Chapter 4 Asset Analysis.pptx

- Количество слайдов: 14

CH 4. Asset Analysis Business Valuation

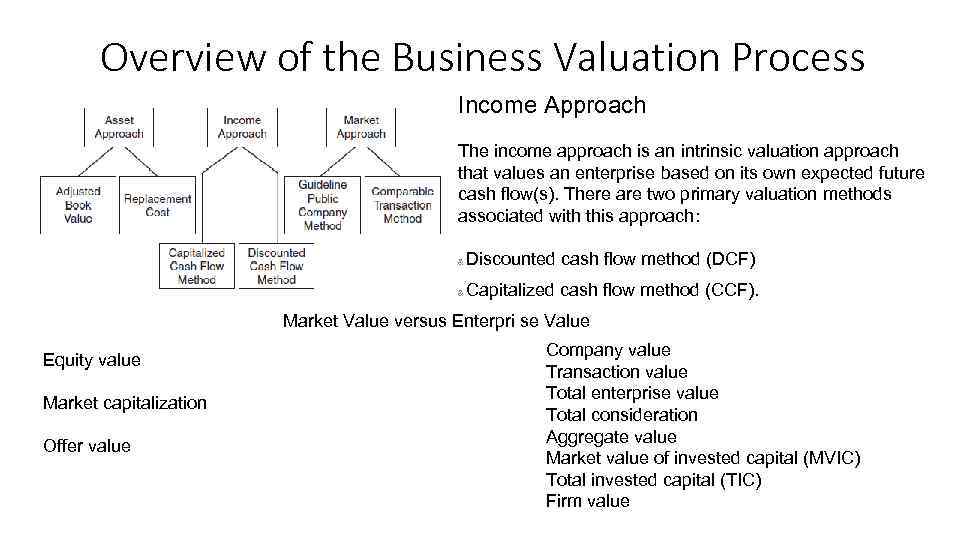

Overview of the Business Valuation Process Income Approach The income approach is an intrinsic valuation approach that values an enterprise based on its own expected future cash flow(s). There are two primary valuation methods associated with this approach: & Discounted cash flow method (DCF) & Capitalized cash flow method (CCF). Market Value versus Enterpri se Value Equity value Market capitalization Offer value Company value Transaction value Total enterprise value Total consideration Aggregate value Market value of invested capital (MVIC) Total invested capital (TIC) Firm value

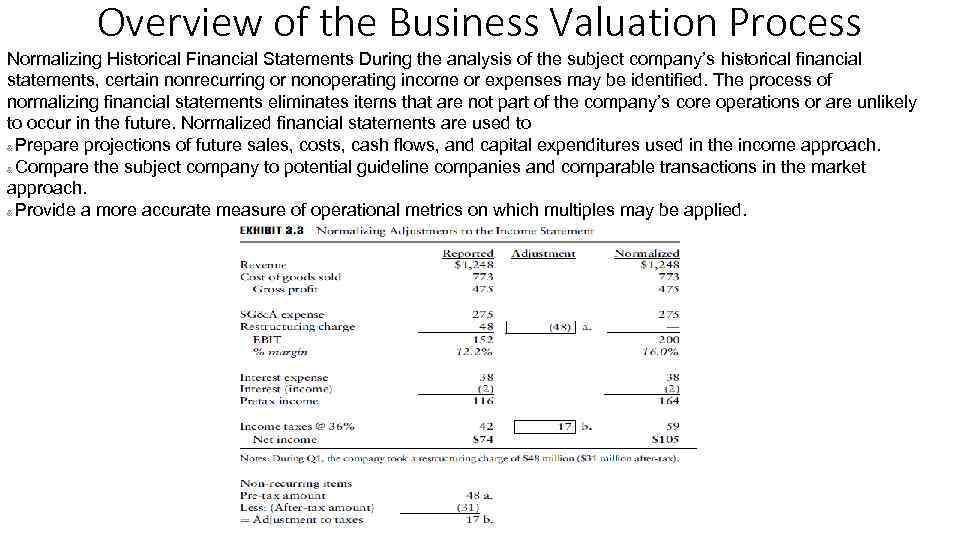

Overview of the Business Valuation Process Normalizing Historical Financial Statements During the analysis of the subject company’s historical financial statements, certain nonrecurring or nonoperating income or expenses may be identified. The process of normalizing financial statements eliminates items that are not part of the company’s core operations or are unlikely to occur in the future. Normalized financial statements are used to & Prepare projections of future sales, costs, cash flows, and capital expenditures used in the income approach. & Compare the subject company to potential guideline companies and comparable transactions in the market approach. & Provide a more accurate measure of operational metrics on which multiples may be applied.

Preparing Cash Flow Projections The process of projecting FCF requires thorough review of historical data, a comprehensive understanding of the relationship between significant financial-statement variables, in-depth discussions with management, and a clear-eyed assessment of the assumptions underlying the company’s projections. Bankruptcy, cash flow projections must be consistent with the contemplated postrestructuring plan taking into account any structural changes, such as the sale of a division, closure of a plant, rejection of leases or executory contracts, or termination of product lines. The assessment of the projections is often the most important aspect to a valuation. The more information that is known about the company, the industry, and the company’s position within the industry, the more realistic and supportable the assumptions made in the projections will be. Some of the key questions the valuation analyst should answer before developing or relying on projections are listed below: Industry & Have there been any recent changes in the industry? & Is the industry undergoing consolidation? & Is the industry high growth, slow growth, or mature in nature? & What is the overall market size of the industry? Company & What is the subject company’s position within the industry (niche player, volume or quality leader, etc. )? & What are management’s future expectations for the company (gaining/losing market share, etc. ) and are these expectations reasonable? & What issues is the subject company likely to face currently or in the future?

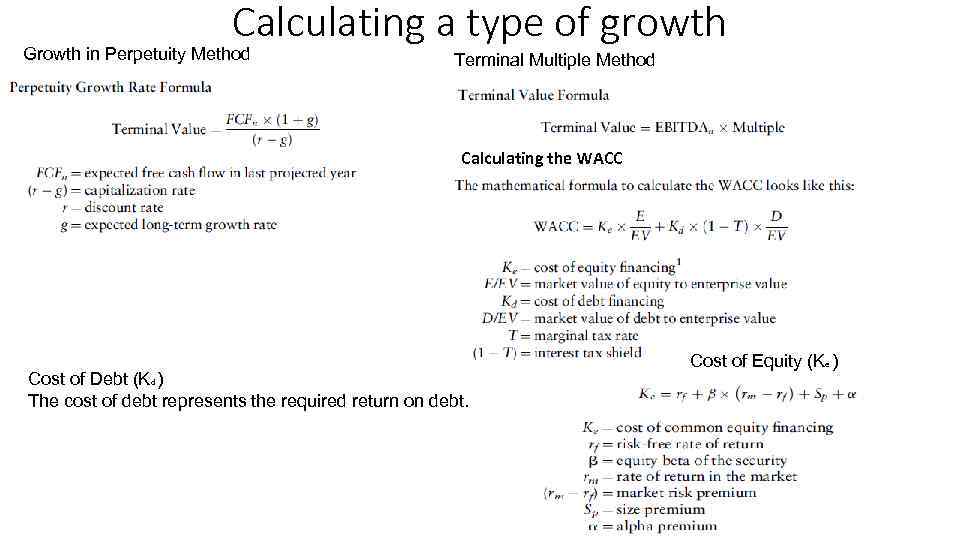

Calculating a type of growth Growth in Perpetuity Method Terminal Multiple Method Calculating the WACC Cost of Debt (Kd ) The cost of debt represents the required return on debt. Cost of Equity (Ke )

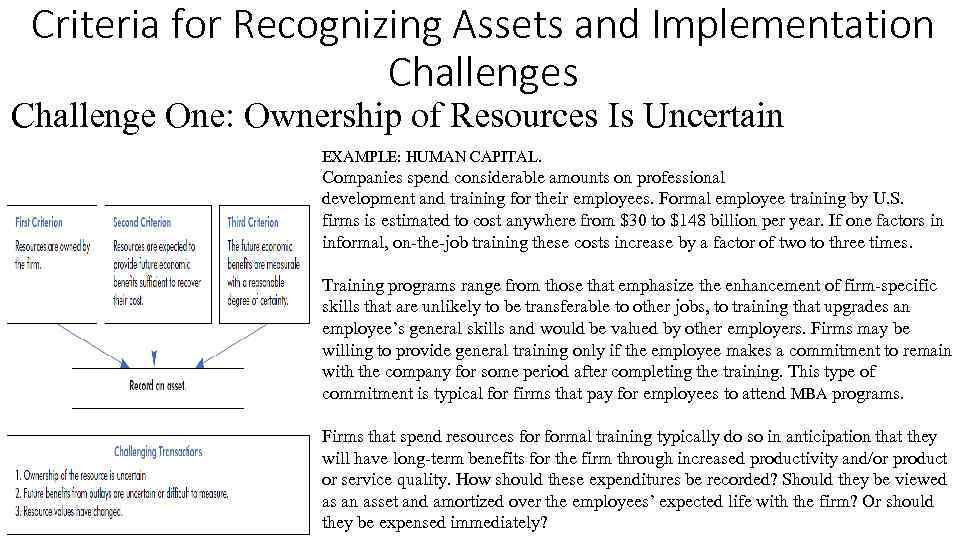

Criteria for Recognizing Assets and Implementation Challenges Challenge One: Ownership of Resources Is Uncertain EXAMPLE: HUMAN CAPITAL. Companies spend considerable amounts on professional development and training for their employees. Formal employee training by U. S. firms is estimated to cost anywhere from $30 to $148 billion per year. If one factors in informal, on-the-job training these costs increase by a factor of two to three times. Training programs range from those that emphasize the enhancement of firm-specific skills that are unlikely to be transferable to other jobs, to training that upgrades an employee’s general skills and would be valued by other employers. Firms may be willing to provide general training only if the employee makes a commitment to remain with the company for some period after completing the training. This type of commitment is typical for firms that pay for employees to attend MBA programs. Firms that spend resources formal training typically do so in anticipation that they will have long-term benefits for the firm through increased productivity and/or product or service quality. How should these expenditures be recorded? Should they be viewed as an asset and amortized over the employees’ expected life with the firm? Or should they be expensed immediately?

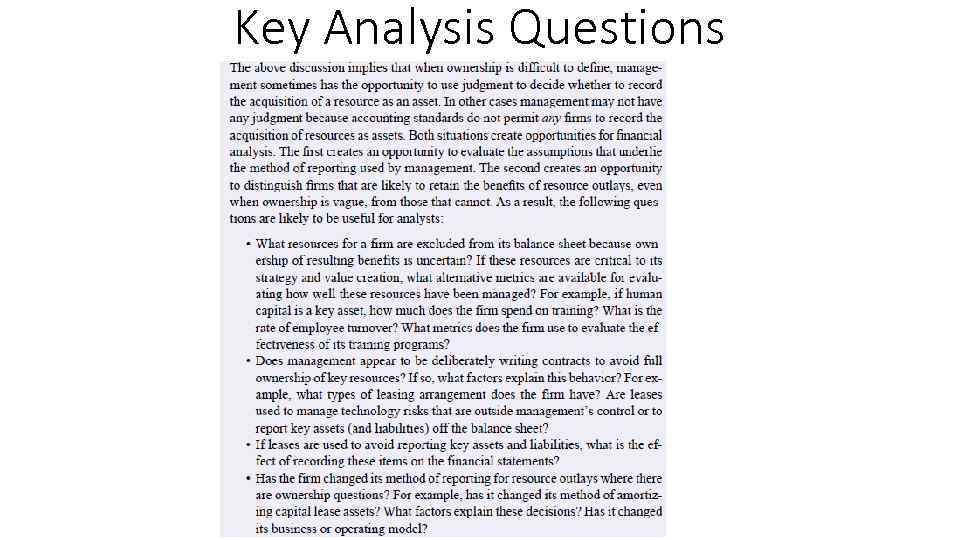

Key Analysis Questions

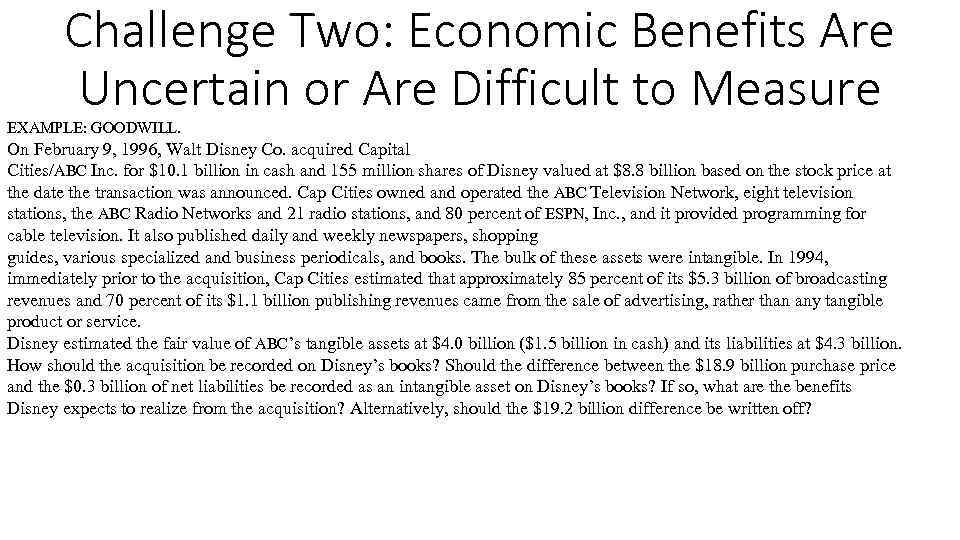

Challenge Two: Economic Benefits Are Uncertain or Are Difficult to Measure EXAMPLE: GOODWILL. On February 9, 1996, Walt Disney Co. acquired Capital Cities/ABC Inc. for $10. 1 billion in cash and 155 million shares of Disney valued at $8. 8 billion based on the stock price at the date the transaction was announced. Cap Cities owned and operated the ABC Television Network, eight television stations, the ABC Radio Networks and 21 radio stations, and 80 percent of ESPN, Inc. , and it provided programming for cable television. It also published daily and weekly newspapers, shopping guides, various specialized and business periodicals, and books. The bulk of these assets were intangible. In 1994, immediately prior to the acquisition, Cap Cities estimated that approximately 85 percent of its $5. 3 billion of broadcasting revenues and 70 percent of its $1. 1 billion publishing revenues came from the sale of advertising, rather than any tangible product or service. Disney estimated the fair value of ABC’s tangible assets at $4. 0 billion ($1. 5 billion in cash) and its liabilities at $4. 3 billion. How should the acquisition be recorded on Disney’s books? Should the difference between the $18. 9 billion purchase price and the $0. 3 billion of net liabilities be recorded as an intangible asset on Disney’s books? If so, what are the benefits Disney expects to realize from the acquisition? Alternatively, should the $19. 2 billion difference be written off?

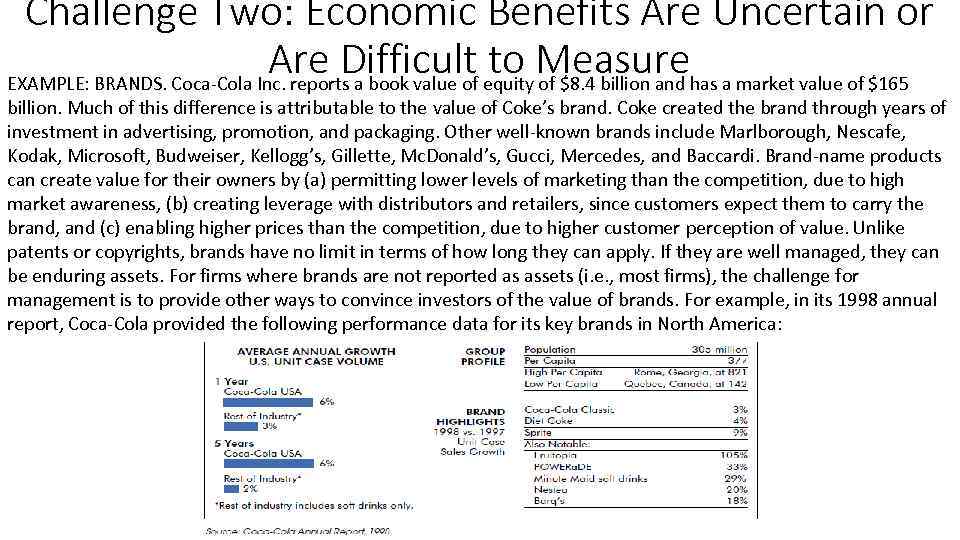

Challenge Two: Economic Benefits Are Uncertain or Are Difficult equity. Measurehas a market value of $165 to of $8. 4 billion and EXAMPLE: BRANDS. Coca-Cola Inc. reports a book value of billion. Much of this difference is attributable to the value of Coke’s brand. Coke created the brand through years of investment in advertising, promotion, and packaging. Other well-known brands include Marlborough, Nescafe, Kodak, Microsoft, Budweiser, Kellogg’s, Gillette, Mc. Donald’s, Gucci, Mercedes, and Baccardi. Brand-name products can create value for their owners by (a) permitting lower levels of marketing than the competition, due to high market awareness, (b) creating leverage with distributors and retailers, since customers expect them to carry the brand, and (c) enabling higher prices than the competition, due to higher customer perception of value. Unlike patents or copyrights, brands have no limit in terms of how long they can apply. If they are well managed, they can be enduring assets. For firms where brands are not reported as assets (i. e. , most firms), the challenge for management is to provide other ways to convince investors of the value of brands. For example, in its 1998 annual report, Coca-Cola provided the following performance data for its key brands in North America:

Key Analysis Questions

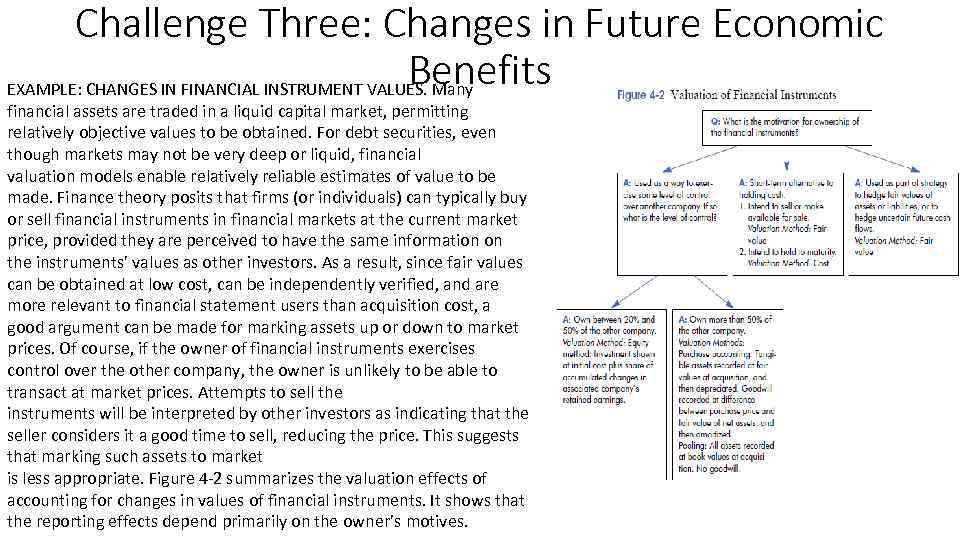

Challenge Three: Changes in Future Economic Benefits EXAMPLE: CHANGES IN FINANCIAL INSTRUMENT VALUES. Many financial assets are traded in a liquid capital market, permitting relatively objective values to be obtained. For debt securities, even though markets may not be very deep or liquid, financial valuation models enable relatively reliable estimates of value to be made. Finance theory posits that firms (or individuals) can typically buy or sell financial instruments in financial markets at the current market price, provided they are perceived to have the same information on the instruments’ values as other investors. As a result, since fair values can be obtained at low cost, can be independently verified, and are more relevant to financial statement users than acquisition cost, a good argument can be made for marking assets up or down to market prices. Of course, if the owner of financial instruments exercises control over the other company, the owner is unlikely to be able to transact at market prices. Attempts to sell the instruments will be interpreted by other investors as indicating that the seller considers it a good time to sell, reducing the price. This suggests that marking such assets to market is less appropriate. Figure 4 -2 summarizes the valuation effects of accounting for changes in values of financial instruments. It shows that the reporting effects depend primarily on the owner’s motives.

Key Analysis Questions

Common Misconceptions About Asset Accounting 1. If a firm paid for a resource, it must be an asset. 2. If you can’t kick a resource, it really isn’t an asset. 3. If you bought a resource, it must be an asset; if you developed it, it must not be. 4. Market values are only relevant if you intend to sell an asset.

Summary and Boston Chicken Case The recording of assets is primarily determined by the principles of historical cost and conservatism. Under the historical cost principle, resources owned by a firm that are likely to produce reasonably certain future benefits are valued at their cost. However, if an asset’s cost exceeds its fair value, the conservatism principle requires that the resource be written down to fair value. The U. S. has been a strong advocate of the historical cost/conservatism approach to valuing assets. However, even in the U. S. , adherence to these rules has diminished during the last twenty years as firms have been permitted to revalue marketable securities to fair values. Outside the U. S. , some countries permit firms to revalue other types of assets, including intangibles. The implementation of the principles of historical cost and conservatism can be challenging if: 1. There is uncertainty about the ownership of those resources, as is the case for lease transactions and training outlays. 2. Future benefits associated with resources are highly uncertain and/or difficult to measure, such as for goodwill, R&D, brands, and deferred tax assets. 3. Resource values have changed, as in the case of impaired operating assets, changes in fair values of financial instruments, and changes in exchange rates for valuing foreign subsidiaries. Corporate managers are likely to have the best information on the ownership risks and uncertainty about future benefits associated with their firms’ resources. As a result, they are assigned the primary responsibility for deciding which outlays qualify as assets and which do not, and for assessing whether assets have been impaired. Of course, given managers’ incentives to report favorably on their stewardship of owners’ investments and accounting requirements that preclude recording some key economic assets (e. g. , R&D, brands, human capital), there is ample opportunity for analysts to independently assess how a firm’s resources are being managed.

Chapter 4 Asset Analysis.pptx