Lecture_1.pptx

- Количество слайдов: 37

CERGE-EI Financial Management Fall 2014

Course Syllabus Lecturer: Tamara Vovchak (CERGE-EI) E-mail: tamara. vovchak@cerge-ei. cz Main textbook: Brigham, E. F. and Houston, J. F. Fundamentals of Financial Management. (All editions) Supplementary textbooks: Ross, S. A. , Westerfield, R. W. and Jordan, B. D. Fundamentals of Corporate Finance. (All editions) Brealey, R. A. , Myers, S. C. and Allen, F. Principles of Corporate Finance. (All editions)

Lecture 1: Financial Management, Financial Statements and Taxes • • • The Subject of Finance and Financial Management Decisions Forms of Business Organization The Purpose of the Firm Financial Statements Individual and Corporate Taxes

What is Finance? • Finance is a Money Management

Fields of Finance 1. Financial Management = Corporate/Business Finance 2. Financial Economics • Financial Markets, Institutions and Instruments 3. Investments • Security Analysis, Portfolio Theory, Market Analysis, Behavioral Finance 4. Personal Finance 5. Public Finance

Financial Management What is Financial Management? • The management of the finances of a business firm • Concerns the acquisition, financing, and management of assets with some overall goal in mind Financial Management Decisions: 1. Investment decision (capital budgeting) 2. Financing decision (capital structure) 3. Asset management decision (working capital management) 4. The dividend decision

Investment Decisions • What investment projects a firm has? • Are they worth taking? • How to allocate capital among profitable projects? Capital budgeting – a process of planning and managing a firm’s long-term investments. Financing Decisions • How firm will finance its investment projects? • What is the best type of financing? • What is the best financing mix? Capital structure – the mixture of debt and equity maintained by a firm.

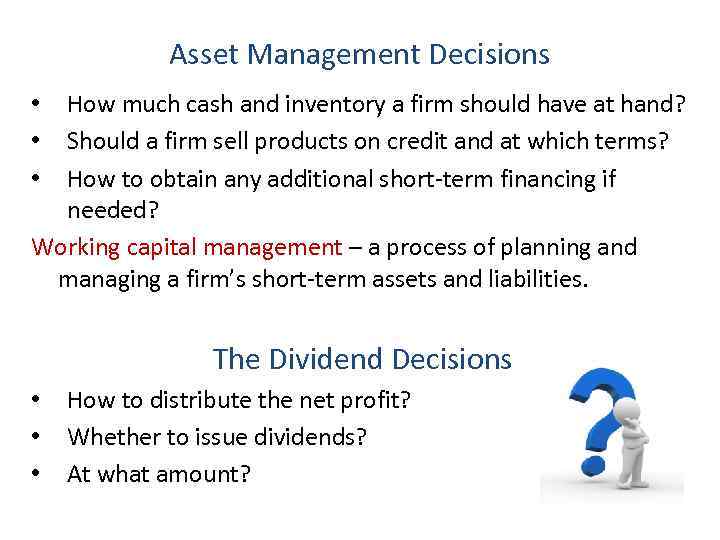

Asset Management Decisions How much cash and inventory a firm should have at hand? Should a firm sell products on credit and at which terms? How to obtain any additional short-term financing if needed? Working capital management – a process of planning and managing a firm’s short-term assets and liabilities. • • • The Dividend Decisions • • • How to distribute the net profit? Whether to issue dividends? At what amount?

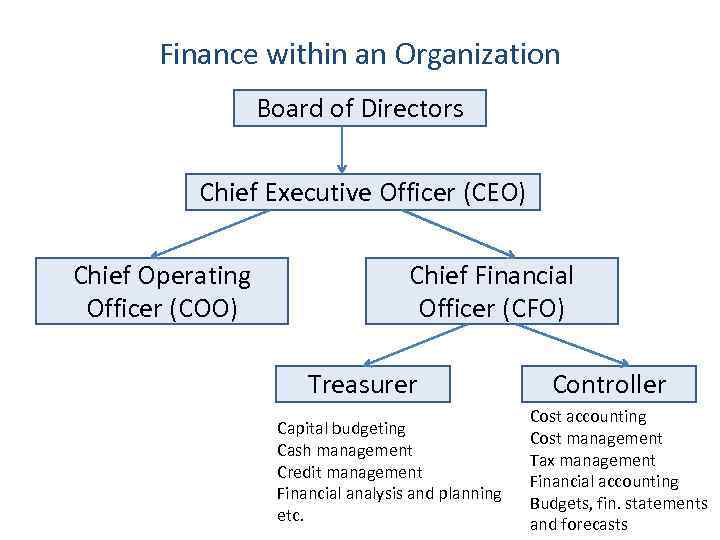

Finance within an Organization Board of Directors Chief Executive Officer (CEO) Chief Operating Officer (COO) Chief Financial Officer (CFO) Treasurer Capital budgeting Cash management Credit management Financial analysis and planning etc. Controller Cost accounting Cost management Tax management Financial accounting Budgets, fin. statements and forecasts

Forms of Business Organization The U. S. has four main forms of business organization: • Sole Proprietorship – an unincorporated business owned by one individual • Partnership - a business form in which two or more individuals act as owners • Corporation - a business form legally separate from its owners and managers • Limited liability company – a hybrid between a partnership and corporation

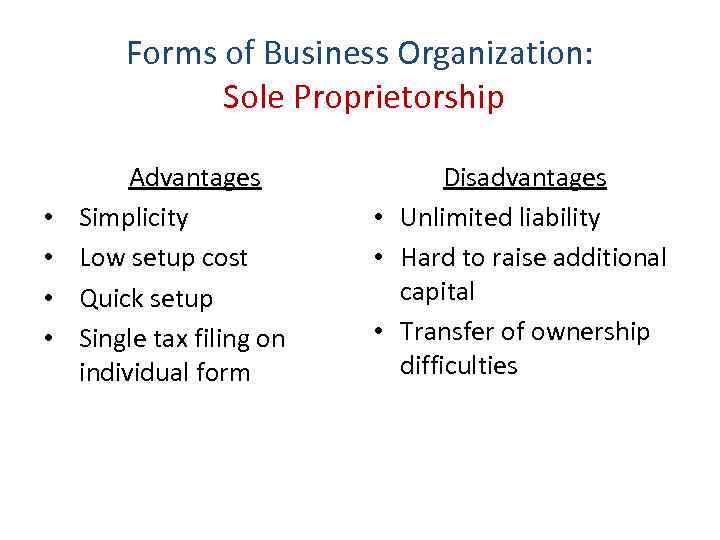

Forms of Business Organization: Sole Proprietorship • • Advantages Simplicity Low setup cost Quick setup Single tax filing on individual form Disadvantages • Unlimited liability • Hard to raise additional capital • Transfer of ownership difficulties

Forms of Business Organization: Partnership • • Advantages Can be simple Low setup cost, but higher than for sole proprietorship Relatively quick setup Avoid corporate income tax Disadvantages • Unlimited liability • Difficult to raise additional capital, but easier than for sole proprietorship • Transfer of ownership difficulties

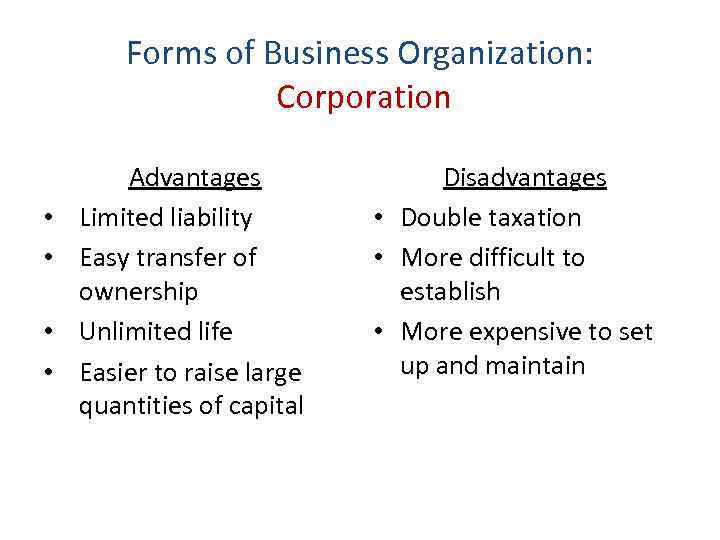

Forms of Business Organization: Corporation • • Advantages Limited liability Easy transfer of ownership Unlimited life Easier to raise large quantities of capital Disadvantages • Double taxation • More difficult to establish • More expensive to set up and maintain

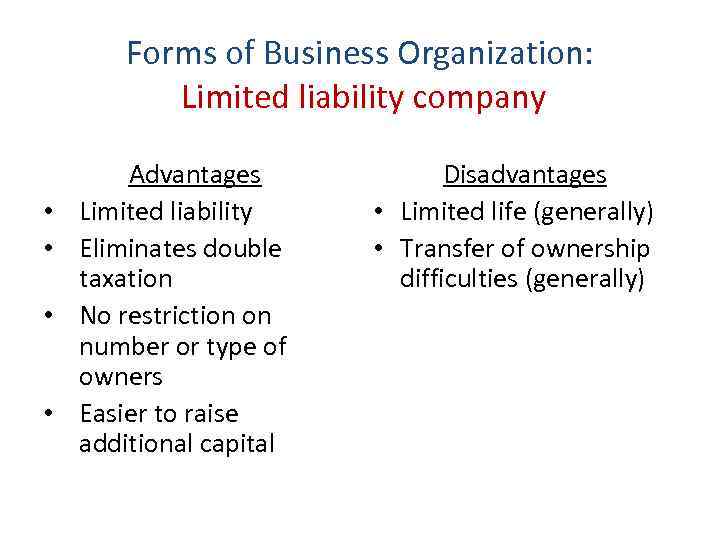

Forms of Business Organization: Limited liability company • • Advantages Limited liability Eliminates double taxation No restriction on number or type of owners Easier to raise additional capital Disadvantages • Limited life (generally) • Transfer of ownership difficulties (generally)

What is the Purpose of the Firm? • Maximization of Shareholder Wealth! Shareholder wealth = the number of shares outstanding * * the market price per share • Maximize the share or the stock price • Problem: Stock prices change over time A manager has to make decisions designed to maximize the firm’s average share price over the long run, not its current market price.

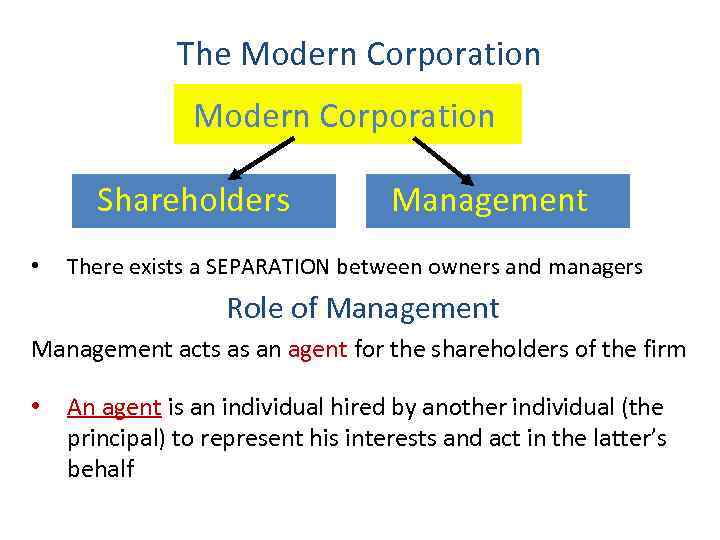

The Modern Corporation Shareholders • Management There exists a SEPARATION between owners and managers Role of Management acts as an agent for the shareholders of the firm • An agent is an individual hired by another individual (the principal) to represent his interests and act in the latter’s behalf

Conflict between Managers and Shareholders Agency problem arises when there is a conflict of interest between the principal and the agent. • • Shareholders interest – to max the long run share price Manager interest – to max their own wealth Motivational tools for managers: 1. Reasonable compensational packages 2. The threat of firing 3. The threat of hostile takeovers

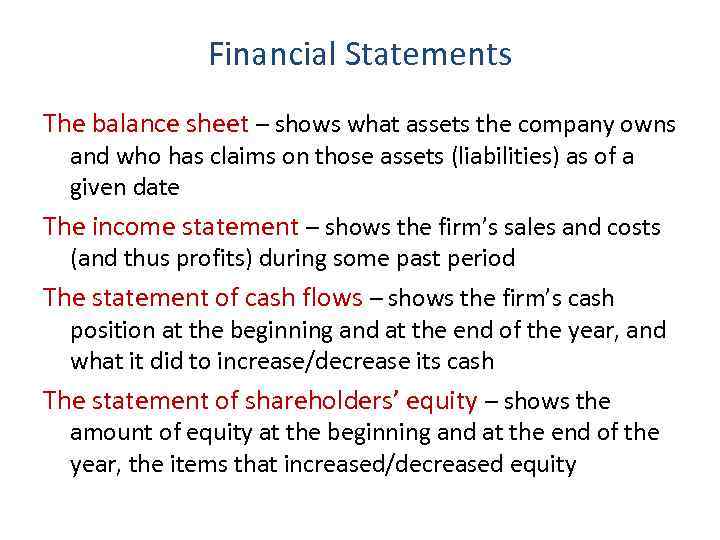

Financial Statements The balance sheet – shows what assets the company owns and who has claims on those assets (liabilities) as of a given date The income statement – shows the firm’s sales and costs (and thus profits) during some past period The statement of cash flows – shows the firm’s cash position at the beginning and at the end of the year, and what it did to increase/decrease its cash The statement of shareholders’ equity – shows the amount of equity at the beginning and at the end of the year, the items that increased/decreased equity

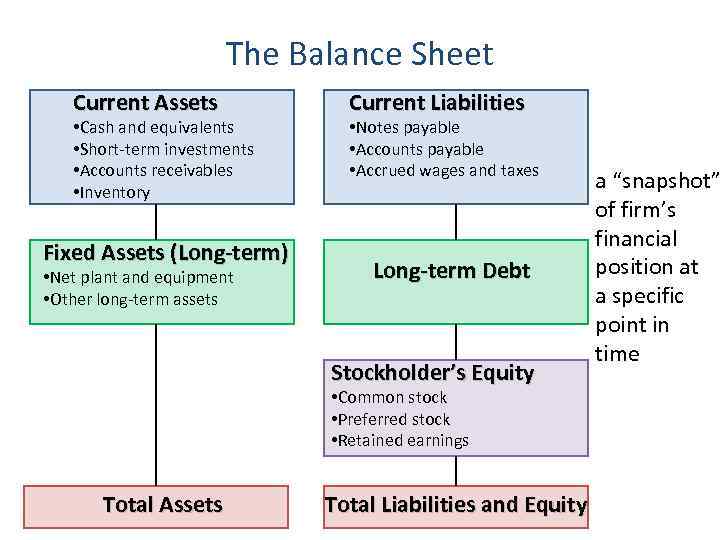

The Balance Sheet Current Assets • Cash and equivalents • Short-term investments • Accounts receivables • Inventory Fixed Assets (Long-term) • Net plant and equipment • Other long-term assets Current Liabilities • Notes payable • Accounts payable • Accrued wages and taxes Long-term Debt Stockholder’s Equity • Common stock • Preferred stock • Retained earnings Total Assets Total Liabilities and Equity a “snapshot” of firm’s financial position at a specific point in time

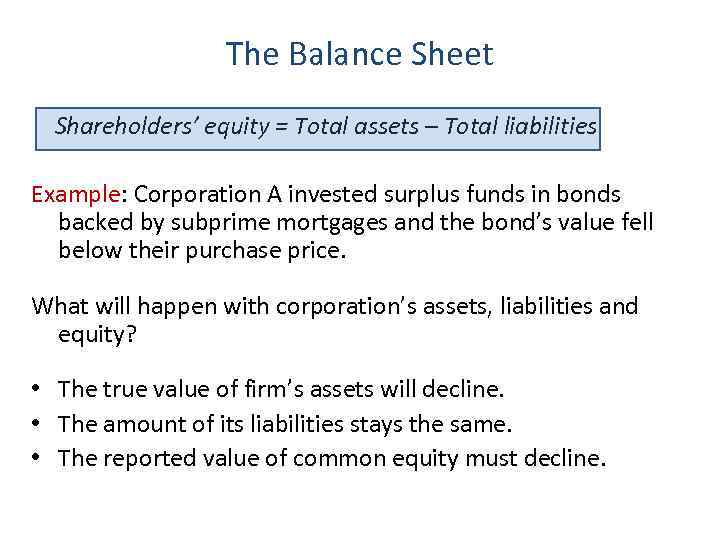

The Balance Sheet Shareholders’ equity = Total assets – Total liabilities Example: Corporation A invested surplus funds in bonds backed by subprime mortgages and the bond’s value fell below their purchase price. What will happen with corporation’s assets, liabilities and equity? • The true value of firm’s assets will decline. • The amount of its liabilities stays the same. • The reported value of common equity must decline.

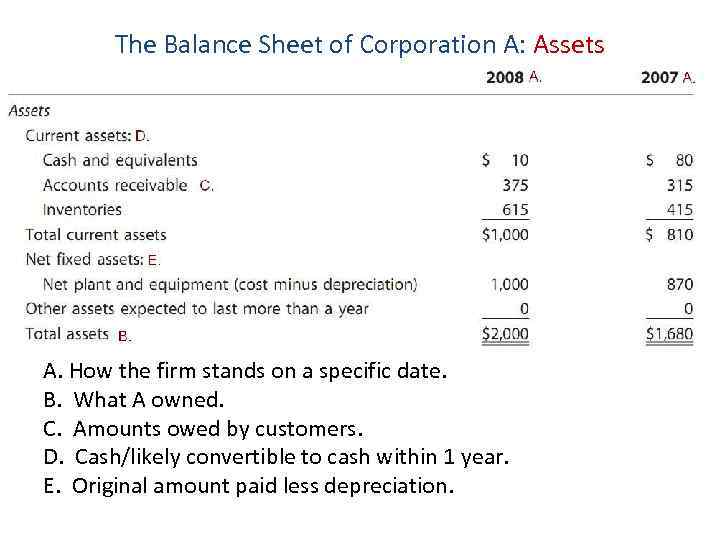

The Balance Sheet of Corporation A: Assets A. How the firm stands on a specific date. B. What A owned. C. Amounts owed by customers. D. Cash/likely convertible to cash within 1 year. E. Original amount paid less depreciation.

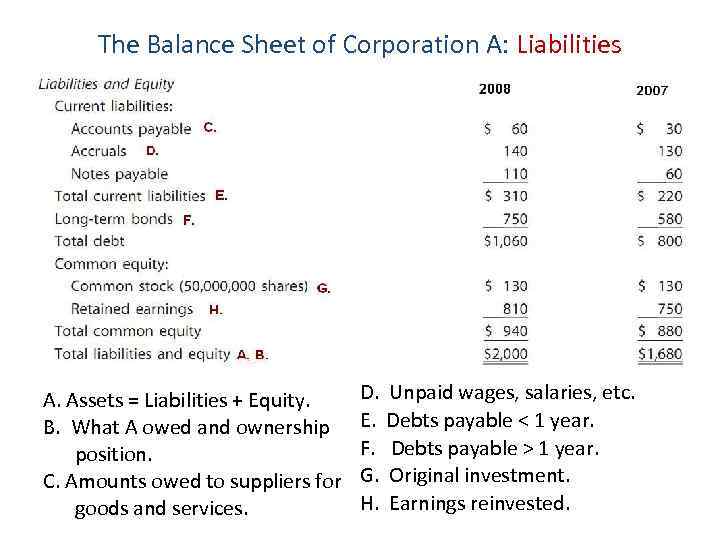

The Balance Sheet of Corporation A: Liabilities A. Assets = Liabilities + Equity. B. What A owed and ownership position. C. Amounts owed to suppliers for goods and services. D. E. F. G. H. Unpaid wages, salaries, etc. Debts payable < 1 year. Debts payable > 1 year. Original investment. Earnings reinvested.

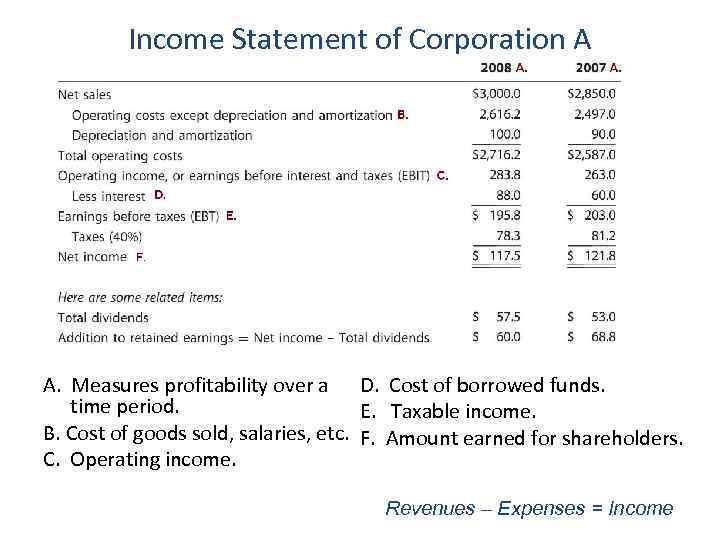

Income Statement of Corporation A A. Measures profitability over a D. Cost of borrowed funds. time period. E. Taxable income. B. Cost of goods sold, salaries, etc. F. Amount earned for shareholders. C. Operating income. Revenues – Expenses = Income

Statement of Cash Flows • a summary of a firm’s payments during a period of time This statement reports cash inflows and outflows based on the firm’s operating, investing and financing activities. Cash flow from operating activities - shows impact of transactions not defined as investing or financing activities. These cash flows are generally the cash effects of transactions that enter into the determination of net income. Cash Flow from investing activities - shows impact of buying and selling fixed assets and debt or equity securities of other entities. Cash Flow from financing activities - shows impact of all cash transactions with shareholders and the borrowing and repaying transactions with lenders.

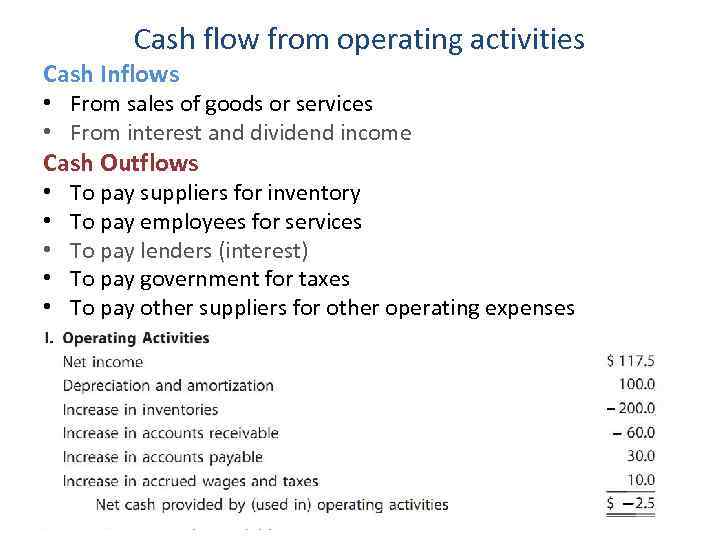

Cash flow from operating activities Cash Inflows • From sales of goods or services • From interest and dividend income Cash Outflows • • • To pay suppliers for inventory To pay employees for services To pay lenders (interest) To pay government for taxes To pay other suppliers for other operating expenses

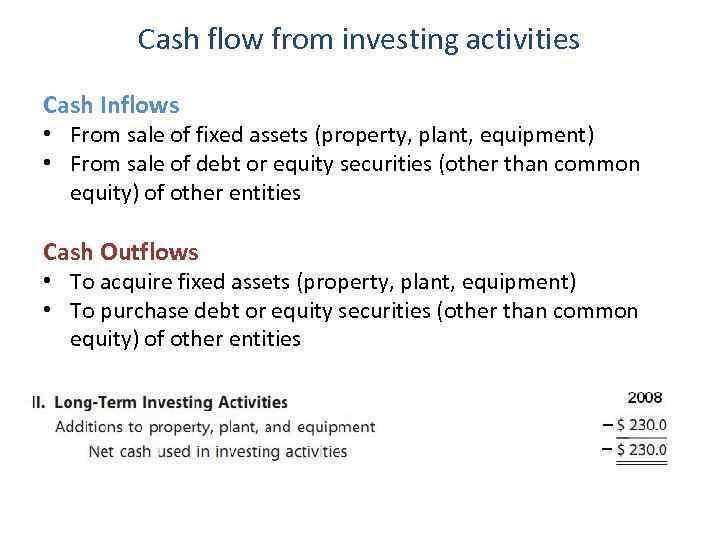

Cash flow from investing activities Cash Inflows • From sale of fixed assets (property, plant, equipment) • From sale of debt or equity securities (other than common equity) of other entities Cash Outflows • To acquire fixed assets (property, plant, equipment) • To purchase debt or equity securities (other than common equity) of other entities

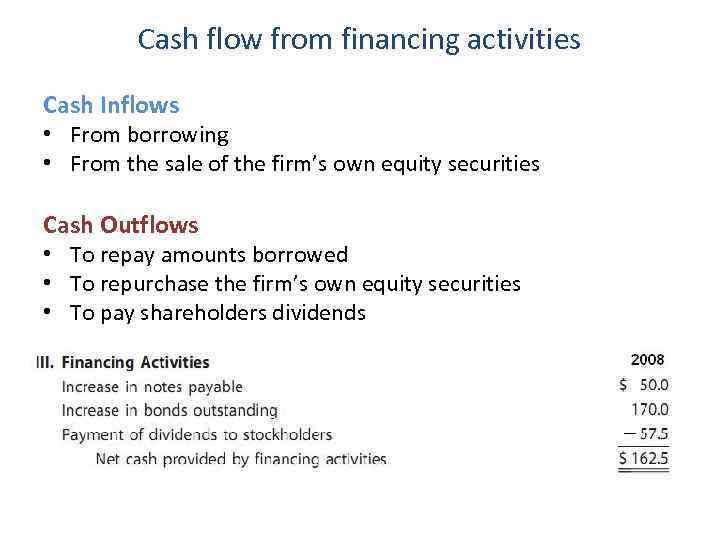

Cash flow from financing activities Cash Inflows • From borrowing • From the sale of the firm’s own equity securities Cash Outflows • To repay amounts borrowed • To repurchase the firm’s own equity securities • To pay shareholders dividends

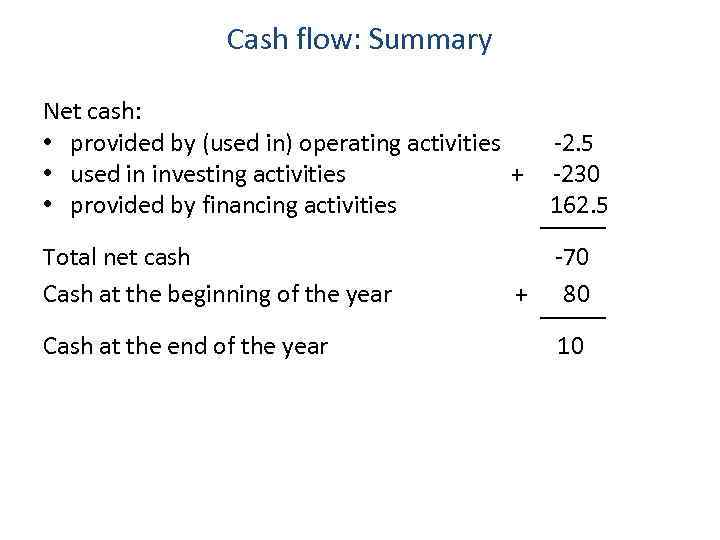

Cash flow: Summary Net cash: • provided by (used in) operating activities • used in investing activities + • provided by financing activities -2. 5 -230 162. 5 Total net cash Cash at the beginning of the year -70 80 Cash at the end of the year + 10

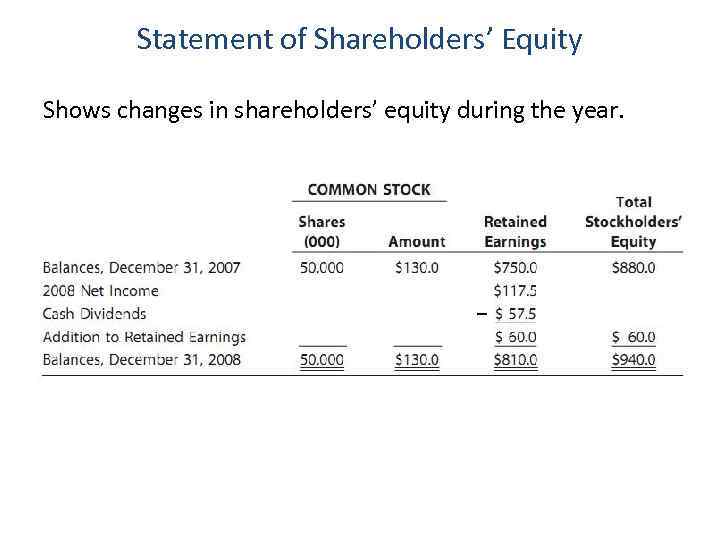

Statement of Shareholders’ Equity Shows changes in shareholders’ equity during the year.

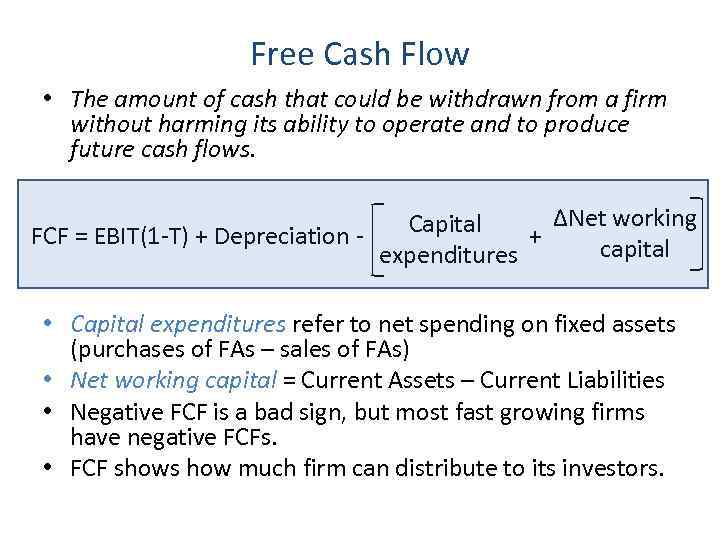

Free Cash Flow • The amount of cash that could be withdrawn from a firm without harming its ability to operate and to produce future cash flows. ΔNet working Capital FCF = EBIT(1 -T) + Depreciation + capital expenditures • Capital expenditures refer to net spending on fixed assets (purchases of FAs – sales of FAs) • Net working capital = Current Assets – Current Liabilities • Negative FCF is a bad sign, but most fast growing firms have negative FCFs. • FCF shows how much firm can distribute to its investors.

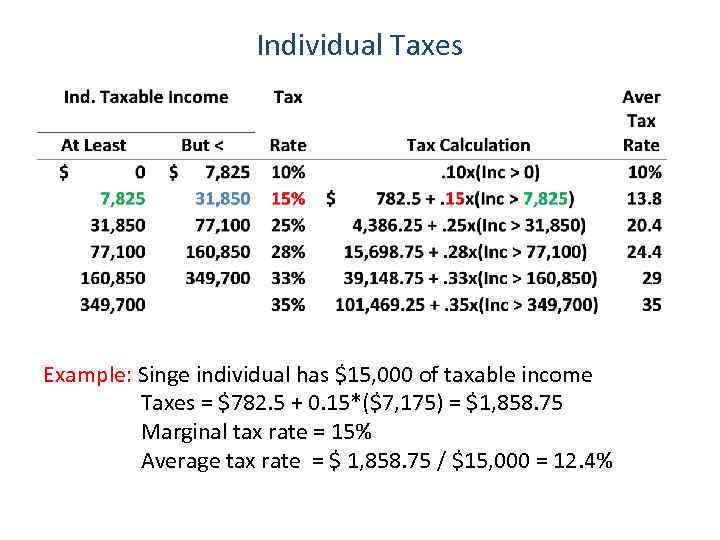

Individual Taxes Example: Singe individual has $15, 000 of taxable income Taxes = $782. 5 + 0. 15*($7, 175) = $1, 858. 75 Marginal tax rate = 15% Average tax rate = $ 1, 858. 75 / $15, 000 = 12. 4%

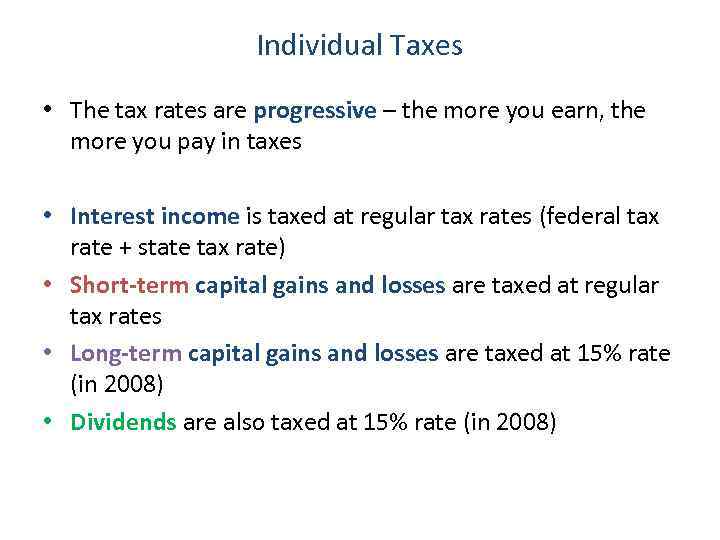

Individual Taxes • The tax rates are progressive – the more you earn, the more you pay in taxes • Interest income is taxed at regular tax rates (federal tax rate + state tax rate) • Short-term capital gains and losses are taxed at regular tax rates • Long-term capital gains and losses are taxed at 15% rate (in 2008) • Dividends are also taxed at 15% rate (in 2008)

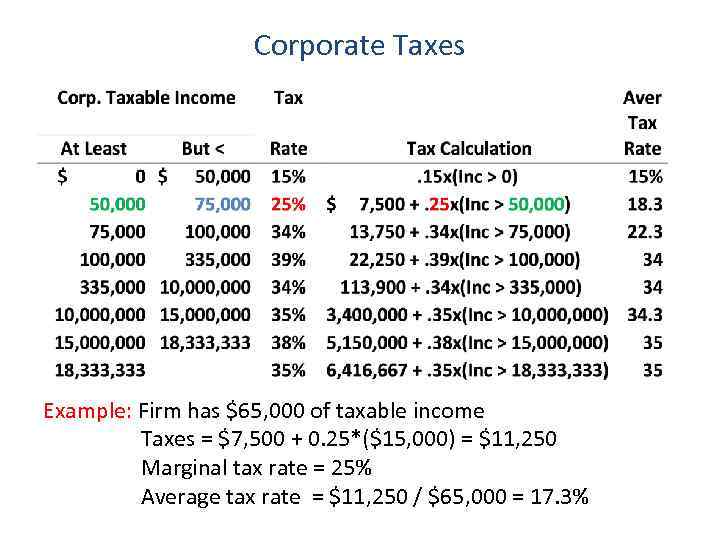

Corporate Taxes Example: Firm has $65, 000 of taxable income Taxes = $7, 500 + 0. 25*($15, 000) = $11, 250 Marginal tax rate = 25% Average tax rate = $11, 250 / $65, 000 = 17. 3%

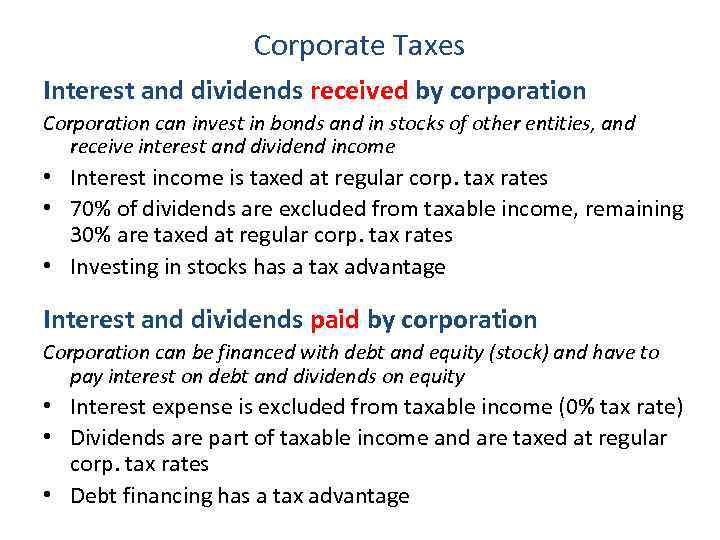

Corporate Taxes Interest and dividends received by corporation Corporation can invest in bonds and in stocks of other entities, and receive interest and dividend income • Interest income is taxed at regular corp. tax rates • 70% of dividends are excluded from taxable income, remaining 30% are taxed at regular corp. tax rates • Investing in stocks has a tax advantage Interest and dividends paid by corporation Corporation can be financed with debt and equity (stock) and have to pay interest on debt and dividends on equity • Interest expense is excluded from taxable income (0% tax rate) • Dividends are part of taxable income and are taxed at regular corp. tax rates • Debt financing has a tax advantage

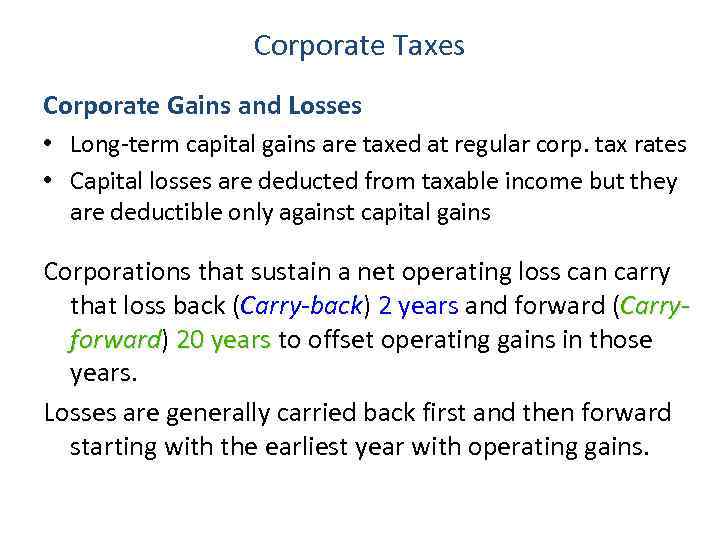

Corporate Taxes Corporate Gains and Losses • Long-term capital gains are taxed at regular corp. tax rates • Capital losses are deducted from taxable income but they are deductible only against capital gains Corporations that sustain a net operating loss can carry that loss back (Carry-back) 2 years and forward (Carryforward) 20 years to offset operating gains in those forward years. Losses are generally carried back first and then forward starting with the earliest year with operating gains.

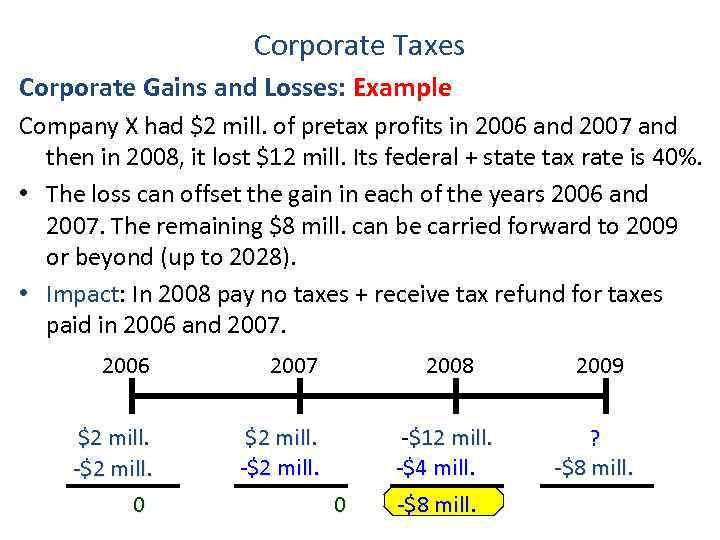

Corporate Taxes Corporate Gains and Losses: Example Company X had $2 mill. of pretax profits in 2006 and 2007 and then in 2008, it lost $12 mill. Its federal + state tax rate is 40%. • The loss can offset the gain in each of the years 2006 and 2007. The remaining $8 mill. can be carried forward to 2009 or beyond (up to 2028). • Impact: In 2008 pay no taxes + receive tax refund for taxes paid in 2006 and 2007. 2006 2007 $2 mill. -$2 mill. 0 2008 $2 mill. -$2 mill. -$12 mill. -$4 mill. 0 2009 ? -$8 mill.

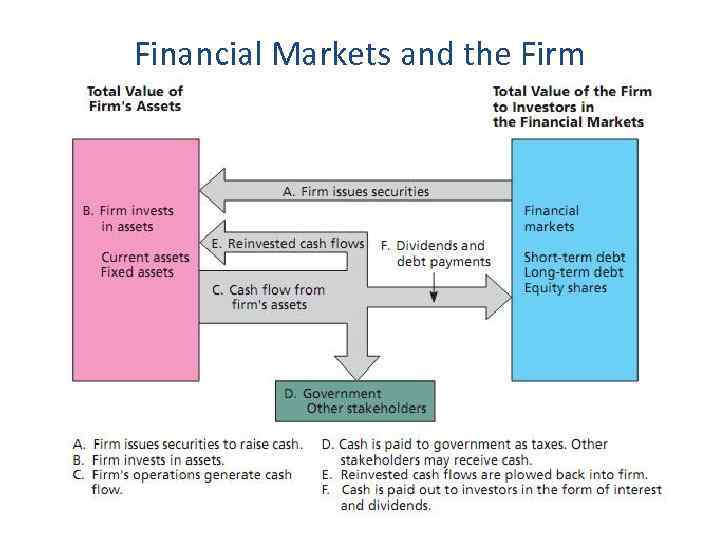

Financial Markets and the Firm

Lecture_1.pptx