bafcf542bfd5328b0b4cb064d8b7a745.ppt

- Количество слайдов: 32

Challenging Asset Allocation Promises W. A. Ruch, III, CIMA Chief Executive Officer Sterne Agee Asset Management, Inc. Sterne Agee Investment Advisors, Inc. Trust Company of Sterne Agee FIRMA-Orlando, FL April 9, 2008

Challenging Asset Allocation Promises W. A. Ruch, III, CIMA Chief Executive Officer Sterne Agee Asset Management, Inc. Sterne Agee Investment Advisors, Inc. Trust Company of Sterne Agee FIRMA-Orlando, FL April 9, 2008

Universal Investment Quest Managing Risk for Client

Universal Investment Quest Managing Risk for Client

Risk Management = Asset Allocation Modeling § Strategic Asset Allocation An investment strategy that aims to balance risk and reward by apportioning a portfolio's assets according to an individual's goals, risk tolerance and investment horizon. At the inception of the portfolio, a "base policy mix" is determined based upon expected returns. Because the value of assets can change given market conditions, the portfolio constantly needs to be rebalanced to meet the policy.

Risk Management = Asset Allocation Modeling § Strategic Asset Allocation An investment strategy that aims to balance risk and reward by apportioning a portfolio's assets according to an individual's goals, risk tolerance and investment horizon. At the inception of the portfolio, a "base policy mix" is determined based upon expected returns. Because the value of assets can change given market conditions, the portfolio constantly needs to be rebalanced to meet the policy.

Diversification Ingredients § Major Classes- stocks, bonds, cash § Style Categories- LCG, MCV, GL, INT, MCG, MCV, SCG, SCV, ITM, LTM, TB, ITF-T, LTF-T, MMF, etc… § Alternative Investments- real estate, energy, basic commodities, currency § Alternative Strategies- equity hedge, event driven, macro, relative value

Diversification Ingredients § Major Classes- stocks, bonds, cash § Style Categories- LCG, MCV, GL, INT, MCG, MCV, SCG, SCV, ITM, LTM, TB, ITF-T, LTF-T, MMF, etc… § Alternative Investments- real estate, energy, basic commodities, currency § Alternative Strategies- equity hedge, event driven, macro, relative value

Investment Program Packaging § SMA – Separately Managed Accounts § UMA – Unified Managed Accounts § MSA – Multi-style Accounts § MSP – Multiple-style Portfolios (Models) § OMS-Overlay Management Strategies

Investment Program Packaging § SMA – Separately Managed Accounts § UMA – Unified Managed Accounts § MSA – Multi-style Accounts § MSP – Multiple-style Portfolios (Models) § OMS-Overlay Management Strategies

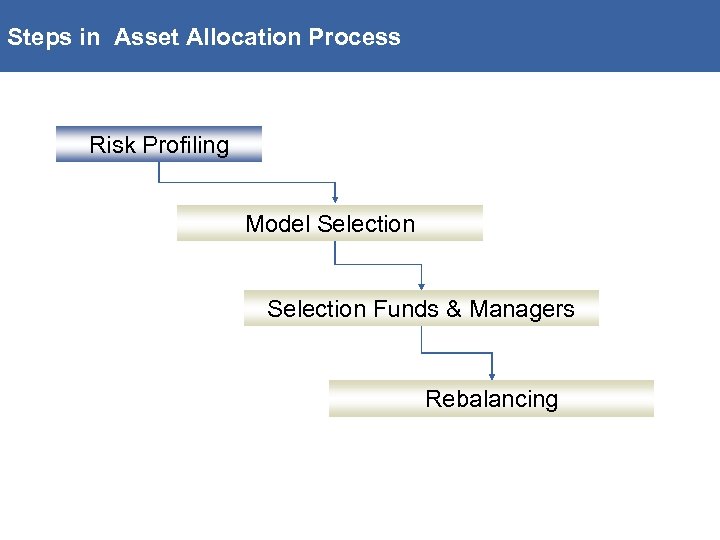

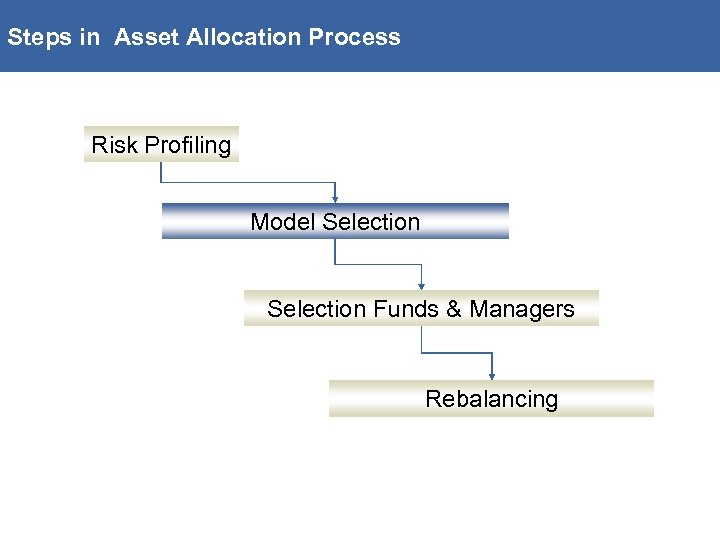

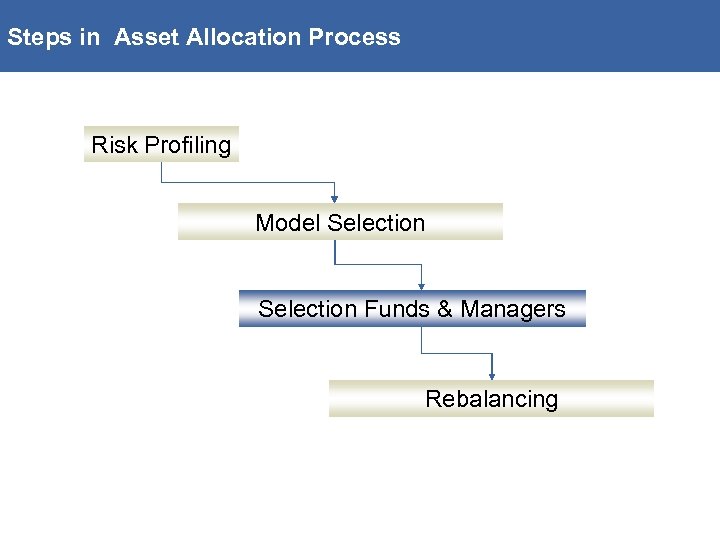

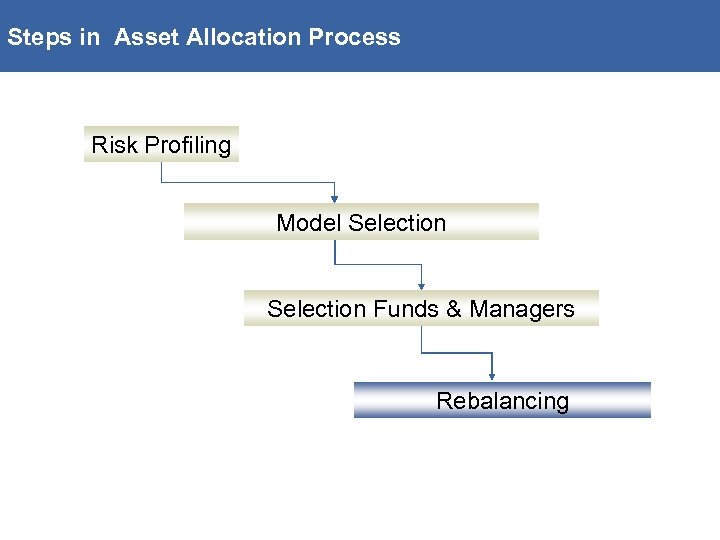

Steps in Asset Allocation Process Risk Profiling Model Selection Funds & Managers Rebalancing

Steps in Asset Allocation Process Risk Profiling Model Selection Funds & Managers Rebalancing

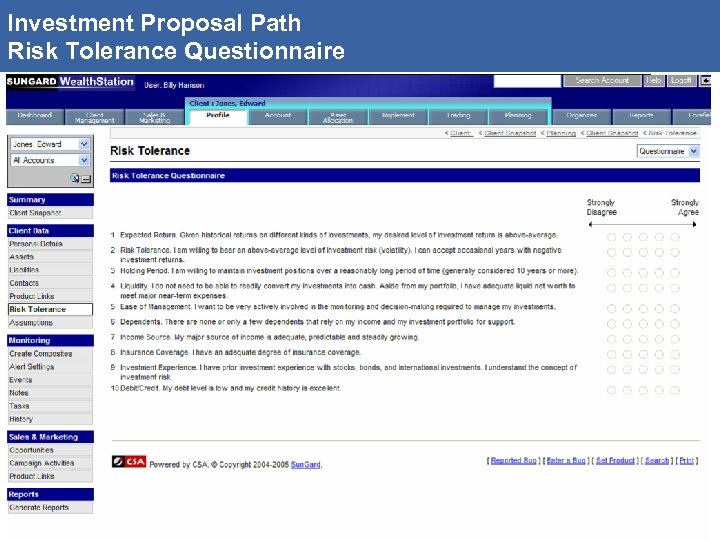

Investment Proposal Path Risk Tolerance Questionnaire

Investment Proposal Path Risk Tolerance Questionnaire

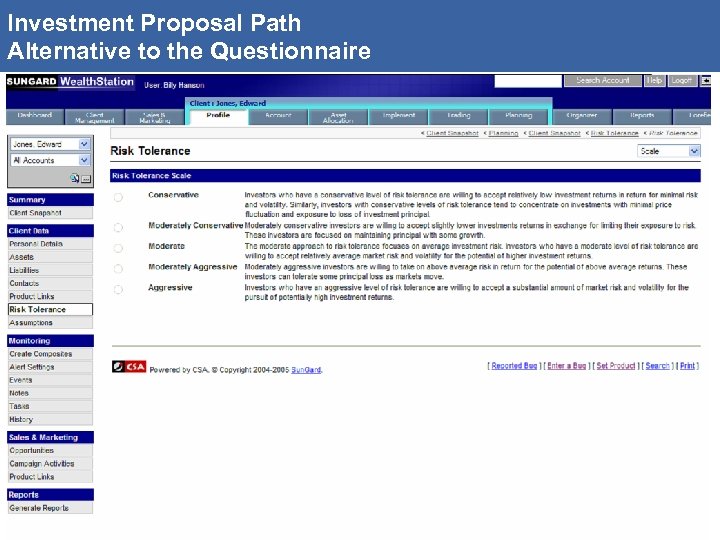

Investment Proposal Path Alternative to the Questionnaire

Investment Proposal Path Alternative to the Questionnaire

Steps in Asset Allocation Process Risk Profiling Model Selection Funds & Managers Rebalancing

Steps in Asset Allocation Process Risk Profiling Model Selection Funds & Managers Rebalancing

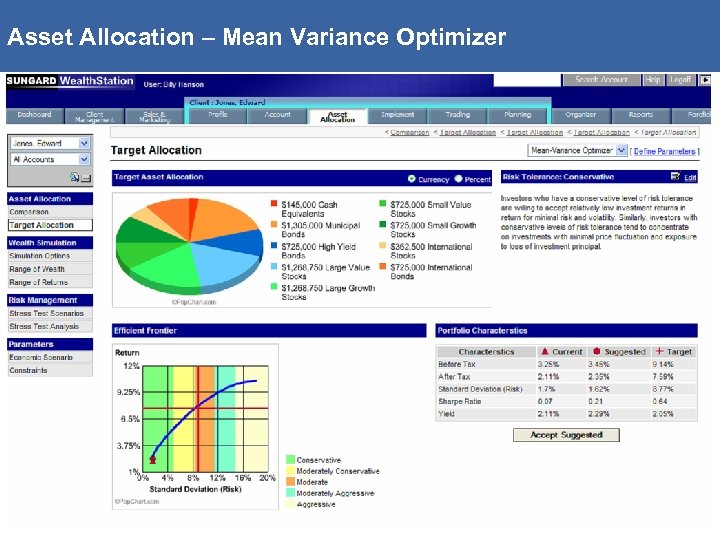

Asset Allocation – Mean Variance Optimizer

Asset Allocation – Mean Variance Optimizer

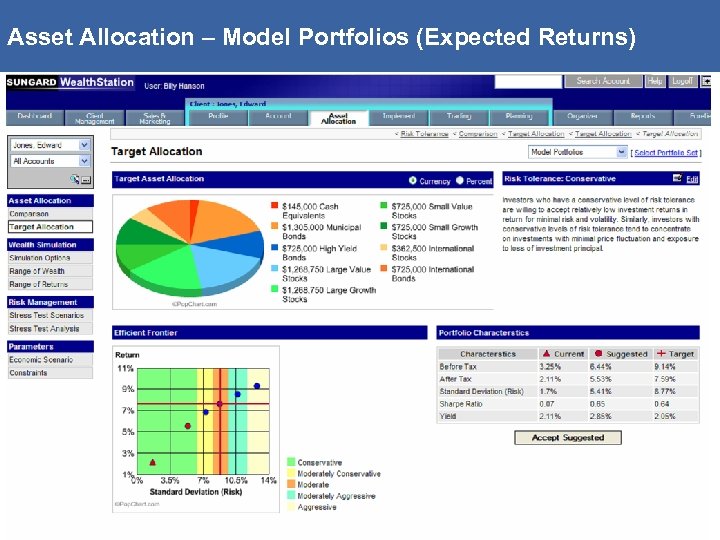

Asset Allocation – Model Portfolios (Expected Returns)

Asset Allocation – Model Portfolios (Expected Returns)

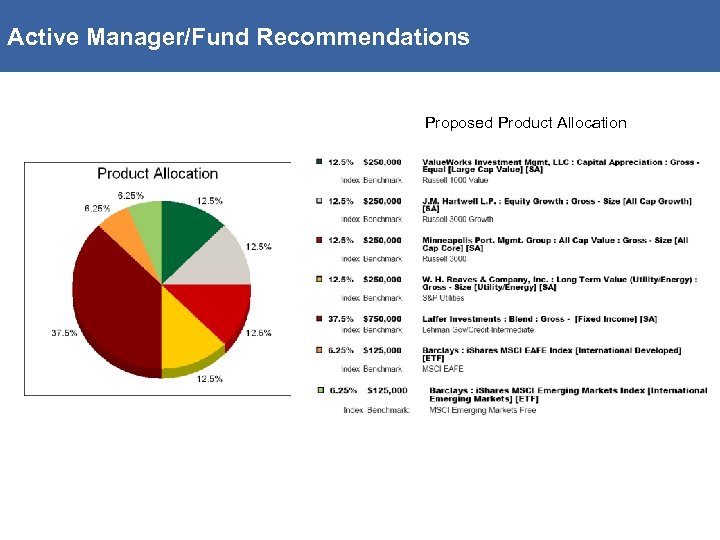

Active Manager/Fund Recommendations Proposed Product Allocation

Active Manager/Fund Recommendations Proposed Product Allocation

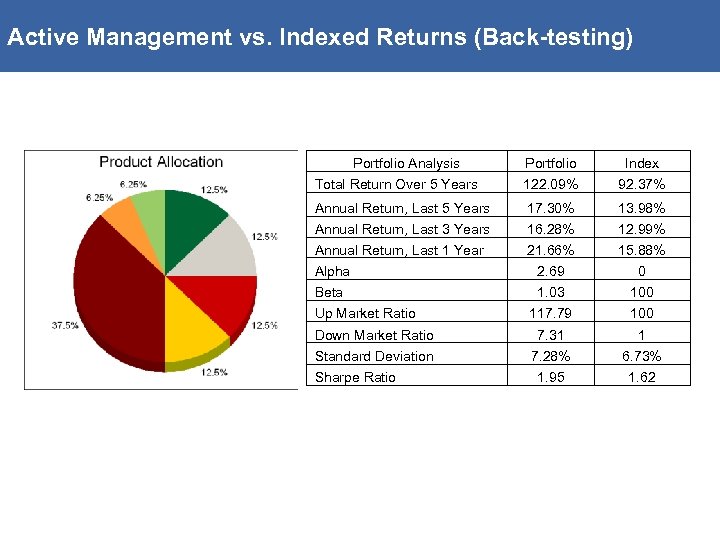

Active Management vs. Indexed Returns (Back-testing) Portfolio Analysis Portfolio Index Total Return Over 5 Years 122. 09% 92. 37% Annual Return, Last 5 Years Annual Return, Last 3 Years Annual Return, Last 1 Year 17. 30% 16. 28% 21. 66% 13. 98% 12. 99% 15. 88% Alpha 2. 69 0 Beta 1. 03 100 117. 79 100 Down Market Ratio 7. 31 1 Standard Deviation 7. 28% 6. 73% 1. 95 1. 62 Up Market Ratio Sharpe Ratio

Active Management vs. Indexed Returns (Back-testing) Portfolio Analysis Portfolio Index Total Return Over 5 Years 122. 09% 92. 37% Annual Return, Last 5 Years Annual Return, Last 3 Years Annual Return, Last 1 Year 17. 30% 16. 28% 21. 66% 13. 98% 12. 99% 15. 88% Alpha 2. 69 0 Beta 1. 03 100 117. 79 100 Down Market Ratio 7. 31 1 Standard Deviation 7. 28% 6. 73% 1. 95 1. 62 Up Market Ratio Sharpe Ratio

Steps in Asset Allocation Process Risk Profiling Model Selection Funds & Managers Rebalancing

Steps in Asset Allocation Process Risk Profiling Model Selection Funds & Managers Rebalancing

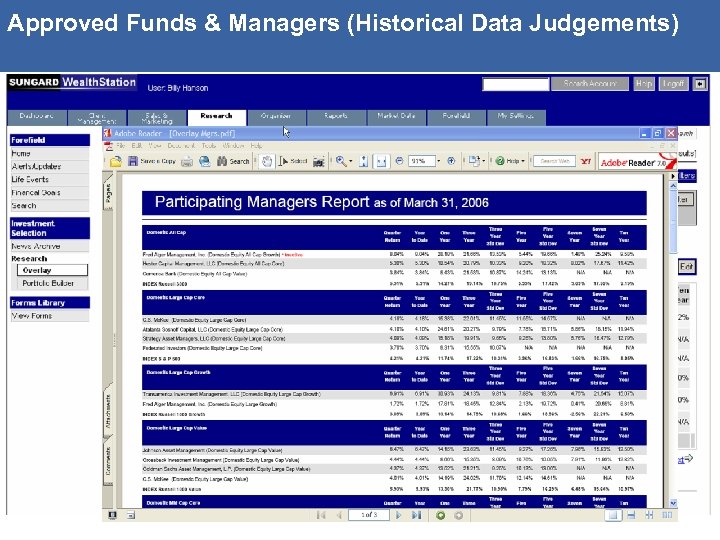

Approved Funds & Managers (Historical Data Judgements)

Approved Funds & Managers (Historical Data Judgements)

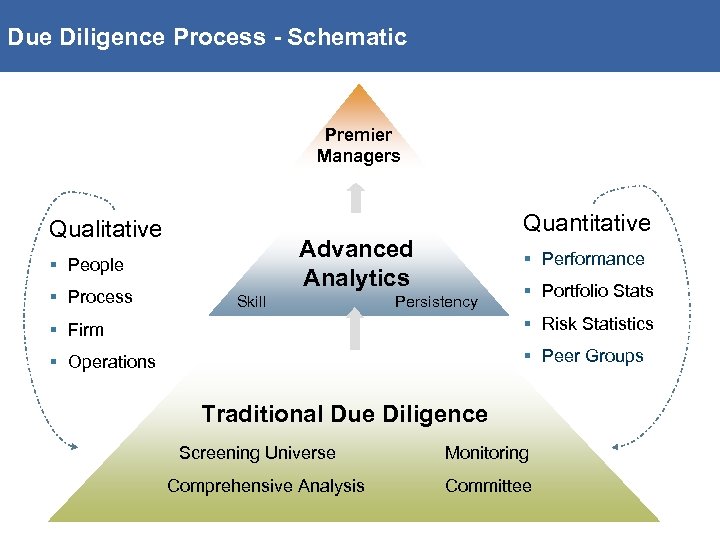

Due Diligence Process - Schematic Premier Managers Qualitative Advanced Analytics § People § Process Quantitative Skill § Performance Persistency § Portfolio Stats § Firm § Risk Statistics § Operations § Peer Groups Traditional Due Diligence Screening Universe Monitoring Comprehensive Analysis Committee

Due Diligence Process - Schematic Premier Managers Qualitative Advanced Analytics § People § Process Quantitative Skill § Performance Persistency § Portfolio Stats § Firm § Risk Statistics § Operations § Peer Groups Traditional Due Diligence Screening Universe Monitoring Comprehensive Analysis Committee

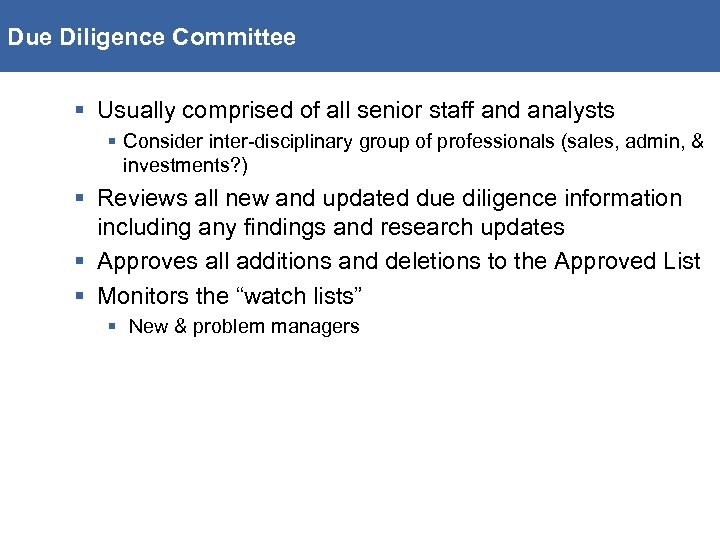

Due Diligence Committee § Usually comprised of all senior staff and analysts § Consider inter-disciplinary group of professionals (sales, admin, & investments? ) § Reviews all new and updated due diligence information including any findings and research updates § Approves all additions and deletions to the Approved List § Monitors the “watch lists” § New & problem managers

Due Diligence Committee § Usually comprised of all senior staff and analysts § Consider inter-disciplinary group of professionals (sales, admin, & investments? ) § Reviews all new and updated due diligence information including any findings and research updates § Approves all additions and deletions to the Approved List § Monitors the “watch lists” § New & problem managers

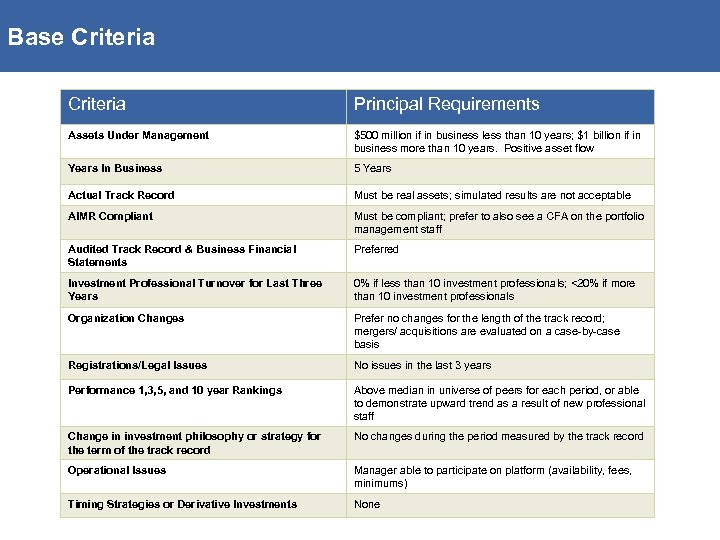

Base Criteria Principal Requirements Assets Under Management $500 million if in business less than 10 years; $1 billion if in business more than 10 years. Positive asset flow Years In Business 5 Years Actual Track Record Must be real assets; simulated results are not acceptable AIMR Compliant Must be compliant; prefer to also see a CFA on the portfolio management staff Audited Track Record & Business Financial Statements Preferred Investment Professional Turnover for Last Three Years 0% if less than 10 investment professionals; <20% if more than 10 investment professionals Organization Changes Prefer no changes for the length of the track record; mergers/ acquisitions are evaluated on a case-by-case basis Registrations/Legal Issues No issues in the last 3 years Performance 1, 3, 5, and 10 year Rankings Above median in universe of peers for each period, or able to demonstrate upward trend as a result of new professional staff Change in investment philosophy or strategy for the term of the track record No changes during the period measured by the track record Operational Issues Manager able to participate on platform (availability, fees, minimums) Timing Strategies or Derivative Investments None

Base Criteria Principal Requirements Assets Under Management $500 million if in business less than 10 years; $1 billion if in business more than 10 years. Positive asset flow Years In Business 5 Years Actual Track Record Must be real assets; simulated results are not acceptable AIMR Compliant Must be compliant; prefer to also see a CFA on the portfolio management staff Audited Track Record & Business Financial Statements Preferred Investment Professional Turnover for Last Three Years 0% if less than 10 investment professionals; <20% if more than 10 investment professionals Organization Changes Prefer no changes for the length of the track record; mergers/ acquisitions are evaluated on a case-by-case basis Registrations/Legal Issues No issues in the last 3 years Performance 1, 3, 5, and 10 year Rankings Above median in universe of peers for each period, or able to demonstrate upward trend as a result of new professional staff Change in investment philosophy or strategy for the term of the track record No changes during the period measured by the track record Operational Issues Manager able to participate on platform (availability, fees, minimums) Timing Strategies or Derivative Investments None

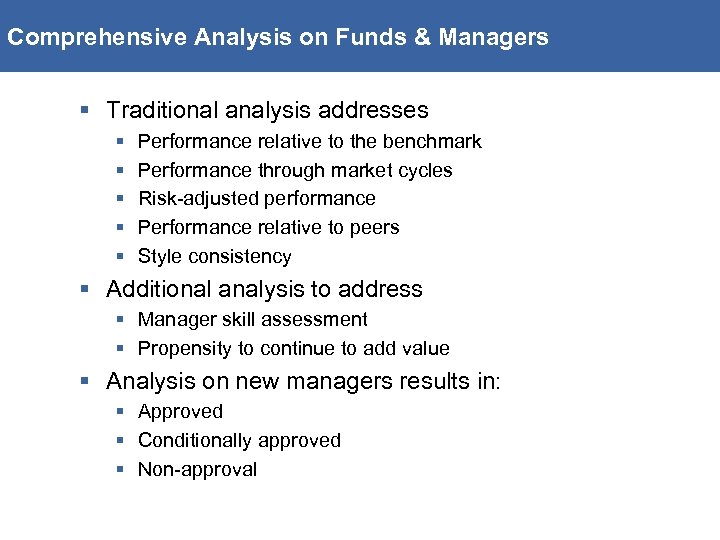

Comprehensive Analysis on Funds & Managers § Traditional analysis addresses § § § Performance relative to the benchmark Performance through market cycles Risk-adjusted performance Performance relative to peers Style consistency § Additional analysis to address § Manager skill assessment § Propensity to continue to add value § Analysis on new managers results in: § Approved § Conditionally approved § Non-approval

Comprehensive Analysis on Funds & Managers § Traditional analysis addresses § § § Performance relative to the benchmark Performance through market cycles Risk-adjusted performance Performance relative to peers Style consistency § Additional analysis to address § Manager skill assessment § Propensity to continue to add value § Analysis on new managers results in: § Approved § Conditionally approved § Non-approval

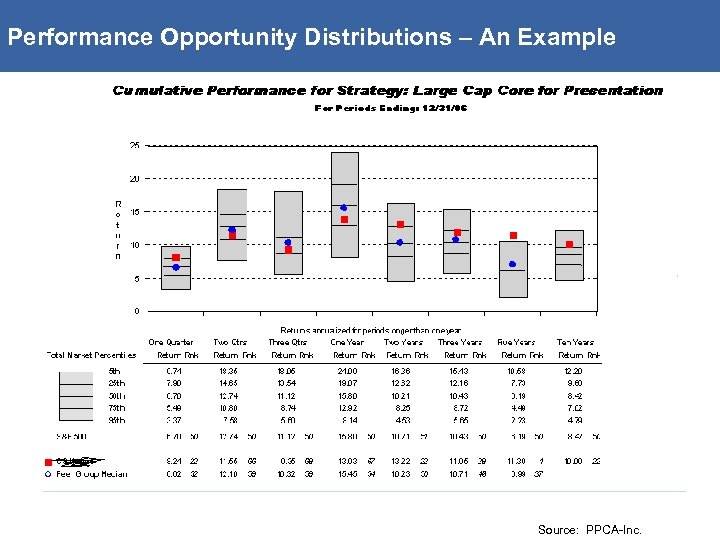

Performance Opportunity Distributions – An Example Source: PPCA-Inc.

Performance Opportunity Distributions – An Example Source: PPCA-Inc.

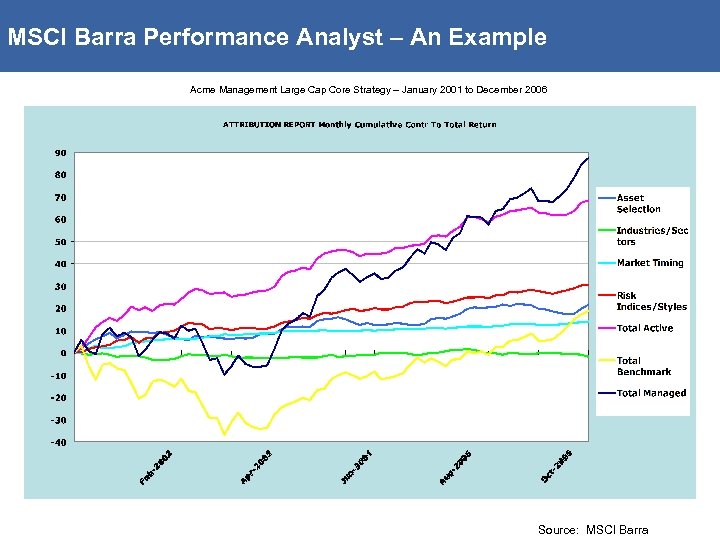

MSCI Barra Performance Analyst – An Example Acme Management Large Cap Core Strategy – January 2001 to December 2006 Source: MSCI Barra

MSCI Barra Performance Analyst – An Example Acme Management Large Cap Core Strategy – January 2001 to December 2006 Source: MSCI Barra

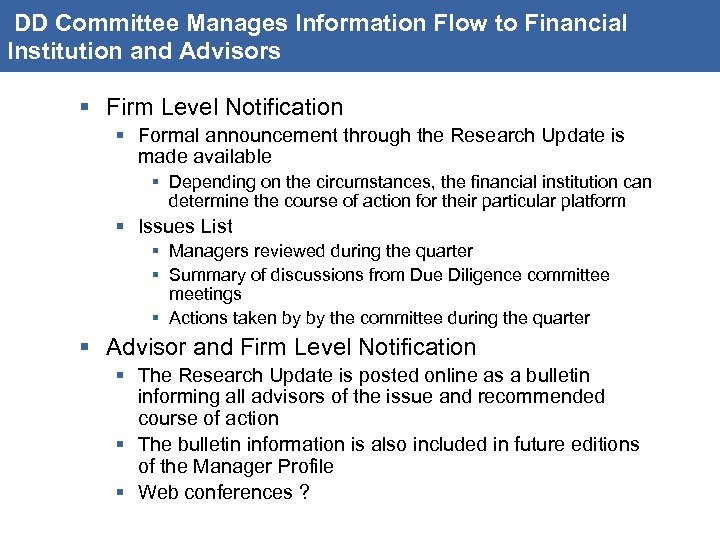

DD Committee Manages Information Flow to Financial Institution and Advisors § Firm Level Notification § Formal announcement through the Research Update is made available § Depending on the circumstances, the financial institution can determine the course of action for their particular platform § Issues List § Managers reviewed during the quarter § Summary of discussions from Due Diligence committee meetings § Actions taken by by the committee during the quarter § Advisor and Firm Level Notification § The Research Update is posted online as a bulletin informing all advisors of the issue and recommended course of action § The bulletin information is also included in future editions of the Manager Profile § Web conferences ?

DD Committee Manages Information Flow to Financial Institution and Advisors § Firm Level Notification § Formal announcement through the Research Update is made available § Depending on the circumstances, the financial institution can determine the course of action for their particular platform § Issues List § Managers reviewed during the quarter § Summary of discussions from Due Diligence committee meetings § Actions taken by by the committee during the quarter § Advisor and Firm Level Notification § The Research Update is posted online as a bulletin informing all advisors of the issue and recommended course of action § The bulletin information is also included in future editions of the Manager Profile § Web conferences ?

Findings End Up in Marketing Material § Displayed due diligence information collected by research team § Updated quarterly and posted to the web § Last page is for the advisor § Fee schedule, minimums, sales and service policies § Important Notes section for relevant information § i. e. , Why a manager is on alert or why a manager holds ADRs

Findings End Up in Marketing Material § Displayed due diligence information collected by research team § Updated quarterly and posted to the web § Last page is for the advisor § Fee schedule, minimums, sales and service policies § Important Notes section for relevant information § i. e. , Why a manager is on alert or why a manager holds ADRs

Steps in Asset Allocation Process Risk Profiling Model Selection Funds & Managers Rebalancing

Steps in Asset Allocation Process Risk Profiling Model Selection Funds & Managers Rebalancing

Rebalancing Standards § Manual or systematic process ? § Mandates and constraints ? § Cusips, separate accounts, overlay ? § Frequency ( % or moment in time) ? § Cost ?

Rebalancing Standards § Manual or systematic process ? § Mandates and constraints ? § Cusips, separate accounts, overlay ? § Frequency ( % or moment in time) ? § Cost ?

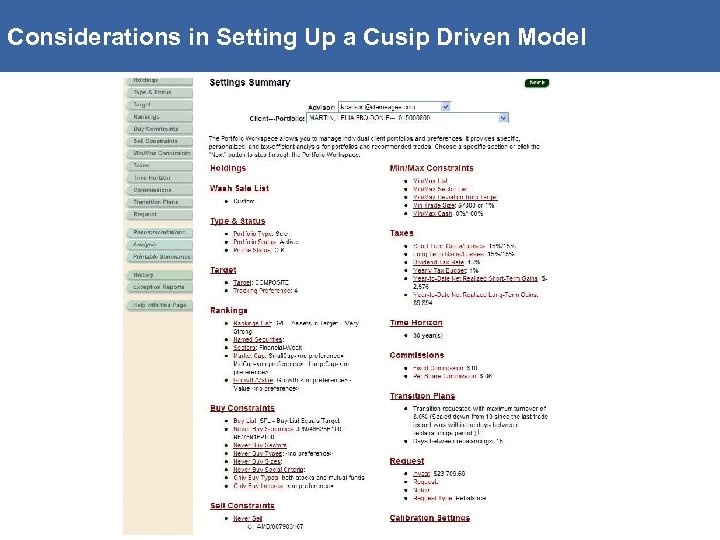

Considerations in Setting Up a Cusip Driven Model

Considerations in Setting Up a Cusip Driven Model

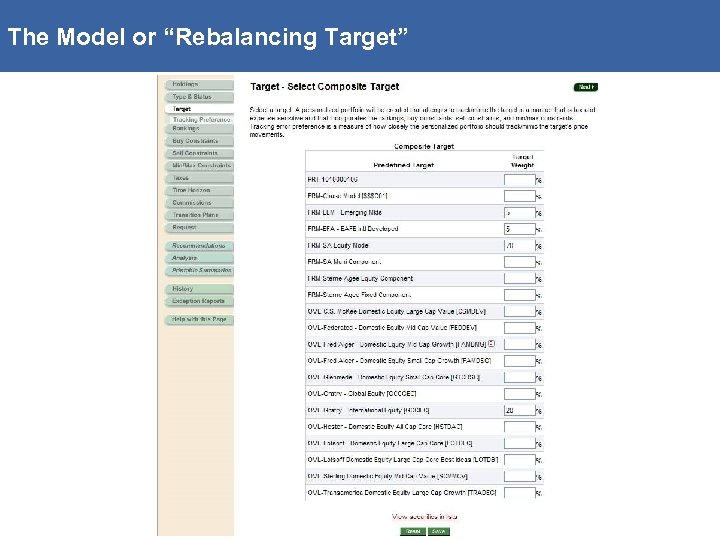

The Model or “Rebalancing Target”

The Model or “Rebalancing Target”

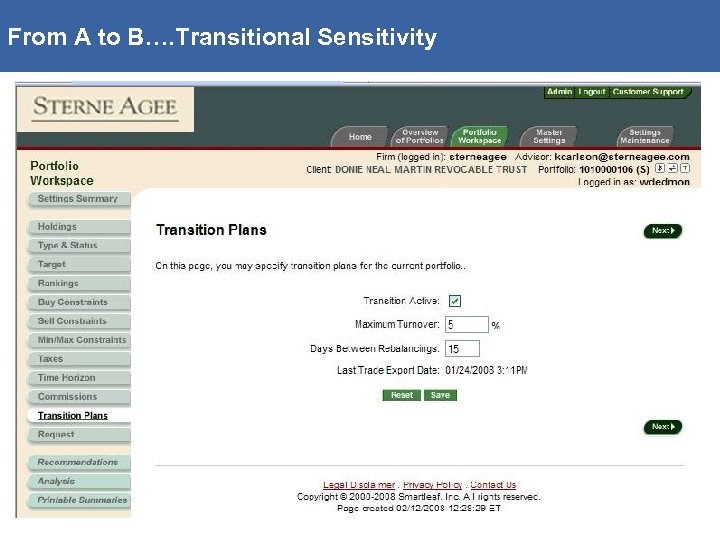

From A to B…. Transitional Sensitivity

From A to B…. Transitional Sensitivity

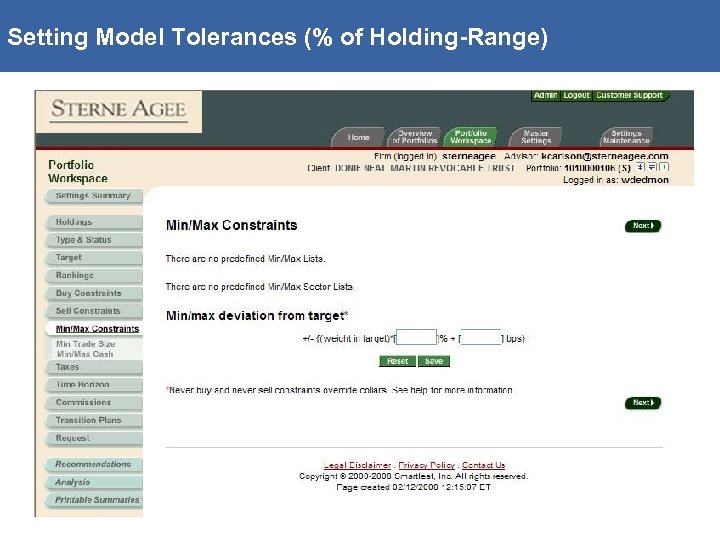

Setting Model Tolerances (% of Holding-Range)

Setting Model Tolerances (% of Holding-Range)

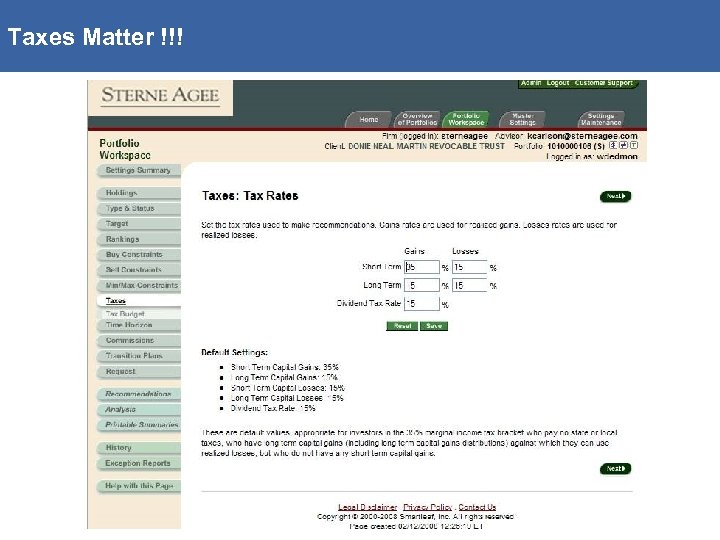

Taxes Matter !!!

Taxes Matter !!!

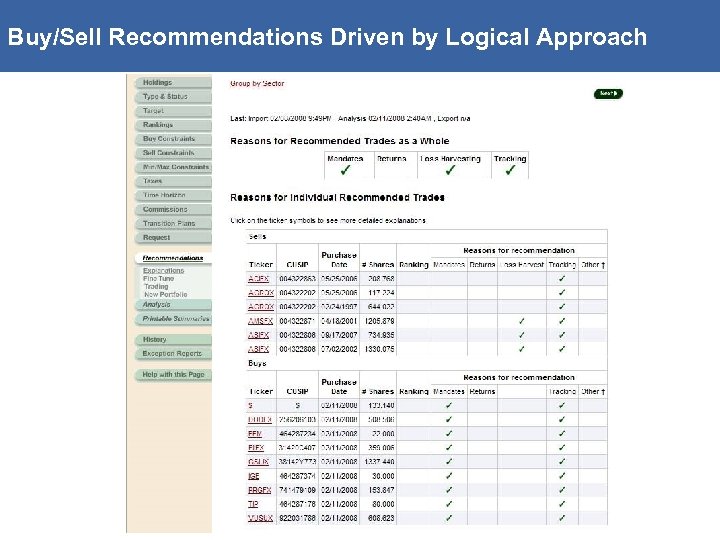

Buy/Sell Recommendations Driven by Logical Approach

Buy/Sell Recommendations Driven by Logical Approach

In Closing… Questions ?

In Closing… Questions ?