44ace0aa9e2ef40431613fcb09ae34f9.ppt

- Количество слайдов: 36

Certificates of Insurance Webinar Tuesday, July 19, 2011 Viewing Instructions: 1. Slides will advance automatically. 2. To advance manually, double click with your mouse or press arrow button twice. 3. If advancing backwards, click speaker icon to start audio. 1

PIA National Certificates Webinar David Eppstein, Assistant Vice President, Regulatory Affairs, PIA National Adam Felton, Director of Insurance Services, PIA Services, Inc. Ann Henstrand, Chief Compliance Officer, Government & Industry Affairs, ACORD Kristina Dixon, U. S. Risk Underwriters, Professional Division Keith Savino, Chief Operating Officer, WRG Insurance and PIA National ACORD Representative 2

What is a certificate of insurance? • • A Certificate of Insurance is a document that provides information about insurance policies Millions of Insurance Certificates are issued every year, primarily in the United States. The majority of certificates are issued upon policy renewal to provide this information to third parties. These third parties are known as certificate requestors/holders. Certificates list one or more lines of insurance, the limits associated with those coverages and the insurer providing the coverage Every certificate must include the following 3 key provisions: ― Information Only Provision ― Policy Governing Statement ― Notice of Cancellation 3

What is the problem? • Independent agents are receiving demands from noninsurance entity 3 rd parties to issue certificates that do not comply with the underlying policy terms. • This puts agents in a difficult position because they either have to issue the flawed certificate or risk losing the business. • Many departments have issued bulletins making it clear that this practice is illegal and in some cases this has cured the problem but in other cases these demands are still being made. 4

What is the Solution? In 2008 PIA worked with other agent associations, carriers, other interested parties, regulators and legislators in Louisiana to help craft a solution. The legislation, along with the subsequent regulation, issued by the department largely resolved the problem. 5

What does the bill do? The legislation makes it clear that a certificate is for information only and can not change the policy terms. It makes it illegal to demand or issue certificates that do not reflect the policy terms and requires the forms to be filed and approved by the department. 6

Efforts in other states Recognizing the success of the Louisiana efforts we worked with our local PIA state affiliates to help resolve the problems they have. Several states have enacted, or are considering enacting, legislation similar to Louisiana. 7

NCOIL Certificates Model In an effort to bring certainty and uniformity to certificates, the National Conference of Insurance Legislators (NCOIL) is considering a model that contains similar provisions as the Louisiana bill. PIA supports the base model and is working with the legislators on some amendments to improve the model further. 8

NAIC Activity The National Association of Insurance Commissioners (NAIC) has expressed some renewed interest in this issue. We are hopeful the regulators may consider issuing a model bulletin that would complement the NCOIL model. 9

Lender Interests Lenders have a legitimate interest in making sure they have evidence that a property is covered by insurance. In some cases, the policy may not be available so what can the lenders rely upon? The certificate of insurance is not the proper document for lenders. 10

The Binder The certificate of insurance is NOT intended to fully satisfy the needs of lenders. The binder and/or the policy is. If the policy is not available, the lenders should rely on the binder as evidence of coverage. 11

Liability vs. Property Coverage We are attempting to resolve the problems agents have with 3 rd party demands for certificates of liability coverage. The issue the lenders have with evidence of property coverage is separate. These are two different problems requiring two different solutions. 12

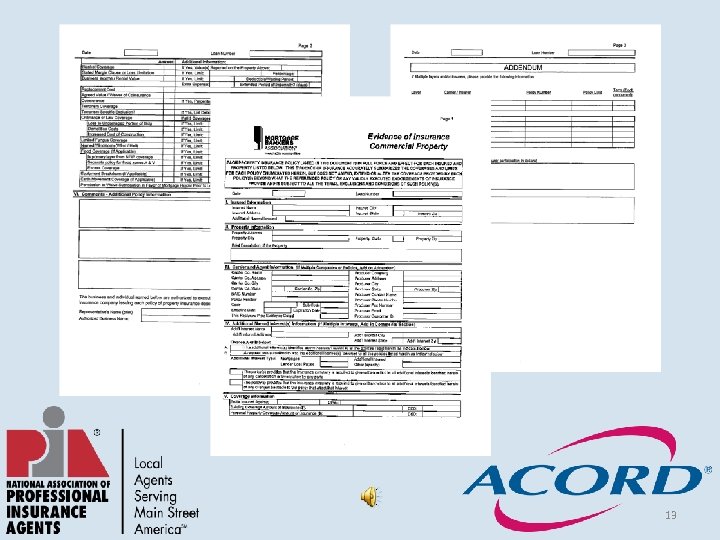

13

A Certificate of Insurance is NOT an Insurance Policy • No coverage is provided, endorsed, amended, extended or altered in any way by the issuance of any Certificate to a Certificate Holder. Only an endorsement, rider or amendment to the policy can effect changes in coverage, such as Additional Insureds, Waiver of Subrogation or Loss Payee • Reference to a contract between the client and a third party on a Certificate does not provide coverage. Such coverage is provided only to the extent that it is contained in the subject policy or endorsed thereto. • The right to receive notice of cancellation is only provided within the policy terms and condition. 14

Use Approved Forms • 13 States Require Approval of Forms and this proposed MBA form would need to be approved by the department before it can be used in those states. • ACORD Forms are all approved in each state where approval is required. 15

PIA Supports ACORD • The Proposed MBA Form would have to be manually filled in • PIA National CAN NOT support the use of the proposed MBA form • ACORD forms are compatible with automated agency systems 16

Agency Procedures • • What happens when agents get a request for a certificate? Have agency procedures in place Check with your carrier When issuing certificates of insurance, insurance agents should consider the following: – What is the purpose of the certificate? – What does your agency agreement with the carrier/MGA state? Do you have the authority to issue certificates of insurance on behalf of the carrier/MGA? 17

• When issuing certificates make sure the appropriate information is represented, e. g. type of insurance/coverage, policy number, policy term, limits of insurance, carrier and if applicable the appropriate additional insured is stated. • Where can I get the Latest ACORD Forms? 18

ACORD Highlights – Who We Are • Association for Cooperative Operations Research and Development. • A global, not-for-profit standards development organization. • Membership-driven, serving insurance and related financial service industries. 19

ACORD Forms Improve Efficiency • A single document that can be used with multiple partners • Reduces duplication of work 20

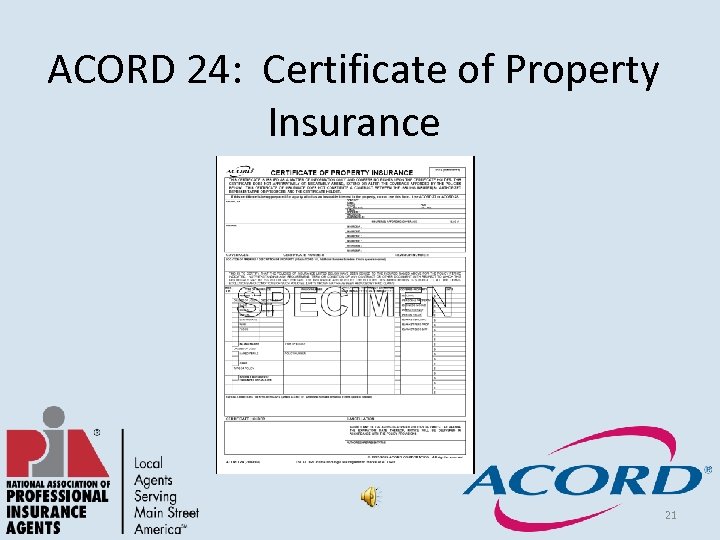

ACORD 24: Certificate of Property Insurance 21

ACORD 25: Certificate of Liability Insurance 22

Why do brokers and agents issue Certificates of Insurance? • Their Client requires certificates of insurance because: • They are the tenant in a building, and owner is requesting evidence of liability insurance • They are the mortgagor of a building, and owner is requesting evidence of property insurance • They leased equipment and the owner of equipment wants evidence of property insurance while equipment is in possession of our client • They need evidence of workers compensation insurance in order to obtain a contract to work for someone, i. e. security guard, temp services, contractors entering job sites etc. • Often the delivery of a certificate is time sensitive and is critical to the completion of a commercial transaction 23

• • • What is usually included on a certificate? Date of issuance Producer (agent/broker) Insured Insurance Companies providing the coverage Type of insurance Policy numbers, effective and expiration dates Limits carried Description of operations/activities to which the certificate pertains Certificate holder/requestor Cancellation provision 24

Information Only Provision • “This Certificate is issued as a matter of information only and confers no rights upon the Certificate Holder. This Certificate does not affirmatively or negatively amend, extend or alter the coverage afforded by the policies below. This Certificate of Insurance does not constitute a contract between the issuing insurer(s), authorized representative or producer, and the Certificate Holder. ” 25

Policy Governing Statement • “This is to certify that the policies of insurance described herein have been issued to the insured named herein for the policy period indicated. Notwithstanding any requirement, term or condition of any contract or other document with respect to which the Certificate may be issued or may pertain, the insurance afforded by the policies described herein is subject to all the terms, conditions and exclusions of such policies. (Aggregate) Limits shown my have been reduced by paid claims. “ 26

30 -Day Cancellation Notification • Previous wording: “Should any of the above described policies be cancelled before the expiration date thereof, the issuing insurer will endeavor to mail ____ days written notice…” • Current wording: “… expiration date thereof, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. ” 27

Only current editions of any ACORD form can be used • Older ACORD Certificates that have been withdrawn from our forms library are obsolete and can be non-compliant. It is imperative that all ACORD members to use the most current and compliant versions of our forms. • Any earlier editions of our forms that have been withdrawn from the forms library are not kept up-to-date as to regulatory requirements, and therefore should not be distributed for use. 28

ACORD Forms Availability • ACORD. org – Forms Programs – e. Forms – Agents/Distributors/Brokers – Insurers/Reinsurers – Solution Providers • Agency Management System Vendors 29

ACORD Forms Programs http: //www. acord. org/standards/forms/ 30

PIA & ACORD • History of Agents and ACORD • Industry Participation • Future Efforts 31

ACORD Development Process • Members Request New Standards – Formal Process for a Member to Request a New Standard – Reviewed By Member Leadership for Approval • Working Groups Create Standard – Once Approved Members Meet Periodically to Discuss and Develop the Standard • Final Draft Published – Once the Development is Complete, A Final Draft is Created • Membership Review – Members Review and Discuss the Final Draft 32

ACORD Implementation of Development • Publication of the Candidate Recommendation – Once the Final Draft is complete, a Candidate Recommendation is Published – Implementation Testing Begins – Several Candidate Recommendations Can Be Published Throughout Testing • Final Release – Implementation Testing is Completed – Final Discussion by Members – New Standard is Published 33

ACORD Maintenance Cycle • Six Month Cycle of Maintenance – Allows Members to Request Changes – Members Review All Changes – New Standard Published • Why Six Months? – Quick Support for Market Changes – Allows Time for Each Change to Be Discussed and Evaluated – Provides a Predictable Pattern for Changes – Allows for Incremental Growth of Standards 34

GET INVOLVED! 35

Have a question? 36

44ace0aa9e2ef40431613fcb09ae34f9.ppt