Disney in Japan Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 5

The Role of Financial Markets • Insurance companies and individual communities/families have traditionally helped each other to share risks • Markets make risk-sharing more efficient Diversifiable risks vanish Non-diversifiable risks are reallocated • Recent example: earthquake bonds by Walt Disney in Japan Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 5

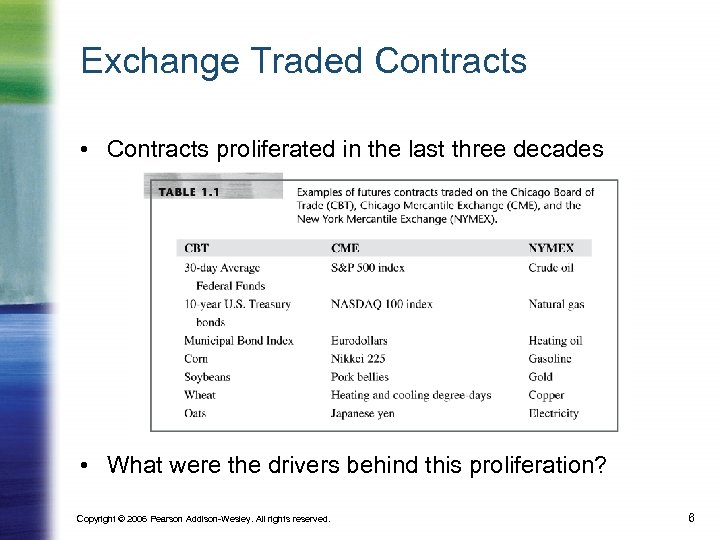

Exchange Traded Contracts • Contracts proliferated in the last three decades • What were the drivers behind this proliferation? Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 6

Exchange Traded Contracts • Contracts proliferated in the last three decades • What were the drivers behind this proliferation? Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 6

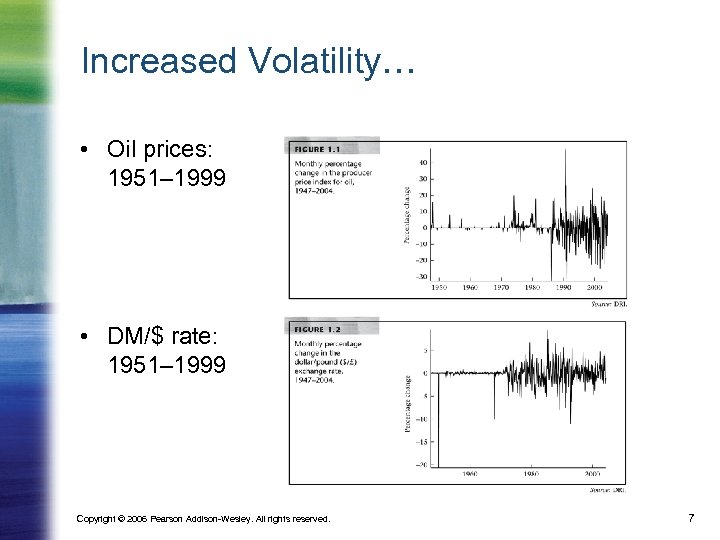

Increased Volatility… • Oil prices: 1951– 1999 • DM/$ rate: 1951– 1999 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 7

Increased Volatility… • Oil prices: 1951– 1999 • DM/$ rate: 1951– 1999 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 7

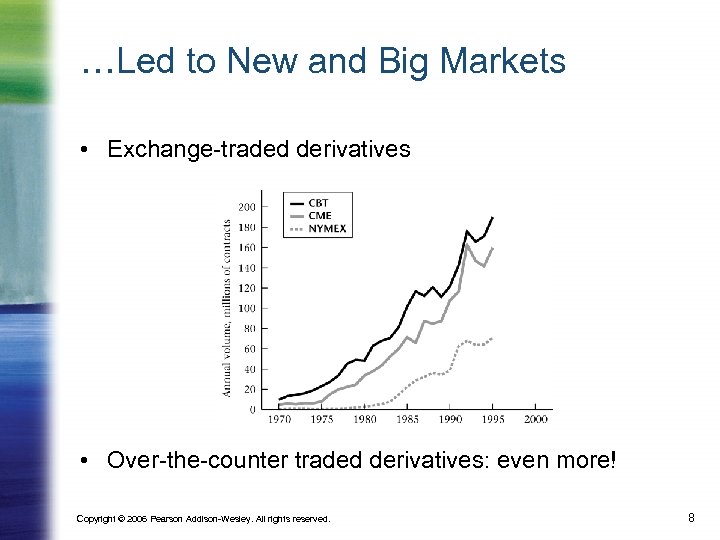

…Led to New and Big Markets • Exchange-traded derivatives • Over-the-counter traded derivatives: even more! Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 8

…Led to New and Big Markets • Exchange-traded derivatives • Over-the-counter traded derivatives: even more! Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 8

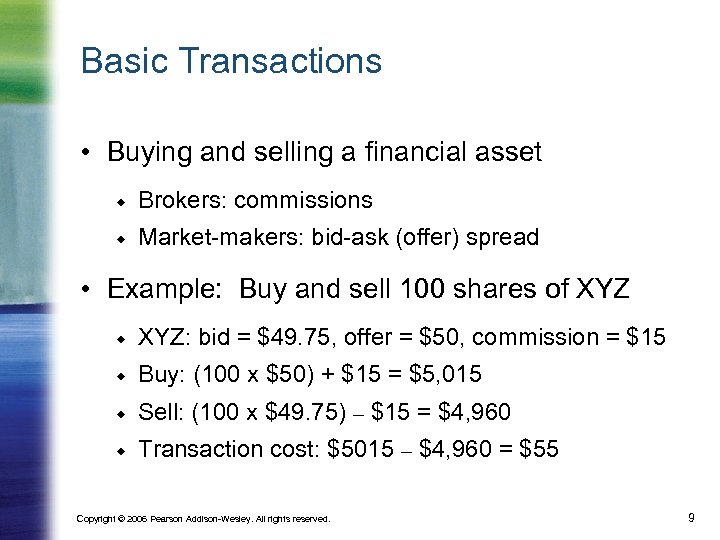

Basic Transactions • Buying and selling a financial asset Brokers: commissions Market-makers: bid-ask (offer) spread • Example: Buy and sell 100 shares of XYZ: bid = $49. 75, offer = $50, commission = $15 Buy: (100 x $50) + $15 = $5, 015 Sell: (100 x $49. 75) – $15 = $4, 960 Transaction cost: $5015 – $4, 960 = $55 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 9

Basic Transactions • Buying and selling a financial asset Brokers: commissions Market-makers: bid-ask (offer) spread • Example: Buy and sell 100 shares of XYZ: bid = $49. 75, offer = $50, commission = $15 Buy: (100 x $50) + $15 = $5, 015 Sell: (100 x $49. 75) – $15 = $4, 960 Transaction cost: $5015 – $4, 960 = $55 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 9

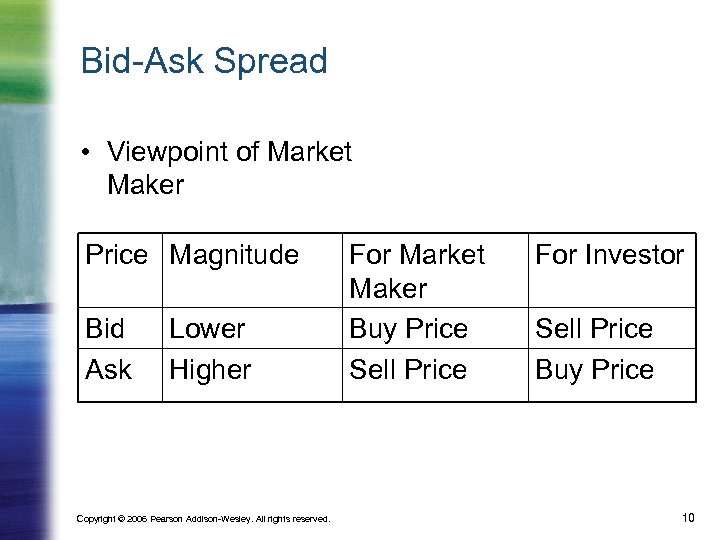

Bid-Ask Spread • Viewpoint of Market Maker Price Magnitude Bid Ask Lower Higher Copyright © 2006 Pearson Addison-Wesley. All rights reserved. For Market Maker Buy Price Sell Price For Investor Sell Price Buy Price 10

Bid-Ask Spread • Viewpoint of Market Maker Price Magnitude Bid Ask Lower Higher Copyright © 2006 Pearson Addison-Wesley. All rights reserved. For Market Maker Buy Price Sell Price For Investor Sell Price Buy Price 10

Short-Selling • Long Position or “Go Long” You pay money up front. • Short Sale or Short or Go Short or Short Position You collect money up front Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 11

Short-Selling • Long Position or “Go Long” You pay money up front. • Short Sale or Short or Go Short or Short Position You collect money up front Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 11

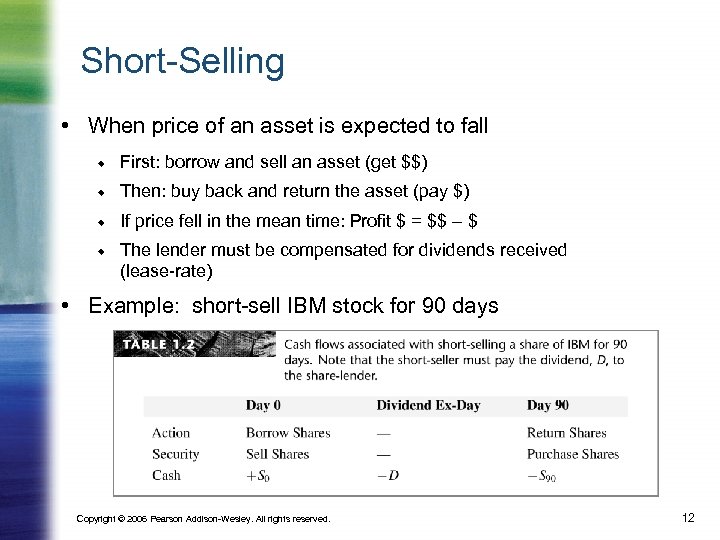

Short-Selling • When price of an asset is expected to fall First: borrow and sell an asset (get $$) Then: buy back and return the asset (pay $) If price fell in the mean time: Profit $ = $$ – $ The lender must be compensated for dividends received (lease-rate) • Example: short-sell IBM stock for 90 days Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 12

Short-Selling • When price of an asset is expected to fall First: borrow and sell an asset (get $$) Then: buy back and return the asset (pay $) If price fell in the mean time: Profit $ = $$ – $ The lender must be compensated for dividends received (lease-rate) • Example: short-sell IBM stock for 90 days Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 12

Short-Selling (cont’d) • Why short-sell? Speculation Financing Hedging • Credit risk in short-selling Collateral and “haircut” • Interest received from lender on collateral Spread is additional cost Scarcity decreases the interest rate Repo rate in bond markets Short rebate in the stock market Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13

Short-Selling (cont’d) • Why short-sell? Speculation Financing Hedging • Credit risk in short-selling Collateral and “haircut” • Interest received from lender on collateral Spread is additional cost Scarcity decreases the interest rate Repo rate in bond markets Short rebate in the stock market Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13