d033a57a9b69aadbc4740d8544ebc691.ppt

- Количество слайдов: 23

CDO and CDS Litigation Trends Kiran H. Mehta, Partner, Charlotte Office Anthony R. G. Nolan, Partner, New York Office

CDO and CDS Litigation Trends Kiran H. Mehta, Partner, Charlotte Office Anthony R. G. Nolan, Partner, New York Office

Today’s Presenters Kiran H. Mehta, Partner Charlotte, NC Office kiran. mehta@klgates. com 704. 331. 7437 Anthony R. G. Nolan, Partner New York Office anthony. nolan@klgates. com 212. 536. 4843 1

Today’s Presenters Kiran H. Mehta, Partner Charlotte, NC Office kiran. mehta@klgates. com 704. 331. 7437 Anthony R. G. Nolan, Partner New York Office anthony. nolan@klgates. com 212. 536. 4843 1

2

2

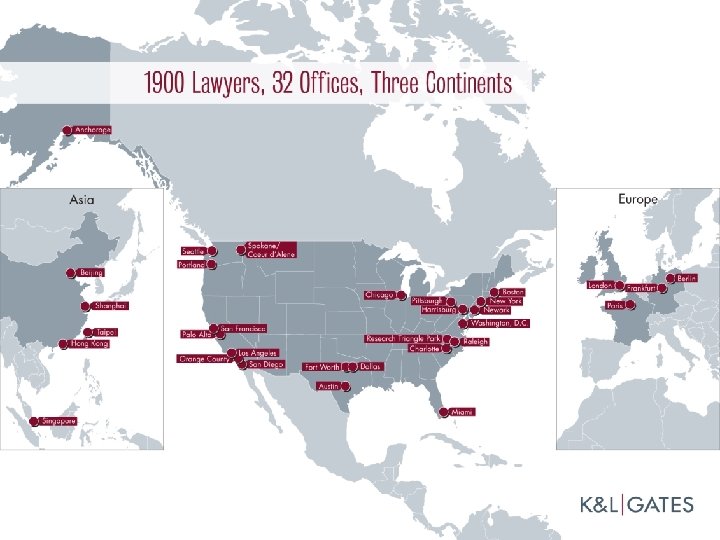

About K&L Gates § K&L Gates comprises approximately 1, 900 lawyers in 32 offices located in North America, Europe and Asia. We represent capital markets participants, entrepreneurs, growth and middle market companies, leading FORTUNE 100 and FTSE 100 global corporations and public sector entities. § K&L Gates maintains one of the most prominent financial services practices in the United States – with more than 150 U. S. -based lawyers representing diversified financial services institutions and their affiliated service providers. § The U. S. National Law Journal has identified K&L Gates as a “go-to” law firm for Financial America. § In 2007 and 2008, Chambers USA, an independent and research-based guide to the legal profession, ranked K&L Gates as having one of the leading financial services practices in the country. 3

About K&L Gates § K&L Gates comprises approximately 1, 900 lawyers in 32 offices located in North America, Europe and Asia. We represent capital markets participants, entrepreneurs, growth and middle market companies, leading FORTUNE 100 and FTSE 100 global corporations and public sector entities. § K&L Gates maintains one of the most prominent financial services practices in the United States – with more than 150 U. S. -based lawyers representing diversified financial services institutions and their affiliated service providers. § The U. S. National Law Journal has identified K&L Gates as a “go-to” law firm for Financial America. § In 2007 and 2008, Chambers USA, an independent and research-based guide to the legal profession, ranked K&L Gates as having one of the leading financial services practices in the country. 3

Agenda § § CDO and CDS overview Recent cases and themes in litigation Rating agency suits and the viability of traditional defenses Strategies in administration and liquidation suits 4

Agenda § § CDO and CDS overview Recent cases and themes in litigation Rating agency suits and the viability of traditional defenses Strategies in administration and liquidation suits 4

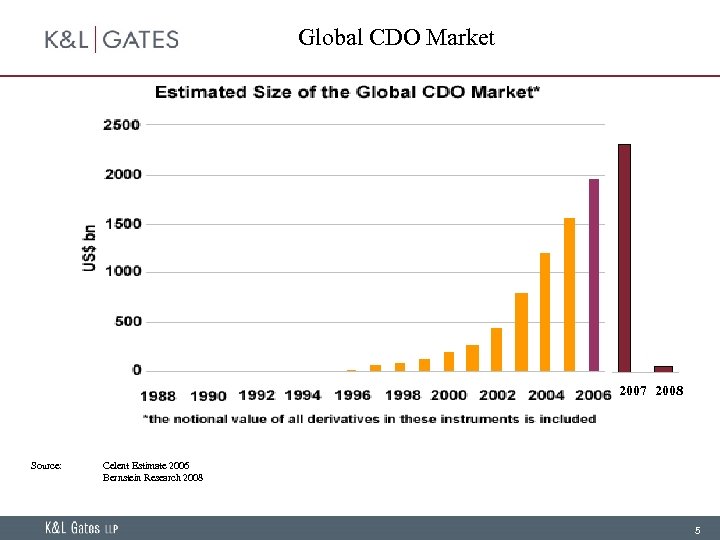

Global CDO Market 2007 2008 Source: Celent Estimate 2006 Bernstein Research 2008 5

Global CDO Market 2007 2008 Source: Celent Estimate 2006 Bernstein Research 2008 5

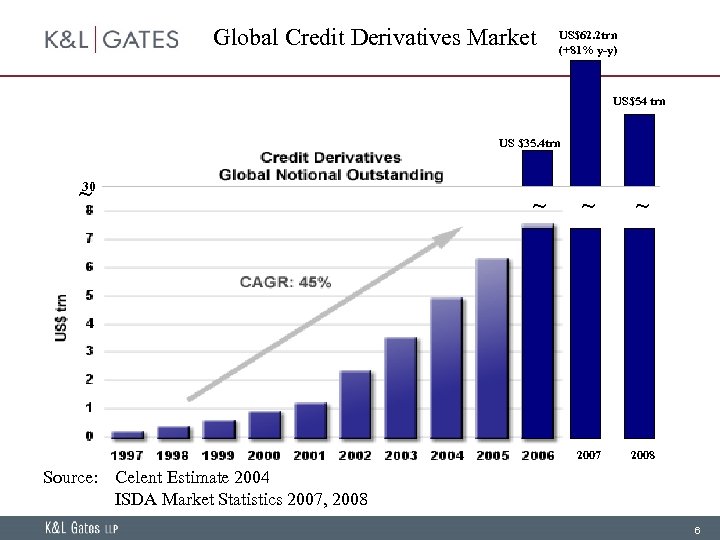

Global Credit Derivatives Market US$62. 2 trn (+81% y-y) US$54 trn US $35. 4 trn 30 ~ ~ 2007 2008 Source: Celent Estimate 2004 ISDA Market Statistics 2007, 2008 6

Global Credit Derivatives Market US$62. 2 trn (+81% y-y) US$54 trn US $35. 4 trn 30 ~ ~ 2007 2008 Source: Celent Estimate 2004 ISDA Market Statistics 2007, 2008 6

Some CDO and CDS Market Dynamics § CDO portfolios became increasingly concentrated in MBS and CMBS from 2003. § 2005 -2006 vintages moved towards CDO portfolios consisting largely of home equity ABS and Alt-A / Subprime RMBS. § CDS began referencing HEL ABS / MBS in 2005; CDOs in 2006. § 250 CDOs experienced events of default by late 2008. 160 of those (64%) were ABS CDOs that had events of default when downgrades of underlying ABS and MBS caused portfolios to be valued at less than par; this breached OC tests and triggered EOD. § CDO defaults correlated to credit events on CDS referencing CDOs. CMBS downgrades correlated to credit events on some ABS CDS. CDO defaults triggered termination events on embedded derivatives. 7

Some CDO and CDS Market Dynamics § CDO portfolios became increasingly concentrated in MBS and CMBS from 2003. § 2005 -2006 vintages moved towards CDO portfolios consisting largely of home equity ABS and Alt-A / Subprime RMBS. § CDS began referencing HEL ABS / MBS in 2005; CDOs in 2006. § 250 CDOs experienced events of default by late 2008. 160 of those (64%) were ABS CDOs that had events of default when downgrades of underlying ABS and MBS caused portfolios to be valued at less than par; this breached OC tests and triggered EOD. § CDO defaults correlated to credit events on CDS referencing CDOs. CMBS downgrades correlated to credit events on some ABS CDS. CDO defaults triggered termination events on embedded derivatives. 7

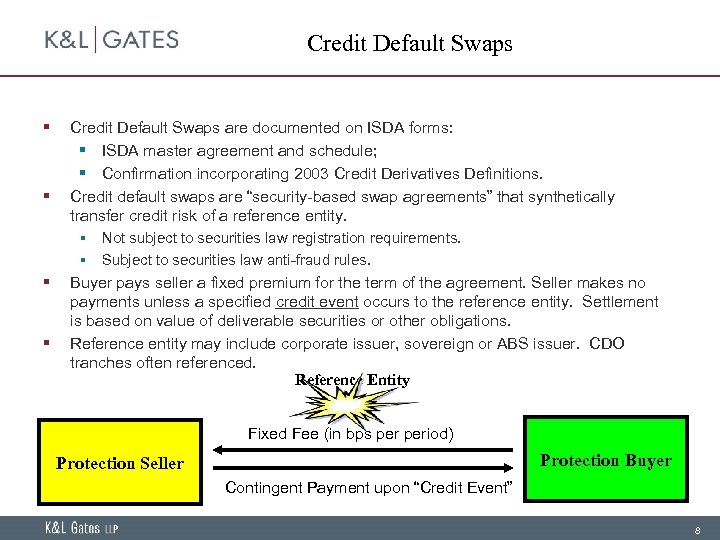

Credit Default Swaps § § Credit Default Swaps are documented on ISDA forms: § ISDA master agreement and schedule; § Confirmation incorporating 2003 Credit Derivatives Definitions. Credit default swaps are “security-based swap agreements” that synthetically transfer credit risk of a reference entity. § Not subject to securities law registration requirements. § Subject to securities law anti-fraud rules. Buyer pays seller a fixed premium for the term of the agreement. Seller makes no payments unless a specified credit event occurs to the reference entity. Settlement is based on value of deliverable securities or other obligations. Reference entity may include corporate issuer, sovereign or ABS issuer. CDO tranches often referenced. Reference Entity Fixed Fee (in bps period) Protection Buyer Protection Seller Contingent Payment upon “Credit Event” 8

Credit Default Swaps § § Credit Default Swaps are documented on ISDA forms: § ISDA master agreement and schedule; § Confirmation incorporating 2003 Credit Derivatives Definitions. Credit default swaps are “security-based swap agreements” that synthetically transfer credit risk of a reference entity. § Not subject to securities law registration requirements. § Subject to securities law anti-fraud rules. Buyer pays seller a fixed premium for the term of the agreement. Seller makes no payments unless a specified credit event occurs to the reference entity. Settlement is based on value of deliverable securities or other obligations. Reference entity may include corporate issuer, sovereign or ABS issuer. CDO tranches often referenced. Reference Entity Fixed Fee (in bps period) Protection Buyer Protection Seller Contingent Payment upon “Credit Event” 8

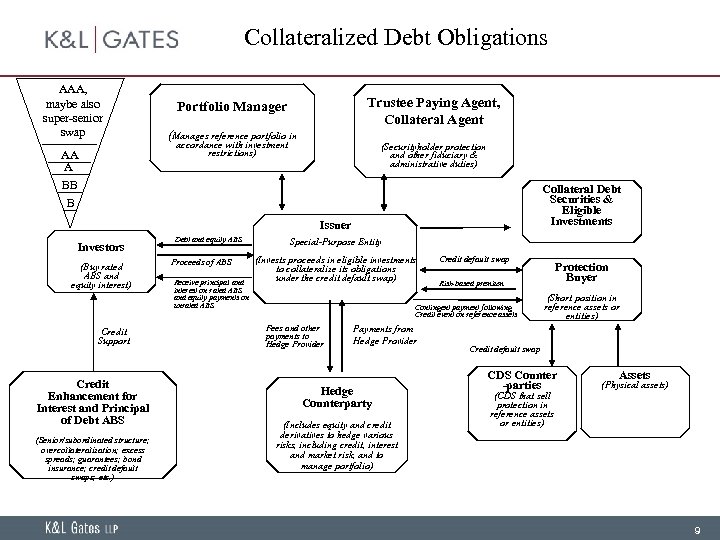

Collateralized Debt Obligations AAA, maybe also super-senior swap AA A BB B Trustee Paying Agent, Collateral Agent Portfolio Manager (Manages reference portfolio in accordance with investment restrictions) (Securityholder protection and other fiduciary & administrative duties) Collateral Debt Securities & Eligible Investments Issuer Investors (Buy rated ABS and equity interest) Credit Support Credit Enhancement for Interest and Principal of Debt ABS (Senior/subordinated structure; overcollateralization; excess spreads; guarantees; bond insurance; credit default swaps; etc. ) Debt and equity ABS Proceeds of ABS Receive principal and interest on rated ABS and equity payments on unrated ABS Special-Purpose Entity (Invests proceeds in eligible investments to collateralize its obligations under the credit default swap) Credit default swap Risk-based premium Contingent payment following Credit event on reference assets Fees and other payments to Hedge Provider Payments from Hedge Provider Hedge Counterparty (Includes equity and credit derivatives to hedge various risks, including credit, interest and market risk, and to manage portfolio) Protection Buyer (Short position in reference assets or entities) Credit default swap CDS Counter -parties (CDS that sell protection in reference assets or entities) Assets (Physical assets) 9

Collateralized Debt Obligations AAA, maybe also super-senior swap AA A BB B Trustee Paying Agent, Collateral Agent Portfolio Manager (Manages reference portfolio in accordance with investment restrictions) (Securityholder protection and other fiduciary & administrative duties) Collateral Debt Securities & Eligible Investments Issuer Investors (Buy rated ABS and equity interest) Credit Support Credit Enhancement for Interest and Principal of Debt ABS (Senior/subordinated structure; overcollateralization; excess spreads; guarantees; bond insurance; credit default swaps; etc. ) Debt and equity ABS Proceeds of ABS Receive principal and interest on rated ABS and equity payments on unrated ABS Special-Purpose Entity (Invests proceeds in eligible investments to collateralize its obligations under the credit default swap) Credit default swap Risk-based premium Contingent payment following Credit event on reference assets Fees and other payments to Hedge Provider Payments from Hedge Provider Hedge Counterparty (Includes equity and credit derivatives to hedge various risks, including credit, interest and market risk, and to manage portfolio) Protection Buyer (Short position in reference assets or entities) Credit default swap CDS Counter -parties (CDS that sell protection in reference assets or entities) Assets (Physical assets) 9

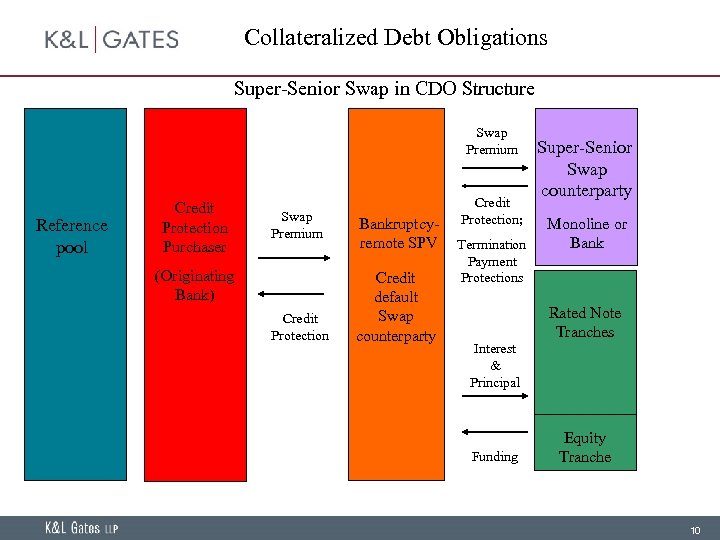

Collateralized Debt Obligations Super-Senior Swap in CDO Structure Swap Premium Reference pool Credit Protection Purchaser Swap Premium (Originating Bank) Credit Protection Bankruptcyremote SPV Credit default Swap counterparty Credit Protection; Termination Payment Protections Super-Senior Swap counterparty Monoline or Bank Rated Note Tranches Interest & Principal Funding Equity Tranche 10

Collateralized Debt Obligations Super-Senior Swap in CDO Structure Swap Premium Reference pool Credit Protection Purchaser Swap Premium (Originating Bank) Credit Protection Bankruptcyremote SPV Credit default Swap counterparty Credit Protection; Termination Payment Protections Super-Senior Swap counterparty Monoline or Bank Rated Note Tranches Interest & Principal Funding Equity Tranche 10

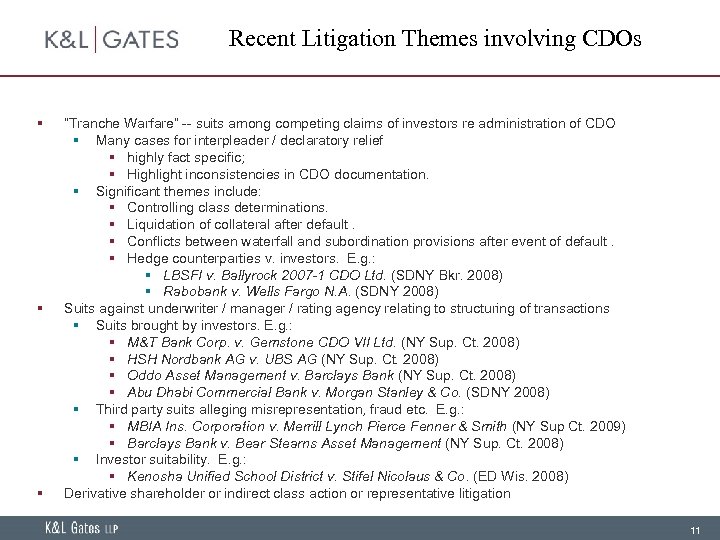

Recent Litigation Themes involving CDOs § § § “Tranche Warfare” -- suits among competing claims of investors re administration of CDO § Many cases for interpleader / declaratory relief § highly fact specific; § Highlight inconsistencies in CDO documentation. § Significant themes include: § Controlling class determinations. § Liquidation of collateral after default. § Conflicts between waterfall and subordination provisions after event of default. § Hedge counterparties v. investors. E. g. : § LBSFI v. Ballyrock 2007 -1 CDO Ltd. (SDNY Bkr. 2008) § Rabobank v. Wells Fargo N. A. (SDNY 2008) Suits against underwriter / manager / rating agency relating to structuring of transactions § Suits brought by investors. E. g. : § M&T Bank Corp. v. Gemstone CDO VII Ltd. (NY Sup. Ct. 2008) § HSH Nordbank AG v. UBS AG (NY Sup. Ct. 2008) § Oddo Asset Management v. Barclays Bank (NY Sup. Ct. 2008) § Abu Dhabi Commercial Bank v. Morgan Stanley & Co. (SDNY 2008) § Third party suits alleging misrepresentation, fraud etc. E. g. : § MBIA Ins. Corporation v. Merrill Lynch Pierce Fenner & Smith (NY Sup Ct. 2009) § Barclays Bank v. Bear Stearns Asset Management (NY Sup. Ct. 2008) § Investor suitability. E. g. : § Kenosha Unified School District v. Stifel Nicolaus & Co. (ED Wis. 2008) Derivative shareholder or indirect class action or representative litigation 11

Recent Litigation Themes involving CDOs § § § “Tranche Warfare” -- suits among competing claims of investors re administration of CDO § Many cases for interpleader / declaratory relief § highly fact specific; § Highlight inconsistencies in CDO documentation. § Significant themes include: § Controlling class determinations. § Liquidation of collateral after default. § Conflicts between waterfall and subordination provisions after event of default. § Hedge counterparties v. investors. E. g. : § LBSFI v. Ballyrock 2007 -1 CDO Ltd. (SDNY Bkr. 2008) § Rabobank v. Wells Fargo N. A. (SDNY 2008) Suits against underwriter / manager / rating agency relating to structuring of transactions § Suits brought by investors. E. g. : § M&T Bank Corp. v. Gemstone CDO VII Ltd. (NY Sup. Ct. 2008) § HSH Nordbank AG v. UBS AG (NY Sup. Ct. 2008) § Oddo Asset Management v. Barclays Bank (NY Sup. Ct. 2008) § Abu Dhabi Commercial Bank v. Morgan Stanley & Co. (SDNY 2008) § Third party suits alleging misrepresentation, fraud etc. E. g. : § MBIA Ins. Corporation v. Merrill Lynch Pierce Fenner & Smith (NY Sup Ct. 2009) § Barclays Bank v. Bear Stearns Asset Management (NY Sup. Ct. 2008) § Investor suitability. E. g. : § Kenosha Unified School District v. Stifel Nicolaus & Co. (ED Wis. 2008) Derivative shareholder or indirect class action or representative litigation 11

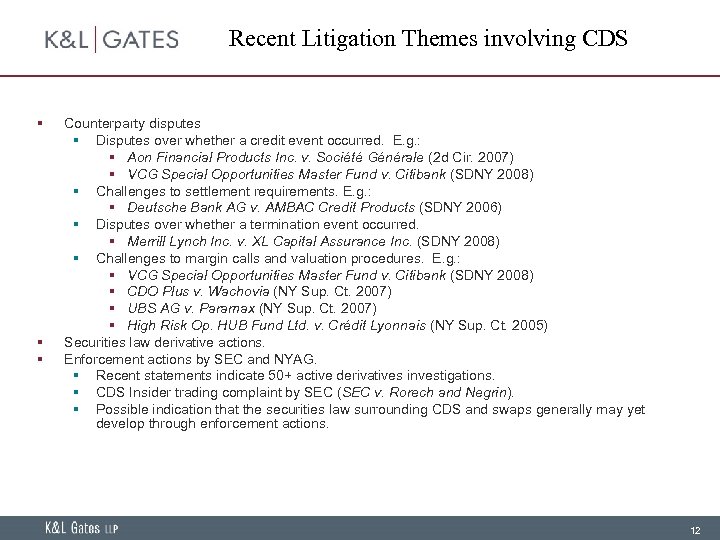

Recent Litigation Themes involving CDS § § § Counterparty disputes § Disputes over whether a credit event occurred. E. g. : § Aon Financial Products Inc. v. Société Générale (2 d Cir. 2007) § VCG Special Opportunities Master Fund v. Citibank (SDNY 2008) § Challenges to settlement requirements. E. g. : § Deutsche Bank AG v. AMBAC Credit Products (SDNY 2006) § Disputes over whether a termination event occurred. § Merrill Lynch Inc. v. XL Capital Assurance Inc. (SDNY 2008) § Challenges to margin calls and valuation procedures. E. g. : § VCG Special Opportunities Master Fund v. Citibank (SDNY 2008) § CDO Plus v. Wachovia (NY Sup. Ct. 2007) § UBS AG v. Paramax (NY Sup. Ct. 2007) § High Risk Op. HUB Fund Ltd. v. Crédit Lyonnais (NY Sup. Ct. 2005) Securities law derivative actions. Enforcement actions by SEC and NYAG. § Recent statements indicate 50+ active derivatives investigations. § CDS Insider trading complaint by SEC (SEC v. Rorech and Negrin). § Possible indication that the securities law surrounding CDS and swaps generally may yet develop through enforcement actions. 12

Recent Litigation Themes involving CDS § § § Counterparty disputes § Disputes over whether a credit event occurred. E. g. : § Aon Financial Products Inc. v. Société Générale (2 d Cir. 2007) § VCG Special Opportunities Master Fund v. Citibank (SDNY 2008) § Challenges to settlement requirements. E. g. : § Deutsche Bank AG v. AMBAC Credit Products (SDNY 2006) § Disputes over whether a termination event occurred. § Merrill Lynch Inc. v. XL Capital Assurance Inc. (SDNY 2008) § Challenges to margin calls and valuation procedures. E. g. : § VCG Special Opportunities Master Fund v. Citibank (SDNY 2008) § CDO Plus v. Wachovia (NY Sup. Ct. 2007) § UBS AG v. Paramax (NY Sup. Ct. 2007) § High Risk Op. HUB Fund Ltd. v. Crédit Lyonnais (NY Sup. Ct. 2005) Securities law derivative actions. Enforcement actions by SEC and NYAG. § Recent statements indicate 50+ active derivatives investigations. § CDS Insider trading complaint by SEC (SEC v. Rorech and Negrin). § Possible indication that the securities law surrounding CDS and swaps generally may yet develop through enforcement actions. 12

CDO / CDS Litigation Trends: The More Things Change. . . • “Exotic” instruments; familiar legal theories • • Securities fraud – Rule 10 b 5 Common law fraud and misrepresentation Negligence / negligent misrepresentation Breach of Contract • The players, however, can be different from the “classic” securities case, as can the forums in which the litigation occurs • Rating Agencies 13

CDO / CDS Litigation Trends: The More Things Change. . . • “Exotic” instruments; familiar legal theories • • Securities fraud – Rule 10 b 5 Common law fraud and misrepresentation Negligence / negligent misrepresentation Breach of Contract • The players, however, can be different from the “classic” securities case, as can the forums in which the litigation occurs • Rating Agencies 13

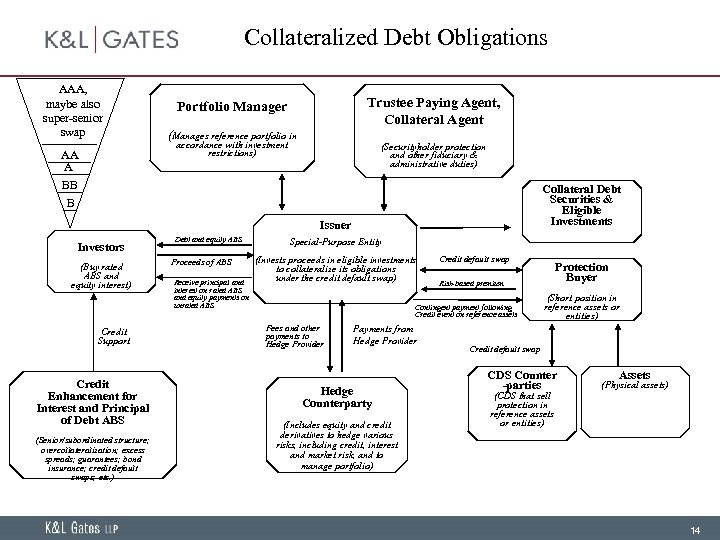

Collateralized Debt Obligations AAA, maybe also super-senior swap AA A BB B Trustee Paying Agent, Collateral Agent Portfolio Manager (Manages reference portfolio in accordance with investment restrictions) (Securityholder protection and other fiduciary & administrative duties) Collateral Debt Securities & Eligible Investments Issuer Investors (Buy rated ABS and equity interest) Credit Support Credit Enhancement for Interest and Principal of Debt ABS (Senior/subordinated structure; overcollateralization; excess spreads; guarantees; bond insurance; credit default swaps; etc. ) Debt and equity ABS Proceeds of ABS Receive principal and interest on rated ABS and equity payments on unrated ABS Special-Purpose Entity (Invests proceeds in eligible investments to collateralize its obligations under the credit default swap) Credit default swap Risk-based premium Contingent payment following Credit event on reference assets Fees and other payments to Hedge Provider Payments from Hedge Provider Hedge Counterparty (Includes equity and credit derivatives to hedge various risks, including credit, interest and market risk, and to manage portfolio) Protection Buyer (Short position in reference assets or entities) Credit default swap CDS Counter -parties (CDS that sell protection in reference assets or entities) Assets (Physical assets) 14

Collateralized Debt Obligations AAA, maybe also super-senior swap AA A BB B Trustee Paying Agent, Collateral Agent Portfolio Manager (Manages reference portfolio in accordance with investment restrictions) (Securityholder protection and other fiduciary & administrative duties) Collateral Debt Securities & Eligible Investments Issuer Investors (Buy rated ABS and equity interest) Credit Support Credit Enhancement for Interest and Principal of Debt ABS (Senior/subordinated structure; overcollateralization; excess spreads; guarantees; bond insurance; credit default swaps; etc. ) Debt and equity ABS Proceeds of ABS Receive principal and interest on rated ABS and equity payments on unrated ABS Special-Purpose Entity (Invests proceeds in eligible investments to collateralize its obligations under the credit default swap) Credit default swap Risk-based premium Contingent payment following Credit event on reference assets Fees and other payments to Hedge Provider Payments from Hedge Provider Hedge Counterparty (Includes equity and credit derivatives to hedge various risks, including credit, interest and market risk, and to manage portfolio) Protection Buyer (Short position in reference assets or entities) Credit default swap CDS Counter -parties (CDS that sell protection in reference assets or entities) Assets (Physical assets) 14

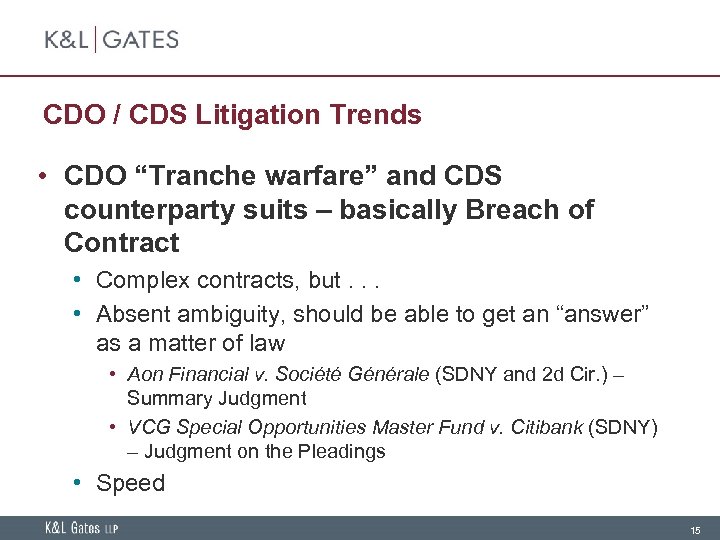

CDO / CDS Litigation Trends • CDO “Tranche warfare” and CDS counterparty suits – basically Breach of Contract • Complex contracts, but. . . • Absent ambiguity, should be able to get an “answer” as a matter of law • Aon Financial v. Société Générale (SDNY and 2 d Cir. ) – Summary Judgment • VCG Special Opportunities Master Fund v. Citibank (SDNY) – Judgment on the Pleadings • Speed 15

CDO / CDS Litigation Trends • CDO “Tranche warfare” and CDS counterparty suits – basically Breach of Contract • Complex contracts, but. . . • Absent ambiguity, should be able to get an “answer” as a matter of law • Aon Financial v. Société Générale (SDNY and 2 d Cir. ) – Summary Judgment • VCG Special Opportunities Master Fund v. Citibank (SDNY) – Judgment on the Pleadings • Speed 15

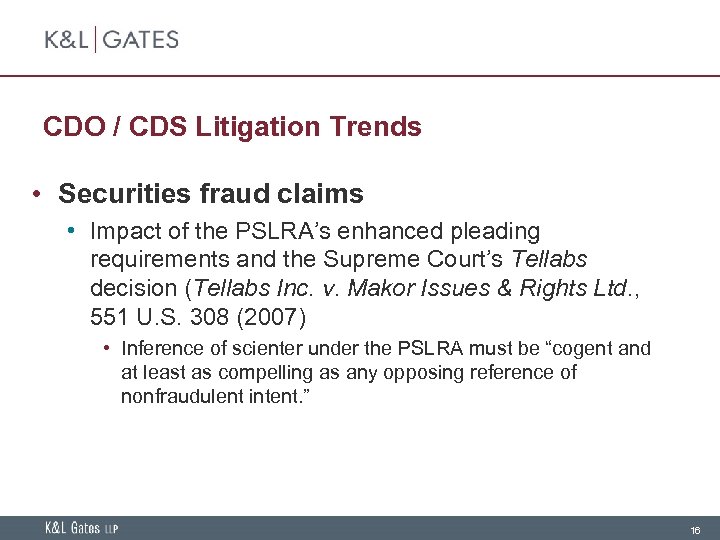

CDO / CDS Litigation Trends • Securities fraud claims • Impact of the PSLRA’s enhanced pleading requirements and the Supreme Court’s Tellabs decision (Tellabs Inc. v. Makor Issues & Rights Ltd. , 551 U. S. 308 (2007) • Inference of scienter under the PSLRA must be “cogent and at least as compelling as any opposing reference of nonfraudulent intent. ” 16

CDO / CDS Litigation Trends • Securities fraud claims • Impact of the PSLRA’s enhanced pleading requirements and the Supreme Court’s Tellabs decision (Tellabs Inc. v. Makor Issues & Rights Ltd. , 551 U. S. 308 (2007) • Inference of scienter under the PSLRA must be “cogent and at least as compelling as any opposing reference of nonfraudulent intent. ” 16

CDO / CDS Litigation Trends • Claims against Rating Agencies • Historically, few liability concerns • Today, a different story – because of the central role played by the Ratings Agencies in the subprime meltdown • In re Nat’l Century Financial Enters. , Inc. , 580 F. Supp. 2 d 630 (S. D. Ohio 2008) • Dismissal of Rule 10 b 5 and fraud claims • Survival of negligent misrepresentation and Ohio “Blue Sky” claims 17

CDO / CDS Litigation Trends • Claims against Rating Agencies • Historically, few liability concerns • Today, a different story – because of the central role played by the Ratings Agencies in the subprime meltdown • In re Nat’l Century Financial Enters. , Inc. , 580 F. Supp. 2 d 630 (S. D. Ohio 2008) • Dismissal of Rule 10 b 5 and fraud claims • Survival of negligent misrepresentation and Ohio “Blue Sky” claims 17

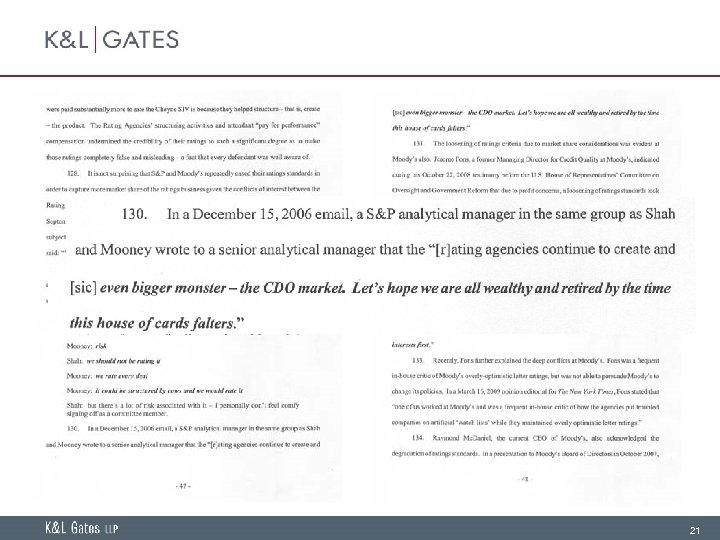

CDO / CDS Litigation Trends • Rating Agency Litigation • SEC Investigation (July 2008) • Damaging emails 18

CDO / CDS Litigation Trends • Rating Agency Litigation • SEC Investigation (July 2008) • Damaging emails 18

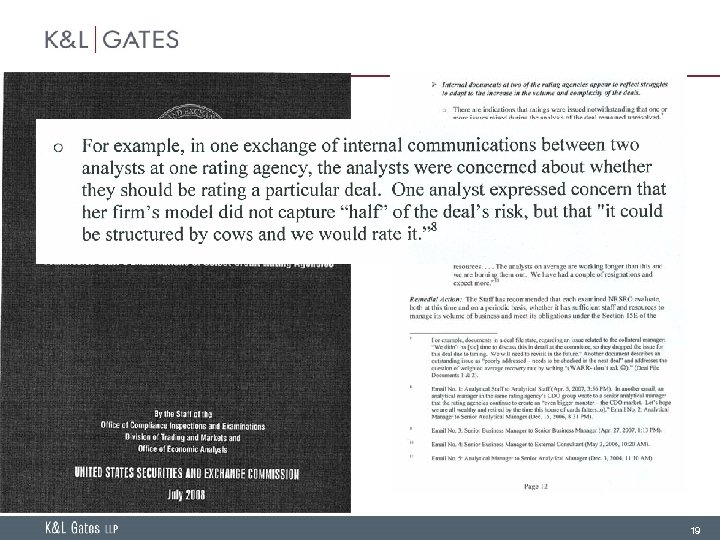

19

19

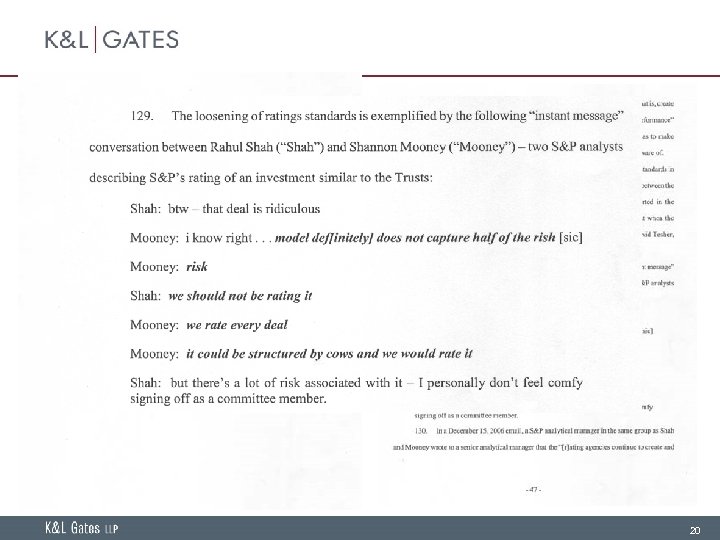

20

20

21

21

CDO / CDS Litigation Trends Questions? 22

CDO / CDS Litigation Trends Questions? 22