87480409f2e096cdb6f729d21942ea8c.ppt

- Количество слайдов: 28

Chapter 1 Introduction to College Accounting

Basics of Business • Business an organization that provides a good or service. Objective: make a profit – Profit = Revenue – expenses, where revenue are greater than expenses • Revenues: amounts received from customers for goods/services provided • Expenses: amounts paid for inputs used to provided goods/services – Many businesses have a net loss (expenses>revenues) in the first years of operation

Starting a business: Decisions to make…. A. Types of Business (for profit) i. Manufacturing: Change inputs/make/assemble into a product (FORD) ii. Merchandising: Purchase products from a business and sell to customers (Abercrombie and Fitch) iii. Service: Sell intangible product (Barber)

Decisions to make continued… B. Organization/Forms 1. Proprietorship: owned by one person (owner is called a proprietor) • • • Most popular/common form Easy to organize, low cost Taxed once Limited resource Unlimited liability (owner’s personal assets at risk)

Organization/forms 2. Partnership: owned by two or more, owners called partners • • • Least popular form More financial resources than single owner Same pos. /neg. as proprietorship 3. Corporation: organized by gov’t laws as a separate legal taxable entity, owners called shareholders or stakeholders • • • More financial resources Limited liability (shareholders personal assets, other than value of shares, are not at risk Double taxation

Organization/forms (continued) 4. Limited liability corporation (LLC): organized as a corporation, but taxed like a partnership **Ownership in any type of business is generally called equity

Decisions to make… C. Business Strategy: i. Low-cost: sells products at a lower cost than competitors (Kia) ii. Differentiation: sells product that possesses a unique quality (BMW) iii. Combination: attributes of both (Ford) D. Value Chain: how a business adds value for customers

Who will take an interest in your business? • Stakeholders: people who will take an interest in the financial performance of the business – Owner(s): profit or return on their investment – Managers: operate business, job status is usually evaluated based on performance of business – Employees: job depends on performance, lay offs in economic downturns – Customers: will company continue to exist – Creditors (people we owe $ to): may invest in the company (provide loans), can business pay back? – Government: business meeting regulations, collecting/paying taxes

Role of Accounting • Accounting: info system that provides reports to stakeholders about the financial activities/condition of business. ACCOUNTING helps stakeholders make informed decisions. • The profession: – Accountants must be ethical (Ethics: moral principles that guide people, right vs. wrong)

Accounting profession (continued) Private vs. Public Accounting • Private: work for one organization. May have various duties depending upon position within company. Tax, managerial, audit. Chief accountant usually called the controller. • Public: provide acctg services to many clients/business. Can practice as an individual or public acctg firm. Most are CPAs

Accounting profession (continued) • Specialized fields – Financial: recording and reporting financial info, reports are issued to stakeholders – Managerial: uses financial acctg and estimated data to aid management in running a business – Tax – Accounting systems – Forensic – Not-for-profit

Accounting profession (continued) • Generally accepted accounting principles (GAAP): rules accountants follow so that all reporting is comparable to other business. • The Financial Accounting Standards Board (FASB) is the primary authority for developing (GAAP). – Important acctg concepts: • Business entity concept: the business is a separate entity from owner(s) • Cost concept: record $ you paid/owe for an item • Objectivity concept: acctg info is based on nonbiased evidence • Unit of measurement concept: data to be recorded in term sof dollars

The Accounting Equation Assets = Liabilities + Owner’s Equity ALOE Can be rewritten assets-liab. =owner’s equity • Assets: resources (that have value) owned by a business Ex) Money, land, vehicles, computers, buildings, merchandise inventory, supplies, patent, etc. Where do assets come from? • Use one asset to buy/sell another asset (i. e. , money used to buy a car). One asset increases the other decreases, having no overall effect on ALOE • Assets may have claims on them: rights/claims creditors or rights/claims of owners

Accounting Equation (cont) • Liabilities: rights/claims of creditors which represent the debts of a business. Amounts owed to other businesses. Ex) When a bank loans a business money…Assets (money) increases for the business, so do the liabilities (the bank has a claim in the business). Both sides of the equation increase. Creditors have first claim over the assets, then owners.

Accounting Equation (con’t) • Owner’s Equity: rights/claims of the owner. Ex) the owner invests (gives) her money into the business. The assets of the business increase (money) and the claim of the owner increases (equity). Both sides of the equation increase.

Transactions in ALOE Business Transactions: an event that changes a business’ financial condition. These transactions affect ALOE. Examples: 1)The owner deposits $125, 000 into the business’ bank account as an investment. A = L + OE +$125 K cash= +$125 K invest

Transactions in ALOE 2) The business pays $100, 000 cash for a parcel of land. A = L + OE -$100 K cash +$100 K land

Transactions in ALOE 3) The business purchased $200 supplies on account (agreeing to pay in cash at a later date) from Staples. • Purchases “on account” creates a liability called accounts payable • Prepaids (or prepaid expenses): items that will be used at a later date (ex, supplies, insurance premiums paid in advance) they are assets A = L + OE +200 K supplies= +200 K Staples Account

Transactions in ALOE 4) The business receives $20, 000 for repairing a client’s computer system • Revenue: earning money for providing services/products. Revenue is only earned and recorded when the service is complete or product is provided – Revenue may be called: Fees earned: in a service business or sales: in a merchandise/manufact. A = L + OE $20 K cash = $20 K revenue • If the customer does not give the business cash, but the business provides a service/product the business still records revenue (an increase in OE). Since cash was not received, another asset called ACCOUNTS RECEIVABLE is recorded. The customer is agreeing to pay at a later date.

Transactions in ALOE 5) The business paid its employees for the week, $2, 000. • Expenses: resources or services used/consumed in the process of earning revenue…wages/salaries, utilities, advertising, using supplies. A = L + OE -2 K cash = -$2 K expense

Transactions in ALOE 6) The business pays Staples $200 for the supplies purchased previously (3). Pay off/pay on account. A = L + OE -$200 cash = -200 Staples Account

Transactions in ALOE 7) The business uses $100 of supplies this month. A = L + OE -$100 supplies= -$100 expense

Transactions in ALOE 8) The owner withdraws $50 from the business. A = L + OE -$50 cash -$50 withdraw

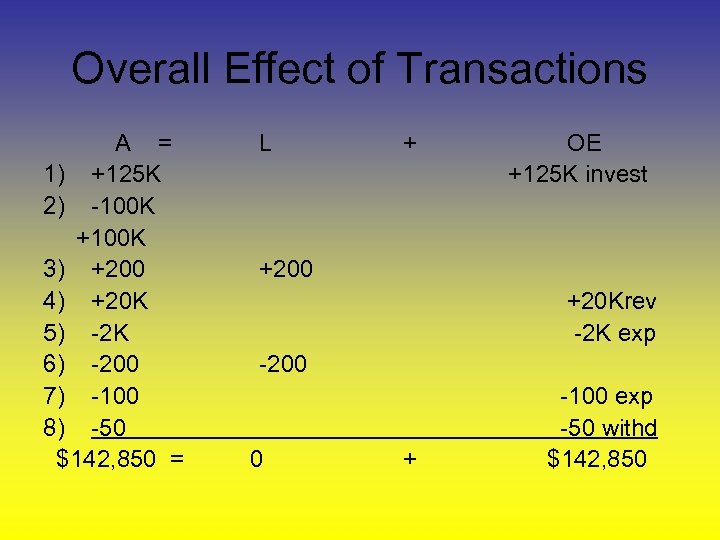

Overall Effect of Transactions A = 1) +125 K 2) -100 K +100 K 3) +200 4) +20 K 5) -2 K 6) -200 7) -100 8) -50 $142, 850 = L + OE +125 K invest +200 +20 Krev -2 K exp -200 0 + -100 exp -50 withd $142, 850

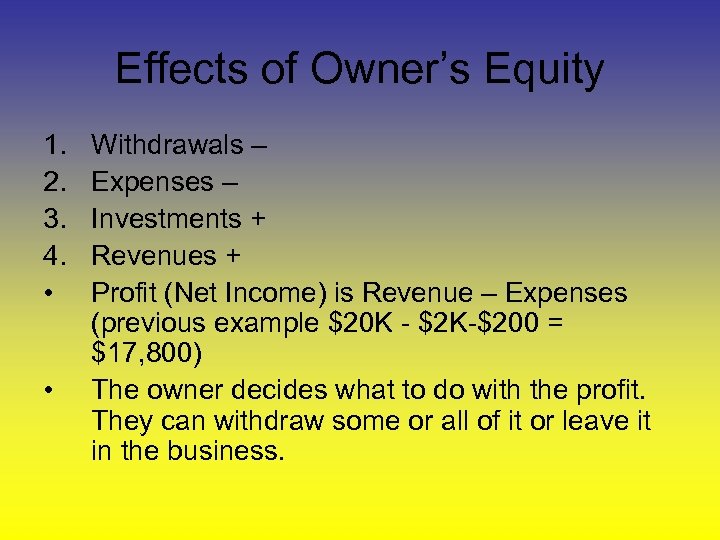

Effects of Owner’s Equity 1. 2. 3. 4. • • Withdrawals – Expenses – Investments + Revenues + Profit (Net Income) is Revenue – Expenses (previous example $20 K - $2 K-$200 = $17, 800) The owner decides what to do with the profit. They can withdraw some or all of it or leave it in the business.

Reporting the summarized effects of business transactions Financial Statements: reports that provide financial information Types: 1. Income Statement (IS): reports the revenue and expenses for a period of time (month, quarter, year) • • A net income (profit) or a net loss Use matching concept: revenues earned for period are “matched” with the expenses incurred for period

Financial Statements (con’t) 2. Statement of Owner’s Equity (SCOE): reports the change in the owner’s claims/rights for a period of time. • • Looks at the 4 items that affect equity Prepared after the IS, because the net loss or net income is reported on this statement

Financial Statements (cont) 3. Balance Sheet: reports amounts in assets, liabilities and owner’s equity on a specific date (last day of month or last day of fiscal year). • • Prepared after the SCOE because the final balance in OE is needed Account form: resembles ALOE because assets on left, liab and OE on right. 4. Statement of Cash Flows: details the change in cash during a period of time.

87480409f2e096cdb6f729d21942ea8c.ppt