Polish Tax Law changes.pptx

- Количество слайдов: 7

Changes in Polish Tax Law Baltic Business Forum 2016

Presentation structure 1. Background: Freedom Of Commercial Activity In Poland 2. Tax Rates Reduction For Enterprises 3. Full depreciation of the investment costs the year they arise 4. Obligation to inform about obtaining the tax advantages

Freedom of Commercial Activity The principle of freedom of commercial activity is not absolute – the maintenance of certain types of activities requires obtaining a concession, patent, license or permit. 1) Entry into Poland requires a valid travel document and a valid visa 2) Stay in Poland requires a permission to stay. For example, a permit with business purpose. It requires: - health insurance - stable and regular source of income - temporary registration at the place of residence in Poland

Tax Rates Reduction For Enterprises • This rate should be reduced from 19% to 15% for taxpayers whose annual turnover does not exceed 1. 2 million euros per year.

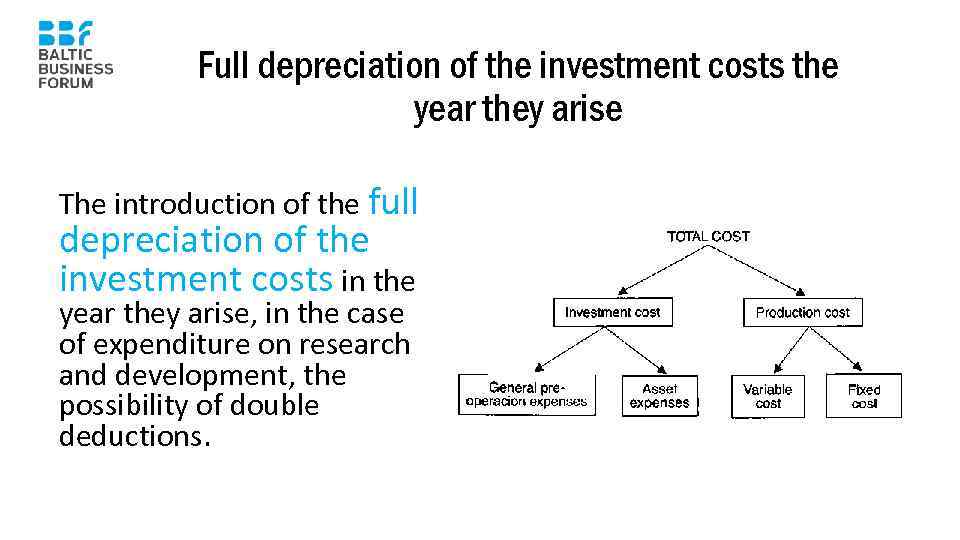

Full depreciation of the investment costs the year they arise The introduction of the full depreciation of the investment costs in the year they arise, in the case of expenditure on research and development, the possibility of double deductions.

Obligation to inform about obtaining the tax advantages The idea is to introduce the obligation to inform tax authorities about any transactions with the aim of obtaining the so-called tax advantages aimed at restricting financial transfers to tax havens. In the absence of information about such benefits is supposed to use the increased tax rate. Proposed sales tax must be applied in large shopping stores. The proposal involves the introduction of tax rates ranging from 0. 5% to 2% and will apply to shops with an area exceeding 250 square meters.

Polish Tax Law changes.pptx