Challenges for Inflation Targeting in EM in View of the Current Global Crisis by Leonardo Leiderman Berglas School of Economics, Tel-Aviv University, Israel (leoleid@post. tau. ac. il) To be presented at the National Bank of Georgia’s international conference, Tbilisi, June 26 -27, 2009

Challenges for Inflation Targeting in EM in View of the Current Global Crisis by Leonardo Leiderman Berglas School of Economics, Tel-Aviv University, Israel (leoleid@post. tau. ac. il) To be presented at the National Bank of Georgia’s international conference, Tbilisi, June 26 -27, 2009

Initial concerns about using IT in EM… Once upon a time it was argued that: • “IT will not work in EM” • “There is a very high pass-through from exchange rates to prices” • “To stabilize inflation it is essential to have a nominal exchange-rate anchor” • “EM lack monetary policy credibility and transparency” • “De facto, central banks will not have operational independence” • “EM inflation dynamics will be mainly governed by fiscal dominance and not by monetary policy”

Initial concerns about using IT in EM… Once upon a time it was argued that: • “IT will not work in EM” • “There is a very high pass-through from exchange rates to prices” • “To stabilize inflation it is essential to have a nominal exchange-rate anchor” • “EM lack monetary policy credibility and transparency” • “De facto, central banks will not have operational independence” • “EM inflation dynamics will be mainly governed by fiscal dominance and not by monetary policy”

Yet, it is common to find EM where… • IT is being used as the monetary policy framework for reducing and stabilizing inflation • The nominal exchange rate has become flexible • Fiscal discipline has been tightened • Monetary policy has gained credibility • Fiscal and monetary policy have become more transparent • No immediate changes in this monetary regime (i. e. , IT) are being contemplated

Yet, it is common to find EM where… • IT is being used as the monetary policy framework for reducing and stabilizing inflation • The nominal exchange rate has become flexible • Fiscal discipline has been tightened • Monetary policy has gained credibility • Fiscal and monetary policy have become more transparent • No immediate changes in this monetary regime (i. e. , IT) are being contemplated

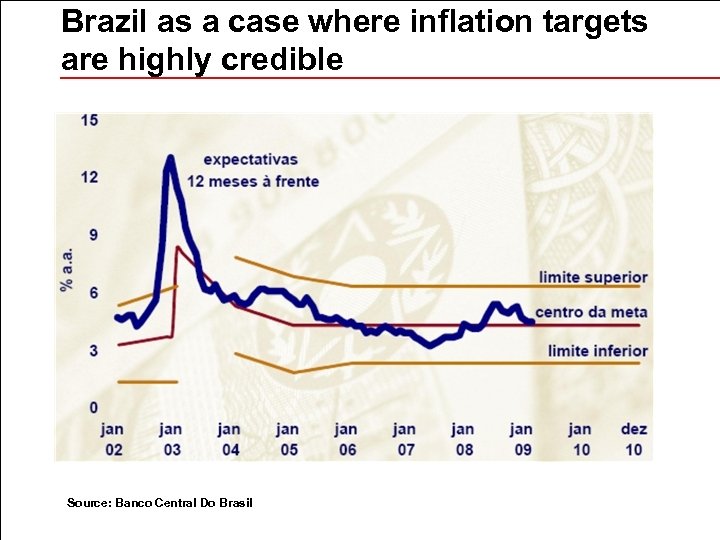

Brazil as a case where inflation targets are highly credible Source: Banco Central Do Brasil

Brazil as a case where inflation targets are highly credible Source: Banco Central Do Brasil

Israel: strong IT credibility in spite of frequent deviations of inflation from target Inflation rate – year over year 12 -month ahead break-even inflation Sources: Bank of Israel and Central Bureau of Statistics

Israel: strong IT credibility in spite of frequent deviations of inflation from target Inflation rate – year over year 12 -month ahead break-even inflation Sources: Bank of Israel and Central Bureau of Statistics

Some ‘good news’ for EM in the context of the current global crisis • EM are playing a stabilizing role for the global economy • No major crises or imbalances in most EM; decoupling… • Good functioning of FX markets • Substantial gains in EM stock and bond markets YTD • Inflation has remained under control

Some ‘good news’ for EM in the context of the current global crisis • EM are playing a stabilizing role for the global economy • No major crises or imbalances in most EM; decoupling… • Good functioning of FX markets • Substantial gains in EM stock and bond markets YTD • Inflation has remained under control

EM Growth is Expected to Lead the Global Recovery GDP growth rates – The figures for 2009/10 are IMF forecasts Sources: IMF

EM Growth is Expected to Lead the Global Recovery GDP growth rates – The figures for 2009/10 are IMF forecasts Sources: IMF

Single-digit inflation rates in EM: here to stay? Testing time ahead for monetary policy Source: IMF

Single-digit inflation rates in EM: here to stay? Testing time ahead for monetary policy Source: IMF

Weaker fiscal discipline ahead: EM budget deficits as percent of GDP Source: IMF

Weaker fiscal discipline ahead: EM budget deficits as percent of GDP Source: IMF

The nominal exchange rate as a shock absorber: currency depreciation since the Lehman event of Sept. 15, 2008… % nominal exchange rate depreciation up to June 19, 2009 (LTD) and up to mid March (LTMAX) Sources: Bloomberg

The nominal exchange rate as a shock absorber: currency depreciation since the Lehman event of Sept. 15, 2008… % nominal exchange rate depreciation up to June 19, 2009 (LTD) and up to mid March (LTMAX) Sources: Bloomberg

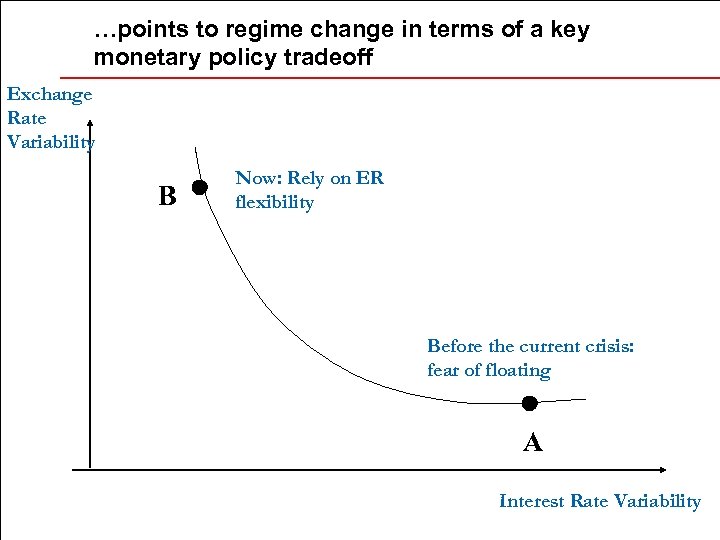

…points to regime change in terms of a key monetary policy tradeoff Exchange Rate Variability B Now: Rely on ER flexibility Before the current crisis: fear of floating A Interest Rate Variability

…points to regime change in terms of a key monetary policy tradeoff Exchange Rate Variability B Now: Rely on ER flexibility Before the current crisis: fear of floating A Interest Rate Variability

Major difficulties and challenges ahead • The return of fiscal dominance? • A larger role for central banks as lenders of last resort? • How to deal with growing risks of corporate debt defaults? • Is there room for quantitative easing as a policy instrument? • A larger role of asset prices in setting the policy rate? • How to deal with commodity-price fluctuations? • Weak growth but higher inflation: back to the Phillips curve dilemmas? In summary: the next few years will be a severe testing time for inflation targeting not only in emerging-market economies

Major difficulties and challenges ahead • The return of fiscal dominance? • A larger role for central banks as lenders of last resort? • How to deal with growing risks of corporate debt defaults? • Is there room for quantitative easing as a policy instrument? • A larger role of asset prices in setting the policy rate? • How to deal with commodity-price fluctuations? • Weak growth but higher inflation: back to the Phillips curve dilemmas? In summary: the next few years will be a severe testing time for inflation targeting not only in emerging-market economies

THANK YOU!

THANK YOU!