Cat.pptx

- Количество слайдов: 8

Center of Mathematical Finance Eurasia Drilling Company – C. A. T. Oil – Team 3 06 December 2014

Center of Mathematical Finance Eurasia Drilling Company – C. A. T. Oil – Team 3 06 December 2014

Uralkali Acquisition Team 3 members and roles Strategic Rationale • Иван Свинцов Financial model of the target company • Георгий Горбатов Financial model of the target company • Никита Трифонов Strategic Rationale, Comparable company and transaction analysis • Мария Мельникова Share price performance and shareholder breakdown, Comparable company and transaction analysis • Богдан Литвак Team Leader • Джамал Баглиев Financial model of the target company U. S. • Алексей Филиппов Financial model of the target company • Ирина Земскова Strategic Rationale, Comparable company and transaction analysis • Станислав Иванов Comparable company and transaction analysis, Merger analysis • Екатерина Кан Strategic Rationale • Дана Жунусова Strategic Rationale • Наиль Матыгуллин Comparable company and transaction analysis

Uralkali Acquisition Team 3 members and roles Strategic Rationale • Иван Свинцов Financial model of the target company • Георгий Горбатов Financial model of the target company • Никита Трифонов Strategic Rationale, Comparable company and transaction analysis • Мария Мельникова Share price performance and shareholder breakdown, Comparable company and transaction analysis • Богдан Литвак Team Leader • Джамал Баглиев Financial model of the target company U. S. • Алексей Филиппов Financial model of the target company • Ирина Земскова Strategic Rationale, Comparable company and transaction analysis • Станислав Иванов Comparable company and transaction analysis, Merger analysis • Екатерина Кан Strategic Rationale • Дана Жунусова Strategic Rationale • Наиль Матыгуллин Comparable company and transaction analysis

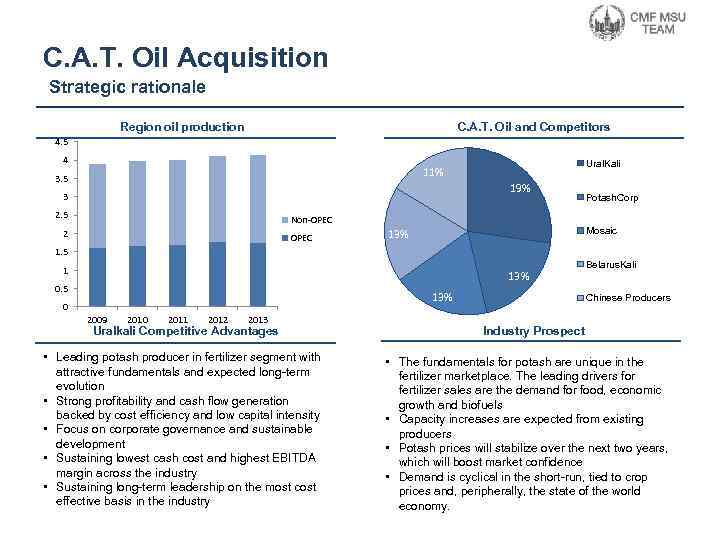

C. A. T. Oil Acquisition Strategic rationale Region oil production C. A. T. Oil and Competitors 4. 5 4 Ural. Kali 11% 3. 5 19% 3 2. 5 Non-OPEC 2 OPEC Potash. Corp Mosaic 13% 1. 5 1 13% 0. 5 13% 0 2009 2010 2011 2012 2013 Uralkali Competitive Advantages • Leading potash producer in fertilizer segment with attractive fundamentals and expected long-term evolution • Strong profitability and cash flow generation backed by cost efficiency and low capital intensity • Focus on corporate governance and sustainable development • Sustaining lowest cash cost and highest EBITDA margin across the industry • Sustaining long-term leadership on the most cost effective basis in the industry Belarus. Kali Chinese Producers Industry Prospect • The fundamentals for potash are unique in the fertilizer marketplace. The leading drivers for fertilizer sales are the demand for food, economic growth and biofuels • Capacity increases are expected from existing producers • Potash prices will stabilize over the next two years, which will boost market confidence • Demand is cyclical in the short-run, tied to crop prices and, peripherally, the state of the world economy.

C. A. T. Oil Acquisition Strategic rationale Region oil production C. A. T. Oil and Competitors 4. 5 4 Ural. Kali 11% 3. 5 19% 3 2. 5 Non-OPEC 2 OPEC Potash. Corp Mosaic 13% 1. 5 1 13% 0. 5 13% 0 2009 2010 2011 2012 2013 Uralkali Competitive Advantages • Leading potash producer in fertilizer segment with attractive fundamentals and expected long-term evolution • Strong profitability and cash flow generation backed by cost efficiency and low capital intensity • Focus on corporate governance and sustainable development • Sustaining lowest cash cost and highest EBITDA margin across the industry • Sustaining long-term leadership on the most cost effective basis in the industry Belarus. Kali Chinese Producers Industry Prospect • The fundamentals for potash are unique in the fertilizer marketplace. The leading drivers for fertilizer sales are the demand for food, economic growth and biofuels • Capacity increases are expected from existing producers • Potash prices will stabilize over the next two years, which will boost market confidence • Demand is cyclical in the short-run, tied to crop prices and, peripherally, the state of the world economy.

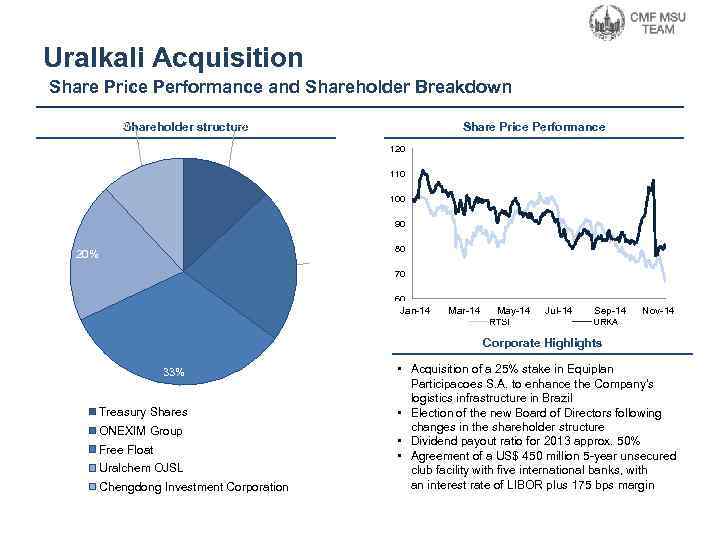

Uralkali Acquisition Share Price Performance and Shareholder Breakdown 12% 13% Shareholder structure Share Price Performance 120 110 100 90 80 20% 22% 70 60 Jan-00 Jan-14 Mar-14 May-14 RTSI Jul-14 Sep-14 Nov-14 URKA Corporate Highlights 33% Treasury Shares ONEXIM Group Free Float Uralchem OJSL Chengdong Investment Corporation • Acquisition of a 25% stake in Equiplan Participacoes S. A. to enhance the Company’s logistics infrastructure in Brazil • Election of the new Board of Directors following changes in the shareholder structure • Dividend payout ratio for 2013 approx. 50% • Agreement of a US$ 450 million 5 -year unsecured club facility with five international banks, with an interest rate of LIBOR plus 175 bps margin

Uralkali Acquisition Share Price Performance and Shareholder Breakdown 12% 13% Shareholder structure Share Price Performance 120 110 100 90 80 20% 22% 70 60 Jan-00 Jan-14 Mar-14 May-14 RTSI Jul-14 Sep-14 Nov-14 URKA Corporate Highlights 33% Treasury Shares ONEXIM Group Free Float Uralchem OJSL Chengdong Investment Corporation • Acquisition of a 25% stake in Equiplan Participacoes S. A. to enhance the Company’s logistics infrastructure in Brazil • Election of the new Board of Directors following changes in the shareholder structure • Dividend payout ratio for 2013 approx. 50% • Agreement of a US$ 450 million 5 -year unsecured club facility with five international banks, with an interest rate of LIBOR plus 175 bps margin

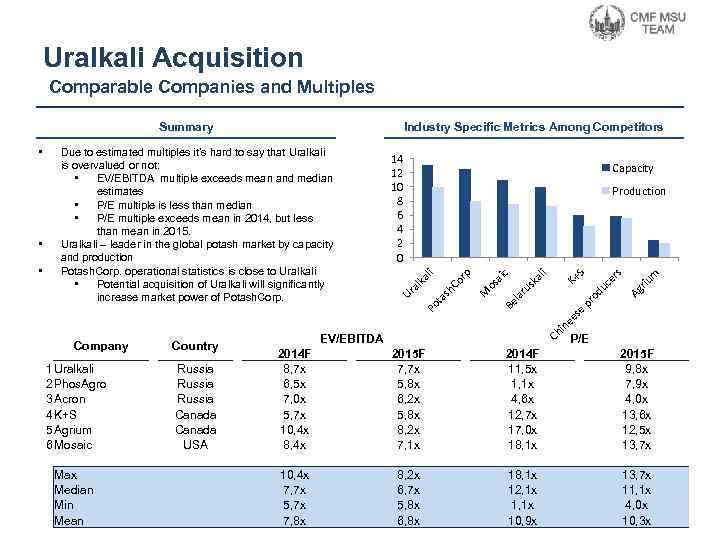

Uralkali Acquisition Comparable Companies and Multiples Capacity 1 Uralkali 2 Phos. Agro 3 Acron 4 K+S 5 Agrium 6 Mosaic Max Median Min Mean 2014 F 8, 7 x 6, 5 x 7, 0 x 5, 7 x 10, 4 x 8, 4 x Russia Canada USA 10, 4 x 7, 7 x 5, 7 x 7, 8 x 8, 2 x 6, 7 x 5, 8 x 6, 8 x m riu er s uc S pr od ee se in 2015 F 7, 7 x 5, 8 x 6, 2 x 5, 8 x 8, 2 x 7, 1 x K+ al i ru sk c la EV/EBITDA Country Ch Company os ai Be ta M sh Co rp Production Po • 14 12 10 8 6 4 2 0 al ka li • Due to estimated multiples it’s hard to say that Uralkali is overvalued or not: • EV/EBITDA multiple exceeds mean and median estimates • P/E multiple is less than median • P/E multiple exceeds mean in 2014, but less than mean in 2015. Uralkali – leader in the global potash market by capacity and production Potash. Corp. operational statistics is close to Uralkali • Potential acquisition of Uralkali will significantly increase market power of Potash. Corp. Ur • Industry Specific Metrics Among Competitors Ag Summary P/E 2014 F 11, 5 x 1, 1 x 4, 6 x 12, 7 x 17, 0 x 18, 1 x 2015 F 9, 8 x 7, 9 x 4, 0 x 13, 6 x 12, 5 x 13, 7 x 18, 1 x 12, 1 x 10, 9 x 13, 7 x 11, 1 x 4, 0 x 10, 3 x

Uralkali Acquisition Comparable Companies and Multiples Capacity 1 Uralkali 2 Phos. Agro 3 Acron 4 K+S 5 Agrium 6 Mosaic Max Median Min Mean 2014 F 8, 7 x 6, 5 x 7, 0 x 5, 7 x 10, 4 x 8, 4 x Russia Canada USA 10, 4 x 7, 7 x 5, 7 x 7, 8 x 8, 2 x 6, 7 x 5, 8 x 6, 8 x m riu er s uc S pr od ee se in 2015 F 7, 7 x 5, 8 x 6, 2 x 5, 8 x 8, 2 x 7, 1 x K+ al i ru sk c la EV/EBITDA Country Ch Company os ai Be ta M sh Co rp Production Po • 14 12 10 8 6 4 2 0 al ka li • Due to estimated multiples it’s hard to say that Uralkali is overvalued or not: • EV/EBITDA multiple exceeds mean and median estimates • P/E multiple is less than median • P/E multiple exceeds mean in 2014, but less than mean in 2015. Uralkali – leader in the global potash market by capacity and production Potash. Corp. operational statistics is close to Uralkali • Potential acquisition of Uralkali will significantly increase market power of Potash. Corp. Ur • Industry Specific Metrics Among Competitors Ag Summary P/E 2014 F 11, 5 x 1, 1 x 4, 6 x 12, 7 x 17, 0 x 18, 1 x 2015 F 9, 8 x 7, 9 x 4, 0 x 13, 6 x 12, 5 x 13, 7 x 18, 1 x 12, 1 x 10, 9 x 13, 7 x 11, 1 x 4, 0 x 10, 3 x

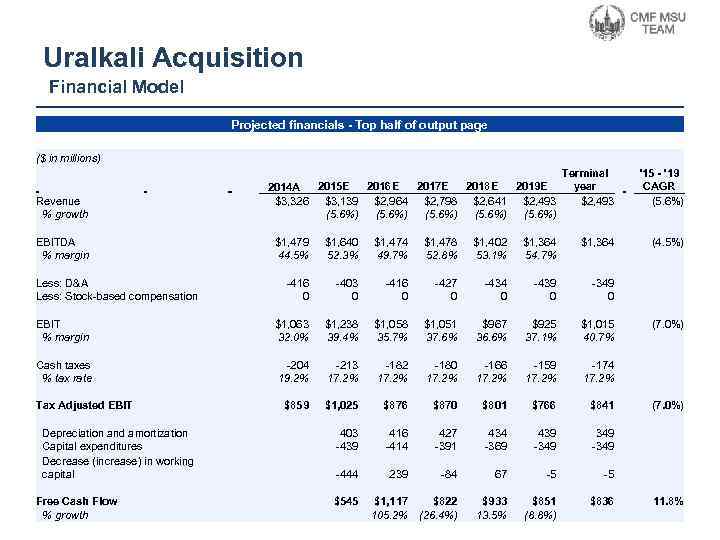

Uralkali Acquisition Financial Model Projected financials - Top half of output page ($ in millions) Revenue % growth EBITDA % margin Less: D&A Less: Stock-based compensation EBIT % margin Cash taxes % tax rate Tax Adjusted EBIT Depreciation and amortization Capital expenditures Decrease (increase) in working capital Free Cash Flow % growth Terminal 2015 E 2016 E 2017 E 2018 E 2019 E year 2014 A $3, 326 $3, 139 $2, 964 $2, 798 $2, 641 $2, 493 (5. 6%) $1, 479 $1, 640 $1, 474 $1, 478 $1, 402 $1, 364 44. 5% 52. 3% 49. 7% 52. 8% 53. 1% 54. 7% -416 -403 -416 -427 -434 -439 -349 0 0 $1, 063 $1, 238 $1, 051 $967 $925 $1, 015 32. 0% 39. 4% 35. 7% 37. 6% 36. 6% 37. 1% 40. 7% -204 -213 -182 -180 -166 -159 -174 19. 2% 17. 2% $859 $1, 025 $876 $870 $801 $766 $841 403 416 427 434 439 349 -439 -414 -391 -369 -349 -444 239 -84 $545 $1, 117 $822 105. 2% (26. 4%) 67 $933 13. 5% -5 $851 (8. 8%) -5 $836 '15 - '19 CAGR (5. 6%) (4. 5%) (7. 0%) 11. 8%

Uralkali Acquisition Financial Model Projected financials - Top half of output page ($ in millions) Revenue % growth EBITDA % margin Less: D&A Less: Stock-based compensation EBIT % margin Cash taxes % tax rate Tax Adjusted EBIT Depreciation and amortization Capital expenditures Decrease (increase) in working capital Free Cash Flow % growth Terminal 2015 E 2016 E 2017 E 2018 E 2019 E year 2014 A $3, 326 $3, 139 $2, 964 $2, 798 $2, 641 $2, 493 (5. 6%) $1, 479 $1, 640 $1, 474 $1, 478 $1, 402 $1, 364 44. 5% 52. 3% 49. 7% 52. 8% 53. 1% 54. 7% -416 -403 -416 -427 -434 -439 -349 0 0 $1, 063 $1, 238 $1, 051 $967 $925 $1, 015 32. 0% 39. 4% 35. 7% 37. 6% 36. 6% 37. 1% 40. 7% -204 -213 -182 -180 -166 -159 -174 19. 2% 17. 2% $859 $1, 025 $876 $870 $801 $766 $841 403 416 427 434 439 349 -439 -414 -391 -369 -349 -444 239 -84 $545 $1, 117 $822 105. 2% (26. 4%) 67 $933 13. 5% -5 $851 (8. 8%) -5 $836 '15 - '19 CAGR (5. 6%) (4. 5%) (7. 0%) 11. 8%

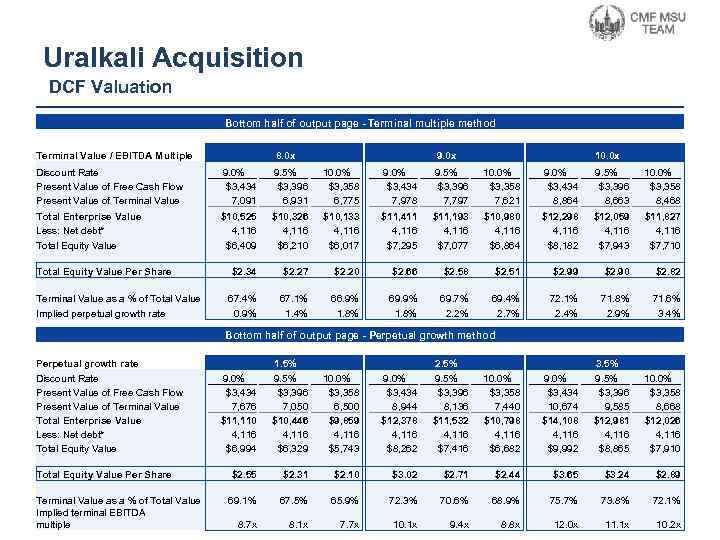

Uralkali Acquisition DCF Valuation Bottom half of output page - Terminal multiple method Terminal Value / EBITDA Multiple 8. 0 x Discount Rate Present Value of Free Cash Flow Present Value of Terminal Value Total Enterprise Value Less: Net debt* Total Equity Value Per Share Terminal Value as a % of Total Value Implied perpetual growth rate $10, 525 $10, 326 $10, 133 $11, 411 $11, 193 $10, 980 $12, 298 $12, 059 $11, 827 4, 116 4, 116 4, 116 $6, 409 $6, 210 $6, 017 $7, 295 $7, 077 $6, 864 $8, 182 $7, 943 $7, 710 $2. 34 $2. 27 $2. 20 $2. 66 $2. 58 $2. 51 $2. 99 $2. 90 $2. 82 67. 4% 67. 1% 66. 9% 69. 7% 69. 4% 72. 1% 71. 8% 71. 6% 0. 9% 1. 4% 1. 8% 2. 2% 2. 7% 2. 4% 2. 9% 3. 4% 9. 0% 9. 5% 10. 0% $3, 434 $3, 396 $3, 358 7, 091 6, 931 6, 775 9. 0 x 9. 0% 9. 5% 10. 0% $3, 434 $3, 396 $3, 358 7, 978 7, 797 7, 621 10. 0 x 9. 0% 9. 5% 10. 0% $3, 434 $3, 396 $3, 358 8, 864 8, 663 8, 468 Bottom half of output page - Perpetual growth method Perpetual growth rate Discount Rate Present Value of Free Cash Flow Present Value of Terminal Value Total Enterprise Value Less: Net debt* Total Equity Value Per Share Terminal Value as a % of Total Value Implied terminal EBITDA multiple 9. 0% 9. 5% 10. 0% $3, 434 $3, 396 $3, 358 7, 676 7, 050 6, 500 8, 944 8, 136 7, 440 10, 674 9, 585 8, 668 $11, 110 $10, 446 $9, 859 $12, 378 $11, 532 $10, 798 $14, 108 $12, 981 $12, 026 4, 116 4, 116 4, 116 $6, 994 $6, 329 $5, 743 $8, 262 $7, 416 $6, 682 $9, 992 $8, 865 $7, 910 $2. 55 $2. 31 $2. 10 $3. 02 $2. 71 $2. 44 $3. 65 $3. 24 $2. 89 69. 1% 67. 5% 65. 9% 72. 3% 70. 6% 68. 9% 75. 7% 73. 8% 72. 1% 8. 7 x 1. 5% 8. 1 x 7. 7 x 10. 1 x 2. 5% 9. 4 x 8. 8 x 12. 0 x 3. 5% 11. 1 x 10. 2 x

Uralkali Acquisition DCF Valuation Bottom half of output page - Terminal multiple method Terminal Value / EBITDA Multiple 8. 0 x Discount Rate Present Value of Free Cash Flow Present Value of Terminal Value Total Enterprise Value Less: Net debt* Total Equity Value Per Share Terminal Value as a % of Total Value Implied perpetual growth rate $10, 525 $10, 326 $10, 133 $11, 411 $11, 193 $10, 980 $12, 298 $12, 059 $11, 827 4, 116 4, 116 4, 116 $6, 409 $6, 210 $6, 017 $7, 295 $7, 077 $6, 864 $8, 182 $7, 943 $7, 710 $2. 34 $2. 27 $2. 20 $2. 66 $2. 58 $2. 51 $2. 99 $2. 90 $2. 82 67. 4% 67. 1% 66. 9% 69. 7% 69. 4% 72. 1% 71. 8% 71. 6% 0. 9% 1. 4% 1. 8% 2. 2% 2. 7% 2. 4% 2. 9% 3. 4% 9. 0% 9. 5% 10. 0% $3, 434 $3, 396 $3, 358 7, 091 6, 931 6, 775 9. 0 x 9. 0% 9. 5% 10. 0% $3, 434 $3, 396 $3, 358 7, 978 7, 797 7, 621 10. 0 x 9. 0% 9. 5% 10. 0% $3, 434 $3, 396 $3, 358 8, 864 8, 663 8, 468 Bottom half of output page - Perpetual growth method Perpetual growth rate Discount Rate Present Value of Free Cash Flow Present Value of Terminal Value Total Enterprise Value Less: Net debt* Total Equity Value Per Share Terminal Value as a % of Total Value Implied terminal EBITDA multiple 9. 0% 9. 5% 10. 0% $3, 434 $3, 396 $3, 358 7, 676 7, 050 6, 500 8, 944 8, 136 7, 440 10, 674 9, 585 8, 668 $11, 110 $10, 446 $9, 859 $12, 378 $11, 532 $10, 798 $14, 108 $12, 981 $12, 026 4, 116 4, 116 4, 116 $6, 994 $6, 329 $5, 743 $8, 262 $7, 416 $6, 682 $9, 992 $8, 865 $7, 910 $2. 55 $2. 31 $2. 10 $3. 02 $2. 71 $2. 44 $3. 65 $3. 24 $2. 89 69. 1% 67. 5% 65. 9% 72. 3% 70. 6% 68. 9% 75. 7% 73. 8% 72. 1% 8. 7 x 1. 5% 8. 1 x 7. 7 x 10. 1 x 2. 5% 9. 4 x 8. 8 x 12. 0 x 3. 5% 11. 1 x 10. 2 x

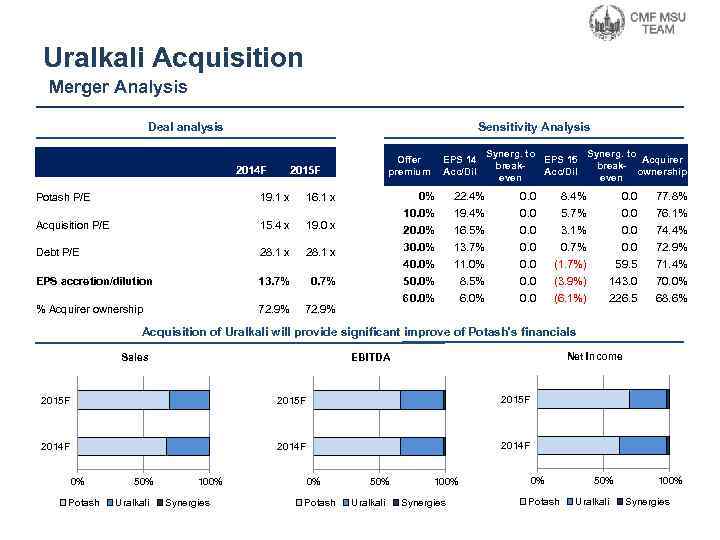

Uralkali Acquisition Merger Analysis Deal analysis Sensitivity Analysis 2014 F Offer premium 2015 F Potash P/E 19. 1 x 15. 4 x 28. 1 x EPS accretion/dilution 13. 7% % Acquirer ownership 72. 9% 0. 0 77. 8% 19. 4% 0. 0 5. 7% 0. 0 76. 1% 16. 5% 0. 0 3. 1% 0. 0 74. 4% 13. 7% 0. 0 0. 7% 0. 0 72. 9% 40. 0% 11. 0% 0. 0 (1. 7%) 59. 5 71. 4% 50. 0% 8. 5% 0. 0 (3. 9%) 143. 0 70. 0% 60. 0% 72. 9% 8. 4% 30. 0% 0. 7% 0. 0 20. 0% 28. 1 x 22. 4% 10. 0% 19. 0 x Debt P/E Synerg. to EPS 15 Acquirer break. Acc/Dil ownership even 0% 16. 1 x Acquisition P/E EPS 14 Acc/Dil 6. 0% 0. 0 (6. 1%) 226. 5 68. 6% Acquisition of Uralkali will provide significant improve of Potash's financials Sales Net Income EBITDA 2015 F 2014 F 0% Potash 50% Uralkali 100% Synergies

Uralkali Acquisition Merger Analysis Deal analysis Sensitivity Analysis 2014 F Offer premium 2015 F Potash P/E 19. 1 x 15. 4 x 28. 1 x EPS accretion/dilution 13. 7% % Acquirer ownership 72. 9% 0. 0 77. 8% 19. 4% 0. 0 5. 7% 0. 0 76. 1% 16. 5% 0. 0 3. 1% 0. 0 74. 4% 13. 7% 0. 0 0. 7% 0. 0 72. 9% 40. 0% 11. 0% 0. 0 (1. 7%) 59. 5 71. 4% 50. 0% 8. 5% 0. 0 (3. 9%) 143. 0 70. 0% 60. 0% 72. 9% 8. 4% 30. 0% 0. 7% 0. 0 20. 0% 28. 1 x 22. 4% 10. 0% 19. 0 x Debt P/E Synerg. to EPS 15 Acquirer break. Acc/Dil ownership even 0% 16. 1 x Acquisition P/E EPS 14 Acc/Dil 6. 0% 0. 0 (6. 1%) 226. 5 68. 6% Acquisition of Uralkali will provide significant improve of Potash's financials Sales Net Income EBITDA 2015 F 2014 F 0% Potash 50% Uralkali 100% Synergies