9bded4df37faab3426221751f68676ac.ppt

- Количество слайдов: 23

CDSL Welcomes You

CDSL Welcomes You

Enhancements in Depository and KRA

Enhancements in Depository and KRA

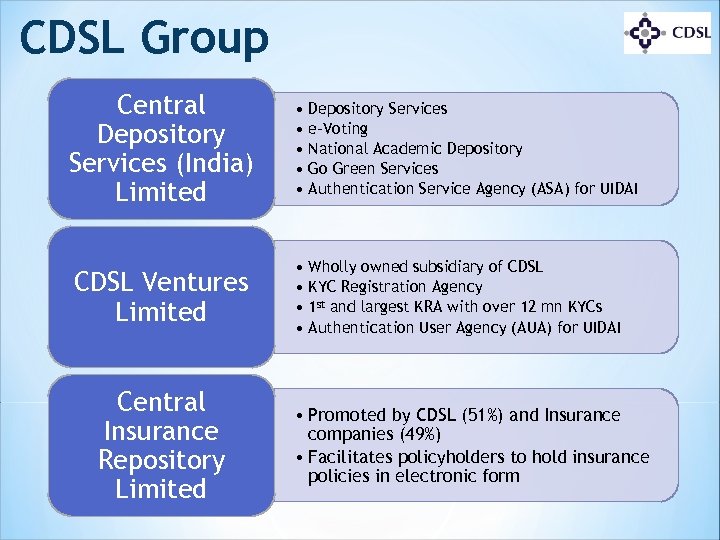

CDSL Group Central Depository Services (India) Limited CDSL Ventures Limited Central Insurance Repository Limited • Depository Services • e-Voting • National Academic Depository • Go Green Services • Authentication Service Agency (ASA) for UIDAI • Wholly owned subsidiary of CDSL • KYC Registration Agency • 1 st and largest KRA with over 12 mn KYCs • Authentication User Agency (AUA) for UIDAI • Promoted by CDSL (51%) and Insurance companies (49%) • Facilitates policyholders to hold insurance policies in electronic form

CDSL Group Central Depository Services (India) Limited CDSL Ventures Limited Central Insurance Repository Limited • Depository Services • e-Voting • National Academic Depository • Go Green Services • Authentication Service Agency (ASA) for UIDAI • Wholly owned subsidiary of CDSL • KYC Registration Agency • 1 st and largest KRA with over 12 mn KYCs • Authentication User Agency (AUA) for UIDAI • Promoted by CDSL (51%) and Insurance companies (49%) • Facilitates policyholders to hold insurance policies in electronic form

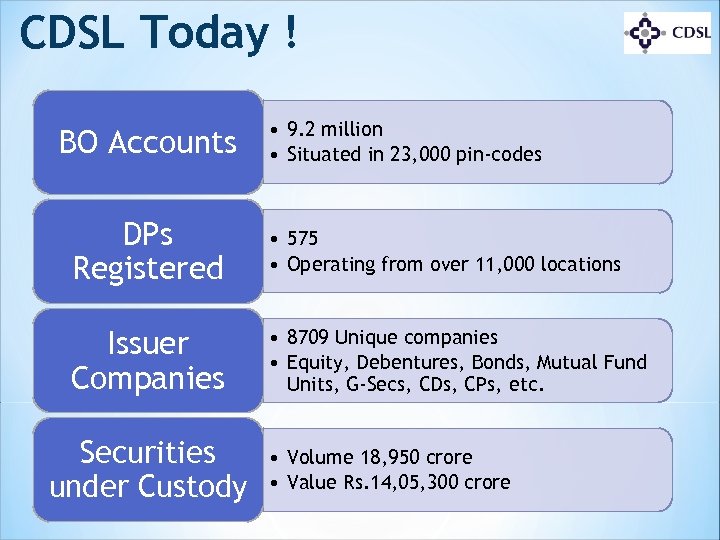

CDSL Today ! BO Accounts • 9. 2 million • Situated in 23, 000 pin-codes DPs Registered • 575 • Operating from over 11, 000 locations Issuer Companies • 8709 Unique companies • Equity, Debentures, Bonds, Mutual Fund Units, G-Secs, CDs, CPs, etc. Securities under Custody • Volume 18, 950 crore • Value Rs. 14, 05, 300 crore

CDSL Today ! BO Accounts • 9. 2 million • Situated in 23, 000 pin-codes DPs Registered • 575 • Operating from over 11, 000 locations Issuer Companies • 8709 Unique companies • Equity, Debentures, Bonds, Mutual Fund Units, G-Secs, CDs, CPs, etc. Securities under Custody • Volume 18, 950 crore • Value Rs. 14, 05, 300 crore

Current Enhancements

Current Enhancements

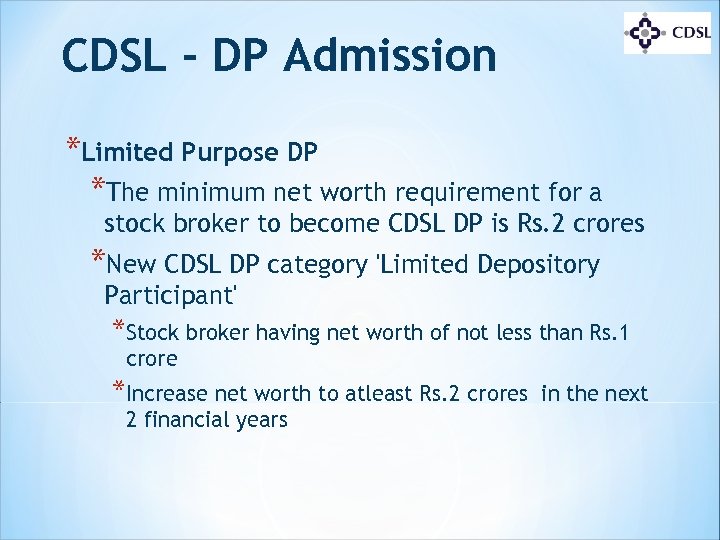

CDSL - DP Admission *Limited Purpose DP *The minimum net worth requirement for a stock broker to become CDSL DP is Rs. 2 crores *New CDSL DP category 'Limited Depository Participant' *Stock broker having net worth of not less than Rs. 1 crore *Increase net worth to atleast Rs. 2 crores 2 financial years in the next

CDSL - DP Admission *Limited Purpose DP *The minimum net worth requirement for a stock broker to become CDSL DP is Rs. 2 crores *New CDSL DP category 'Limited Depository Participant' *Stock broker having net worth of not less than Rs. 1 crore *Increase net worth to atleast Rs. 2 crores 2 financial years in the next

CDSL SYSTEMS *Single File (Common) Upload for all types of transactions *Single download transaction report (DP 57) for convenient Back office Updation. *CDAS application has been made available as a browser based version to keep pace with the new technology and provide greater flexibility and ease of use. *CDSL has obtained ISO 27001 certification for not only its main site, but also for its DRS from world renowned certifying body DNV. *CDSL has obtained BS 25999 -2: 2007 certification for its Business Continuity Management System

CDSL SYSTEMS *Single File (Common) Upload for all types of transactions *Single download transaction report (DP 57) for convenient Back office Updation. *CDAS application has been made available as a browser based version to keep pace with the new technology and provide greater flexibility and ease of use. *CDSL has obtained ISO 27001 certification for not only its main site, but also for its DRS from world renowned certifying body DNV. *CDSL has obtained BS 25999 -2: 2007 certification for its Business Continuity Management System

CDSL Process * DP-BO Agreement has been replaced with Rights and Obligation documents * Transfer of securities which are under Inactive or Lock-in * Target demat account is within CDSL * Balances under Pending Demat / Remat / Destat / Restat will also be transferred * Scanning of Delivery Instruction Slips (DIS) * For operational ease, CDSL has provided a facility to DPs to upload scanned images in the System directly * Scanned Images will be stored by CDSL, hence the DP need not store any DIS after upload nor take backup of the same * CDSL will also provide the Pending DIS Scan report so that there is no Non-Compliance by the DP

CDSL Process * DP-BO Agreement has been replaced with Rights and Obligation documents * Transfer of securities which are under Inactive or Lock-in * Target demat account is within CDSL * Balances under Pending Demat / Remat / Destat / Restat will also be transferred * Scanning of Delivery Instruction Slips (DIS) * For operational ease, CDSL has provided a facility to DPs to upload scanned images in the System directly * Scanned Images will be stored by CDSL, hence the DP need not store any DIS after upload nor take backup of the same * CDSL will also provide the Pending DIS Scan report so that there is no Non-Compliance by the DP

CDSL – IAPs and Training *NISM (National Institute of Securities Markets) *CDSL is an NISM Accredited CPE Provider for conducting CPE Programmes for NISM Series - VI: Depository Operations Certification Examination (DOCE). *CDSL has conducted 59 NISM DOCE –CPE training programmes across the country and has trained 1398 Officials. *CDSL has been conducting various training programmes across the country to help prepare for NISM VI: DOCE. *Audio visual tutorial has been prepared by CDSL which is uploaded in You. Tube.

CDSL – IAPs and Training *NISM (National Institute of Securities Markets) *CDSL is an NISM Accredited CPE Provider for conducting CPE Programmes for NISM Series - VI: Depository Operations Certification Examination (DOCE). *CDSL has conducted 59 NISM DOCE –CPE training programmes across the country and has trained 1398 Officials. *CDSL has been conducting various training programmes across the country to help prepare for NISM VI: DOCE. *Audio visual tutorial has been prepared by CDSL which is uploaded in You. Tube.

CDSL – IAPs and Training *IAPs (Investor awareness programs ) *Conducting IAPs across the country free of cost to Investors *In association with DPs and media *Distribution of booklets i. e. investor guides and Q&A on demat *DP Training *Over 10000 officials of DPs across the country *Over 1200 Compliance Officers & Over 1785 officials of Auditors

CDSL – IAPs and Training *IAPs (Investor awareness programs ) *Conducting IAPs across the country free of cost to Investors *In association with DPs and media *Distribution of booklets i. e. investor guides and Q&A on demat *DP Training *Over 10000 officials of DPs across the country *Over 1200 Compliance Officers & Over 1785 officials of Auditors

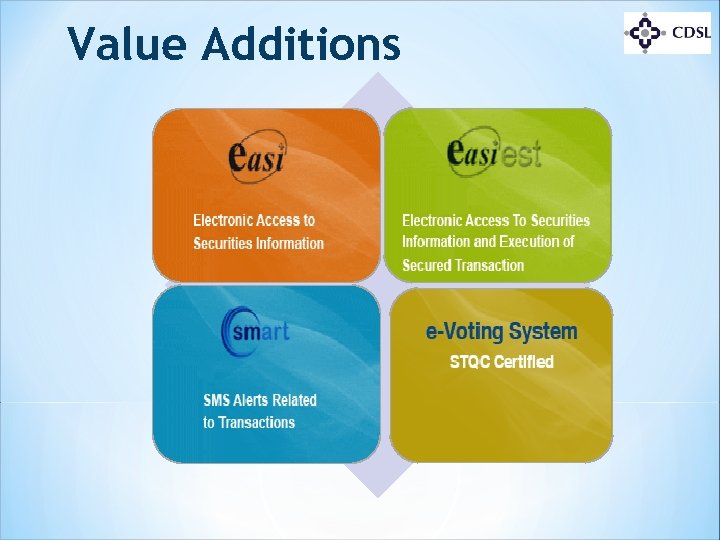

Value Additions

Value Additions

Easi – Internet Based *Electronic access to securities information *Easi enables demat A/c holders (BOs / Brokers) to view the holdings and transactions *Anytime/Anywhere access to the demat account through CDSL’s website www. cdslindia. com *Transaction information for last 7 days *Valuation of their holding *Information on Corporate announcements on a separate tab *BO can add/modify Mobile Number for SMS Alerts *BOs registered for easi/easiest can now freeze /unfreeze their securities at their convenience.

Easi – Internet Based *Electronic access to securities information *Easi enables demat A/c holders (BOs / Brokers) to view the holdings and transactions *Anytime/Anywhere access to the demat account through CDSL’s website www. cdslindia. com *Transaction information for last 7 days *Valuation of their holding *Information on Corporate announcements on a separate tab *BO can add/modify Mobile Number for SMS Alerts *BOs registered for easi/easiest can now freeze /unfreeze their securities at their convenience.

Easiest- Internet based *Electronic access to securities information and execution of secured transactions *All the benefits of easi are available *BO/CM can enter debit/credit instructions on the internet. *Easiest has two types of facility a) Trusted A/c b) Account of choice *BOs using Easiest can now transfer securities to any 4 pre-notified accounts including CM a/c. *BOs can use their existing Class 2 digital signature for using Easiest- Account of choice.

Easiest- Internet based *Electronic access to securities information and execution of secured transactions *All the benefits of easi are available *BO/CM can enter debit/credit instructions on the internet. *Easiest has two types of facility a) Trusted A/c b) Account of choice *BOs using Easiest can now transfer securities to any 4 pre-notified accounts including CM a/c. *BOs can use their existing Class 2 digital signature for using Easiest- Account of choice.

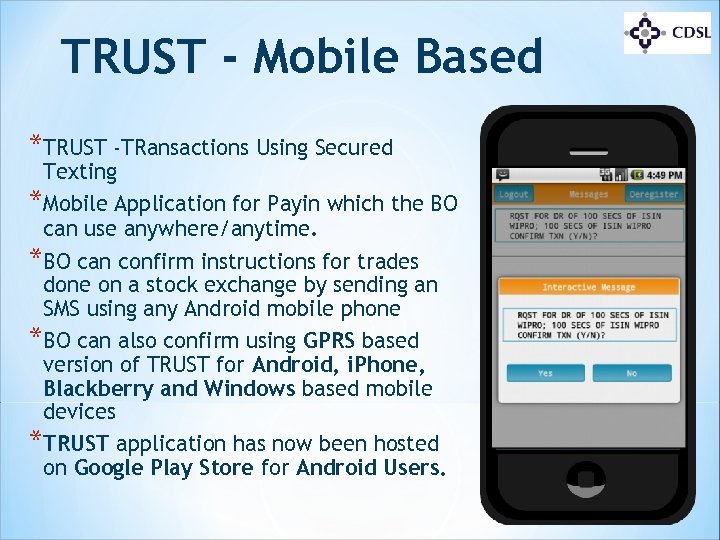

TRUST - Mobile Based *TRUST -TRansactions Using Secured Texting *Mobile Application for Payin which the BO can use anywhere/anytime. *BO can confirm instructions for trades done on a stock exchange by sending an SMS using any Android mobile phone *BO can also confirm using GPRS based version of TRUST for Android, i. Phone, Blackberry and Windows based mobile devices *TRUST application has now been hosted on Google Play Store for Android Users.

TRUST - Mobile Based *TRUST -TRansactions Using Secured Texting *Mobile Application for Payin which the BO can use anywhere/anytime. *BO can confirm instructions for trades done on a stock exchange by sending an SMS using any Android mobile phone *BO can also confirm using GPRS based version of TRUST for Android, i. Phone, Blackberry and Windows based mobile devices *TRUST application has now been hosted on Google Play Store for Android Users.

e-Voting * CDSL’s e-Voting System enables investors to cast their votes pertaining to company resolutions through www. evotingindia. com * e-Voting can be used for AGMs, EGMs, Postal Ballots and any other meeting * 3345 companies have signed e-Voting Agreement & 2923 companies have Used CDSL’s e-Voting Platform * Automated system which records votes and gives results instantaneously. * Corporate and MF can now use CDSL’s e-Voting Platform * Single Sign-on to enable online customers to vote

e-Voting * CDSL’s e-Voting System enables investors to cast their votes pertaining to company resolutions through www. evotingindia. com * e-Voting can be used for AGMs, EGMs, Postal Ballots and any other meeting * 3345 companies have signed e-Voting Agreement & 2923 companies have Used CDSL’s e-Voting Platform * Automated system which records votes and gives results instantaneously. * Corporate and MF can now use CDSL’s e-Voting Platform * Single Sign-on to enable online customers to vote

CVL KRA * CDSL Ventures Limited (CVL) is the first and largest KRA with over 1. 2 crore KYC and 3152 Intermediaries registered * Intermediary can check in CVL KRA, the KYC status of a customer across all KRAs * CVL - KRA Interoperability enables intermediary to download KYC data available in other KRA * Registered Users of Intermediaries can get the Investors KYC status using SMS. User can also download the data using SMS facility. ABCDE 1234 F KYC REGISTERED

CVL KRA * CDSL Ventures Limited (CVL) is the first and largest KRA with over 1. 2 crore KYC and 3152 Intermediaries registered * Intermediary can check in CVL KRA, the KYC status of a customer across all KRAs * CVL - KRA Interoperability enables intermediary to download KYC data available in other KRA * Registered Users of Intermediaries can get the Investors KYC status using SMS. User can also download the data using SMS facility. ABCDE 1234 F KYC REGISTERED

*CDSL –Other Updates *Statement Dispatch: * Dispatch of transaction cum holding statements on behalf of Depository Participants * Personalised Billing/Ledger of the client can be dispatched. *Database of Distinctive Number (DNs) * Maintained by Depository to facilitate capital reconciliation * Facility for DN database inquiry through ‘CDAS’ for DPs * Participants are required to check the correctness of the ISINs based on DNs before entering the demat request

*CDSL –Other Updates *Statement Dispatch: * Dispatch of transaction cum holding statements on behalf of Depository Participants * Personalised Billing/Ledger of the client can be dispatched. *Database of Distinctive Number (DNs) * Maintained by Depository to facilitate capital reconciliation * Facility for DN database inquiry through ‘CDAS’ for DPs * Participants are required to check the correctness of the ISINs based on DNs before entering the demat request

Future Enhancements

Future Enhancements

*E-KYC (electronic, paper-less KYC experience to Aadhar holders) will be soon available through CVL. *Approx 71 crore Aadhar cards have been issued *KYC details available in Aadhar can be downloaded by the intermediary using two Options: * OTP Authentication * Biometric Authentication

*E-KYC (electronic, paper-less KYC experience to Aadhar holders) will be soon available through CVL. *Approx 71 crore Aadhar cards have been issued *KYC details available in Aadhar can be downloaded by the intermediary using two Options: * OTP Authentication * Biometric Authentication

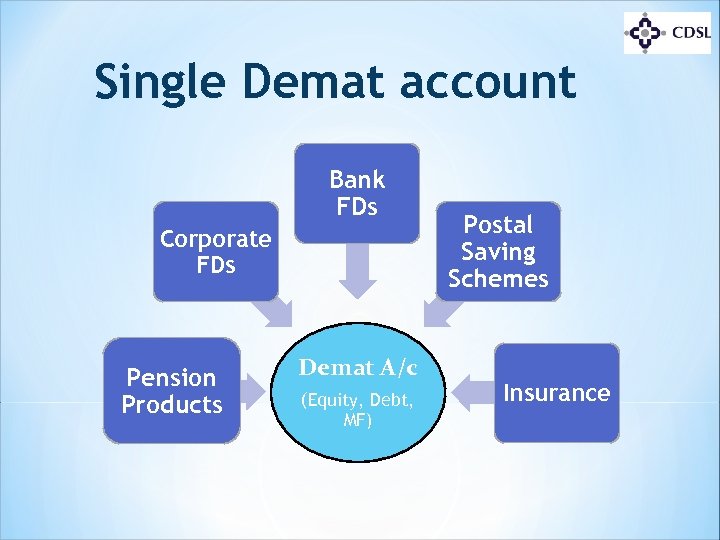

Single Demat account Bank FDs Corporate FDs Pension Products Demat A/c (Equity, Debt, MF) Postal Saving Schemes Insurance

Single Demat account Bank FDs Corporate FDs Pension Products Demat A/c (Equity, Debt, MF) Postal Saving Schemes Insurance

Consolidated A/c Statement (CAS) *Investors will be able to view their entire investments in Mutual Funds and Securities held in demat A/c in a single Consolidated Account Statement sent by the Depository

Consolidated A/c Statement (CAS) *Investors will be able to view their entire investments in Mutual Funds and Securities held in demat A/c in a single Consolidated Account Statement sent by the Depository

Single KYC for all financial products *Single KYC can be used across all segments of the Financial Markets. *Uniform KYC norms will encourage Investors to participate in Indian capital markets.

Single KYC for all financial products *Single KYC can be used across all segments of the Financial Markets. *Uniform KYC norms will encourage Investors to participate in Indian capital markets.

Thank You

Thank You