cf2fa5cf7618562d22f64fbed2e3ea80.ppt

- Количество слайдов: 29

CHAP 19…. TYPES OF BUSINESS ORGANISATION

CHAPTER TOPICS 1. 2. 3. 4. 5. 6. 7. 8. 9. WHAT ARE THE DIFFERENT TYPES OF BUSINESS ORGANISATIONS? WHAT ARE SOLE TRADERS? WHAT ARE PARTNERSHIPS? WHAT IS A LIMITED COMPANY? WHAT IS A CO-OPERATIVE? WHAT ARE STATE OWNED ENTERPRISES? WHAT ARE THE CHANGING TRENDS IN BUSINESS OWNERSHIP AND STRUCTURE? WHY HAVE AGRICULTURAL CO-OPS TURNED INTO PLC’S? WHY DO BUSINESSES CHANGE THEIR LEGAL STRUCTURE OVER TIME?

1. WHAT ARE THE DIFFERENT TYPES OF BUSINESS ORGANISATIONS? l l l SOLE TRADER PARTNERSHIP PRIVATE LIMITED COMPANY CO-OPERATIVE STATE OWNED ENTERPRISES These business structures are going to be compared under the following headings: 1. Formation 2. Dissolution 3. Ownership 4. Management & finance 5. Profits & risk

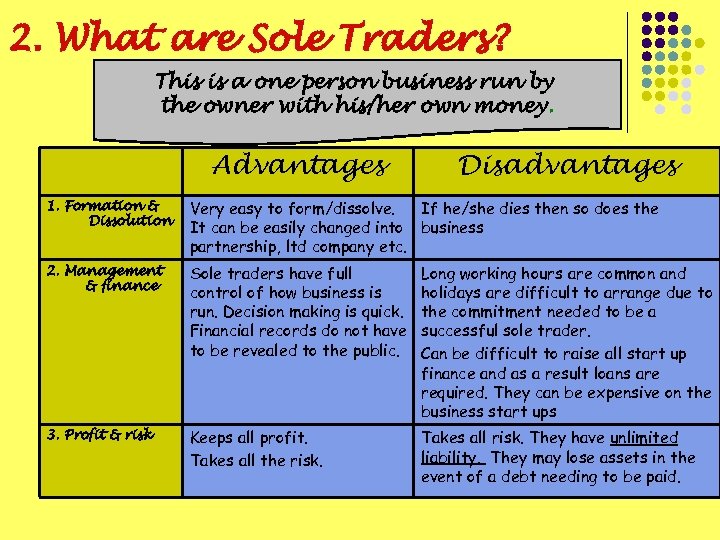

2. What are Sole Traders? This is a one person business run by the owner with his/her own money. Advantages Disadvantages 1. Formation & Dissolution Very easy to form/dissolve. If he/she dies then so does the It can be easily changed into business partnership, ltd company etc. 2. Management & finance Sole traders have full control of how business is run. Decision making is quick. Financial records do not have to be revealed to the public. Long working hours are common and holidays are difficult to arrange due to the commitment needed to be a successful sole trader. Can be difficult to raise all start up finance and as a result loans are required. They can be expensive on the business start ups 3. Profit & risk Keeps all profit. Takes all the risk. Takes all risk. They have unlimited liability. They may lose assets in the event of a debt needing to be paid.

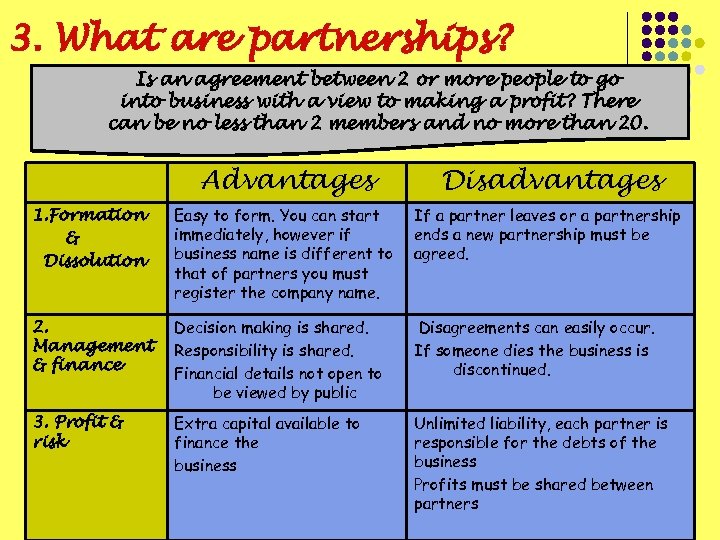

3. What are partnerships? Is an agreement between 2 or more people to go into business with a view to making a profit? There can be no less than 2 members and no more than 20. Advantages Disadvantages 1. Formation & Dissolution Easy to form. You can start immediately, however if business name is different to that of partners you must register the company name. If a partner leaves or a partnership ends a new partnership must be agreed. 2. Management & finance Decision making is shared. Responsibility is shared. Financial details not open to be viewed by public Disagreements can easily occur. If someone dies the business is discontinued. 3. Profit & risk Extra capital available to finance the business Unlimited liability, each partner is responsible for the debts of the business Profits must be shared between partners

4. What is a limited company? Ltd companies are regarded as separate legal entities from the people who own and run them. The owners are called shareholders and only gain/lose on the amount they put into the business. There are two main types of company: l Private limited company (Ltd) – HEITON BUCKLEY l Public limited companies (PLC’s) – LIVERPOOL FC The main difference is that shares of PLC’s can be freely bought and sold on the stock exchange

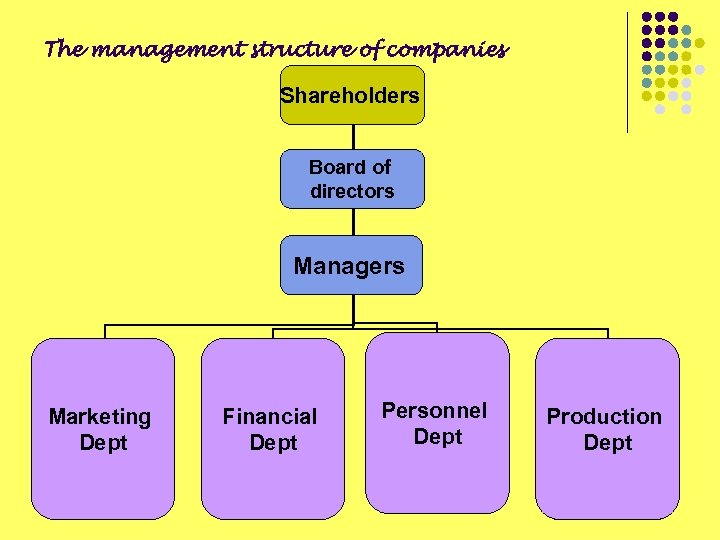

The management structure of companies Shareholders Board of directors Managers Marketing Dept Financial Dept Personnel Dept Production Dept

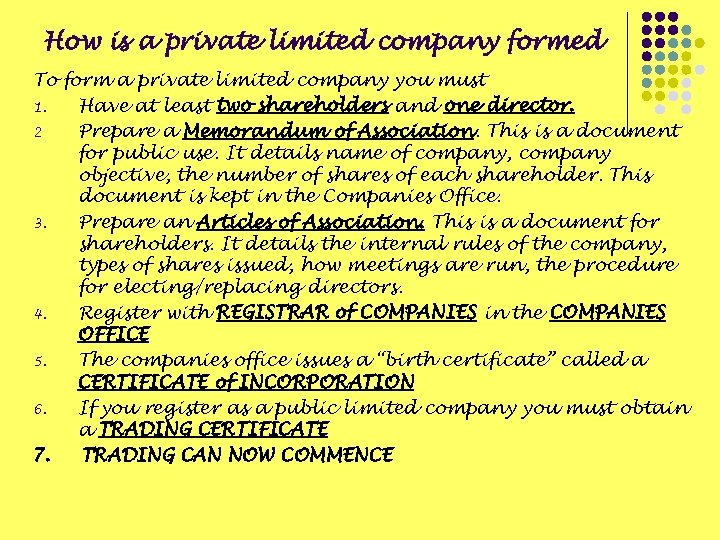

How is a private limited company formed To form a private limited company you must 1. Have at least two shareholders and one director. 2 Prepare a Memorandum of Association. This is a document for public use. It details name of company, company objective, the number of shares of each shareholder. This document is kept in the Companies Office. 3. Prepare an Articles of Association. This is a document for shareholders. It details the internal rules of the company, types of shares issued, how meetings are run, the procedure for electing/replacing directors. 4. Register with REGISTRAR of COMPANIES in the COMPANIES OFFICE 5. The companies office issues a “birth certificate” called a CERTIFICATE of INCORPORATION 6. If you register as a public limited company you must obtain a TRADING CERTIFICATE 7. TRADING CAN NOW COMMENCE

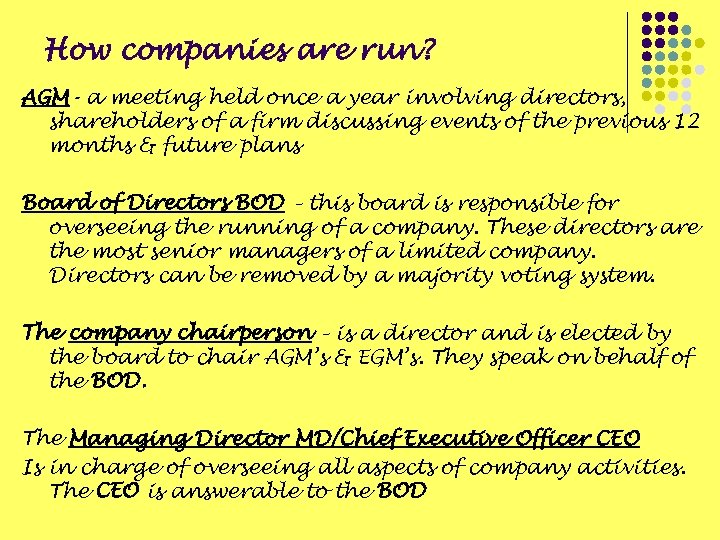

How companies are run? AGM- a meeting held once a year involving directors, shareholders of a firm discussing events of the previous 12 months & future plans Board of Directors BOD – this board is responsible for overseeing the running of a company. These directors are the most senior managers of a limited company. Directors can be removed by a majority voting system. The company chairperson – is a director and is elected by the board to chair AGM’s & EGM’s. They speak on behalf of the BOD. The Managing Director MD/Chief Executive Officer CEO Is in charge of overseeing all aspects of company activities. The CEO is answerable to the BOD

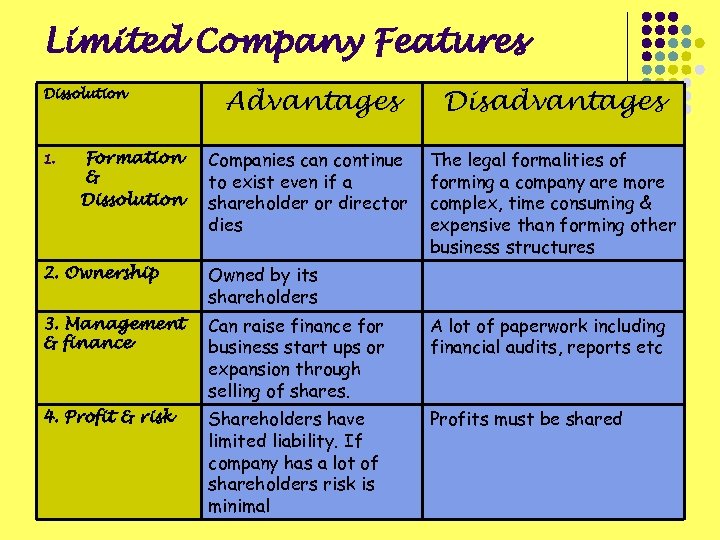

Limited Company Features Dissolution 1. Formation & Dissolution Advantages Disadvantages Companies can continue to exist even if a shareholder or director dies The legal formalities of forming a company are more complex, time consuming & expensive than forming other business structures 2. Ownership Owned by its shareholders 3. Management & finance Can raise finance for business start ups or expansion through selling of shares. A lot of paperwork including financial audits, reports etc 4. Profit & risk Shareholders have limited liability. If company has a lot of shareholders risk is minimal Profits must be shared

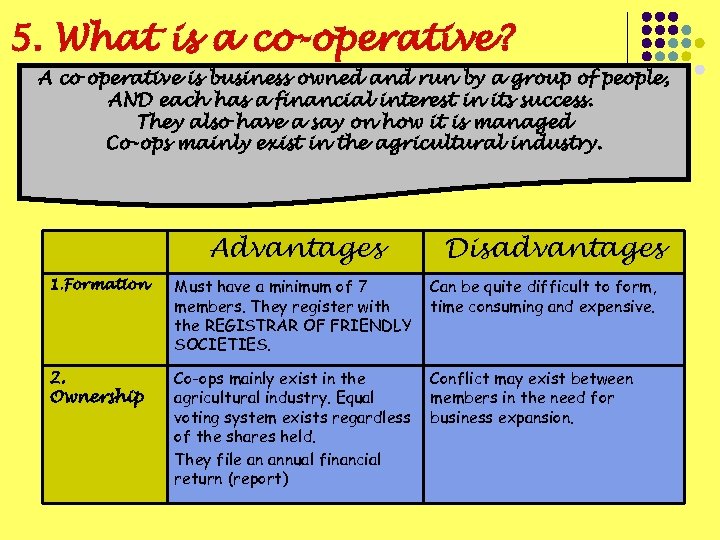

5. What is a co-operative? A co operative is business owned and run by a group of people, AND each has a financial interest in its success. They also have a say on how it is managed Co-ops mainly exist in the agricultural industry. Advantages Disadvantages 1. Formation Must have a minimum of 7 members. They register with the REGISTRAR OF FRIENDLY SOCIETIES. Can be quite difficult to form, time consuming and expensive. 2. Ownership Co-ops mainly exist in the agricultural industry. Equal voting system exists regardless of the shares held. They file an annual financial return (report) Conflict may exist between members in the need for business expansion.

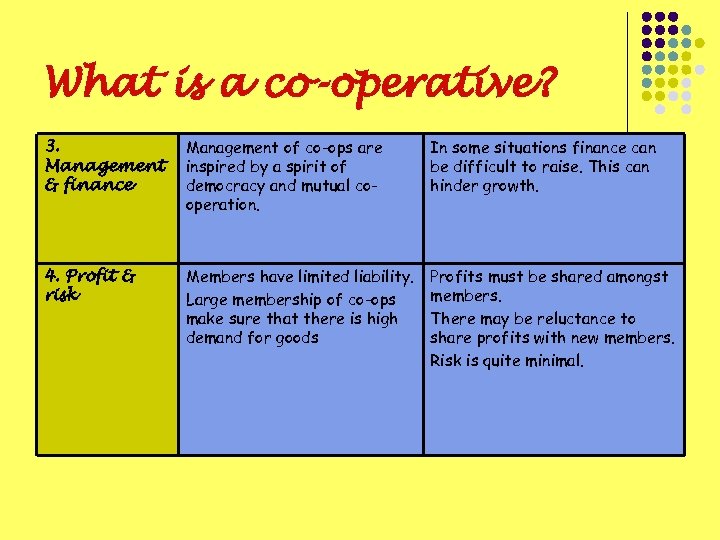

What is a co-operative? 3. Management & finance Management of co-ops are inspired by a spirit of democracy and mutual cooperation. In some situations finance can be difficult to raise. This can hinder growth. 4. Profit & risk Members have limited liability. Large membership of co-ops make sure that there is high demand for goods Profits must be shared amongst members. There may be reluctance to share profits with new members. Risk is quite minimal.

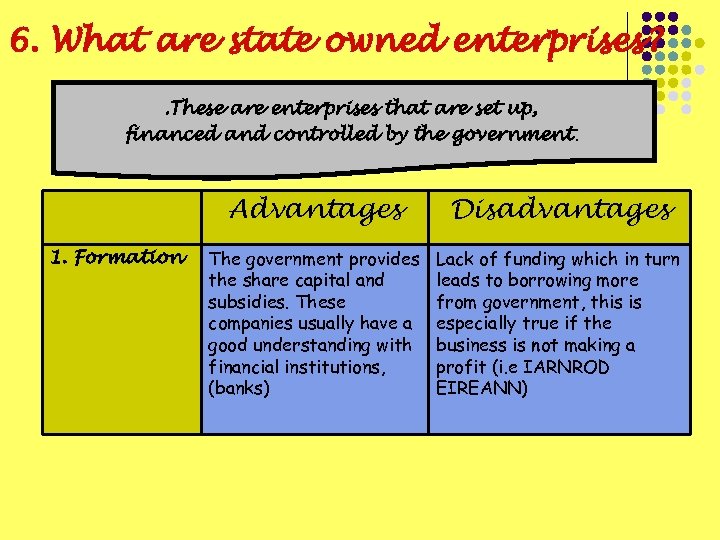

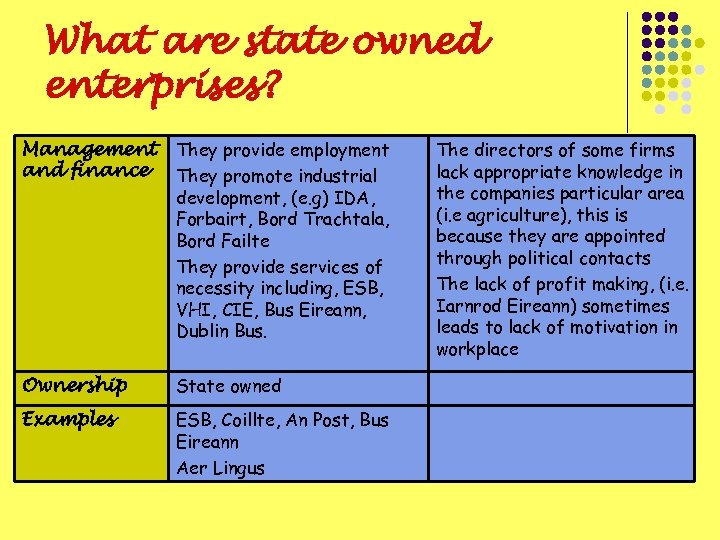

6. What are state owned enterprises? . These are enterprises that are set up, financed and controlled by the government. Advantages 1. Formation Disadvantages The government provides the share capital and subsidies. These companies usually have a good understanding with financial institutions, (banks) Lack of funding which in turn leads to borrowing more from government, this is especially true if the business is not making a profit (i. e IARNROD EIREANN)

What are state owned enterprises? Management and finance They provide employment They promote industrial development, (e. g) IDA, Forbairt, Bord Trachtala, Bord Failte They provide services of necessity including, ESB, VHI, CIE, Bus Eireann, Dublin Bus. Ownership State owned Examples ESB, Coillte, An Post, Bus Eireann Aer Lingus The directors of some firms lack appropriate knowledge in the companies particular area (i. e agriculture), this is because they are appointed through political contacts The lack of profit making, (i. e. Iarnrod Eireann) sometimes leads to lack of motivation in workplace

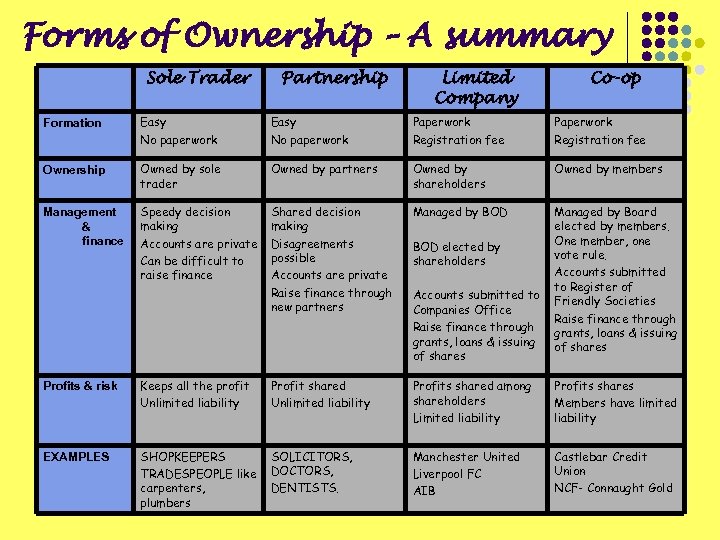

Forms of Ownership – A summary Sole Trader Partnership Limited Company Co-op Formation Easy No paperwork Paperwork Registration fee Ownership Owned by sole trader Owned by partners Owned by shareholders Owned by members Management & finance Speedy decision making Accounts are private Can be difficult to raise finance Shared decision making Disagreements possible Accounts are private Raise finance through new partners Managed by BOD Managed by Board elected by members. One member, one vote rule. Accounts submitted to Register of Friendly Societies Raise finance through grants, loans & issuing of shares BOD elected by shareholders Accounts submitted to Companies Office Raise finance through grants, loans & issuing of shares Profits & risk Keeps all the profit Unlimited liability Profit shared Unlimited liability Profits shared among shareholders Limited liability Profits shares Members have limited liability EXAMPLES SHOPKEEPERS TRADESPEOPLE like carpenters, plumbers SOLICITORS, DOCTORS, DENTISTS. Manchester United Liverpool FC AIB Castlebar Credit Union NCF- Connaught Gold

7. WHAT ARE THE CHANGING TRENDS IN BUSINESS OWNERSHIP AND STRUCTURE? a) b) c) d) e) Rise in the number of firms entering into alliances Emergence of Irish TNC’s Rise in the number of SME’s Privatisation of state owned companies Agricultural co-ops turning into PLC’s a) Rise in the number of firms entering into alliances Many Irish firms are now entering into alliances such as joint ventures. This helps them against larger international firms. They can also share skills, pool resources to further their growth.

b) Emergence of Irish TNC’s The growth of free trade areas and Irelands membership of the EU has led to potential large Irish firms becoming TNC’s. They now have access to a larger market size in which to develop their companies. Examples: Kerry Group AIB FYFFES These companies are now set up in different global locations such as UK, mainland Europe, USA etc.

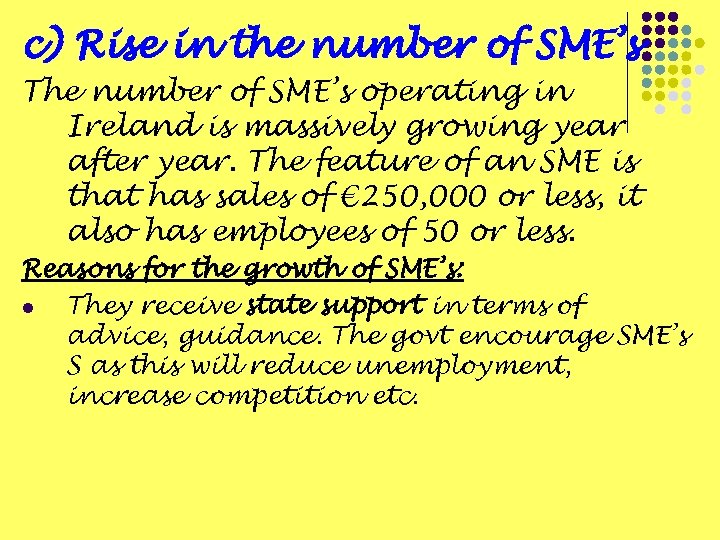

c) Rise in the number of SME’s The number of SME’s operating in Ireland is massively growing year after year. The feature of an SME is that has sales of € 250, 000 or less, it also has employees of 50 or less. Reasons for the growth of SME’s: l They receive state support in terms of advice, guidance. The govt encourage SME’s S as this will reduce unemployment, increase competition etc.

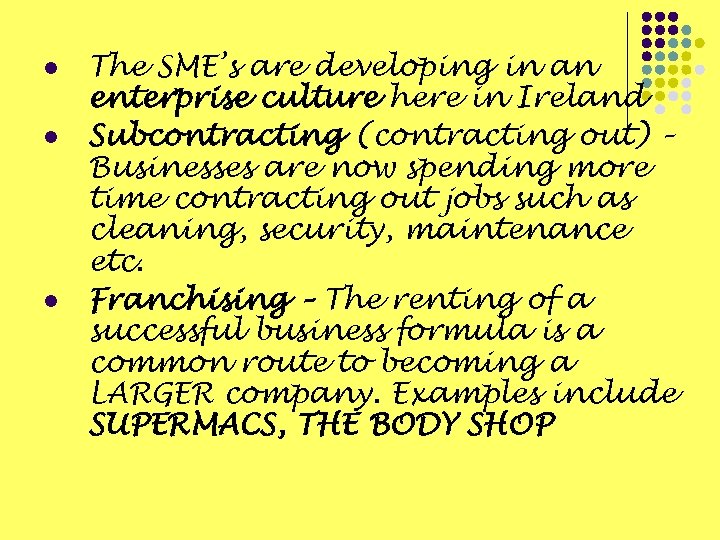

l l l The SME’s are developing in an enterprise culture here in Ireland Subcontracting (contracting out) – Businesses are now spending more time contracting out jobs such as cleaning, security, maintenance etc. Franchising – The renting of a successful business formula is a common route to becoming a LARGER company. Examples include SUPERMACS, THE BODY SHOP

d) Privatisation of state owned companies This means the selling of some or all of the shares in state – owned company to private investors. Examples: GREENCORE, IRISH LIFE e) Agricultural co-ops turning into PLC’s PLC’S are companies that only sell shares on the stock exchange. This makes it easier to raise much needed finance for future business developments. In recent years agricultural co-ops have become PLC’s Example: KERRY GROUP

8. WHY HAVE AGRICULTURAL CO-OP’S TURNED INTO PLC’s ? With the international food industry getting very competitive Irish agricultural co-ops have become increasingly competitive. To be able to spend large sums of money on R & D has enabled these co-ops to increase their economies of scale. Existing Problems: l The limit to equity/investors: agricultural co-ops are owned by farmers. Under the laws governing co-ops there is a limit on the amount of shares each individual shareholder can have. As only farmers can hold shares it makes it difficult to raise finance. l Limit to borrowings: borrowing large sums of money would be high risk.

Solutions to the problems: 1. 2. 3. 4. set up a PLC company on the stock market Transfer ownership of some of the co-ops business assets to the PLC. The farmers own the co-op and the co-op has shares on the stock market When they need finance the sell shares on the stock market. They always retain a 51% share to keep the majority of the company. Examples: Kerry group, Golden Vale , Avonmore co-ops NB: building societies are now following the trend of these co-ops in raising finance on the stock market

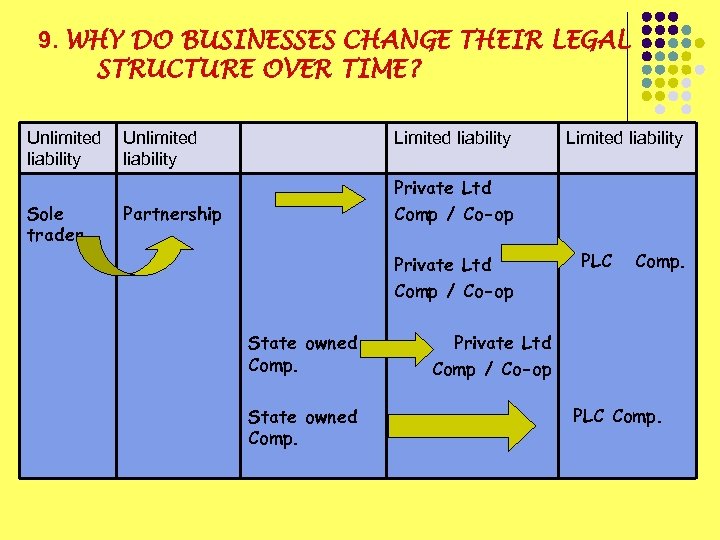

9. WHY DO BUSINESSES CHANGE THEIR LEGAL STRUCTURE OVER TIME? Unlimited liability Sole trader Unlimited liability Limited liability Private Ltd Comp / Co-op Partnership Private Ltd Comp / Co-op State owned Comp. PLC Comp. Private Ltd Comp / Co-op PLC Comp.

Businesses change their Business Structure from Sole Trader to Partnership to Private Limited Company to a PLC because: 1. 2. 3. It helps them bring in new skills, experience, resources It reduces risk as the sole trader or the partners can now enjoy limited liability Helps to raise finance through investors, stock exchange etc. for future expansion

4. 5. Helps to market the company. Being a limited company enhances the image of the business. This adds to the reputation of the company as advertising and promotions will be more convincing to the intended customers. Business profit prestige- changing a co-op owned company to a PLC offers the management and employees a stronger allegiance to making profit rather than operating for the goodwill of the local area farmers etc.

KEY DEFINITIONS

LC EXAM QUESTION 2005 Q 2. (a) 15 marks Distinguish between a Sole Trader and a Partnership as a form of Business organisation. Use an example in each of your answers. 2005 – SQ Explain the concept Limited Liability 10 marks

LC EXAM QUESTION 2004 - Q 2 – (C) 20 MARKS Explain why you would recommend a private limited company Ltd as a type of business organisation for a new business venture. 2001 – Q 2 -(A) 20 MARKS Contrast a Private Limited Company LTD with a Public Limited Company PLC as a form of Business Organisation.

LC EXAM QUESTION MOCK QUES 25 MARKS Contrast the contents and functions of the articles of association and memorandum of association of a limited company.

cf2fa5cf7618562d22f64fbed2e3ea80.ppt