ca7e988a60facaa573cde39a8f923db2.ppt

- Количество слайдов: 15

Changing Data Standards from Wall Street to DC & Beyond John Mulholland Vice President for Enterprise Data Fannie Mae February 29, 2012 1

Changing Data Standards from Wall Street to DC & Beyond John Mulholland Vice President for Enterprise Data Fannie Mae February 29, 2012 1

Agenda ■ Impetus for Change ■ Technology Maturity Comparison ■ Current State ■ Future State ■ Roadmap to Success ■ The Balance ■ Challenges & Opportunities ■ Changing the Industry – Fannie Mae Leading Change © 2012 Fannie Mae 2

Agenda ■ Impetus for Change ■ Technology Maturity Comparison ■ Current State ■ Future State ■ Roadmap to Success ■ The Balance ■ Challenges & Opportunities ■ Changing the Industry – Fannie Mae Leading Change © 2012 Fannie Mae 2

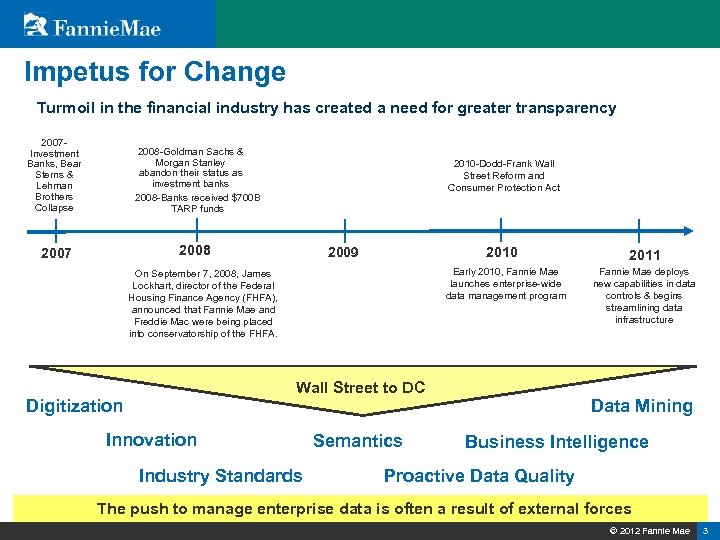

Impetus for Change Turmoil in the financial industry has created a need for greater transparency 2007 Investment Banks, Bear Sterns & Lehman Brothers Collapse 2008 -Goldman Sachs & Morgan Stanley abandon their status as investment banks 2008 -Banks received $700 B TARP funds 2007 2008 2010 -Dodd-Frank Wall Street Reform and Consumer Protection Act 2009 2010 Early 2010, Fannie Mae launches enterprise-wide data management program On September 7, 2008, James Lockhart, director of the Federal Housing Finance Agency (FHFA), announced that Fannie Mae and Freddie Mac were being placed into conservatorship of the FHFA. Wall Street to DC Digitization Innovation Industry Standards Semantics 2011 Fannie Mae deploys new capabilities in data controls & begins streamlining data infrastructure Data Mining Business Intelligence Proactive Data Quality The push to manage enterprise data is often a result of external forces © 2012 Fannie Mae 3

Impetus for Change Turmoil in the financial industry has created a need for greater transparency 2007 Investment Banks, Bear Sterns & Lehman Brothers Collapse 2008 -Goldman Sachs & Morgan Stanley abandon their status as investment banks 2008 -Banks received $700 B TARP funds 2007 2008 2010 -Dodd-Frank Wall Street Reform and Consumer Protection Act 2009 2010 Early 2010, Fannie Mae launches enterprise-wide data management program On September 7, 2008, James Lockhart, director of the Federal Housing Finance Agency (FHFA), announced that Fannie Mae and Freddie Mac were being placed into conservatorship of the FHFA. Wall Street to DC Digitization Innovation Industry Standards Semantics 2011 Fannie Mae deploys new capabilities in data controls & begins streamlining data infrastructure Data Mining Business Intelligence Proactive Data Quality The push to manage enterprise data is often a result of external forces © 2012 Fannie Mae 3

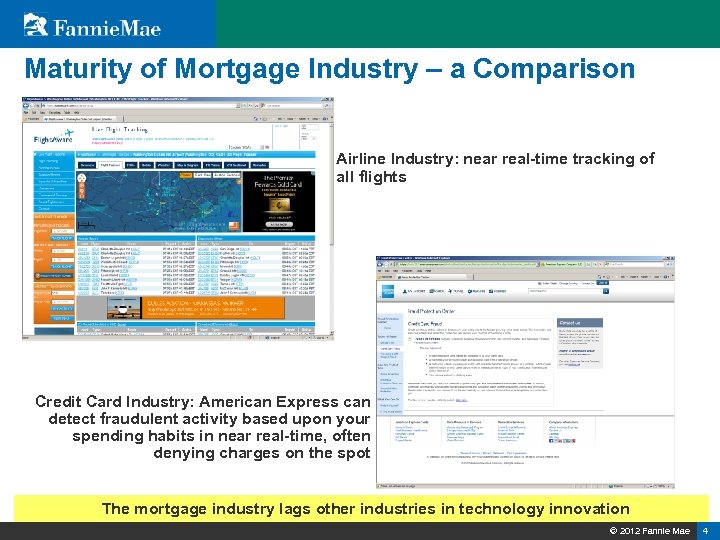

Maturity of Mortgage Industry – a Comparison Airline Industry: near real-time tracking of all flights Credit Card Industry: American Express can detect fraudulent activity based upon your spending habits in near real-time, often denying charges on the spot The mortgage industry lags other industries in technology innovation © 2012 Fannie Mae 4

Maturity of Mortgage Industry – a Comparison Airline Industry: near real-time tracking of all flights Credit Card Industry: American Express can detect fraudulent activity based upon your spending habits in near real-time, often denying charges on the spot The mortgage industry lags other industries in technology innovation © 2012 Fannie Mae 4

Maturity of Mortgage Industry – a Comparison (cont’d) Other industries can track data near real-time, but our partners in the mortgage industry have difficulty tracking the status of their loans in real-time Secondary Mortgage Market ■ Buried under paper ■ Manual processes ■ Minimal automation The mortgage industry lags other industries in technology innovation © 2012 Fannie Mae 5

Maturity of Mortgage Industry – a Comparison (cont’d) Other industries can track data near real-time, but our partners in the mortgage industry have difficulty tracking the status of their loans in real-time Secondary Mortgage Market ■ Buried under paper ■ Manual processes ■ Minimal automation The mortgage industry lags other industries in technology innovation © 2012 Fannie Mae 5

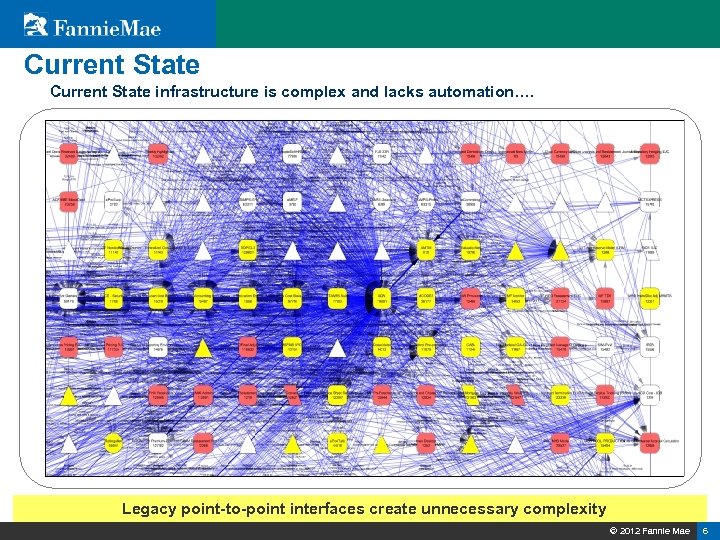

Current State infrastructure is complex and lacks automation…. Legacy point-to-point interfaces create unnecessary complexity © 2012 Fannie Mae 6

Current State infrastructure is complex and lacks automation…. Legacy point-to-point interfaces create unnecessary complexity © 2012 Fannie Mae 6

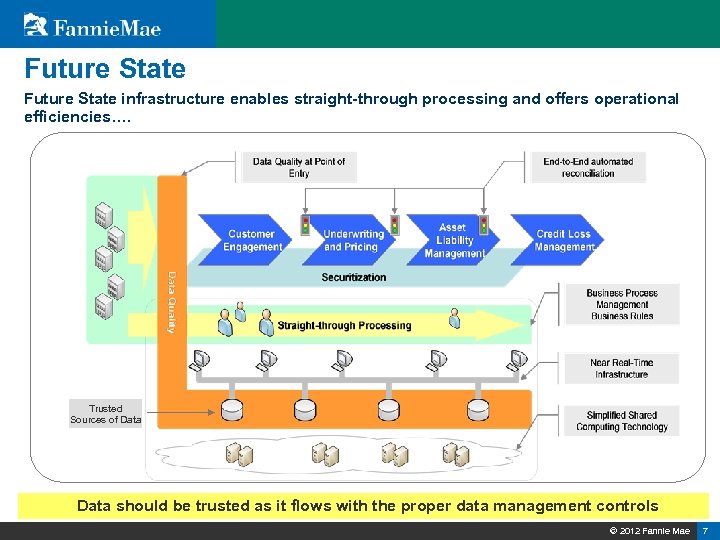

Future State infrastructure enables straight-through processing and offers operational efficiencies…. Trusted Sources of Data should be trusted as it flows with the proper data management controls © 2012 Fannie Mae 7

Future State infrastructure enables straight-through processing and offers operational efficiencies…. Trusted Sources of Data should be trusted as it flows with the proper data management controls © 2012 Fannie Mae 7

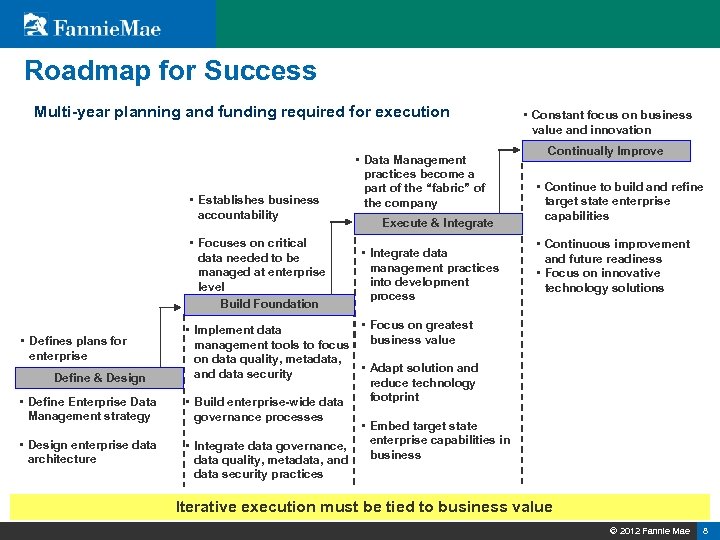

Roadmap for Success Multi-year planning and funding required for execution • Establishes business accountability • Focuses on critical data needed to be managed at enterprise level Build Foundation • Defines plans for enterprise Define & Design • Define Enterprise Data Management strategy • Design enterprise data architecture • Data Management practices become a part of the “fabric” of the company Execute & Integrate • Integrate data management practices into development process • Constant focus on business value and innovation Continually Improve • Continue to build and refine target state enterprise capabilities • Continuous improvement and future readiness • Focus on innovative technology solutions • Focus on greatest • Implement data business value management tools to focus on data quality, metadata, • Adapt solution and data security reduce technology footprint • Build enterprise-wide data governance processes • Embed target state enterprise capabilities in • Integrate data governance, business data quality, metadata, and data security practices Iterative execution must be tied to business value © 2012 Fannie Mae 8

Roadmap for Success Multi-year planning and funding required for execution • Establishes business accountability • Focuses on critical data needed to be managed at enterprise level Build Foundation • Defines plans for enterprise Define & Design • Define Enterprise Data Management strategy • Design enterprise data architecture • Data Management practices become a part of the “fabric” of the company Execute & Integrate • Integrate data management practices into development process • Constant focus on business value and innovation Continually Improve • Continue to build and refine target state enterprise capabilities • Continuous improvement and future readiness • Focus on innovative technology solutions • Focus on greatest • Implement data business value management tools to focus on data quality, metadata, • Adapt solution and data security reduce technology footprint • Build enterprise-wide data governance processes • Embed target state enterprise capabilities in • Integrate data governance, business data quality, metadata, and data security practices Iterative execution must be tied to business value © 2012 Fannie Mae 8

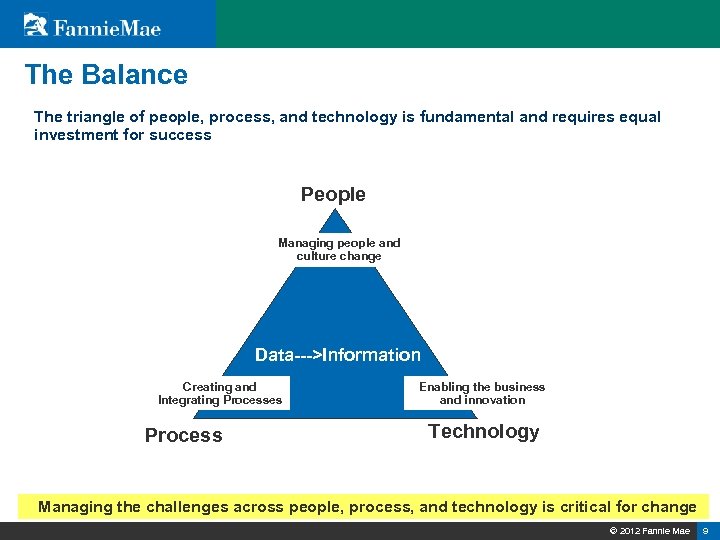

The Balance The triangle of people, process, and technology is fundamental and requires equal investment for success People Managing people and culture change Data--->Information Creating and Integrating Processes Process Enabling the business and innovation Technology Managing the challenges across people, process, and technology is critical for change © 2012 Fannie Mae 9

The Balance The triangle of people, process, and technology is fundamental and requires equal investment for success People Managing people and culture change Data--->Information Creating and Integrating Processes Process Enabling the business and innovation Technology Managing the challenges across people, process, and technology is critical for change © 2012 Fannie Mae 9

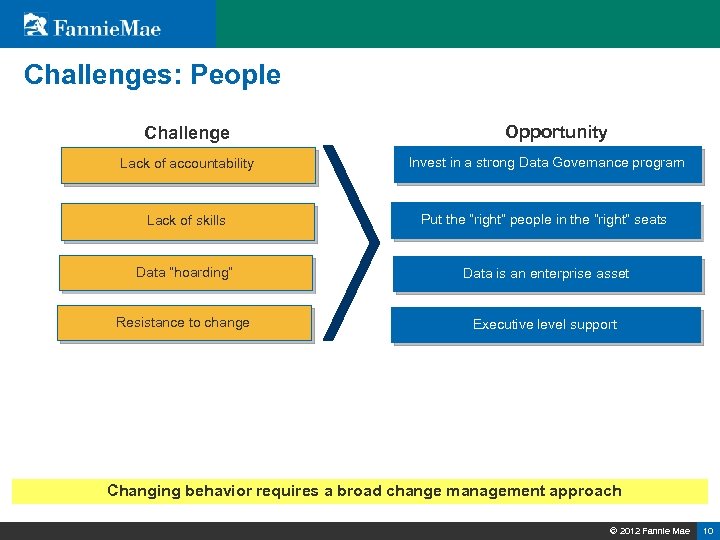

Challenges: People Challenge Opportunity Lack of accountability Invest in a strong Data Governance program Lack of skills Put the “right” people in the “right” seats Data “hoarding” Data is an enterprise asset Resistance to change Executive level support Changing behavior requires a broad change management approach © 2012 Fannie Mae 10

Challenges: People Challenge Opportunity Lack of accountability Invest in a strong Data Governance program Lack of skills Put the “right” people in the “right” seats Data “hoarding” Data is an enterprise asset Resistance to change Executive level support Changing behavior requires a broad change management approach © 2012 Fannie Mae 10

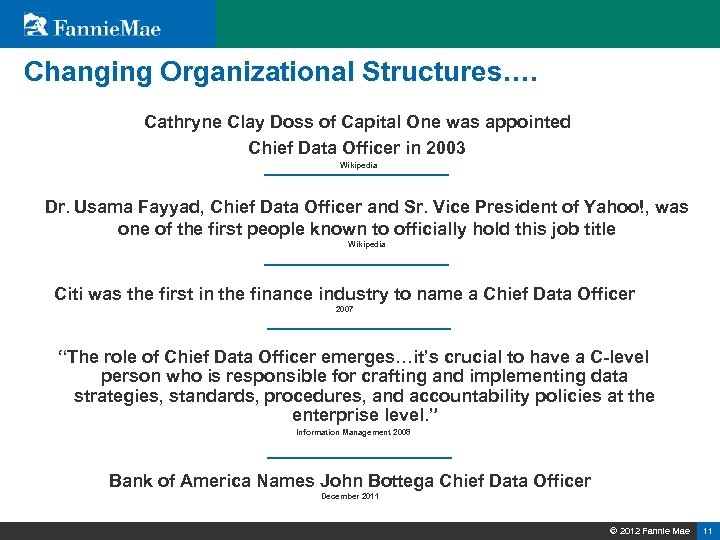

Changing Organizational Structures…. Cathryne Clay Doss of Capital One was appointed Chief Data Officer in 2003 Wikipedia Dr. Usama Fayyad, Chief Data Officer and Sr. Vice President of Yahoo!, was one of the first people known to officially hold this job title Wikipedia Citi was the first in the finance industry to name a Chief Data Officer 2007 “The role of Chief Data Officer emerges…it’s crucial to have a C-level person who is responsible for crafting and implementing data strategies, standards, procedures, and accountability policies at the enterprise level. ” Information Management 2008 Bank of America Names John Bottega Chief Data Officer December 2011 © 2012 Fannie Mae 11

Changing Organizational Structures…. Cathryne Clay Doss of Capital One was appointed Chief Data Officer in 2003 Wikipedia Dr. Usama Fayyad, Chief Data Officer and Sr. Vice President of Yahoo!, was one of the first people known to officially hold this job title Wikipedia Citi was the first in the finance industry to name a Chief Data Officer 2007 “The role of Chief Data Officer emerges…it’s crucial to have a C-level person who is responsible for crafting and implementing data strategies, standards, procedures, and accountability policies at the enterprise level. ” Information Management 2008 Bank of America Names John Bottega Chief Data Officer December 2011 © 2012 Fannie Mae 11

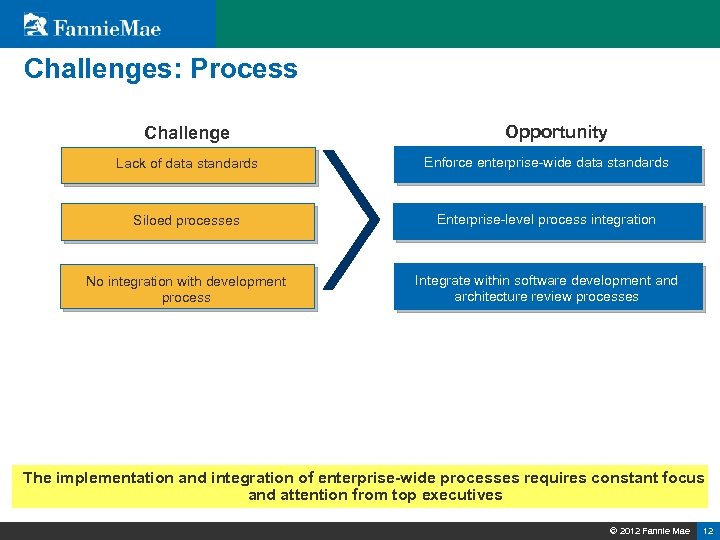

Challenges: Process Challenge Opportunity Lack of data standards Enforce enterprise-wide data standards Siloed processes Enterprise-level process integration No integration with development process Integrate within software development and architecture review processes The implementation and integration of enterprise-wide processes requires constant focus and attention from top executives © 2012 Fannie Mae 12

Challenges: Process Challenge Opportunity Lack of data standards Enforce enterprise-wide data standards Siloed processes Enterprise-level process integration No integration with development process Integrate within software development and architecture review processes The implementation and integration of enterprise-wide processes requires constant focus and attention from top executives © 2012 Fannie Mae 12

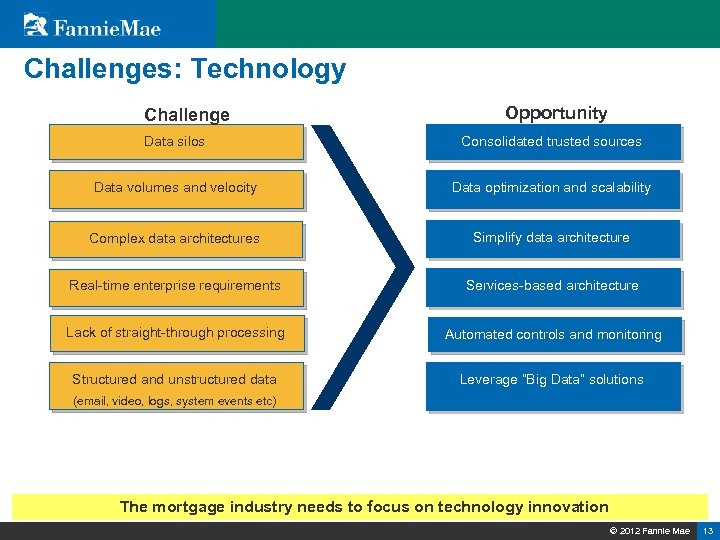

Challenges: Technology Challenge Opportunity Data silos Consolidated trusted sources Data volumes and velocity Data optimization and scalability Complex data architectures Simplify data architecture Real-time enterprise requirements Services-based architecture Lack of straight-through processing Automated controls and monitoring Structured and unstructured data Leverage “Big Data” solutions (email, video, logs, system events etc) The mortgage industry needs to focus on technology innovation © 2012 Fannie Mae 13

Challenges: Technology Challenge Opportunity Data silos Consolidated trusted sources Data volumes and velocity Data optimization and scalability Complex data architectures Simplify data architecture Real-time enterprise requirements Services-based architecture Lack of straight-through processing Automated controls and monitoring Structured and unstructured data Leverage “Big Data” solutions (email, video, logs, system events etc) The mortgage industry needs to focus on technology innovation © 2012 Fannie Mae 13

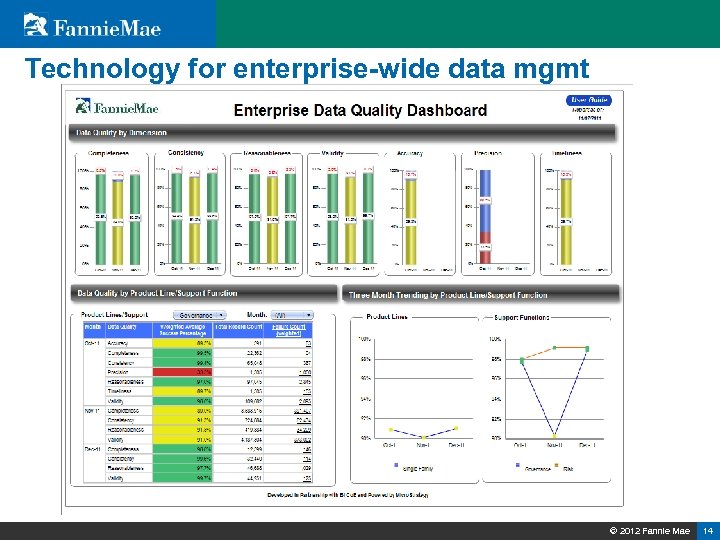

Technology for enterprise-wide data mgmt © 2012 Fannie Mae 14

Technology for enterprise-wide data mgmt © 2012 Fannie Mae 14

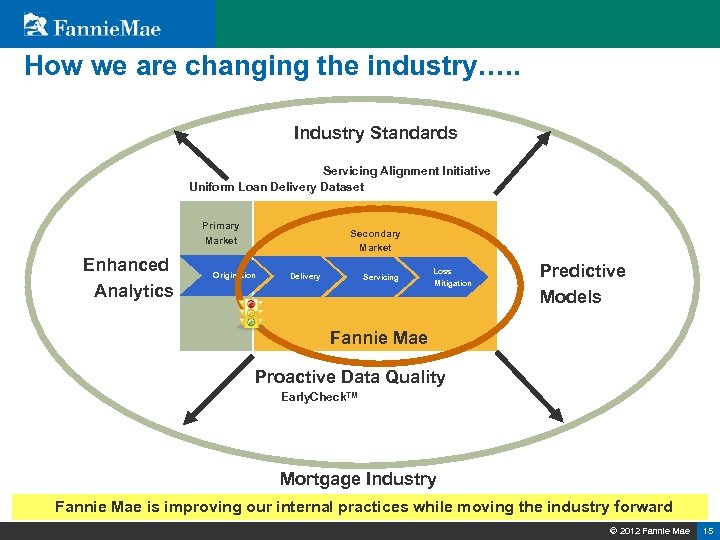

How we are changing the industry…. . Industry Standards Servicing Alignment Initiative Uniform Loan Delivery Dataset Primary Market Enhanced Analytics Secondary Market Origination Delivery Servicing Loss Mitigation Predictive Models Fannie Mae Proactive Data Quality Early. Check. TM Mortgage Industry Fannie Mae is improving our internal practices while moving the industry forward © 2012 Fannie Mae 15

How we are changing the industry…. . Industry Standards Servicing Alignment Initiative Uniform Loan Delivery Dataset Primary Market Enhanced Analytics Secondary Market Origination Delivery Servicing Loss Mitigation Predictive Models Fannie Mae Proactive Data Quality Early. Check. TM Mortgage Industry Fannie Mae is improving our internal practices while moving the industry forward © 2012 Fannie Mae 15