62fa6b1e98d1b5da799deab5b7ae5074.ppt

- Количество слайдов: 20

“Challenges & opportunities in the used car industry”. How to develop a healthy and sustainable remarketing policy in present times as a leasing company”. Managing Remarketing in a Changing Market Bucharest, 12 November 2009 Rob M. Henneveld Global Automotive Consultancy Thinking Global, Performing Local!

“Challenges & opportunities in the used car industry”. How to develop a healthy and sustainable remarketing policy in present times as a leasing company”. Managing Remarketing in a Changing Market Bucharest, 12 November 2009 Rob M. Henneveld Global Automotive Consultancy Thinking Global, Performing Local!

Agenda for today Introduction What drives the car manufacturer? Managing remarketing in an unstable new car market Pricing pressure, sales barriers & -channels Optimizing & managing the sales channels Conclusions ALB 2009 conference 1. 2. 3. 4. 5. 6. © 2009 Global Automotive Consultancy, the Netherlands/Romania 2

Agenda for today Introduction What drives the car manufacturer? Managing remarketing in an unstable new car market Pricing pressure, sales barriers & -channels Optimizing & managing the sales channels Conclusions ALB 2009 conference 1. 2. 3. 4. 5. 6. © 2009 Global Automotive Consultancy, the Netherlands/Romania 2

1. Introduction Background: Before founding Global Automotive Consultancy, an international in-depth knowledge and diversified automotive experience was acquired. This developed into a well-balanced vision in a wide range of issues, covering: Car Leasing, Rental, Remarketing, Aftersales, Fleet Management and Insurance – involving a clientele in the wholesale, retail and end-user segments of the supplier-chain. Active in several countries: the Netherlands, Germany, Belgium, France, Italy, Israel, Turkey, Poland, South-Africa, Spain, Poland Romania. ALB 2009 conference In a variety of capacities: as an Independent International Business Consultant, Trainer, Coach, Interim- and Project manager, writer of articles and white-papers. Mostly applied during strategic- & product development, in-depth market research and direct consultancy in areas such as, the (Financial) Service Industry, Aftermarket, Remarketing and IT. More recently, co-founder and chairman of the Dutch Remarketing Council, objectives: promote Dutch cars throughout Europe, lower tradebarriers among car traders, create a knowledge-center used cars. © 2009 Global Automotive Consultancy, the Netherlands/Romania 3

1. Introduction Background: Before founding Global Automotive Consultancy, an international in-depth knowledge and diversified automotive experience was acquired. This developed into a well-balanced vision in a wide range of issues, covering: Car Leasing, Rental, Remarketing, Aftersales, Fleet Management and Insurance – involving a clientele in the wholesale, retail and end-user segments of the supplier-chain. Active in several countries: the Netherlands, Germany, Belgium, France, Italy, Israel, Turkey, Poland, South-Africa, Spain, Poland Romania. ALB 2009 conference In a variety of capacities: as an Independent International Business Consultant, Trainer, Coach, Interim- and Project manager, writer of articles and white-papers. Mostly applied during strategic- & product development, in-depth market research and direct consultancy in areas such as, the (Financial) Service Industry, Aftermarket, Remarketing and IT. More recently, co-founder and chairman of the Dutch Remarketing Council, objectives: promote Dutch cars throughout Europe, lower tradebarriers among car traders, create a knowledge-center used cars. © 2009 Global Automotive Consultancy, the Netherlands/Romania 3

ALB 2009 conference 2. What drives the Car Manufacturer? © 2009 Global Automotive Consultancy, the Netherlands/Romania 4

ALB 2009 conference 2. What drives the Car Manufacturer? © 2009 Global Automotive Consultancy, the Netherlands/Romania 4

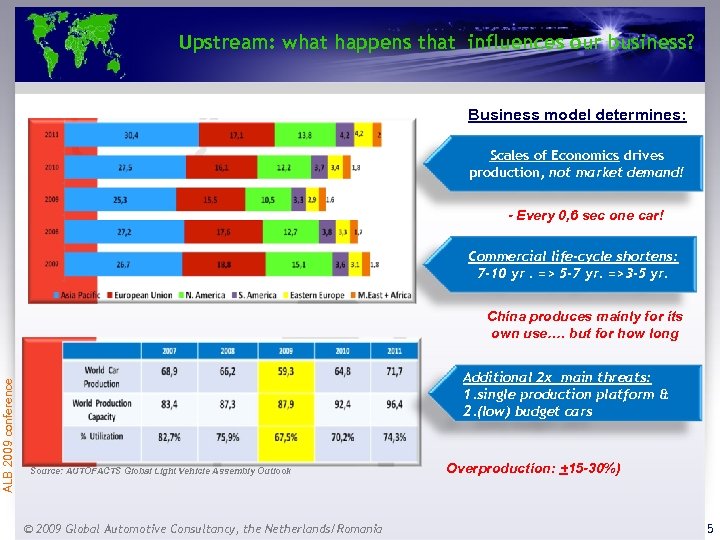

Upstream: what happens that influences our business? Business model determines: Scales of Economics drives production, not market demand! - Every 0, 6 sec one car! Commercial life-cycle shortens: 7 -10 yr. => 5 -7 yr. =>3 -5 yr. ALB 2009 conference China produces mainly for its own use…. but for how long Additional 2 x main threats: 1. single production platform & 2. (low) budget cars Source: AUTOFACTS Global Light Vehicle Assembly Outlook © 2009 Global Automotive Consultancy, the Netherlands/Romania Overproduction: +15 -30%) 5

Upstream: what happens that influences our business? Business model determines: Scales of Economics drives production, not market demand! - Every 0, 6 sec one car! Commercial life-cycle shortens: 7 -10 yr. => 5 -7 yr. =>3 -5 yr. ALB 2009 conference China produces mainly for its own use…. but for how long Additional 2 x main threats: 1. single production platform & 2. (low) budget cars Source: AUTOFACTS Global Light Vehicle Assembly Outlook © 2009 Global Automotive Consultancy, the Netherlands/Romania Overproduction: +15 -30%) 5

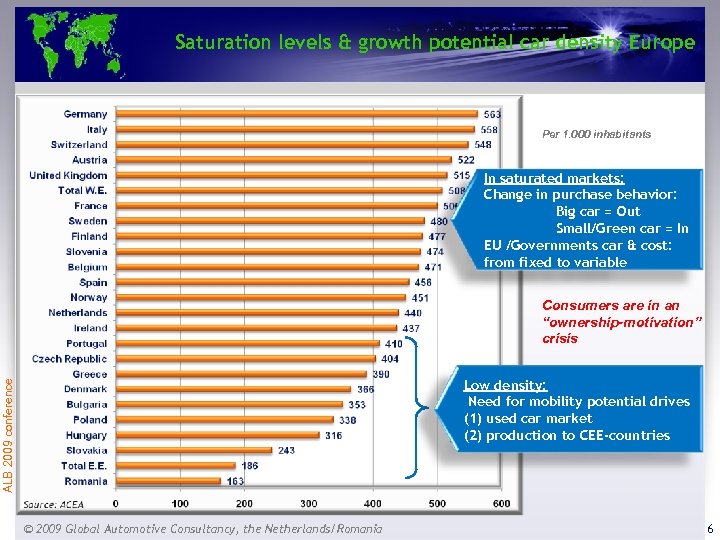

Saturation levels & growth potential car density Europe Per 1. 000 inhabitants In saturated markets: Change in purchase behavior: Big car = Out Small/Green car = In EU /Governments car & cost: from fixed to variable Consumers are in an “ownership-motivation” crisis ALB 2009 conference Low density: Need for mobility potential drives (1) used car market (2) production to CEE-countries © 2009 Global Automotive Consultancy, the Netherlands/Romania 6

Saturation levels & growth potential car density Europe Per 1. 000 inhabitants In saturated markets: Change in purchase behavior: Big car = Out Small/Green car = In EU /Governments car & cost: from fixed to variable Consumers are in an “ownership-motivation” crisis ALB 2009 conference Low density: Need for mobility potential drives (1) used car market (2) production to CEE-countries © 2009 Global Automotive Consultancy, the Netherlands/Romania 6

ALB 2009 conference 3. Managing remarketing in an unstable (new) car market © 2009 Global Automotive Consultancy, the Netherlands/Romania 7

ALB 2009 conference 3. Managing remarketing in an unstable (new) car market © 2009 Global Automotive Consultancy, the Netherlands/Romania 7

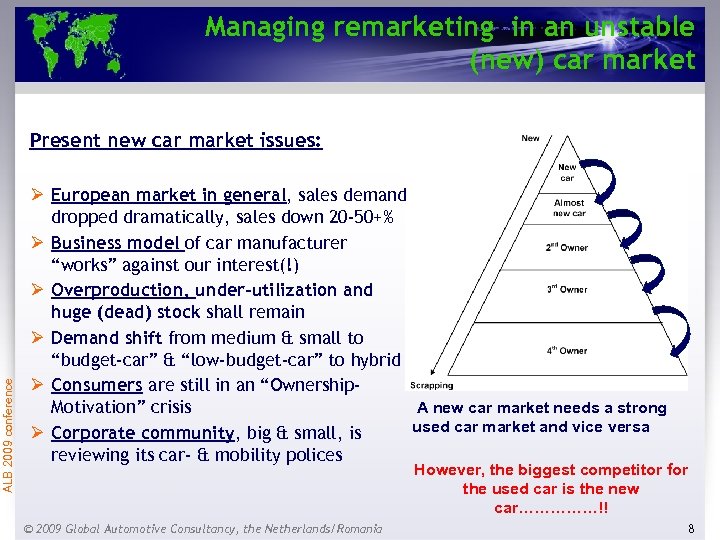

Managing remarketing in an unstable (new) car market ALB 2009 conference Present new car market issues: Ø European market in general, sales demand dropped dramatically, sales down 20 -50+% Ø Business model of car manufacturer “works” against our interest(!) Ø Overproduction, under-utilization and huge (dead) stock shall remain Ø Demand shift from medium & small to “budget-car” & “low-budget-car” to hybrid Ø Consumers are still in an “Ownership. A new car market needs a strong Motivation” crisis used car market and vice versa Ø Corporate community, big & small, is reviewing its car- & mobility polices However, the biggest competitor for the used car is the new car……………!! © 2009 Global Automotive Consultancy, the Netherlands/Romania 8

Managing remarketing in an unstable (new) car market ALB 2009 conference Present new car market issues: Ø European market in general, sales demand dropped dramatically, sales down 20 -50+% Ø Business model of car manufacturer “works” against our interest(!) Ø Overproduction, under-utilization and huge (dead) stock shall remain Ø Demand shift from medium & small to “budget-car” & “low-budget-car” to hybrid Ø Consumers are still in an “Ownership. A new car market needs a strong Motivation” crisis used car market and vice versa Ø Corporate community, big & small, is reviewing its car- & mobility polices However, the biggest competitor for the used car is the new car……………!! © 2009 Global Automotive Consultancy, the Netherlands/Romania 8

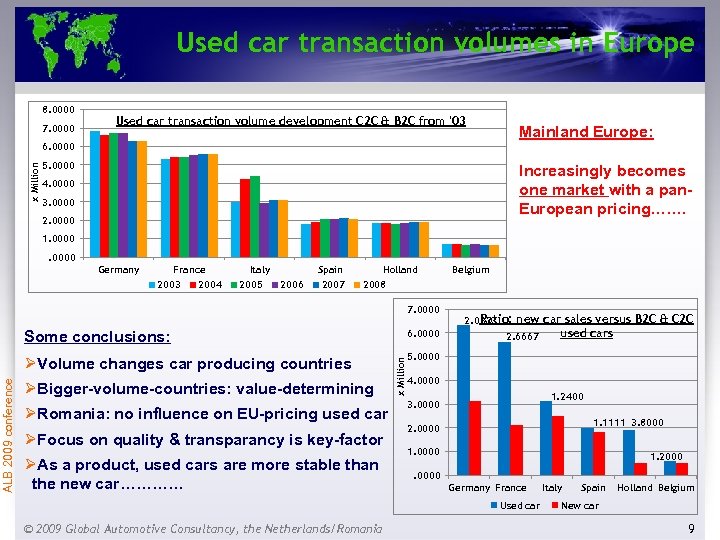

Used car transaction volumes in Europe 8. 0000 7. 0000 Used car transaction volume development C 2 C & B 2 C from '03 Mainland Europe: x Million 6. 0000 5. 0000 Increasingly becomes one market with a pan. European pricing……. 4. 0000 3. 0000 2. 0000 1. 0000 Germany France 2003 2004 Italy 2005 Spain 2006 2007 Holland 2008 7. 0000 6. 0000 ØVolume changes car producing countries Ratio: 2. 0323 new car sales versus B 2 C & C 2 C used cars 2. 6667 5. 0000 ØBigger-volume-countries: value-determining ØRomania: no influence on EU-pricing used car ØFocus on quality & transparancy is key-factor ØAs a product, used cars are more stable than the new car………… x Million Some conclusions: ALB 2009 conference Belgium 4. 0000 1. 2400 3. 0000 1. 1111 3. 8000 2. 0000 1. 2000 . 0000 Germany France Used car © 2009 Global Automotive Consultancy, the Netherlands/Romania Italy Spain Holland Belgium New car 9

Used car transaction volumes in Europe 8. 0000 7. 0000 Used car transaction volume development C 2 C & B 2 C from '03 Mainland Europe: x Million 6. 0000 5. 0000 Increasingly becomes one market with a pan. European pricing……. 4. 0000 3. 0000 2. 0000 1. 0000 Germany France 2003 2004 Italy 2005 Spain 2006 2007 Holland 2008 7. 0000 6. 0000 ØVolume changes car producing countries Ratio: 2. 0323 new car sales versus B 2 C & C 2 C used cars 2. 6667 5. 0000 ØBigger-volume-countries: value-determining ØRomania: no influence on EU-pricing used car ØFocus on quality & transparancy is key-factor ØAs a product, used cars are more stable than the new car………… x Million Some conclusions: ALB 2009 conference Belgium 4. 0000 1. 2400 3. 0000 1. 1111 3. 8000 2. 0000 1. 2000 . 0000 Germany France Used car © 2009 Global Automotive Consultancy, the Netherlands/Romania Italy Spain Holland Belgium New car 9

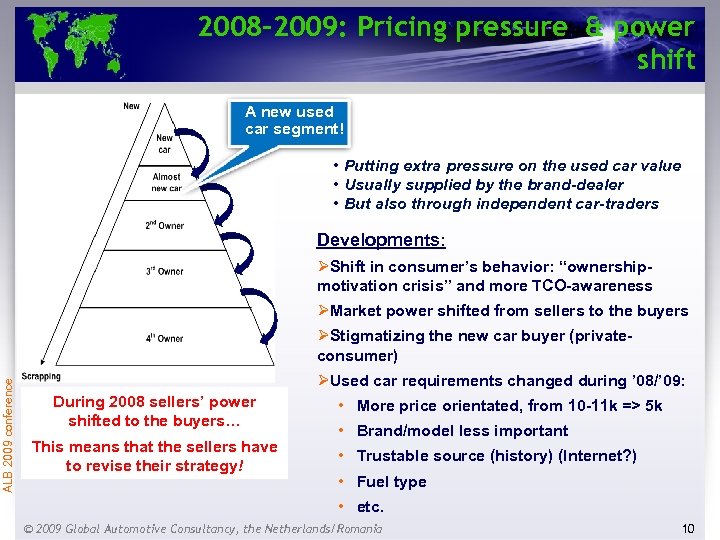

2008 -2009: Pricing pressure & power shift A new used car segment! • Putting extra pressure on the used car value • Usually supplied by the brand-dealer • But also through independent car-traders Developments: ØShift in consumer’s behavior: “ownershipmotivation crisis” and more TCO-awareness ØMarket power shifted from sellers to the buyers ALB 2009 conference ØStigmatizing the new car buyer (privateconsumer) ØUsed car requirements changed during ’ 08/’ 09: During 2008 sellers’ power shifted to the buyers… This means that the sellers have to revise their strategy! • More price orientated, from 10 -11 k => 5 k • Brand/model less important • Trustable source (history) (Internet? ) • Fuel type • etc. © 2009 Global Automotive Consultancy, the Netherlands/Romania 10

2008 -2009: Pricing pressure & power shift A new used car segment! • Putting extra pressure on the used car value • Usually supplied by the brand-dealer • But also through independent car-traders Developments: ØShift in consumer’s behavior: “ownershipmotivation crisis” and more TCO-awareness ØMarket power shifted from sellers to the buyers ALB 2009 conference ØStigmatizing the new car buyer (privateconsumer) ØUsed car requirements changed during ’ 08/’ 09: During 2008 sellers’ power shifted to the buyers… This means that the sellers have to revise their strategy! • More price orientated, from 10 -11 k => 5 k • Brand/model less important • Trustable source (history) (Internet? ) • Fuel type • etc. © 2009 Global Automotive Consultancy, the Netherlands/Romania 10

The (large) leasing companies For the car leasing industry: A shockwave went through the used car market Ø Shift of power in ‘ 08 was big surprise for the leasing industry, who were the first ones to start bleeding, Ø Consumer wanted a different car (cheaper!) Ø Encountering very confrontational issues, such as: Ø No solid used car policy in place (afterall: “disposals”) Ø Single sales channel orientated & mainly wholesale ALB 2009 conference Ø Strong process orientation (“allocating cars”) Ø Not sales driven (not adding value) Ø Lack of sales competence among staff Ø Too short internal lead-times Ø Wrong mix of fuel (95 -diesel/5% petrol) Selling the cars within short leadtimes, accelerates the drop in car value, making things worse………… Ø AND NO CONTINGENCY PLAN © 2009 Global Automotive Consultancy, the Netherlands/Romania 11

The (large) leasing companies For the car leasing industry: A shockwave went through the used car market Ø Shift of power in ‘ 08 was big surprise for the leasing industry, who were the first ones to start bleeding, Ø Consumer wanted a different car (cheaper!) Ø Encountering very confrontational issues, such as: Ø No solid used car policy in place (afterall: “disposals”) Ø Single sales channel orientated & mainly wholesale ALB 2009 conference Ø Strong process orientation (“allocating cars”) Ø Not sales driven (not adding value) Ø Lack of sales competence among staff Ø Too short internal lead-times Ø Wrong mix of fuel (95 -diesel/5% petrol) Selling the cars within short leadtimes, accelerates the drop in car value, making things worse………… Ø AND NO CONTINGENCY PLAN © 2009 Global Automotive Consultancy, the Netherlands/Romania 11

ALB 2009 conference 4. Pricing pressure, sales barriers & -channels © 2009 Global Automotive Consultancy, the Netherlands/Romania 12

ALB 2009 conference 4. Pricing pressure, sales barriers & -channels © 2009 Global Automotive Consultancy, the Netherlands/Romania 12

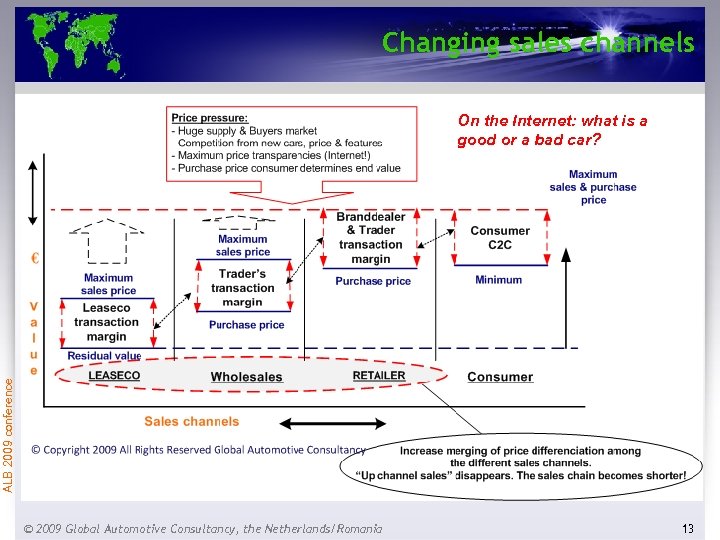

Changing sales channels ALB 2009 conference On the Internet: what is a good or a bad car? © 2009 Global Automotive Consultancy, the Netherlands/Romania 13

Changing sales channels ALB 2009 conference On the Internet: what is a good or a bad car? © 2009 Global Automotive Consultancy, the Netherlands/Romania 13

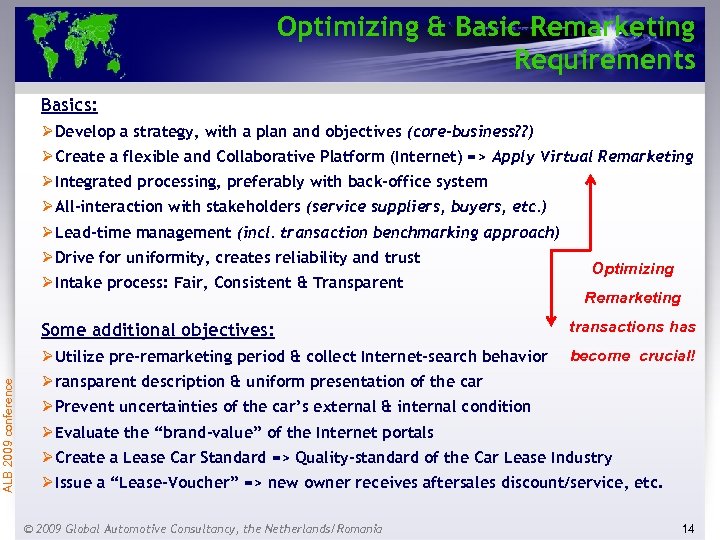

Optimizing & Basic Remarketing Requirements Basics: Ø Develop a strategy, with a plan and objectives (core-business? ? ) Ø Create a flexible and Collaborative Platform (Internet) => Apply Virtual Remarketing Ø Integrated processing, preferably with back-office system Ø All-interaction with stakeholders (service suppliers, buyers, etc. ) Ø Lead-time management (incl. transaction benchmarking approach) Ø Drive for uniformity, creates reliability and trust Ø Intake process: Fair, Consistent & Transparent Optimizing Remarketing transactions has Ø Utilize pre-remarketing period & collect Internet-search behavior ALB 2009 conference Some additional objectives: become crucial! Ø ransparent description & uniform presentation of the car Ø Prevent uncertainties of the car’s external & internal condition Ø Evaluate the “brand-value” of the Internet portals Ø Create a Lease Car Standard => Quality-standard of the Car Lease Industry Ø Issue a “Lease-Voucher” => new owner receives aftersales discount/service, etc. © 2009 Global Automotive Consultancy, the Netherlands/Romania 14

Optimizing & Basic Remarketing Requirements Basics: Ø Develop a strategy, with a plan and objectives (core-business? ? ) Ø Create a flexible and Collaborative Platform (Internet) => Apply Virtual Remarketing Ø Integrated processing, preferably with back-office system Ø All-interaction with stakeholders (service suppliers, buyers, etc. ) Ø Lead-time management (incl. transaction benchmarking approach) Ø Drive for uniformity, creates reliability and trust Ø Intake process: Fair, Consistent & Transparent Optimizing Remarketing transactions has Ø Utilize pre-remarketing period & collect Internet-search behavior ALB 2009 conference Some additional objectives: become crucial! Ø ransparent description & uniform presentation of the car Ø Prevent uncertainties of the car’s external & internal condition Ø Evaluate the “brand-value” of the Internet portals Ø Create a Lease Car Standard => Quality-standard of the Car Lease Industry Ø Issue a “Lease-Voucher” => new owner receives aftersales discount/service, etc. © 2009 Global Automotive Consultancy, the Netherlands/Romania 14

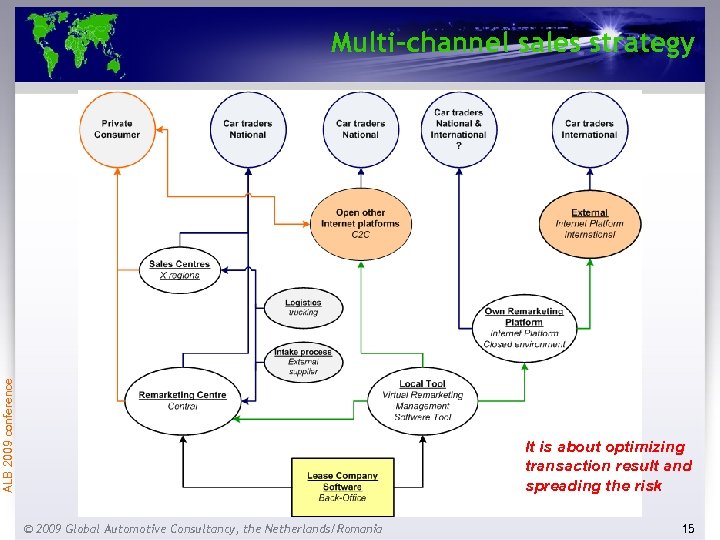

ALB 2009 conference Multi-channel sales strategy It is about optimizing transaction result and spreading the risk © 2009 Global Automotive Consultancy, the Netherlands/Romania 15

ALB 2009 conference Multi-channel sales strategy It is about optimizing transaction result and spreading the risk © 2009 Global Automotive Consultancy, the Netherlands/Romania 15

Required: purchase barriers ALB 2009 conference Purchase barriers pan-European & local market: Ø Correct and complete description of the car Ø Insight in the technical state of the car: Ø Optical, outside & inside Ø Repair/Maintenance history, Inspection: MOT Ø Body repair history Ø Tyre condition, in mm’s, sparewheel? Ø Number of owners (private/company) Ø Knowledge navigation system (import/export) Ø Countries & language settings Ø VAT-number buyer & seller Ø Local taxations by import Ø Administration by im- & export Ø Missing the Certificate of Conformity (Co. C) © 2009 Global Automotive Consultancy, the Netherlands/Romania These barriers are alike for the private-consumer and the professional car trader By taking them away, you add value to the used car proposition. Make sure the prospect buyer recognises the good points of your car………. . 16

Required: purchase barriers ALB 2009 conference Purchase barriers pan-European & local market: Ø Correct and complete description of the car Ø Insight in the technical state of the car: Ø Optical, outside & inside Ø Repair/Maintenance history, Inspection: MOT Ø Body repair history Ø Tyre condition, in mm’s, sparewheel? Ø Number of owners (private/company) Ø Knowledge navigation system (import/export) Ø Countries & language settings Ø VAT-number buyer & seller Ø Local taxations by import Ø Administration by im- & export Ø Missing the Certificate of Conformity (Co. C) © 2009 Global Automotive Consultancy, the Netherlands/Romania These barriers are alike for the private-consumer and the professional car trader By taking them away, you add value to the used car proposition. Make sure the prospect buyer recognises the good points of your car………. . 16

ALB 2009 conference 5. Optimizing & Managing the sales channels © 2009 Global Automotive Consultancy, the Netherlands/Romania 17

ALB 2009 conference 5. Optimizing & Managing the sales channels © 2009 Global Automotive Consultancy, the Netherlands/Romania 17

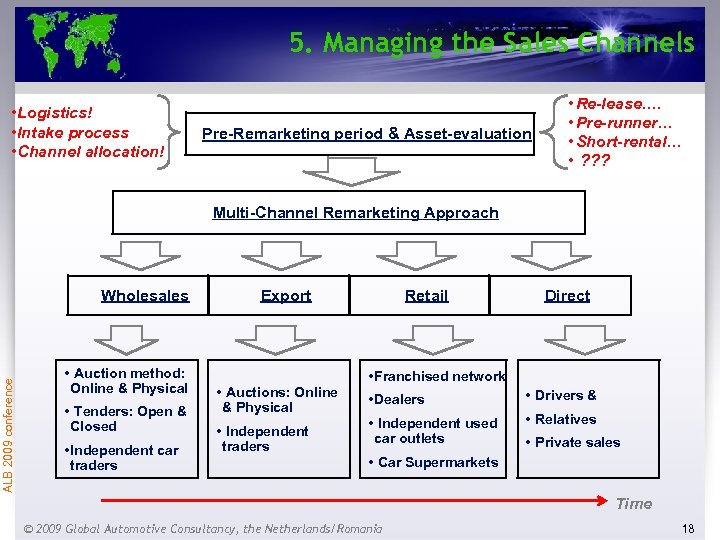

5. Managing the Sales Channels • Logistics! • Intake process • Channel allocation! Pre-Remarketing period & Asset-evaluation • Re-lease…. • Pre-runner… • Short-rental… • ? ? ? Multi-Channel Remarketing Approach ALB 2009 conference Wholesales • Auction method: Online & Physical • Tenders: Open & Closed • Independent car traders Export • Auctions: Online & Physical • Independent traders Retail Direct • Franchised network • Dealers • Drivers & • Independent used car outlets • Relatives • Private sales • Car Supermarkets Time © 2009 Global Automotive Consultancy, the Netherlands/Romania 18

5. Managing the Sales Channels • Logistics! • Intake process • Channel allocation! Pre-Remarketing period & Asset-evaluation • Re-lease…. • Pre-runner… • Short-rental… • ? ? ? Multi-Channel Remarketing Approach ALB 2009 conference Wholesales • Auction method: Online & Physical • Tenders: Open & Closed • Independent car traders Export • Auctions: Online & Physical • Independent traders Retail Direct • Franchised network • Dealers • Drivers & • Independent used car outlets • Relatives • Private sales • Car Supermarkets Time © 2009 Global Automotive Consultancy, the Netherlands/Romania 18

ALB 2009 conference 6. Some conclusions ü ü ü ü ü Business model of car manufacturer “works” against our interest! Huge stock & under-utilization shall remain Shift from medium & small to “budget-car” & “low-budget-car” Biggest competitor for the used car is the new car Consumers are entering an “Ownership-Motivation” crisis Sales management approach is needed Multi-channel strategy is justified, to spread the risk Introduction of “Virtual Remarketing” (Smart-Internet) Reducing traditional purchase barriers is vital to optimize sales transaction © 2009 Global Automotive Consultancy, the Netherlands/Romania 19

ALB 2009 conference 6. Some conclusions ü ü ü ü ü Business model of car manufacturer “works” against our interest! Huge stock & under-utilization shall remain Shift from medium & small to “budget-car” & “low-budget-car” Biggest competitor for the used car is the new car Consumers are entering an “Ownership-Motivation” crisis Sales management approach is needed Multi-channel strategy is justified, to spread the risk Introduction of “Virtual Remarketing” (Smart-Internet) Reducing traditional purchase barriers is vital to optimize sales transaction © 2009 Global Automotive Consultancy, the Netherlands/Romania 19

Thank You! ALB 2009 conference Rob M. Henneveld +31 654921409 or +40 751254551 www. globaucon. com Rob. Henneveld@globaucon. com © 2009 Global Automotive Consultancy, the Netherlands/Romania 20

Thank You! ALB 2009 conference Rob M. Henneveld +31 654921409 or +40 751254551 www. globaucon. com Rob. Henneveld@globaucon. com © 2009 Global Automotive Consultancy, the Netherlands/Romania 20