889f723db869a4c54a67fb8b2fba10de.ppt

- Количество слайдов: 34

Central Securities Depositories, ISO Standards and SWIFT Automation today and for the future Edward de Courcy-Ireland Regional Manager - Securities 4 th November 20061019_AECSD Slide 1

Central Securities Depositories, ISO Standards and SWIFT Automation today and for the future Edward de Courcy-Ireland Regional Manager - Securities 4 th November 20061019_AECSD Slide 1

Agenda SWIFT update Securities Market Infrastructures using SWIFT ISO Standards 20061019_AECSD Slide 2

Agenda SWIFT update Securities Market Infrastructures using SWIFT ISO Standards 20061019_AECSD Slide 2

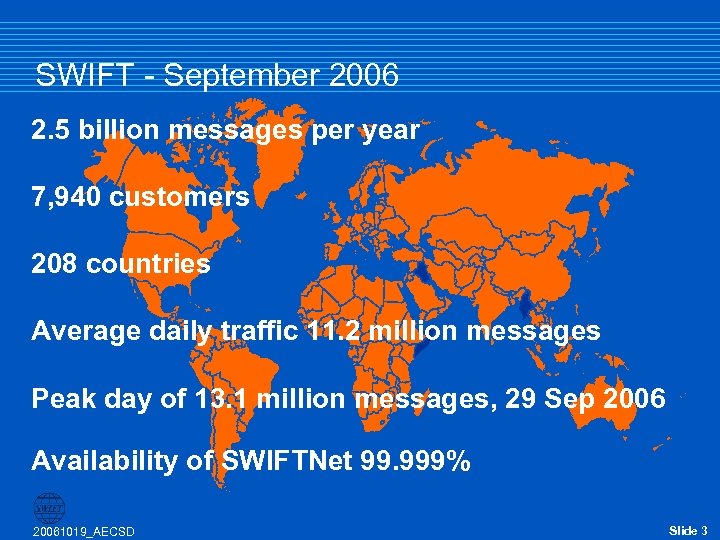

SWIFT - September 2006 2. 5 billion messages per year 7, 940 customers 208 countries Average daily traffic 11. 2 million messages Peak day of 13. 1 million messages, 29 Sep 2006 Availability of SWIFTNet 99. 999% 20061019_AECSD Slide 3

SWIFT - September 2006 2. 5 billion messages per year 7, 940 customers 208 countries Average daily traffic 11. 2 million messages Peak day of 13. 1 million messages, 29 Sep 2006 Availability of SWIFTNet 99. 999% 20061019_AECSD Slide 3

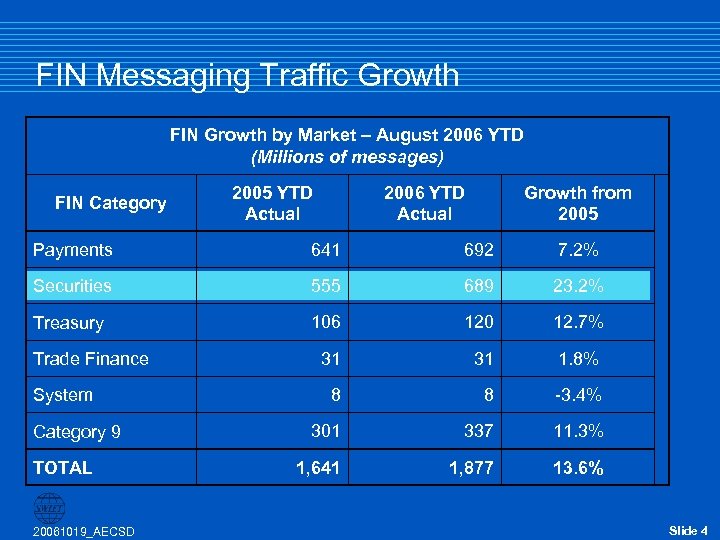

FIN Messaging Traffic Growth FIN Growth by Market – August 2006 YTD (Millions of messages) FIN Category 2005 YTD Actual 2006 YTD Actual Growth from 2005 Payments 641 692 7. 2% Securities 555 689 23. 2% Treasury 106 120 12. 7% 31 1. 8% 8 8 -3. 4% 301 337 11. 3% 1, 641 1, 877 13. 6% Trade Finance System Category 9 TOTAL 20061019_AECSD Slide 4

FIN Messaging Traffic Growth FIN Growth by Market – August 2006 YTD (Millions of messages) FIN Category 2005 YTD Actual 2006 YTD Actual Growth from 2005 Payments 641 692 7. 2% Securities 555 689 23. 2% Treasury 106 120 12. 7% 31 1. 8% 8 8 -3. 4% 301 337 11. 3% 1, 641 1, 877 13. 6% Trade Finance System Category 9 TOTAL 20061019_AECSD Slide 4

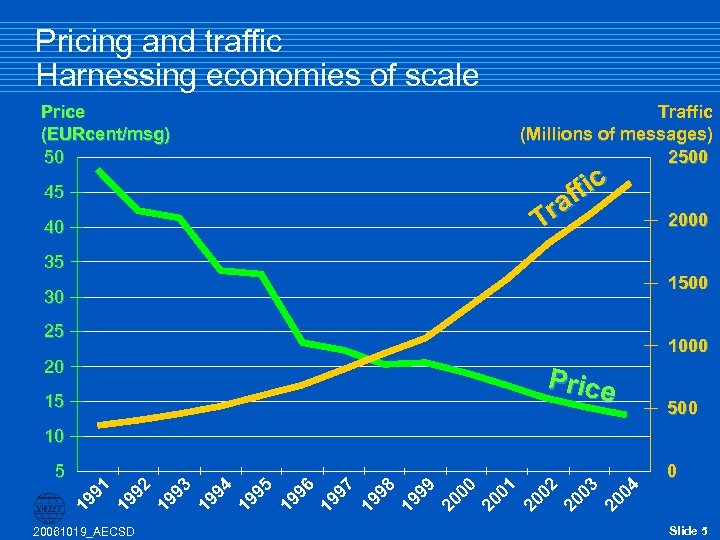

Pricing and traffic Harnessing economies of scale Price (EURcent/msg) 50 Traffic (Millions of messages) 2500 fic f ra T 45 40 2000 35 1500 30 25 1000 20 Price 15 500 10 20061019_AECSD 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 4 19 9 93 19 19 2 0 91 5 Slide 5

Pricing and traffic Harnessing economies of scale Price (EURcent/msg) 50 Traffic (Millions of messages) 2500 fic f ra T 45 40 2000 35 1500 30 25 1000 20 Price 15 500 10 20061019_AECSD 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 4 19 9 93 19 19 2 0 91 5 Slide 5

Agenda SWIFT update Securities Market Infrastructures using SWIFT ISO Standards 20061019_AECSD Slide 6

Agenda SWIFT update Securities Market Infrastructures using SWIFT ISO Standards 20061019_AECSD Slide 6

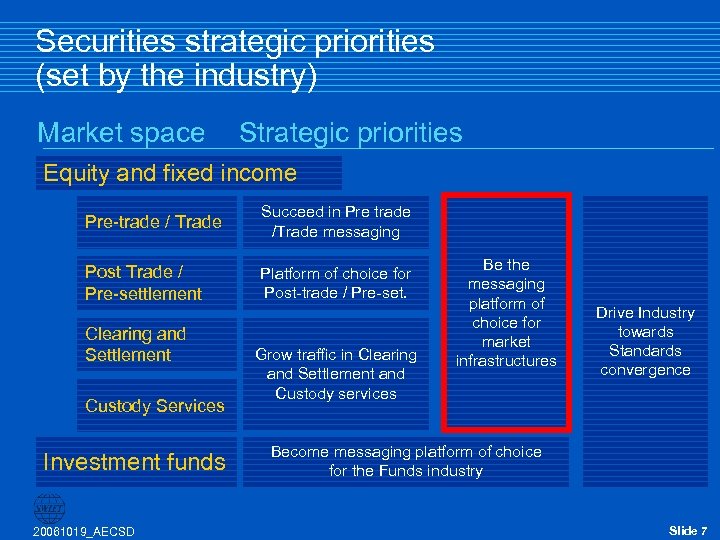

Securities strategic priorities (set by the industry) Market space Strategic priorities Equity and fixed income Pre-trade / Trade Succeed in Pre trade /Trade messaging Post Trade / Pre-settlement Platform of choice for Post-trade / Pre-set. Clearing and Settlement Custody Services Investment funds 20061019_AECSD Grow traffic in Clearing and Settlement and Custody services Be the messaging platform of choice for market infrastructures Drive Industry towards Standards convergence Become messaging platform of choice for the Funds industry Slide 7

Securities strategic priorities (set by the industry) Market space Strategic priorities Equity and fixed income Pre-trade / Trade Succeed in Pre trade /Trade messaging Post Trade / Pre-settlement Platform of choice for Post-trade / Pre-set. Clearing and Settlement Custody Services Investment funds 20061019_AECSD Grow traffic in Clearing and Settlement and Custody services Be the messaging platform of choice for market infrastructures Drive Industry towards Standards convergence Become messaging platform of choice for the Funds industry Slide 7

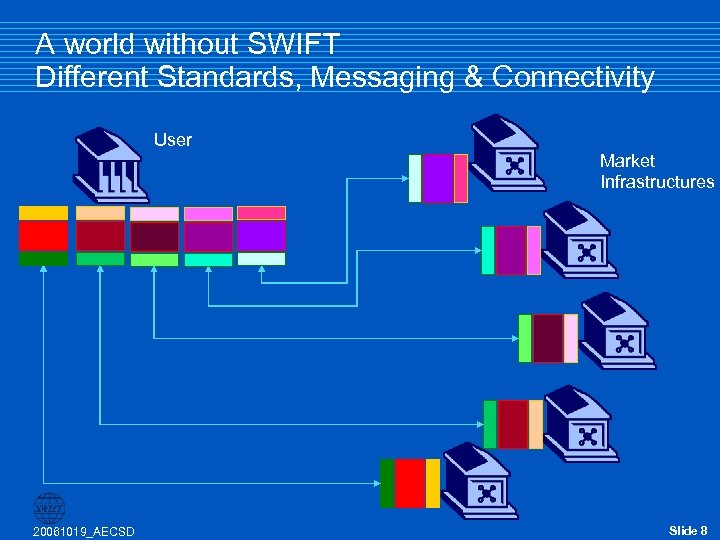

A world without SWIFT Different Standards, Messaging & Connectivity User Market Infrastructures 20061019_AECSD Slide 8

A world without SWIFT Different Standards, Messaging & Connectivity User Market Infrastructures 20061019_AECSD Slide 8

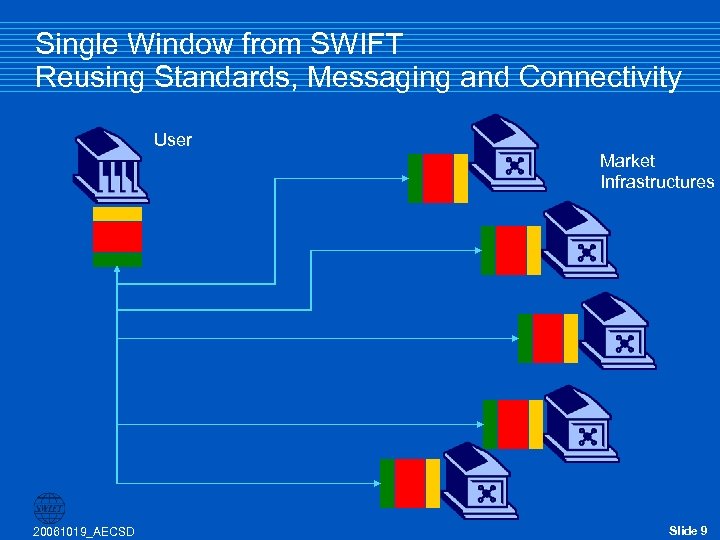

Single Window from SWIFT Reusing Standards, Messaging and Connectivity User Market Infrastructures 20061019_AECSD Slide 9

Single Window from SWIFT Reusing Standards, Messaging and Connectivity User Market Infrastructures 20061019_AECSD Slide 9

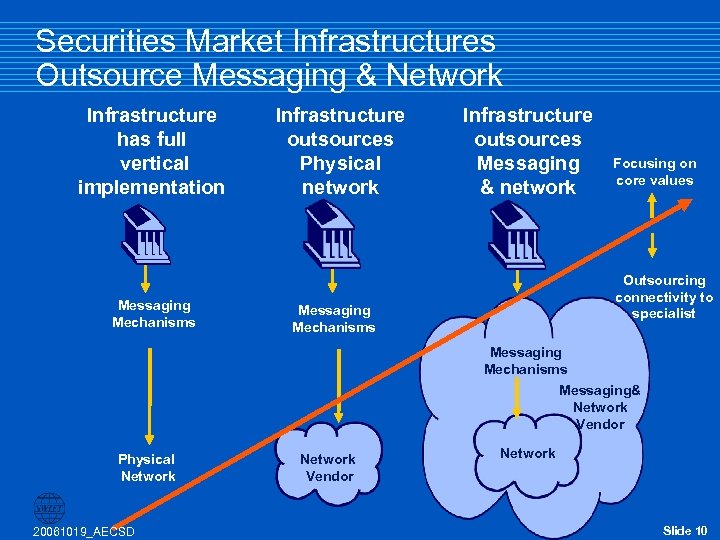

Securities Market Infrastructures Outsource Messaging & Network Infrastructure has full vertical implementation Messaging Mechanisms Infrastructure outsources Physical network Infrastructure outsources Messaging & network Focusing on core values Outsourcing connectivity to specialist Messaging Mechanisms Messaging& Network Vendor Physical Network 20061019_AECSD Network Vendor Network Slide 10

Securities Market Infrastructures Outsource Messaging & Network Infrastructure has full vertical implementation Messaging Mechanisms Infrastructure outsources Physical network Infrastructure outsources Messaging & network Focusing on core values Outsourcing connectivity to specialist Messaging Mechanisms Messaging& Network Vendor Physical Network 20061019_AECSD Network Vendor Network Slide 10

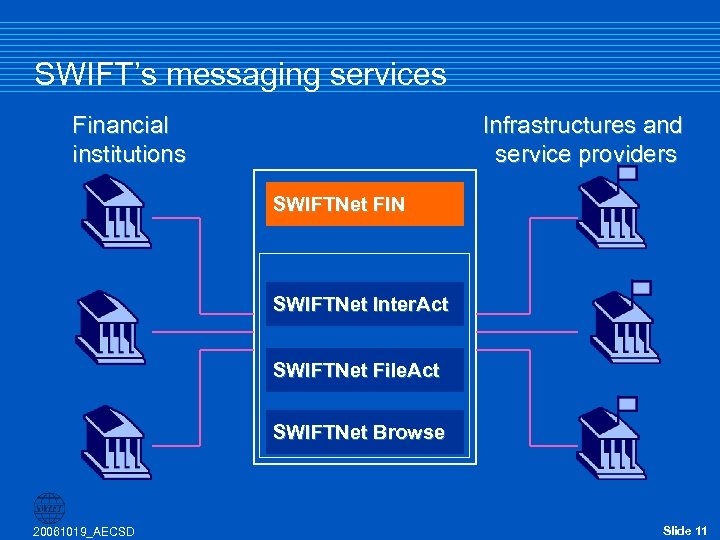

SWIFT’s messaging services Financial institutions Infrastructures and service providers SWIFTNet FIN SWIFTNet Inter. Act SWIFTNet File. Act SWIFTNet Browse 20061019_AECSD Slide 11

SWIFT’s messaging services Financial institutions Infrastructures and service providers SWIFTNet FIN SWIFTNet Inter. Act SWIFTNet File. Act SWIFTNet Browse 20061019_AECSD Slide 11

Securities Market Infrastructures – SWIFTNet FIN Argentina Caja de Valores Australia CIK Euroclear Bank MTS National Bank of Belgium Portugal Banco de Portugal – SITEME MTS Russian Federation Depository Clearing Company The National Depository Center Hungary Keler Singapore Israel Tel Aviv Stock Exchange Central Depository Singapore Exchange Italy CCG Monte Titoli Slovakia Bank of Slovakia Slovenia Japan JSCC Tokyo Stock Exchange Central Securities Clearing Corporation – KDD South Africa STRATE JSE Securities Exchange Spain Iberclear MEFF MTS Oe. KB Belgium HK Futures Exchange Hong Kong Monetary Authority SEHK Options Clearing House Australian Stock Exchange SFE – Austraclear Austria Hong Kong Brazil CBLC Canada CDS Croatia Sredisnja Depositarrna Agencija Kazakhstan Stock Exchange Denmark OMX VP Korea Securities Depository Latvia Dubai DIFX Bank of Latvia Central Depository OMX Sweden NCSD Sweden – VPC OMX Estonian Securities Depository OMX Lebanon Midclear Switzerland Lithuania OMX SIS x-clear NCSD Finland – APK OMX Luxemburg Clearstream Banking SA Taiwan Securities Central Depository Mexico S. D. Indeval Thailand Securities Depository Netherlands Euroclear Nederland MTS UK (& Ireland) CREST LCH. Clearnet London Stock Exchange Norway VPS USA Poland National Depository for Securities – KDPW Chicago Mercantile Exchange Clearing Corporation DTCC Omgeo Options Clearing Corporation Finland France Euroclear France Euronext Paris – MATIF MTS Germany Eurex Clearing Clearstream Banking AG MTS Greece Central Securities Depository Bank of Greece 20061019_AECSD Slide 12

Securities Market Infrastructures – SWIFTNet FIN Argentina Caja de Valores Australia CIK Euroclear Bank MTS National Bank of Belgium Portugal Banco de Portugal – SITEME MTS Russian Federation Depository Clearing Company The National Depository Center Hungary Keler Singapore Israel Tel Aviv Stock Exchange Central Depository Singapore Exchange Italy CCG Monte Titoli Slovakia Bank of Slovakia Slovenia Japan JSCC Tokyo Stock Exchange Central Securities Clearing Corporation – KDD South Africa STRATE JSE Securities Exchange Spain Iberclear MEFF MTS Oe. KB Belgium HK Futures Exchange Hong Kong Monetary Authority SEHK Options Clearing House Australian Stock Exchange SFE – Austraclear Austria Hong Kong Brazil CBLC Canada CDS Croatia Sredisnja Depositarrna Agencija Kazakhstan Stock Exchange Denmark OMX VP Korea Securities Depository Latvia Dubai DIFX Bank of Latvia Central Depository OMX Sweden NCSD Sweden – VPC OMX Estonian Securities Depository OMX Lebanon Midclear Switzerland Lithuania OMX SIS x-clear NCSD Finland – APK OMX Luxemburg Clearstream Banking SA Taiwan Securities Central Depository Mexico S. D. Indeval Thailand Securities Depository Netherlands Euroclear Nederland MTS UK (& Ireland) CREST LCH. Clearnet London Stock Exchange Norway VPS USA Poland National Depository for Securities – KDPW Chicago Mercantile Exchange Clearing Corporation DTCC Omgeo Options Clearing Corporation Finland France Euroclear France Euronext Paris – MATIF MTS Germany Eurex Clearing Clearstream Banking AG MTS Greece Central Securities Depository Bank of Greece 20061019_AECSD Slide 12

Banking Market Infrastructures Albania Algeria Angola Australia Austria Azerbaijan Bahamas Bahrain Barbados Belgium Bosnia and Herzegovina Botswana Brazil Bulgaria Canada Chile CLS Croatia Denmark East Caribbean Egypt EBA (EURO 1/STEP 1) ECB (TARGET) 20061019_AECSD Eurosystem (TARGET 2) Fiji Finland France Georgia Germany Ghana Greece Guatemala Hong Kong Hungary Ireland Italy Jordan Kenya Kuwait Latvia Lebanon Lesotho Luxemburg Malta Mauritius Namibia Netherlands New Zealand Norway Oman Pakistan Palestine Philippines Romania Russian Federation Singapore Slovenia South Africa Spain Sri Lanka Sweden Switzerland Tanzania Thailand Trinidad and Tobago Tunisia Uganda United Kingdom United States Venezuela Zambia Zimbabwe Central African States West African States High-Value Payments Countries Live 67 Implementation 8 Planning 8 Slide 13

Banking Market Infrastructures Albania Algeria Angola Australia Austria Azerbaijan Bahamas Bahrain Barbados Belgium Bosnia and Herzegovina Botswana Brazil Bulgaria Canada Chile CLS Croatia Denmark East Caribbean Egypt EBA (EURO 1/STEP 1) ECB (TARGET) 20061019_AECSD Eurosystem (TARGET 2) Fiji Finland France Georgia Germany Ghana Greece Guatemala Hong Kong Hungary Ireland Italy Jordan Kenya Kuwait Latvia Lebanon Lesotho Luxemburg Malta Mauritius Namibia Netherlands New Zealand Norway Oman Pakistan Palestine Philippines Romania Russian Federation Singapore Slovenia South Africa Spain Sri Lanka Sweden Switzerland Tanzania Thailand Trinidad and Tobago Tunisia Uganda United Kingdom United States Venezuela Zambia Zimbabwe Central African States West African States High-Value Payments Countries Live 67 Implementation 8 Planning 8 Slide 13

Agenda SWIFT update Securities Market Infrastructures using SWIFT ISO Standards 20061019_AECSD Slide 14

Agenda SWIFT update Securities Market Infrastructures using SWIFT ISO Standards 20061019_AECSD Slide 14

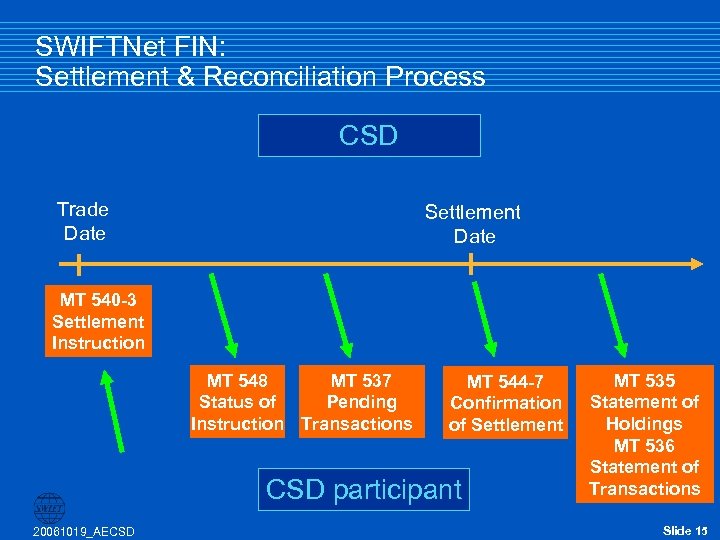

SWIFTNet FIN: Settlement & Reconciliation Process CSD Trade Date Settlement Date MT 540 -3 Settlement Instruction MT 537 MT 548 Pending Status of Instruction Transactions MT 544 -7 Confirmation of Settlement CSD participant 20061019_AECSD MT 535 Statement of Holdings MT 536 Statement of Transactions Slide 15

SWIFTNet FIN: Settlement & Reconciliation Process CSD Trade Date Settlement Date MT 540 -3 Settlement Instruction MT 537 MT 548 Pending Status of Instruction Transactions MT 544 -7 Confirmation of Settlement CSD participant 20061019_AECSD MT 535 Statement of Holdings MT 536 Statement of Transactions Slide 15

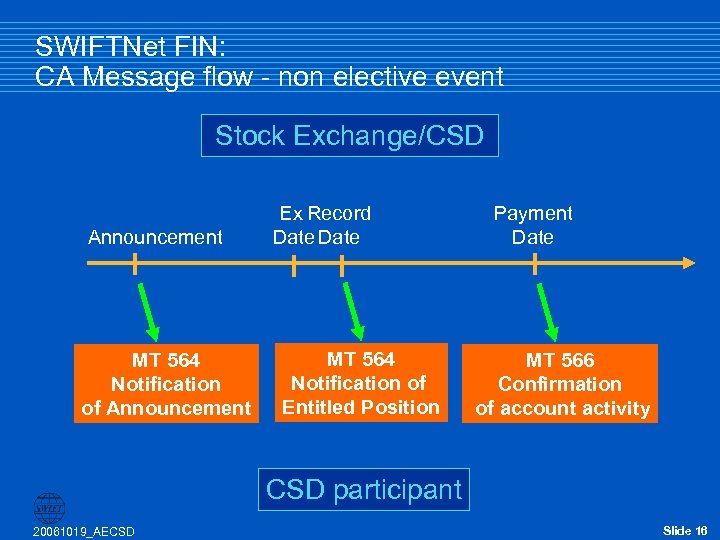

SWIFTNet FIN: CA Message flow - non elective event Stock Exchange/CSD Announcement MT 564 Notification of Announcement Ex Record Date MT 564 Notification of Entitled Position Payment Date MT 566 Confirmation of account activity CSD participant 20061019_AECSD Slide 16

SWIFTNet FIN: CA Message flow - non elective event Stock Exchange/CSD Announcement MT 564 Notification of Announcement Ex Record Date MT 564 Notification of Entitled Position Payment Date MT 566 Confirmation of account activity CSD participant 20061019_AECSD Slide 16

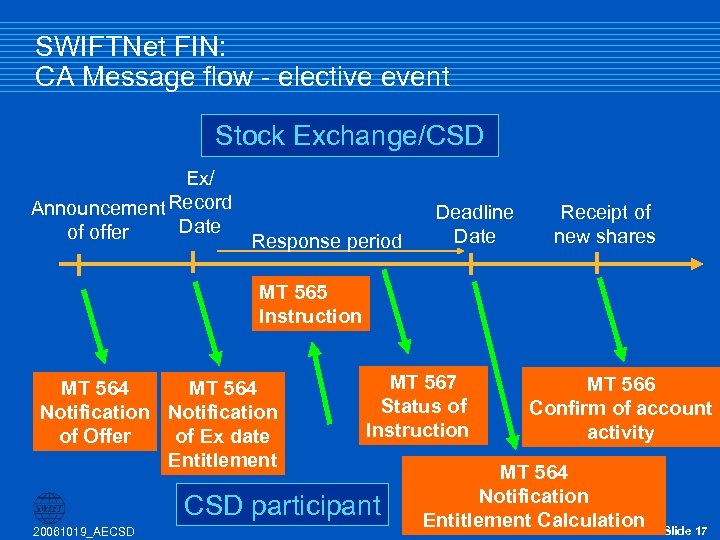

SWIFTNet FIN: CA Message flow - elective event Stock Exchange/CSD Ex/ Announcement Record Date of offer Response period Deadline Date Receipt of new shares MT 565 Instruction MT 564 Notification of Offer of Ex date Entitlement MT 567 Status of Instruction CSD participant 20061019_AECSD MT 566 Confirm of account activity MT 564 Notification Entitlement Calculation Slide 17

SWIFTNet FIN: CA Message flow - elective event Stock Exchange/CSD Ex/ Announcement Record Date of offer Response period Deadline Date Receipt of new shares MT 565 Instruction MT 564 Notification of Offer of Ex date Entitlement MT 567 Status of Instruction CSD participant 20061019_AECSD MT 566 Confirm of account activity MT 564 Notification Entitlement Calculation Slide 17

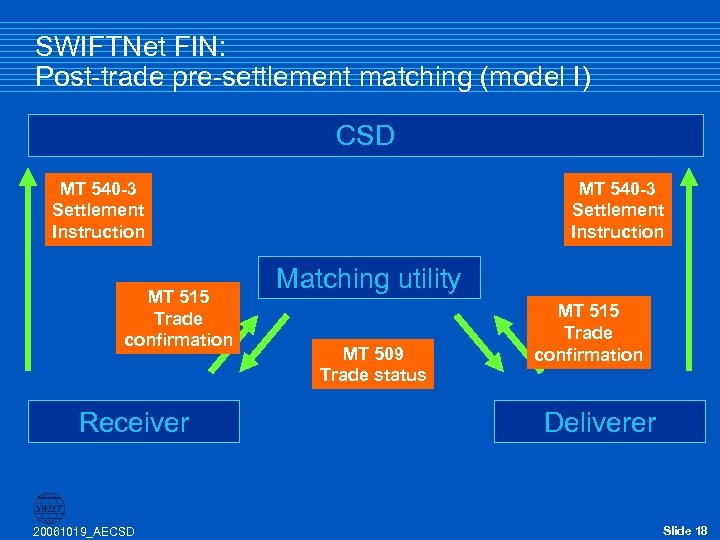

SWIFTNet FIN: Post-trade pre-settlement matching (model I) CSD MT 540 -3 Settlement Instruction MT 515 Trade confirmation Receiver 20061019_AECSD MT 540 -3 Settlement Instruction Matching utility MT 509 Trade status MT 515 Trade confirmation Deliverer Slide 18

SWIFTNet FIN: Post-trade pre-settlement matching (model I) CSD MT 540 -3 Settlement Instruction MT 515 Trade confirmation Receiver 20061019_AECSD MT 540 -3 Settlement Instruction Matching utility MT 509 Trade status MT 515 Trade confirmation Deliverer Slide 18

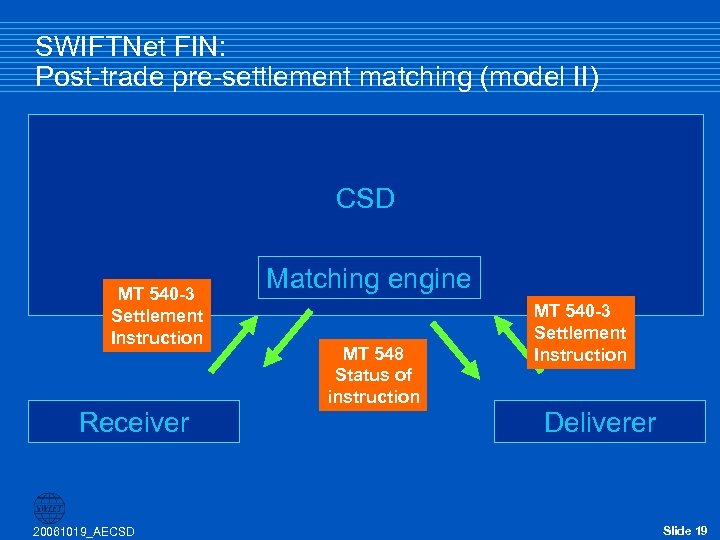

SWIFTNet FIN: Post-trade pre-settlement matching (model II) CSD MT 540 -3 Settlement Instruction Receiver 20061019_AECSD Matching engine MT 548 Status of instruction MT 540 -3 Settlement Instruction Deliverer Slide 19

SWIFTNet FIN: Post-trade pre-settlement matching (model II) CSD MT 540 -3 Settlement Instruction Receiver 20061019_AECSD Matching engine MT 548 Status of instruction MT 540 -3 Settlement Instruction Deliverer Slide 19

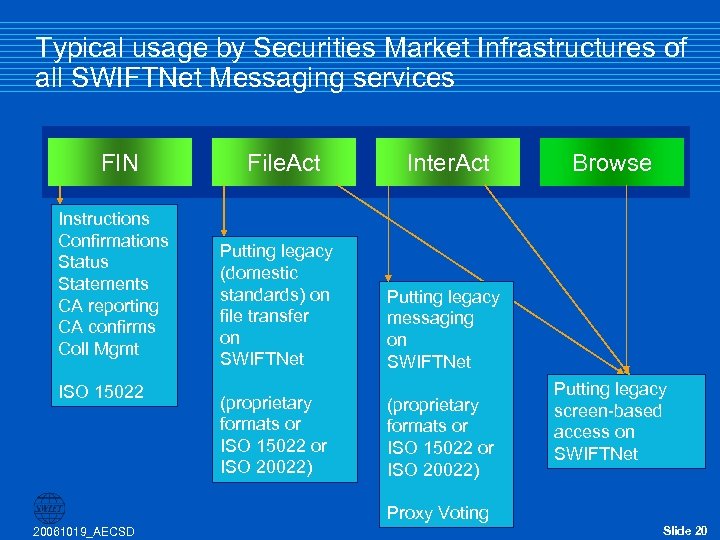

Typical usage by Securities Market Infrastructures of all SWIFTNet Messaging services FIN Instructions Confirmations Status Statements CA reporting CA confirms Coll Mgmt ISO 15022 File. Act Putting legacy (domestic standards) on file transfer on SWIFTNet (proprietary formats or ISO 15022 or ISO 20022) Inter. Act Browse Putting legacy messaging on SWIFTNet (proprietary formats or ISO 15022 or ISO 20022) Putting legacy screen-based access on SWIFTNet Proxy Voting 20061019_AECSD Slide 20

Typical usage by Securities Market Infrastructures of all SWIFTNet Messaging services FIN Instructions Confirmations Status Statements CA reporting CA confirms Coll Mgmt ISO 15022 File. Act Putting legacy (domestic standards) on file transfer on SWIFTNet (proprietary formats or ISO 15022 or ISO 20022) Inter. Act Browse Putting legacy messaging on SWIFTNet (proprietary formats or ISO 15022 or ISO 20022) Putting legacy screen-based access on SWIFTNet Proxy Voting 20061019_AECSD Slide 20

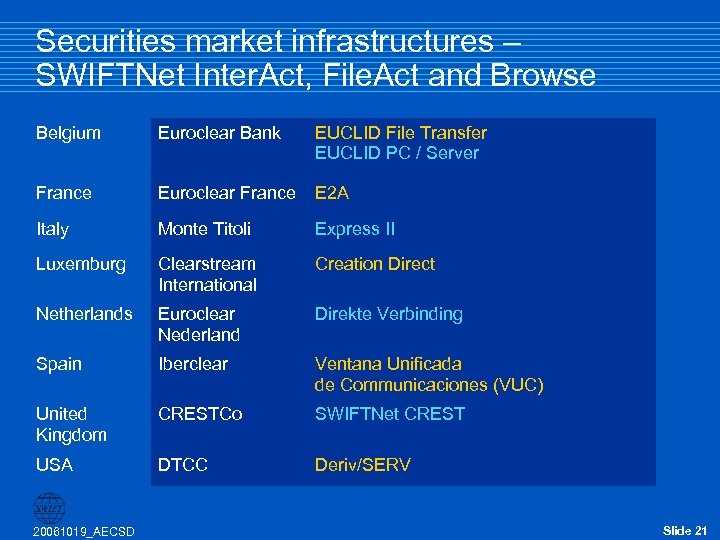

Securities market infrastructures – SWIFTNet Inter. Act, File. Act and Browse Belgium Euroclear Bank EUCLID File Transfer EUCLID PC / Server France Euroclear France E 2 A Italy Monte Titoli Express II Luxemburg Clearstream International Creation Direct Netherlands Euroclear Nederland Direkte Verbinding Spain Iberclear Ventana Unificada de Communicaciones (VUC) United Kingdom CRESTCo SWIFTNet CREST USA DTCC Deriv/SERV 20061019_AECSD Slide 21

Securities market infrastructures – SWIFTNet Inter. Act, File. Act and Browse Belgium Euroclear Bank EUCLID File Transfer EUCLID PC / Server France Euroclear France E 2 A Italy Monte Titoli Express II Luxemburg Clearstream International Creation Direct Netherlands Euroclear Nederland Direkte Verbinding Spain Iberclear Ventana Unificada de Communicaciones (VUC) United Kingdom CRESTCo SWIFTNet CREST USA DTCC Deriv/SERV 20061019_AECSD Slide 21

Who is listening? < ECSDA (EU) < ACSDA (Americas) < ACG (APAC) < AECSD (CIS) < and you, the AMEDA < and a date for your diaries Boston October 1 -5, 2007 20061019_AECSD Slide 22

Who is listening? < ECSDA (EU) < ACSDA (Americas) < ACG (APAC) < AECSD (CIS) < and you, the AMEDA < and a date for your diaries Boston October 1 -5, 2007 20061019_AECSD Slide 22

Accessing CSDs through SWIFT: Market needs < < < UN DE RD ISC US SIO N One standardised solution standardised – Interfaces – Messaging – Security Giovannini compliant and EU integration future proof Giovannini compliant Complete range of communication channels ISO compliant standards (15022 and 20022) ISO compliant Uniform service (support, liability, …) Uniform service Value-added services 20061019_AECSD Slide 23

Accessing CSDs through SWIFT: Market needs < < < UN DE RD ISC US SIO N One standardised solution standardised – Interfaces – Messaging – Security Giovannini compliant and EU integration future proof Giovannini compliant Complete range of communication channels ISO compliant standards (15022 and 20022) ISO compliant Uniform service (support, liability, …) Uniform service Value-added services 20061019_AECSD Slide 23

Thank you for your attention 20061019_AECSD Slide 24

Thank you for your attention 20061019_AECSD Slide 24

Central Securities Depositories, ISO Standards and SWIFT Automation today and for the future John Falk 19 October 20061019_AECSD Slide 25

Central Securities Depositories, ISO Standards and SWIFT Automation today and for the future John Falk 19 October 20061019_AECSD Slide 25

Back-up 20061019_AECSD Slide 26

Back-up 20061019_AECSD Slide 26

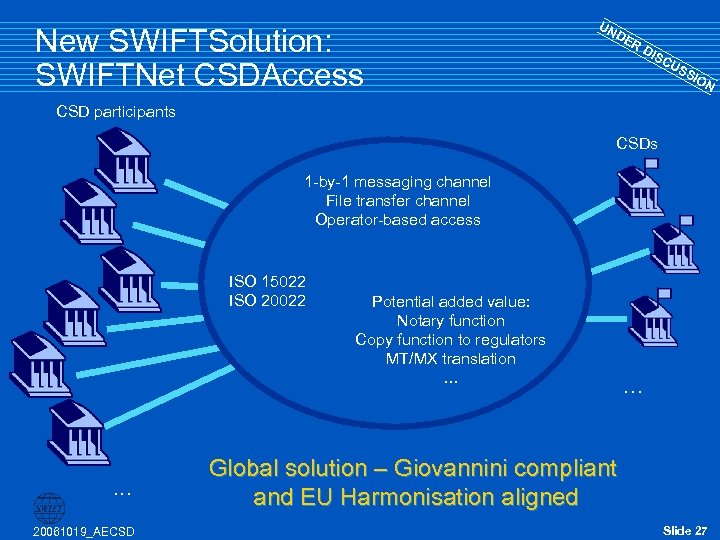

New SWIFTSolution: SWIFTNet CSDAccess UN DE RD ISC US SIO N CSD participants CSDs 1 -by-1 messaging channel File transfer channel Operator-based access ISO 15022 ISO 20022 . . . 20061019_AECSD Potential added value: Notary function Copy function to regulators MT/MX translation … . . . Global solution – Giovannini compliant and EU Harmonisation aligned Slide 27

New SWIFTSolution: SWIFTNet CSDAccess UN DE RD ISC US SIO N CSD participants CSDs 1 -by-1 messaging channel File transfer channel Operator-based access ISO 15022 ISO 20022 . . . 20061019_AECSD Potential added value: Notary function Copy function to regulators MT/MX translation … . . . Global solution – Giovannini compliant and EU Harmonisation aligned Slide 27

Agenda SWIFT update Securities MIs using SWIFT EU C&S harmonisation New SWIFTSolution: SWIFTNet CSDAccess SN Kits: Connectivity for small users 20061019_AECSD Slide 28

Agenda SWIFT update Securities MIs using SWIFT EU C&S harmonisation New SWIFTSolution: SWIFTNet CSDAccess SN Kits: Connectivity for small users 20061019_AECSD Slide 28

SWIFT usage for local intermediaries < Local CSD, Central Bank & settlement agents < International Cash Correspondents < Global Custodians < International B/Ds 20061019_AECSD Slide 29

SWIFT usage for local intermediaries < Local CSD, Central Bank & settlement agents < International Cash Correspondents < Global Custodians < International B/Ds 20061019_AECSD Slide 29

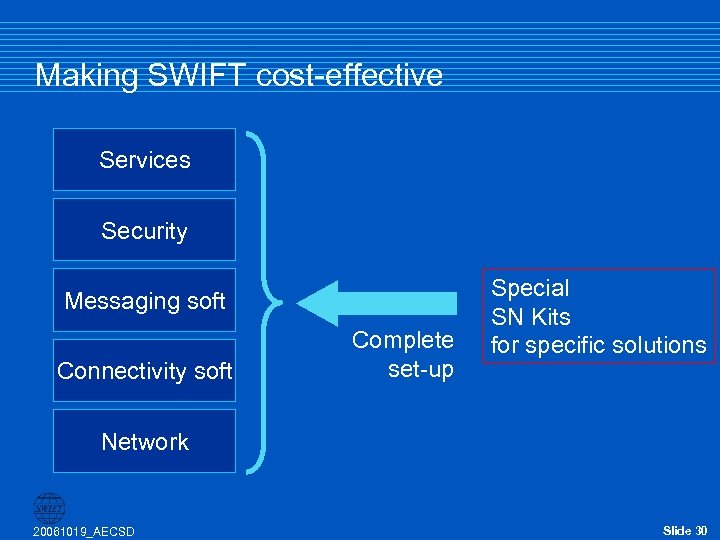

Making SWIFT cost-effective Services Security Messaging soft Connectivity soft Complete set-up Special SN Kits for specific solutions Network 20061019_AECSD Slide 30

Making SWIFT cost-effective Services Security Messaging soft Connectivity soft Complete set-up Special SN Kits for specific solutions Network 20061019_AECSD Slide 30

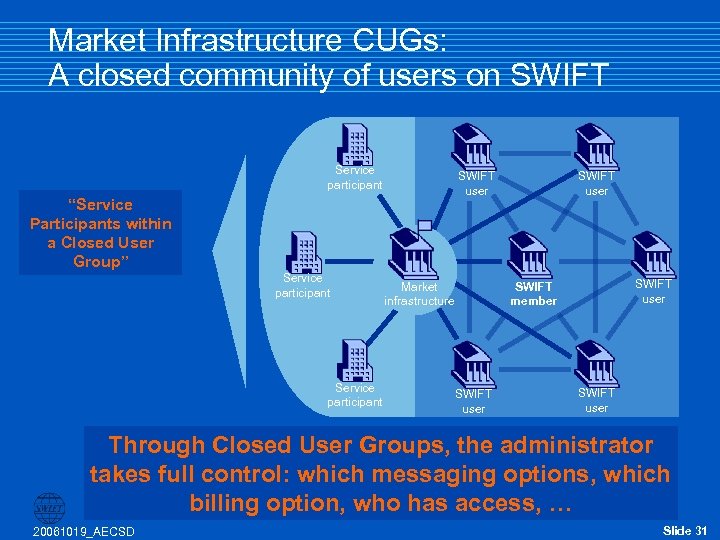

Market Infrastructure CUGs: A closed community of users on SWIFT Service participant SWIFT user “Service Participants within a Closed User Group” Service participant Market infrastructure SWIFT user SWIFT member SWIFT user Through Closed User Groups, the administrator takes full control: which messaging options, which billing option, who has access, … 20061019_AECSD Slide 31

Market Infrastructure CUGs: A closed community of users on SWIFT Service participant SWIFT user “Service Participants within a Closed User Group” Service participant Market infrastructure SWIFT user SWIFT member SWIFT user Through Closed User Groups, the administrator takes full control: which messaging options, which billing option, who has access, … 20061019_AECSD Slide 31

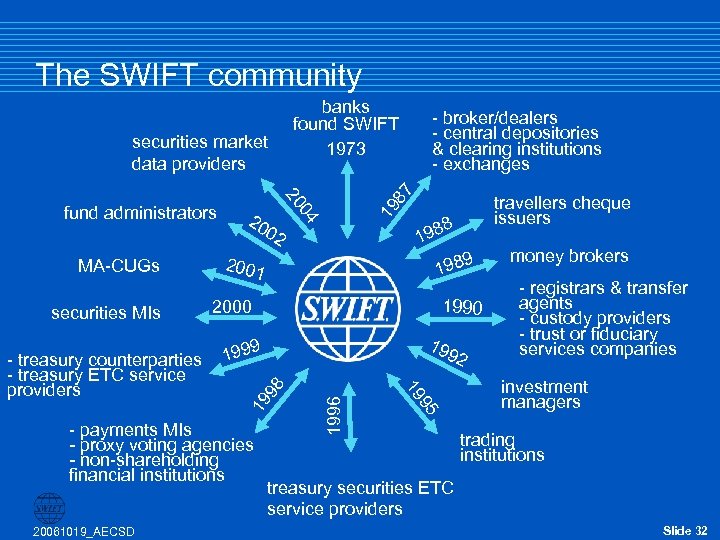

The SWIFT community banks found SWIFT 1973 19 8 9 198 2001 1990 2000 19 9 1996 98 92 95 - payments MIs - proxy voting agencies - non-shareholding financial institutions 20061019_AECSD travellers cheque issuers 988 1 19 - treasury counterparties - treasury ETC service providers 02 19 securities MIs 20 04 MA-CUGs 20 fund administrators 7 securities market data providers - broker/dealers - central depositories & clearing institutions - exchanges money brokers - registrars & transfer agents - custody providers - trust or fiduciary services companies investment managers trading institutions treasury securities ETC service providers Slide 32

The SWIFT community banks found SWIFT 1973 19 8 9 198 2001 1990 2000 19 9 1996 98 92 95 - payments MIs - proxy voting agencies - non-shareholding financial institutions 20061019_AECSD travellers cheque issuers 988 1 19 - treasury counterparties - treasury ETC service providers 02 19 securities MIs 20 04 MA-CUGs 20 fund administrators 7 securities market data providers - broker/dealers - central depositories & clearing institutions - exchanges money brokers - registrars & transfer agents - custody providers - trust or fiduciary services companies investment managers trading institutions treasury securities ETC service providers Slide 32

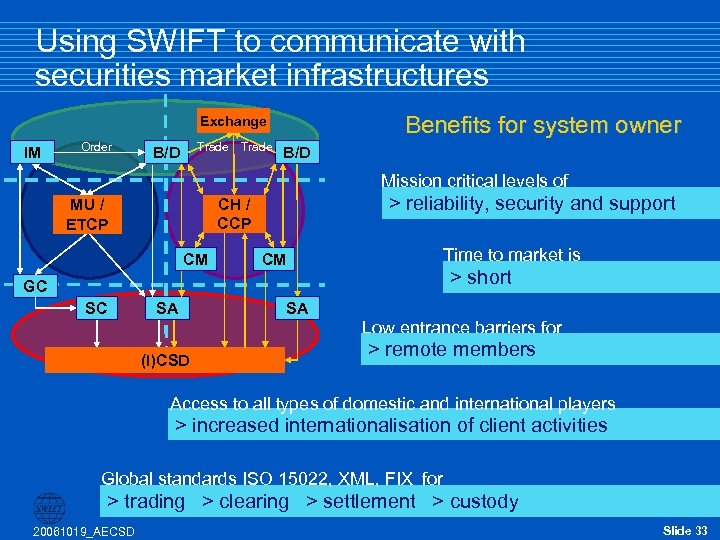

Using SWIFT to communicate with securities market infrastructures Benefits for system owner Exchange IM Order Trade B/D Mission critical levels of > reliability, security and support CH / CCP MU / ETCP CM CM Time to market is > short GC SC SA (I)CSD SA Low entrance barriers for > remote members Access to all types of domestic and international players > increased internationalisation of client activities Global standards ISO 15022, XML, FIX for > trading > clearing > settlement > custody 20061019_AECSD Slide 33

Using SWIFT to communicate with securities market infrastructures Benefits for system owner Exchange IM Order Trade B/D Mission critical levels of > reliability, security and support CH / CCP MU / ETCP CM CM Time to market is > short GC SC SA (I)CSD SA Low entrance barriers for > remote members Access to all types of domestic and international players > increased internationalisation of client activities Global standards ISO 15022, XML, FIX for > trading > clearing > settlement > custody 20061019_AECSD Slide 33

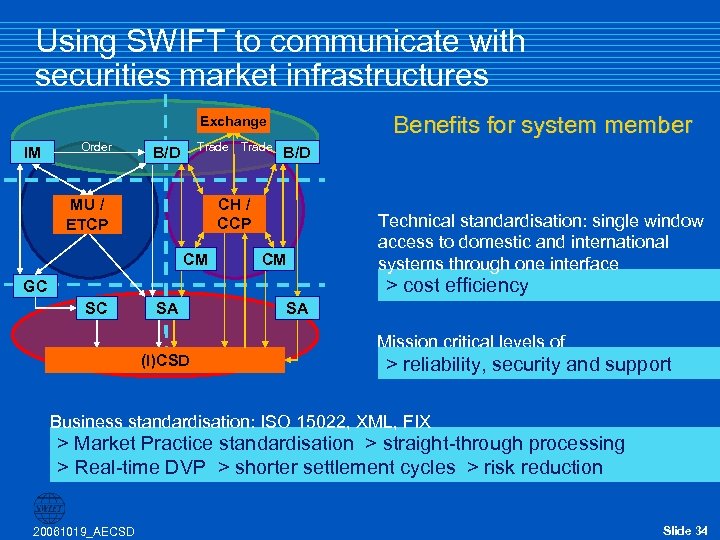

Using SWIFT to communicate with securities market infrastructures Benefits for system member Exchange IM Order Trade B/D CH / CCP MU / ETCP CM CM Technical standardisation: single window access to domestic and international systems through one interface > cost efficiency GC SC SA (I)CSD SA Mission critical levels of > reliability, security and support Business standardisation: ISO 15022, XML, FIX > Market Practice standardisation > straight-through processing > Real-time DVP > shorter settlement cycles > risk reduction 20061019_AECSD Slide 34

Using SWIFT to communicate with securities market infrastructures Benefits for system member Exchange IM Order Trade B/D CH / CCP MU / ETCP CM CM Technical standardisation: single window access to domestic and international systems through one interface > cost efficiency GC SC SA (I)CSD SA Mission critical levels of > reliability, security and support Business standardisation: ISO 15022, XML, FIX > Market Practice standardisation > straight-through processing > Real-time DVP > shorter settlement cycles > risk reduction 20061019_AECSD Slide 34