6f3214988eb999b95bef9d577defb0e2.ppt

- Количество слайдов: 29

Central & Eastern Europe Developments Automotive News Global Conference - Detroit Jan ’ 08 Chris Lacey – General Motors

Today : • Central & Eastern European Markets − What are they − How are they developing − GM’s go-to-market strategy − Conclusions …. . and finally ………

GM’s “Central & Eastern Europe” • 29 countries − East of Germany, North, West & East of both India & China! − 12 time zones / 25 million sq. kilometers − 475 million population [8% of the world, 54% of Europe] − 84 million vehicles in car parc today [Average = 12+ years] − 30 languages, 4 religions • GDP range (nominal 2006) GDP Total (million USD) Russia 986 940 Moldova 3 266 Per Capita (USD) Slovenia 22 079 Uzbekistan 753 • Complex legislative environment • Less than 20 years ago private vehicle retailing illegal – now one of the fastest growing vehicle markets in the world !

To put the Region in perspective

Diverse demand usage

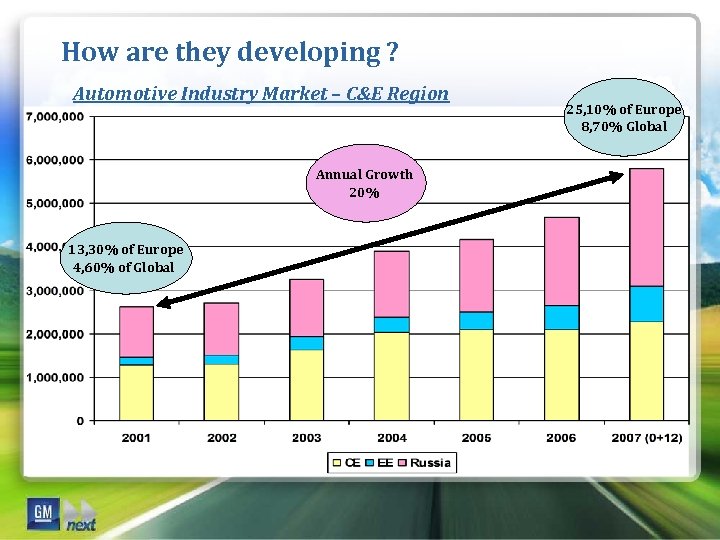

How are they developing ? Automotive Industry Market – C&E Region Annual Growth 20% 13, 30% of Europe 4, 60% of Global 25, 10% of Europe 8, 70% Global

GM’S “Go-to-market approach” • Our 5 P’s − The right Partners within GM to provide products for the range of price points required − The right Partners in market place for manufacturing − The right Partners for component supply − The right Partners in the market for vehicle distribution and repair − The right Partner philosophy with our customers

The right Partners within GM for Product : • European Opel & SAAB • North American Cadillac / Hummer / Chevrolet SUVs • Asian [GM DAT] Chevrolet cars and SUVs • Russian [GM Avto. Vaz] Chevrolet Niva Real evidence of GM’s Globalisation and “One Company” approach.

The right Partners within GM for Product:

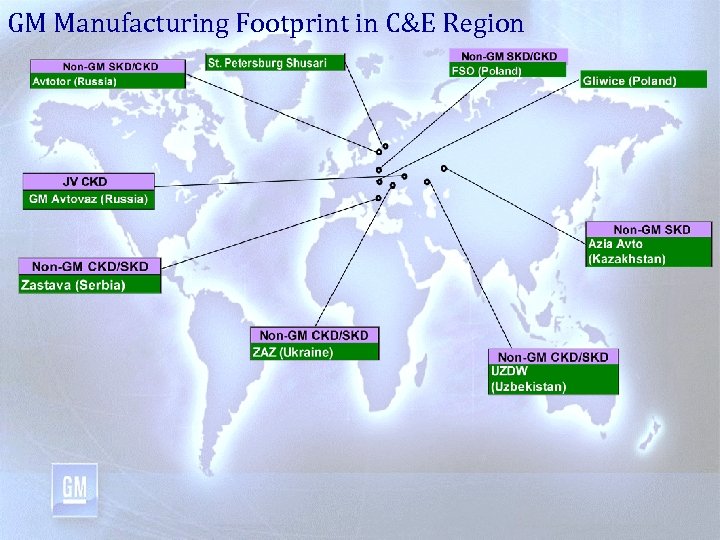

The right Partners for manufacturing • GM and GM DAT (formerly Daewoo) have a long history of manufacturing in the C&E Region from early 90’s • GM in late 90’s actually stopped vehicle manufacturing in 3 GM plants in the region – Hungary, Poland (Warsaw), and Turkey • Daewoo had 4 regional plants (licensed assemblers) all still operating (in Ukraine, Poland (FSO), Uzbekistan, & Romania) • 180, 000 GM DAT vehicle kits assembled in these plants are not recorded in GM Sales in the region • Recent developments include the new GM plant in St Petersburg and manufacturing licenses being granted to Zastava in Serbia, Azia Avto in Kazakhstan, and FSO in Poland • Currently GM vehicles are manufactured or assembled at 9 locations in the region

GM Manufacturing Footprint in C&E Region

The right Partners for component supply • GM’s Global Purchasing and Supply Chain group aims to increase component sourcing close to where we build • They extend supply channels, identify local suppliers and develop to GM standards for local and global manufacturing • Purchases in C&E region increased by 81% from 2003 to 2007, now 21. 4% of total GME purchases • 440 TIER 1 Suppliers in C&E region • Resident Global Purchasing staff in C&E region increased by 305% • C&E region purchasing transactions 100% integrated in GPSC processes

Innovative customers need to be served well !

![The right Partners for Distribution & Repair • GM network growth [contracts] ‘ 95 The right Partners for Distribution & Repair • GM network growth [contracts] ‘ 95](https://present5.com/presentation/6f3214988eb999b95bef9d577defb0e2/image-14.jpg)

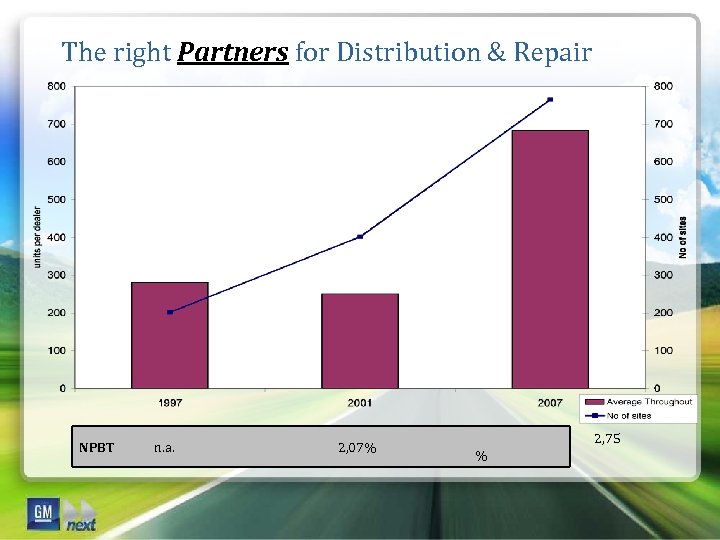

The right Partners for Distribution & Repair • GM network growth [contracts] ‘ 95 = 202 ‘ 01= 402 ‘ 07 = 765 • In depth blueprinting • Best applicant selection: Management focus / site location / funding / customer service attitude • Full multi-brand approach appropriate to location & opportunity • Facilities to full European standards from day 1 • Communication / motivation / training & guidance

The right Partners for Distribution & Repair NPBT n. a. 2, 07% 2, 75 %

The right Partner philosophy with our customers. • Changing the “old image” of the pre ’ 90’s industry & treating customers with respect − − − − − Transparent retail pricing [no premiums] Warranty & “Policy” Realistic labor / repair rates Satisfaction survey CRM activities Retail finance and leasing options Vehicle exchange or “buy back” policy Excellent parts warehousing and fast delivery Open communication /dialogue / CAC’s G 2 used car programme

Self Assessment / Learnings & Observations Could we have done better? • Dealer in house systems • Full portfolio - only in 60% of market covered - Full CV range - Low cost product < $8, 000 • Wholesale & Retail finance in all markets • Faster manufacturing capacity increases • More training & more training Learnings & Observations • No phones to mobiles • Cash to credit cards • Brand is King • High % Internet use • Mobile / clothes / travel / car / apartment / house • Millionaires Show [Russia] • Distribution partners’ positive can do attitude and investment policy • Entrepreneurs everywhere

Operational Difficulties and Legislation We try hard not be lost in the complex maze…

2001 through 2007 – A Success Story GM Volume & Share Development – Central & Eastern Europe *Excludes 180 K GM Daewoo Kits sold in the region in 2007

……………. . and finally • Market Volumes : - Russia = 2, 708, 659 - Ukraine = 584, 823 - Turkey = 625, 843 - Poland = 372, 054 - China = 8, 190, 436 - Brazil = 2, 220, 481 - India = 1, 812, 375

…. and finally …. Emerging Markets ? ?

……………. . and finally Request: Can all of the Global Automotive Industry stop calling these markets & Brazil, China and many others: “Emerging” Fact: They have “Emerged” and are our markets of “Growth & Opportunity” We forget / ignore/ mistreat them at our peril.

Central & Eastern Europe Playing To Win

6f3214988eb999b95bef9d577defb0e2.ppt