CH 4. Merger Strategy M&A: Faster growth and synergy

CH 4. Merger Strategy M&A: Faster growth and synergy

Growth However, when the demand for an industry’s products and services slows, it becomes more difficult to continue to grow.

Growth However, when the demand for an industry’s products and services slows, it becomes more difficult to continue to grow.

Is Growth or Increased Return the More Appropriate Goal? Hewlett-Packard in the post-Fiorina era. Having made a highly questionable $19 billion mega-acquisition of Compaq in 2002 (Compaq itself had acquired Tandem Computers in 1997 and Digital Equipment in 1998), Hewlett-Packard found itself managing several business segments in which it was a leader in only one—printers. When we consider the fact that much of its business comes from the highly competitive personal computer market with its weak margins coupled with steady product price deflation, such growth can be a challenge.

Is Growth or Increased Return the More Appropriate Goal? Hewlett-Packard in the post-Fiorina era. Having made a highly questionable $19 billion mega-acquisition of Compaq in 2002 (Compaq itself had acquired Tandem Computers in 1997 and Digital Equipment in 1998), Hewlett-Packard found itself managing several business segments in which it was a leader in only one—printers. When we consider the fact that much of its business comes from the highly competitive personal computer market with its weak margins coupled with steady product price deflation, such growth can be a challenge.

Currency-Related Effects In analyzing a large sample of 56, 978 cross border M&As covering the period 1990– 2007, Erel, Liao, and Wesibach confirmed the important role that exchange rates play in M&As. In their sample they found that countries whose currencies appreciated were more likely to have acquirers and countries whose currency decreciated were more likely to have targets. Lin, Officer, and Shen analyzed a sample of 12, 131 cross border M&As over the period 1996– 2012 and found that not only do acquirers from countries with appreciating currencies realize higher announcement period returns than those not affected by such currency changes, but also that this positive effect, which was present at the time of the announcement and also in the post-merger period, was greater the better the corporate governance of the acquirer.

Currency-Related Effects In analyzing a large sample of 56, 978 cross border M&As covering the period 1990– 2007, Erel, Liao, and Wesibach confirmed the important role that exchange rates play in M&As. In their sample they found that countries whose currencies appreciated were more likely to have acquirers and countries whose currency decreciated were more likely to have targets. Lin, Officer, and Shen analyzed a sample of 12, 131 cross border M&As over the period 1996– 2012 and found that not only do acquirers from countries with appreciating currencies realize higher announcement period returns than those not affected by such currency changes, but also that this positive effect, which was present at the time of the announcement and also in the post-merger period, was greater the better the corporate governance of the acquirer.

International diversification in the Automobile Industry Probably the most notable flop was Daimler’s 1998 takeover of Chrysler. General Motors pursued a number of international acquisitions as it sought to expand its presence throughout the world. Many of these were major losers. Perhaps the most embarrassing for GM was its investment in Fiat, which gave the troubled Italian automaker the right to require GM to pay $2 billion to Fiat if GM wanted to end their alliance. As Fiat’s financial problems mounted, GM was forced to pay $2 billion at a time when it was experiencing many other financial problems. Ford experienced its share of M&A woes. It acquired targets in Europe so as to expand its presence in that market while also providing the number-two U. S. auto maker with luxury brands, such as Jaguar. While Jaguar is a worldrenowned brand and, along with Land Rover, served as a key component in Ford’s Premier Auto Group, it failed to generate profits for Ford.

International diversification in the Automobile Industry Probably the most notable flop was Daimler’s 1998 takeover of Chrysler. General Motors pursued a number of international acquisitions as it sought to expand its presence throughout the world. Many of these were major losers. Perhaps the most embarrassing for GM was its investment in Fiat, which gave the troubled Italian automaker the right to require GM to pay $2 billion to Fiat if GM wanted to end their alliance. As Fiat’s financial problems mounted, GM was forced to pay $2 billion at a time when it was experiencing many other financial problems. Ford experienced its share of M&A woes. It acquired targets in Europe so as to expand its presence in that market while also providing the number-two U. S. auto maker with luxury brands, such as Jaguar. While Jaguar is a worldrenowned brand and, along with Land Rover, served as a key component in Ford’s Premier Auto Group, it failed to generate profits for Ford.

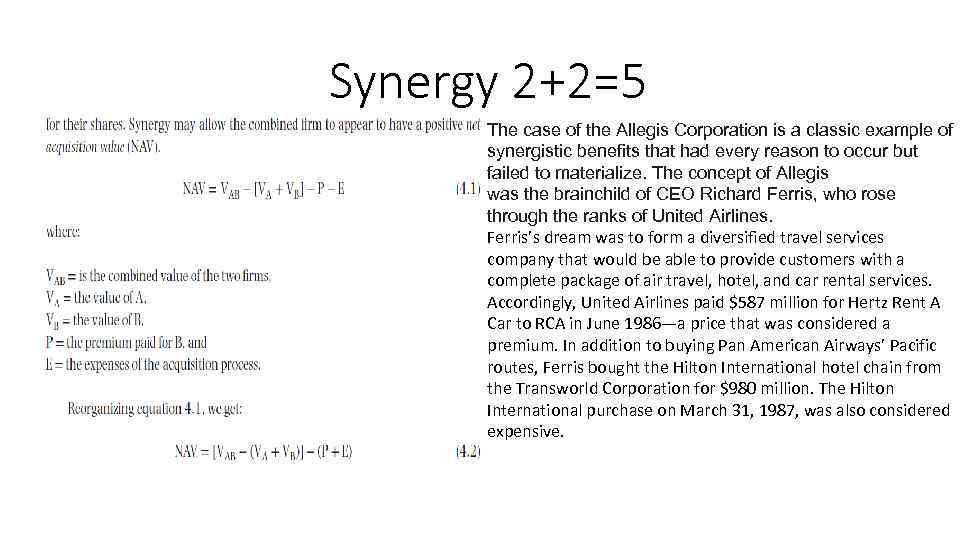

Synergy 2+2=5 The case of the Allegis Corporation is a classic example of synergistic benefits that had every reason to occur but failed to materialize. The concept of Allegis was the brainchild of CEO Richard Ferris, who rose through the ranks of United Airlines. Ferris’s dream was to form a diversified travel services company that would be able to provide customers with a complete package of air travel, hotel, and car rental services. Accordingly, United Airlines paid $587 million for Hertz Rent A Car to RCA in June 1986—a price that was considered a premium. In addition to buying Pan American Airways’ Pacific routes, Ferris bought the Hilton International hotel chain from the Transworld Corporation for $980 million. The Hilton International purchase on March 31, 1987, was also considered expensive.

Synergy 2+2=5 The case of the Allegis Corporation is a classic example of synergistic benefits that had every reason to occur but failed to materialize. The concept of Allegis was the brainchild of CEO Richard Ferris, who rose through the ranks of United Airlines. Ferris’s dream was to form a diversified travel services company that would be able to provide customers with a complete package of air travel, hotel, and car rental services. Accordingly, United Airlines paid $587 million for Hertz Rent A Car to RCA in June 1986—a price that was considered a premium. In addition to buying Pan American Airways’ Pacific routes, Ferris bought the Hilton International hotel chain from the Transworld Corporation for $980 million. The Hilton International purchase on March 31, 1987, was also considered expensive.

Operating Synergy Operating synergy can come from gains that enhance revenues or those that lower costs. Of the two, revenue enhancements can be the more difficult to achieve. Such gains are easier for deal proponents to talk about than to achieve. Revenue-enhancing synergies can come from various sources: 1. Pricing power 2. Combination of functional strengths 3. Growth from faster-growth markets or new markets Merger planners tend to look for cost-reducing synergies as the main source of operating synergies. These cost reductions may come as a result of economies of scale—decreases in per-unit costs that result from an increase in the size or scale of a company’s operations.

Operating Synergy Operating synergy can come from gains that enhance revenues or those that lower costs. Of the two, revenue enhancements can be the more difficult to achieve. Such gains are easier for deal proponents to talk about than to achieve. Revenue-enhancing synergies can come from various sources: 1. Pricing power 2. Combination of functional strengths 3. Growth from faster-growth markets or new markets Merger planners tend to look for cost-reducing synergies as the main source of operating synergies. These cost reductions may come as a result of economies of scale—decreases in per-unit costs that result from an increase in the size or scale of a company’s operations.

Financial Synergy Diversification One reason management may opt for diversified expansion is its desire to enter industries that are more profitable than the acquiring firm’s current industry. It could be that the parent company’s industry has reached the mature stage or that the competitive pressures within that industry preclude the possibility of raising prices to a level where extra normal profits can be enjoyed.

Financial Synergy Diversification One reason management may opt for diversified expansion is its desire to enter industries that are more profitable than the acquiring firm’s current industry. It could be that the parent company’s industry has reached the mature stage or that the competitive pressures within that industry preclude the possibility of raising prices to a level where extra normal profits can be enjoyed.

TYPES OF FOCUS INCREASES A study by Dasilas and Leventi analyzed the types of focus-increasing spin-offs that had the greatest positive shareholder wealth effects. 41 Their research compared spin-offs that increased industrial focus with those that increased geographical focus. Spin-offs that increased industrial focus generated positive shareholder wealth effects, while those that increased geographical focus did not. In addition, the positive market response to increases in industrial focus was greater for U. S. spinoffs than it was for European deals. FOCUS INCREASING ASSET SALES INCREASE FIRM VALUES EXPLANATION FOR THE DIVERSIFICATION DISCOUNT DO DIVERSIFIED OR FOCUSED FIRMS DO BETTER ACQUISITIONS? OTHER ECONOMIC MOTIVES Horizontal Integration Market Power Vertical Integration

TYPES OF FOCUS INCREASES A study by Dasilas and Leventi analyzed the types of focus-increasing spin-offs that had the greatest positive shareholder wealth effects. 41 Their research compared spin-offs that increased industrial focus with those that increased geographical focus. Spin-offs that increased industrial focus generated positive shareholder wealth effects, while those that increased geographical focus did not. In addition, the positive market response to increases in industrial focus was greater for U. S. spinoffs than it was for European deals. FOCUS INCREASING ASSET SALES INCREASE FIRM VALUES EXPLANATION FOR THE DIVERSIFICATION DISCOUNT DO DIVERSIFIED OR FOCUSED FIRMS DO BETTER ACQUISITIONS? OTHER ECONOMIC MOTIVES Horizontal Integration Market Power Vertical Integration