e0520e7df59b29d2d2e9c5949e41af4f.ppt

- Количество слайдов: 93

Chanda Bihari, goat farmer in Varanasi, India. Measuring, Managing and Ending Poverty Training on Progress out of Poverty Index® SPTF 2015, Siem Reap, Cambodia Trainer - Muhammad Awais – Responsible Inclusive Finance Lead - Good Return Skype: mawaisq | Email: awais@goodreturn. org

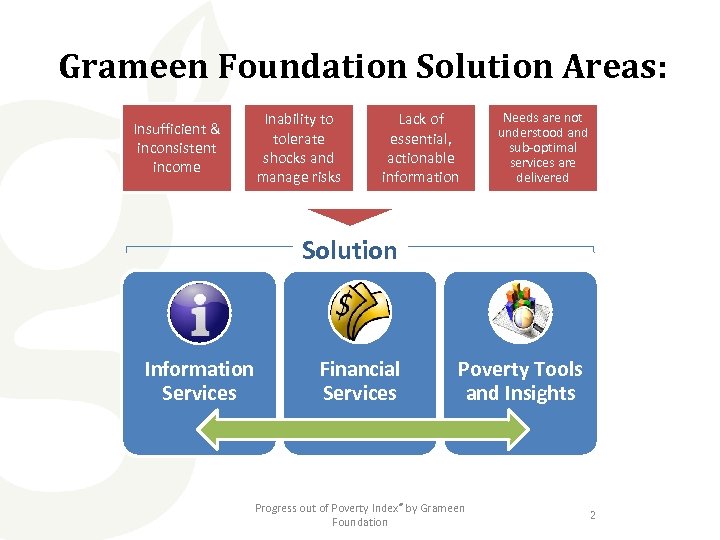

Grameen Foundation Solution Areas: Insufficient & inconsistent income Inability to tolerate shocks and manage risks Lack of essential, actionable information Needs are not understood and sub-optimal services are delivered Solution Areas Information Services Financial Services Poverty Tools and Insights Progress out of Poverty Index® by Grameen Foundation 2

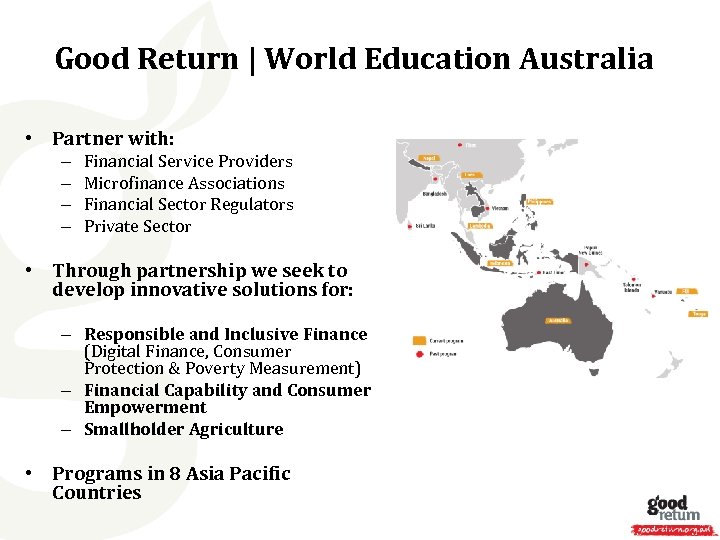

Good Return | World Education Australia • Partner with: – – Financial Service Providers Microfinance Associations Financial Sector Regulators Private Sector • Through partnership we seek to develop innovative solutions for: – Responsible and Inclusive Finance (Digital Finance, Consumer Protection & Poverty Measurement) – Financial Capability and Consumer Empowerment – Smallholder Agriculture • Programs in 8 Asia Pacific Countries

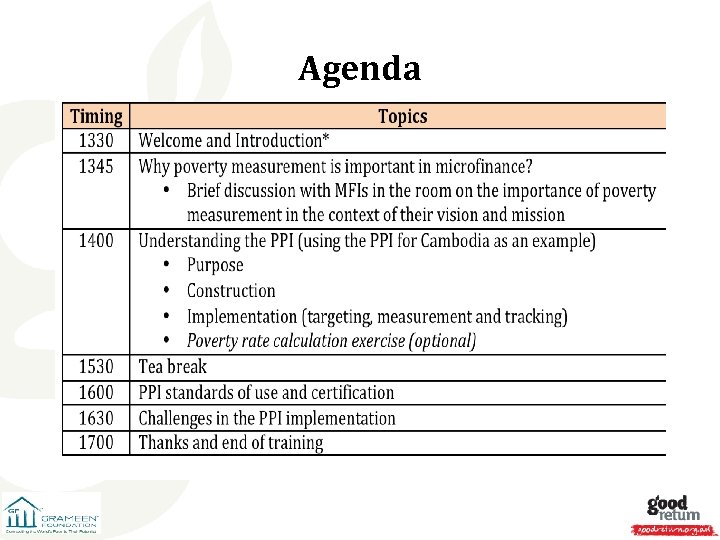

Agenda

Session 2 Why poverty measurement is important in microfinance?

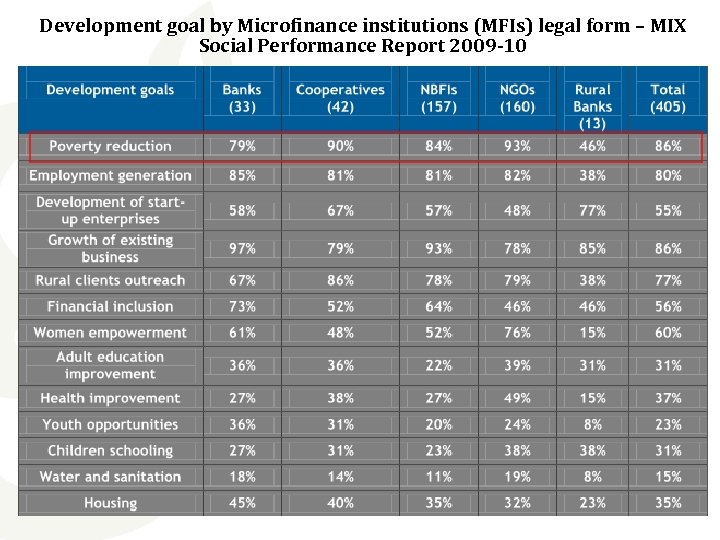

Development goal by Microfinance institutions (MFIs) legal form – MIX Social Performance Report 2009 -10

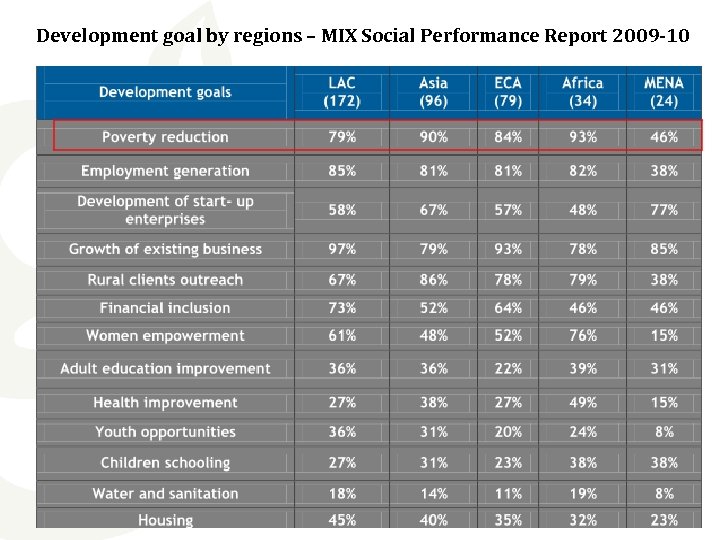

Development goal by regions – MIX Social Performance Report 2009 -10

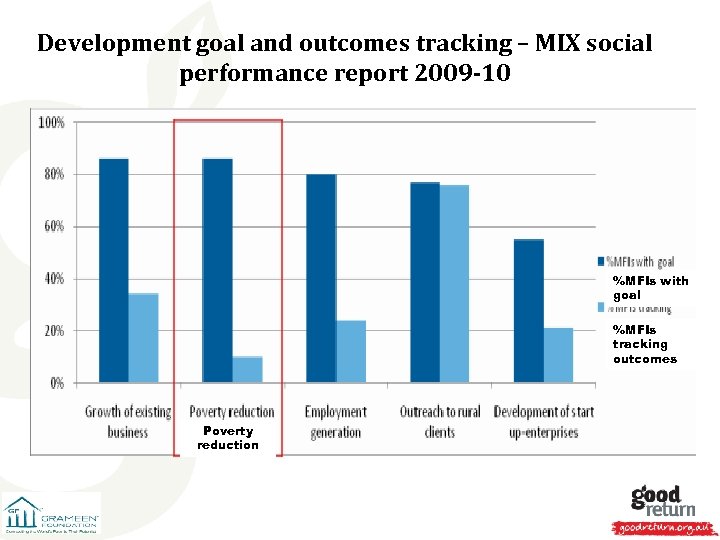

Development goal and outcomes tracking – MIX social performance report 2009 -10 %MFIs with goal %MFIs tracking outcomes Poverty reduction

2009 Social Performance Report – Pakistan Microfinance Network (PMN)

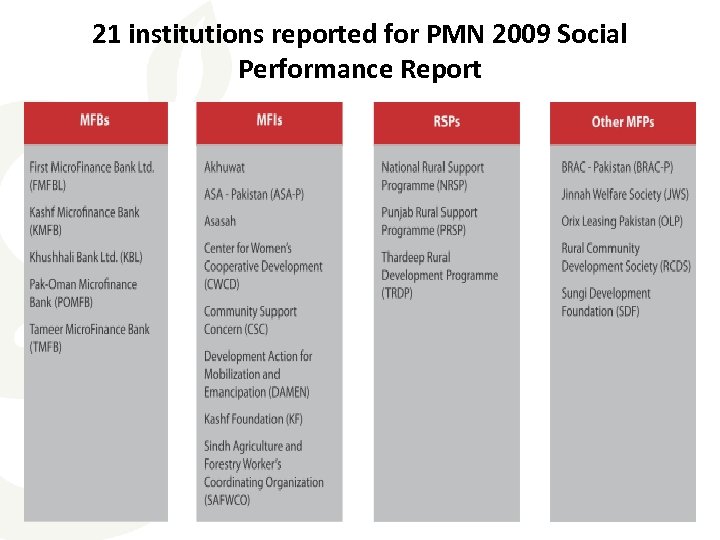

21 institutions reported for PMN 2009 Social Performance Report

Social Performance Report 2009 of PMN 1. Poverty reduction is the second most popular development objective 2. Very few institutions have a poverty assessment strategy in place or have reliable data on the poverty profile of their clients. 3. Institutions assume they are lending to the ‘poor’, so they are meeting their objective.

Social Performance Report 2009 of PMN – Poverty Tracking 1. 2. 3. To reduce poverty, its vital to track poverty Very few Institutions are tracking the poverty level of clients Most institutions can’t report data on whether the program has helped clients move above a poverty threshold 4. Reliable and actionable data on poverty is not being collected or collated by institutions 5. Tools in use are subjective and make local or international benchmarking difficult 6. Significant data gaps, especially in terms of tracking client poverty

Why to measure and report poverty? 1. Not to forget the poor but to keep them as part of the agenda 2. Be true to vision, mission and objectives [of poverty alleviation] 3. Identification of poor to target interventions 4. Achievement of Millennium Development Goals (halve # < $1/day) 5. Financial Institutions reporting to the Microcredit Summit Campaign i. e. 100 million microfinance clients cross $1/day line by 2015 6. Donors (report % poor, decide how to allot funds) 7. To make poverty outreach transparent and verifiable and thus more explicit and intentional 8. Monitoring, evaluation and impact measurement of policies, programs and institutions

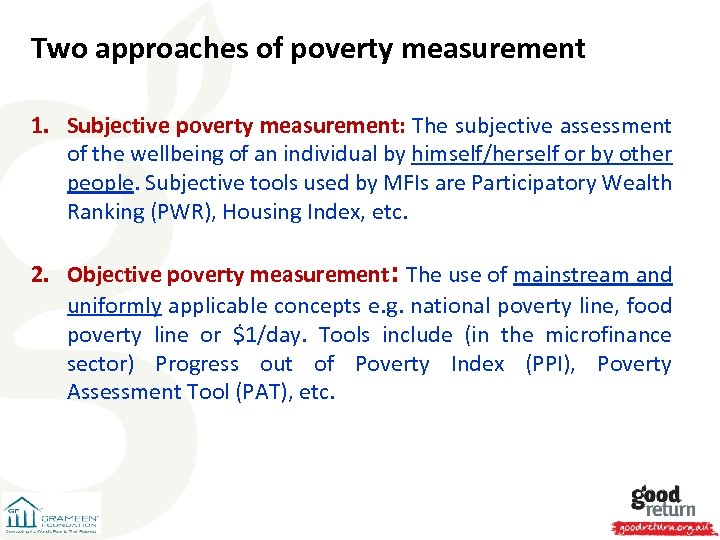

Two approaches of poverty measurement 1. Subjective poverty measurement: The subjective assessment of the wellbeing of an individual by himself/herself or by other people. Subjective tools used by MFIs are Participatory Wealth Ranking (PWR), Housing Index, etc. 2. Objective poverty measurement: The use of mainstream and uniformly applicable concepts e. g. national poverty line, food poverty line or $1/day. Tools include (in the microfinance sector) Progress out of Poverty Index (PPI), Poverty Assessment Tool (PAT), etc.

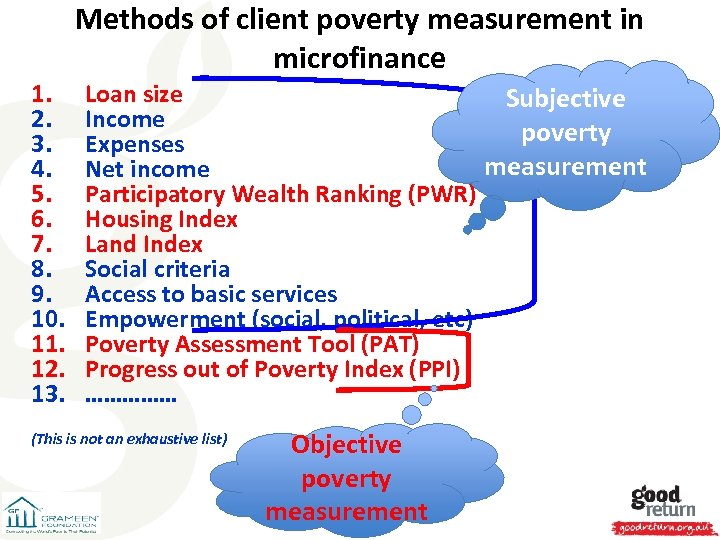

Methods of client poverty measurement in microfinance 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. Loan size Subjective Income poverty Expenses measurement Net income Participatory Wealth Ranking (PWR) Housing Index Land Index Social criteria Access to basic services Empowerment (social, political, etc) Poverty Assessment Tool (PAT) Progress out of Poverty Index (PPI) …………… (This is not an exhaustive list) Objective poverty measurement

Q&A

Session 3 Understanding the Progress out of Poverty Index (PPI) Material for this session is based on http: //www. microfinance. com/English/Papers/Scoring_Poverty_Cambodia_2011_EN. pdf developed by Mark Schreiner from Microfinance Risk Management L. L. C.

Introduction

Progress out of Poverty Index (PPI) PPI for Cambodia is objective, country-specific, and easy-to-use poverty scorecard. Pro-poor programs can use one Poverty Scorecard that applies to the whole county (both urban and rural) to estimate the likelihood that a household has a per-capita consumption below a given poverty line.

Three basic uses of the PPI 1. Measure poverty - number or percentage of households under a poverty line at a point in time 2. Track changes in the poverty of households over time 3. Segment [poor] households to target services PPI do not measure impact!

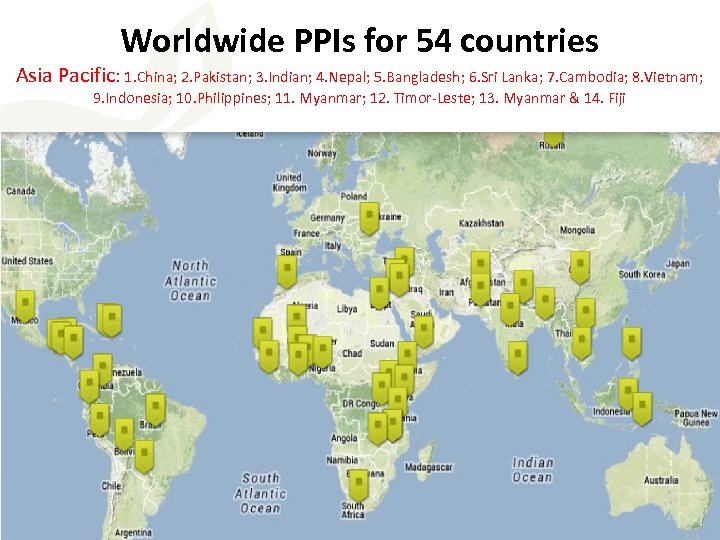

Worldwide PPIs for 54 countries Asia Pacific: 1. China; 2. Pakistan; 3. Indian; 4. Nepal; 5. Bangladesh; 6. Sri Lanka; 7. Cambodia; 8. Vietnam; 9. Indonesia; 10. Philippines; 11. Myanmar; 12. Timor-Leste; 13. Myanmar & 14. Fiji

Why use the PPI? • The direct approach to poverty measurement via survey is difficult and costly. The 2011 Cambodia Socio Economic Survey (CSES) runs on 58 pages. • Participatory Wealth Ranking (PWR) is subjective and relative. Poverty measurement based on land ownership or housing quality is blunt with unknown precision. These can’t be consolidated and benchmarked. • The indirect approach (the approach of PPI) via poverty scoring is simple, quick, and inexpensive. The PPI uses 10 non- financial but verifiable indicators.

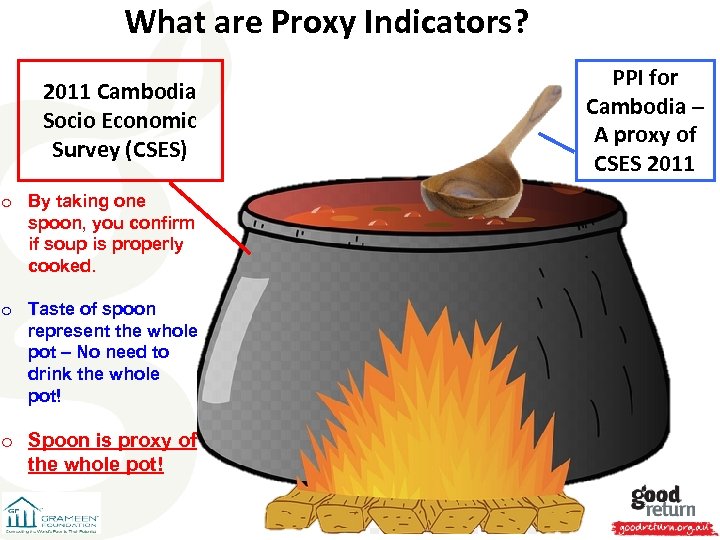

What are Proxy Indicators? 2011 Cambodia Socio Economic Survey (CSES) o By taking one spoon, you confirm if soup is properly cooked. o Taste of spoon represent the whole pot – No need to drink the whole pot! o Spoon is proxy of the whole pot! PPI for Cambodia – A proxy of CSES 2011

Features of the PPI 1. Objective: Based on national survey data: 1. Highest-quality expenditure measurement 2. Quantitative and observable indicators 2. Universal: For all poverty alleviation programs 3. Practical: Accepted and actually used: 1. Few indicators, inexpensive to collect 2. Simple enough to understand compute on paper in the field in real time without software 4. Known targeting accuracy

PPI Implementation

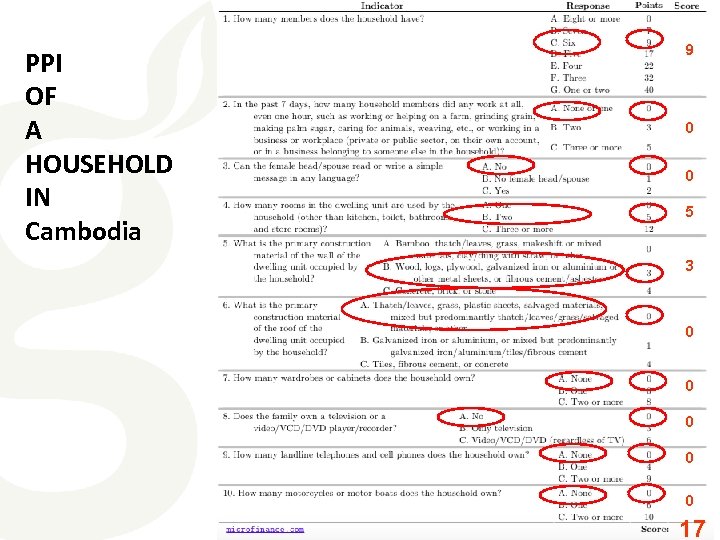

PPI OF A HOUSEHOLD IN Cambodia 9 0 0 5 3 0 0 0 17

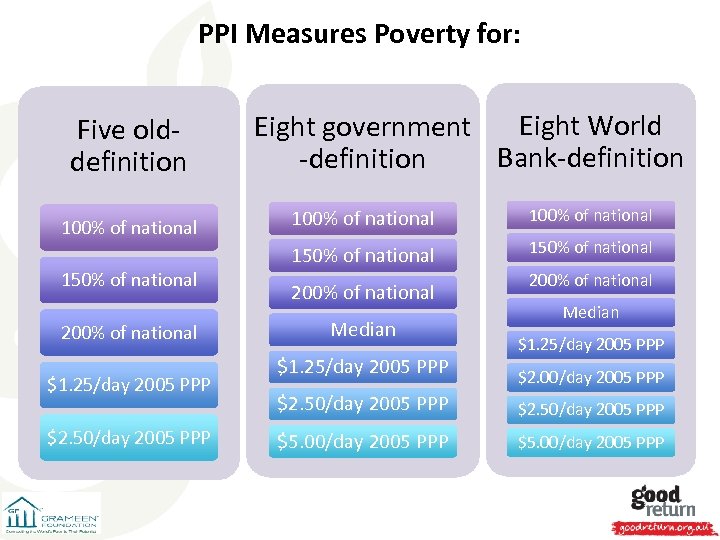

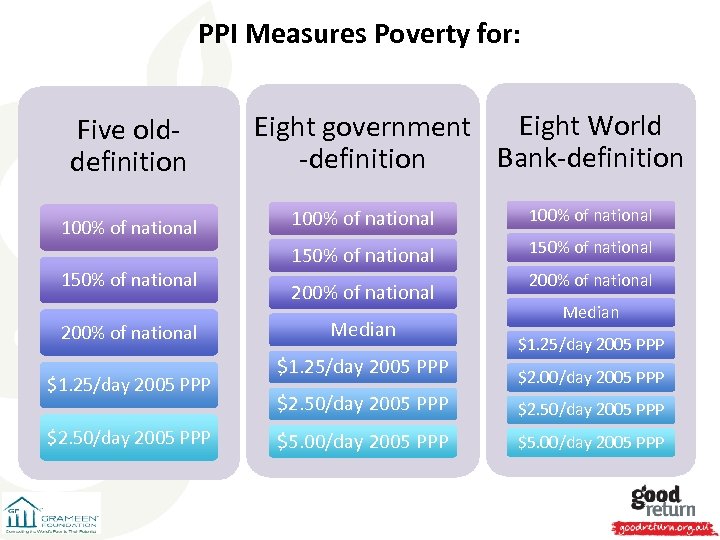

PPI Measures Poverty for: Five olddefinition 100% of national 150% of national 200% of national $1. 25/day 2005 PPP $2. 50/day 2005 PPP Eight World Eight government Bank-definition 100% of national 150% of national 200% of national Median $1. 25/day 2005 PPP $2. 00/day 2005 PPP $2. 50/day 2005 PPP $5. 00/day 2005 PPP

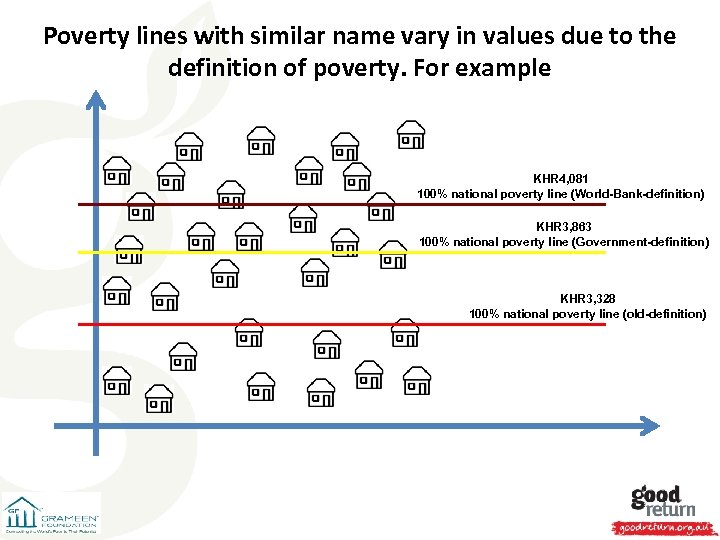

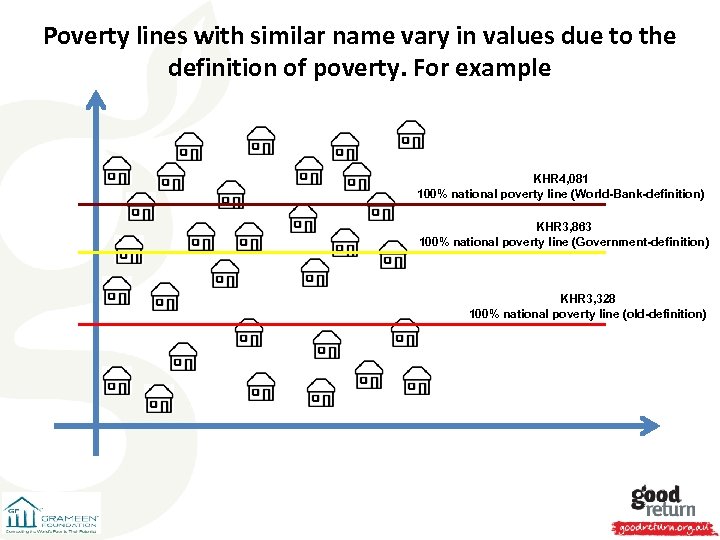

Poverty lines with similar name vary in values due to the definition of poverty. For example KHR 4, 081 100% national poverty line (World-Bank-definition) KHR 3, 863 100% national poverty line (Government-definition) KHR 3, 328 100% national poverty line (old-definition)

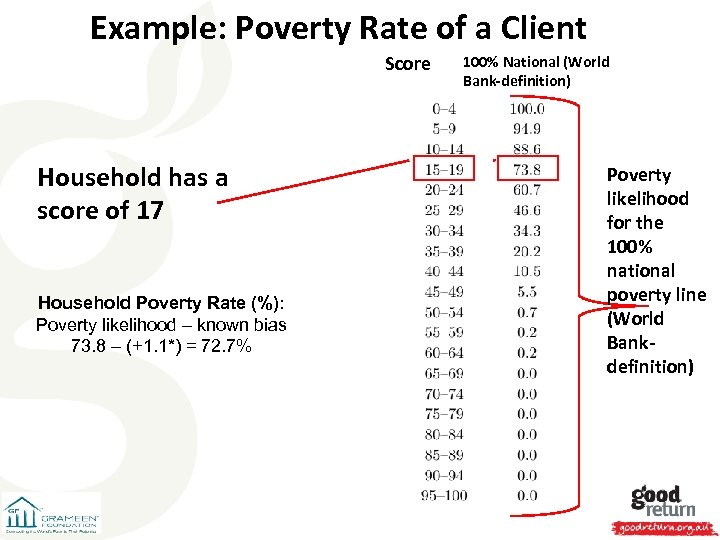

Example: Poverty Rate of a Client Score Household has a score of 17 Household Poverty Rate (%): Poverty likelihood – known bias 73. 8 – (+1. 1*) = 72. 7% 100% National (World Bank-definition) Poverty likelihood for the 100% national poverty line (World Bankdefinition)

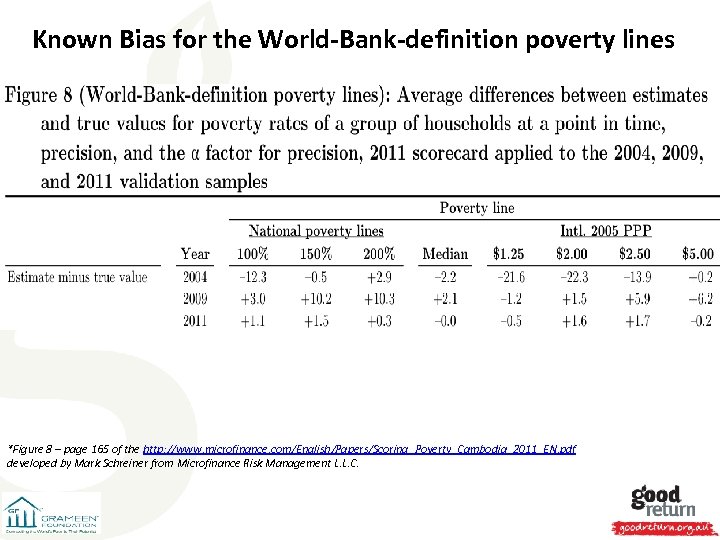

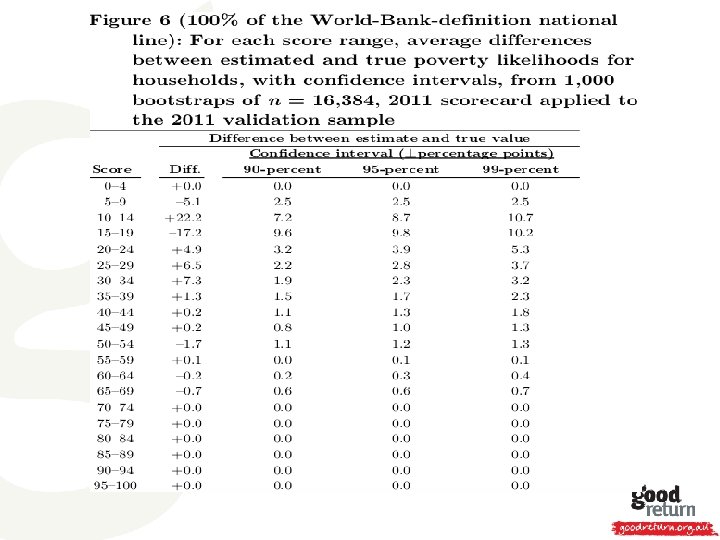

Known Bias for the World-Bank-definition poverty lines *Figure 8 – page 165 of the http: //www. microfinance. com/English/Papers/Scoring_Poverty_Cambodia_2011_EN. pdf developed by Mark Schreiner from Microfinance Risk Management L. L. C.

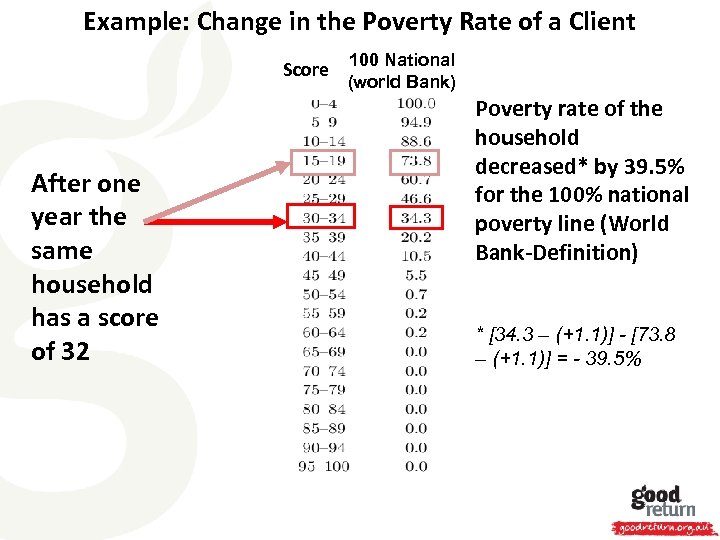

Example: Change in the Poverty Rate of a Client Score After one year the same household has a score of 32 100 National (world Bank) Poverty rate of the household decreased* by 39. 5% for the 100% national poverty line (World Bank-Definition) * [34. 3 – (+1. 1)] - [73. 8 – (+1. 1)] = - 39. 5%

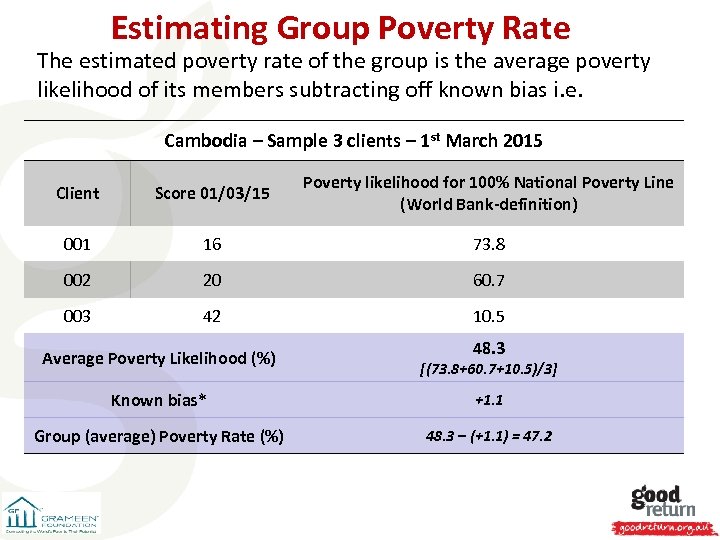

Estimating Group Poverty Rate The estimated poverty rate of the group is the average poverty likelihood of its members subtracting off known bias i. e. Cambodia – Sample 3 clients – 1 st March 2015 Client Score 01/03/15 Poverty likelihood for 100% National Poverty Line (World Bank-definition) 001 16 73. 8 002 20 60. 7 003 42 10. 5 Average Poverty Likelihood (%) 48. 3 [(73. 8+60. 7+10. 5)/3] Known bias* +1. 1 Group (average) Poverty Rate (%) 48. 3 – (+1. 1) = 47. 2

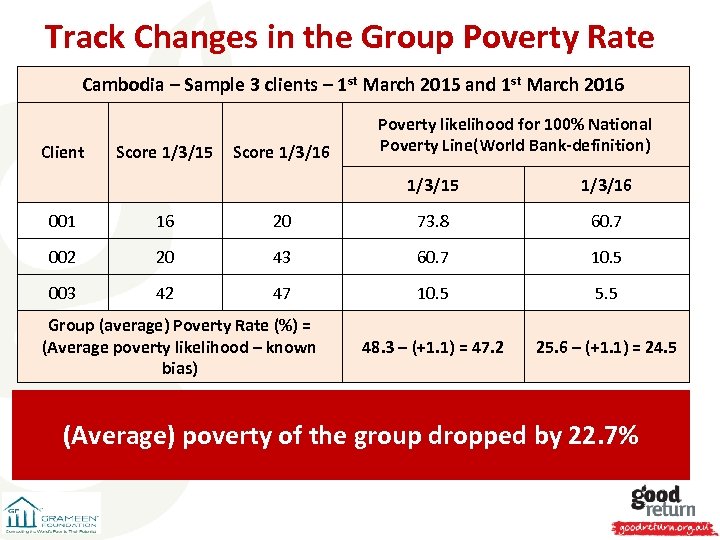

Track Changes in the Group Poverty Rate Cambodia – Sample 3 clients – 1 st March 2015 and 1 st March 2016 Client Score 1/3/15 Score 1/3/16 Poverty likelihood for 100% National Poverty Line(World Bank-definition) 1/3/15 1/3/16 001 16 20 73. 8 60. 7 002 20 43 60. 7 10. 5 003 42 47 10. 5 5. 5 48. 3 – (+1. 1) = 47. 2 25. 6 – (+1. 1) = 24. 5 Group (average) Poverty Rate (%) = (Average poverty likelihood – known bias) (Average) poverty of the group dropped by 22. 7%

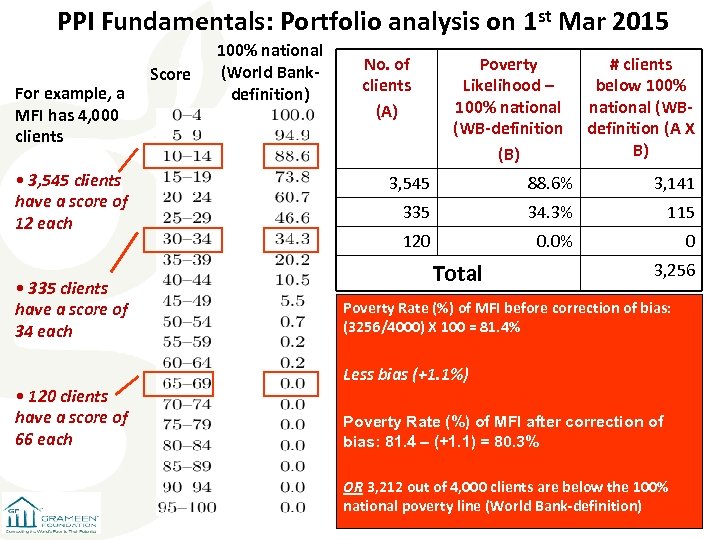

PPI Fundamentals: Portfolio analysis on 1 st Mar 2015 For example, a MFI has 4, 000 clients • 3, 545 clients have a score of 12 each • 335 clients have a score of 34 each • 120 clients have a score of 66 each Score 100% national (World Bankdefinition) No. of clients (A) Poverty Likelihood – 100% national (WB-definition (B) # clients below 100% national (WBdefinition (A X B) 3, 545 88. 6% 3, 141 335 34. 3% 115 120 0. 0% 0 Total 3, 256 Poverty Rate (%) of MFI before correction of bias: (3256/4000) X 100 = 81. 4% Less bias (+1. 1%) Poverty Rate (%) of MFI after correction of bias: 81. 4 – (+1. 1) = 80. 3% OR 3, 212 out of 4, 000 clients are below the 100% national poverty line (World Bank-definition)

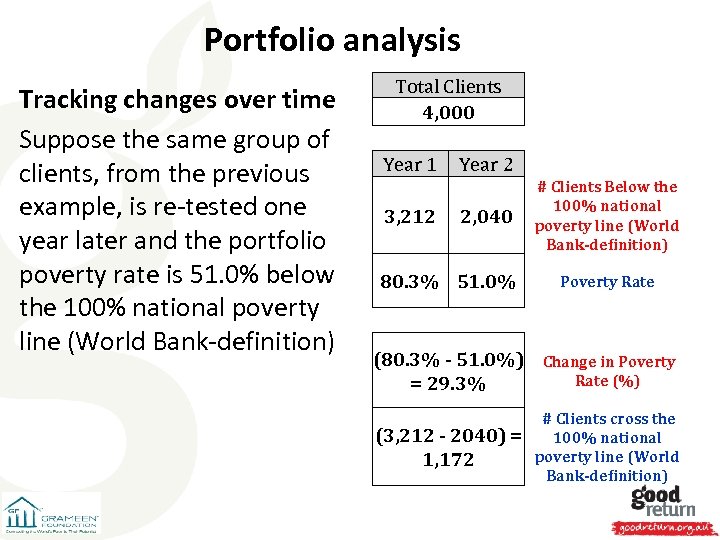

Portfolio analysis Tracking changes over time Suppose the same group of clients, from the previous example, is re-tested one year later and the portfolio poverty rate is 51. 0% below the 100% national poverty line (World Bank-definition) Total Clients 4, 000 Year 1 3, 212 Year 2 2, 040 # Clients Below the 100% national poverty line (World Bank-definition) 80. 3% 51. 0% Poverty Rate (80. 3% - 51. 0%) = 29. 3% Change in Poverty Rate (%) (3, 212 - 2040) = 1, 172 # Clients cross the 100% national poverty line (World Bank-definition)

PPI Exercise 0 5 10 15 min

PPI Construction

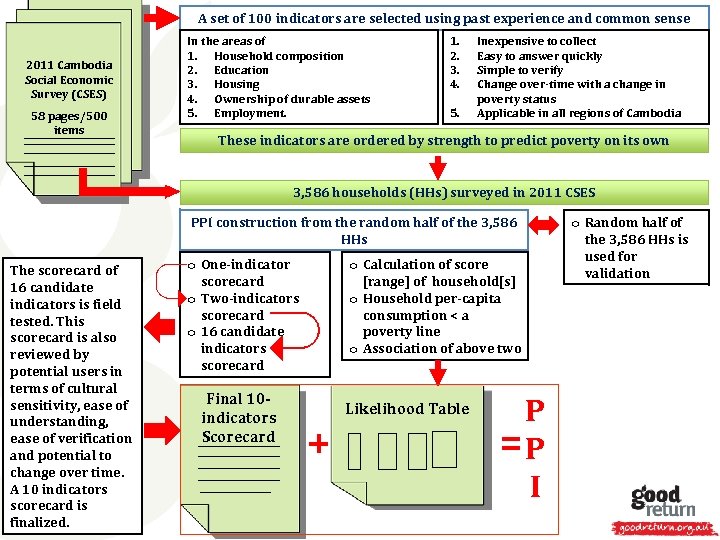

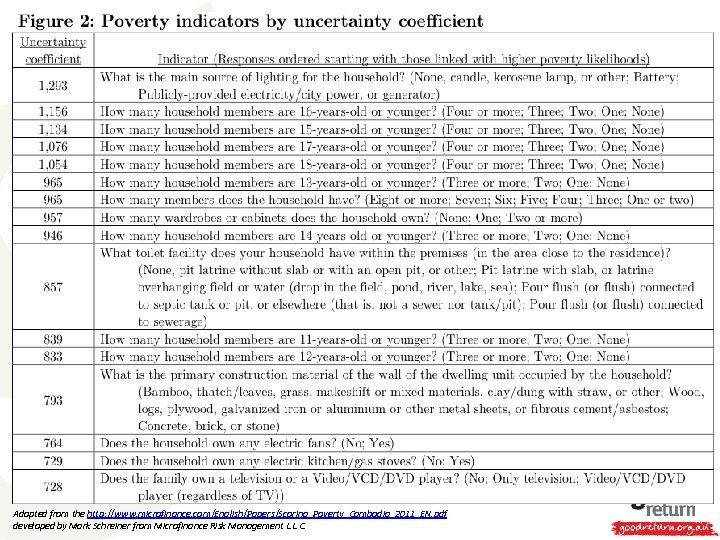

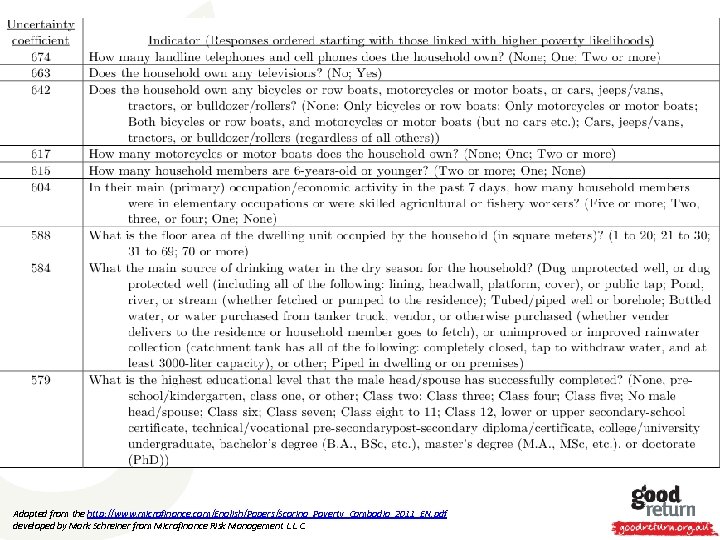

A set of 100 indicators are selected using past experience and common sense 2011 Cambodia Social Economic Survey (CSES) 58 pages/500 items In the areas of 1. Household composition 2. Education 3. Housing 4. Ownership of durable assets 5. Employment. 1. 2. 3. 4. 5. Inexpensive to collect Easy to answer quickly Simple to verify Change over-time with a change in poverty status Applicable in all regions of Cambodia These indicators are ordered by strength to predict poverty on its own 3, 586 households (HHs) surveyed in 2011 CSES PPI construction from the random half of the 3, 586 HHs The scorecard of 16 candidate indicators is field tested. This scorecard is also reviewed by potential users in terms of cultural sensitivity, ease of understanding, ease of verification and potential to change over time. A 10 indicators scorecard is finalized. o Calculation of score [range] of household[s] o Household per-capita consumption < a poverty line o Association of above two o One-indicator scorecard o Two-indicators scorecard o 16 candidate indicators scorecard Final 10 indicators Scorecard + Likelihood Table P =P I o Random half of the 3, 586 HHs is used for validation

Adopted from the http: //www. microfinance. com/English/Papers/Scoring_Poverty_Cambodia_2011_EN. pdf developed by Mark Schreiner from Microfinance Risk Management L. L. C.

Adopted from the http: //www. microfinance. com/English/Papers/Scoring_Poverty_Cambodia_2011_EN. pdf developed by Mark Schreiner from Microfinance Risk Management L. L. C.

Data and Definitions of Poverty

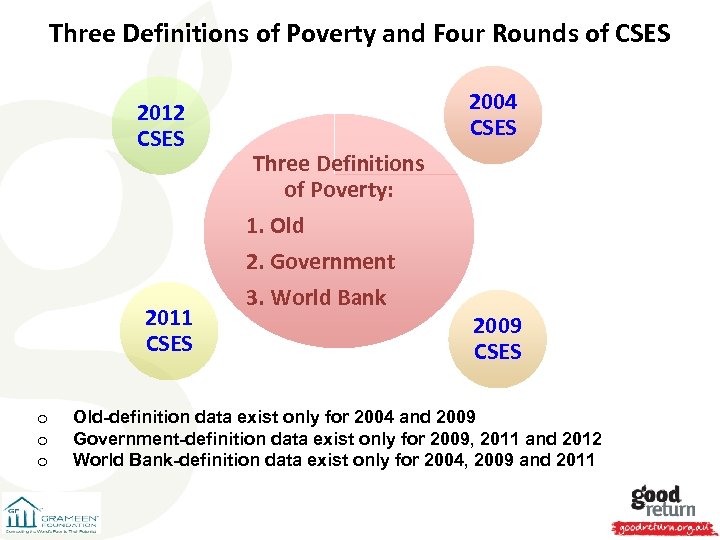

Three Definitions of Poverty and Four Rounds of CSES 2012 CSES 2011 CSES o o o 2004 CSES Three Definitions of Poverty: 1. Old 2. Government 3. World Bank 2009 CSES Old-definition data exist only for 2004 and 2009 Government-definition data exist only for 2009, 2011 and 2012 World Bank-definition data exist only for 2004, 2009 and 2011

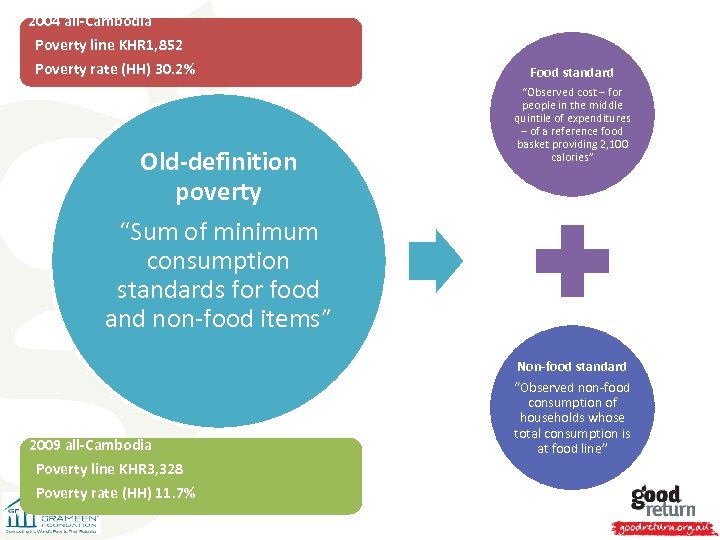

2004 all-Cambodia Poverty line KHR 1, 852 Poverty rate (HH) 30. 2% Old-definition poverty “Sum of minimum consumption standards for food and non-food items” 2009 all-Cambodia Poverty line KHR 3, 328 Poverty rate (HH) 11. 7% Food standard “Observed cost – for people in the middle quintile of expenditures – of a reference food basket providing 2, 100 calories” Non-food standard “Observed non-food consumption of households whose total consumption is at food line”

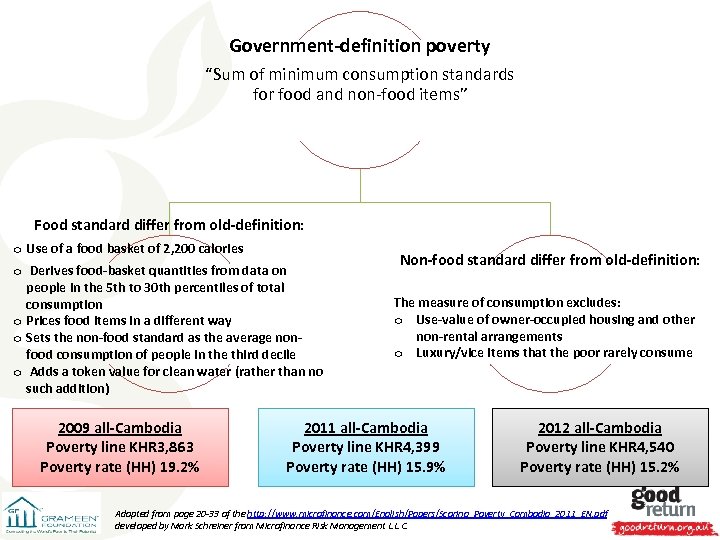

Government-definition poverty “Sum of minimum consumption standards for food and non-food items” Food standard differ from old-definition: o Use of a food basket of 2, 200 calories o Derives food-basket quantities from data on people in the 5 th to 30 th percentiles of total consumption o Prices food items in a different way o Sets the non-food standard as the average nonfood consumption of people in the third decile o Adds a token value for clean water (rather than no such addition) 2009 all-Cambodia Poverty line KHR 3, 863 Poverty rate (HH) 19. 2% Non-food standard differ from old-definition: The measure of consumption excludes: o Use-value of owner-occupied housing and other non-rental arrangements o Luxury/vice items that the poor rarely consume 2011 all-Cambodia Poverty line KHR 4, 399 Poverty rate (HH) 15. 9% 2012 all-Cambodia Poverty line KHR 4, 540 Poverty rate (HH) 15. 2% Adopted from page 20 -33 of the http: //www. microfinance. com/English/Papers/Scoring_Poverty_Cambodia_2011_EN. pdf developed by Mark Schreiner from Microfinance Risk Management L. L. C.

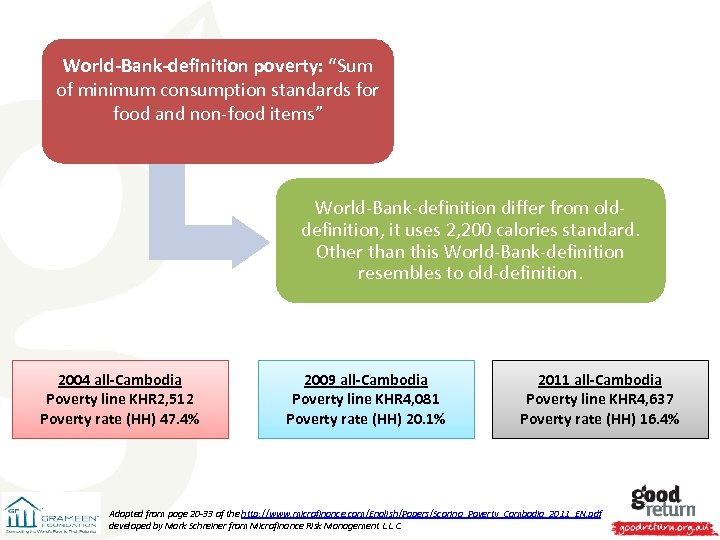

World-Bank-definition poverty: “Sum of minimum consumption standards for food and non-food items” World-Bank-definition differ from olddefinition, it uses 2, 200 calories standard. Other than this World-Bank-definition resembles to old-definition. 2004 all-Cambodia Poverty line KHR 2, 512 Poverty rate (HH) 47. 4% 2009 all-Cambodia Poverty line KHR 4, 081 Poverty rate (HH) 20. 1% 2011 all-Cambodia Poverty line KHR 4, 637 Poverty rate (HH) 16. 4% Adopted from page 20 -33 of the http: //www. microfinance. com/English/Papers/Scoring_Poverty_Cambodia_2011_EN. pdf developed by Mark Schreiner from Microfinance Risk Management L. L. C.

PPI Measures Poverty for: Five olddefinition 100% of national 150% of national 200% of national $1. 25/day 2005 PPP $2. 50/day 2005 PPP Eight World Eight government Bank-definition 100% of national 150% of national 200% of national Median $1. 25/day 2005 PPP $2. 00/day 2005 PPP $2. 50/day 2005 PPP $5. 00/day 2005 PPP

Poverty lines with similar name vary in values due to the definition of poverty. For example KHR 4, 081 100% national poverty line (World-Bank-definition) KHR 3, 863 100% national poverty line (Government-definition) KHR 3, 328 100% national poverty line (old-definition)

Estimates of Poverty Likelihood

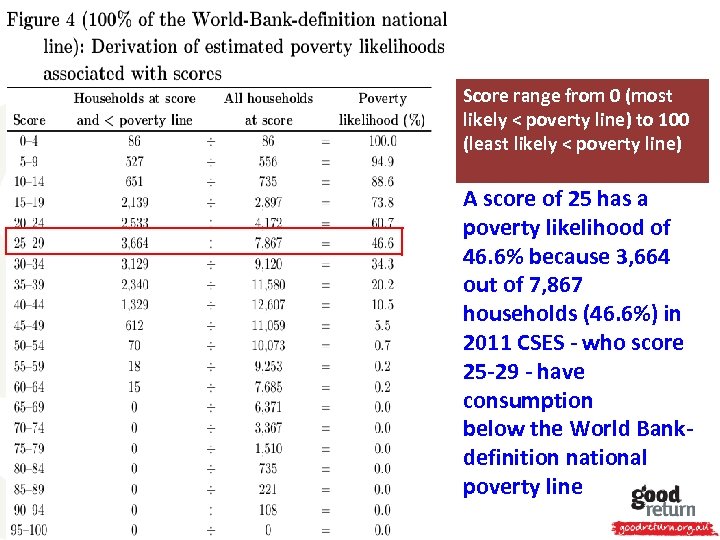

Score range from 0 (most likely < poverty line) to 100 (least likely < poverty line) A score of 25 has a poverty likelihood of 46. 6% because 3, 664 out of 7, 867 households (46. 6%) in 2011 CSES - who score 25 -29 - have consumption below the World Bankdefinition national poverty line

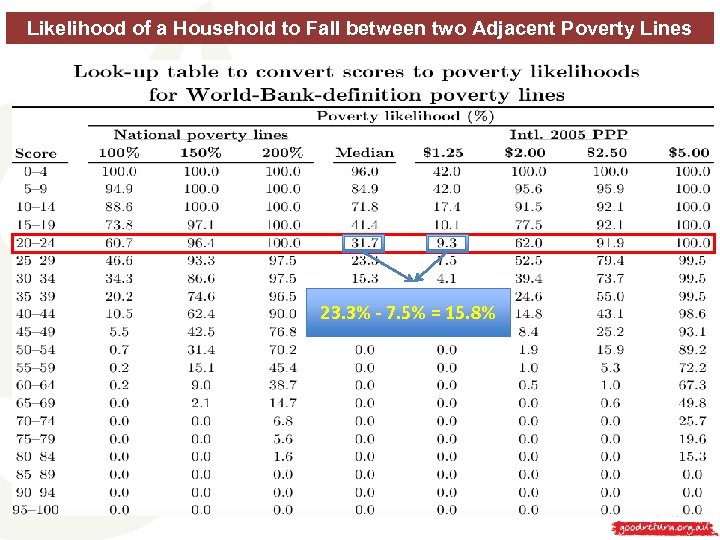

Likelihood of a Household to Fall between two Adjacent Poverty Lines 23. 3% - 7. 5% = 15. 8%

Targeting

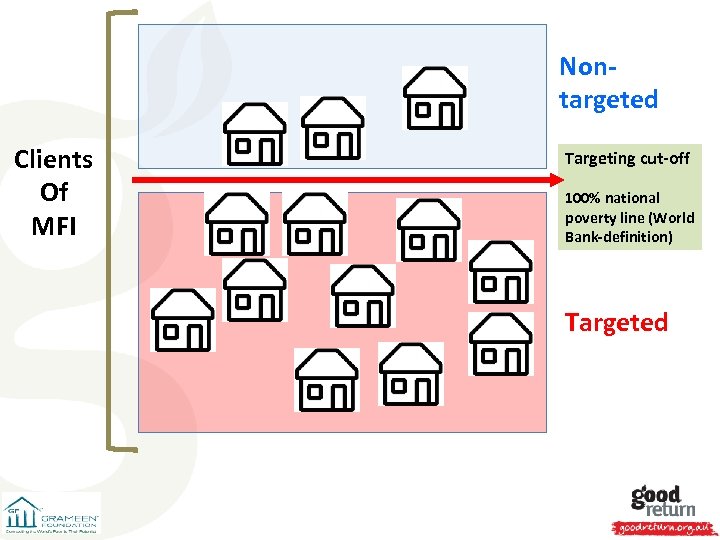

Nontargeted Clients Of MFI Targeting cut-off 100% national poverty line (World Bank-definition) Targeted

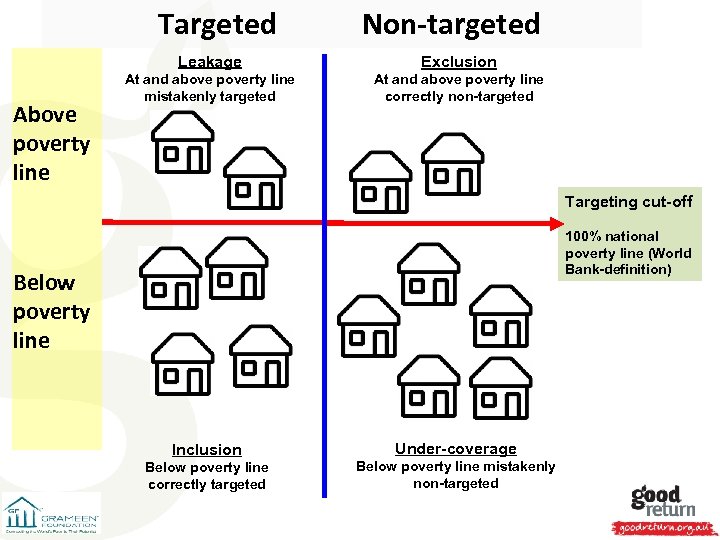

Targeted Non-targeted Leakage Above poverty line Exclusion At and above poverty line mistakenly targeted At and above poverty line correctly non-targeted Targeting cut-off 100% national poverty line (World Bank-definition) Below poverty line Inclusion Under-coverage Below poverty line correctly targeted Below poverty line mistakenly non-targeted

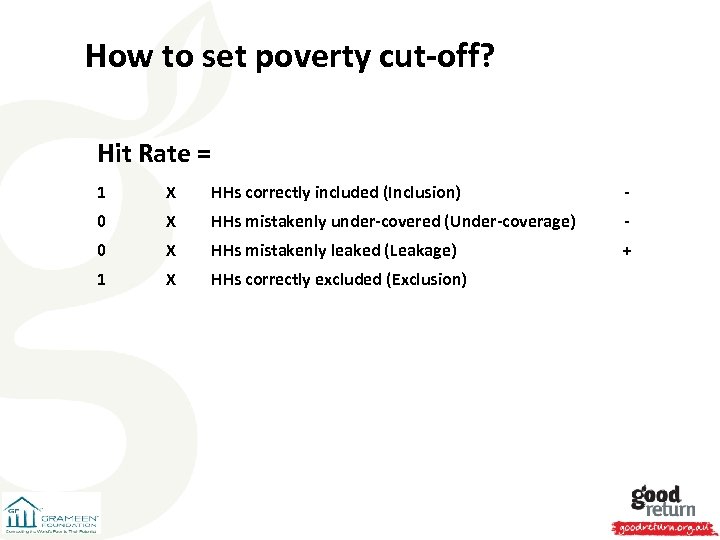

How to set poverty cut-off? Hit Rate = 1 X HHs correctly included (Inclusion) - 0 X HHs mistakenly under-covered (Under-coverage) - 0 X HHs mistakenly leaked (Leakage) + 1 X HHs correctly excluded (Exclusion)

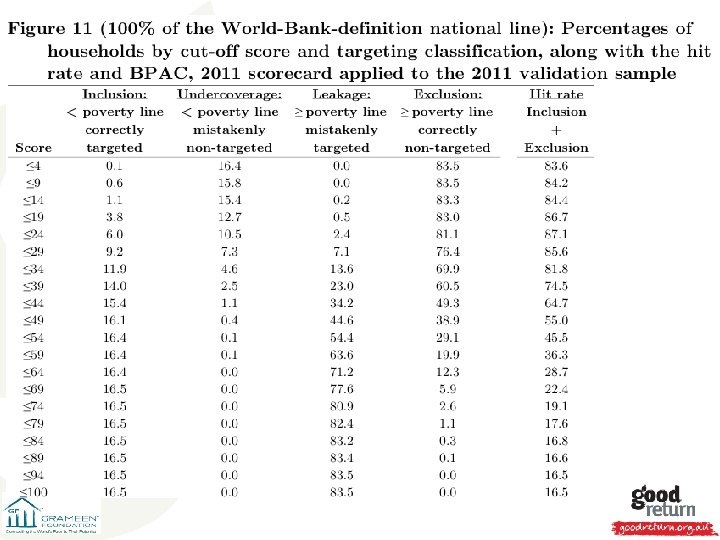

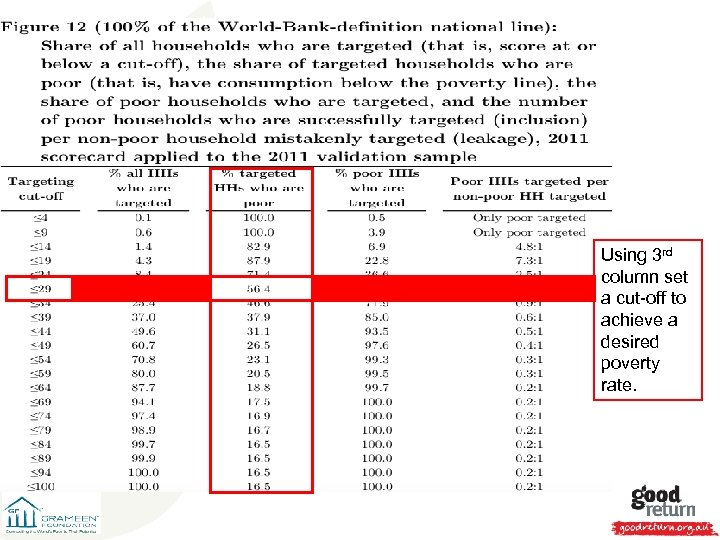

Using 3 rd column set a cut-off to achieve a desired poverty rate.

Measuring changes in poverty rates over time using the old definition of poverty with the old 2004 and new 2011 PPI

Use Revised PPI (based on 2011 CSES) from this point on! To Compare Poverty Rate Between Old PPI and New PPI, use the (Similar) Poverty Line of Old-Definition!

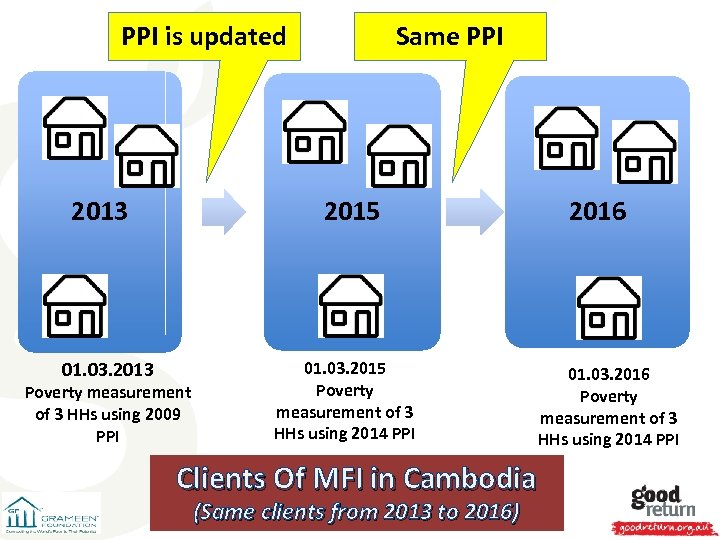

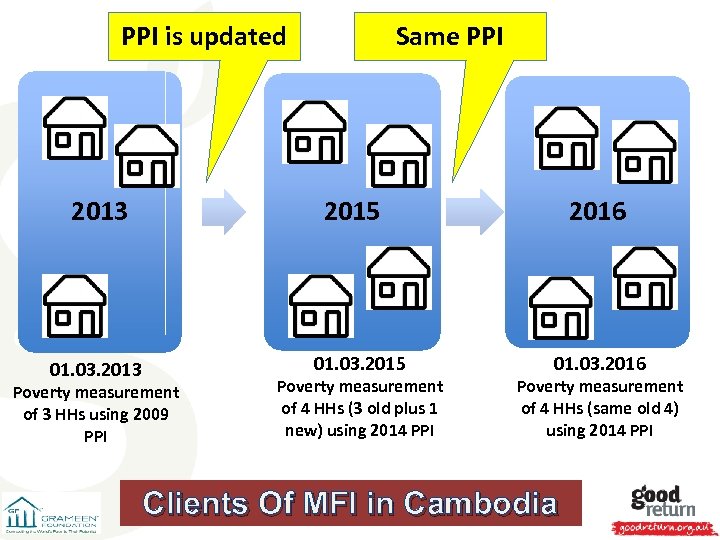

PPI is updated 2013 01. 03. 2013 Same PPI 2016 2015 Poverty measurement of 3 HHs using 2009 PPI 01. 03. 2015 Poverty measurement of 3 HHs using 2014 PPI 01. 03. 2016 Poverty measurement of 3 HHs using 2014 PPI Clients Of MFI in Cambodia (Same clients from 2013 to 2016)

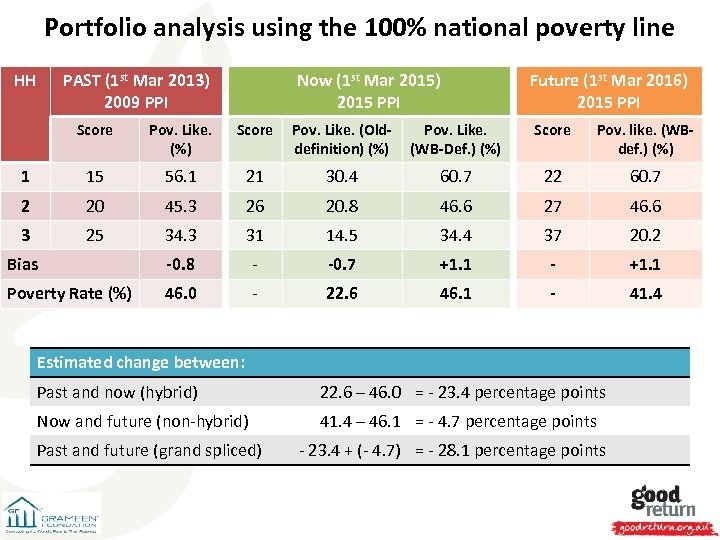

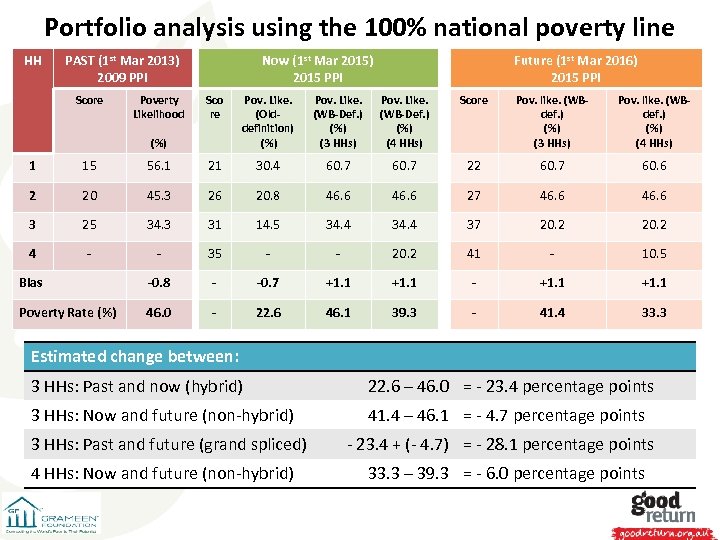

Portfolio analysis using the 100% national poverty line HH PAST (1 st Mar 2013) 2009 PPI Now (1 st Mar 2015) 2015 PPI Future (1 st Mar 2016) 2015 PPI Score Pov. Like. (%) Score Pov. Like. (Olddefinition) (%) Pov. Like. (WB-Def. ) (%) Score Pov. like. (WBdef. ) (%) 1 15 56. 1 21 30. 4 60. 7 22 60. 7 2 20 45. 3 26 20. 8 46. 6 27 46. 6 3 25 34. 3 31 14. 5 34. 4 37 20. 2 Bias -0. 8 - -0. 7 +1. 1 - +1. 1 Poverty Rate (%) 46. 0 - 22. 6 46. 1 - 41. 4 Estimated change between: Past and now (hybrid) 22. 6 – 46. 0 = - 23. 4 percentage points Now and future (non-hybrid) 41. 4 – 46. 1 = - 4. 7 percentage points Past and future (grand spliced) - 23. 4 + (- 4. 7) = - 28. 1 percentage points

PPI is updated 2013 01. 03. 2013 Same PPI 2016 2015 01. 03. 2015 Poverty measurement of 3 HHs using 2009 PPI Poverty measurement of 4 HHs (3 old plus 1 new) using 2014 PPI 01. 03. 2016 Poverty measurement of 4 HHs (same old 4) using 2014 PPI Clients Of MFI in Cambodia

Portfolio analysis using the 100% national poverty line HH PAST (1 st Mar 2013) 2009 PPI Score Poverty Likelihood Now (1 st Mar 2015) 2015 PPI Future (1 st Mar 2016) 2015 PPI Sco re Pov. Like. (Olddefinition) (%) Pov. Like. (WB-Def. ) (%) (3 HHs) Pov. Like. (WB-Def. ) (%) (4 HHs) Score Pov. like. (WBdef. ) (%) (3 HHs) Pov. like. (WBdef. ) (%) (4 HHs) (%) 1 15 56. 1 21 30. 4 60. 7 22 60. 7 60. 6 2 20 45. 3 26 20. 8 46. 6 27 46. 6 3 25 34. 3 31 14. 5 34. 4 37 20. 2 4 - - 35 - - 20. 2 41 - 10. 5 Bias -0. 8 - -0. 7 +1. 1 - +1. 1 Poverty Rate (%) 46. 0 - 22. 6 46. 1 39. 3 - 41. 4 33. 3 Estimated change between: 3 HHs: Past and now (hybrid) 22. 6 – 46. 0 = - 23. 4 percentage points 3 HHs: Now and future (non-hybrid) 41. 4 – 46. 1 = - 4. 7 percentage points 3 HHs: Past and future (grand spliced) 4 HHs: Now and future (non-hybrid) - 23. 4 + (- 4. 7) = - 28. 1 percentage points 33. 3 – 39. 3 = - 6. 0 percentage points

Practical guidelines for PPI Use

Practical Guidelines for the PPI Use o Main challenge in the scorecard design is not to achieve maximum statistical accuracy but to increase the chances of its usage; o For the PPI, statistical accuracy is balanced with simplicity, ease-of-use and face-validity; o PPI score can be computed in the field because it has: ² Only 10 indicators ² Only multiple-choice indicators ² Only simple points – non-negative integers and no arithmetic beyond addition o The PPI is readily available to be used;

Practical Guidelines for the PPI Use o Training, monitoring and evaluation are key to get high quality PPI data; o MFI to consider followings for the PPI implementation: ²Who will do the scoring ² How scores will be recorded ² What participants will be scored ² How many participants will be scored ² How frequently participants will be scored ² Whether scoring will be applied at more than one point in time ² Whether the same participants will be scored at more than one point in time

Practical Guidelines for the PPI Use o PPI data can be collected in the field by: ² Staff ² Third parties (community, professional enumerators, etc. ) ² A combination of above two o PPI data can be collected from: ² All relevant participants (a census) ² A representative sample of relevant participants ² All relevant participants in a representative sample of relevant branches ² A representative sample of relevant participants in a representative sample of relevant branches

Practical Guidelines for the PPI Use o The frequency of the PPI data collection can be: ² As a once-off project (precluding measuring change) ² Every two years (or at any other fixed or variable time interval, allowing measuring change) ² Each time a field worker visits a participant at home (allowing measuring change) o To measure change using the PPI ² Score a new, independent sample, measuring change across samples ² Score the sample at both baseline and follow-up o PPI data can be collected through: ² Paper in the field, and then filed at a central office ² Paper in the field, and then keyed into a database or spreadsheet at a central office ² Portable electronic devices in the field, and then uploaded to a database (e. g. using ODK, Taro. Works, etc)

Thank You

PPI CERTIFICATION

What is PPI certification? o A confirmation that PPI data is reliable and accurate meeting PPI standards of use o A recognition of excellence in poverty measurement with the PPI

What are PPI Standards of Use? 1. Basic Standards of Use: Best practices to accurately report the PPI data 2. Advanced Standards of Use: Best practices to integrate the accurate and reliable (PPI) data into operations

Basic PPI Standards of Use (report reliable and accurate data) An organization must meet all of the Basic Standards to qualify for Basic PPI Certification. Basic standards cover: A. B. C. D. E. F. G. Commitment to poverty measurement Training Collection Data storage and validation Data analysis Data use Reporting

Group Work 1. What standards are not clear? 2. What are most challenging standards?

A. Commitment to poverty measurement 1. The board demonstrates commitment to poverty measurement data, requiring that management be responsible for its tracking and requesting periodic updates on poverty data. 2. Senior management responsible for the PPI understands the PPI, can explain why the organization implements it, and monitors its implementation. 3. A written plan or detailed manual for PPI implementation is in place and includes a clear design of the process.

B. Training 4. The current PPI project manager has been trained on the PPI, either by an external party or by someone with significant experience using the PPI within the organization. 5. Staff responsible for surveying have been trained on and understand the precise meaning of the PPI questions and responses. In addition, they are informed when data validation is in place to verify responses to surveys they collect. 6. If PPI data are manually entered into a database, data entry staff are trained on and understand the PPI data entry process. 7. Staff involved in PPI data analysis are trained in accurate analysis and reporting guidelines.

C. Collection 8. PPI data are collected on a census basis or, if sampling is used, with samples random and representative of the population(s) to be analyzed. 9. PPI surveys are completed with the date the survey is administered, identifying information of the enumerator, identifying information of the client (such as a unique client ID number), answers to each question and a final score. 10. The PPI survey and look-up tables used do not deviate from the original country-specific PPI as found on Progressoutofpoverty. org or microfinance. com. If a translated version is used, the translation is in writing and either matches the national household expenditure survey or has been professionally translated if no official translation is available.

C. Collection 11. Enumerators ask each PPI question in a manner reflective of the original meaning of the question. The best approach to achieve this is to ask the question exactly as it is written. Where doing so causes confusion or is otherwise problematic, the enumerator either visually verifies an indicator or rephrases the question in a way that does not distort the meaning of the question. Enumerators carry a copy of an interview guide with them during survey collection. 12. The latest available version of the PPI, including the scorecard and the look-up table, is in use within one year of release.

D. Data storage and validation 13. Before PPI data is analyzed, a quality control check of the accuracy of PPI collection occurs by someone other than the original enumerator to verify that (a) the interview actually took place and (b) the responses match those originally recorded. A random and representative sample of at least 30 or a number representing at least 5%, whichever is greater, of collected PPI scorecards is reviewed for each data collection or on at least a quarterly basis. A review process is in place to identify and correct the source of error if checked surveys significantly deviate from the original data collected. A discrepancy rate is calculated by averaging the percentage of inconsistent responses of each PPI validated. Batches with a discrepancy rate above 10% should not be used during analysis until all PPIs have been reviewed.

D. Data storage and validation 14. PPI data are secured to prevent unauthorized access. 15. All collected PPI data, including client scores and look-up tables, are centrally stored in an electronic manner that permits analysis. Furthermore, the PPI version used is clearly tracked in the database. A basic system like a spreadsheet is acceptable. 16. Data are reviewed and cleaned before analysis. 17. Original PPI surveys, including answers to each question, are stored, either in physical or electronic form, for backchecking for at least one year.

D. Data storage and validation 18. Before PPI data is analyzed, the PPI data entry process is checked for accuracy. A random sample of at least 30 or a number representing at least 5%, whichever is greater, of encoded PPI scorecards is reviewed. A review process is in place to identify and correct the source of error if checked surveys significantly deviate from entered data. A discrepancy rate is calculated by averaging the percentage of inconsistent responses of each PPI validated. Batches with a discrepancy rate above 10% should not be used during analysis until all PPIs have been reviewed. This standard is not applicable to organizations that enter PPI data directly into a database system, e. g. , with a mobile data collection tool like Taro. Works.

E. Data analysis 19. If an updated PPI has been adopted after use of an earlier version and the organization plans to track poverty movement or compare results from different versions, the organization is correctly comparing such results according to the appropriate case: I. Green reset: Poverty likelihoods are compared across versions without complication. II. Yellow reset: Legacy poverty lines developed specifically for calculating hybrid estimates of change are used to compare results to a previous PPI. Newdefinition poverty lines should be used to report outreach. III. Red reset: The previous PPI must continue to be collected for comparison purposes while the updated PPI must be collected to report outreach.

E. Data analysis 20. Computation of the percentage of clients or customers below a given poverty line is accurately calculated. 20. PPI scores are not used during data analysis.

F. Data usage 22. Poverty data are benchmarked using objective regional rates, peer benchmarks or internally set benchmarks.

G. Reporting 23. Poverty lines used for analysis align with the objectives of the organization and/or project. For example, if an organization strives to reach only the extreme poor, use of a poverty line that is too high will obscure whether the organization is reaching the extreme poor and offer less insight into the population served relative to the organization’s objective. Furthermore, these poverty lines are understood by the PPI project manager. Finally, the organization does not unintentionally or otherwise misrepresent its poverty outreach by using a poverty line significantly higher or lower than one appropriate for a stated target, if such a target exists.

G. Reporting 24. Recent PPI results are reported to the board and senior management with a frequency appropriate to the PPI implementation plan (e. g. , upon completion of a one-time data collection or on a quarterly basis for continual data collection). Reported results are timely, with underlying data taking no more than four months to be included in a report for the first time. Reports must indicate the rate of poverty of incoming clients (i. e. , concentration), as well as benchmarked results. 25. PPI results, particularly when displayed in graphs, include the number of PPIs analyzed, the poverty line(s) used for analysis, the dates or time period in which data collection occurred, and the population represented, e. g. , rural branches, all regions, incoming clients for year 2014, and all clients.

Advanced PPI Standards of Use (visit the website: http: //www. progressoutofpoverty. org/sites/default/files /Advanced%20 Standards%20 v 2. 0. PDF )

Steps to PPI certification 1. Download the PPI Standards of Use at progressoutofpoverty. org/standards. 2. Gauge certification readiness with the PPI Self. Assessment Tool, available at progressoutofpoverty. org/resources. 3. Contact a rating agency. 4. Submit the documentation required by the rating agency and facilitate an on-site evaluation led by rating agency representatives. 5. If needed, improve your organization’s PPI practices based on rating agency feedback. 6. Certification is awarded at either the Basic or Advanced level at the rating agency’s discretion.

Q&A

The Challenges of the PPI

The challenges • Simplicity of PPI is difficult to accept for some people. • Can poverty be measured with 10 questions? PPI consist of 10 proxy indicators which have values with scores Plus poverty look-up tables. PPI is NOT just 10 questions. • The gaps between PPI results and the results from MFI’s own poverty measurement tools. Where does MFI’s poverty tool fits in terms of poverty line(s)? Comparing apples with apples. • Strong ownership in MFI for its own poverty measurement tool although it knows that the responses are inflated and the results are not accurate due to the subjectivity and non-verifiable nature of the indicators.

The challenges • PPI is developed from old (2 or more years) national socio -economic survey. So people think that PPI is not reflective of the current situation. Govt. is also using the results of the latest national survey means it is still highly relevant. • PPI doesn’t fit to all extreme situations. Sur, it doesn’t. Its not perfect like any other tool. • Top management and Board lack understanding of PPI. • Social performance is just a talk and not the walk. • MFI lacks capacity to interpret PPI results. • How does PPI make a business case?

Q&A

e0520e7df59b29d2d2e9c5949e41af4f.ppt