Chapter 6 Takeover Tactics.pptx

- Количество слайдов: 11

CH 6. Takeover Tactics M&A

CH 6. Takeover Tactics M&A

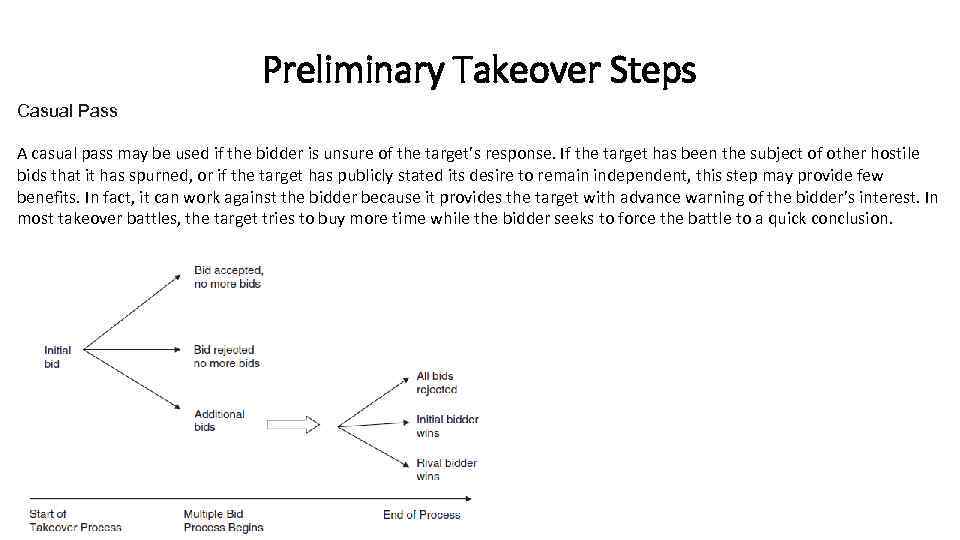

Preliminary Takeover Steps Casual Pass A casual pass may be used if the bidder is unsure of the target’s response. If the target has been the subject of other hostile bids that it has spurned, or if the target has publicly stated its desire to remain independent, this step may provide few benefits. In fact, it can work against the bidder because it provides the target with advance warning of the bidder’s interest. In most takeover battles, the target tries to buy more time while the bidder seeks to force the battle to a quick conclusion.

Preliminary Takeover Steps Casual Pass A casual pass may be used if the bidder is unsure of the target’s response. If the target has been the subject of other hostile bids that it has spurned, or if the target has publicly stated its desire to remain independent, this step may provide few benefits. In fact, it can work against the bidder because it provides the target with advance warning of the bidder’s interest. In most takeover battles, the target tries to buy more time while the bidder seeks to force the battle to a quick conclusion.

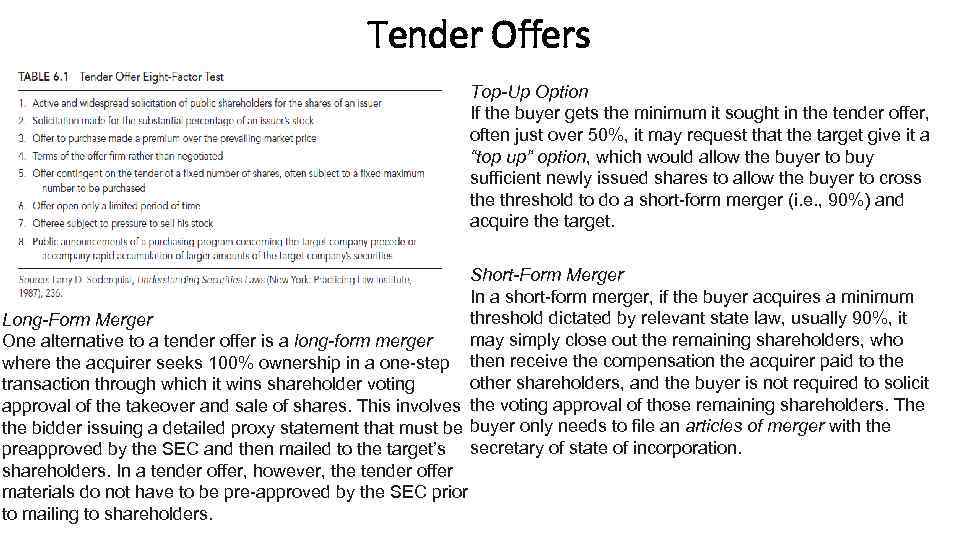

Tender Offers Top-Up Option If the buyer gets the minimum it sought in the tender offer, often just over 50%, it may request that the target give it a “top up” option, which would allow the buyer to buy sufficient newly issued shares to allow the buyer to cross the threshold to do a short-form merger (i. e. , 90%) and acquire the target. Short-Form Merger In a short-form merger, if the buyer acquires a minimum threshold dictated by relevant state law, usually 90%, it Long-Form Merger may simply close out the remaining shareholders, who One alternative to a tender offer is a long-form merger where the acquirer seeks 100% ownership in a one-step then receive the compensation the acquirer paid to the other shareholders, and the buyer is not required to solicit transaction through which it wins shareholder voting approval of the takeover and sale of shares. This involves the voting approval of those remaining shareholders. The the bidder issuing a detailed proxy statement that must be buyer only needs to file an articles of merger with the preapproved by the SEC and then mailed to the target’s secretary of state of incorporation. shareholders. In a tender offer, however, the tender offer materials do not have to be pre-approved by the SEC prior to mailing to shareholders.

Tender Offers Top-Up Option If the buyer gets the minimum it sought in the tender offer, often just over 50%, it may request that the target give it a “top up” option, which would allow the buyer to buy sufficient newly issued shares to allow the buyer to cross the threshold to do a short-form merger (i. e. , 90%) and acquire the target. Short-Form Merger In a short-form merger, if the buyer acquires a minimum threshold dictated by relevant state law, usually 90%, it Long-Form Merger may simply close out the remaining shareholders, who One alternative to a tender offer is a long-form merger where the acquirer seeks 100% ownership in a one-step then receive the compensation the acquirer paid to the other shareholders, and the buyer is not required to solicit transaction through which it wins shareholder voting approval of the takeover and sale of shares. This involves the voting approval of those remaining shareholders. The the bidder issuing a detailed proxy statement that must be buyer only needs to file an articles of merger with the preapproved by the SEC and then mailed to the target’s secretary of state of incorporation. shareholders. In a tender offer, however, the tender offer materials do not have to be pre-approved by the SEC prior to mailing to shareholders.

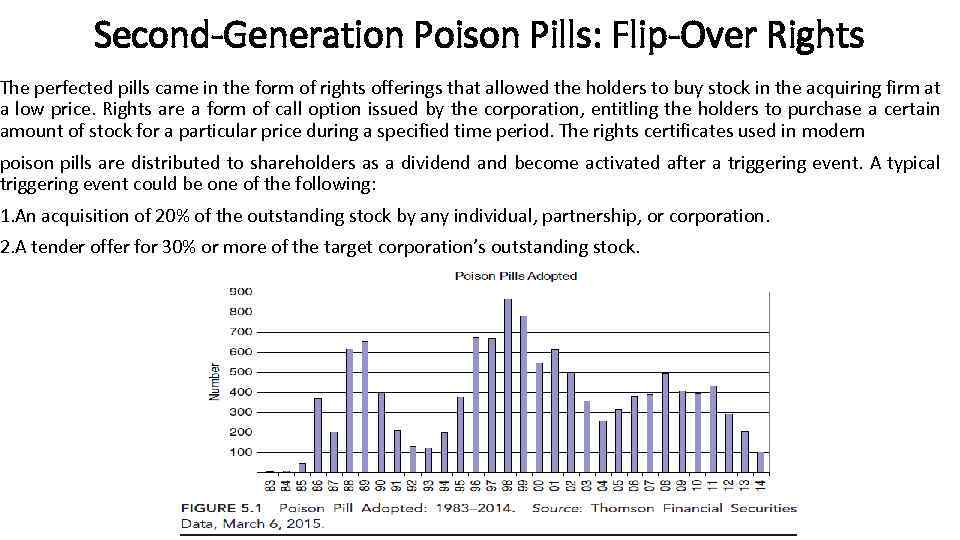

Second-Generation Poison Pills: Flip-Over Rights The perfected pills came in the form of rights offerings that allowed the holders to buy stock in the acquiring firm at a low price. Rights are a form of call option issued by the corporation, entitling the holders to purchase a certain amount of stock for a particular price during a specified time period. The rights certificates used in modern poison pills are distributed to shareholders as a dividend and become activated after a triggering event. A typical triggering event could be one of the following: 1. An acquisition of 20% of the outstanding stock by any individual, partnership, or corporation. 2. A tender offer for 30% or more of the target corporation’s outstanding stock.

Second-Generation Poison Pills: Flip-Over Rights The perfected pills came in the form of rights offerings that allowed the holders to buy stock in the acquiring firm at a low price. Rights are a form of call option issued by the corporation, entitling the holders to purchase a certain amount of stock for a particular price during a specified time period. The rights certificates used in modern poison pills are distributed to shareholders as a dividend and become activated after a triggering event. A typical triggering event could be one of the following: 1. An acquisition of 20% of the outstanding stock by any individual, partnership, or corporation. 2. A tender offer for 30% or more of the target corporation’s outstanding stock.

Third-Generation Poison Pills: Flip-In Poison Pills Flip-over poison pills have the drawback that they are effective only if the bidder acquires 100% of the target; they are not effective in preventing the acquisition of a controlling but less than 100%interest in the target. Given that most acquirers want to obtain 100% of the target’s stock so as to have unrestricted access to the target’s resources, flip-over provisions may prevent many, but not all, control transactions. Flip-in poison pills were an innovation designed to deal with the problem of a bidder who was not trying to purchase 100% of the target. With the flip-over provisions, a bidder could avoid the impact of the pill simply by not buying all of the target’s outstanding stock. Back-End Plans Another variant on the poison pill theme are back-end plans, also known as note purchase rights plans. The first back-end plan was developed in 1984. Under a back-end plan, shareholders receive a rights dividend, which gives shareholders the ability to exchange this right along with a share of stock for cash or senior securities that are equal in value to a specific “back-end” price stipulated by the issuer’s board of directors. These rights may be exercised after the acquirer purchases shares in excess of a specific percentage of the target’s outstanding shares. The backend price is set above the market price, so back-end plans establish a minimum price for a takeover. The board of directors, however, must in good faith set a reasonable price. Voting Plans Voting plans were first developed in 1985. They are designed to prevent any outside entity from obtaining voting control of the company. Under these plans the company issues a dividend of preferred stock. If any outside entity acquires a substantial percentage of the company’s stock, holders of preferred stock become entitled to super voting rights.

Third-Generation Poison Pills: Flip-In Poison Pills Flip-over poison pills have the drawback that they are effective only if the bidder acquires 100% of the target; they are not effective in preventing the acquisition of a controlling but less than 100%interest in the target. Given that most acquirers want to obtain 100% of the target’s stock so as to have unrestricted access to the target’s resources, flip-over provisions may prevent many, but not all, control transactions. Flip-in poison pills were an innovation designed to deal with the problem of a bidder who was not trying to purchase 100% of the target. With the flip-over provisions, a bidder could avoid the impact of the pill simply by not buying all of the target’s outstanding stock. Back-End Plans Another variant on the poison pill theme are back-end plans, also known as note purchase rights plans. The first back-end plan was developed in 1984. Under a back-end plan, shareholders receive a rights dividend, which gives shareholders the ability to exchange this right along with a share of stock for cash or senior securities that are equal in value to a specific “back-end” price stipulated by the issuer’s board of directors. These rights may be exercised after the acquirer purchases shares in excess of a specific percentage of the target’s outstanding shares. The backend price is set above the market price, so back-end plans establish a minimum price for a takeover. The board of directors, however, must in good faith set a reasonable price. Voting Plans Voting plans were first developed in 1985. They are designed to prevent any outside entity from obtaining voting control of the company. Under these plans the company issues a dividend of preferred stock. If any outside entity acquires a substantial percentage of the company’s stock, holders of preferred stock become entitled to super voting rights.

10 -Day Window of the Williams Act - 13 D Response of the Target Management SEC Rule 14 e-2(a) requires that the target issues its response to the bid no later than 10 business days after the offer commenced. This response is done through the filing of a Schedule 14 D-9. In its response the target basically has four options: 1. Recommend acceptance 2. Recommend rejection 3. State that it has no opinion and is neutral 4. State that it cannot take a position on the bid

10 -Day Window of the Williams Act - 13 D Response of the Target Management SEC Rule 14 e-2(a) requires that the target issues its response to the bid no later than 10 business days after the offer commenced. This response is done through the filing of a Schedule 14 D-9. In its response the target basically has four options: 1. Recommend acceptance 2. Recommend rejection 3. State that it has no opinion and is neutral 4. State that it cannot take a position on the bid

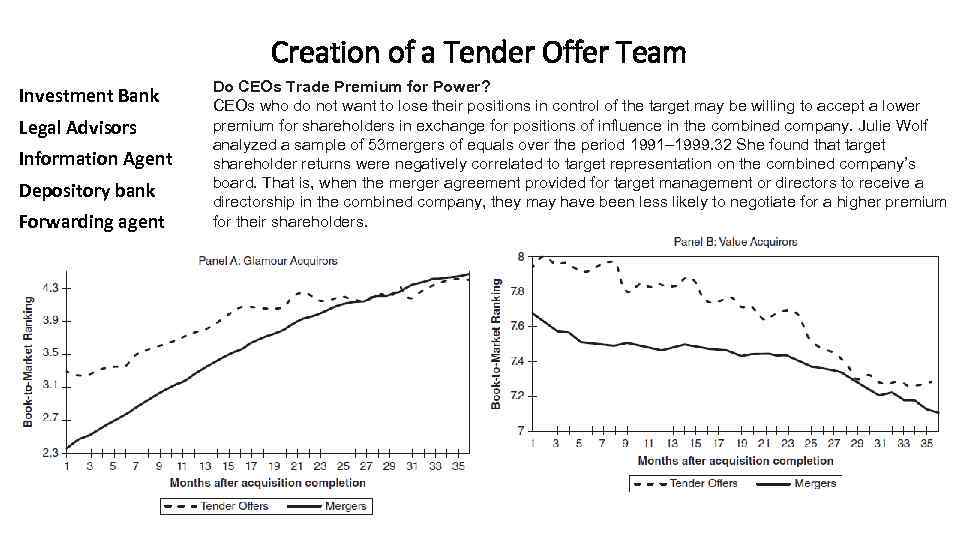

Creation of a Tender Offer Team Investment Bank Legal Advisors Information Agent Depository bank Forwarding agent Do CEOs Trade Premium for Power? CEOs who do not want to lose their positions in control of the target may be willing to accept a lower premium for shareholders in exchange for positions of influence in the combined company. Julie Wolf analyzed a sample of 53 mergers of equals over the period 1991– 1999. 32 She found that target shareholder returns were negatively correlated to target representation on the combined company’s board. That is, when the merger agreement provided for target management or directors to receive a directorship in the combined company, they may have been less likely to negotiate for a higher premium for their shareholders.

Creation of a Tender Offer Team Investment Bank Legal Advisors Information Agent Depository bank Forwarding agent Do CEOs Trade Premium for Power? CEOs who do not want to lose their positions in control of the target may be willing to accept a lower premium for shareholders in exchange for positions of influence in the combined company. Julie Wolf analyzed a sample of 53 mergers of equals over the period 1991– 1999. 32 She found that target shareholder returns were negatively correlated to target representation on the combined company’s board. That is, when the merger agreement provided for target management or directors to receive a directorship in the combined company, they may have been less likely to negotiate for a higher premium for their shareholders.

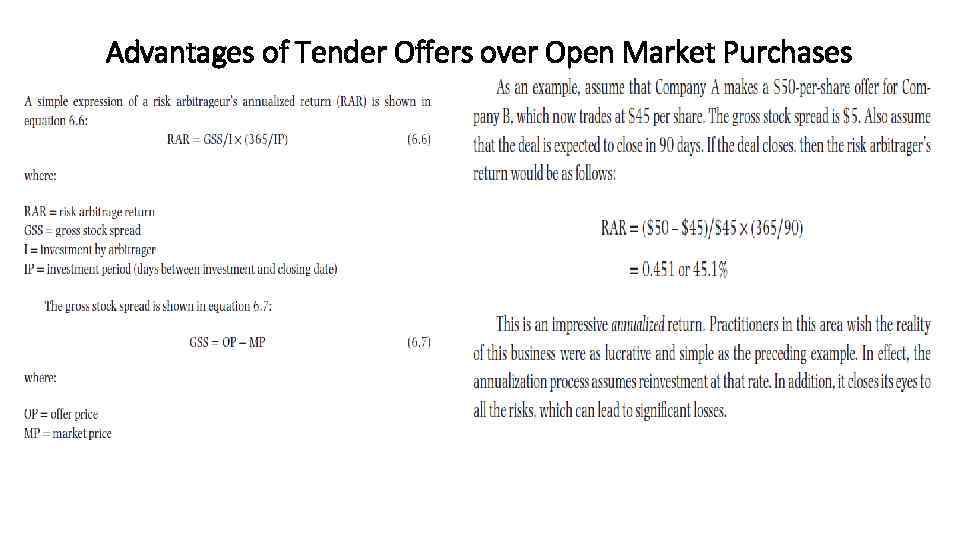

Advantages of Tender Offers over Open Market Purchases

Advantages of Tender Offers over Open Market Purchases

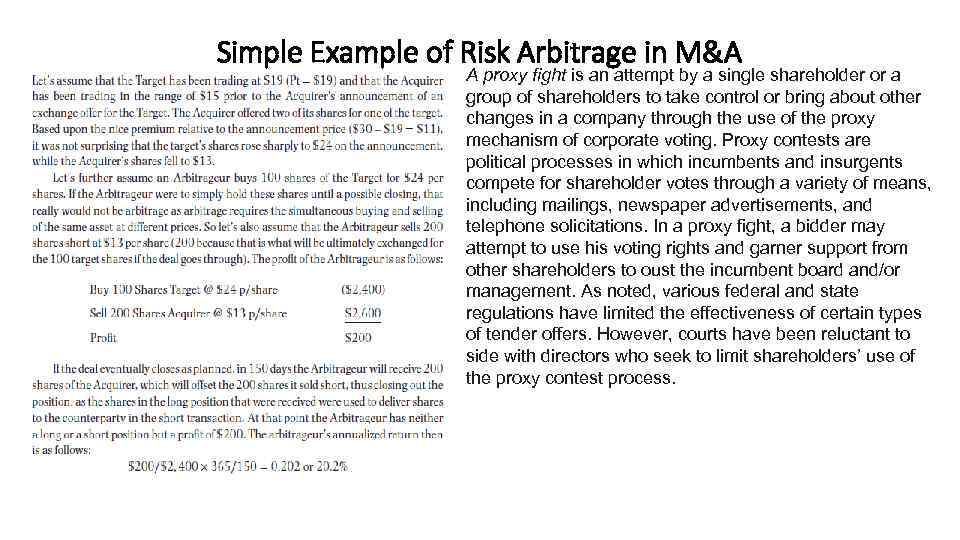

Simple Example of Risk Arbitrage in M&A A proxy fight is an attempt by a single shareholder or a group of shareholders to take control or bring about other changes in a company through the use of the proxy mechanism of corporate voting. Proxy contests are political processes in which incumbents and insurgents compete for shareholder votes through a variety of means, including mailings, newspaper advertisements, and telephone solicitations. In a proxy fight, a bidder may attempt to use his voting rights and garner support from other shareholders to oust the incumbent board and/or management. As noted, various federal and state regulations have limited the effectiveness of certain types of tender offers. However, courts have been reluctant to side with directors who seek to limit shareholders’ use of the proxy contest process.

Simple Example of Risk Arbitrage in M&A A proxy fight is an attempt by a single shareholder or a group of shareholders to take control or bring about other changes in a company through the use of the proxy mechanism of corporate voting. Proxy contests are political processes in which incumbents and insurgents compete for shareholder votes through a variety of means, including mailings, newspaper advertisements, and telephone solicitations. In a proxy fight, a bidder may attempt to use his voting rights and garner support from other shareholders to oust the incumbent board and/or management. As noted, various federal and state regulations have limited the effectiveness of certain types of tender offers. However, courts have been reluctant to side with directors who seek to limit shareholders’ use of the proxy contest process.

Different Types of Proxy Contexts Typically, there are two main forms of proxy contests: 1. Contests for seats on the board of directors. An insurgent group of stockholders may use this means to replace management. If the opposing slate of directors is elected, it may then use its authority to remove management and replace them with a new management team. In recent years we have seen insurgents who believe they may lack the power to unseat directors try to organize a campaign to have shareholders withhold their votes as a way of recording their disapproval. 2. Contests about management proposals. These proposals can be control proposals relating to a merger or acquisition. Management may oppose the merger, and the insurgent group of stockholders may be in favor. Other relevant proposals might be the passage of antitakeover amendments in the company’s charter. Management might be in favor, whereas the insurgent group might be opposed, believing that its opposition will cause the stock price to fall and/or reduce the likelihood of a takeover.

Different Types of Proxy Contexts Typically, there are two main forms of proxy contests: 1. Contests for seats on the board of directors. An insurgent group of stockholders may use this means to replace management. If the opposing slate of directors is elected, it may then use its authority to remove management and replace them with a new management team. In recent years we have seen insurgents who believe they may lack the power to unseat directors try to organize a campaign to have shareholders withhold their votes as a way of recording their disapproval. 2. Contests about management proposals. These proposals can be control proposals relating to a merger or acquisition. Management may oppose the merger, and the insurgent group of stockholders may be in favor. Other relevant proposals might be the passage of antitakeover amendments in the company’s charter. Management might be in favor, whereas the insurgent group might be opposed, believing that its opposition will cause the stock price to fall and/or reduce the likelihood of a takeover.

CASE: Mittal What technique were used?

CASE: Mittal What technique were used?