8271d817281bcc5f526f9a455201bc95.ppt

- Количество слайдов: 20

Chapter 02 Determinants of Interest Rates

Chapter 02 Determinants of Interest Rates

Chapter Outline Interest Rate Fundamentals: Chapter Overview Time Value of Money and Interest Rates Loanable Funds Theory Movement of Interest Rates Over Time Determinants of Interest Rates For Individual Securities Term Structure of Interest Rates Forecasting Interest Rates

Chapter Outline Interest Rate Fundamentals: Chapter Overview Time Value of Money and Interest Rates Loanable Funds Theory Movement of Interest Rates Over Time Determinants of Interest Rates For Individual Securities Term Structure of Interest Rates Forecasting Interest Rates

Interest Rate Fundamentals nominal interest rates, the real riskless rate of interest an expected inflation premium And a risk premium for liquidity Interest rates affect the price the seller receives and the buyer pays for a security

Interest Rate Fundamentals nominal interest rates, the real riskless rate of interest an expected inflation premium And a risk premium for liquidity Interest rates affect the price the seller receives and the buyer pays for a security

Time Value of Money and Interest Rates Time Value of Money Simple interest Compound interest Lump Sum Valuation Annuity Valuation Effective annual rate: PV = PMT (1 – (1+i/M)–N×M) / i FV = PMT ((1 + (i/M))N×M – 1) / i i = nominal rate PMT = annuity payment N = number of years M = number of compounding periods per year

Time Value of Money and Interest Rates Time Value of Money Simple interest Compound interest Lump Sum Valuation Annuity Valuation Effective annual rate: PV = PMT (1 – (1+i/M)–N×M) / i FV = PMT ((1 + (i/M))N×M – 1) / i i = nominal rate PMT = annuity payment N = number of years M = number of compounding periods per year

Loanable Funds Theory The interaction of supply and demand of funds sets the basic opportunity cost rate (real interest rate) in the economy. The Federal Reserve estimates supply and demand of funds from households, business, government (financial markets participants) and foreign sources through its flow of funds accounts. Flow of funds tables are available at the Federal Reserve website at www. federalreserve. gov

Loanable Funds Theory The interaction of supply and demand of funds sets the basic opportunity cost rate (real interest rate) in the economy. The Federal Reserve estimates supply and demand of funds from households, business, government (financial markets participants) and foreign sources through its flow of funds accounts. Flow of funds tables are available at the Federal Reserve website at www. federalreserve. gov

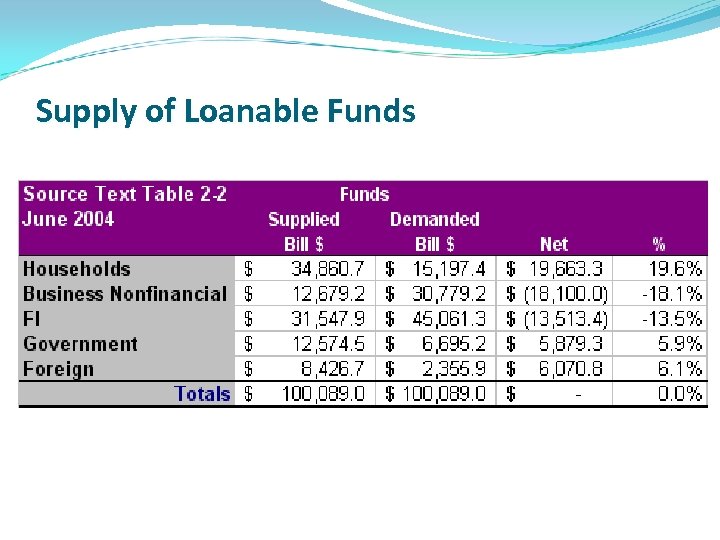

Supply of Loanable Funds

Supply of Loanable Funds

Supply of Loanable Funds SS increases with interest rates. Predominant suppliers of loanable funds are households at about 35% Main determinants of household savings are Some funds are supplied by governments and businesses Foreign funds suppliers examine the same factors as U. S. funds suppliers except that they must also factor in: U. S. is considered a safe haven, i. e. , a country with relatively low political and economic risk and a stable currency. Changes in home country conditions changes investment decision

Supply of Loanable Funds SS increases with interest rates. Predominant suppliers of loanable funds are households at about 35% Main determinants of household savings are Some funds are supplied by governments and businesses Foreign funds suppliers examine the same factors as U. S. funds suppliers except that they must also factor in: U. S. is considered a safe haven, i. e. , a country with relatively low political and economic risk and a stable currency. Changes in home country conditions changes investment decision

Demand for Loanable Funds Quantity of funds demanded increases as interest rates fall Businesses Consumers Government Foreign participants

Demand for Loanable Funds Quantity of funds demanded increases as interest rates fall Businesses Consumers Government Foreign participants

Equilibrium Interest Rates Federal Reserve banks (in US) estimate aggregate supply and demand of funds In free capital markets the interest rate observed will tend toward equilibrium at the rate that intersects the supply and demand curves for each traded instrument.

Equilibrium Interest Rates Federal Reserve banks (in US) estimate aggregate supply and demand of funds In free capital markets the interest rate observed will tend toward equilibrium at the rate that intersects the supply and demand curves for each traded instrument.

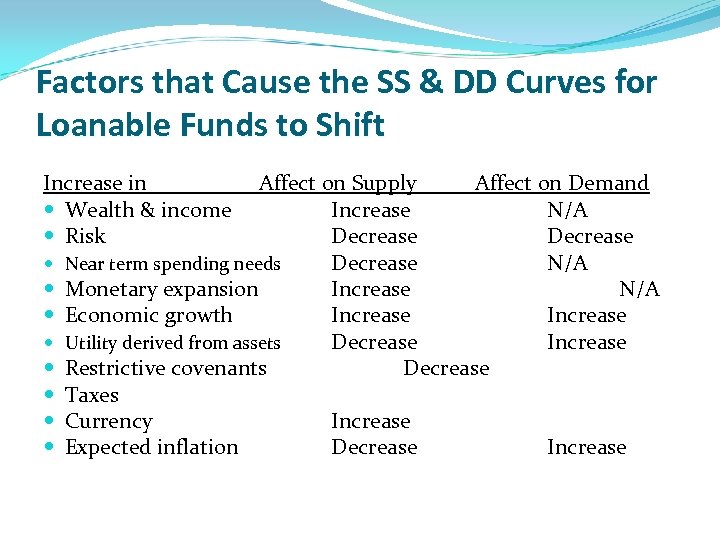

Factors that Cause the SS & DD Curves for Loanable Funds to Shift Increase in Wealth & income Risk Affect on Supply Affect on Demand Increase N/A Decrease Near term spending needs Decrease N/A Monetary expansion Increase N/A Economic growth Increase Utility derived from assets Decrease Increase Restrictive covenants Decrease Taxes Currency Increase Expected inflation Decrease Increase

Factors that Cause the SS & DD Curves for Loanable Funds to Shift Increase in Wealth & income Risk Affect on Supply Affect on Demand Increase N/A Decrease Near term spending needs Decrease N/A Monetary expansion Increase N/A Economic growth Increase Utility derived from assets Decrease Increase Restrictive covenants Decrease Taxes Currency Increase Expected inflation Decrease Increase

Movement of Interest Rates Over Time Interest rates fluctuate in a nearly continuous manner due to the actions of traders, and conditions described earlier Actions to buy, sell and issue securities affect interest rates Demand supply of funds fluctuate daily as current and expected macro and instrument specific conditions evolve

Movement of Interest Rates Over Time Interest rates fluctuate in a nearly continuous manner due to the actions of traders, and conditions described earlier Actions to buy, sell and issue securities affect interest rates Demand supply of funds fluctuate daily as current and expected macro and instrument specific conditions evolve

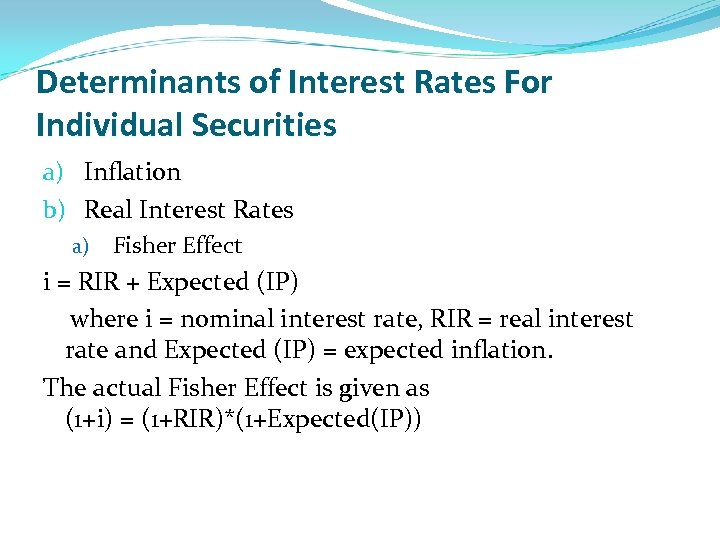

Determinants of Interest Rates For Individual Securities a) Inflation b) Real Interest Rates a) Fisher Effect i = RIR + Expected (IP) where i = nominal interest rate, RIR = real interest rate and Expected (IP) = expected inflation. The actual Fisher Effect is given as (1+i) = (1+RIR)*(1+Expected(IP))

Determinants of Interest Rates For Individual Securities a) Inflation b) Real Interest Rates a) Fisher Effect i = RIR + Expected (IP) where i = nominal interest rate, RIR = real interest rate and Expected (IP) = expected inflation. The actual Fisher Effect is given as (1+i) = (1+RIR)*(1+Expected(IP))

Example Suppose “It” originally cost you $1. You have $10 so could buy 10 of “it. ” If inflation is 5%, in one year “it” will cost $1 +. 05 =$1. 05. If you invest your $10 and earn 10% + 5% = 15% (the approximate Fisher Effect) you will get back $10 * 1. 15 = $11. 50. Can you buy $10% more of “it? ” I. E. can you now buy 10 * 1. 1 or 11 of “it? ” 11 * $1. 05 = $11. 55; so you are short 5 cents. In order to buy 10% more of it you must earn an interest rate equal to (1. 10 * 1. 05) - 1 = 1. 155 - 1 = 15. 5% nominal interest. Then your $10 will grow to $10 * 1. 155 = $11. 55 and you CAN buy 10% more of it! Since both P & Q are rising, the rate charged must reflect the increments to both P and Q. The difference matters little if inflation is low and/or the time period under consideration is not very long. In international investing environments where inflation is much higher than the U. S. is currently experiencing, the difference can be material.

Example Suppose “It” originally cost you $1. You have $10 so could buy 10 of “it. ” If inflation is 5%, in one year “it” will cost $1 +. 05 =$1. 05. If you invest your $10 and earn 10% + 5% = 15% (the approximate Fisher Effect) you will get back $10 * 1. 15 = $11. 50. Can you buy $10% more of “it? ” I. E. can you now buy 10 * 1. 1 or 11 of “it? ” 11 * $1. 05 = $11. 55; so you are short 5 cents. In order to buy 10% more of it you must earn an interest rate equal to (1. 10 * 1. 05) - 1 = 1. 155 - 1 = 15. 5% nominal interest. Then your $10 will grow to $10 * 1. 155 = $11. 55 and you CAN buy 10% more of it! Since both P & Q are rising, the rate charged must reflect the increments to both P and Q. The difference matters little if inflation is low and/or the time period under consideration is not very long. In international investing environments where inflation is much higher than the U. S. is currently experiencing, the difference can be material.

Determinants of Interest Rates For Individual Securities (continued) c) d) e) f) Default or Credit Risk Liquidity Risk Special Provisions of Covenants Term to Maturity

Determinants of Interest Rates For Individual Securities (continued) c) d) e) f) Default or Credit Risk Liquidity Risk Special Provisions of Covenants Term to Maturity

In Summary ij* = f(Riskless real rate, Expected inflation, Default risk premium, Liquidity risk premium, Special covenant premium, Maturity risk premium)

In Summary ij* = f(Riskless real rate, Expected inflation, Default risk premium, Liquidity risk premium, Special covenant premium, Maturity risk premium)

Term Structure of Interest Rates Unbiased Expectations Theory (UET): states that long term interest rate is the geometric average (geometric averages are used to account for compounding) of the current and expected future short term rates. If the expected one year rates are 6%, 7% and 8% for the next three years respectively, and the three year rate is 5%, how could one make money on this relationship? 0 R 1 = 6%, 1 R 1=7% and 2 R 1 = 8% but 0 R 3=5% The average of the short term one year rates is 7%, but the three year rate is only 5%.

Term Structure of Interest Rates Unbiased Expectations Theory (UET): states that long term interest rate is the geometric average (geometric averages are used to account for compounding) of the current and expected future short term rates. If the expected one year rates are 6%, 7% and 8% for the next three years respectively, and the three year rate is 5%, how could one make money on this relationship? 0 R 1 = 6%, 1 R 1=7% and 2 R 1 = 8% but 0 R 3=5% The average of the short term one year rates is 7%, but the three year rate is only 5%.

![1+1 RN= [(1+1 R 1)(1+E(2 r 1))…(1+E(Nr 1))]1/N-1 1+1 RN= [(1+1 R 1)(1+E(2 r 1))…(1+E(Nr 1))]1/N-1](https://present5.com/presentation/8271d817281bcc5f526f9a455201bc95/image-17.jpg) 1+1 RN= [(1+1 R 1)(1+E(2 r 1))…(1+E(Nr 1))]1/N-1

1+1 RN= [(1+1 R 1)(1+E(2 r 1))…(1+E(Nr 1))]1/N-1

Liquidity Premium Theory: If investors prefer shorter maturities to long, they will require a premium to invest for N years all at once instead of investing for 1 year and rolling the investment over N-1 times. In other words, the long term rate cannot be the average of the expected short term rates. The long term rate must equal the average of the short term rates plus what is illogically called a ‘liquidity premium. ’

Liquidity Premium Theory: If investors prefer shorter maturities to long, they will require a premium to invest for N years all at once instead of investing for 1 year and rolling the investment over N-1 times. In other words, the long term rate cannot be the average of the expected short term rates. The long term rate must equal the average of the short term rates plus what is illogically called a ‘liquidity premium. ’

Market Segmentation Theory: Market segmentation or preferred habitat theory claims that there are two or three distinct maturity segments (the segments are ill-defined) and market participants will not venture out of their preferred segment, even if favorable rates may be found in a different maturity.

Market Segmentation Theory: Market segmentation or preferred habitat theory claims that there are two or three distinct maturity segments (the segments are ill-defined) and market participants will not venture out of their preferred segment, even if favorable rates may be found in a different maturity.

Forecasting Interest Rates A forward rate is a rate that can be imputed from the existing term structure: (1+1 R 6)6 = (1+1 R 5)5 * (1+5 F 1) (1+1 R 5)5 = (1+1 R 4)4 * (1+4 F 1) … where 1 R 6 and 1 R 5 are the long term spot rates from today to year 6 and 5 respectively and F stands for a forward rate.

Forecasting Interest Rates A forward rate is a rate that can be imputed from the existing term structure: (1+1 R 6)6 = (1+1 R 5)5 * (1+5 F 1) (1+1 R 5)5 = (1+1 R 4)4 * (1+4 F 1) … where 1 R 6 and 1 R 5 are the long term spot rates from today to year 6 and 5 respectively and F stands for a forward rate.