Сверх-сырое 2.pptx

- Количество слайдов: 29

CFA Institute Research Challenge 2012 -2013 Taras Shevchenko National University of Kyiv Kernel Holding S. A. Whether the market’s optimism is reasonable

CFA Institute Research Challenge 2012 -2013 Taras Shevchenko National University of Kyiv Kernel Holding S. A. Whether the market’s optimism is reasonable

About Kernel Company Profile

About Kernel Company Profile

About Kernel Company Profile

About Kernel Company Profile

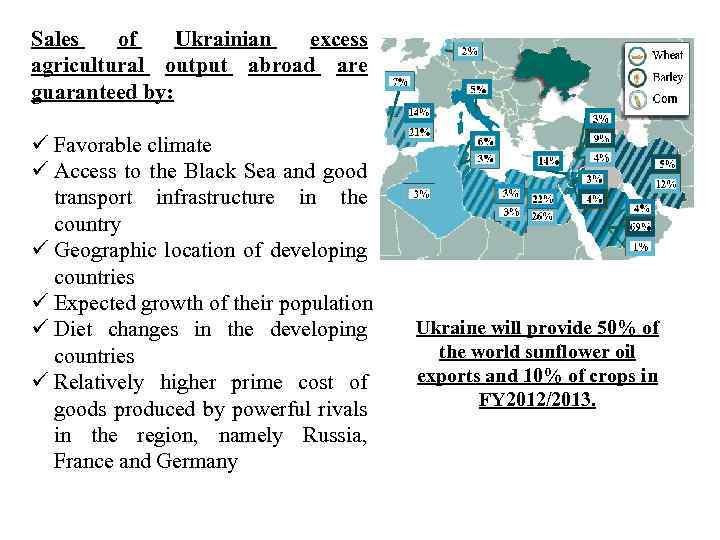

Sales of Ukrainian excess agricultural output abroad are guaranteed by: ü Favorable climate ü Access to the Black Sea and good transport infrastructure in the country ü Geographic location of developing countries ü Expected growth of their population ü Diet changes in the developing countries ü Relatively higher prime cost of goods produced by powerful rivals in the region, namely Russia, France and Germany Ukraine will provide 50% of the world sunflower oil exports and 10% of crops in FY 2012/2013.

Sales of Ukrainian excess agricultural output abroad are guaranteed by: ü Favorable climate ü Access to the Black Sea and good transport infrastructure in the country ü Geographic location of developing countries ü Expected growth of their population ü Diet changes in the developing countries ü Relatively higher prime cost of goods produced by powerful rivals in the region, namely Russia, France and Germany Ukraine will provide 50% of the world sunflower oil exports and 10% of crops in FY 2012/2013.

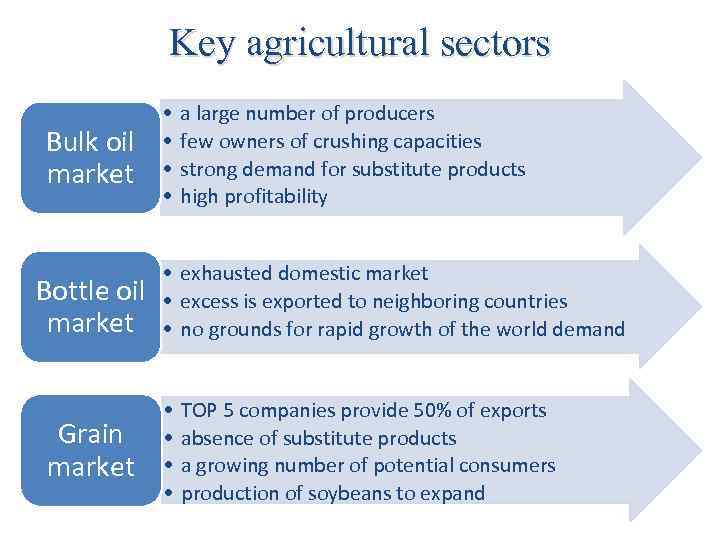

Key agricultural sectors Bulk oil market Bottle oil market Grain market • • a large number of producers few owners of crushing capacities strong demand for substitute products high profitability • exhausted domestic market • excess is exported to neighboring countries • no grounds for rapid growth of the world demand • • TOP 5 companies provide 50% of exports absence of substitute products a growing number of potential consumers production of soybeans to expand

Key agricultural sectors Bulk oil market Bottle oil market Grain market • • a large number of producers few owners of crushing capacities strong demand for substitute products high profitability • exhausted domestic market • excess is exported to neighboring countries • no grounds for rapid growth of the world demand • • TOP 5 companies provide 50% of exports absence of substitute products a growing number of potential consumers production of soybeans to expand

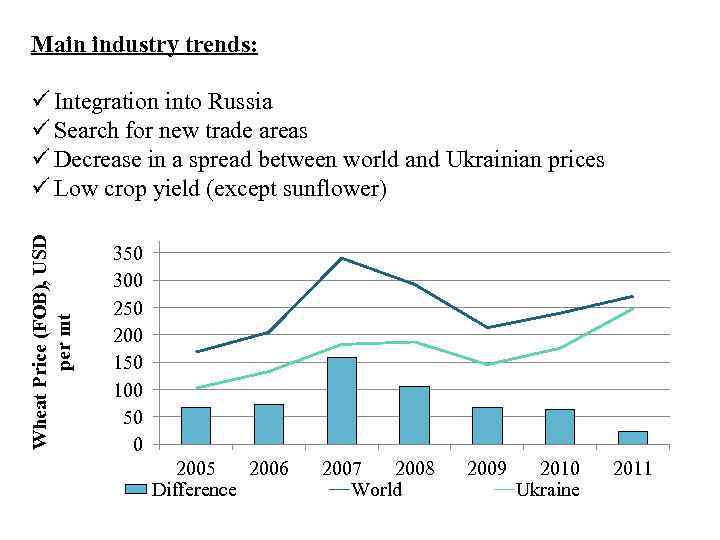

Main industry trends: Wheat Price (FOB), USD per mt ü Integration into Russia ü Search for new trade areas ü Decrease in a spread between world and Ukrainian prices ü Low crop yield (except sunflower) 350 300 250 200 150 100 50 0 2005 2006 Difference 2007 2008 World 2009 2010 Ukraine 2011

Main industry trends: Wheat Price (FOB), USD per mt ü Integration into Russia ü Search for new trade areas ü Decrease in a spread between world and Ukrainian prices ü Low crop yield (except sunflower) 350 300 250 200 150 100 50 0 2005 2006 Difference 2007 2008 World 2009 2010 Ukraine 2011

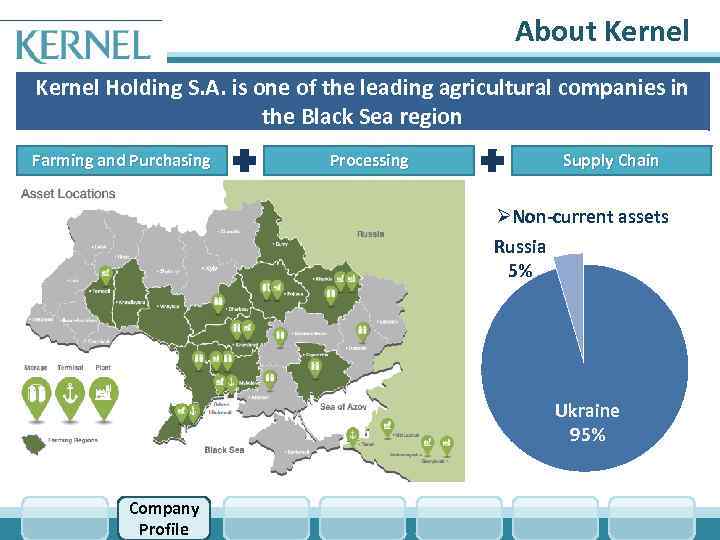

About Kernel Holding S. A. is one of the leading agricultural companies in the Black Sea region Farming and Purchasing Processing Supply Chain ØNon-current assets Russia 5% Ukraine 95% Company Profile

About Kernel Holding S. A. is one of the leading agricultural companies in the Black Sea region Farming and Purchasing Processing Supply Chain ØNon-current assets Russia 5% Ukraine 95% Company Profile

Main activities of Kernel Holding Farming and Purchasing Grain Sunflower Sugar beet Processing Supply Chain ØAcreage under crops: 248, 562 ha Ø#3 Land bank in Ukraine Cultivated land by crops Sugar beet 10% Sunflower 15, 6% Grain Ukraine 74. 3% 95% Company Profile

Main activities of Kernel Holding Farming and Purchasing Grain Sunflower Sugar beet Processing Supply Chain ØAcreage under crops: 248, 562 ha Ø#3 Land bank in Ukraine Cultivated land by crops Sugar beet 10% Sunflower 15, 6% Grain Ukraine 74. 3% 95% Company Profile

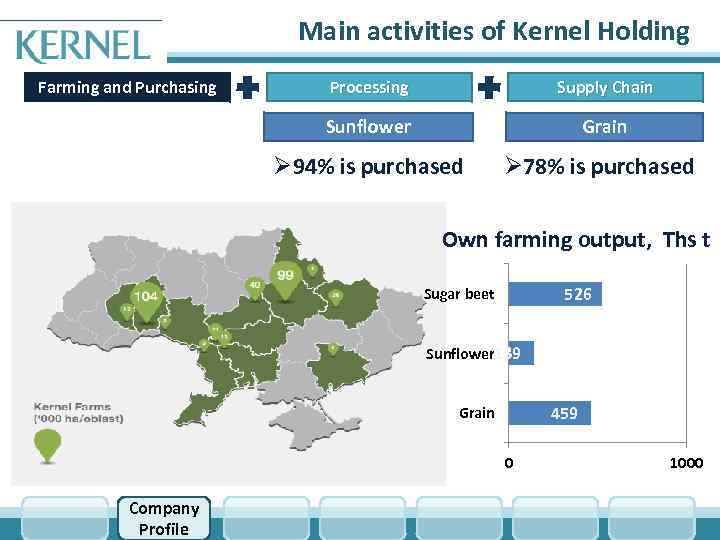

Main activities of Kernel Holding Farming and Purchasing Processing Supply Chain Sunflower Grain Ø 94% is purchased Ø 78% is purchased Own farming output, Ths t 526 Sugar beet Sunflower 15, 6% Sunflower 139 459 Grain 0 Company Profile 1000

Main activities of Kernel Holding Farming and Purchasing Processing Supply Chain Sunflower Grain Ø 94% is purchased Ø 78% is purchased Own farming output, Ths t 526 Sugar beet Sunflower 15, 6% Sunflower 139 459 Grain 0 Company Profile 1000

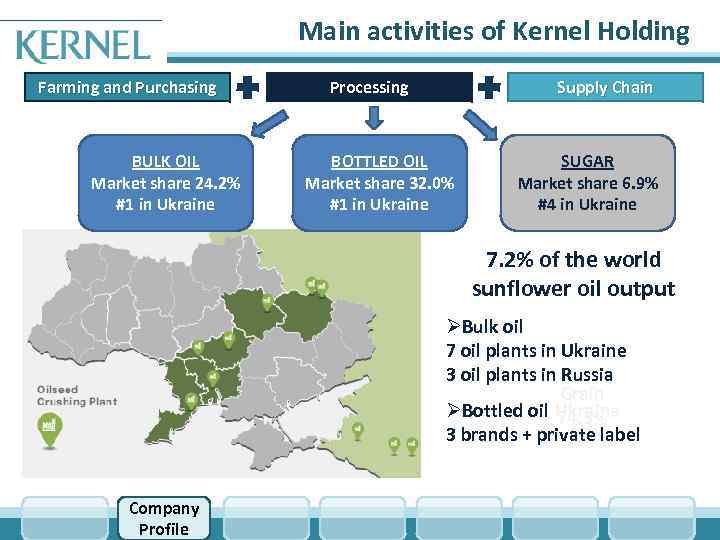

Main activities of Kernel Holding Farming and Purchasing BULK OIL Market share 24. 2% #1 in Ukraine Processing Supply Chain BOTTLED OIL Market share 32. 0% #1 in Ukraine SUGAR Market share 6. 9% #4 in Ukraine 7. 2% of the world sunflower oil output ØBulk oil 7 oil plants in Ukraine 3 oil plants in Russia Grain ØBottled oil Ukraine 74. 3% 95% 3 brands + private label Company Profile

Main activities of Kernel Holding Farming and Purchasing BULK OIL Market share 24. 2% #1 in Ukraine Processing Supply Chain BOTTLED OIL Market share 32. 0% #1 in Ukraine SUGAR Market share 6. 9% #4 in Ukraine 7. 2% of the world sunflower oil output ØBulk oil 7 oil plants in Ukraine 3 oil plants in Russia Grain ØBottled oil Ukraine 74. 3% 95% 3 brands + private label Company Profile

About Kernel Farming and Purchasing Processing SILO SERVICES Intersegment sales=38. 7% 7. 1% of Ukrainian capacities Supply Chain EXPORT TERMONALS Intersegment sales=72. 3% 2 – in Ukraine 1 – in Russia 85 % of Kernel`s production is sold on the foreign market GRAIN EXPORT #3 in Ukraine Market share: 8% Company Profile

About Kernel Farming and Purchasing Processing SILO SERVICES Intersegment sales=38. 7% 7. 1% of Ukrainian capacities Supply Chain EXPORT TERMONALS Intersegment sales=72. 3% 2 – in Ukraine 1 – in Russia 85 % of Kernel`s production is sold on the foreign market GRAIN EXPORT #3 in Ukraine Market share: 8% Company Profile

Farming of Kernel Farming and Purchasing Grain Sunflower Sugar beet Processing Sunflower oil Sugar Supply Chain T&H Oil sales Grain sales Kernel Farming сначала карта уменьшается, а потом от Украины начинают идти стрелки (нарисую) Company Profile

Farming of Kernel Farming and Purchasing Grain Sunflower Sugar beet Processing Sunflower oil Sugar Supply Chain T&H Oil sales Grain sales Kernel Farming сначала карта уменьшается, а потом от Украины начинают идти стрелки (нарисую) Company Profile

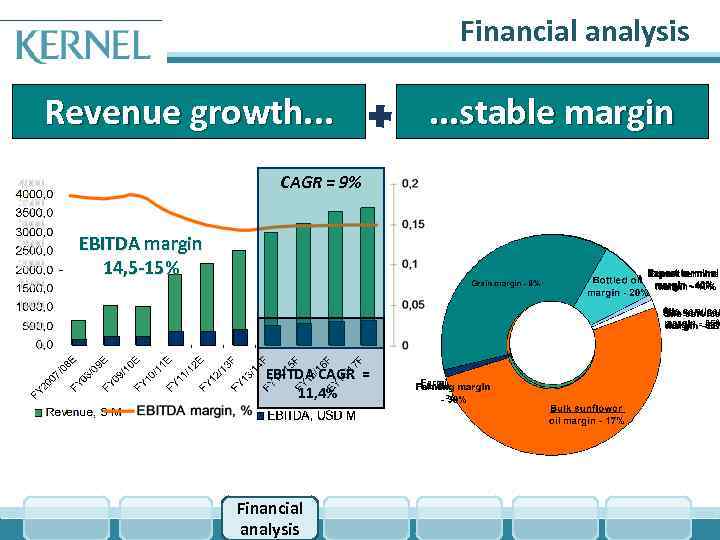

Financial analysis Revenue growth. . . CAGR = 9% EBITDA margin 14, 5 -15% EBITDA CAGR = 11, 4% Financial analysis . . . stable margin

Financial analysis Revenue growth. . . CAGR = 9% EBITDA margin 14, 5 -15% EBITDA CAGR = 11, 4% Financial analysis . . . stable margin

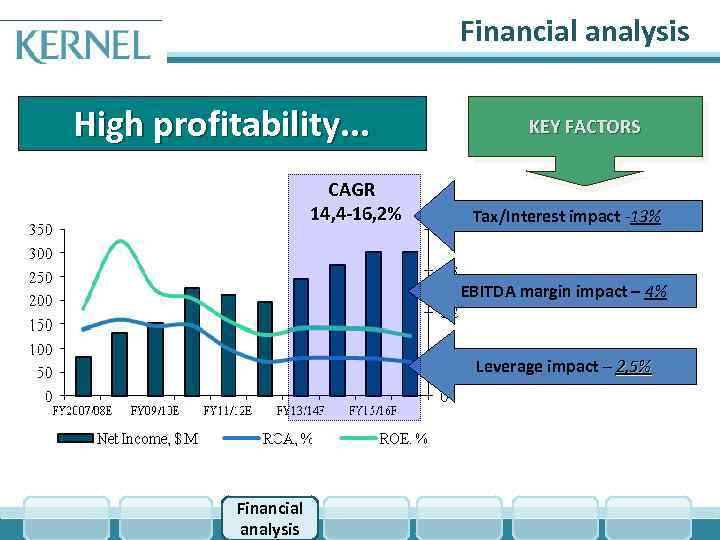

Financial analysis High profitability. . . CAGR 14, 4 -16, 2% KEY FACTORS Tax/Interest impact -13% EBITDA margin impact – 4% Leverage impact – 2, 5% Financial analysis

Financial analysis High profitability. . . CAGR 14, 4 -16, 2% KEY FACTORS Tax/Interest impact -13% EBITDA margin impact – 4% Leverage impact – 2, 5% Financial analysis

Financial analysis Conservative capital structure. . . 1, 86 x Equity 68% FY 2011/12 FY 2008/09 0, 76 x Debt Cap. Ex Plan 32% XXX USD M. . . create invest opportunities Financial analysis

Financial analysis Conservative capital structure. . . 1, 86 x Equity 68% FY 2011/12 FY 2008/09 0, 76 x Debt Cap. Ex Plan 32% XXX USD M. . . create invest opportunities Financial analysis

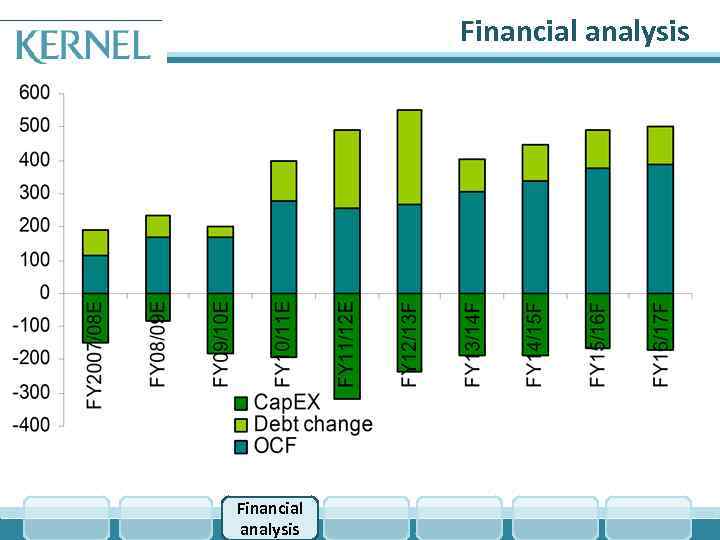

Cap. Ex program Financial analysis

Cap. Ex program Financial analysis

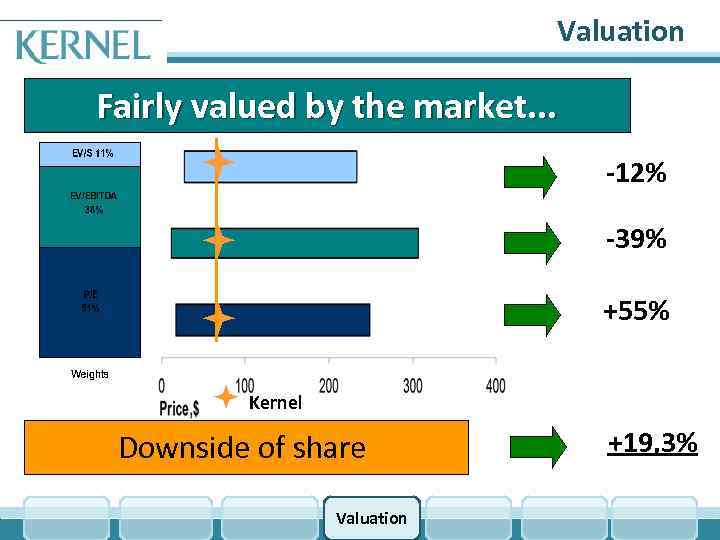

Valuation Fairly valued by the market. . . -12% -39% +55% Kernel Downside of share Valuation +19, 3%

Valuation Fairly valued by the market. . . -12% -39% +55% Kernel Downside of share Valuation +19, 3%

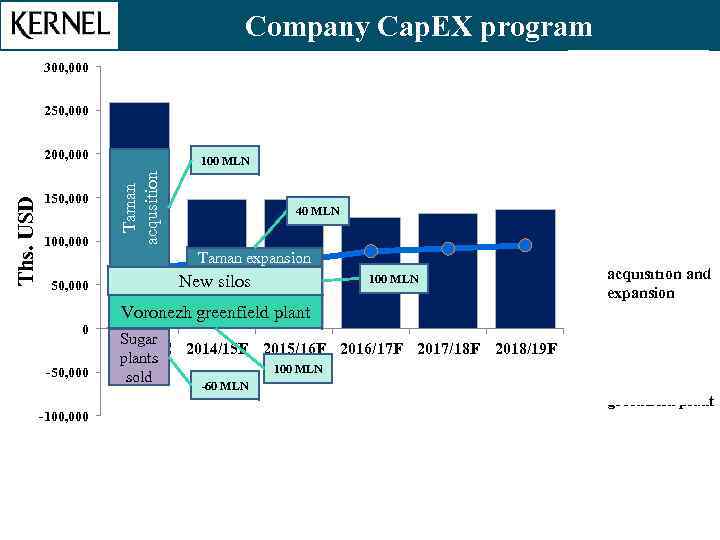

. Company Cap. EX program Depreciation 300, 000 250, 000 Other capex 150, 000 100, 000 50, 000 0 -50, 000 -100, 000 100 MLN Taman acqusition Ths. USD 200, 000 Sugar plants sold 40 MLN Taman expansion New silos 100 MLN Voronezh greenfield plant Sugar 2013/14 E 2014/15 F 2015/16 F 2016/17 F 2017/18 F 2018/19 F plants 100 MLN sold -60 MLN Taman acquisition and expansion New silos Voronezh greenfield plant

. Company Cap. EX program Depreciation 300, 000 250, 000 Other capex 150, 000 100, 000 50, 000 0 -50, 000 -100, 000 100 MLN Taman acqusition Ths. USD 200, 000 Sugar plants sold 40 MLN Taman expansion New silos 100 MLN Voronezh greenfield plant Sugar 2013/14 E 2014/15 F 2015/16 F 2016/17 F 2017/18 F 2018/19 F plants 100 MLN sold -60 MLN Taman acquisition and expansion New silos Voronezh greenfield plant

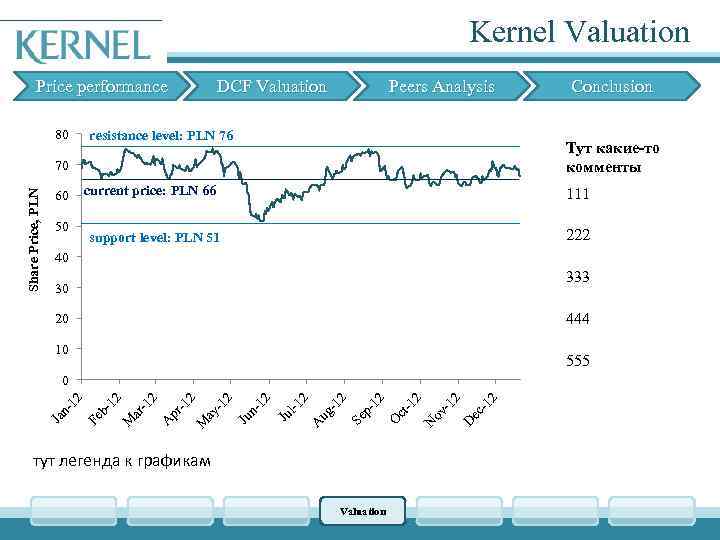

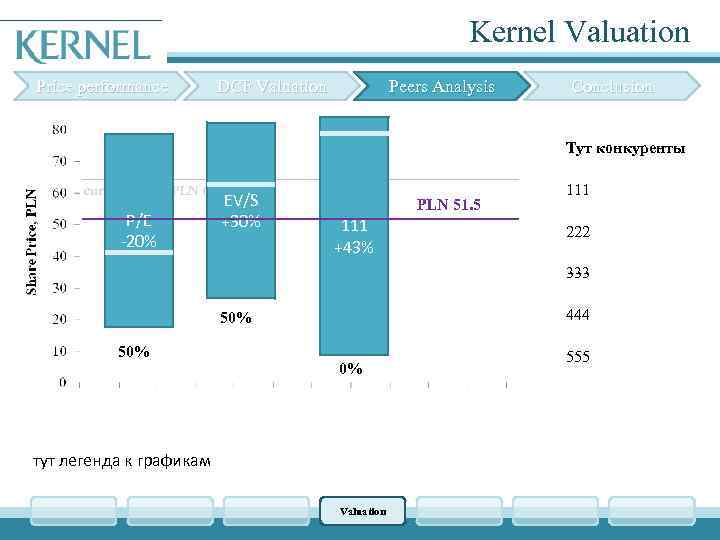

Kernel Valuation Price performance 80 DCF Valuation Peers Analysis resistance level: PLN 76 Тут какие-то комменты Share Price, PLN 70 60 50 Conclusion current price: PLN 66 111 support level: PLN 51 222 40 333 30 444 20 10 555 Ja n 12 Fe b 12 M ar -1 2 A pr -1 2 M ay -1 2 Ju n 12 Ju l-1 2 A ug -1 2 Se p 12 O ct -1 2 N ov -1 2 D ec -1 2 0 тут легенда к графикам Valuation

Kernel Valuation Price performance 80 DCF Valuation Peers Analysis resistance level: PLN 76 Тут какие-то комменты Share Price, PLN 70 60 50 Conclusion current price: PLN 66 111 support level: PLN 51 222 40 333 30 444 20 10 555 Ja n 12 Fe b 12 M ar -1 2 A pr -1 2 M ay -1 2 Ju n 12 Ju l-1 2 A ug -1 2 Se p 12 O ct -1 2 N ov -1 2 D ec -1 2 0 тут легенда к графикам Valuation

Kernel Valuation Price performance DCF Valuation Peers Analysis Conclusion Тут конкуренты current price: PLN 66 P/E -20% EV/S +30% PLN 51. 5 111 +43% 111 222 333 444 50% 0% тут легенда к графикам Valuation 555

Kernel Valuation Price performance DCF Valuation Peers Analysis Conclusion Тут конкуренты current price: PLN 66 P/E -20% EV/S +30% PLN 51. 5 111 +43% 111 222 333 444 50% 0% тут легенда к графикам Valuation 555

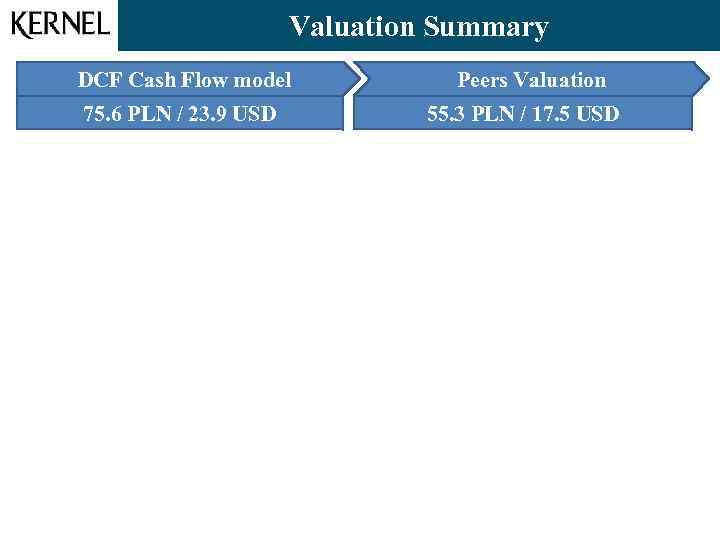

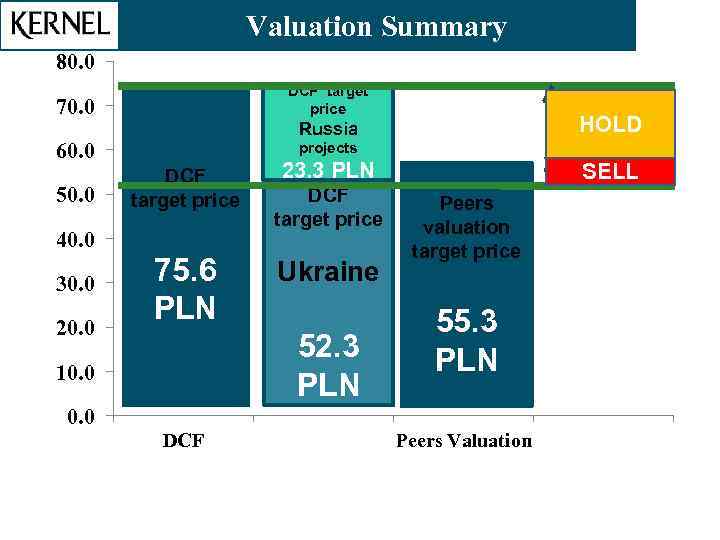

Valuation Summary DCF Cash Flow model 75. 6 PLN / 23. 9 USD Peers Valuation 55. 3 PLN / 17. 5 USD

Valuation Summary DCF Cash Flow model 75. 6 PLN / 23. 9 USD Peers Valuation 55. 3 PLN / 17. 5 USD

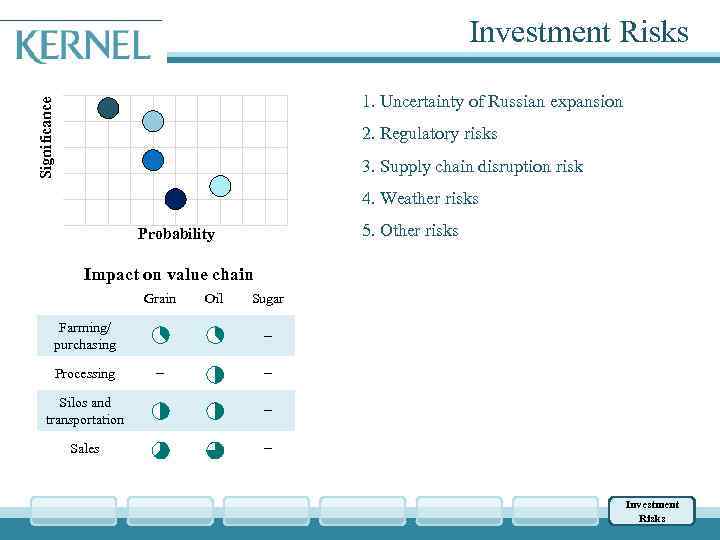

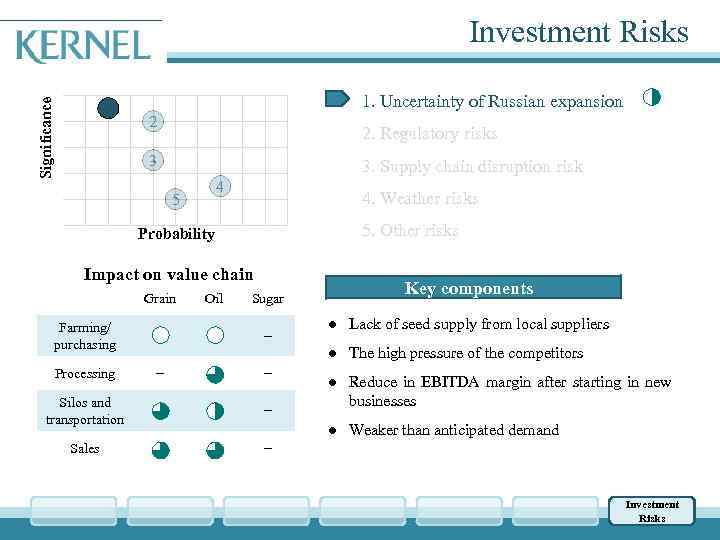

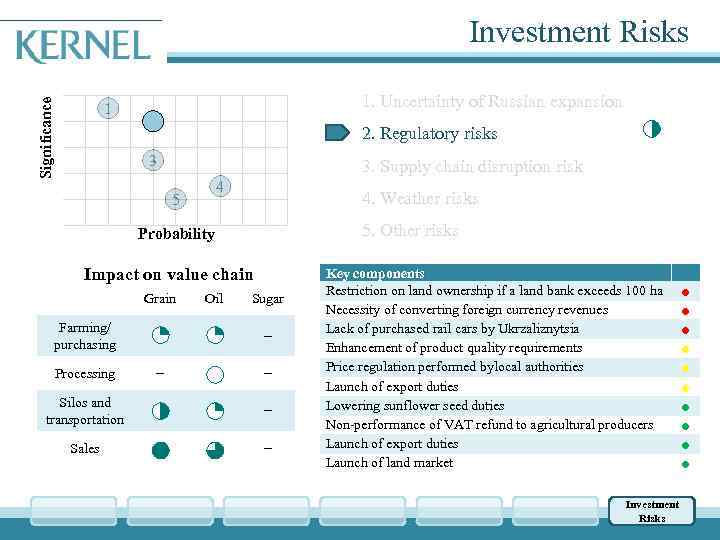

Significance Investment Risks 1 1. Uncertainty of Russian expansion 2 2. Regulatory risks 3 3. Supply chain disruption risk 4 5 4. Weather risks 5. Other risks Probability Impact on value chain Grain Farming/ purchasing Processing Oil Sugar − − − Silos and transportation − Sales − Investment Risks

Significance Investment Risks 1 1. Uncertainty of Russian expansion 2 2. Regulatory risks 3 3. Supply chain disruption risk 4 5 4. Weather risks 5. Other risks Probability Impact on value chain Grain Farming/ purchasing Processing Oil Sugar − − − Silos and transportation − Sales − Investment Risks

Significance Investment Risks 1 1. Uncertainty of Russian expansion 2 2. Regulatory risks 3 3. Supply chain disruption risk 4 5 4. Weather risks 5. Other risks Probability Impact on value chain Grain Farming/ purchasing Processing Oil Sugar − − − Silos and transportation − Sales Key components ● Lack of seed supply from local suppliers ● The high pressure of the competitors ● Reduce in EBITDA margin after starting in new businesses − ● Weaker than anticipated demand Investment Risks

Significance Investment Risks 1 1. Uncertainty of Russian expansion 2 2. Regulatory risks 3 3. Supply chain disruption risk 4 5 4. Weather risks 5. Other risks Probability Impact on value chain Grain Farming/ purchasing Processing Oil Sugar − − − Silos and transportation − Sales Key components ● Lack of seed supply from local suppliers ● The high pressure of the competitors ● Reduce in EBITDA margin after starting in new businesses − ● Weaker than anticipated demand Investment Risks

Significance Investment Risks 1 1. Uncertainty of Russian expansion 2 2. Regulatory risks 3 3. Supply chain disruption risk 4 5 4. Weather risks 5. Other risks Probability Impact on value chain Grain Farming/ purchasing Processing Oil Sugar − − − Silos and transportation − Sales − Key components Restriction on land ownership if a land bank exceeds 100 ha Necessity of converting foreign currency revenues Lack of purchased rail cars by Ukrzaliznytsia Enhancement of product quality requirements Price regulation performed bylocal authorities Launch of export duties Lowering sunflower seed duties Non-performance of VAT refund to agricultural producers Launch of export duties Launch of land market Investment Risks ● ● ● ● ●

Significance Investment Risks 1 1. Uncertainty of Russian expansion 2 2. Regulatory risks 3 3. Supply chain disruption risk 4 5 4. Weather risks 5. Other risks Probability Impact on value chain Grain Farming/ purchasing Processing Oil Sugar − − − Silos and transportation − Sales − Key components Restriction on land ownership if a land bank exceeds 100 ha Necessity of converting foreign currency revenues Lack of purchased rail cars by Ukrzaliznytsia Enhancement of product quality requirements Price regulation performed bylocal authorities Launch of export duties Lowering sunflower seed duties Non-performance of VAT refund to agricultural producers Launch of export duties Launch of land market Investment Risks ● ● ● ● ●

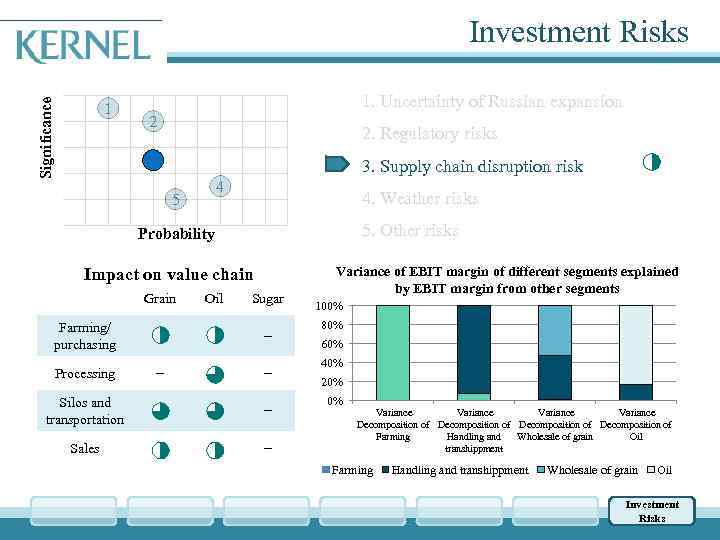

Significance Investment Risks 1 1. Uncertainty of Russian expansion 2 2. Regulatory risks 3 3. Supply chain disruption risk 4 5 4. Weather risks 5. Other risks Probability Impact on value chain Grain Farming/ purchasing Processing Oil Sugar − − − Silos and transportation − Sales − Variance of EBIT margin of different segments explained by EBIT margin from other segments 100% 80% 60% 40% 20% 0% Variance Decomposition of Farming Handling and Wholesale of grain Oil transhippment Farming Handling and transhippment Wholesale of grain Oil Investment Risks

Significance Investment Risks 1 1. Uncertainty of Russian expansion 2 2. Regulatory risks 3 3. Supply chain disruption risk 4 5 4. Weather risks 5. Other risks Probability Impact on value chain Grain Farming/ purchasing Processing Oil Sugar − − − Silos and transportation − Sales − Variance of EBIT margin of different segments explained by EBIT margin from other segments 100% 80% 60% 40% 20% 0% Variance Decomposition of Farming Handling and Wholesale of grain Oil transhippment Farming Handling and transhippment Wholesale of grain Oil Investment Risks

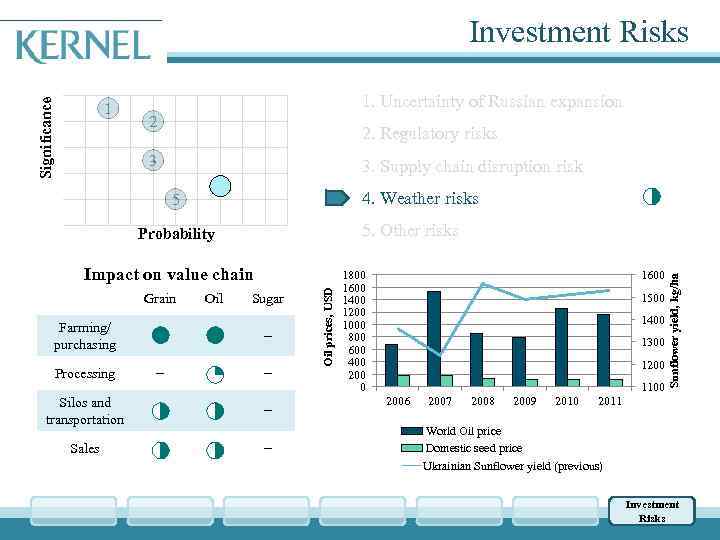

1 1. Uncertainty of Russian expansion 2 2. Regulatory risks 3 3. Supply chain disruption risk 4 5 4. Weather risks 5. Other risks Probability Grain Farming/ purchasing Processing Oil Sugar − − − Silos and transportation − Sales − Oil prices, USD Impact on value chain 1800 1600 1400 1200 1000 800 600 400 200 0 1600 1500 1400 1300 1200 1100 2006 2007 2008 2009 2010 Sunflower yield, kg/ha Significance Investment Risks 2011 World Oil price Domestic seed price Ukrainian Sunflower yield (previous) Investment Risks

1 1. Uncertainty of Russian expansion 2 2. Regulatory risks 3 3. Supply chain disruption risk 4 5 4. Weather risks 5. Other risks Probability Grain Farming/ purchasing Processing Oil Sugar − − − Silos and transportation − Sales − Oil prices, USD Impact on value chain 1800 1600 1400 1200 1000 800 600 400 200 0 1600 1500 1400 1300 1200 1100 2006 2007 2008 2009 2010 Sunflower yield, kg/ha Significance Investment Risks 2011 World Oil price Domestic seed price Ukrainian Sunflower yield (previous) Investment Risks

. Valuation Summary 80. 0 DCF target price 70. 0 Russia 60. 0 50. 0 projects DCF target price 40. 0 30. 0 20. 0 Technical analysis HOLD price SELL tunnel 75. 6 PLN 23. 3 PLN DCF target price Ukraine 52. 3 PLN 10. 0 Peers valuation target price 55. 3 PLN 0. 0 DCF Peers Valuation

. Valuation Summary 80. 0 DCF target price 70. 0 Russia 60. 0 50. 0 projects DCF target price 40. 0 30. 0 20. 0 Technical analysis HOLD price SELL tunnel 75. 6 PLN 23. 3 PLN DCF target price Ukraine 52. 3 PLN 10. 0 Peers valuation target price 55. 3 PLN 0. 0 DCF Peers Valuation

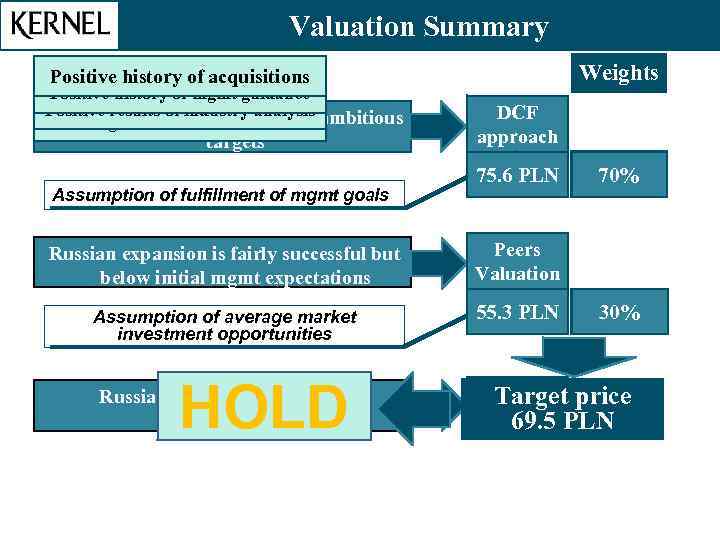

. Valuation Summary Weights Positive history of acquisitions Positive history of mgmt guidance Positive results of industry analysis ambitious 100% fulfillment of managerial Entering new market is still a risk targets Assumption of fulfillment of mgmt goals DCF approach 75. 6 PLN Russian expansion is fairly successful but below initial mgmt expectations Peers Valuation Assumption of average market investment opportunities 55. 3 PLN 20% 40% ? 70% HOLD Russian market is completely unsuccessful Highly Target 30% ? price improbable PLN 69. 5

. Valuation Summary Weights Positive history of acquisitions Positive history of mgmt guidance Positive results of industry analysis ambitious 100% fulfillment of managerial Entering new market is still a risk targets Assumption of fulfillment of mgmt goals DCF approach 75. 6 PLN Russian expansion is fairly successful but below initial mgmt expectations Peers Valuation Assumption of average market investment opportunities 55. 3 PLN 20% 40% ? 70% HOLD Russian market is completely unsuccessful Highly Target 30% ? price improbable PLN 69. 5

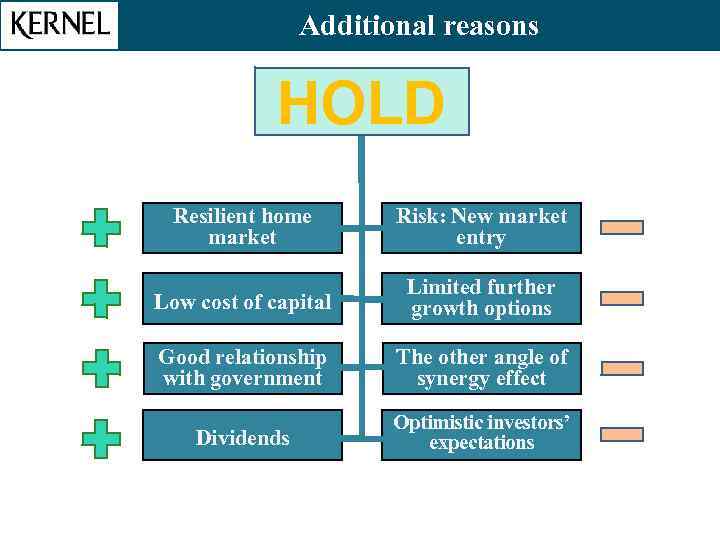

. Additional reasons Valuation Summary HOLD Resilient home market Risk: New market entry Low cost of capital Limited further growth options Good relationship with government The other angle of synergy effect Dividends Optimistic investors’ expectations

. Additional reasons Valuation Summary HOLD Resilient home market Risk: New market entry Low cost of capital Limited further growth options Good relationship with government The other angle of synergy effect Dividends Optimistic investors’ expectations