Magnit_Team_O2.pptx

- Количество слайдов: 15

CFA Research Challenge Team O

CFA Research Challenge Team O

Current Price (MOEX): 10 299 RUB Target Price (MOEX): 12 108 RUB Upside: 17. 6 % Recommendation: HOLD Current Price (LSE): 31, 04 USD Target Price (LSE): 37, 5 USD Upside: 20. 8 % Recommendation: HOLD Share prices on MOEX, RUB Share prices on LSE, USD 80 14, 000 70 12, 000 60 10, 000 50 8, 000 40 6, 000 30 4, 000 20 Source: MOEX 15 /1 0 /2 0 14 28 /1 0 28 /2 0 /1 0 /2 0 13 12 28 28 /1 0 /2 0 11 /2 0 /1 0 28 28 /1 0 /2 0 10 15 8. 20 01 4 14. 0 0. 2 23. 1 . 2 0. 0 1 09 . 2 0 . 0 3 12 22 6. 20 . 2 0 04. 0 8 . 2 0 23 . 1 0 28 14 0 13 0 11 10 10 2, 000 Source: LSE

Current Price (MOEX): 10 299 RUB Target Price (MOEX): 12 108 RUB Upside: 17. 6 % Recommendation: HOLD Current Price (LSE): 31, 04 USD Target Price (LSE): 37, 5 USD Upside: 20. 8 % Recommendation: HOLD Share prices on MOEX, RUB Share prices on LSE, USD 80 14, 000 70 12, 000 60 10, 000 50 8, 000 40 6, 000 30 4, 000 20 Source: MOEX 15 /1 0 /2 0 14 28 /1 0 28 /2 0 /1 0 /2 0 13 12 28 28 /1 0 /2 0 11 /2 0 /1 0 28 28 /1 0 /2 0 10 15 8. 20 01 4 14. 0 0. 2 23. 1 . 2 0. 0 1 09 . 2 0 . 0 3 12 22 6. 20 . 2 0 04. 0 8 . 2 0 23 . 1 0 28 14 0 13 0 11 10 10 2, 000 Source: LSE

ü The leading company in the Russian food retail market; ü Over 12 089 stores; ü 45% among Russia’s 5 largest retailers. Retail market share, % 6. 9% 5. 9% 1. 8% 2. 1% 1. 4% 1. 9% Magnit X 5 Dixy Okey 3. 1% 76. 9% Selling space, % 8. 1% 9. 0% Magnit X 5 5. 7% Okey Lenta Dixy Metro 45. 5% Auchan Other Source: Company data Lenta 31. 7% Source: Company data Magnit’s market share 6, 9%

ü The leading company in the Russian food retail market; ü Over 12 089 stores; ü 45% among Russia’s 5 largest retailers. Retail market share, % 6. 9% 5. 9% 1. 8% 2. 1% 1. 4% 1. 9% Magnit X 5 Dixy Okey 3. 1% 76. 9% Selling space, % 8. 1% 9. 0% Magnit X 5 5. 7% Okey Lenta Dixy Metro 45. 5% Auchan Other Source: Company data Lenta 31. 7% Source: Company data Magnit’s market share 6, 9%

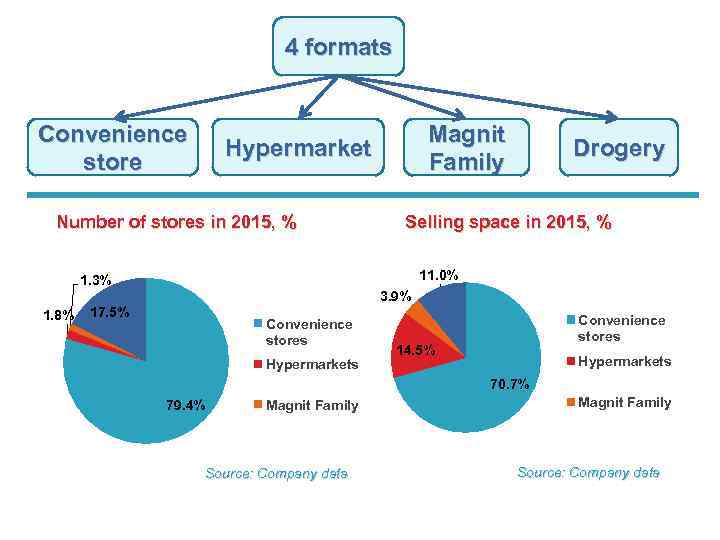

4 formats Convenience store Magnit Family Hypermarket Number of stores in 2015, % Selling space in 2015, % 11. 0% 1. 3% 1. 8% Drogery 3. 9% 17. 5% Convenience stores Hypermarkets Convenience stores 14. 5% Hypermarkets 70. 7% 79. 4% Magnit Family Source: Company data

4 formats Convenience store Magnit Family Hypermarket Number of stores in 2015, % Selling space in 2015, % 11. 0% 1. 3% 1. 8% Drogery 3. 9% 17. 5% Convenience stores Hypermarkets Convenience stores 14. 5% Hypermarkets 70. 7% 79. 4% Magnit Family Source: Company data

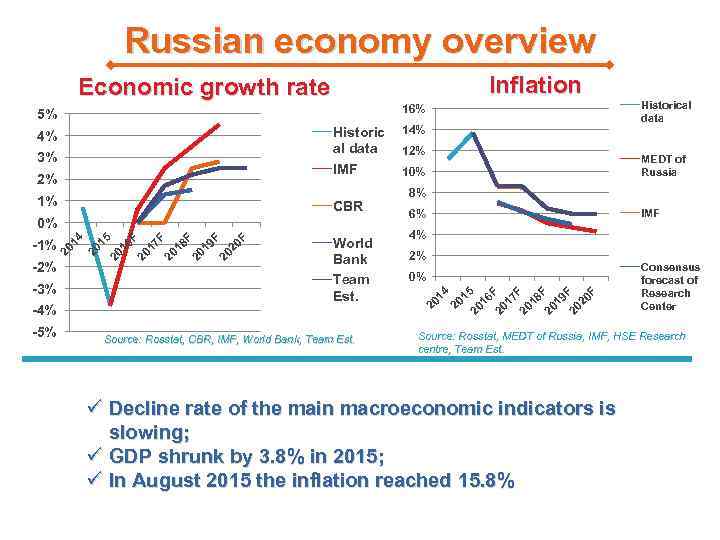

Russian economy overview Inflation Economic growth rate 16% 1% CBR -3% -4% -5% F 20 19 F 20 18 F 20 17 F 20 16 15 20 -2% 20 20 -1% 14 0% World Bank Team Est. Source: Rosstat, CBR, IMF, World Bank, Team Est. Historical data MEDT of Russia 10% 8% IMF 6% 4% 2% 0% 1 20 5 16 20 F 17 20 F 18 20 F 19 20 F 2% 14 3% 14% 20 Historic al data IMF 4% 20 5% Consensus forecast of Research Center Source: Rosstat, MEDT of Russia, IMF, HSE Research centre, Team Est. ü Decline rate of the main macroeconomic indicators is slowing; ü GDP shrunk by 3. 8% in 2015; ü In August 2015 the inflation reached 15. 8%

Russian economy overview Inflation Economic growth rate 16% 1% CBR -3% -4% -5% F 20 19 F 20 18 F 20 17 F 20 16 15 20 -2% 20 20 -1% 14 0% World Bank Team Est. Source: Rosstat, CBR, IMF, World Bank, Team Est. Historical data MEDT of Russia 10% 8% IMF 6% 4% 2% 0% 1 20 5 16 20 F 17 20 F 18 20 F 19 20 F 2% 14 3% 14% 20 Historic al data IMF 4% 20 5% Consensus forecast of Research Center Source: Rosstat, MEDT of Russia, IMF, HSE Research centre, Team Est. ü Decline rate of the main macroeconomic indicators is slowing; ü GDP shrunk by 3. 8% in 2015; ü In August 2015 the inflation reached 15. 8%

Industry review ü The availability of selling space in the regions to decline in the next 5 years; ü Ruble devaluation leads to higher costs. Correlation between average ticket and CPI 30% 25% 20% CPI 15% Average ticket 10% 7% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 F 2017 F 2018 F 2019 F 2020 F 5% 0% Average market growth potential Source: Rosstat, Company data, Team Est. Source: Team Est.

Industry review ü The availability of selling space in the regions to decline in the next 5 years; ü Ruble devaluation leads to higher costs. Correlation between average ticket and CPI 30% 25% 20% CPI 15% Average ticket 10% 7% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 F 2017 F 2018 F 2019 F 2020 F 5% 0% Average market growth potential Source: Rosstat, Company data, Team Est. Source: Team Est.

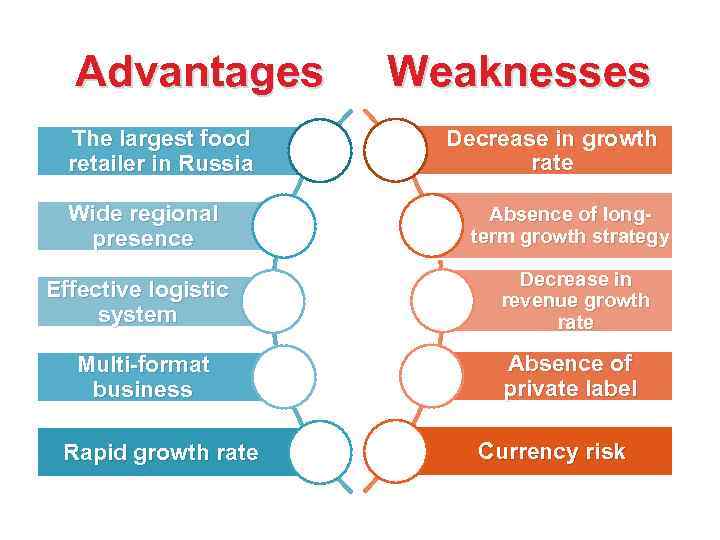

Advantages The largest food retailer in Russia Weaknesses Decrease in growth rate Wide regional presence Absence of longterm growth strategy Effective logistic system Decrease in revenue growth rate Multi-format business Absence of private label Rapid growth rate Currency risk

Advantages The largest food retailer in Russia Weaknesses Decrease in growth rate Wide regional presence Absence of longterm growth strategy Effective logistic system Decrease in revenue growth rate Multi-format business Absence of private label Rapid growth rate Currency risk

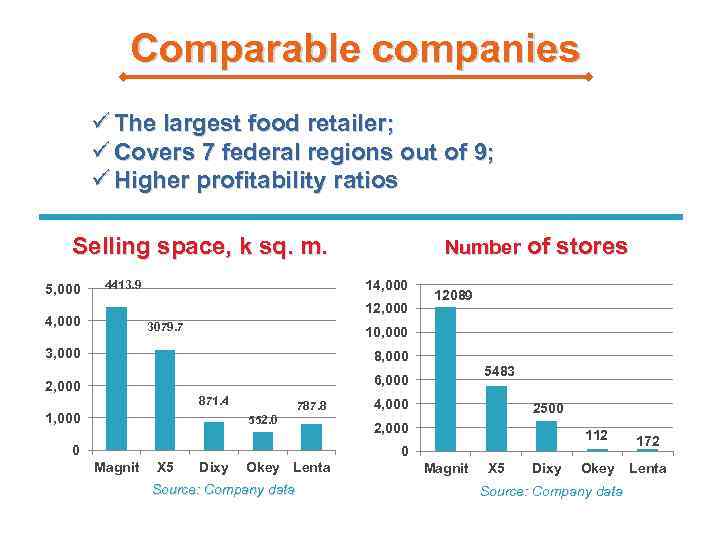

Comparable companies ü The largest food retailer; ü Covers 7 federal regions out of 9; ü Higher profitability ratios Selling space, k sq. m. 5, 000 Number of stores 14, 000 4413. 9 12, 000 4, 000 3079. 7 12089 10, 000 3, 000 8, 000 2, 000 6, 000 871. 4 1, 000 787. 8 552. 0 0 5483 4, 000 2500 2, 000 112 172 Okey Lenta 0 Magnit X 5 Dixy Okey Lenta Source: Company data Magnit X 5 Dixy Source: Company data

Comparable companies ü The largest food retailer; ü Covers 7 federal regions out of 9; ü Higher profitability ratios Selling space, k sq. m. 5, 000 Number of stores 14, 000 4413. 9 12, 000 4, 000 3079. 7 12089 10, 000 3, 000 8, 000 2, 000 6, 000 871. 4 1, 000 787. 8 552. 0 0 5483 4, 000 2500 2, 000 112 172 Okey Lenta 0 Magnit X 5 Dixy Okey Lenta Source: Company data Magnit X 5 Dixy Source: Company data

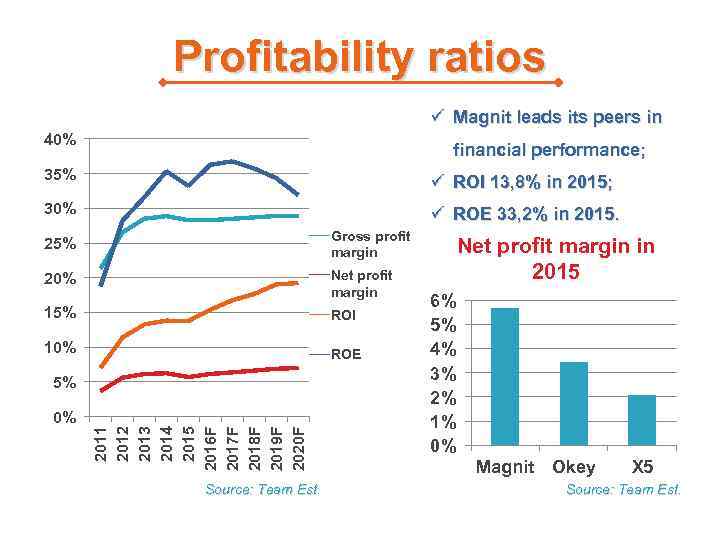

Profitability ratios ü Magnit leads its peers in 40% financial performance; 35% ü ROI 13, 8% in 2015; 30% ü ROE 33, 2% in 2015. 25% Gross profit margin 20% Net profit margin 15% ROI 10% ROE 5% 2011 2012 2013 2014 2015 2016 F 2017 F 2018 F 2019 F 2020 F 0% Source: Team Est. Net profit margin in 2015 6% 5% 4% 3% 2% 1% 0% Magnit Okey X 5 Source: Team Est.

Profitability ratios ü Magnit leads its peers in 40% financial performance; 35% ü ROI 13, 8% in 2015; 30% ü ROE 33, 2% in 2015. 25% Gross profit margin 20% Net profit margin 15% ROI 10% ROE 5% 2011 2012 2013 2014 2015 2016 F 2017 F 2018 F 2019 F 2020 F 0% Source: Team Est. Net profit margin in 2015 6% 5% 4% 3% 2% 1% 0% Magnit Okey X 5 Source: Team Est.

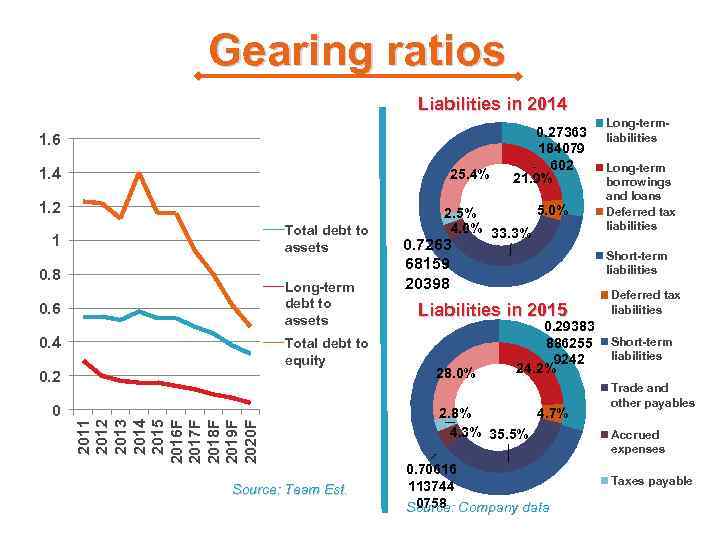

Gearing ratios Liabilities in 2014 1. 6 1. 4 25. 4% 1. 2 Total debt to assets 1 0. 8 Long-term debt to assets 0. 6 0. 4 Total debt to equity 0. 2 2011 2012 2013 2014 2015 2016 F 2017 F 2018 F 2019 F 2020 F 0 Source: Team Est. 0. 27363 184079 602 21. 9% 5. 0% 2. 5% 4. 0% 33. 3% 0. 7263 68159 20398 Long-term borrowings and loans Deferred tax liabilities Short-term liabilities Liabilities in 2015 28. 0% Long-termliabilities 0. 29383 886255 9242 24. 2% 2. 8% 4. 7% 4. 3% 35. 5% 0. 70616 113744 0758 Source: Company data Deferred tax liabilities Short-term liabilities Trade and other payables Accrued expenses Taxes payable

Gearing ratios Liabilities in 2014 1. 6 1. 4 25. 4% 1. 2 Total debt to assets 1 0. 8 Long-term debt to assets 0. 6 0. 4 Total debt to equity 0. 2 2011 2012 2013 2014 2015 2016 F 2017 F 2018 F 2019 F 2020 F 0 Source: Team Est. 0. 27363 184079 602 21. 9% 5. 0% 2. 5% 4. 0% 33. 3% 0. 7263 68159 20398 Long-term borrowings and loans Deferred tax liabilities Short-term liabilities Liabilities in 2015 28. 0% Long-termliabilities 0. 29383 886255 9242 24. 2% 2. 8% 4. 7% 4. 3% 35. 5% 0. 70616 113744 0758 Source: Company data Deferred tax liabilities Short-term liabilities Trade and other payables Accrued expenses Taxes payable

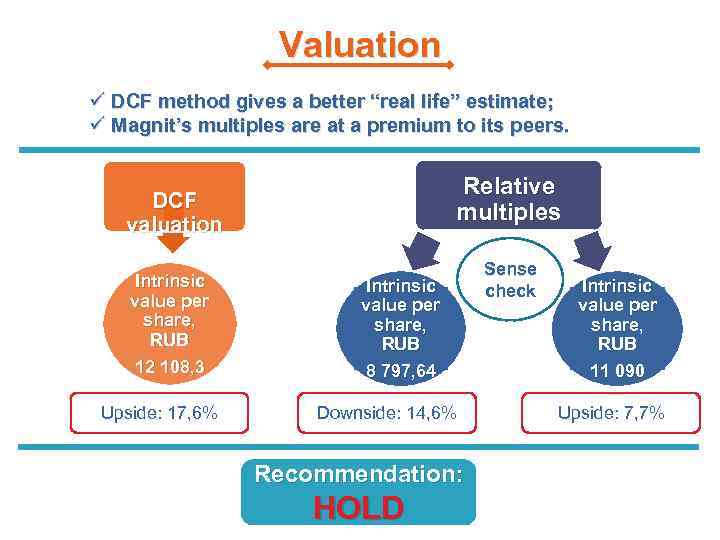

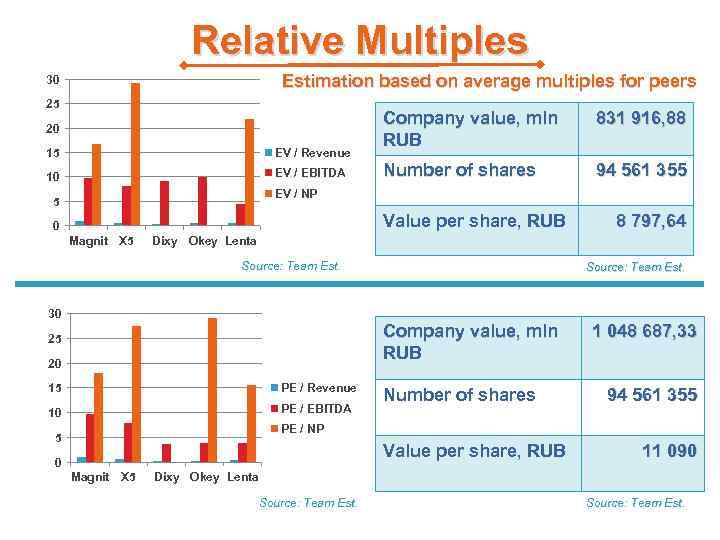

Valuation ü DCF method gives a better “real life” estimate; ü Magnit’s multiples are at a premium to its peers. Relative multiples DCF valuation Intrinsic value per share, RUB 12 108, 3 Upside: 17, 6% Intrinsic value per share, RUB 8 797, 64 Downside: 14, 6% Recommendation: HOLD Sense check Intrinsic value per share, RUB 11 090 Upside: 7, 7%

Valuation ü DCF method gives a better “real life” estimate; ü Magnit’s multiples are at a premium to its peers. Relative multiples DCF valuation Intrinsic value per share, RUB 12 108, 3 Upside: 17, 6% Intrinsic value per share, RUB 8 797, 64 Downside: 14, 6% Recommendation: HOLD Sense check Intrinsic value per share, RUB 11 090 Upside: 7, 7%

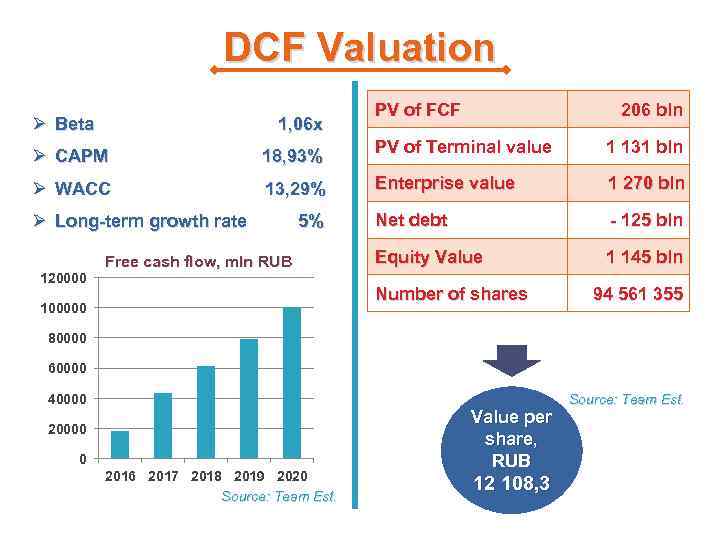

DCF Valuation Ø Beta 1, 06 x Ø CAPM 18, 93% Ø WACC 13, 29% Ø Long-term growth rate 120000 5% Free cash flow, mln RUB PV of FCF 206 bln PV of Terminal value 1 131 bln Enterprise value 1 270 bln Net debt - 125 bln Equity Value 1 145 bln Number of shares 100000 94 561 355 80000 60000 40000 20000 0 2016 2017 2018 2019 2020 Source: Team Est. Value per share, RUB 12 108, 3 Source: Team Est.

DCF Valuation Ø Beta 1, 06 x Ø CAPM 18, 93% Ø WACC 13, 29% Ø Long-term growth rate 120000 5% Free cash flow, mln RUB PV of FCF 206 bln PV of Terminal value 1 131 bln Enterprise value 1 270 bln Net debt - 125 bln Equity Value 1 145 bln Number of shares 100000 94 561 355 80000 60000 40000 20000 0 2016 2017 2018 2019 2020 Source: Team Est. Value per share, RUB 12 108, 3 Source: Team Est.

Relative Multiples Estimation based on average multiples for peers 30 25 20 15 EV / Revenue 10 EV / EBITDA Company value, mln RUB 831 916, 88 Number of shares 94 561 355 EV / NP 5 Value per share, RUB 0 Magnit X 5 8 797, 64 Dixy Okey Lenta Source: Team Est. 30 Company value, mln RUB 25 20 15 PE / Revenue 10 PE / EBITDA Number of shares 1 048 687, 33 94 561 355 PE / NP 5 Value per share, RUB 0 Magnit X 5 11 090 Dixy Okey Lenta Source: Team Est.

Relative Multiples Estimation based on average multiples for peers 30 25 20 15 EV / Revenue 10 EV / EBITDA Company value, mln RUB 831 916, 88 Number of shares 94 561 355 EV / NP 5 Value per share, RUB 0 Magnit X 5 8 797, 64 Dixy Okey Lenta Source: Team Est. 30 Company value, mln RUB 25 20 15 PE / Revenue 10 PE / EBITDA Number of shares 1 048 687, 33 94 561 355 PE / NP 5 Value per share, RUB 0 Magnit X 5 11 090 Dixy Okey Lenta Source: Team Est.

High Average Impact Ø Negative economic pressures; Ø Slowing revenue growth; Ø Currency risks; Ø Ø Low Investment Risks Ø Credit limits changes Dependence on Russian banks; Investments in real estate; Interest rate changes; Oil prices decrease;

High Average Impact Ø Negative economic pressures; Ø Slowing revenue growth; Ø Currency risks; Ø Ø Low Investment Risks Ø Credit limits changes Dependence on Russian banks; Investments in real estate; Interest rate changes; Oil prices decrease;

Thank you for your attention!

Thank you for your attention!