1255be46358748c2380abf57b251f8b3.ppt

- Количество слайдов: 50

CEO Summit XIV Welcome & State of the Financial Services Industry Tiburon CEO Summit XIV New York, NY April 10, 2008

CEO Summit XIV Welcome & State of the Financial Services Industry Tiburon CEO Summit XIV New York, NY April 10, 2008

Outline · Tiburon CEO Summit XIV – Vision & History · State of the Financial Services Industry – Recap of the Semi-Annual News: Six Months of Amazing Industry News Stories – Fundamental Industry Trends: Reinforcing Tiburon Research Findings · Leveraging Tiburon Strategic Advisors · Tiburon CEO Summit XIV – Schedule & Tactics 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 1

Outline · Tiburon CEO Summit XIV – Vision & History · State of the Financial Services Industry – Recap of the Semi-Annual News: Six Months of Amazing Industry News Stories – Fundamental Industry Trends: Reinforcing Tiburon Research Findings · Leveraging Tiburon Strategic Advisors · Tiburon CEO Summit XIV – Schedule & Tactics 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 1

The Vision for Tiburon’s CEO Summits Has Not Changed Since CEO Summit I in 2001 (the M Financial Group Story) Tiburon CEO Summits Vision “The financial services industry lacks a CEO level conference that runs across traditional industry lines. I have come to realize that CEOs from many segments are dealing with the same issues from different perspectives. I have benefited greatly from hearing these perspectives, and Tiburon’s clients would as well. My vision is probably most like Allen & Company’s Media Summit, as I envision all CEOs attendees from just the financial services industry” Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 2

The Vision for Tiburon’s CEO Summits Has Not Changed Since CEO Summit I in 2001 (the M Financial Group Story) Tiburon CEO Summits Vision “The financial services industry lacks a CEO level conference that runs across traditional industry lines. I have come to realize that CEOs from many segments are dealing with the same issues from different perspectives. I have benefited greatly from hearing these perspectives, and Tiburon’s clients would as well. My vision is probably most like Allen & Company’s Media Summit, as I envision all CEOs attendees from just the financial services industry” Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 2

Tiburon’s CEO Summits Have Come to Support Two Key Themes, Including Challenging Conventional Wisdom and Maintaining a Consumer Orientation Tiburon CEO Summit Themes Challenging Conventional Wisdom • Tiburon research leads with skeptical view of industry truths • General session guest speakers encouraged to discuss the tough issues • General session panel discussion leaders and break-out session leaders encouraged to stir up true discussion & debate Maintaining a Consumer Orientation • Tiburon opening speech leads with consumer wealth • Three general session panel discussions focus on levels of consumers Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 3

Tiburon’s CEO Summits Have Come to Support Two Key Themes, Including Challenging Conventional Wisdom and Maintaining a Consumer Orientation Tiburon CEO Summit Themes Challenging Conventional Wisdom • Tiburon research leads with skeptical view of industry truths • General session guest speakers encouraged to discuss the tough issues • General session panel discussion leaders and break-out session leaders encouraged to stir up true discussion & debate Maintaining a Consumer Orientation • Tiburon opening speech leads with consumer wealth • Three general session panel discussions focus on levels of consumers Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 3

The Tiburon CEO Summit Planning Committee Deserves Recognition for Helping to Plan & Execute CEO Summit XIV; Thanks! Tiburon CEO Summits Planning Committee • Tim Armour (Janus Capital Group) • Dennis Clark (Advisor Partners) • Tif Joyce (Joyce Financial Management) • Tom Lydon (Global Trends) • Scott Mac. Killop (Frontier Asset Management) • Kevin Malone (Greenrock Research) • Kirk Michie (Triton Pacific) • Skip Schweiss (TD Ameritrade) • Gib Watson (Prima Capital Management) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 4

The Tiburon CEO Summit Planning Committee Deserves Recognition for Helping to Plan & Execute CEO Summit XIV; Thanks! Tiburon CEO Summits Planning Committee • Tim Armour (Janus Capital Group) • Dennis Clark (Advisor Partners) • Tif Joyce (Joyce Financial Management) • Tom Lydon (Global Trends) • Scott Mac. Killop (Frontier Asset Management) • Kevin Malone (Greenrock Research) • Kirk Michie (Triton Pacific) • Skip Schweiss (TD Ameritrade) • Gib Watson (Prima Capital Management) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 4

Tiburon CEO Summit XIV Includes Nine Terrific Guest Speakers… Tiburon CEO Summit XIV Speakers • Walt Bettinger (President, The Charles Schwab Corporation) • Mike Byrum (President, Rydex Investments) • Joe Deitch (CEO, Commonwealth Financial Network) • John Hailer (CEO, Natixis Global Associates) • Joe Moglia (CEO, TD Ameritrade) • John Murphy (CEO, Oppenheimer Funds & Chairman, Investment Company Institute) • Bob Pozen (Chairman, MFS Investment Management) • Ron Ryan (CEO, Ryan ALM) • Michael Steinhardt (Chairman, Wisdom Tree Investments) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 5

Tiburon CEO Summit XIV Includes Nine Terrific Guest Speakers… Tiburon CEO Summit XIV Speakers • Walt Bettinger (President, The Charles Schwab Corporation) • Mike Byrum (President, Rydex Investments) • Joe Deitch (CEO, Commonwealth Financial Network) • John Hailer (CEO, Natixis Global Associates) • Joe Moglia (CEO, TD Ameritrade) • John Murphy (CEO, Oppenheimer Funds & Chairman, Investment Company Institute) • Bob Pozen (Chairman, MFS Investment Management) • Ron Ryan (CEO, Ryan ALM) • Michael Steinhardt (Chairman, Wisdom Tree Investments) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 5

Tiburon CEO Summit XIV Has Fifteen Terrific Sponsors who Made the Move to the Ritz Carlton Hotel Possible; Thank You! Tiburon CEO Summit XIV Sponsors Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 6

Tiburon CEO Summit XIV Has Fifteen Terrific Sponsors who Made the Move to the Ritz Carlton Hotel Possible; Thank You! Tiburon CEO Summit XIV Sponsors Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 6

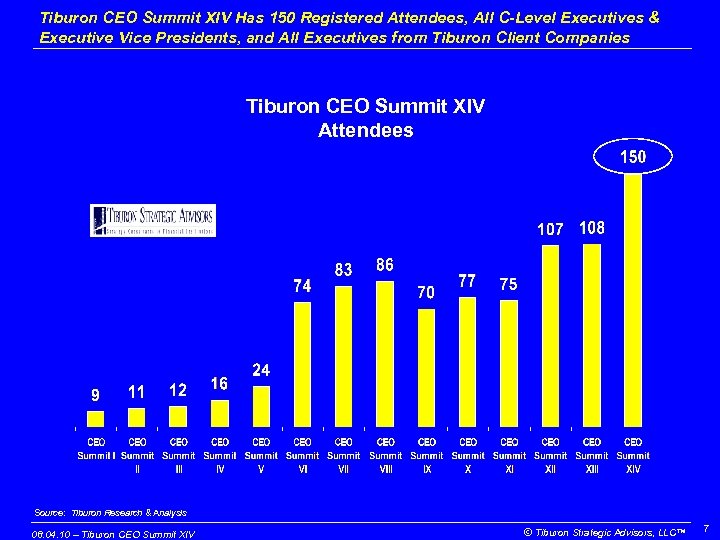

Tiburon CEO Summit XIV Has 150 Registered Attendees, All C-Level Executives & Executive Vice Presidents, and All Executives from Tiburon Client Companies Tiburon CEO Summit XIV Attendees Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 7

Tiburon CEO Summit XIV Has 150 Registered Attendees, All C-Level Executives & Executive Vice Presidents, and All Executives from Tiburon Client Companies Tiburon CEO Summit XIV Attendees Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 7

Outline · Tiburon CEO Summit XIV – Vision & History · State of the Financial Services Industry – Recap of the Semi-Annual News: Six Months of Amazing Industry News Stories – Fundamental Industry Trends: Reinforcing Tiburon Research Findings · Leveraging Tiburon Strategic Advisors · Tiburon CEO Summit XIV – Schedule & Tactics 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 8

Outline · Tiburon CEO Summit XIV – Vision & History · State of the Financial Services Industry – Recap of the Semi-Annual News: Six Months of Amazing Industry News Stories – Fundamental Industry Trends: Reinforcing Tiburon Research Findings · Leveraging Tiburon Strategic Advisors · Tiburon CEO Summit XIV – Schedule & Tactics 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 8

The Past Six Months Has Brought Dozens of Amazing Financial News Stories (Leaving Aside Eliot Spitzer) Tiburon Semi-Annual News Review • Sub-Prime Mortgage Write-Offs • Capital Raising • Sovereign Wealth Funds • The Bear Stearns Companies • Societe Generale • Countrywide • Thornburg Mortgage • E*Trade Financial • Private Equity Industry Collapse • Hedge Fund Troubles • Auction Rate Securities Market Collapse • Money Market Fund Bailouts • Stock Market Disaster • Senior Executive Ousters • Wall Street Layoffs • Ratings Agency Conflicts • Bond Insurers Confusion • Consumer Mortgage Defaults & Quasi Bailout • Housing Values Down, Challenging the Liquefaction • Financial Services Stocks Down (Even More than Others) • Presidential (& Congressional Elections) & the Related Spin • Proposed Regulatory Changes • Pending Recession Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 9

The Past Six Months Has Brought Dozens of Amazing Financial News Stories (Leaving Aside Eliot Spitzer) Tiburon Semi-Annual News Review • Sub-Prime Mortgage Write-Offs • Capital Raising • Sovereign Wealth Funds • The Bear Stearns Companies • Societe Generale • Countrywide • Thornburg Mortgage • E*Trade Financial • Private Equity Industry Collapse • Hedge Fund Troubles • Auction Rate Securities Market Collapse • Money Market Fund Bailouts • Stock Market Disaster • Senior Executive Ousters • Wall Street Layoffs • Ratings Agency Conflicts • Bond Insurers Confusion • Consumer Mortgage Defaults & Quasi Bailout • Housing Values Down, Challenging the Liquefaction • Financial Services Stocks Down (Even More than Others) • Presidential (& Congressional Elections) & the Related Spin • Proposed Regulatory Changes • Pending Recession Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 9

The Most Recent Industry Headache of Sub-Prime Mortgages Seems to be Self-Created… Tiburon View “The basic premise is that the investment banks create CDOs to buy risky paper, pool those risks, and then sell those CDOs so that they can then go buy more risky paper… And we are surprised when this business ultimately blows up? ” Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 10

The Most Recent Industry Headache of Sub-Prime Mortgages Seems to be Self-Created… Tiburon View “The basic premise is that the investment banks create CDOs to buy risky paper, pool those risks, and then sell those CDOs so that they can then go buy more risky paper… And we are surprised when this business ultimately blows up? ” Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 10

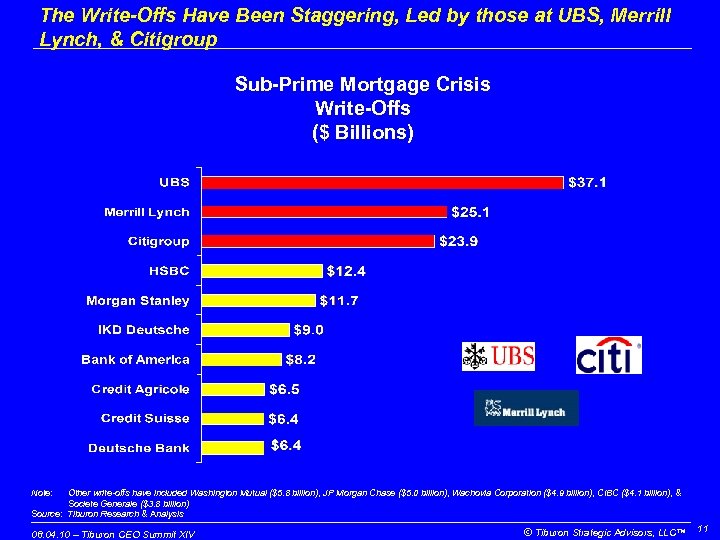

The Write-Offs Have Been Staggering, Led by those at UBS, Merrill Lynch, & Citigroup Sub-Prime Mortgage Crisis Write-Offs ($ Billions) Note: Other write-offs have included Washington Mutual ($5. 8 billion), JP Morgan Chase ($5. 0 billion), Wachovia Corporation ($4. 9 billion), CIBC ($4. 1 billion), & Societe Generale ($3. 8 billion) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 11

The Write-Offs Have Been Staggering, Led by those at UBS, Merrill Lynch, & Citigroup Sub-Prime Mortgage Crisis Write-Offs ($ Billions) Note: Other write-offs have included Washington Mutual ($5. 8 billion), JP Morgan Chase ($5. 0 billion), Wachovia Corporation ($4. 9 billion), CIBC ($4. 1 billion), & Societe Generale ($3. 8 billion) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 11

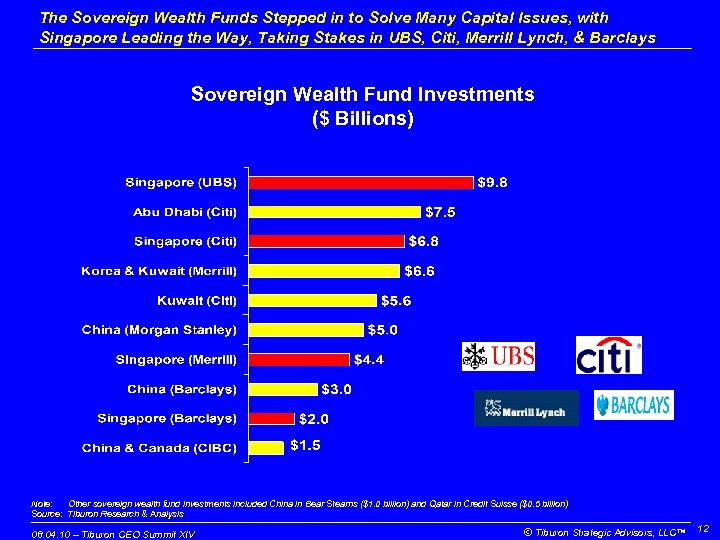

The Sovereign Wealth Funds Stepped in to Solve Many Capital Issues, with Singapore Leading the Way, Taking Stakes in UBS, Citi, Merrill Lynch, & Barclays Sovereign Wealth Fund Investments ($ Billions) Note: Other sovereign wealth fund investments included China in Bear Stearns ($1. 0 billion) and Qatar in Credit Suisse ($0. 5 billion) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 12

The Sovereign Wealth Funds Stepped in to Solve Many Capital Issues, with Singapore Leading the Way, Taking Stakes in UBS, Citi, Merrill Lynch, & Barclays Sovereign Wealth Fund Investments ($ Billions) Note: Other sovereign wealth fund investments included China in Bear Stearns ($1. 0 billion) and Qatar in Credit Suisse ($0. 5 billion) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 12

And We as a Country Feel the Need to Bail these Folks Out…. Federal Reserve View “The damage caused by a default by Bear Stearns could have been extremely difficult to contain. We did what we did because we felt that it was necessary to sustain the viability of the American financial system” - Ben Bernanke Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 13

And We as a Country Feel the Need to Bail these Folks Out…. Federal Reserve View “The damage caused by a default by Bear Stearns could have been extremely difficult to contain. We did what we did because we felt that it was necessary to sustain the viability of the American financial system” - Ben Bernanke Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 13

The Individuals Have the Same View, Seeking a Bail Out After their Gambles Went Wrong… Bear Stearns View “How will you make us whole? ” - Bear Stearns Senior Managing Director Question to JP Morgan’s Jamie Dimon Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 14

The Individuals Have the Same View, Seeking a Bail Out After their Gambles Went Wrong… Bear Stearns View “How will you make us whole? ” - Bear Stearns Senior Managing Director Question to JP Morgan’s Jamie Dimon Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 14

We May be Losing Perspective… $4. 0 Billion was One of the Smaller Write-Offs… Wall Street Journal Comment “When is a good time to write off $4 billion (Deutsche Bank)? The same day that your European neighbor (UBS) writes off $19 billion!” - Wall Street Journal Reporter Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 15

We May be Losing Perspective… $4. 0 Billion was One of the Smaller Write-Offs… Wall Street Journal Comment “When is a good time to write off $4 billion (Deutsche Bank)? The same day that your European neighbor (UBS) writes off $19 billion!” - Wall Street Journal Reporter Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 15

And there Seemed to be a Clear Outcome Involving CEO Heads Rolling Until We Got to HSBC and Morgan Stanley…. Tiburon View “Am I the only one that noticed that the CEOs of HSBC and Morgan Stanley slipped through as did every board of directors” Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 16

And there Seemed to be a Clear Outcome Involving CEO Heads Rolling Until We Got to HSBC and Morgan Stanley…. Tiburon View “Am I the only one that noticed that the CEOs of HSBC and Morgan Stanley slipped through as did every board of directors” Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 16

Unfortunately, Tiburon’s Belief is that this is Going to Continue to Happen… What is Unclear About the Outcomes that will Result from the Compensation System? Tiburon View “I am afraid that the investment banking compensation system incentivize executives to take extreme risks (moral hazard). Just think back to the bonuses in the good years; do they give those back? Then why not take another big risk? ” Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 17

Unfortunately, Tiburon’s Belief is that this is Going to Continue to Happen… What is Unclear About the Outcomes that will Result from the Compensation System? Tiburon View “I am afraid that the investment banking compensation system incentivize executives to take extreme risks (moral hazard). Just think back to the bonuses in the good years; do they give those back? Then why not take another big risk? ” Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 17

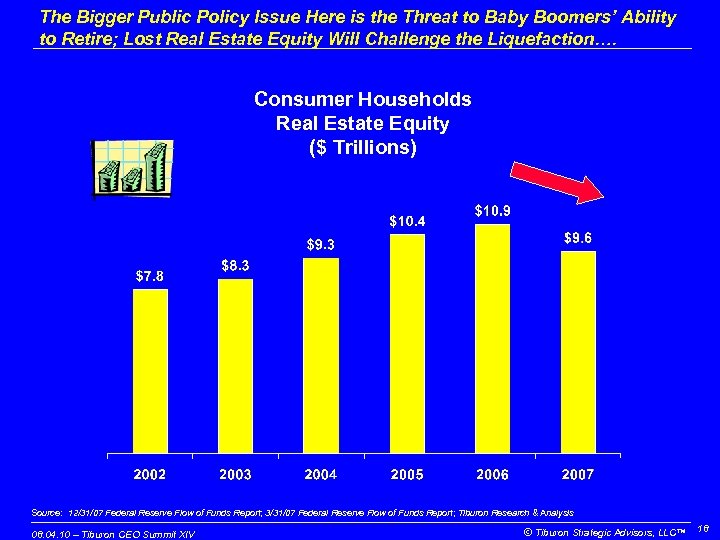

The Bigger Public Policy Issue Here is the Threat to Baby Boomers’ Ability to Retire; Lost Real Estate Equity Will Challenge the Liquefaction…. Consumer Households Real Estate Equity ($ Trillions) Source: 12/31/07 Federal Reserve Flow of Funds Report; 3/31/07 Federal Reserve Flow of Funds Report; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 18

The Bigger Public Policy Issue Here is the Threat to Baby Boomers’ Ability to Retire; Lost Real Estate Equity Will Challenge the Liquefaction…. Consumer Households Real Estate Equity ($ Trillions) Source: 12/31/07 Federal Reserve Flow of Funds Report; 3/31/07 Federal Reserve Flow of Funds Report; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 18

And on the Regulatory Front, the Skeptics are Not So Sure that the Power Should Go to the Federal Reserve… Chairman Chris Dodd View “It is like giving a bigger shovel to the guy who dug the hole” - Chris Dodd Chairman, Senate Banking Committee Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 19

And on the Regulatory Front, the Skeptics are Not So Sure that the Power Should Go to the Federal Reserve… Chairman Chris Dodd View “It is like giving a bigger shovel to the guy who dug the hole” - Chris Dodd Chairman, Senate Banking Committee Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 19

Outline · Tiburon CEO Summit XIV – Vision & History · State of the Financial Services Industry – Recap of the Semi-Annual News: Six Months of Amazing Industry News Stories – Fundamental Industry Trends: Reinforcing Tiburon Research Findings · Leveraging Tiburon Strategic Advisors · Tiburon CEO Summit XIV – Schedule & Tactics 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 20

Outline · Tiburon CEO Summit XIV – Vision & History · State of the Financial Services Industry – Recap of the Semi-Annual News: Six Months of Amazing Industry News Stories – Fundamental Industry Trends: Reinforcing Tiburon Research Findings · Leveraging Tiburon Strategic Advisors · Tiburon CEO Summit XIV – Schedule & Tactics 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 20

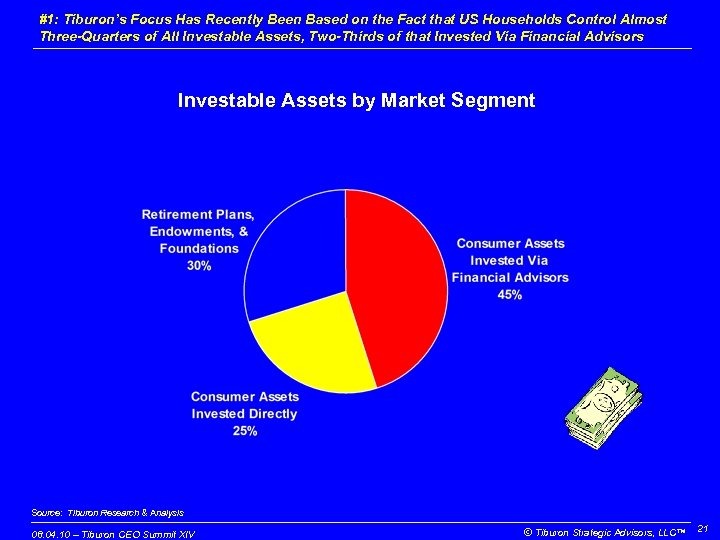

#1: Tiburon’s Focus Has Recently Been Based on the Fact that US Households Control Almost Three-Quarters of All Investable Assets, Two-Thirds of that Invested Via Financial Advisors Investable Assets by Market Segment Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 21

#1: Tiburon’s Focus Has Recently Been Based on the Fact that US Households Control Almost Three-Quarters of All Investable Assets, Two-Thirds of that Invested Via Financial Advisors Investable Assets by Market Segment Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 21

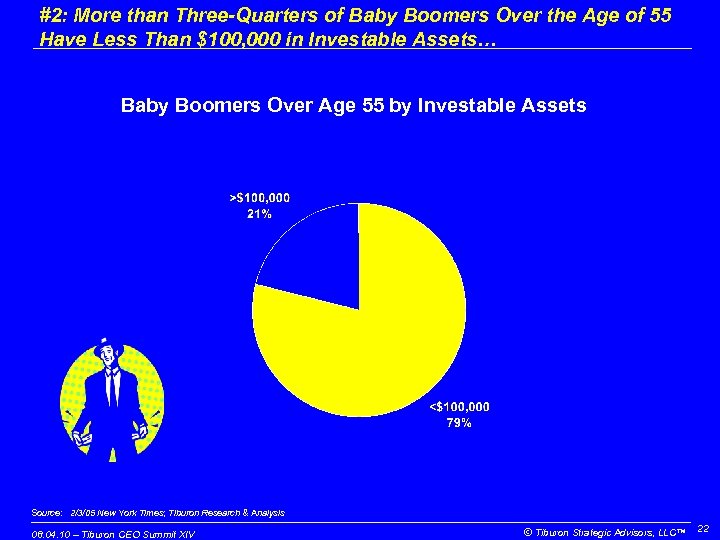

#2: More than Three-Quarters of Baby Boomers Over the Age of 55 Have Less Than $100, 000 in Investable Assets… Baby Boomers Over Age 55 by Investable Assets Source: 2/3/05 New York Times; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 22

#2: More than Three-Quarters of Baby Boomers Over the Age of 55 Have Less Than $100, 000 in Investable Assets… Baby Boomers Over Age 55 by Investable Assets Source: 2/3/05 New York Times; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 22

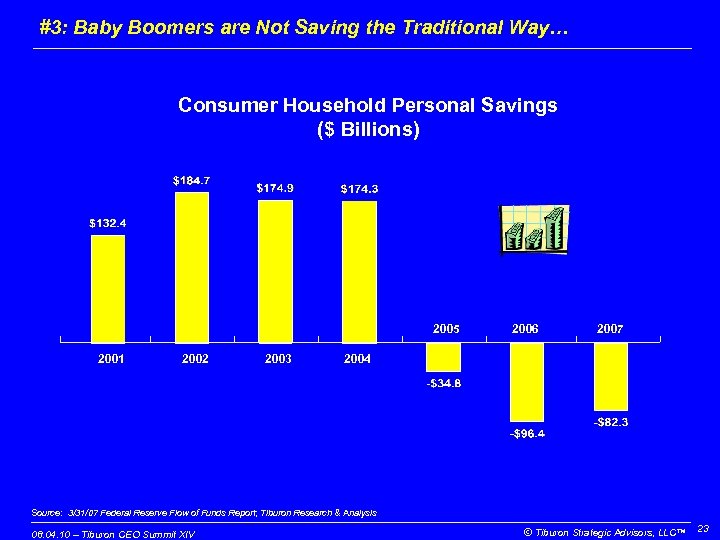

#3: Baby Boomers are Not Saving the Traditional Way… Consumer Household Personal Savings ($ Billions) 2005 2001 2002 2003 2006 2007 2004 Source: 3/31/07 Federal Reserve Flow of Funds Report; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 23

#3: Baby Boomers are Not Saving the Traditional Way… Consumer Household Personal Savings ($ Billions) 2005 2001 2002 2003 2006 2007 2004 Source: 3/31/07 Federal Reserve Flow of Funds Report; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 23

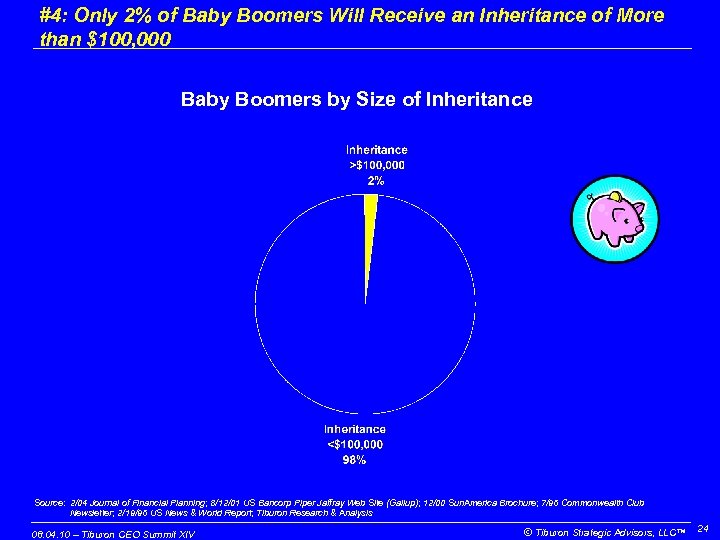

#4: Only 2% of Baby Boomers Will Receive an Inheritance of More than $100, 000 Baby Boomers by Size of Inheritance Source: 2/04 Journal of Financial Planning; 8/12/01 US Bancorp Piper Jaffray Web Site (Gallup); 12/00 Sun. America Brochure; 7/96 Commonwealth Club Newsletter; 2/19/96 US News & World Report; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 24

#4: Only 2% of Baby Boomers Will Receive an Inheritance of More than $100, 000 Baby Boomers by Size of Inheritance Source: 2/04 Journal of Financial Planning; 8/12/01 US Bancorp Piper Jaffray Web Site (Gallup); 12/00 Sun. America Brochure; 7/96 Commonwealth Club Newsletter; 2/19/96 US News & World Report; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 24

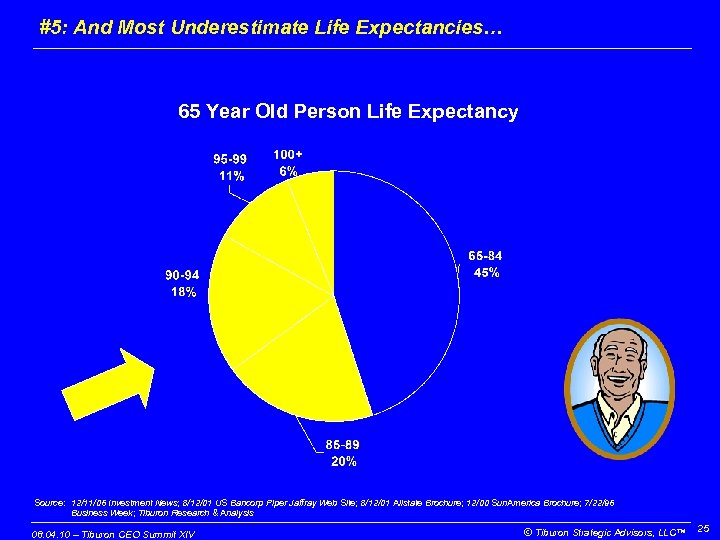

#5: And Most Underestimate Life Expectancies… 65 Year Old Person Life Expectancy Source: 12/11/06 Investment News; 8/12/01 US Bancorp Piper Jaffray Web Site; 8/12/01 Allstate Brochure; 12/00 Sun. America Brochure; 7/22/96 Business Week; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 25

#5: And Most Underestimate Life Expectancies… 65 Year Old Person Life Expectancy Source: 12/11/06 Investment News; 8/12/01 US Bancorp Piper Jaffray Web Site; 8/12/01 Allstate Brochure; 12/00 Sun. America Brochure; 7/22/96 Business Week; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 25

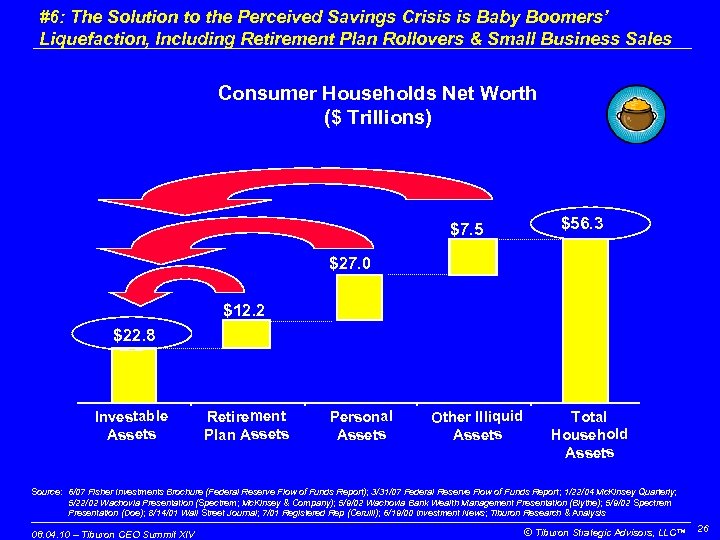

#6: The Solution to the Perceived Savings Crisis is Baby Boomers’ Liquefaction, Including Retirement Plan Rollovers & Small Business Sales Consumer Households Net Worth ($ Trillions) $7. 5 $56. 3 $27. 0 $12. 2 $22. 8 Investable Assets Retirement Plan Assets Personal Assets Other Illiquid Assets Total Household Assets Source: 6/07 Fisher Investments Brochure (Federal Reserve Flow of Funds Report); 3/31/07 Federal Reserve Flow of Funds Report; 1/22/04 Mc. Kinsey Quarterly; 5/22/02 Wachovia Presentation (Spectrem; Mc. Kinsey & Company); 5/9/02 Wachovia Bank Wealth Management Presentation (Blythe); 5/9/02 Spectrem Presentation (Doe); 8/14/01 Wall Street Journal; 7/01 Registered Rep (Cerulli); 6/19/00 Investment News; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 26

#6: The Solution to the Perceived Savings Crisis is Baby Boomers’ Liquefaction, Including Retirement Plan Rollovers & Small Business Sales Consumer Households Net Worth ($ Trillions) $7. 5 $56. 3 $27. 0 $12. 2 $22. 8 Investable Assets Retirement Plan Assets Personal Assets Other Illiquid Assets Total Household Assets Source: 6/07 Fisher Investments Brochure (Federal Reserve Flow of Funds Report); 3/31/07 Federal Reserve Flow of Funds Report; 1/22/04 Mc. Kinsey Quarterly; 5/22/02 Wachovia Presentation (Spectrem; Mc. Kinsey & Company); 5/9/02 Wachovia Bank Wealth Management Presentation (Blythe); 5/9/02 Spectrem Presentation (Doe); 8/14/01 Wall Street Journal; 7/01 Registered Rep (Cerulli); 6/19/00 Investment News; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 26

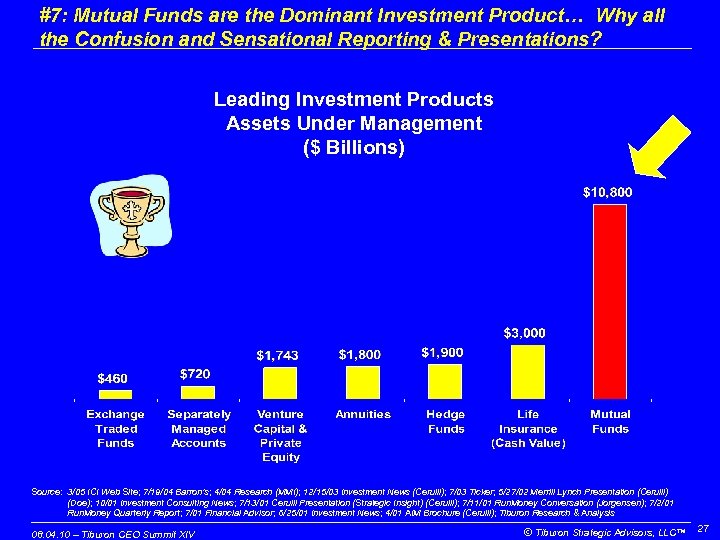

#7: Mutual Funds are the Dominant Investment Product… Why all the Confusion and Sensational Reporting & Presentations? Leading Investment Products Assets Under Management ($ Billions) Source: 3/05 ICI Web Site; 7/19/04 Barron’s; 4/04 Research (MMI); 12/15/03 Investment News (Cerulli); 7/03 Ticker; 5/27/02 Merrill Lynch Presentation (Cerulli) (Doe); 10/01 Investment Consulting News; 7/13/01 Cerulli Presentation (Strategic Insight) (Cerulli); 7/11/01 Run. Money Conversation (Jorgensen); 7/2/01 Run. Money Quarterly Report; 7/01 Financial Advisor; 6/25/01 Investment News; 4/01 AIM Brochure (Cerulli); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 27

#7: Mutual Funds are the Dominant Investment Product… Why all the Confusion and Sensational Reporting & Presentations? Leading Investment Products Assets Under Management ($ Billions) Source: 3/05 ICI Web Site; 7/19/04 Barron’s; 4/04 Research (MMI); 12/15/03 Investment News (Cerulli); 7/03 Ticker; 5/27/02 Merrill Lynch Presentation (Cerulli) (Doe); 10/01 Investment Consulting News; 7/13/01 Cerulli Presentation (Strategic Insight) (Cerulli); 7/11/01 Run. Money Conversation (Jorgensen); 7/2/01 Run. Money Quarterly Report; 7/01 Financial Advisor; 6/25/01 Investment News; 4/01 AIM Brochure (Cerulli); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 27

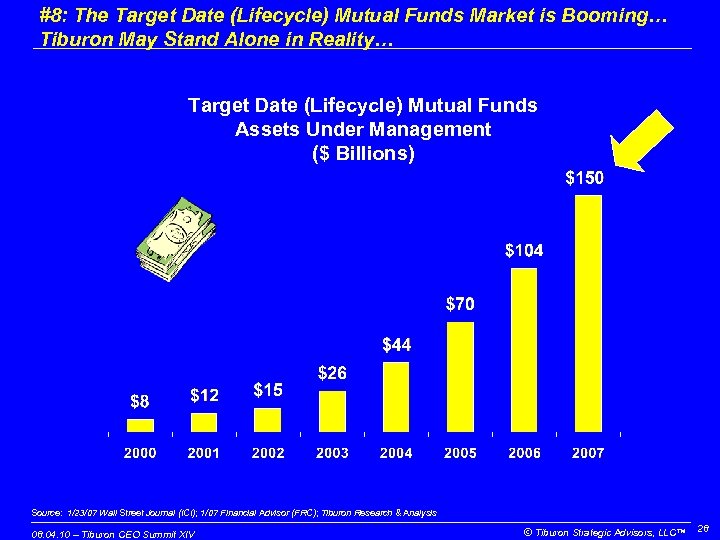

#8: The Target Date (Lifecycle) Mutual Funds Market is Booming… Tiburon May Stand Alone in Reality… Target Date (Lifecycle) Mutual Funds Assets Under Management ($ Billions) Source: 1/23/07 Wall Street Journal (ICI); 1/07 Financial Advisor (FRC); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 28

#8: The Target Date (Lifecycle) Mutual Funds Market is Booming… Tiburon May Stand Alone in Reality… Target Date (Lifecycle) Mutual Funds Assets Under Management ($ Billions) Source: 1/23/07 Wall Street Journal (ICI); 1/07 Financial Advisor (FRC); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 28

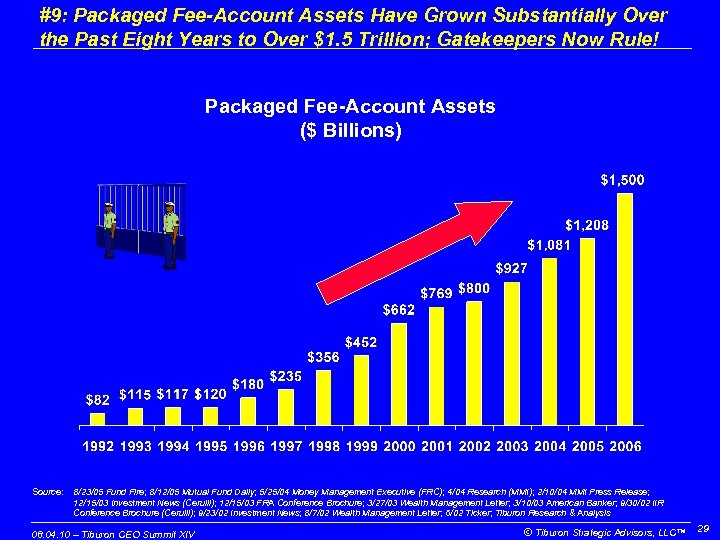

#9: Packaged Fee-Account Assets Have Grown Substantially Over the Past Eight Years to Over $1. 5 Trillion; Gatekeepers Now Rule! Packaged Fee-Account Assets ($ Billions) Source: 8/23/05 Fund Fire; 8/12/05 Mutual Fund Daily; 5/25/04 Money Management Executive (FRC); 4/04 Research (MMI); 2/10/04 MMI Press Release; 12/15/03 Investment News (Cerulli); 12/15/03 FRA Conference Brochure; 3/27/03 Wealth Management Letter; 3/10/03 American Banker; 9/30/02 IIR Conference Brochure (Cerulli); 9/23/02 Investment News; 8/7/02 Wealth Management Letter; 6/02 Ticker; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 29

#9: Packaged Fee-Account Assets Have Grown Substantially Over the Past Eight Years to Over $1. 5 Trillion; Gatekeepers Now Rule! Packaged Fee-Account Assets ($ Billions) Source: 8/23/05 Fund Fire; 8/12/05 Mutual Fund Daily; 5/25/04 Money Management Executive (FRC); 4/04 Research (MMI); 2/10/04 MMI Press Release; 12/15/03 Investment News (Cerulli); 12/15/03 FRA Conference Brochure; 3/27/03 Wealth Management Letter; 3/10/03 American Banker; 9/30/02 IIR Conference Brochure (Cerulli); 9/23/02 Investment News; 8/7/02 Wealth Management Letter; 6/02 Ticker; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 29

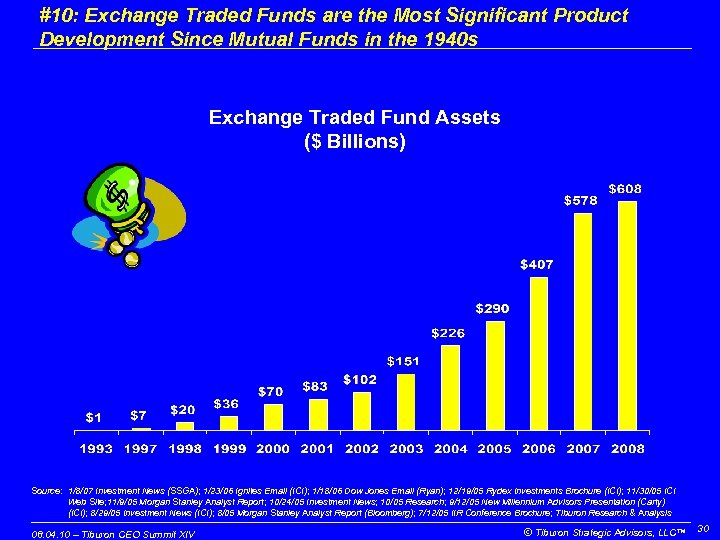

#10: Exchange Traded Funds are the Most Significant Product Development Since Mutual Funds in the 1940 s Exchange Traded Fund Assets ($ Billions) Source: 1/8/07 Investment News (SSGA); 1/23/06 Ignites Email (ICI); 1/18/06 Dow Jones Email (Ryan); 12/19/05 Rydex Investments Brochure (ICI); 11/30/05 ICI Web Site; 11/9/05 Morgan Stanley Analyst Report; 10/24/05 Investment News; 10/05 Research; 9/12/05 New Millennium Advisors Presentation (Carty) (ICI); 8/29/05 Investment News (ICI); 8/05 Morgan Stanley Analyst Report (Bloomberg); 7/12/05 IIR Conference Brochure; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 30

#10: Exchange Traded Funds are the Most Significant Product Development Since Mutual Funds in the 1940 s Exchange Traded Fund Assets ($ Billions) Source: 1/8/07 Investment News (SSGA); 1/23/06 Ignites Email (ICI); 1/18/06 Dow Jones Email (Ryan); 12/19/05 Rydex Investments Brochure (ICI); 11/30/05 ICI Web Site; 11/9/05 Morgan Stanley Analyst Report; 10/24/05 Investment News; 10/05 Research; 9/12/05 New Millennium Advisors Presentation (Carty) (ICI); 8/29/05 Investment News (ICI); 8/05 Morgan Stanley Analyst Report (Bloomberg); 7/12/05 IIR Conference Brochure; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 30

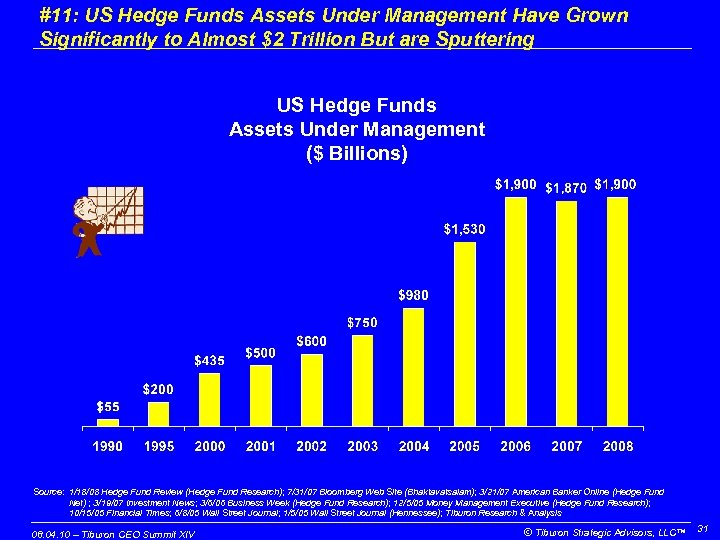

#11: US Hedge Funds Assets Under Management Have Grown Significantly to Almost $2 Trillion But are Sputtering US Hedge Funds Assets Under Management ($ Billions) Source: 1/18/08 Hedge Fund Review (Hedge Fund Research); 7/31/07 Bloomberg Web Site (Bhaktavatsalam); 3/21/07 American Banker Online (Hedge Fund Net) ; 3/19/07 Investment News; 3/6/06 Business Week (Hedge Fund Research); 12/5/05 Money Management Executive (Hedge Fund Research); 10/15/05 Financial Times; 6/8/05 Wall Street Journal; 1/5/05 Wall Street Journal (Hennessee); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 31

#11: US Hedge Funds Assets Under Management Have Grown Significantly to Almost $2 Trillion But are Sputtering US Hedge Funds Assets Under Management ($ Billions) Source: 1/18/08 Hedge Fund Review (Hedge Fund Research); 7/31/07 Bloomberg Web Site (Bhaktavatsalam); 3/21/07 American Banker Online (Hedge Fund Net) ; 3/19/07 Investment News; 3/6/06 Business Week (Hedge Fund Research); 12/5/05 Money Management Executive (Hedge Fund Research); 10/15/05 Financial Times; 6/8/05 Wall Street Journal; 1/5/05 Wall Street Journal (Hennessee); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 31

#12: For the Vast Majority of Consumer Households, the Twin Retirement Challenges Revolve Around Health Care & Retirement Income Consumer Household Retirement Challenges Health Care • Cost up twice as fast as overall costs • Employer coverage down Retirement Income • • Annuities Reverse mortgages Other ideas to tap into home values Government intervention? Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 32

#12: For the Vast Majority of Consumer Households, the Twin Retirement Challenges Revolve Around Health Care & Retirement Income Consumer Household Retirement Challenges Health Care • Cost up twice as fast as overall costs • Employer coverage down Retirement Income • • Annuities Reverse mortgages Other ideas to tap into home values Government intervention? Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 32

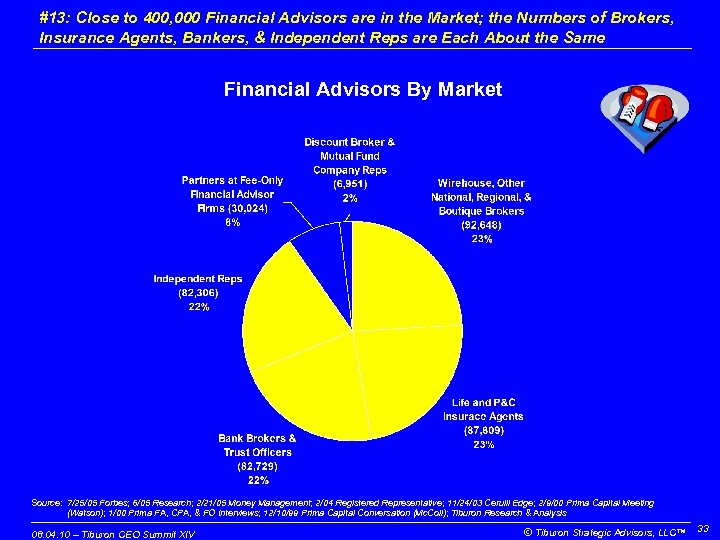

#13: Close to 400, 000 Financial Advisors are in the Market; the Numbers of Brokers, Insurance Agents, Bankers, & Independent Reps are Each About the Same Financial Advisors By Market Source: 7/25/05 Forbes; 6/05 Research; 2/21/05 Money Management; 2/04 Registered Representative; 11/24/03 Cerulli Edge; 2/9/00 Prima Capital Meeting (Watson); 1/00 Prima FA, CPA, & FO Interviews; 12/10/99 Prima Capital Conversation (Mc. Coll); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 33

#13: Close to 400, 000 Financial Advisors are in the Market; the Numbers of Brokers, Insurance Agents, Bankers, & Independent Reps are Each About the Same Financial Advisors By Market Source: 7/25/05 Forbes; 6/05 Research; 2/21/05 Money Management; 2/04 Registered Representative; 11/24/03 Cerulli Edge; 2/9/00 Prima Capital Meeting (Watson); 1/00 Prima FA, CPA, & FO Interviews; 12/10/99 Prima Capital Conversation (Mc. Coll); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 33

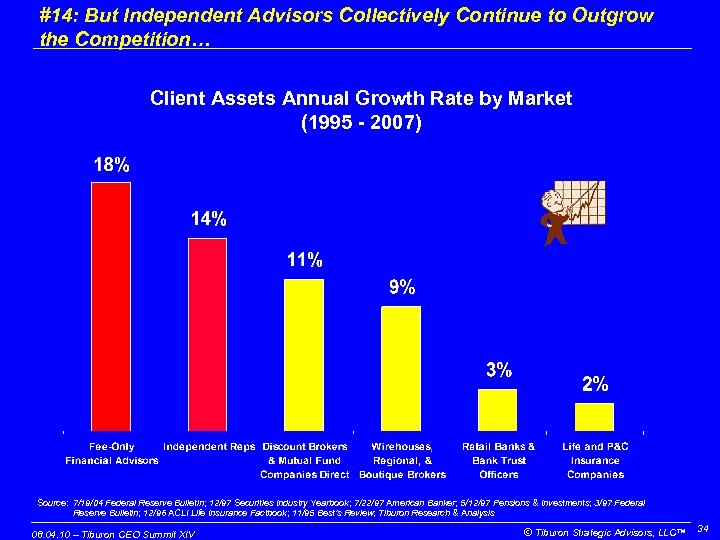

#14: But Independent Advisors Collectively Continue to Outgrow the Competition… Client Assets Annual Growth Rate by Market (1995 - 2007) Source: 7/19/04 Federal Reserve Bulletin; 12/97 Securities Industry Yearbook; 7/22/97 American Banker; 5/12/97 Pensions & Investments; 3/97 Federal Reserve Bulletin; 12/96 ACLI Life Insurance Factbook; 11/95 Best’s Review; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 34

#14: But Independent Advisors Collectively Continue to Outgrow the Competition… Client Assets Annual Growth Rate by Market (1995 - 2007) Source: 7/19/04 Federal Reserve Bulletin; 12/97 Securities Industry Yearbook; 7/22/97 American Banker; 5/12/97 Pensions & Investments; 3/97 Federal Reserve Bulletin; 12/96 ACLI Life Insurance Factbook; 11/95 Best’s Review; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 34

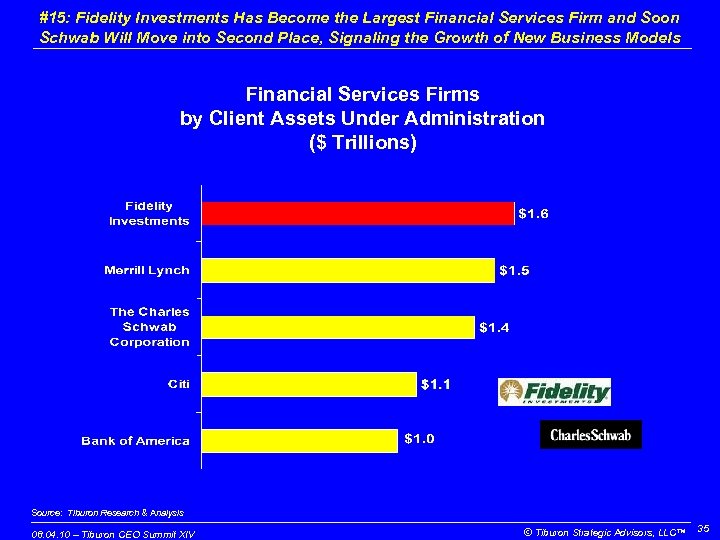

#15: Fidelity Investments Has Become the Largest Financial Services Firm and Soon Schwab Will Move into Second Place, Signaling the Growth of New Business Models Financial Services Firms by Client Assets Under Administration ($ Trillions) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 35

#15: Fidelity Investments Has Become the Largest Financial Services Firm and Soon Schwab Will Move into Second Place, Signaling the Growth of New Business Models Financial Services Firms by Client Assets Under Administration ($ Trillions) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 35

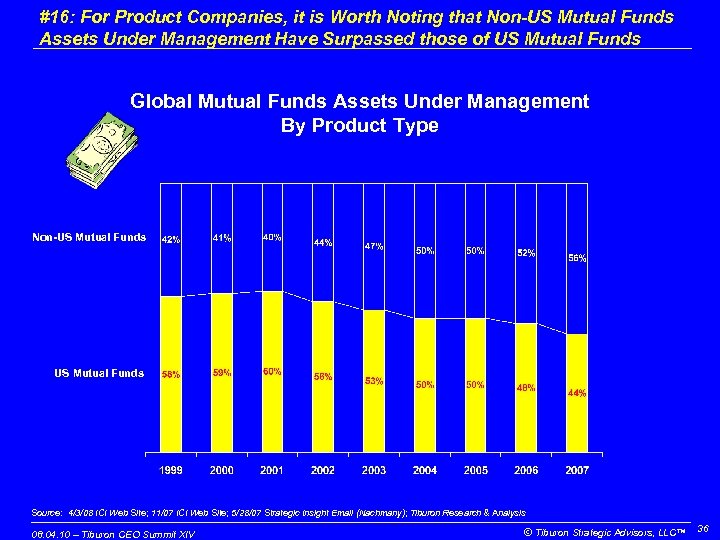

#16: For Product Companies, it is Worth Noting that Non-US Mutual Funds Assets Under Management Have Surpassed those of US Mutual Funds Global Mutual Funds Assets Under Management By Product Type Non-US Mutual Funds Source: 4/3/08 ICI Web Site; 11/07 ICI Web Site; 5/28/07 Strategic Insight Email (Nachmany); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 36

#16: For Product Companies, it is Worth Noting that Non-US Mutual Funds Assets Under Management Have Surpassed those of US Mutual Funds Global Mutual Funds Assets Under Management By Product Type Non-US Mutual Funds Source: 4/3/08 ICI Web Site; 11/07 ICI Web Site; 5/28/07 Strategic Insight Email (Nachmany); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 36

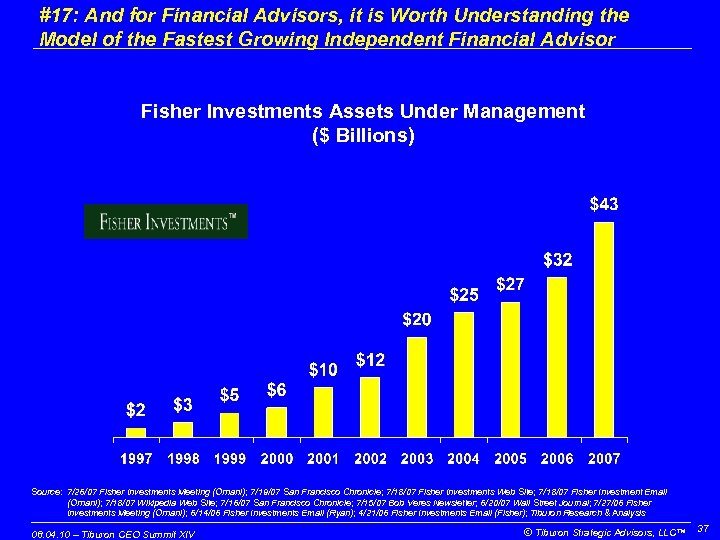

#17: And for Financial Advisors, it is Worth Understanding the Model of the Fastest Growing Independent Financial Advisor Fisher Investments Assets Under Management ($ Billions) Source: 7/26/07 Fisher Investments Meeting (Ornani); 7/19/07 San Francisco Chronicle; 7/18/07 Fisher Investments Web Site; 7/18/07 Fisher Investment Email (Ornani); 7/18/07 Wikipedia Web Site; 7/16/07 San Francisco Chronicle; 7/15/07 Bob Veres Newsletter; 6/20/07 Wall Street Journal; 7/27/06 Fisher Investments Meeting (Ornani); 6/14/06 Fisher Investments Email (Ryan); 4/21/06 Fisher Investments Email (Fisher); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 37

#17: And for Financial Advisors, it is Worth Understanding the Model of the Fastest Growing Independent Financial Advisor Fisher Investments Assets Under Management ($ Billions) Source: 7/26/07 Fisher Investments Meeting (Ornani); 7/19/07 San Francisco Chronicle; 7/18/07 Fisher Investments Web Site; 7/18/07 Fisher Investment Email (Ornani); 7/18/07 Wikipedia Web Site; 7/16/07 San Francisco Chronicle; 7/15/07 Bob Veres Newsletter; 6/20/07 Wall Street Journal; 7/27/06 Fisher Investments Meeting (Ornani); 6/14/06 Fisher Investments Email (Ryan); 4/21/06 Fisher Investments Email (Fisher); Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 37

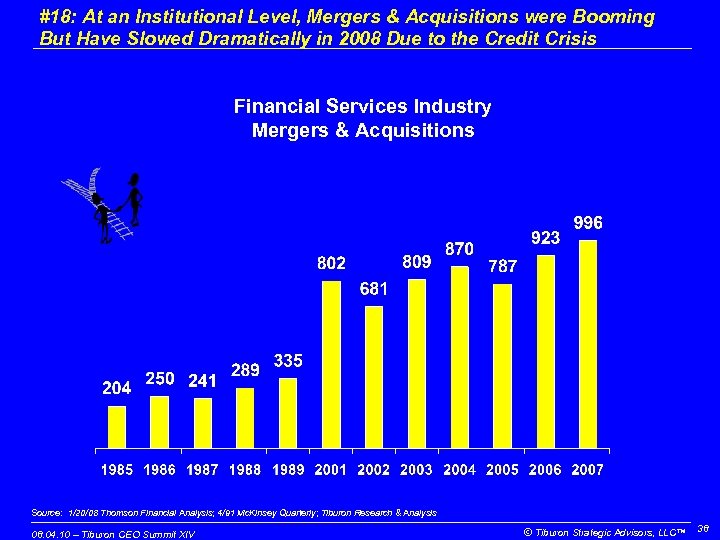

#18: At an Institutional Level, Mergers & Acquisitions were Booming But Have Slowed Dramatically in 2008 Due to the Credit Crisis Financial Services Industry Mergers & Acquisitions Source: 1/20/08 Thomson Financial Analysis; 4/91 Mc. Kinsey Quarterly; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 38

#18: At an Institutional Level, Mergers & Acquisitions were Booming But Have Slowed Dramatically in 2008 Due to the Credit Crisis Financial Services Industry Mergers & Acquisitions Source: 1/20/08 Thomson Financial Analysis; 4/91 Mc. Kinsey Quarterly; Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 38

#19: Management Theories can Often be Applied at Various Levels throughout the Financial Services Industry Tiburon Strategic Thoughts Bifurcation • • Target Marketing Confusing % & $ Retail banks Full-service brokers Mutual funds Financial advisors • Hanson Mc. Clain Retirement Network • CMS Companies • Clearly Gull • Rydex • Pro Funds • DFA • Full-service brokers versus RIAs • Mutual funds versus separate accounts Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 39

#19: Management Theories can Often be Applied at Various Levels throughout the Financial Services Industry Tiburon Strategic Thoughts Bifurcation • • Target Marketing Confusing % & $ Retail banks Full-service brokers Mutual funds Financial advisors • Hanson Mc. Clain Retirement Network • CMS Companies • Clearly Gull • Rydex • Pro Funds • DFA • Full-service brokers versus RIAs • Mutual funds versus separate accounts Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 39

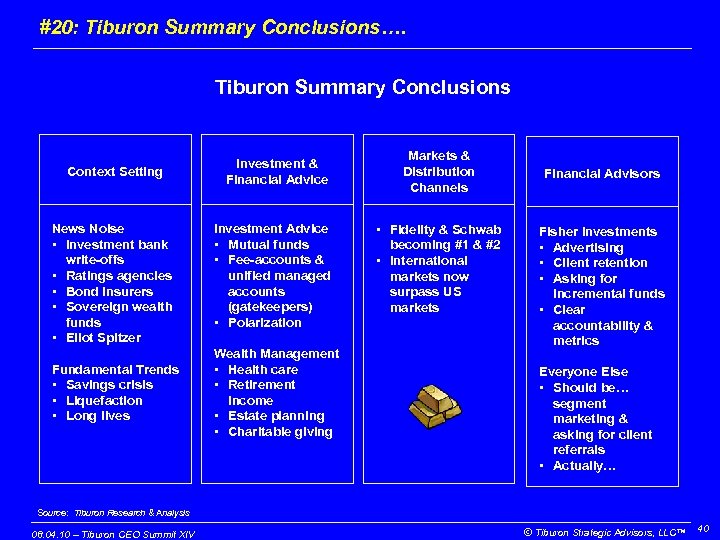

#20: Tiburon Summary Conclusions…. Tiburon Summary Conclusions Context Setting News Noise • Investment bank write-offs • Ratings agencies • Bond insurers • Sovereign wealth funds • Eliot Spitzer Fundamental Trends • Savings crisis • Liquefaction • Long lives Investment & Financial Advice Investment Advice • Mutual funds • Fee-accounts & unified managed accounts (gatekeepers) • Polarization Wealth Management • Health care • Retirement income • Estate planning • Charitable giving Markets & Distribution Channels • Fidelity & Schwab becoming #1 & #2 • International markets now surpass US markets Financial Advisors Fisher Investments • Advertising • Client retention • Asking for incremental funds • Clear accountability & metrics Everyone Else • Should be… segment marketing & asking for client referrals • Actually… Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 40

#20: Tiburon Summary Conclusions…. Tiburon Summary Conclusions Context Setting News Noise • Investment bank write-offs • Ratings agencies • Bond insurers • Sovereign wealth funds • Eliot Spitzer Fundamental Trends • Savings crisis • Liquefaction • Long lives Investment & Financial Advice Investment Advice • Mutual funds • Fee-accounts & unified managed accounts (gatekeepers) • Polarization Wealth Management • Health care • Retirement income • Estate planning • Charitable giving Markets & Distribution Channels • Fidelity & Schwab becoming #1 & #2 • International markets now surpass US markets Financial Advisors Fisher Investments • Advertising • Client retention • Asking for incremental funds • Clear accountability & metrics Everyone Else • Should be… segment marketing & asking for client referrals • Actually… Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 40

Tiburon Q&A…. Tiburon Q&A Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 41

Tiburon Q&A…. Tiburon Q&A Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 41

Outline · Tiburon CEO Summit XIV – Vision & History · State of the Financial Services Industry – Recap of the Semi-Annual News: Six Months of Amazing Industry News Stories – Fundamental Industry Trends: Reinforcing Tiburon Research Findings · Leveraging Tiburon Strategic Advisors · Tiburon CEO Summit XIV – Schedule & Tactics 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 42

Outline · Tiburon CEO Summit XIV – Vision & History · State of the Financial Services Industry – Recap of the Semi-Annual News: Six Months of Amazing Industry News Stories – Fundamental Industry Trends: Reinforcing Tiburon Research Findings · Leveraging Tiburon Strategic Advisors · Tiburon CEO Summit XIV – Schedule & Tactics 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 42

Tiburon Value Proposition…. Tiburon Value Proposition “Research-based strategy consulting for financial services firms” Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 43

Tiburon Value Proposition…. Tiburon Value Proposition “Research-based strategy consulting for financial services firms” Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 43

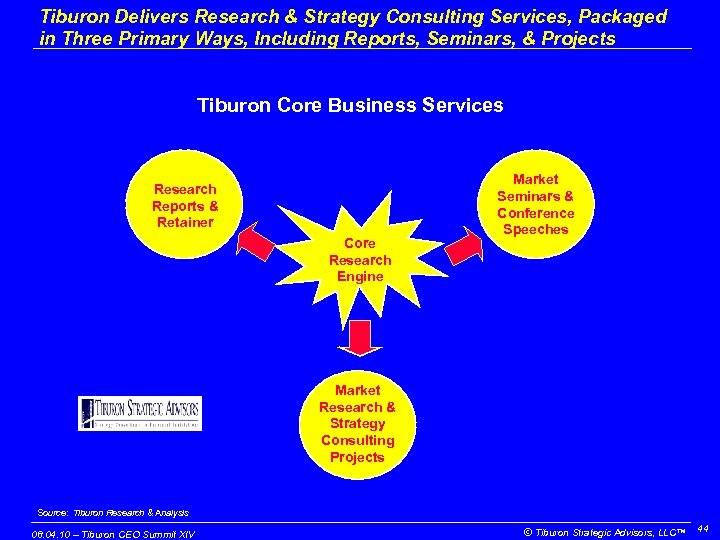

Tiburon Delivers Research & Strategy Consulting Services, Packaged in Three Primary Ways, Including Reports, Seminars, & Projects Tiburon Core Business Services Research Reports & Retainer Core Research Engine Market Seminars & Conference Speeches Market Research & Strategy Consulting Projects Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 44

Tiburon Delivers Research & Strategy Consulting Services, Packaged in Three Primary Ways, Including Reports, Seminars, & Projects Tiburon Core Business Services Research Reports & Retainer Core Research Engine Market Seminars & Conference Speeches Market Research & Strategy Consulting Projects Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 44

Outline · Tiburon CEO Summit XIV – Vision & History · State of the Financial Services Industry – Recap of the Semi-Annual News: Six Months of Amazing Industry News Stories – Fundamental Industry Trends: Reinforcing Tiburon Research Findings · Leveraging Tiburon Strategic Advisors · Tiburon CEO Summit XIV – Schedule & Tactics 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 45

Outline · Tiburon CEO Summit XIV – Vision & History · State of the Financial Services Industry – Recap of the Semi-Annual News: Six Months of Amazing Industry News Stories – Fundamental Industry Trends: Reinforcing Tiburon Research Findings · Leveraging Tiburon Strategic Advisors · Tiburon CEO Summit XIV – Schedule & Tactics 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 45

Tiburon CEO Summit XIV Includes Nine Terrific Guest Speakers… Tiburon CEO Summit XIV Speakers Public Policy Products • Walt Bettinger (President, The Charles Schwab Corporation) • Ron Ryan (CEO, Ryan ALM) • Bob Pozen (Chairman, MFS Investment Management) • Michael Steinhardt (Chairman, Wisdom Tree Investments) • John Murphy (CEO, Oppenheimer Funds & Chairman Investment Company Institute) • Mike Byrum (President, Rydex Investments) Management • John Hailer (CEO, Natixis Global Associates) • Joe Deitch (CEO, Commonwealth Financial Network) • Joe Moglia (CEO, TD Ameritrade) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 46

Tiburon CEO Summit XIV Includes Nine Terrific Guest Speakers… Tiburon CEO Summit XIV Speakers Public Policy Products • Walt Bettinger (President, The Charles Schwab Corporation) • Ron Ryan (CEO, Ryan ALM) • Bob Pozen (Chairman, MFS Investment Management) • Michael Steinhardt (Chairman, Wisdom Tree Investments) • John Murphy (CEO, Oppenheimer Funds & Chairman Investment Company Institute) • Mike Byrum (President, Rydex Investments) Management • John Hailer (CEO, Natixis Global Associates) • Joe Deitch (CEO, Commonwealth Financial Network) • Joe Moglia (CEO, TD Ameritrade) Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 46

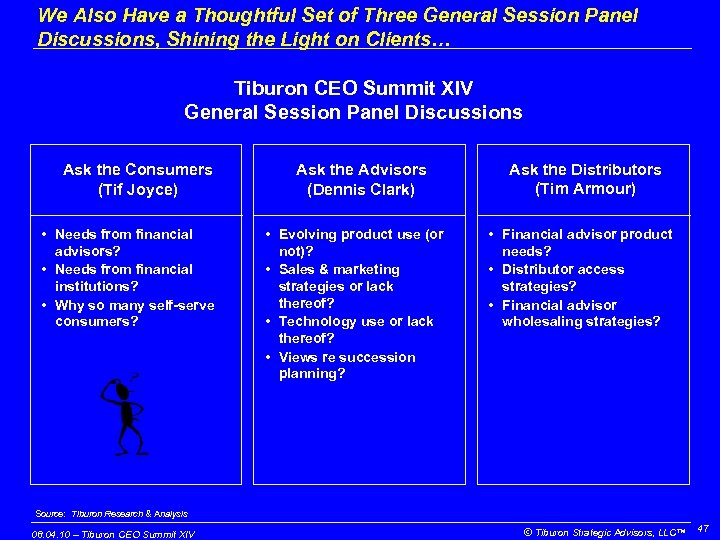

We Also Have a Thoughtful Set of Three General Session Panel Discussions, Shining the Light on Clients… Tiburon CEO Summit XIV General Session Panel Discussions Ask the Consumers (Tif Joyce) • Needs from financial advisors? • Needs from financial institutions? • Why so many self-serve consumers? Ask the Advisors (Dennis Clark) • Evolving product use (or not)? • Sales & marketing strategies or lack thereof? • Technology use or lack thereof? • Views re succession planning? Ask the Distributors (Tim Armour) • Financial advisor product needs? • Distributor access strategies? • Financial advisor wholesaling strategies? Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 47

We Also Have a Thoughtful Set of Three General Session Panel Discussions, Shining the Light on Clients… Tiburon CEO Summit XIV General Session Panel Discussions Ask the Consumers (Tif Joyce) • Needs from financial advisors? • Needs from financial institutions? • Why so many self-serve consumers? Ask the Advisors (Dennis Clark) • Evolving product use (or not)? • Sales & marketing strategies or lack thereof? • Technology use or lack thereof? • Views re succession planning? Ask the Distributors (Tim Armour) • Financial advisor product needs? • Distributor access strategies? • Financial advisor wholesaling strategies? Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 47

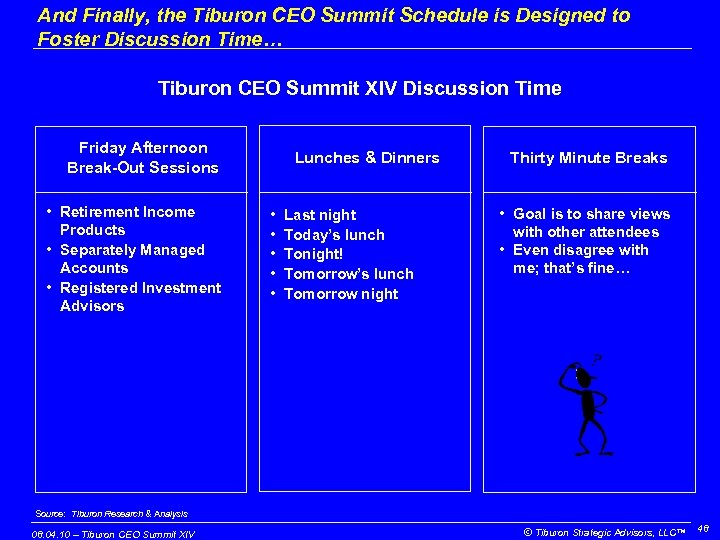

And Finally, the Tiburon CEO Summit Schedule is Designed to Foster Discussion Time… Tiburon CEO Summit XIV Discussion Time Friday Afternoon Break-Out Sessions • Retirement Income Products • Separately Managed Accounts • Registered Investment Advisors Lunches & Dinners • • • Last night Today’s lunch Tonight! Tomorrow’s lunch Tomorrow night Thirty Minute Breaks • Goal is to share views with other attendees • Even disagree with me; that’s fine… Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 48

And Finally, the Tiburon CEO Summit Schedule is Designed to Foster Discussion Time… Tiburon CEO Summit XIV Discussion Time Friday Afternoon Break-Out Sessions • Retirement Income Products • Separately Managed Accounts • Registered Investment Advisors Lunches & Dinners • • • Last night Today’s lunch Tonight! Tomorrow’s lunch Tomorrow night Thirty Minute Breaks • Goal is to share views with other attendees • Even disagree with me; that’s fine… Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 48

Tiburon Strategic Advisors Comments • Focus on corporate-level strategy - Serve senior executives only at financial services companies - Key services: market seminars, market research, & strategy consulting - Served over 300 corporate clients and completed over 1, 000 projects since 1998 - Host semi-annual CEO Summits, offer free weekly research releases, and offer free business benchmarking tools for all types of advisors • Chip Roame background - Mc. Kinsey & Company - Charles Schwab & Company - Tiburon since 1998 Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 49

Tiburon Strategic Advisors Comments • Focus on corporate-level strategy - Serve senior executives only at financial services companies - Key services: market seminars, market research, & strategy consulting - Served over 300 corporate clients and completed over 1, 000 projects since 1998 - Host semi-annual CEO Summits, offer free weekly research releases, and offer free business benchmarking tools for all types of advisors • Chip Roame background - Mc. Kinsey & Company - Charles Schwab & Company - Tiburon since 1998 Source: Tiburon Research & Analysis 08. 04. 10 – Tiburon CEO Summit XIV © Tiburon Strategic Advisors, LLC™ 49