2882996d5af03069113b021f45881eec.ppt

- Количество слайдов: 68

Ch. 13: Exchange Rates and the Foreign Exchange Market: An Asset Approach 1

Ch. 13: Exchange Rates and the Foreign Exchange Market: An Asset Approach 1

Exchange Rates Exchange rate is the price of one currency in terms of another. l On October 18, 2002 at 15: 48: 14 GMT, 1 USD was worth € 1. 0301 or 1€ was worth $0. 9709. l On Jan. 1, 1999, 1€=$1. 1497; on March 5, 2001, 1€=$0. 9358. l You can check the exchange rates at l http: //www. economist. com/markets/currency/ 2

Exchange Rates Exchange rate is the price of one currency in terms of another. l On October 18, 2002 at 15: 48: 14 GMT, 1 USD was worth € 1. 0301 or 1€ was worth $0. 9709. l On Jan. 1, 1999, 1€=$1. 1497; on March 5, 2001, 1€=$0. 9358. l You can check the exchange rates at l http: //www. economist. com/markets/currency/ 2

Exchange Rates Changes in the exchange rates affect the prices of imports, exports, foreign assets purchased by locals and local assets purchased by foreigners. l When the domestic currency becomes more valuable (appreciates, becomes stronger), foreign commodities and assets become cheaper. l 3

Exchange Rates Changes in the exchange rates affect the prices of imports, exports, foreign assets purchased by locals and local assets purchased by foreigners. l When the domestic currency becomes more valuable (appreciates, becomes stronger), foreign commodities and assets become cheaper. l 3

Exchange Rates If € 1=$1. 1497 on 01/01/99 and € 1=$0. 9358 on 03/05/01, then euro depreciated and USD appreciated in this period. l European goods and assets would be cheaper at the recent date. l American goods and assets would be more expensive at the recent date. l In this example exchange rates are given per euro. l 4

Exchange Rates If € 1=$1. 1497 on 01/01/99 and € 1=$0. 9358 on 03/05/01, then euro depreciated and USD appreciated in this period. l European goods and assets would be cheaper at the recent date. l American goods and assets would be more expensive at the recent date. l In this example exchange rates are given per euro. l 4

Price Comparisons Suppose on 1/01/99 and 3/5/01 the price of a Ferrari remained € 100, 000. l Likewise, the price of a server at those dates was $50, 000. l A Ferrari would have cost Americans $114, 970 on 1/01/99 and $93, 580 on 3/5/01. l A server would have cost Europeans [($50, 000)(€ 1/$1. 1497)]=€ 43, 489. 61 on 1/01/99 and on 3/5/01 [($50, 000)(€ 1/$0. 9358)]=€ 53, 430. 22. l 5

Price Comparisons Suppose on 1/01/99 and 3/5/01 the price of a Ferrari remained € 100, 000. l Likewise, the price of a server at those dates was $50, 000. l A Ferrari would have cost Americans $114, 970 on 1/01/99 and $93, 580 on 3/5/01. l A server would have cost Europeans [($50, 000)(€ 1/$1. 1497)]=€ 43, 489. 61 on 1/01/99 and on 3/5/01 [($50, 000)(€ 1/$0. 9358)]=€ 53, 430. 22. l 5

Price Comparisons l l l If the currency appreciates (as in the previous example for USD) imports become cheaper and exports more expensive. US can get more European goods for the same amount of exports: terms of trade improvement. If the currency depreciates (€ in the example), Europe has to give up more exports for the same amount of imports: terms of trade deterioration. 6

Price Comparisons l l l If the currency appreciates (as in the previous example for USD) imports become cheaper and exports more expensive. US can get more European goods for the same amount of exports: terms of trade improvement. If the currency depreciates (€ in the example), Europe has to give up more exports for the same amount of imports: terms of trade deterioration. 6

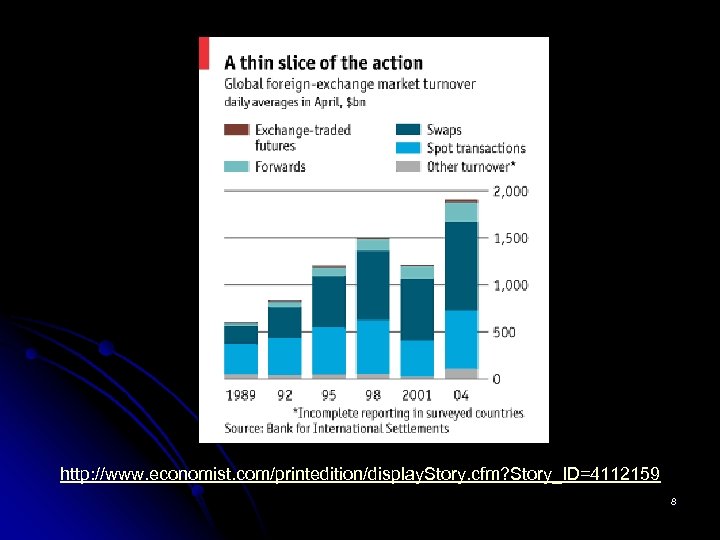

The Foreign Exchange Market Forex market is where international currencies are traded. l Major participants are commercial banks, corporations, nonbank financial institutions and central banks. l The DAILY global trading in the FX market is about $4 trillion. l http: //online. wsj. com/article/SB 10001424052748703380104576015824083855578. html? mod=igoogle_wsj_gadgv 1& 7

The Foreign Exchange Market Forex market is where international currencies are traded. l Major participants are commercial banks, corporations, nonbank financial institutions and central banks. l The DAILY global trading in the FX market is about $4 trillion. l http: //online. wsj. com/article/SB 10001424052748703380104576015824083855578. html? mod=igoogle_wsj_gadgv 1& 7

http: //www. economist. com/printedition/display. Story. cfm? Story_ID=4112159 8

http: //www. economist. com/printedition/display. Story. cfm? Story_ID=4112159 8

Commercial Banks For every import and export transaction banks have to be involved for payments. l An importer has to instruct her bank to pay the exporter in exporter’s currency. l The bank has to exchange the domestic currency foreign currency and transfer the funds to the exporter’s bank. l Because they are involved with FX market, banks also buy and sell for their own accounts to reduce risk. l 9

Commercial Banks For every import and export transaction banks have to be involved for payments. l An importer has to instruct her bank to pay the exporter in exporter’s currency. l The bank has to exchange the domestic currency foreign currency and transfer the funds to the exporter’s bank. l Because they are involved with FX market, banks also buy and sell for their own accounts to reduce risk. l 9

Corporations l Both for importing purposes and for expenses in another country, corporations might need to have foreign currency holdings. 10

Corporations l Both for importing purposes and for expenses in another country, corporations might need to have foreign currency holdings. 10

Nonbank Financial Institutions More and more nonbank financial institutions have been undertaking banking functions. l More and more mutual funds, insurance companies have been involved in foreign businesses. l 11

Nonbank Financial Institutions More and more nonbank financial institutions have been undertaking banking functions. l More and more mutual funds, insurance companies have been involved in foreign businesses. l 11

Central Banks l Central banks keep international reserves to intervene in the FX market to keep the exchange rate at a target level. 12

Central Banks l Central banks keep international reserves to intervene in the FX market to keep the exchange rate at a target level. 12

The Location of FX Market FX is traded 24/7 around the world. l Sunday is a work day in Israel. l Buying and selling is done with computers, phone lines. l In short, FX market is truly global single market. l There should not be any price differentials from one place to another. l 13

The Location of FX Market FX is traded 24/7 around the world. l Sunday is a work day in Israel. l Buying and selling is done with computers, phone lines. l In short, FX market is truly global single market. l There should not be any price differentials from one place to another. l 13

Arbitrage Suppose $1=¥ 100 in New York but $1=¥ 101 in London. l You work at the FX desk of Citibank. l How would you make money for Citibank? l 14

Arbitrage Suppose $1=¥ 100 in New York but $1=¥ 101 in London. l You work at the FX desk of Citibank. l How would you make money for Citibank? l 14

Arbitrage You buy USD in New York (sell ¥) and sell USD in London (buy ¥). l You borrow yen in New York, buy USD, exchange USD to yen in London and pay your yen debt. l ¥ 100 million in New York will become ¥ 101 million in London. l http: //www. marketwatch. com/tools/stockresearch/globalmarkets/default. asp? siteid=mktw&dist=10 moverview& 15

Arbitrage You buy USD in New York (sell ¥) and sell USD in London (buy ¥). l You borrow yen in New York, buy USD, exchange USD to yen in London and pay your yen debt. l ¥ 100 million in New York will become ¥ 101 million in London. l http: //www. marketwatch. com/tools/stockresearch/globalmarkets/default. asp? siteid=mktw&dist=10 moverview& 15

Equilibrium FX Buying USD in New York will raise the price of $: $1 will be worth more than ¥ 100 or ¥ 100 will be worth less than $1. l Selling USD in London will lower the price of $: $1 will be less than ¥ 101 or ¥ 101 will be more than $1. l Prices in New York and London will be $1=¥ 100. 5. l 16

Equilibrium FX Buying USD in New York will raise the price of $: $1 will be worth more than ¥ 100 or ¥ 100 will be worth less than $1. l Selling USD in London will lower the price of $: $1 will be less than ¥ 101 or ¥ 101 will be more than $1. l Prices in New York and London will be $1=¥ 100. 5. l 16

Vehicle Currency If there are hardly any trade and asset purchases between two countries, they might not have inventories of each other’s currencies. l Typically, USD is the international reserve currency that is used to exchange from one currency to another. l USD acting as a vehicle currency allows to calculate cross rates. l 17

Vehicle Currency If there are hardly any trade and asset purchases between two countries, they might not have inventories of each other’s currencies. l Typically, USD is the international reserve currency that is used to exchange from one currency to another. l USD acting as a vehicle currency allows to calculate cross rates. l 17

Cross Rates Suppose $1=¥ 100 and $1=SF 0. 75. l What is the cross rate between Yen and Swiss Franc? l ¥ 1=$0. 01(SF 0. 75/$) =SF 0. 0075 l SF 1=$1. 33(¥ 100/$)=¥ 133 l 18

Cross Rates Suppose $1=¥ 100 and $1=SF 0. 75. l What is the cross rate between Yen and Swiss Franc? l ¥ 1=$0. 01(SF 0. 75/$) =SF 0. 0075 l SF 1=$1. 33(¥ 100/$)=¥ 133 l 18

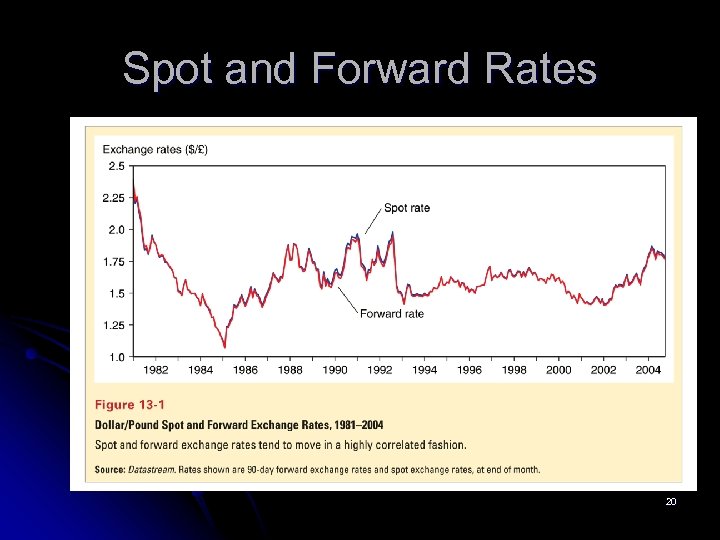

Spot and Forward Rates FX transaction that takes effect immediately (even if the funds cannot be cleared before two days) is a spot transaction. l FX transaction that will take effect in the future (say one month or three months) is a forward transaction. l The difference between the spot and forward rates shows the interest rate differential between two currencies. l 19

Spot and Forward Rates FX transaction that takes effect immediately (even if the funds cannot be cleared before two days) is a spot transaction. l FX transaction that will take effect in the future (say one month or three months) is a forward transaction. l The difference between the spot and forward rates shows the interest rate differential between two currencies. l 19

Spot and Forward Rates 20

Spot and Forward Rates 20

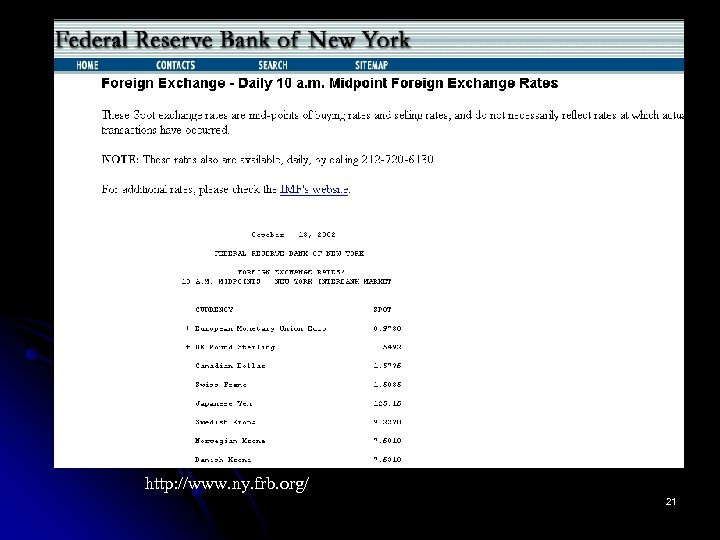

http: //www. ny. frb. org/ 21

http: //www. ny. frb. org/ 21

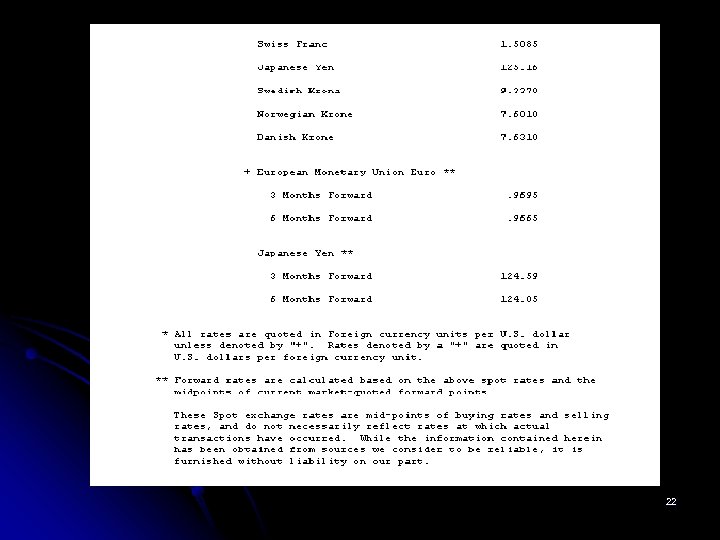

22

22

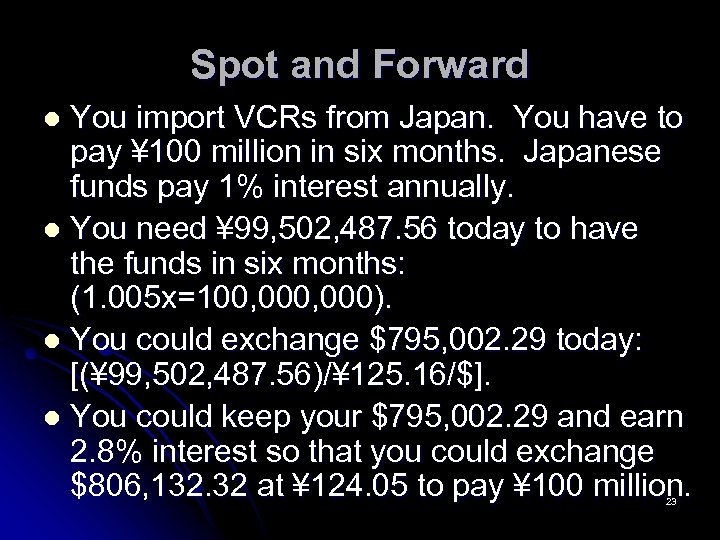

Spot and Forward You import VCRs from Japan. You have to pay ¥ 100 million in six months. Japanese funds pay 1% interest annually. l You need ¥ 99, 502, 487. 56 today to have the funds in six months: (1. 005 x=100, 000). l You could exchange $795, 002. 29 today: [(¥ 99, 502, 487. 56)/¥ 125. 16/$]. l You could keep your $795, 002. 29 and earn 2. 8% interest so that you could exchange $806, 132. 32 at ¥ 124. 05 to pay ¥ 100 million. l 23

Spot and Forward You import VCRs from Japan. You have to pay ¥ 100 million in six months. Japanese funds pay 1% interest annually. l You need ¥ 99, 502, 487. 56 today to have the funds in six months: (1. 005 x=100, 000). l You could exchange $795, 002. 29 today: [(¥ 99, 502, 487. 56)/¥ 125. 16/$]. l You could keep your $795, 002. 29 and earn 2. 8% interest so that you could exchange $806, 132. 32 at ¥ 124. 05 to pay ¥ 100 million. l 23

Spot and Forward l l If it doesn’t make any difference, i. e. , it costs you the same amount today, why bother? Because in six months ¥/$ rate may be different. If ¥/$ rate in six months turns out to be ¥ 120, you could only get ¥ 96, 735, 878. 40. ($806, 132. 32)(¥ 120). By entering a forward contract with your bank you know exactly how much you are paying and can price your VCRs accordingly. 24

Spot and Forward l l If it doesn’t make any difference, i. e. , it costs you the same amount today, why bother? Because in six months ¥/$ rate may be different. If ¥/$ rate in six months turns out to be ¥ 120, you could only get ¥ 96, 735, 878. 40. ($806, 132. 32)(¥ 120). By entering a forward contract with your bank you know exactly how much you are paying and can price your VCRs accordingly. 24

Other Instruments To Reduce Risk FX Swaps: You buy a foreign currency with the understanding that you will sell it in a specified time. l Futures: You buy a futures contract that will deliver a certain amount of foreign currency at a specified price at a specified date. You can sell this contract within the period; you can’t sell forward contract. l Options: You buy a put option to have the right to sell; you buy a call option to have the right to buy. l 25

Other Instruments To Reduce Risk FX Swaps: You buy a foreign currency with the understanding that you will sell it in a specified time. l Futures: You buy a futures contract that will deliver a certain amount of foreign currency at a specified price at a specified date. You can sell this contract within the period; you can’t sell forward contract. l Options: You buy a put option to have the right to sell; you buy a call option to have the right to buy. l 25

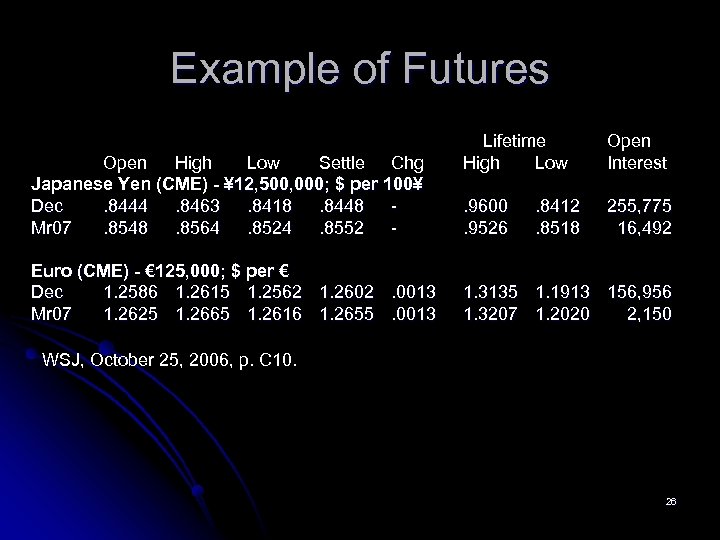

Example of Futures Open High Low Settle Chg Japanese Yen (CME) - ¥ 12, 500, 000; $ per 100¥ Dec. 8444. 8463. 8418. 8448 Mr 07. 8548. 8564. 8524. 8552 Euro (CME) - € 125, 000; $ per € Dec 1. 2586 1. 2615 1. 2562 1. 2602. 0013 Mr 07 1. 2625 1. 2665 1. 2616 1. 2655. 0013 Lifetime High Low Open Interest . 9600. 9526 255, 775 16, 492 . 8412. 8518 1. 3135 1. 1913 156, 956 1. 3207 1. 2020 2, 150 WSJ, October 25, 2006, p. C 10. 26

Example of Futures Open High Low Settle Chg Japanese Yen (CME) - ¥ 12, 500, 000; $ per 100¥ Dec. 8444. 8463. 8418. 8448 Mr 07. 8548. 8564. 8524. 8552 Euro (CME) - € 125, 000; $ per € Dec 1. 2586 1. 2615 1. 2562 1. 2602. 0013 Mr 07 1. 2625 1. 2665 1. 2616 1. 2655. 0013 Lifetime High Low Open Interest . 9600. 9526 255, 775 16, 492 . 8412. 8518 1. 3135 1. 1913 156, 956 1. 3207 1. 2020 2, 150 WSJ, October 25, 2006, p. C 10. 26

FX: Commodity or Asset Not long ago, the demand supply of foreign currency were determined through import and export demands. l Thirty years ago current account determined the demand supply of foreign currency. l 27

FX: Commodity or Asset Not long ago, the demand supply of foreign currency were determined through import and export demands. l Thirty years ago current account determined the demand supply of foreign currency. l 27

FX: Commodity or Asset l In 1980 US (not global) foreign currency trading was around $18 billion per day. In Oct. 2008 this amount was $762 billion per day. http: //www. newyorkfed. org/fxc/volumesurvey/2008/octoberfxsur vey 2008. pdf l It is not imports/exports but the function of FX as an asset that matters. 28

FX: Commodity or Asset l In 1980 US (not global) foreign currency trading was around $18 billion per day. In Oct. 2008 this amount was $762 billion per day. http: //www. newyorkfed. org/fxc/volumesurvey/2008/octoberfxsur vey 2008. pdf l It is not imports/exports but the function of FX as an asset that matters. 28

The Demand for an Asset Foreign currency bank deposits are assets. l As with any asset, the future value is paramount in determining price. l Assets (wealth) allow to postpone purchasing power into the future. l 29

The Demand for an Asset Foreign currency bank deposits are assets. l As with any asset, the future value is paramount in determining price. l Assets (wealth) allow to postpone purchasing power into the future. l 29

The Demand for an Asset l The demand for an asset depends on the generated income (interest rate), capital gain (expected price), riskiness, liquidity. 30

The Demand for an Asset l The demand for an asset depends on the generated income (interest rate), capital gain (expected price), riskiness, liquidity. 30

Rate of Return A $1000 bond that pays $50 provides an interest rate of 5%. l If you sell the bond for $1100, your rate of return is 15%. l If you sell the bond for $900, your rate of return is -5%. l If inflation were 5%, your real rate of return would have been 10% and -10%, respectively. l 31

Rate of Return A $1000 bond that pays $50 provides an interest rate of 5%. l If you sell the bond for $1100, your rate of return is 15%. l If you sell the bond for $900, your rate of return is -5%. l If inflation were 5%, your real rate of return would have been 10% and -10%, respectively. l 31

Risk is a measure of uncertainty of future returns. The higher the variations in returns, the higher is the risk. l The higher the risk, the less desirable is the asset. l 32

Risk is a measure of uncertainty of future returns. The higher the variations in returns, the higher is the risk. l The higher the risk, the less desirable is the asset. l 32

Liquidity is a measure of cost and speed to convert an asset into cash. The cheaper and speedier an asset can be converted to cash, the more liquid it is. l The more liquid an asset, the more desirable it is. l 33

Liquidity is a measure of cost and speed to convert an asset into cash. The cheaper and speedier an asset can be converted to cash, the more liquid it is. l The more liquid an asset, the more desirable it is. l 33

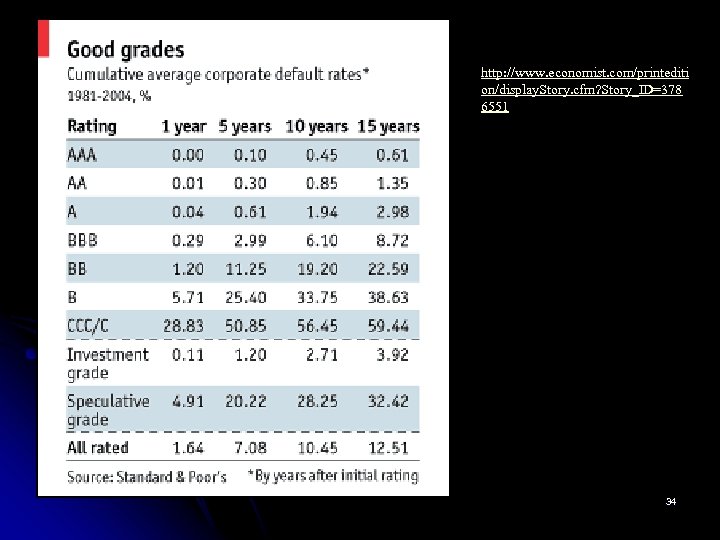

http: //www. economist. com/printediti on/display. Story. cfm? Story_ID=378 6551 34

http: //www. economist. com/printediti on/display. Story. cfm? Story_ID=378 6551 34

Comparison of Returns Suppose the $/€ exchange rate is $0. 93 per €. l What is the €/$ rate? l It is the reciprocal, or 1/0. 93 = € 1. 075 35

Comparison of Returns Suppose the $/€ exchange rate is $0. 93 per €. l What is the €/$ rate? l It is the reciprocal, or 1/0. 93 = € 1. 075 35

Comparison of Returns Suppose $ deposits pay 5% interest rate. l Suppose € deposits pay 8% interest rate. l Which asset ($ or €) would you rather hold? l € of course. 36

Comparison of Returns Suppose $ deposits pay 5% interest rate. l Suppose € deposits pay 8% interest rate. l Which asset ($ or €) would you rather hold? l € of course. 36

Comparison of Returns Suppose you will need your $ a year from now. Today the exchange rate is $0. 93/€. l You expect the $/€ rate to be $0. 91. l Do you expect the $ to appreciate or depreciate? l Do you expect the € to appreciate or depreciate? l Your expectation is for $ to appreciate and for € to depreciate. 37

Comparison of Returns Suppose you will need your $ a year from now. Today the exchange rate is $0. 93/€. l You expect the $/€ rate to be $0. 91. l Do you expect the $ to appreciate or depreciate? l Do you expect the € to appreciate or depreciate? l Your expectation is for $ to appreciate and for € to depreciate. 37

Comparison of Returns The rate of appreciation of $ will increase the percentage return on USD. l The rate of depreciation of € will decrease the percentage return on €. l If € is expected to move from $0. 93 to $0. 91, its rate of depreciation is ($0. 91$0. 93)/$0. 93 = -0. 0215 or -2. 15%. l The rate of appreciation for $ is (€ 1. 099€ 1. 075)/ € 1. 075= 0. 022 or 2. 2%. l 38

Comparison of Returns The rate of appreciation of $ will increase the percentage return on USD. l The rate of depreciation of € will decrease the percentage return on €. l If € is expected to move from $0. 93 to $0. 91, its rate of depreciation is ($0. 91$0. 93)/$0. 93 = -0. 0215 or -2. 15%. l The rate of appreciation for $ is (€ 1. 099€ 1. 075)/ € 1. 075= 0. 022 or 2. 2%. l 38

Comparison of Returns l l l Since the appreciation/depreciation calculations are approximately equal, we will treat them to be equal for simplicity. If we compare interest rate on $ (5%) with the returns on € (8% - 2. 15%), we are still better off keeping our wealth in €. If we compare interest rate on € (8%) with the returns on $ (5% + 2. 2%), again we are still better off keeping our wealth in €. 39

Comparison of Returns l l l Since the appreciation/depreciation calculations are approximately equal, we will treat them to be equal for simplicity. If we compare interest rate on $ (5%) with the returns on € (8% - 2. 15%), we are still better off keeping our wealth in €. If we compare interest rate on € (8%) with the returns on $ (5% + 2. 2%), again we are still better off keeping our wealth in €. 39

![Comparison of Returns R$ compared to R€ + [($/€)e - ($/€)]/($/€) will show dollar Comparison of Returns R$ compared to R€ + [($/€)e - ($/€)]/($/€) will show dollar](https://present5.com/presentation/2882996d5af03069113b021f45881eec/image-40.jpg) Comparison of Returns R$ compared to R€ + [($/€)e - ($/€)]/($/€) will show dollar returns in US versus dollar returns in Europe. l R€ compared to R$ + [(€/$)e - (€/$)]/(€/$) will show euro returns in Europe versus euro returns in the US. l If the exchange rate is always kept as ($/€), the euro returns comparison will be R$ - [($/€)e - ($/€)]/($/€) or appreciation of euro subtracted from R$. l 40

Comparison of Returns R$ compared to R€ + [($/€)e - ($/€)]/($/€) will show dollar returns in US versus dollar returns in Europe. l R€ compared to R$ + [(€/$)e - (€/$)]/(€/$) will show euro returns in Europe versus euro returns in the US. l If the exchange rate is always kept as ($/€), the euro returns comparison will be R$ - [($/€)e - ($/€)]/($/€) or appreciation of euro subtracted from R$. l 40

Comparison of Returns The difference between appreciation and depreciation is the result of simplifying the calculation. l The correct calculation proceeds from exchanging a $ into €, earning interest on €, exchanging € back to $ and subtracting the principal ($1). l $1(€/$) [1+R€] ($/€)e - $1 = [1+ R€][($/€)e/($/€)] - [($/€)/($/€)] + R€ [($/€)/($/€)] - R€ [($/€)/($/€)] l 41

Comparison of Returns The difference between appreciation and depreciation is the result of simplifying the calculation. l The correct calculation proceeds from exchanging a $ into €, earning interest on €, exchanging € back to $ and subtracting the principal ($1). l $1(€/$) [1+R€] ($/€)e - $1 = [1+ R€][($/€)e/($/€)] - [($/€)/($/€)] + R€ [($/€)/($/€)] - R€ [($/€)/($/€)] l 41

![Comparison of Returns Replace $/€ by E. l =[1+ R][Ee/E] - [E/E] + R Comparison of Returns Replace $/€ by E. l =[1+ R][Ee/E] - [E/E] + R](https://present5.com/presentation/2882996d5af03069113b021f45881eec/image-42.jpg) Comparison of Returns Replace $/€ by E. l =[1+ R][Ee/E] - [E/E] + R [E/E] - R [E/E] l = [REe/E - RE/E] + R + [Ee/E - E/E] l = R[(Ee-E)/E] + R + [(Ee-E)/E] l When interest rate and appreciation/depreciation rate are small, the first term may be ignored. l 42

Comparison of Returns Replace $/€ by E. l =[1+ R][Ee/E] - [E/E] + R [E/E] - R [E/E] l = [REe/E - RE/E] + R + [Ee/E - E/E] l = R[(Ee-E)/E] + R + [(Ee-E)/E] l When interest rate and appreciation/depreciation rate are small, the first term may be ignored. l 42

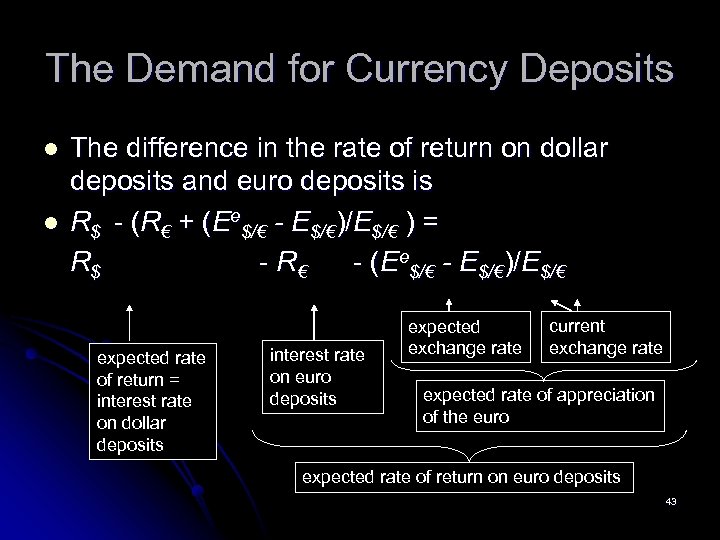

The Demand for Currency Deposits l l The difference in the rate of return on dollar deposits and euro deposits is R$ - (R€ + (Ee$/€ - E$/€)/E$/€ ) = R$ - R€ - (Ee$/€ - E$/€)/E$/€ expected rate of return = interest rate on dollar deposits interest rate on euro deposits expected exchange rate current exchange rate expected rate of appreciation of the euro expected rate of return on euro deposits 43

The Demand for Currency Deposits l l The difference in the rate of return on dollar deposits and euro deposits is R$ - (R€ + (Ee$/€ - E$/€)/E$/€ ) = R$ - R€ - (Ee$/€ - E$/€)/E$/€ expected rate of return = interest rate on dollar deposits interest rate on euro deposits expected exchange rate current exchange rate expected rate of appreciation of the euro expected rate of return on euro deposits 43

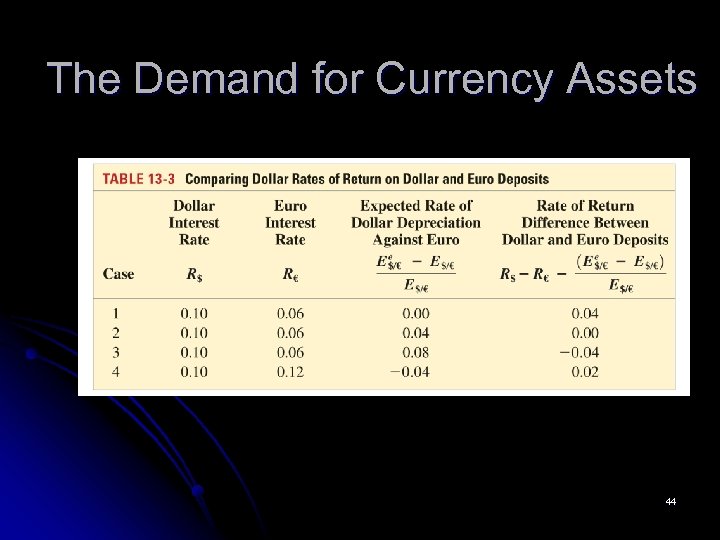

The Demand for Currency Assets 44

The Demand for Currency Assets 44

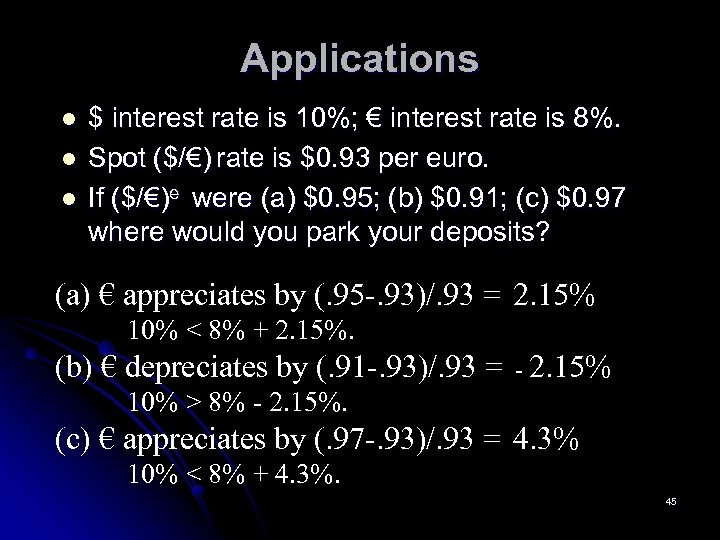

Applications l l l $ interest rate is 10%; € interest rate is 8%. Spot ($/€) rate is $0. 93 per euro. If ($/€)e were (a) $0. 95; (b) $0. 91; (c) $0. 97 where would you park your deposits? (a) € appreciates by (. 95 -. 93)/. 93 = 2. 15% 10% < 8% + 2. 15%. (b) € depreciates by (. 91 -. 93)/. 93 = - 2. 15% 10% > 8% - 2. 15%. (c) € appreciates by (. 97 -. 93)/. 93 = 4. 3% 10% < 8% + 4. 3%. 45

Applications l l l $ interest rate is 10%; € interest rate is 8%. Spot ($/€) rate is $0. 93 per euro. If ($/€)e were (a) $0. 95; (b) $0. 91; (c) $0. 97 where would you park your deposits? (a) € appreciates by (. 95 -. 93)/. 93 = 2. 15% 10% < 8% + 2. 15%. (b) € depreciates by (. 91 -. 93)/. 93 = - 2. 15% 10% > 8% - 2. 15%. (c) € appreciates by (. 97 -. 93)/. 93 = 4. 3% 10% < 8% + 4. 3%. 45

Equilibrium When returns from $ are the same as returns from euro, there will be no adjustments: the foreign exchange market between USD and euro is in equilibrium. l The returns are equal when the USD interest rate is exactly equal to euro interest rate plus the rate of appreciation of euro. l Alternatively, the returns are equal when the euro interest rate is equal to $ interest rate minus the depreciation of euro. l 46

Equilibrium When returns from $ are the same as returns from euro, there will be no adjustments: the foreign exchange market between USD and euro is in equilibrium. l The returns are equal when the USD interest rate is exactly equal to euro interest rate plus the rate of appreciation of euro. l Alternatively, the returns are equal when the euro interest rate is equal to $ interest rate minus the depreciation of euro. l 46

Equilibrium in the foreign exchange market will take place when the interest parity condition holds. l R$ = R€ + [($/€)e - ($/€)]/($/€) l If R$ > R€ + [($/€)e - ($/€)]/($/€), there will be an excess demand for USD (excess supply of €) in the foreign exchange market. l If R$ < R€ + [($/€)e - ($/€)]/($/€), there will be an excess demand for euro and an excess supply of USD. l 47

Equilibrium in the foreign exchange market will take place when the interest parity condition holds. l R$ = R€ + [($/€)e - ($/€)]/($/€) l If R$ > R€ + [($/€)e - ($/€)]/($/€), there will be an excess demand for USD (excess supply of €) in the foreign exchange market. l If R$ < R€ + [($/€)e - ($/€)]/($/€), there will be an excess demand for euro and an excess supply of USD. l 47

Current FX and Returns If the current FX goes up, e. g. , euro appreciates today but the expected FX remains the same, the dollar return on euro deposits will decrease. l R€ + [($/€)e - ($/€)]/($/€) will be lower if ($/€) rises. l R$ - [($/€)e - ($/€)]/($/€) will be higher if ($/€) rises. l In other words, if USD depreciates today, the dollar return on euro deposits will fall. l 48

Current FX and Returns If the current FX goes up, e. g. , euro appreciates today but the expected FX remains the same, the dollar return on euro deposits will decrease. l R€ + [($/€)e - ($/€)]/($/€) will be lower if ($/€) rises. l R$ - [($/€)e - ($/€)]/($/€) will be higher if ($/€) rises. l In other words, if USD depreciates today, the dollar return on euro deposits will fall. l 48

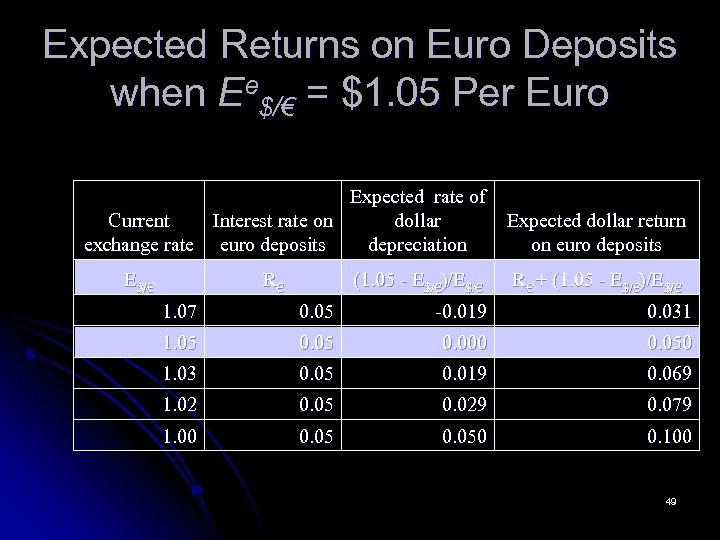

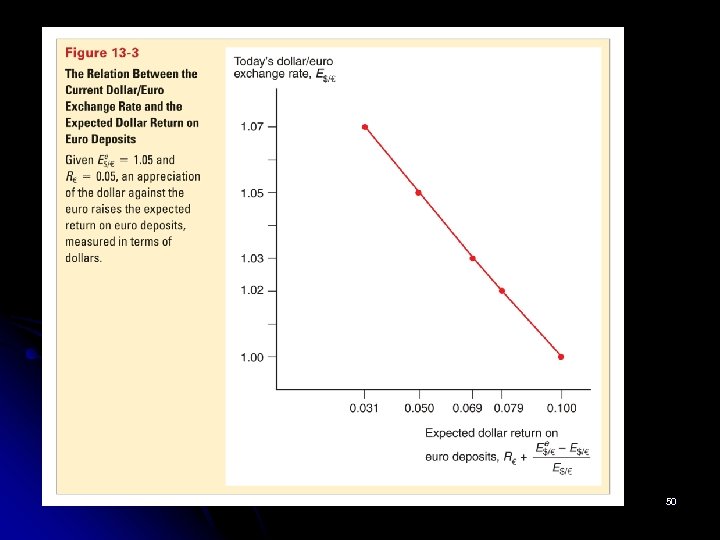

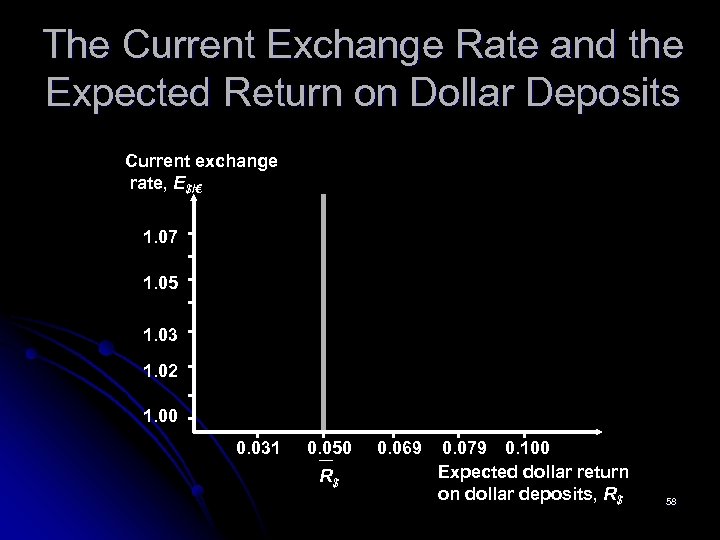

Expected Returns on Euro Deposits when Ee$/€ = $1. 05 Per Euro Expected rate of Current Interest rate on dollar exchange rate euro deposits depreciation E$/€ R€ (1. 05 - E$/€)/E$/€ Expected dollar return on euro deposits R€ + (1. 05 - E$/€)/E$/€ 1. 07 0. 05 -0. 019 0. 031 1. 05 0. 000 0. 050 1. 03 0. 05 0. 019 0. 069 1. 02 0. 05 0. 029 0. 079 1. 00 0. 050 0. 100 49

Expected Returns on Euro Deposits when Ee$/€ = $1. 05 Per Euro Expected rate of Current Interest rate on dollar exchange rate euro deposits depreciation E$/€ R€ (1. 05 - E$/€)/E$/€ Expected dollar return on euro deposits R€ + (1. 05 - E$/€)/E$/€ 1. 07 0. 05 -0. 019 0. 031 1. 05 0. 000 0. 050 1. 03 0. 05 0. 019 0. 069 1. 02 0. 05 0. 029 0. 079 1. 00 0. 050 0. 100 49

50

50

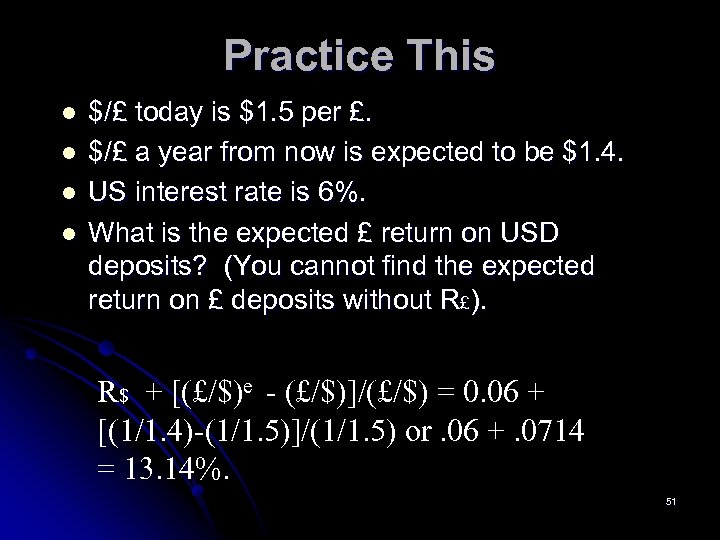

Practice This l l $/£ today is $1. 5 per £. $/£ a year from now is expected to be $1. 4. US interest rate is 6%. What is the expected £ return on USD deposits? (You cannot find the expected return on £ deposits without R£). R$ + [(£/$)e - (£/$)]/(£/$) = 0. 06 + [(1/1. 4)-(1/1. 5)]/(1/1. 5) or. 06 +. 0714 = 13. 14%. 51

Practice This l l $/£ today is $1. 5 per £. $/£ a year from now is expected to be $1. 4. US interest rate is 6%. What is the expected £ return on USD deposits? (You cannot find the expected return on £ deposits without R£). R$ + [(£/$)e - (£/$)]/(£/$) = 0. 06 + [(1/1. 4)-(1/1. 5)]/(1/1. 5) or. 06 +. 0714 = 13. 14%. 51

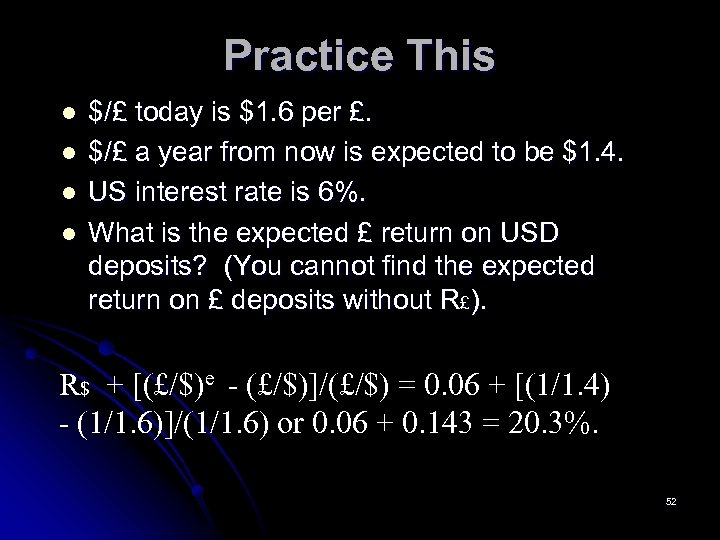

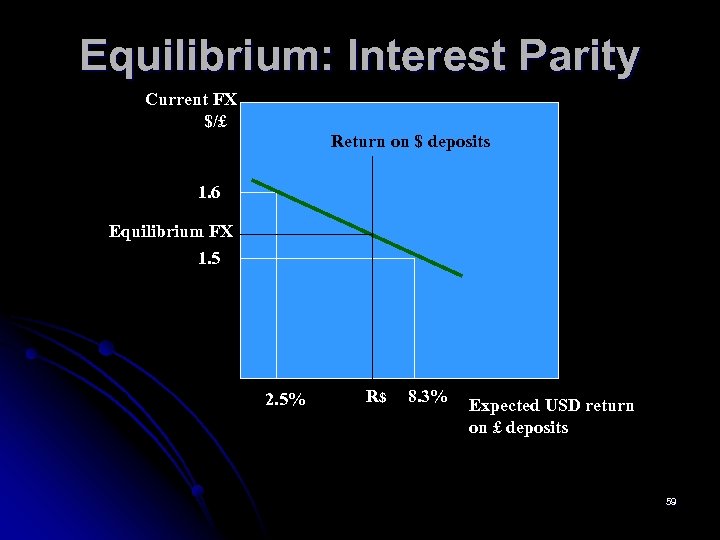

Practice This l l $/£ today is $1. 6 per £. $/£ a year from now is expected to be $1. 4. US interest rate is 6%. What is the expected £ return on USD deposits? (You cannot find the expected return on £ deposits without R£). R$ + [(£/$)e - (£/$)]/(£/$) = 0. 06 + [(1/1. 4) - (1/1. 6)]/(1/1. 6) or 0. 06 + 0. 143 = 20. 3%. 52

Practice This l l $/£ today is $1. 6 per £. $/£ a year from now is expected to be $1. 4. US interest rate is 6%. What is the expected £ return on USD deposits? (You cannot find the expected return on £ deposits without R£). R$ + [(£/$)e - (£/$)]/(£/$) = 0. 06 + [(1/1. 4) - (1/1. 6)]/(1/1. 6) or 0. 06 + 0. 143 = 20. 3%. 52

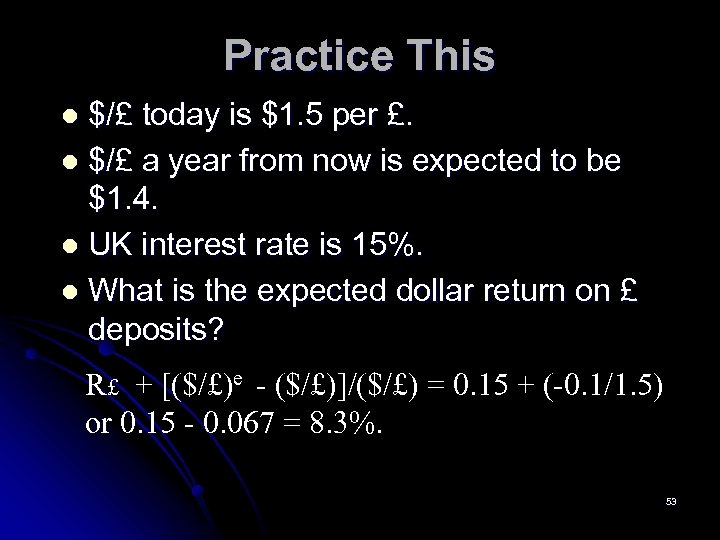

Practice This $/£ today is $1. 5 per £. l $/£ a year from now is expected to be $1. 4. l UK interest rate is 15%. l What is the expected dollar return on £ deposits? l R£ + [($/£)e - ($/£)]/($/£) = 0. 15 + (-0. 1/1. 5) or 0. 15 - 0. 067 = 8. 3%. 53

Practice This $/£ today is $1. 5 per £. l $/£ a year from now is expected to be $1. 4. l UK interest rate is 15%. l What is the expected dollar return on £ deposits? l R£ + [($/£)e - ($/£)]/($/£) = 0. 15 + (-0. 1/1. 5) or 0. 15 - 0. 067 = 8. 3%. 53

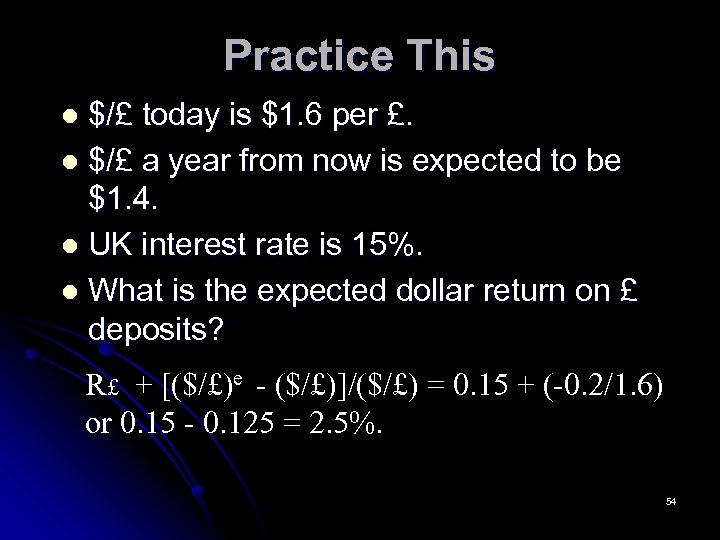

Practice This $/£ today is $1. 6 per £. l $/£ a year from now is expected to be $1. 4. l UK interest rate is 15%. l What is the expected dollar return on £ deposits? l R£ + [($/£)e - ($/£)]/($/£) = 0. 15 + (-0. 2/1. 6) or 0. 15 - 0. 125 = 2. 5%. 54

Practice This $/£ today is $1. 6 per £. l $/£ a year from now is expected to be $1. 4. l UK interest rate is 15%. l What is the expected dollar return on £ deposits? l R£ + [($/£)e - ($/£)]/($/£) = 0. 15 + (-0. 2/1. 6) or 0. 15 - 0. 125 = 2. 5%. 54

Practice Result When £ appreciated today, £ returns on USD deposits increased. l When $ depreciated today, $ returns on £ deposits decreased. l 55

Practice Result When £ appreciated today, £ returns on USD deposits increased. l When $ depreciated today, $ returns on £ deposits decreased. l 55

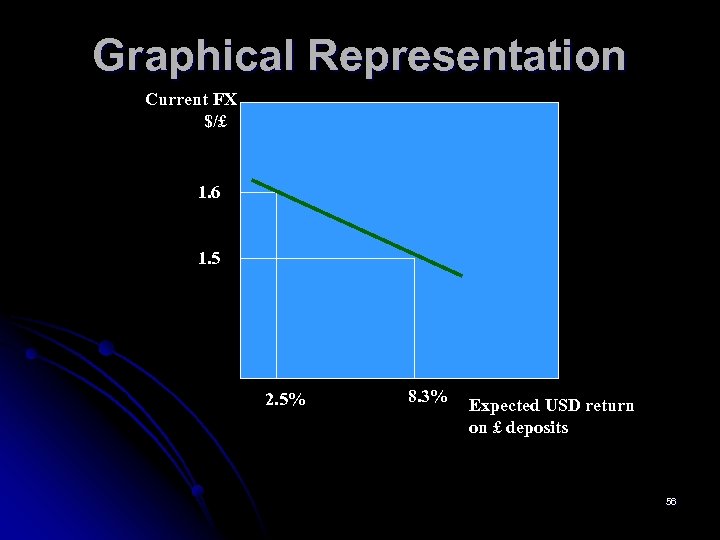

Graphical Representation Current FX $/£ 1. 6 1. 5 2. 5% 8. 3% Expected USD return on £ deposits 56

Graphical Representation Current FX $/£ 1. 6 1. 5 2. 5% 8. 3% Expected USD return on £ deposits 56

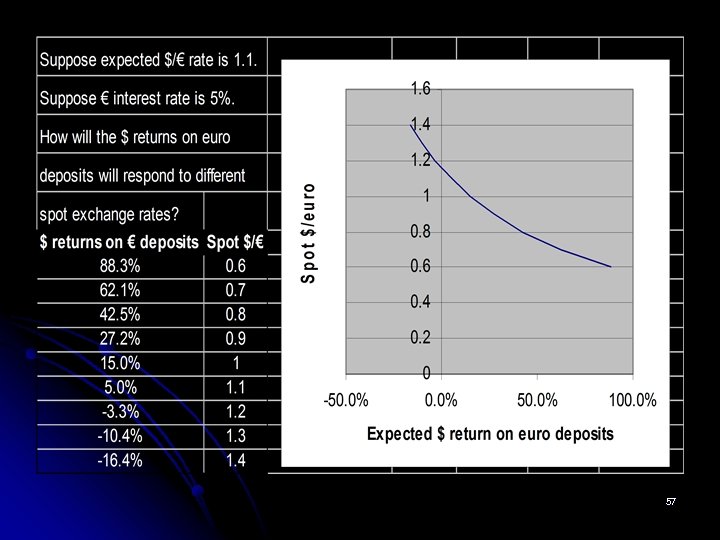

57

57

The Current Exchange Rate and the Expected Return on Dollar Deposits Current exchange rate, E$/€ 1. 07 1. 05 1. 03 1. 02 1. 00 0. 031 0. 050 R$ 0. 069 0. 079 0. 100 Expected dollar return on dollar deposits, R$ 58

The Current Exchange Rate and the Expected Return on Dollar Deposits Current exchange rate, E$/€ 1. 07 1. 05 1. 03 1. 02 1. 00 0. 031 0. 050 R$ 0. 069 0. 079 0. 100 Expected dollar return on dollar deposits, R$ 58

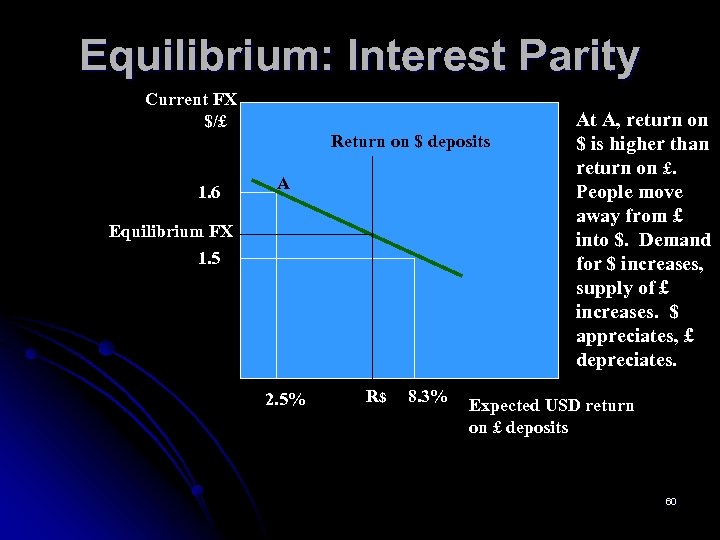

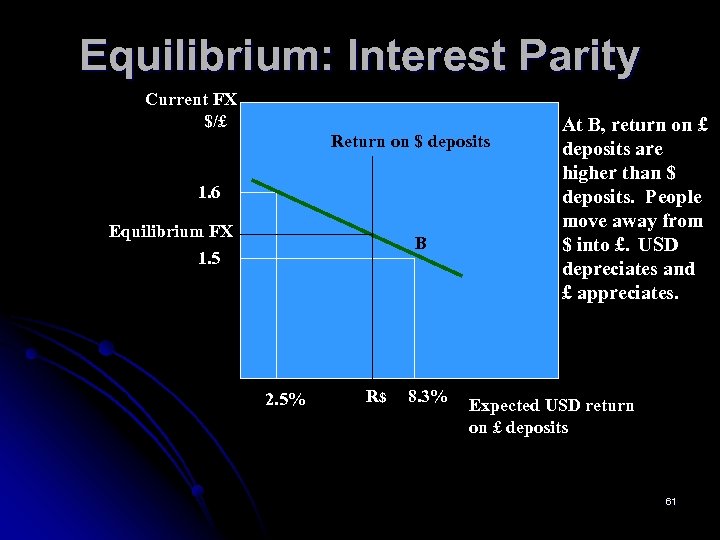

Equilibrium: Interest Parity Current FX $/£ Return on $ deposits 1. 6 Equilibrium FX 1. 5 2. 5% R$ 8. 3% Expected USD return on £ deposits 59

Equilibrium: Interest Parity Current FX $/£ Return on $ deposits 1. 6 Equilibrium FX 1. 5 2. 5% R$ 8. 3% Expected USD return on £ deposits 59

Equilibrium: Interest Parity Current FX $/£ Return on $ deposits 1. 6 A Equilibrium FX 1. 5 2. 5% R$ 8. 3% At A, return on $ is higher than return on £. People move away from £ into $. Demand for $ increases, supply of £ increases. $ appreciates, £ depreciates. Expected USD return on £ deposits 60

Equilibrium: Interest Parity Current FX $/£ Return on $ deposits 1. 6 A Equilibrium FX 1. 5 2. 5% R$ 8. 3% At A, return on $ is higher than return on £. People move away from £ into $. Demand for $ increases, supply of £ increases. $ appreciates, £ depreciates. Expected USD return on £ deposits 60

Equilibrium: Interest Parity Current FX $/£ Return on $ deposits 1. 6 Equilibrium FX 1. 5 B 2. 5% R$ 8. 3% At B, return on £ deposits are higher than $ deposits. People move away from $ into £. USD depreciates and £ appreciates. Expected USD return on £ deposits 61

Equilibrium: Interest Parity Current FX $/£ Return on $ deposits 1. 6 Equilibrium FX 1. 5 B 2. 5% R$ 8. 3% At B, return on £ deposits are higher than $ deposits. People move away from $ into £. USD depreciates and £ appreciates. Expected USD return on £ deposits 61

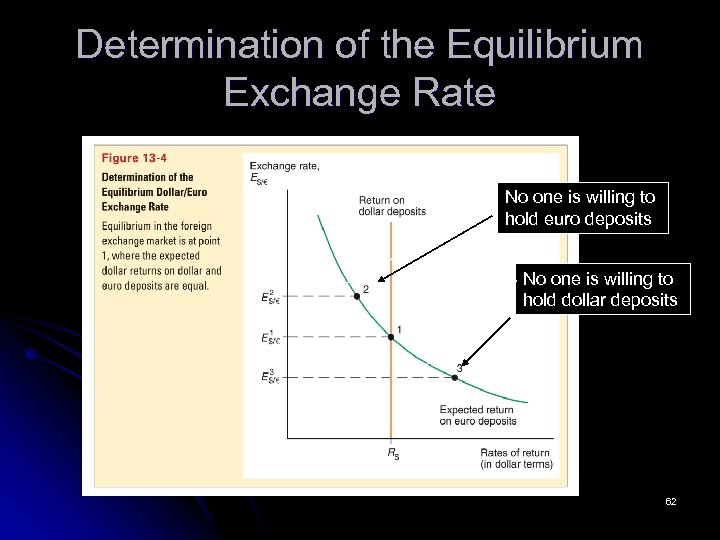

Determination of the Equilibrium Exchange Rate No one is willing to hold euro deposits No one is willing to hold dollar deposits 62

Determination of the Equilibrium Exchange Rate No one is willing to hold euro deposits No one is willing to hold dollar deposits 62

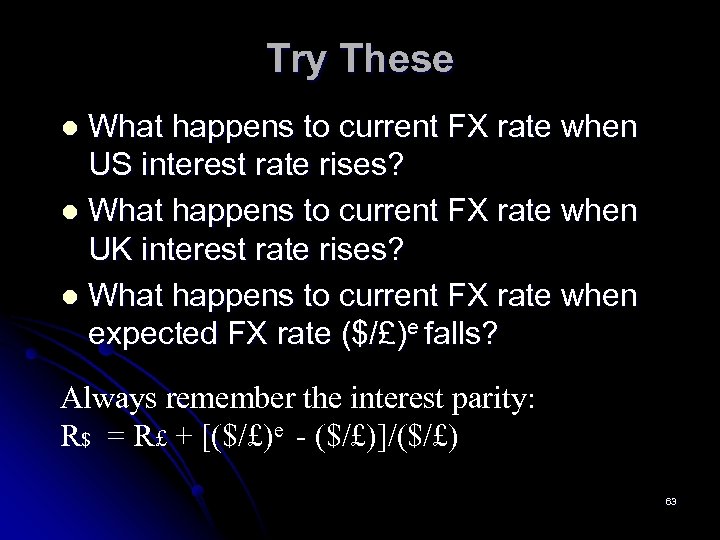

Try These What happens to current FX rate when US interest rate rises? l What happens to current FX rate when UK interest rate rises? l What happens to current FX rate when expected FX rate ($/£)e falls? l Always remember the interest parity: R$ = R£ + [($/£)e - ($/£)]/($/£) 63

Try These What happens to current FX rate when US interest rate rises? l What happens to current FX rate when UK interest rate rises? l What happens to current FX rate when expected FX rate ($/£)e falls? l Always remember the interest parity: R$ = R£ + [($/£)e - ($/£)]/($/£) 63

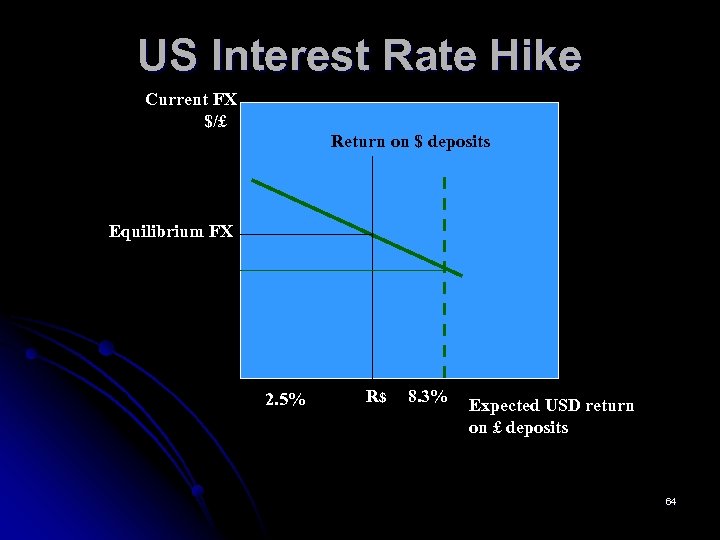

US Interest Rate Hike Current FX $/£ Return on $ deposits Equilibrium FX 2. 5% R$ 8. 3% Expected USD return on £ deposits 64

US Interest Rate Hike Current FX $/£ Return on $ deposits Equilibrium FX 2. 5% R$ 8. 3% Expected USD return on £ deposits 64

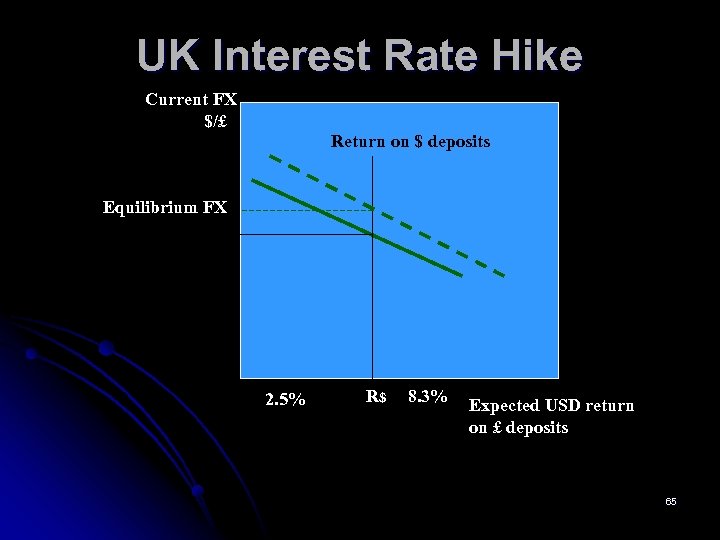

UK Interest Rate Hike Current FX $/£ Return on $ deposits Equilibrium FX 2. 5% R$ 8. 3% Expected USD return on £ deposits 65

UK Interest Rate Hike Current FX $/£ Return on $ deposits Equilibrium FX 2. 5% R$ 8. 3% Expected USD return on £ deposits 65

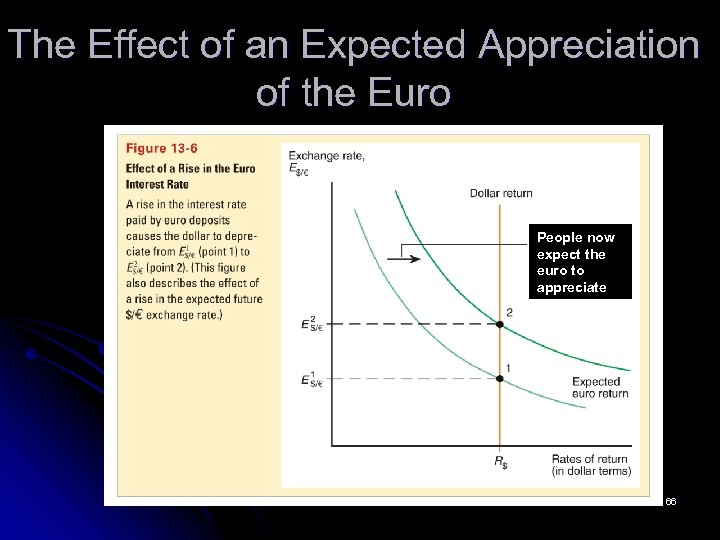

The Effect of an Expected Appreciation of the Euro People now expect the euro to appreciate 66

The Effect of an Expected Appreciation of the Euro People now expect the euro to appreciate 66

The Effect of an Expected Appreciation of the Euro l If people expect the euro to appreciate in the future, then investment will pay off in a valuable (“strong”) euro, so that these future euros will be able to buy many dollars and many dollar denominated goods. l l l the expected return on euros therefore increases. an expected appreciation of a currency leads to an actual appreciation (a self-fulfilling prophecy) an expected depreciation of a currency leads to an actual depreciation (a self-fulfilling prophecy) 67

The Effect of an Expected Appreciation of the Euro l If people expect the euro to appreciate in the future, then investment will pay off in a valuable (“strong”) euro, so that these future euros will be able to buy many dollars and many dollar denominated goods. l l l the expected return on euros therefore increases. an expected appreciation of a currency leads to an actual appreciation (a self-fulfilling prophecy) an expected depreciation of a currency leads to an actual depreciation (a self-fulfilling prophecy) 67

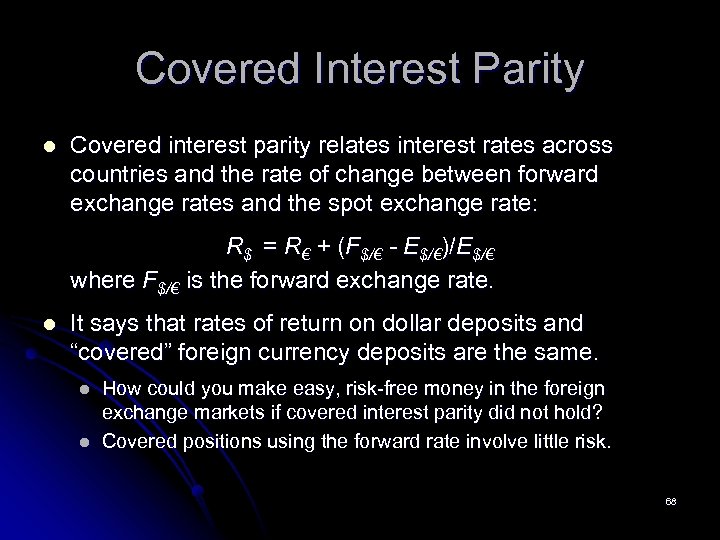

Covered Interest Parity l Covered interest parity relates interest rates across countries and the rate of change between forward exchange rates and the spot exchange rate: R$ = R€ + (F$/€ - E$/€)/E$/€ where F$/€ is the forward exchange rate. l It says that rates of return on dollar deposits and “covered” foreign currency deposits are the same. l l How could you make easy, risk-free money in the foreign exchange markets if covered interest parity did not hold? Covered positions using the forward rate involve little risk. 68

Covered Interest Parity l Covered interest parity relates interest rates across countries and the rate of change between forward exchange rates and the spot exchange rate: R$ = R€ + (F$/€ - E$/€)/E$/€ where F$/€ is the forward exchange rate. l It says that rates of return on dollar deposits and “covered” foreign currency deposits are the same. l l How could you make easy, risk-free money in the foreign exchange markets if covered interest parity did not hold? Covered positions using the forward rate involve little risk. 68