a763dcf8afa9ef9d48a6f0e94e7d962d.ppt

- Количество слайдов: 49

CHAPTER 1 Futures Markets Introduction In this chapter, we introduce futures markets and their key players. This chapter is organized into the following sections: 1. Forward Contracts Versus Futures Contracts 2. Institutions Facilitating Futures Trading 3. Structure of Futures Exchanges 4. Clearinghouses’ Role in Futures Markets 5. Types of Futures Contracts 6. The Social Function of Futures Markets 7. Futures Markets’ Regulatory Framework and Taxation Chapter 1

CHAPTER 1 Futures Markets Introduction In this chapter, we introduce futures markets and their key players. This chapter is organized into the following sections: 1. Forward Contracts Versus Futures Contracts 2. Institutions Facilitating Futures Trading 3. Structure of Futures Exchanges 4. Clearinghouses’ Role in Futures Markets 5. Types of Futures Contracts 6. The Social Function of Futures Markets 7. Futures Markets’ Regulatory Framework and Taxation Chapter 1

Forward Contracts A forward contract is an agreement between two parties (counterparties) for the delivery of a physical asset (e. g. , oil or gold) at a certain time in the future for a certain price that is fixed at the inception of the contract. Forward contracts can be customized to accommodate any commodity, in any quantity, for delivery at any point in the future, at any place. Chapter 1

Forward Contracts A forward contract is an agreement between two parties (counterparties) for the delivery of a physical asset (e. g. , oil or gold) at a certain time in the future for a certain price that is fixed at the inception of the contract. Forward contracts can be customized to accommodate any commodity, in any quantity, for delivery at any point in the future, at any place. Chapter 1

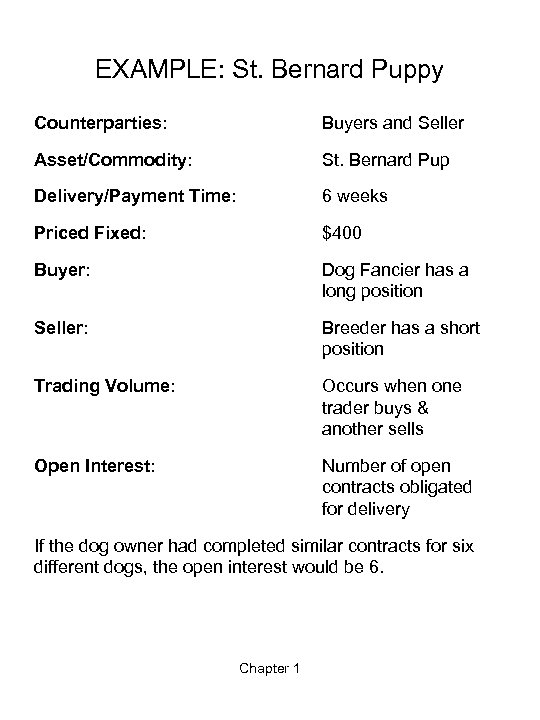

EXAMPLE: St. Bernard Puppy Counterparties: Buyers and Seller Asset/Commodity: St. Bernard Pup Delivery/Payment Time: 6 weeks Priced Fixed: $400 Buyer: Dog Fancier has a long position Seller: Breeder has a short position Trading Volume: Occurs when one trader buys & another sells Open Interest: Number of open contracts obligated for delivery If the dog owner had completed similar contracts for six different dogs, the open interest would be 6. Chapter 1

EXAMPLE: St. Bernard Puppy Counterparties: Buyers and Seller Asset/Commodity: St. Bernard Pup Delivery/Payment Time: 6 weeks Priced Fixed: $400 Buyer: Dog Fancier has a long position Seller: Breeder has a short position Trading Volume: Occurs when one trader buys & another sells Open Interest: Number of open contracts obligated for delivery If the dog owner had completed similar contracts for six different dogs, the open interest would be 6. Chapter 1

Future Contracts Futures contracts are highly uniform and well-specified commitments for a carefully described good (quantity and quality of the good) to be delivered at a certain time and place (acceptable delivery date) and in a certain manner (method for closing the contract) and the permissible price fluctuations are specified (minimum and maximum daily price changes). Chapter 1

Future Contracts Futures contracts are highly uniform and well-specified commitments for a carefully described good (quantity and quality of the good) to be delivered at a certain time and place (acceptable delivery date) and in a certain manner (method for closing the contract) and the permissible price fluctuations are specified (minimum and maximum daily price changes). Chapter 1

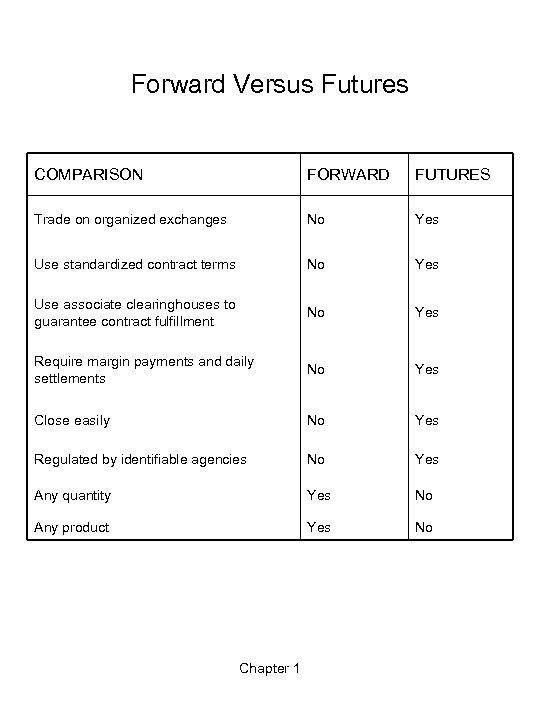

Forward Versus Futures COMPARISON FORWARD FUTURES Trade on organized exchanges No Yes Use standardized contract terms No Yes Use associate clearinghouses to guarantee contract fulfillment No Yes Require margin payments and daily settlements No Yes Close easily No Yes Regulated by identifiable agencies No Yes Any quantity Yes No Any product Yes No Chapter 1

Forward Versus Futures COMPARISON FORWARD FUTURES Trade on organized exchanges No Yes Use standardized contract terms No Yes Use associate clearinghouses to guarantee contract fulfillment No Yes Require margin payments and daily settlements No Yes Close easily No Yes Regulated by identifiable agencies No Yes Any quantity Yes No Any product Yes No Chapter 1

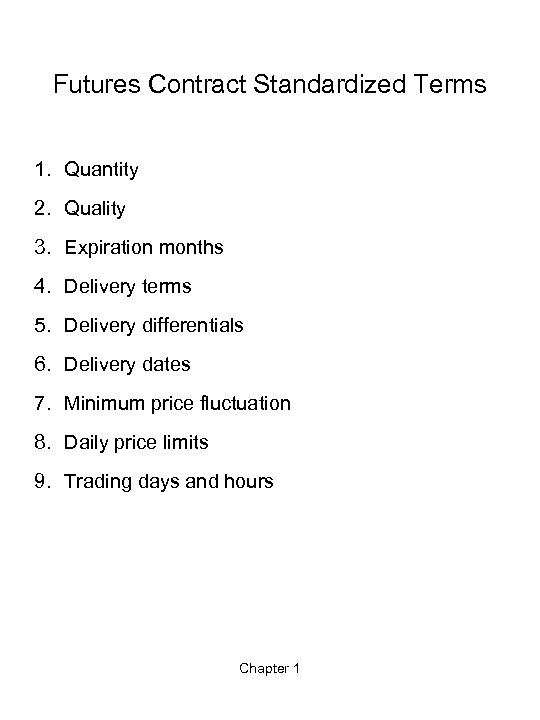

Futures Contract Standardized Terms 1. Quantity 2. Quality 3. Expiration months 4. Delivery terms 5. Delivery differentials 6. Delivery dates 7. Minimum price fluctuation 8. Daily price limits 9. Trading days and hours Chapter 1

Futures Contract Standardized Terms 1. Quantity 2. Quality 3. Expiration months 4. Delivery terms 5. Delivery differentials 6. Delivery dates 7. Minimum price fluctuation 8. Daily price limits 9. Trading days and hours Chapter 1

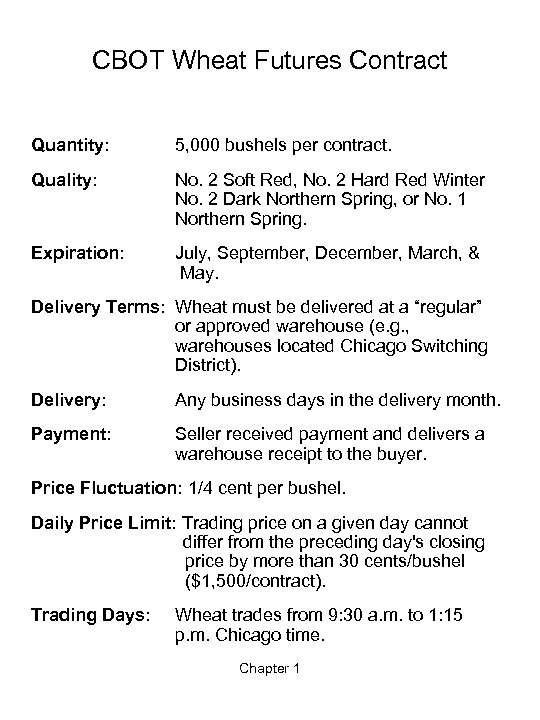

CBOT Wheat Futures Contract Quantity: 5, 000 bushels per contract. Quality: No. 2 Soft Red, No. 2 Hard Red Winter No. 2 Dark Northern Spring, or No. 1 Northern Spring. Expiration: July, September, December, March, & May. Delivery Terms: Wheat must be delivered at a “regular” or approved warehouse (e. g. , warehouses located Chicago Switching District). Delivery: Any business days in the delivery month. Payment: Seller received payment and delivers a warehouse receipt to the buyer. Price Fluctuation: 1/4 cent per bushel. Daily Price Limit: Trading price on a given day cannot differ from the preceding day's closing price by more than 30 cents/bushel ($1, 500/contract). Trading Days: Wheat trades from 9: 30 a. m. to 1: 15 p. m. Chicago time. Chapter 1

CBOT Wheat Futures Contract Quantity: 5, 000 bushels per contract. Quality: No. 2 Soft Red, No. 2 Hard Red Winter No. 2 Dark Northern Spring, or No. 1 Northern Spring. Expiration: July, September, December, March, & May. Delivery Terms: Wheat must be delivered at a “regular” or approved warehouse (e. g. , warehouses located Chicago Switching District). Delivery: Any business days in the delivery month. Payment: Seller received payment and delivers a warehouse receipt to the buyer. Price Fluctuation: 1/4 cent per bushel. Daily Price Limit: Trading price on a given day cannot differ from the preceding day's closing price by more than 30 cents/bushel ($1, 500/contract). Trading Days: Wheat trades from 9: 30 a. m. to 1: 15 p. m. Chicago time. Chapter 1

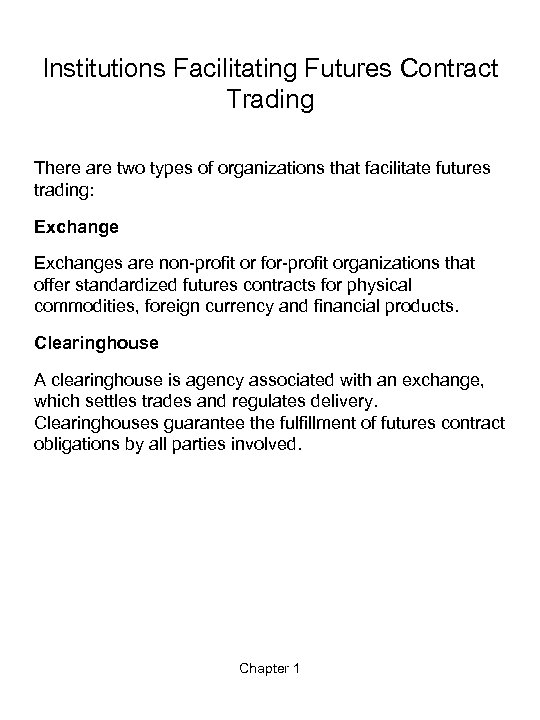

Institutions Facilitating Futures Contract Trading There are two types of organizations that facilitate futures trading: Exchanges are non-profit or for-profit organizations that offer standardized futures contracts for physical commodities, foreign currency and financial products. Clearinghouse A clearinghouse is agency associated with an exchange, which settles trades and regulates delivery. Clearinghouses guarantee the fulfillment of futures contract obligations by all parties involved. Chapter 1

Institutions Facilitating Futures Contract Trading There are two types of organizations that facilitate futures trading: Exchanges are non-profit or for-profit organizations that offer standardized futures contracts for physical commodities, foreign currency and financial products. Clearinghouse A clearinghouse is agency associated with an exchange, which settles trades and regulates delivery. Clearinghouses guarantee the fulfillment of futures contract obligations by all parties involved. Chapter 1

The Organized Exchange Not-for-Profit Organization Structure Members hold exchange memberships or seats that allow them to: 1. Trade on the exchange 2. Have a voice in the exchange’s operation For-Profit Organization Structure Members receive shares or stocks. Demutualize Conversion of an exchange from not-for-profit to for-profit. Chapter 1

The Organized Exchange Not-for-Profit Organization Structure Members hold exchange memberships or seats that allow them to: 1. Trade on the exchange 2. Have a voice in the exchange’s operation For-Profit Organization Structure Members receive shares or stocks. Demutualize Conversion of an exchange from not-for-profit to for-profit. Chapter 1

Organized Exchange: Trading Systems Futures contracts trade by two systems: Open Outcry Open outcry is a trading room where traders literally “cry out” their bids to locate another trader who is willing to trade with them. Electronic Trading Platforms Contracts are traded through electronic computer networks. Electronic trading represents over 50% of futures contracts trading. Chapter 1

Organized Exchange: Trading Systems Futures contracts trade by two systems: Open Outcry Open outcry is a trading room where traders literally “cry out” their bids to locate another trader who is willing to trade with them. Electronic Trading Platforms Contracts are traded through electronic computer networks. Electronic trading represents over 50% of futures contracts trading. Chapter 1

Organized Exchange: Trading Players Speculator A trader who enters the futures market in pursuit of profit, accepting risk in the endeavor. Hedger A Trader who enters the futures market to reduce some pre-existing risk exposure. Broker An Individual or firm acting as an intermediary by conveying customers’ trade instructions. Account executives or floor brokers are examples of brokers. Chapter 1

Organized Exchange: Trading Players Speculator A trader who enters the futures market in pursuit of profit, accepting risk in the endeavor. Hedger A Trader who enters the futures market to reduce some pre-existing risk exposure. Broker An Individual or firm acting as an intermediary by conveying customers’ trade instructions. Account executives or floor brokers are examples of brokers. Chapter 1

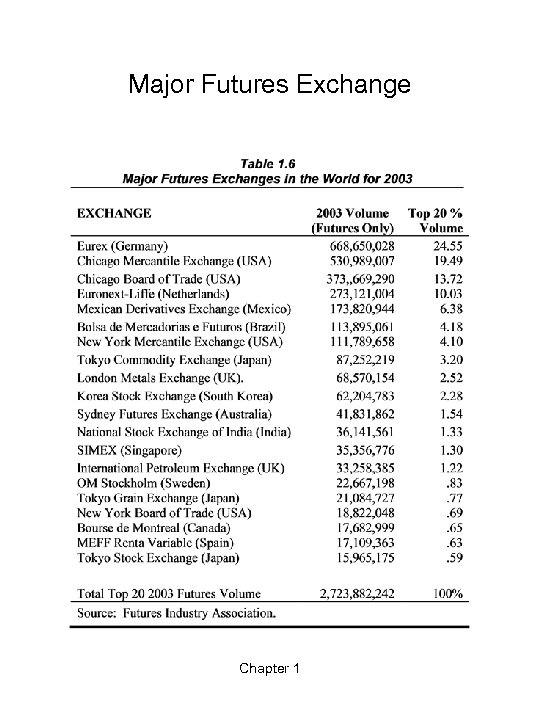

Major Futures Exchange Chapter 1

Major Futures Exchange Chapter 1

Clearinghouses 1. Guarantee that the traders will honor their obligations (solves issues of trust). 2. Each trader has obligations only to the clearinghouse, not to other traders. 3. Each exchange uses a futures clearinghouse. 4. Clearinghouses may be part of a futures exchange (division), or a separate entity. 5. Due to 2000 CFMA, clearing arrangements vary across industries. 6. Clearinghouses are “perfectly hedged” by maintaining no futures market position of their own. Chapter 1

Clearinghouses 1. Guarantee that the traders will honor their obligations (solves issues of trust). 2. Each trader has obligations only to the clearinghouse, not to other traders. 3. Each exchange uses a futures clearinghouse. 4. Clearinghouses may be part of a futures exchange (division), or a separate entity. 5. Due to 2000 CFMA, clearing arrangements vary across industries. 6. Clearinghouses are “perfectly hedged” by maintaining no futures market position of their own. Chapter 1

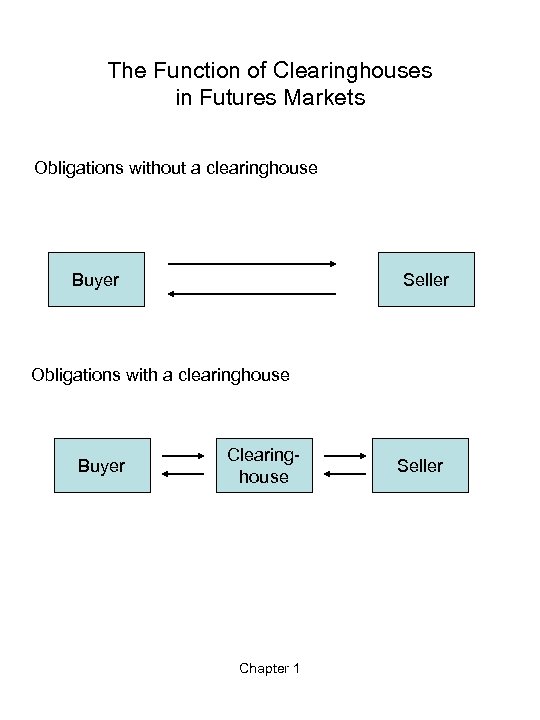

The Function of Clearinghouses in Futures Markets Obligations without a clearinghouse Buyer Seller Obligations with a clearinghouse Buyer Clearinghouse Chapter 1 Seller

The Function of Clearinghouses in Futures Markets Obligations without a clearinghouse Buyer Seller Obligations with a clearinghouse Buyer Clearinghouse Chapter 1 Seller

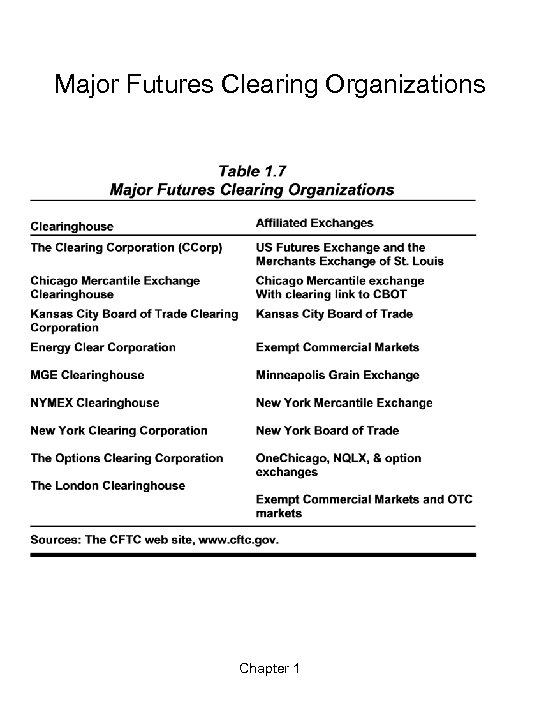

Major Futures Clearing Organizations Chapter 1

Major Futures Clearing Organizations Chapter 1

Margin and Daily Settlement Margin A good-faith deposit (or performance bond) made by a prospective trader with a broker. Margin can be posted in cash, bank letter of credit or short-term U. S. Treasury instruments. Daily Settlement Process by which traders are required to realize any losses in cash immediately (marked-to-the-market). The losses are usually deducted from the margin deposit. Chapter 1

Margin and Daily Settlement Margin A good-faith deposit (or performance bond) made by a prospective trader with a broker. Margin can be posted in cash, bank letter of credit or short-term U. S. Treasury instruments. Daily Settlement Process by which traders are required to realize any losses in cash immediately (marked-to-the-market). The losses are usually deducted from the margin deposit. Chapter 1

TYPES OF MARGIN There are 3 types of margin: 1. Initial Margin Deposit that a trader must make before trading any futures. 2. Maintenance Margin When margin reaches a minimum maintenance level, the trader is required to bring the margin back to its initial level. The maintenance margin is generally about 75% of the initial margin. 3. Variation Margin Additional margin required to bring an account up to the required level. Chapter 1

TYPES OF MARGIN There are 3 types of margin: 1. Initial Margin Deposit that a trader must make before trading any futures. 2. Maintenance Margin When margin reaches a minimum maintenance level, the trader is required to bring the margin back to its initial level. The maintenance margin is generally about 75% of the initial margin. 3. Variation Margin Additional margin required to bring an account up to the required level. Chapter 1

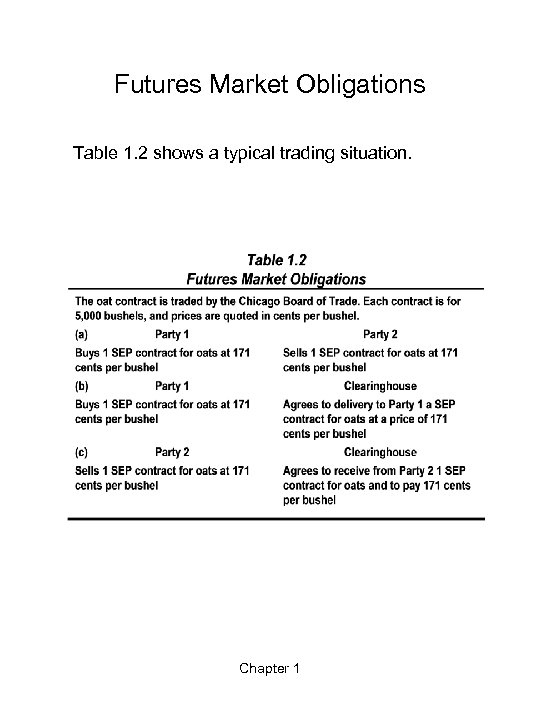

Futures Market Obligations Table 1. 2 shows a typical trading situation. Chapter 1

Futures Market Obligations Table 1. 2 shows a typical trading situation. Chapter 1

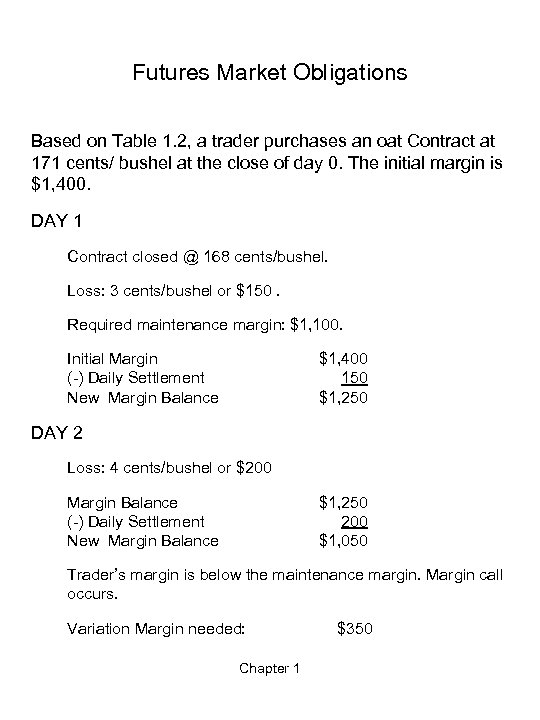

Futures Market Obligations Based on Table 1. 2, a trader purchases an oat Contract at 171 cents/ bushel at the close of day 0. The initial margin is $1, 400. DAY 1 Contract closed @ 168 cents/bushel. Loss: 3 cents/bushel or $150. Required maintenance margin: $1, 100. Initial Margin (-) Daily Settlement New Margin Balance $1, 400 150 $1, 250 DAY 2 Loss: 4 cents/bushel or $200 Margin Balance (-) Daily Settlement New Margin Balance $1, 250 200 $1, 050 Trader’s margin is below the maintenance margin. Margin call occurs. Variation Margin needed: Chapter 1 $350

Futures Market Obligations Based on Table 1. 2, a trader purchases an oat Contract at 171 cents/ bushel at the close of day 0. The initial margin is $1, 400. DAY 1 Contract closed @ 168 cents/bushel. Loss: 3 cents/bushel or $150. Required maintenance margin: $1, 100. Initial Margin (-) Daily Settlement New Margin Balance $1, 400 150 $1, 250 DAY 2 Loss: 4 cents/bushel or $200 Margin Balance (-) Daily Settlement New Margin Balance $1, 250 200 $1, 050 Trader’s margin is below the maintenance margin. Margin call occurs. Variation Margin needed: Chapter 1 $350

Account Equity & Margin Requirements Figure 1. 3 illustrates the account equity and margin requirements at different price levels. Insert figure 1. 3 here Notice that the trader would have received two margin calls. Chapter 1 20

Account Equity & Margin Requirements Figure 1. 3 illustrates the account equity and margin requirements at different price levels. Insert figure 1. 3 here Notice that the trader would have received two margin calls. Chapter 1 20

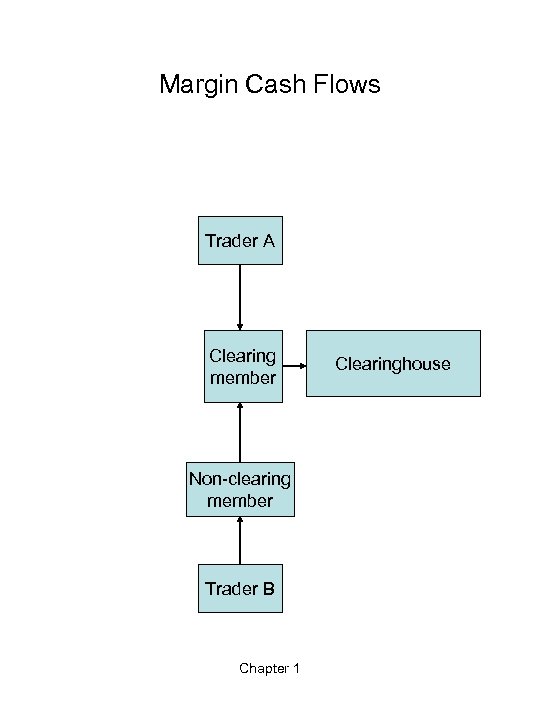

Margin Cash Flows Trader A Clearing member Non-clearing member Trader B Chapter 1 Clearinghouse

Margin Cash Flows Trader A Clearing member Non-clearing member Trader B Chapter 1 Clearinghouse

Closing a Futures Position There are 3 ways to close a futures position: 1. Delivery or cash settlement 2. Offset or reversing trade 3. Exchange-for-physicals (EFP) or ex-pit transaction Chapter 1

Closing a Futures Position There are 3 ways to close a futures position: 1. Delivery or cash settlement 2. Offset or reversing trade 3. Exchange-for-physicals (EFP) or ex-pit transaction Chapter 1

Closing a Futures Position: Delivery or Cash Settlement Delivery Most commodity futures contracts are written for completion of the futures contract through the physical delivery of a particular good. Cash settlement Most financial futures contracts allow completion through cash settlement. In cash settlement, traders make payments at the expiration of the contract to settle any gains or losses, instead of making physical delivery. Chapter 1

Closing a Futures Position: Delivery or Cash Settlement Delivery Most commodity futures contracts are written for completion of the futures contract through the physical delivery of a particular good. Cash settlement Most financial futures contracts allow completion through cash settlement. In cash settlement, traders make payments at the expiration of the contract to settle any gains or losses, instead of making physical delivery. Chapter 1

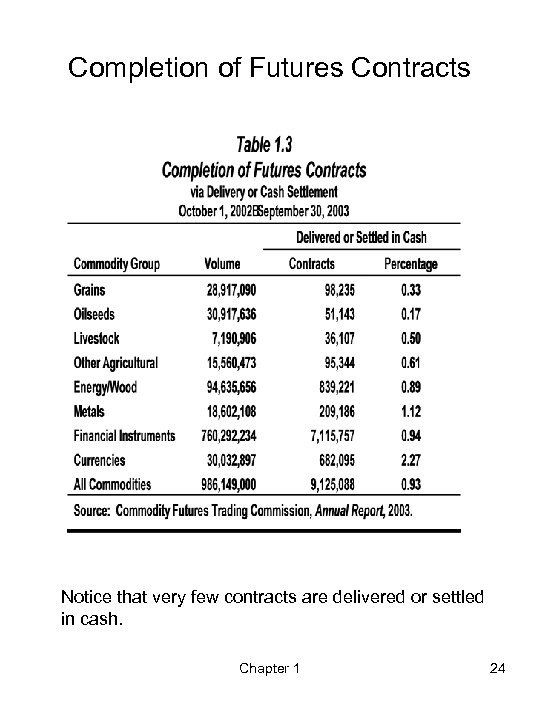

Completion of Futures Contracts Notice that very few contracts are delivered or settled in cash. Chapter 1 24

Completion of Futures Contracts Notice that very few contracts are delivered or settled in cash. Chapter 1 24

Delivery Differential Sometimes the quantity and quality do not exactly match the quantity and quality specified in the contract. In these cases, shorts are given the option of delivering nonstandard commodities at non-standard delivery points. However, they may have to pay a surcharge or “delivery differential” relative to standard terms of the futures contracts. There are 2 types of delivery differential: 1. Quality Differentials 2. Location Differential Chapter 1

Delivery Differential Sometimes the quantity and quality do not exactly match the quantity and quality specified in the contract. In these cases, shorts are given the option of delivering nonstandard commodities at non-standard delivery points. However, they may have to pay a surcharge or “delivery differential” relative to standard terms of the futures contracts. There are 2 types of delivery differential: 1. Quality Differentials 2. Location Differential Chapter 1

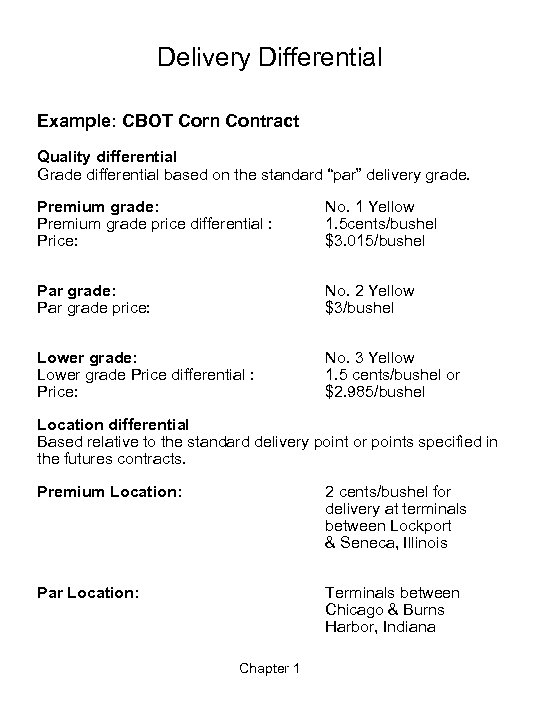

Delivery Differential Example: CBOT Corn Contract Quality differential Grade differential based on the standard “par” delivery grade. Premium grade: Premium grade price differential : Price: No. 1 Yellow 1. 5 cents/bushel $3. 015/bushel Par grade: Par grade price: No. 2 Yellow $3/bushel Lower grade: Lower grade Price differential : Price: No. 3 Yellow 1. 5 cents/bushel or $2. 985/bushel Location differential Based relative to the standard delivery point or points specified in the futures contracts. Premium Location: 2 cents/bushel for delivery at terminals between Lockport & Seneca, Illinois Par Location: Terminals between Chicago & Burns Harbor, Indiana Chapter 1

Delivery Differential Example: CBOT Corn Contract Quality differential Grade differential based on the standard “par” delivery grade. Premium grade: Premium grade price differential : Price: No. 1 Yellow 1. 5 cents/bushel $3. 015/bushel Par grade: Par grade price: No. 2 Yellow $3/bushel Lower grade: Lower grade Price differential : Price: No. 3 Yellow 1. 5 cents/bushel or $2. 985/bushel Location differential Based relative to the standard delivery point or points specified in the futures contracts. Premium Location: 2 cents/bushel for delivery at terminals between Lockport & Seneca, Illinois Par Location: Terminals between Chicago & Burns Harbor, Indiana Chapter 1

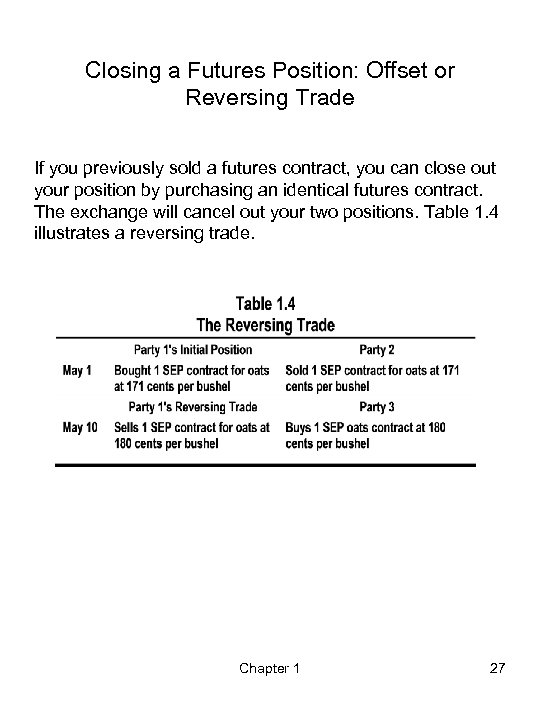

Closing a Futures Position: Offset or Reversing Trade If you previously sold a futures contract, you can close out your position by purchasing an identical futures contract. The exchange will cancel out your two positions. Table 1. 4 illustrates a reversing trade. Chapter 1 27

Closing a Futures Position: Offset or Reversing Trade If you previously sold a futures contract, you can close out your position by purchasing an identical futures contract. The exchange will cancel out your two positions. Table 1. 4 illustrates a reversing trade. Chapter 1 27

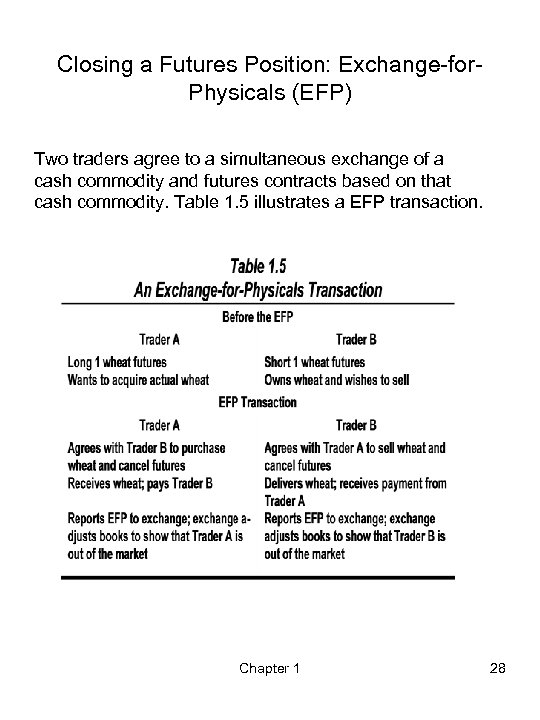

Closing a Futures Position: Exchange-for. Physicals (EFP) Two traders agree to a simultaneous exchange of a cash commodity and futures contracts based on that cash commodity. Table 1. 5 illustrates a EFP transaction. Chapter 1 28

Closing a Futures Position: Exchange-for. Physicals (EFP) Two traders agree to a simultaneous exchange of a cash commodity and futures contracts based on that cash commodity. Table 1. 5 illustrates a EFP transaction. Chapter 1 28

Types of Futures Contracts In this section, we will examine the following types of futures contracts: • Physical Commodity • Foreign Currency • Interest-Earning Asset • Index (Stock Index) • Individual Stocks Chapter 1

Types of Futures Contracts In this section, we will examine the following types of futures contracts: • Physical Commodity • Foreign Currency • Interest-Earning Asset • Index (Stock Index) • Individual Stocks Chapter 1

Future Contracts: Physical Commodity Contracts on physical commodities include: 1. Agricultural contracts 2. Metallurgical contracts 3. Energy contracts These commodities, excluding electricity, are physically settled and are highly storable. Trading varies from commodity to commodity. Chapter 1

Future Contracts: Physical Commodity Contracts on physical commodities include: 1. Agricultural contracts 2. Metallurgical contracts 3. Energy contracts These commodities, excluding electricity, are physically settled and are highly storable. Trading varies from commodity to commodity. Chapter 1

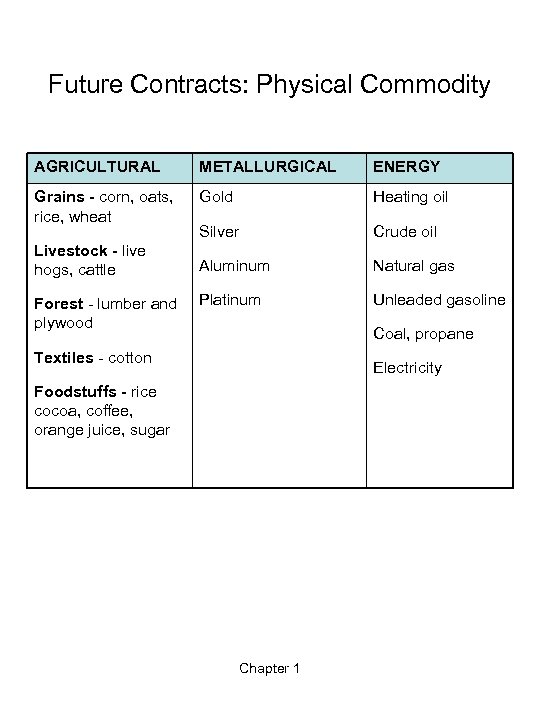

Future Contracts: Physical Commodity AGRICULTURAL METALLURGICAL ENERGY Grains - corn, oats, rice, wheat Gold Heating oil Silver Crude oil Aluminum Natural gas Platinum Unleaded gasoline Livestock - live hogs, cattle Forest - lumber and plywood Coal, propane Textiles - cotton Electricity Foodstuffs - rice cocoa, coffee, orange juice, sugar Chapter 1

Future Contracts: Physical Commodity AGRICULTURAL METALLURGICAL ENERGY Grains - corn, oats, rice, wheat Gold Heating oil Silver Crude oil Aluminum Natural gas Platinum Unleaded gasoline Livestock - live hogs, cattle Forest - lumber and plywood Coal, propane Textiles - cotton Electricity Foodstuffs - rice cocoa, coffee, orange juice, sugar Chapter 1

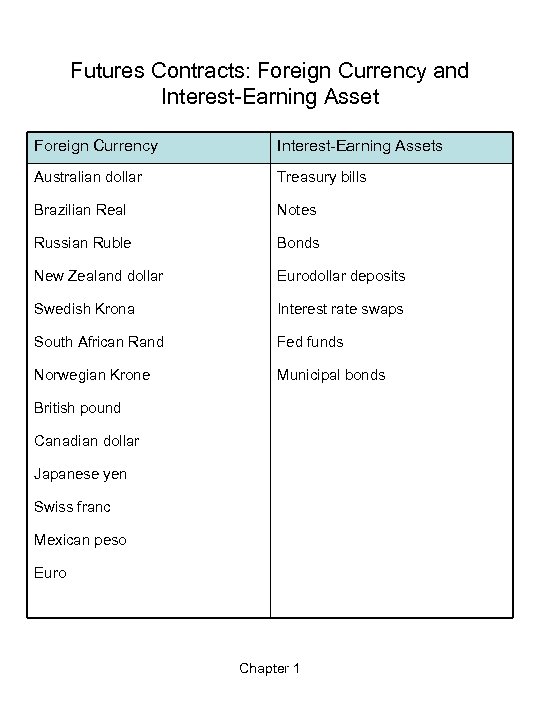

Futures Contracts: Foreign Currency and Interest-Earning Asset Foreign Currency Interest-Earning Assets Australian dollar Treasury bills Brazilian Real Notes Russian Ruble Bonds New Zealand dollar Eurodollar deposits Swedish Krona Interest rate swaps South African Rand Fed funds Norwegian Krone Municipal bonds British pound Canadian dollar Japanese yen Swiss franc Mexican peso Euro Chapter 1

Futures Contracts: Foreign Currency and Interest-Earning Asset Foreign Currency Interest-Earning Assets Australian dollar Treasury bills Brazilian Real Notes Russian Ruble Bonds New Zealand dollar Eurodollar deposits Swedish Krona Interest rate swaps South African Rand Fed funds Norwegian Krone Municipal bonds British pound Canadian dollar Japanese yen Swiss franc Mexican peso Euro Chapter 1

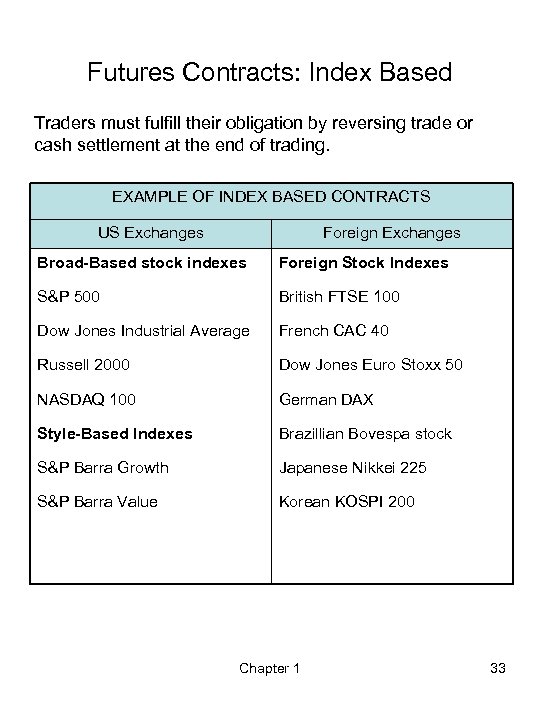

Futures Contracts: Index Based Traders must fulfill their obligation by reversing trade or cash settlement at the end of trading. EXAMPLE OF INDEX BASED CONTRACTS US Exchanges Foreign Exchanges Broad-Based stock indexes Foreign Stock Indexes S&P 500 British FTSE 100 Dow Jones Industrial Average French CAC 40 Russell 2000 Dow Jones Euro Stoxx 50 NASDAQ 100 German DAX Style-Based Indexes Brazillian Bovespa stock S&P Barra Growth Japanese Nikkei 225 S&P Barra Value Korean KOSPI 200 Chapter 1 33

Futures Contracts: Index Based Traders must fulfill their obligation by reversing trade or cash settlement at the end of trading. EXAMPLE OF INDEX BASED CONTRACTS US Exchanges Foreign Exchanges Broad-Based stock indexes Foreign Stock Indexes S&P 500 British FTSE 100 Dow Jones Industrial Average French CAC 40 Russell 2000 Dow Jones Euro Stoxx 50 NASDAQ 100 German DAX Style-Based Indexes Brazillian Bovespa stock S&P Barra Growth Japanese Nikkei 225 S&P Barra Value Korean KOSPI 200 Chapter 1 33

Future Contracts on Individual Stocks Permitted for trade in United States after the passage of the Commodity Futures Modernization Act of 2000 (CFMA). Also called “single stock futures” in the United States and “universal futures” in Great Britain. Chapter 1

Future Contracts on Individual Stocks Permitted for trade in United States after the passage of the Commodity Futures Modernization Act of 2000 (CFMA). Also called “single stock futures” in the United States and “universal futures” in Great Britain. Chapter 1

Relative Importance of Commodity Types INSERT FIGURE 1. 5 HERE Chapter 1 35

Relative Importance of Commodity Types INSERT FIGURE 1. 5 HERE Chapter 1 35

Changing Commodity Trading Volume INSERT FIGURE 1. 6 HERE Chapter 1

Changing Commodity Trading Volume INSERT FIGURE 1. 6 HERE Chapter 1

Social Function of Futures Markets Futures markets meet the needs of three groups of users: 1. Those who wish to discover information about future prices of commodities 2. Those who wish to speculate 3. Those who wish to hedge There are two main social functions of futures markets: 1. Price discovery 2. Hedging Speculation is not regarded as a social function by itself, but it may have socially useful by-products. Chapter 1

Social Function of Futures Markets Futures markets meet the needs of three groups of users: 1. Those who wish to discover information about future prices of commodities 2. Those who wish to speculate 3. Those who wish to hedge There are two main social functions of futures markets: 1. Price discovery 2. Hedging Speculation is not regarded as a social function by itself, but it may have socially useful by-products. Chapter 1

Social Function of Futures Markets PRICE DISCOVERY Futures market information helps people make better estimates of future prices. Futures market information helps people with their production or consumption decisions. Example: silver Mine HEDGING Hedging is the prime social rationale for futures trading. Hedgers have a pre-existing risk exposure that leads them to use futures transactions as a substitute for a cash market transaction. By doing so, they are able to reduce or eliminate their risk. Example: wheat Farmer Chapter 1

Social Function of Futures Markets PRICE DISCOVERY Futures market information helps people make better estimates of future prices. Futures market information helps people with their production or consumption decisions. Example: silver Mine HEDGING Hedging is the prime social rationale for futures trading. Hedgers have a pre-existing risk exposure that leads them to use futures transactions as a substitute for a cash market transaction. By doing so, they are able to reduce or eliminate their risk. Example: wheat Farmer Chapter 1

Regulation of Futures Markets CEA Grain Futures Act of 1922, superseded by the Commodity Exchange Act (CEA) of 1936. The CEA was last amended by the Commodity Futures Modernization Act of 2000 (CFMA). CFMA Promotes competition and innovation in futures markets. Provides a predictable and calibrated regulatory structure tailored to the product, the participant, and the trading platform (the three P’s). Chapter 1

Regulation of Futures Markets CEA Grain Futures Act of 1922, superseded by the Commodity Exchange Act (CEA) of 1936. The CEA was last amended by the Commodity Futures Modernization Act of 2000 (CFMA). CFMA Promotes competition and innovation in futures markets. Provides a predictable and calibrated regulatory structure tailored to the product, the participant, and the trading platform (the three P’s). Chapter 1

The CFMA’s Three Tiers of Regulation First Tier- Agricultural Commodities Futures on commodities (agricultural commodities) that Congress judged to be potentially susceptible to manipulation and that are offered to members of the public. Second Tier- Exempt Futures Contracts Futures contracts on metals and energy that are judged to be less susceptible to manipulation. Third Tier- Trade Principal to Principal Basis Contracts on financial products (swaps) that are privatelynegotiated between large, sophisticated contract counterparties. Chapter 1

The CFMA’s Three Tiers of Regulation First Tier- Agricultural Commodities Futures on commodities (agricultural commodities) that Congress judged to be potentially susceptible to manipulation and that are offered to members of the public. Second Tier- Exempt Futures Contracts Futures contracts on metals and energy that are judged to be less susceptible to manipulation. Third Tier- Trade Principal to Principal Basis Contracts on financial products (swaps) that are privatelynegotiated between large, sophisticated contract counterparties. Chapter 1

Futures Markets Levels of Regulation (Market Regulators) 1. Brokers 2. Exchanges and clearinghouses 3. National Futures Association (NFA), industry selfregulatory body 4. Commodity Futures Trading Commission (CFTC), federal governmental agency Chapter 1

Futures Markets Levels of Regulation (Market Regulators) 1. Brokers 2. Exchanges and clearinghouses 3. National Futures Association (NFA), industry selfregulatory body 4. Commodity Futures Trading Commission (CFTC), federal governmental agency Chapter 1

Market Regulators: Brokers The Broker is responsible for: 1. Knowing the customer's position and intentions. 2. Ensuring that the customer does not disrupt the market or place the system in jeopardy. 3. Keeping the customer's trading activity in line with industry regulations and legal restrictions. Chapter 1

Market Regulators: Brokers The Broker is responsible for: 1. Knowing the customer's position and intentions. 2. Ensuring that the customer does not disrupt the market or place the system in jeopardy. 3. Keeping the customer's trading activity in line with industry regulations and legal restrictions. Chapter 1

Market Regulators: Exchange & Clearinghouses Futures exchanges and clearinghouses formulate and enforce rules to: 1. Prohibit fraud 2. Prohibit dishonorable conduct 3. Prevent defaulting on contract obligations Chapter 1

Market Regulators: Exchange & Clearinghouses Futures exchanges and clearinghouses formulate and enforce rules to: 1. Prohibit fraud 2. Prohibit dishonorable conduct 3. Prevent defaulting on contract obligations Chapter 1

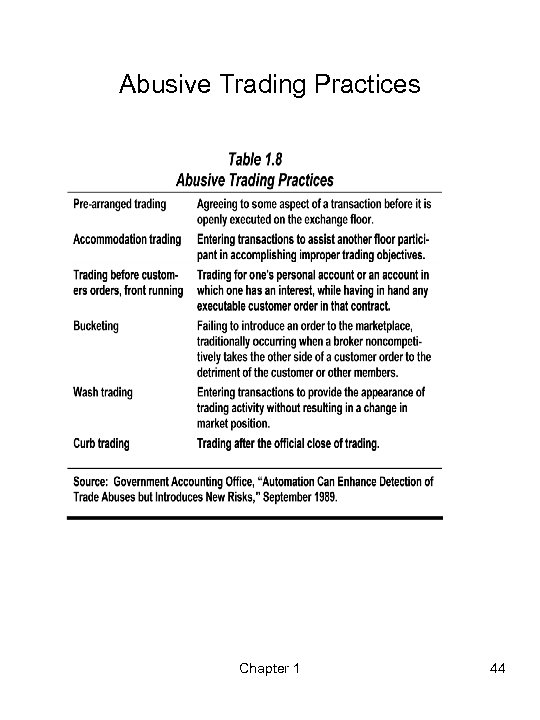

Abusive Trading Practices Chapter 1 44

Abusive Trading Practices Chapter 1 44

Market Regulators: National Futures Association (NFA) The NFA seeks to prevent fraudulent and manipulative acts by: 1. Screening and test applicants for registration. 2. Requiring members who handle customer funds to maintain adequate capital. 3. Requiring members to keep accurate trading records. Chapter 1

Market Regulators: National Futures Association (NFA) The NFA seeks to prevent fraudulent and manipulative acts by: 1. Screening and test applicants for registration. 2. Requiring members who handle customer funds to maintain adequate capital. 3. Requiring members to keep accurate trading records. Chapter 1

Market Regulators: Commodity Futures Trading Commission (CFTC) CFTC protects market participants from manipulation, abusive trading practices, and fraud by enforcing regulatory oversight of: 1. Futures exchanges 2. Futures clearinghouses 3. NFA The heart of the CFTC’s market surveillance is its largetrader electronic reporting system. This reporting system helps identify potential concentrations of market power within a market and to enforce speculative position limits. Chapter 1

Market Regulators: Commodity Futures Trading Commission (CFTC) CFTC protects market participants from manipulation, abusive trading practices, and fraud by enforcing regulatory oversight of: 1. Futures exchanges 2. Futures clearinghouses 3. NFA The heart of the CFTC’s market surveillance is its largetrader electronic reporting system. This reporting system helps identify potential concentrations of market power within a market and to enforce speculative position limits. Chapter 1

Insert figure 1. 7 here Figure 1. 7 shows the place of the CFTC in the regulatory structure of the futures industry in the United States. Insert Figure 1. 7 here Chapter 1 47

Insert figure 1. 7 here Figure 1. 7 shows the place of the CFTC in the regulatory structure of the futures industry in the United States. Insert Figure 1. 7 here Chapter 1 47

Recent Regulatory Initiatives FASB ACCOUNTING RULES In 1998, The FASB adopted new rules for disclosure of risk positions in firms’ derivatives positions. CFMA 2000 Allows futures trading on individual stocks and narrow-based stock indexes. Clarifies the legal status of privately-negotiated swap transactions. Provides a predictable and calibrated regulatory structure tailored to the product, the participant, and the trading platform. Allows exchanges to bring new contracts to market without prior regulatory approval. Establishes a set of standards, that permit futures exchanges and clearinghouses to use different methods to achieve federal requirements. Gives the CFTC clear authority to stop certain illegal, foreign exchange transactions aimed at defrauding small investors. Gives the CFTC separate oversight authority with respect to clearinghouse organizations. Chapter 1

Recent Regulatory Initiatives FASB ACCOUNTING RULES In 1998, The FASB adopted new rules for disclosure of risk positions in firms’ derivatives positions. CFMA 2000 Allows futures trading on individual stocks and narrow-based stock indexes. Clarifies the legal status of privately-negotiated swap transactions. Provides a predictable and calibrated regulatory structure tailored to the product, the participant, and the trading platform. Allows exchanges to bring new contracts to market without prior regulatory approval. Establishes a set of standards, that permit futures exchanges and clearinghouses to use different methods to achieve federal requirements. Gives the CFTC clear authority to stop certain illegal, foreign exchange transactions aimed at defrauding small investors. Gives the CFTC separate oversight authority with respect to clearinghouse organizations. Chapter 1

Recent Regulatory Initiatives TAXATION OF FUTURES TRADING 1981 LAW Futures positions must be marked-to-market at the end of the year. ACT of 1986 Stipulates that short-term and long-term capital gains will be taxed at one rate. Chapter 1

Recent Regulatory Initiatives TAXATION OF FUTURES TRADING 1981 LAW Futures positions must be marked-to-market at the end of the year. ACT of 1986 Stipulates that short-term and long-term capital gains will be taxed at one rate. Chapter 1