4500b15b9da9d89bb1c7cc022832d811.ppt

- Количество слайдов: 38

Ch. 6 Estimating the Project Cost of Capital Budgeting and Investment Analysis By Alan Shapiro

Ch. 6 Estimating the Project Cost of Capital Budgeting and Investment Analysis By Alan Shapiro

Introduction • The cost of capital for a project is the minimum risk-adjusted return required by shareholders of the firm for undertaking that project • Unless the investment generates sufficient funds to repay suppliers of capital, the firm’s value will suffer

Introduction • The cost of capital for a project is the minimum risk-adjusted return required by shareholders of the firm for undertaking that project • Unless the investment generates sufficient funds to repay suppliers of capital, the firm’s value will suffer

Introduction cont. • This rate must take account of both the time value of money, measured by risk-free rate of return and the riskiness of the project’s cash flows • A project whose risk characteristics differ from the corporate or divisional norm will have its own unique cost of capital

Introduction cont. • This rate must take account of both the time value of money, measured by risk-free rate of return and the riskiness of the project’s cash flows • A project whose risk characteristics differ from the corporate or divisional norm will have its own unique cost of capital

Risk and the cost of capital for a project • Each project has its own required return, reflecting three basic elements – the real or inflation adjusted risk-free interest rate – An inflation premium approx. equal to the amount of expected inflation – A Premium for Risk • The minimum or required return is the project’s cost of capital and sometimes referred to as a hurdle rate

Risk and the cost of capital for a project • Each project has its own required return, reflecting three basic elements – the real or inflation adjusted risk-free interest rate – An inflation premium approx. equal to the amount of expected inflation – A Premium for Risk • The minimum or required return is the project’s cost of capital and sometimes referred to as a hurdle rate

Risk and the cost of capital for a project cont. • The cost of capital for a project depends on the riskiness of the assets being financed not on the identity of the firm undertaking the project

Risk and the cost of capital for a project cont. • The cost of capital for a project depends on the riskiness of the assets being financed not on the identity of the firm undertaking the project

Capital Asset Pricing Model (CAPM) • The only risk that will be rewarded with a risk premium will be the asset’s systematic or unavoidable risk as measured by the asset’s “Beta” coefficient • CAPM is still the most widely used risk-based cost of capital model • The CAPM asserts that the risk premium for any asset equals the asset’s beta multiplied by a market risk premium

Capital Asset Pricing Model (CAPM) • The only risk that will be rewarded with a risk premium will be the asset’s systematic or unavoidable risk as measured by the asset’s “Beta” coefficient • CAPM is still the most widely used risk-based cost of capital model • The CAPM asserts that the risk premium for any asset equals the asset’s beta multiplied by a market risk premium

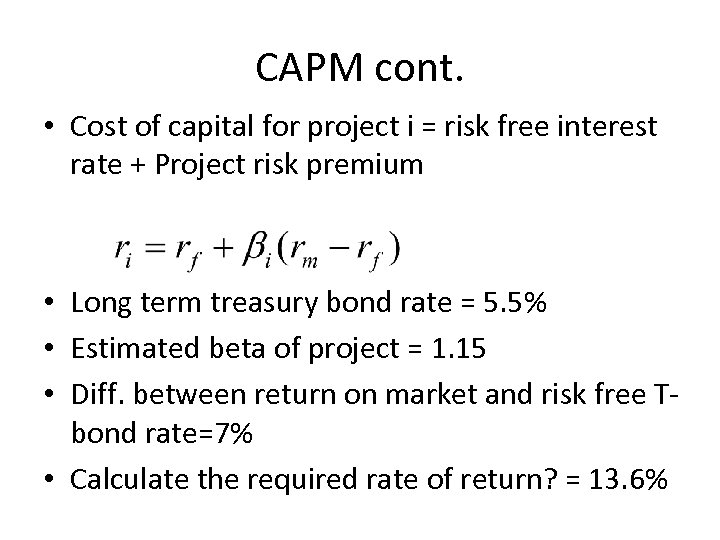

CAPM cont. • Cost of capital for project i = risk free interest rate + Project risk premium • Long term treasury bond rate = 5. 5% • Estimated beta of project = 1. 15 • Diff. between return on market and risk free Tbond rate=7% • Calculate the required rate of return? = 13. 6%

CAPM cont. • Cost of capital for project i = risk free interest rate + Project risk premium • Long term treasury bond rate = 5. 5% • Estimated beta of project = 1. 15 • Diff. between return on market and risk free Tbond rate=7% • Calculate the required rate of return? = 13. 6%

Estimating the Market risk premium • Historical equity risk premium does not measure the forward looking equity risk premium, that is, the risk premium that equity investors expect to realize on stocks bought today • Dimson et al. (2002) survey historical risk premium for 16 countries over the period 19000 -2001 and find that MRP falls within the range 3. 5% to 5. 3% • Aswath Damodaran • Pablo Fernandiz

Estimating the Market risk premium • Historical equity risk premium does not measure the forward looking equity risk premium, that is, the risk premium that equity investors expect to realize on stocks bought today • Dimson et al. (2002) survey historical risk premium for 16 countries over the period 19000 -2001 and find that MRP falls within the range 3. 5% to 5. 3% • Aswath Damodaran • Pablo Fernandiz

Estimating the Project Beta • Find a portfolio of firms that share similar risk characteristics and use the firm’s beta to proxy for the project beta • Example: if a steel company decides to enter the petroleum refining business, it will estimate the average beta of a portfolio of firms already in the industry and substitute this value for Beta • Financial risks will differ if they use different amounts of debt financing

Estimating the Project Beta • Find a portfolio of firms that share similar risk characteristics and use the firm’s beta to proxy for the project beta • Example: if a steel company decides to enter the petroleum refining business, it will estimate the average beta of a portfolio of firms already in the industry and substitute this value for Beta • Financial risks will differ if they use different amounts of debt financing

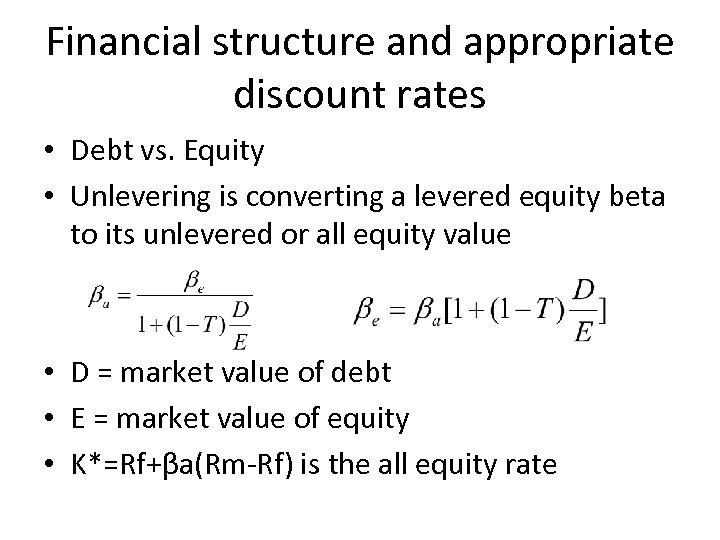

Financial structure and appropriate discount rates • Debt vs. Equity • Unlevering is converting a levered equity beta to its unlevered or all equity value • D = market value of debt • E = market value of equity • K*=Rf+βa(Rm-Rf) is the all equity rate

Financial structure and appropriate discount rates • Debt vs. Equity • Unlevering is converting a levered equity beta to its unlevered or all equity value • D = market value of debt • E = market value of equity • K*=Rf+βa(Rm-Rf) is the all equity rate

Estimating Carborundum’s cost of capital (Pg. 151) • Kennecott Copper is considering acquiring Carborundum company • Carbo’s equity beta is 1. 16 • T-bond rate is 7. 6% • Market risk premium = 7. 5% • MV of Carbo’s equity= $27 million and MV debt = $86. 2 million • If they decide to go ahead with the acquisition, they will issue additional debt of $100 mill followed by immediately payment of $140 mill div to Kennecott

Estimating Carborundum’s cost of capital (Pg. 151) • Kennecott Copper is considering acquiring Carborundum company • Carbo’s equity beta is 1. 16 • T-bond rate is 7. 6% • Market risk premium = 7. 5% • MV of Carbo’s equity= $27 million and MV debt = $86. 2 million • If they decide to go ahead with the acquisition, they will issue additional debt of $100 mill followed by immediately payment of $140 mill div to Kennecott

Carborundum’s cost of capital (Pg. 151) cont. • Calculate Carbo’s pre acquisition cost of equity as 16. 3% • Unlevering Carbo’s equity beta • Carbo’s unlevered or asset Beta = 1. 00 • Carbo’s D/E would rise from 0. 32 to 1. 42 • Equity Beta = 1. 71 • Cost of equity capital = 20. 4%

Carborundum’s cost of capital (Pg. 151) cont. • Calculate Carbo’s pre acquisition cost of equity as 16. 3% • Unlevering Carbo’s equity beta • Carbo’s unlevered or asset Beta = 1. 00 • Carbo’s D/E would rise from 0. 32 to 1. 42 • Equity Beta = 1. 71 • Cost of equity capital = 20. 4%

The cost of capital for the firm • A project to be acceptable to the firm’s shareholders, it must generate a stream of returns sufficient to compensate the suppliers of capital in proportion to the amount and cost of capital supplied by each. This minimum return is the cost of capital to the firm • Weighted average cost of capital (WACC) is used to discount for project’s cash flows ignoring financing charges such as interest and dividend payments

The cost of capital for the firm • A project to be acceptable to the firm’s shareholders, it must generate a stream of returns sufficient to compensate the suppliers of capital in proportion to the amount and cost of capital supplied by each. This minimum return is the cost of capital to the firm • Weighted average cost of capital (WACC) is used to discount for project’s cash flows ignoring financing charges such as interest and dividend payments

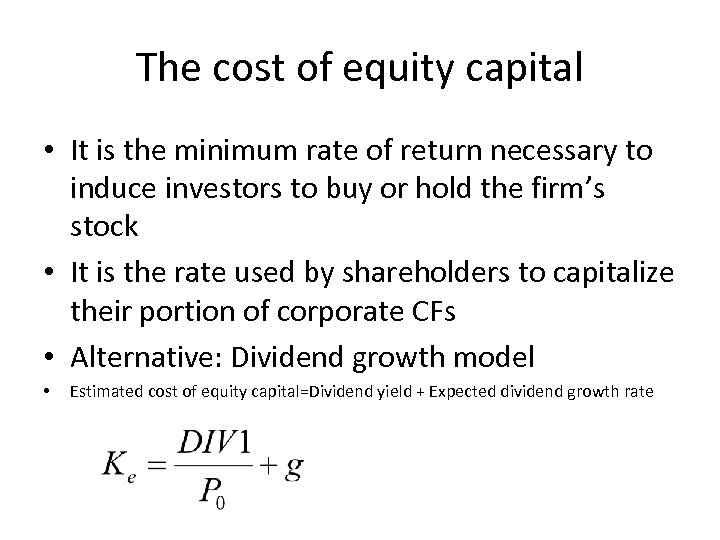

The cost of equity capital • It is the minimum rate of return necessary to induce investors to buy or hold the firm’s stock • It is the rate used by shareholders to capitalize their portion of corporate CFs • Alternative: Dividend growth model • Estimated cost of equity capital=Dividend yield + Expected dividend growth rate

The cost of equity capital • It is the minimum rate of return necessary to induce investors to buy or hold the firm’s stock • It is the rate used by shareholders to capitalize their portion of corporate CFs • Alternative: Dividend growth model • Estimated cost of equity capital=Dividend yield + Expected dividend growth rate

Example: Estimating HP cost of equity (Pg. 187) Risk free = 4. 29% MRP = 5% Beta = 1. 35 Stock price= $20. 25 D 1 = $0. 36 Div expected to grow from $0. 32 in 2003 to $0. 50 in 2008, CAGR=9. 34% • Both CAPM and Dividend growth model • • •

Example: Estimating HP cost of equity (Pg. 187) Risk free = 4. 29% MRP = 5% Beta = 1. 35 Stock price= $20. 25 D 1 = $0. 36 Div expected to grow from $0. 32 in 2003 to $0. 50 in 2008, CAGR=9. 34% • Both CAPM and Dividend growth model • • •

The cost of debt capital • Yield to maturity (YTM) • The interest rate on debt equals the nominal risk-free rate plus risk premiums sufficient to compensate debt holders for the possibility of default; The higher the probability of default is, the greater the risk premium will be • Because interest is tax deductible, the true cost of debt to the firm is the after tax interest rate

The cost of debt capital • Yield to maturity (YTM) • The interest rate on debt equals the nominal risk-free rate plus risk premiums sufficient to compensate debt holders for the possibility of default; The higher the probability of default is, the greater the risk premium will be • Because interest is tax deductible, the true cost of debt to the firm is the after tax interest rate

Cost of Debt cont. • The cost of debt capital equals Kd(1 -T) where Kd is the interest rate on new debt sold at par and T is the firm’s marginal Tax rate • For profitable firms like Coca-Cola and Merck, the after-tax cost of debt is two-thirds of its before tax cost

Cost of Debt cont. • The cost of debt capital equals Kd(1 -T) where Kd is the interest rate on new debt sold at par and T is the firm’s marginal Tax rate • For profitable firms like Coca-Cola and Merck, the after-tax cost of debt is two-thirds of its before tax cost

The cost of preferred stock • Preferred stock is a hybrid of debt and equity • Like debt, preferred stock carry fixed commitment by the firm to make periodic payments • In case of Bankruptcy, they get their money before shareholders but after debt holders

The cost of preferred stock • Preferred stock is a hybrid of debt and equity • Like debt, preferred stock carry fixed commitment by the firm to make periodic payments • In case of Bankruptcy, they get their money before shareholders but after debt holders

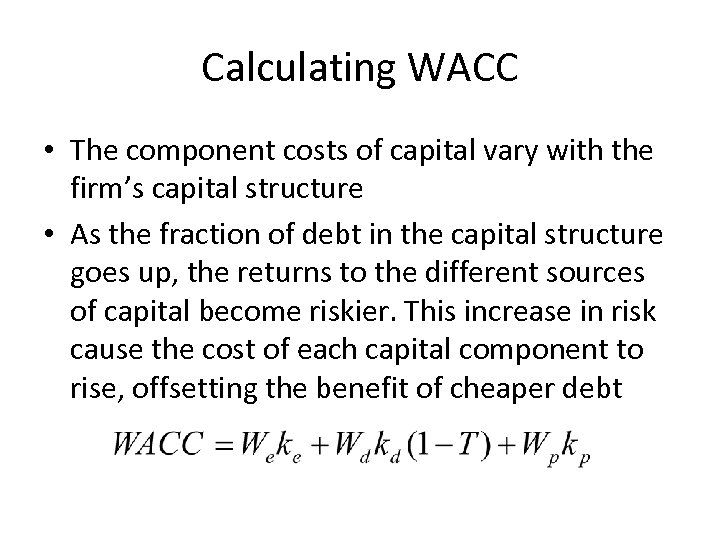

Calculating WACC • The component costs of capital vary with the firm’s capital structure • As the fraction of debt in the capital structure goes up, the returns to the different sources of capital become riskier. This increase in risk cause the cost of each capital component to rise, offsetting the benefit of cheaper debt

Calculating WACC • The component costs of capital vary with the firm’s capital structure • As the fraction of debt in the capital structure goes up, the returns to the different sources of capital become riskier. This increase in risk cause the cost of each capital component to rise, offsetting the benefit of cheaper debt

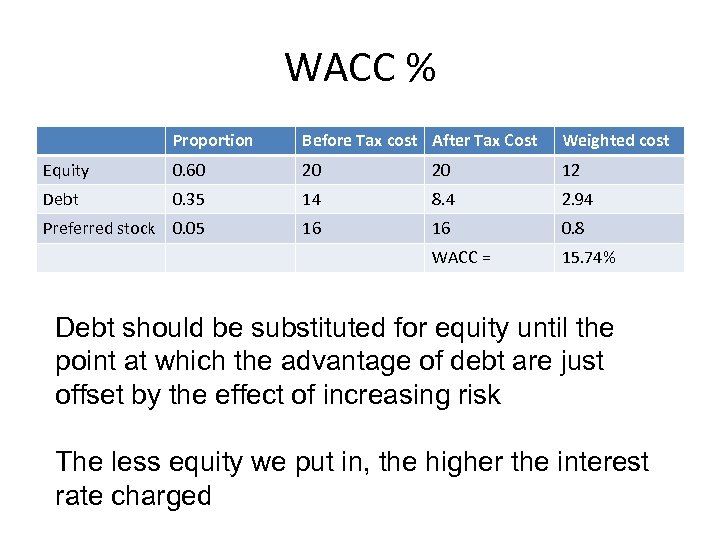

WACC % Proportion Before Tax cost After Tax Cost Weighted cost Equity 0. 60 20 20 12 Debt 0. 35 14 8. 4 2. 94 Preferred stock 0. 05 16 16 0. 8 WACC = 15. 74% Debt should be substituted for equity until the point at which the advantage of debt are just offset by the effect of increasing risk The less equity we put in, the higher the interest rate charged

WACC % Proportion Before Tax cost After Tax Cost Weighted cost Equity 0. 60 20 20 12 Debt 0. 35 14 8. 4 2. 94 Preferred stock 0. 05 16 16 0. 8 WACC = 15. 74% Debt should be substituted for equity until the point at which the advantage of debt are just offset by the effect of increasing risk The less equity we put in, the higher the interest rate charged

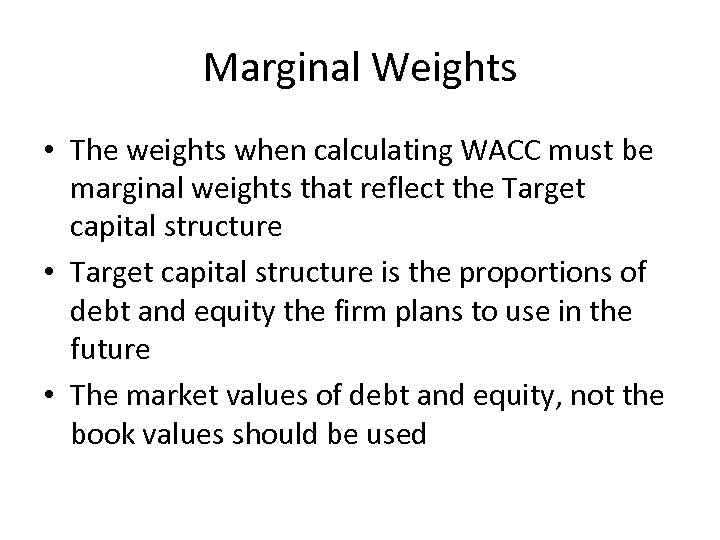

Marginal Weights • The weights when calculating WACC must be marginal weights that reflect the Target capital structure • Target capital structure is the proportions of debt and equity the firm plans to use in the future • The market values of debt and equity, not the book values should be used

Marginal Weights • The weights when calculating WACC must be marginal weights that reflect the Target capital structure • Target capital structure is the proportions of debt and equity the firm plans to use in the future • The market values of debt and equity, not the book values should be used

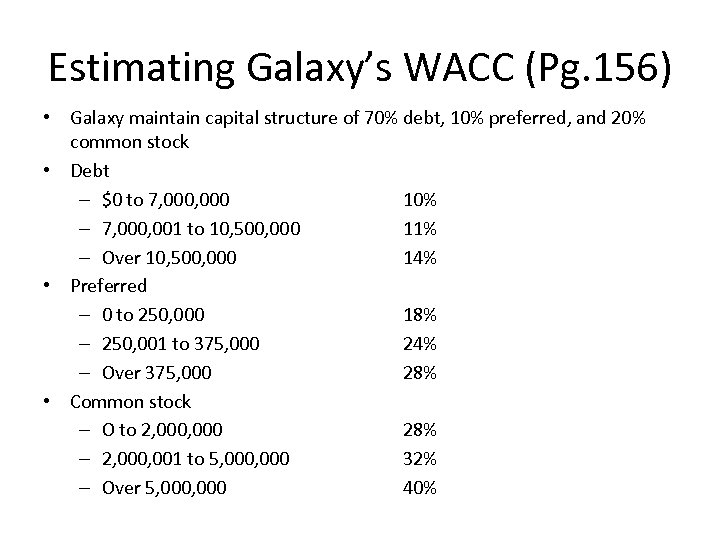

Estimating Galaxy’s WACC (Pg. 156) • Galaxy maintain capital structure of 70% debt, 10% preferred, and 20% common stock • Debt – $0 to 7, 000 10% – 7, 000, 001 to 10, 500, 000 11% – Over 10, 500, 000 14% • Preferred – 0 to 250, 000 18% – 250, 001 to 375, 000 24% – Over 375, 000 28% • Common stock – O to 2, 000 28% – 2, 000, 001 to 5, 000 32% – Over 5, 000 40%

Estimating Galaxy’s WACC (Pg. 156) • Galaxy maintain capital structure of 70% debt, 10% preferred, and 20% common stock • Debt – $0 to 7, 000 10% – 7, 000, 001 to 10, 500, 000 11% – Over 10, 500, 000 14% • Preferred – 0 to 250, 000 18% – 250, 001 to 375, 000 24% – Over 375, 000 28% • Common stock – O to 2, 000 28% – 2, 000, 001 to 5, 000 32% – Over 5, 000 40%

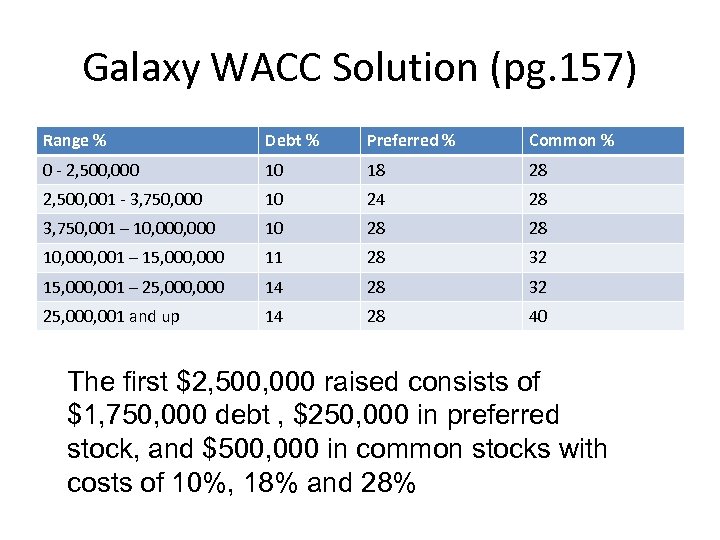

Galaxy WACC Solution (pg. 157) Range % Debt % Preferred % Common % 0 - 2, 500, 000 10 18 28 2, 500, 001 - 3, 750, 000 10 24 28 3, 750, 001 – 10, 000 10 28 28 10, 001 – 15, 000 11 28 32 15, 000, 001 – 25, 000 14 28 32 25, 000, 001 and up 14 28 40 The first $2, 500, 000 raised consists of $1, 750, 000 debt , $250, 000 in preferred stock, and $500, 000 in common stocks with costs of 10%, 18% and 28%

Galaxy WACC Solution (pg. 157) Range % Debt % Preferred % Common % 0 - 2, 500, 000 10 18 28 2, 500, 001 - 3, 750, 000 10 24 28 3, 750, 001 – 10, 000 10 28 28 10, 001 – 15, 000 11 28 32 15, 000, 001 – 25, 000 14 28 32 25, 000, 001 and up 14 28 40 The first $2, 500, 000 raised consists of $1, 750, 000 debt , $250, 000 in preferred stock, and $500, 000 in common stocks with costs of 10%, 18% and 28%

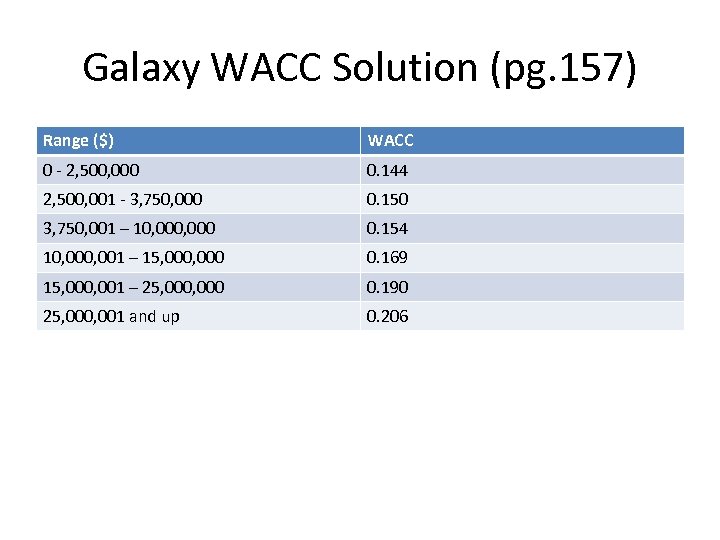

Galaxy WACC Solution (pg. 157) Range ($) WACC 0 - 2, 500, 000 0. 144 2, 500, 001 - 3, 750, 000 0. 150 3, 750, 001 – 10, 000 0. 154 10, 001 – 15, 000 0. 169 15, 000, 001 – 25, 000 0. 190 25, 000, 001 and up 0. 206

Galaxy WACC Solution (pg. 157) Range ($) WACC 0 - 2, 500, 000 0. 144 2, 500, 001 - 3, 750, 000 0. 150 3, 750, 001 – 10, 000 0. 154 10, 001 – 15, 000 0. 169 15, 000, 001 – 25, 000 0. 190 25, 000, 001 and up 0. 206

Flotation costs • Flotation costs include all legal, accounting, printing, marketing, and other expenses associated with the new security issue • Internal funds are usually considered to be less expensive than external funds

Flotation costs • Flotation costs include all legal, accounting, printing, marketing, and other expenses associated with the new security issue • Internal funds are usually considered to be less expensive than external funds

Misusing the WACC • The required return or cost of capital for a project depends on the assets being financed, not on the identity of the company that undertakes the project • WACC can be used only to value assets the firm already owns or new assets of similar risk

Misusing the WACC • The required return or cost of capital for a project depends on the assets being financed, not on the identity of the company that undertakes the project • WACC can be used only to value assets the firm already owns or new assets of similar risk

The cost of capital for a Division • Divisional cost of capital may be valid in some cases in which the use of a companywide cost of capital would be inappropriate • Three Stage Process: – Identifying corporate proxies whose business closely parallels the division’s operations – The cost of capital must be estimated for each of the proxy firms – Averaging the resulting estimates of the individual asset betas

The cost of capital for a Division • Divisional cost of capital may be valid in some cases in which the use of a companywide cost of capital would be inappropriate • Three Stage Process: – Identifying corporate proxies whose business closely parallels the division’s operations – The cost of capital must be estimated for each of the proxy firms – Averaging the resulting estimates of the individual asset betas

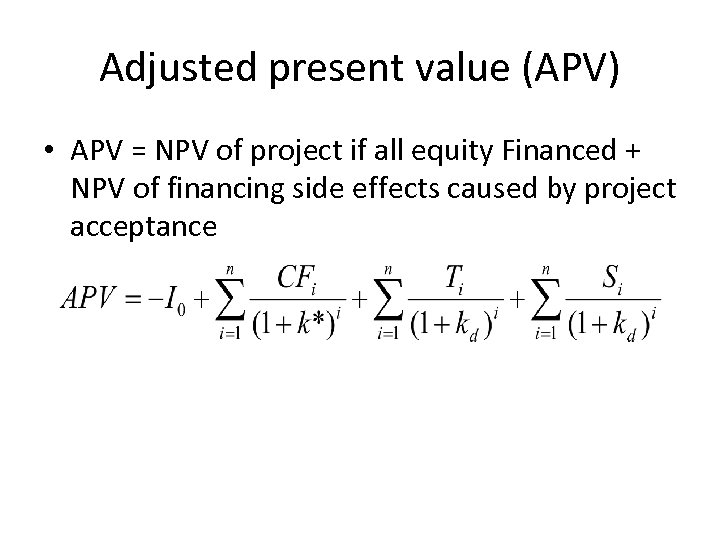

Adjusted present value (APV) • APV = NPV of project if all equity Financed + NPV of financing side effects caused by project acceptance

Adjusted present value (APV) • APV = NPV of project if all equity Financed + NPV of financing side effects caused by project acceptance

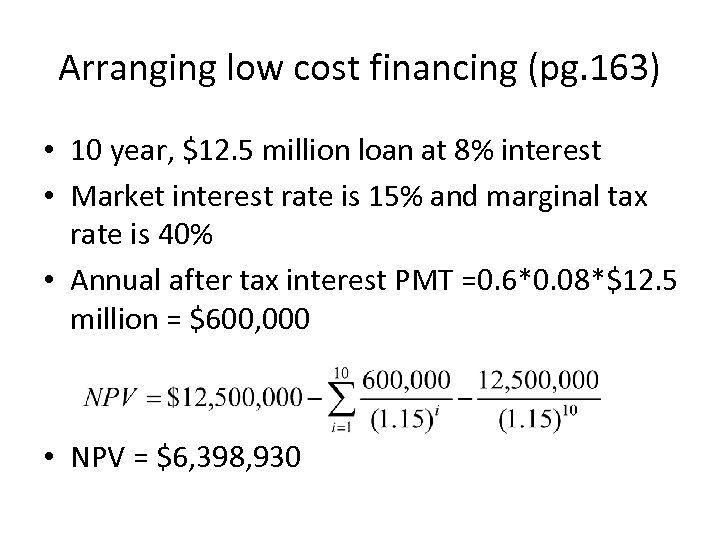

Arranging low cost financing (pg. 163) • 10 year, $12. 5 million loan at 8% interest • Market interest rate is 15% and marginal tax rate is 40% • Annual after tax interest PMT =0. 6*0. 08*$12. 5 million = $600, 000 • NPV = $6, 398, 930

Arranging low cost financing (pg. 163) • 10 year, $12. 5 million loan at 8% interest • Market interest rate is 15% and marginal tax rate is 40% • Annual after tax interest PMT =0. 6*0. 08*$12. 5 million = $600, 000 • NPV = $6, 398, 930

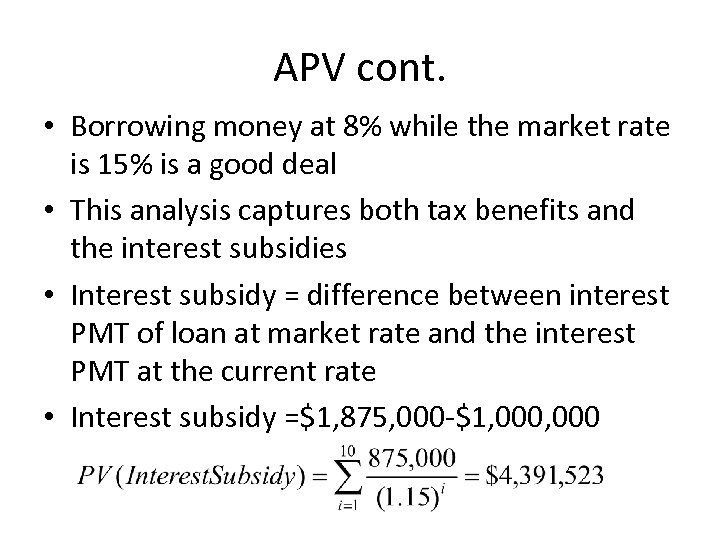

APV cont. • Borrowing money at 8% while the market rate is 15% is a good deal • This analysis captures both tax benefits and the interest subsidies • Interest subsidy = difference between interest PMT of loan at market rate and the interest PMT at the current rate • Interest subsidy =$1, 875, 000 -$1, 000

APV cont. • Borrowing money at 8% while the market rate is 15% is a good deal • This analysis captures both tax benefits and the interest subsidies • Interest subsidy = difference between interest PMT of loan at market rate and the interest PMT at the current rate • Interest subsidy =$1, 875, 000 -$1, 000

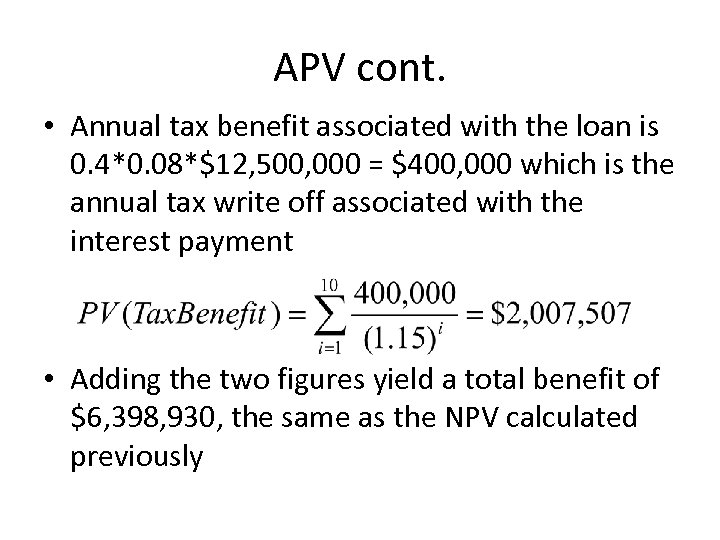

APV cont. • Annual tax benefit associated with the loan is 0. 4*0. 08*$12, 500, 000 = $400, 000 which is the annual tax write off associated with the interest payment • Adding the two figures yield a total benefit of $6, 398, 930, the same as the NPV calculated previously

APV cont. • Annual tax benefit associated with the loan is 0. 4*0. 08*$12, 500, 000 = $400, 000 which is the annual tax write off associated with the interest payment • Adding the two figures yield a total benefit of $6, 398, 930, the same as the NPV calculated previously

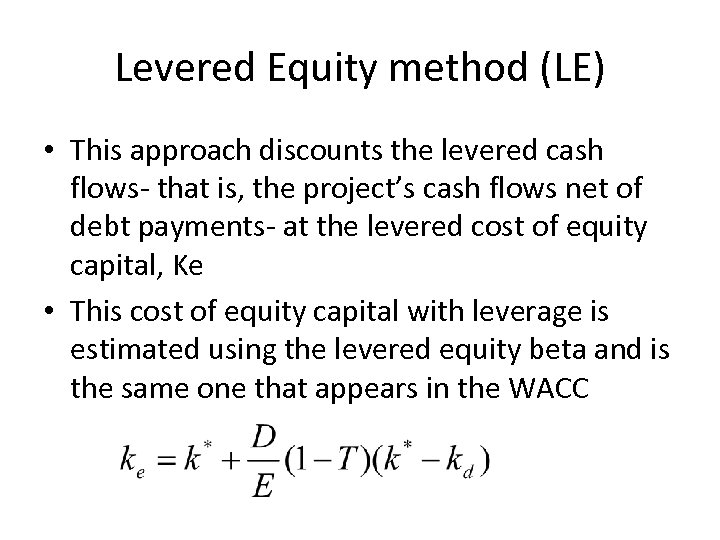

Levered Equity method (LE) • This approach discounts the levered cash flows- that is, the project’s cash flows net of debt payments- at the levered cost of equity capital, Ke • This cost of equity capital with leverage is estimated using the levered equity beta and is the same one that appears in the WACC

Levered Equity method (LE) • This approach discounts the levered cash flows- that is, the project’s cash flows net of debt payments- at the levered cost of equity capital, Ke • This cost of equity capital with leverage is estimated using the levered equity beta and is the same one that appears in the WACC

LE cont. • The CFs discounted with the LE method are the unlevered CFs used in the WACC and APV methods less the after-tax debt charges associated with the project’s financing

LE cont. • The CFs discounted with the LE method are the unlevered CFs used in the WACC and APV methods less the after-tax debt charges associated with the project’s financing

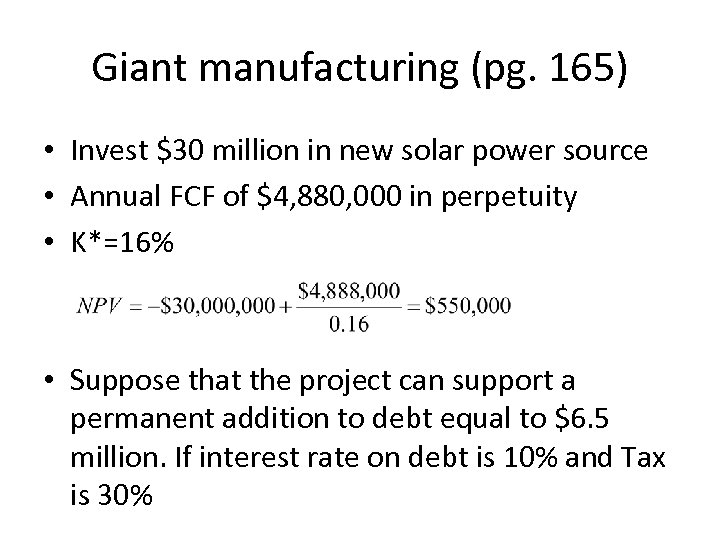

Giant manufacturing (pg. 165) • Invest $30 million in new solar power source • Annual FCF of $4, 880, 000 in perpetuity • K*=16% • Suppose that the project can support a permanent addition to debt equal to $6. 5 million. If interest rate on debt is 10% and Tax is 30%

Giant manufacturing (pg. 165) • Invest $30 million in new solar power source • Annual FCF of $4, 880, 000 in perpetuity • K*=16% • Suppose that the project can support a permanent addition to debt equal to $6. 5 million. If interest rate on debt is 10% and Tax is 30%

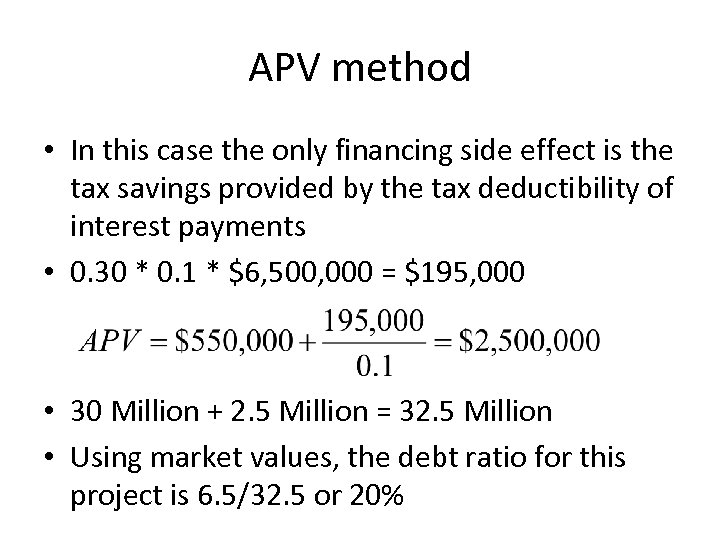

APV method • In this case the only financing side effect is the tax savings provided by the tax deductibility of interest payments • 0. 30 * 0. 1 * $6, 500, 000 = $195, 000 • 30 Million + 2. 5 Million = 32. 5 Million • Using market values, the debt ratio for this project is 6. 5/32. 5 or 20%

APV method • In this case the only financing side effect is the tax savings provided by the tax deductibility of interest payments • 0. 30 * 0. 1 * $6, 500, 000 = $195, 000 • 30 Million + 2. 5 Million = 32. 5 Million • Using market values, the debt ratio for this project is 6. 5/32. 5 or 20%

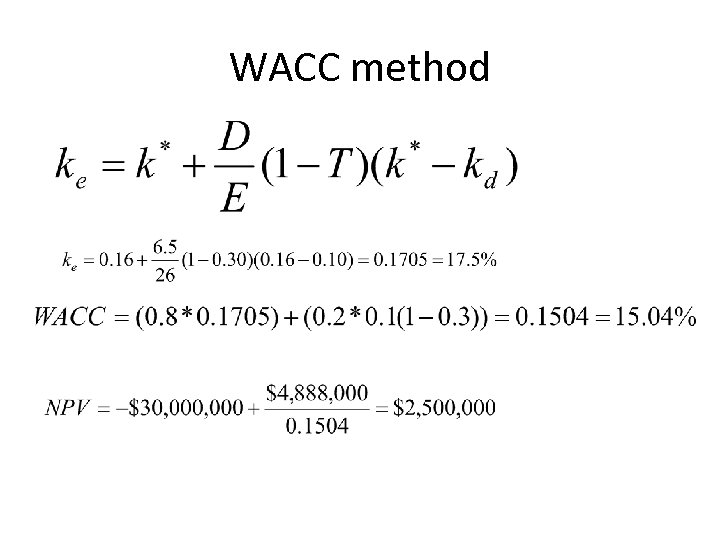

WACC method

WACC method

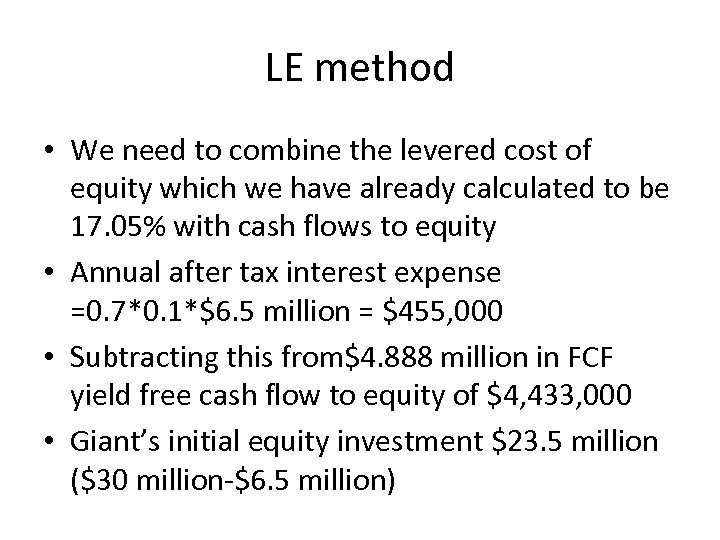

LE method • We need to combine the levered cost of equity which we have already calculated to be 17. 05% with cash flows to equity • Annual after tax interest expense =0. 7*0. 1*$6. 5 million = $455, 000 • Subtracting this from$4. 888 million in FCF yield free cash flow to equity of $4, 433, 000 • Giant’s initial equity investment $23. 5 million ($30 million-$6. 5 million)

LE method • We need to combine the levered cost of equity which we have already calculated to be 17. 05% with cash flows to equity • Annual after tax interest expense =0. 7*0. 1*$6. 5 million = $455, 000 • Subtracting this from$4. 888 million in FCF yield free cash flow to equity of $4, 433, 000 • Giant’s initial equity investment $23. 5 million ($30 million-$6. 5 million)

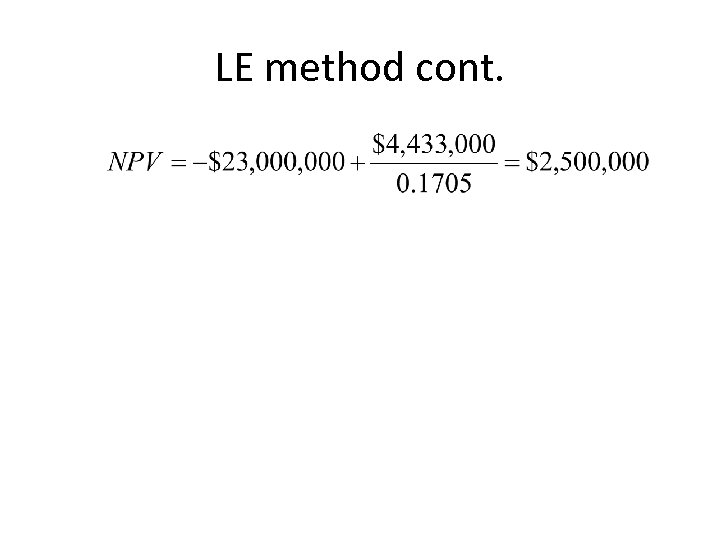

LE method cont.

LE method cont.