a54080b9f9945bd4b7e7ca23885876f7.ppt

- Количество слайдов: 20

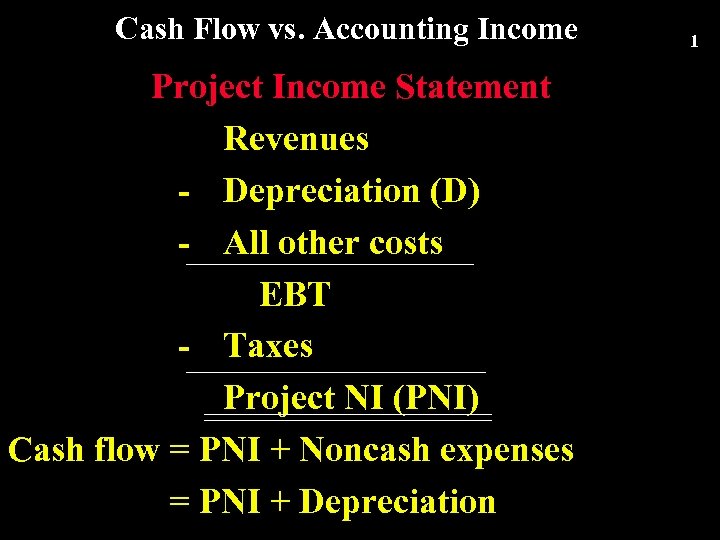

Cash Flow vs. Accounting Income Project Income Statement Revenues - Depreciation (D) - All other costs EBT - Taxes Project NI (PNI) Cash flow = PNI + Noncash expenses = PNI + Depreciation 1

Cash Flow vs. Accounting Income Project Income Statement Revenues - Depreciation (D) - All other costs EBT - Taxes Project NI (PNI) Cash flow = PNI + Noncash expenses = PNI + Depreciation 1

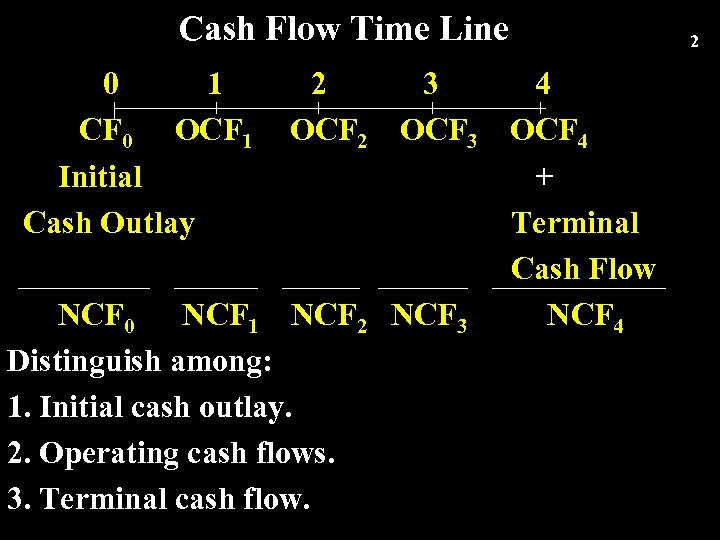

Cash Flow Time Line 0 1 CF 0 OCF 1 Initial Cash Outlay 2 3 4 OCF 2 OCF 3 OCF 4 + Terminal Cash Flow NCF 2 NCF 3 NCF 4 NCF 0 NCF 1 Distinguish among: 1. Initial cash outlay. 2. Operating cash flows. 3. Terminal cash flow. 2

Cash Flow Time Line 0 1 CF 0 OCF 1 Initial Cash Outlay 2 3 4 OCF 2 OCF 3 OCF 4 + Terminal Cash Flow NCF 2 NCF 3 NCF 4 NCF 0 NCF 1 Distinguish among: 1. Initial cash outlay. 2. Operating cash flows. 3. Terminal cash flow. 2

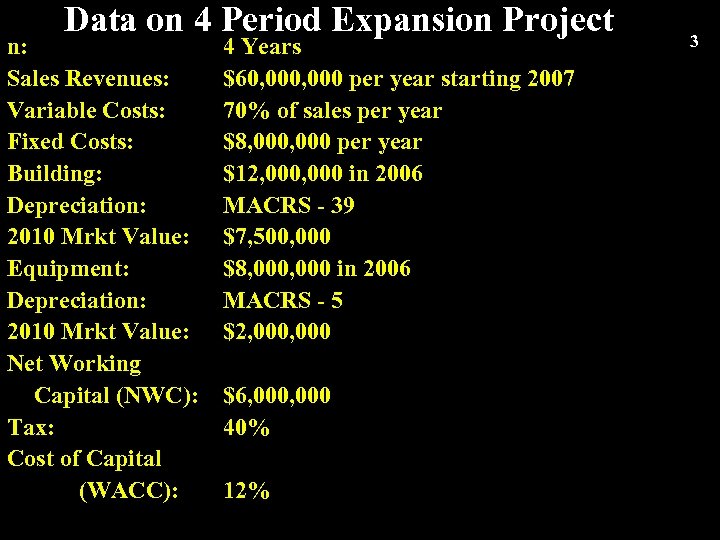

Data on 4 Period Expansion Project n: Sales Revenues: Variable Costs: Fixed Costs: Building: Depreciation: 2010 Mrkt Value: Equipment: Depreciation: 2010 Mrkt Value: Net Working Capital (NWC): Tax: Cost of Capital (WACC): 4 Years $60, 000 per year starting 2007 70% of sales per year $8, 000 per year $12, 000 in 2006 MACRS - 39 $7, 500, 000 $8, 000 in 2006 MACRS - 5 $2, 000 $6, 000 40% 12% 3

Data on 4 Period Expansion Project n: Sales Revenues: Variable Costs: Fixed Costs: Building: Depreciation: 2010 Mrkt Value: Equipment: Depreciation: 2010 Mrkt Value: Net Working Capital (NWC): Tax: Cost of Capital (WACC): 4 Years $60, 000 per year starting 2007 70% of sales per year $8, 000 per year $12, 000 in 2006 MACRS - 39 $7, 500, 000 $8, 000 in 2006 MACRS - 5 $2, 000 $6, 000 40% 12% 3

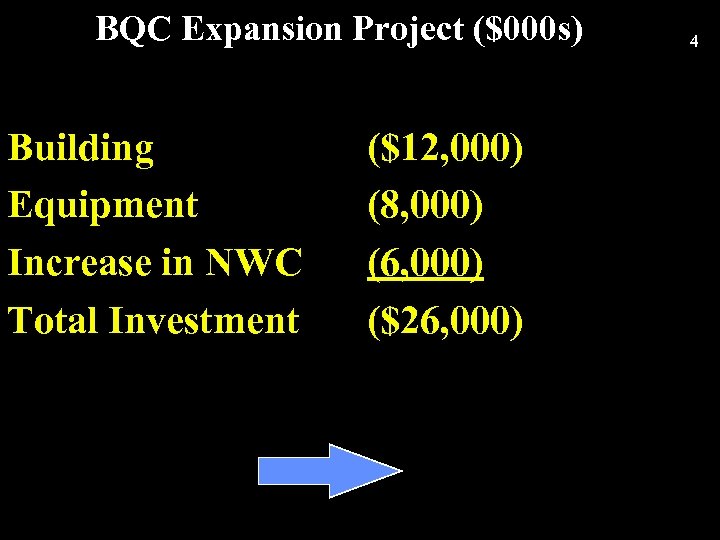

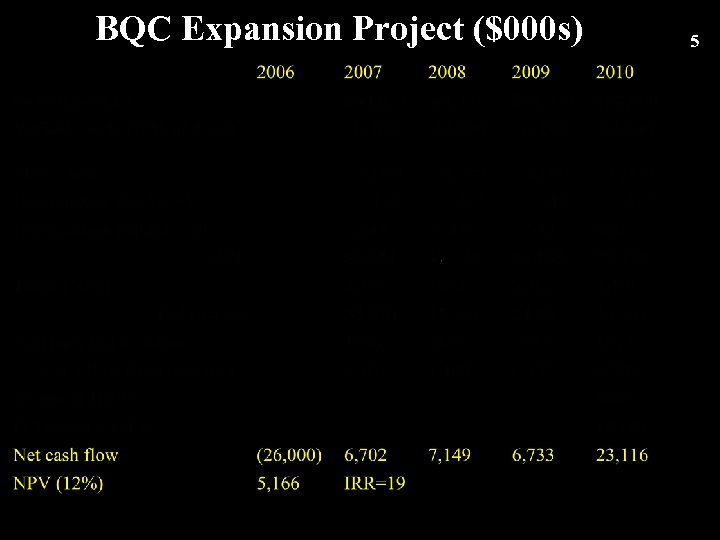

BQC Expansion Project ($000 s) Building Equipment Increase in NWC Total Investment ($12, 000) (8, 000) (6, 000) ($26, 000) 4

BQC Expansion Project ($000 s) Building Equipment Increase in NWC Total Investment ($12, 000) (8, 000) (6, 000) ($26, 000) 4

BQC Expansion Project ($000 s) 5

BQC Expansion Project ($000 s) 5

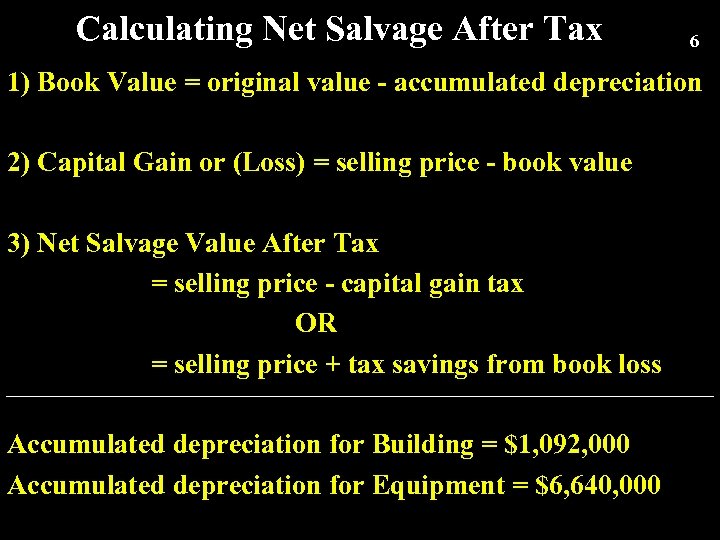

Calculating Net Salvage After Tax 6 1) Book Value = original value - accumulated depreciation 2) Capital Gain or (Loss) = selling price - book value 3) Net Salvage Value After Tax = selling price - capital gain tax OR = selling price + tax savings from book loss Accumulated depreciation for Building = $1, 092, 000 Accumulated depreciation for Equipment = $6, 640, 000

Calculating Net Salvage After Tax 6 1) Book Value = original value - accumulated depreciation 2) Capital Gain or (Loss) = selling price - book value 3) Net Salvage Value After Tax = selling price - capital gain tax OR = selling price + tax savings from book loss Accumulated depreciation for Building = $1, 092, 000 Accumulated depreciation for Equipment = $6, 640, 000

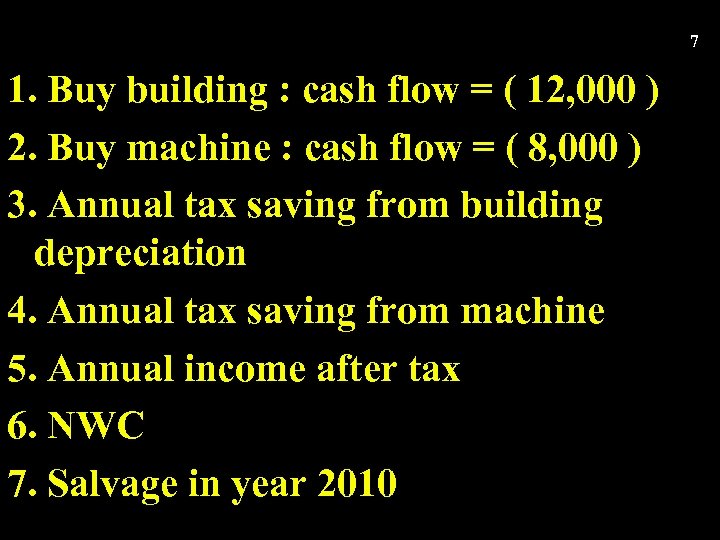

7 1. Buy building : cash flow = ( 12, 000 ) 2. Buy machine : cash flow = ( 8, 000 ) 3. Annual tax saving from building depreciation 4. Annual tax saving from machine 5. Annual income after tax 6. NWC 7. Salvage in year 2010

7 1. Buy building : cash flow = ( 12, 000 ) 2. Buy machine : cash flow = ( 8, 000 ) 3. Annual tax saving from building depreciation 4. Annual tax saving from machine 5. Annual income after tax 6. NWC 7. Salvage in year 2010

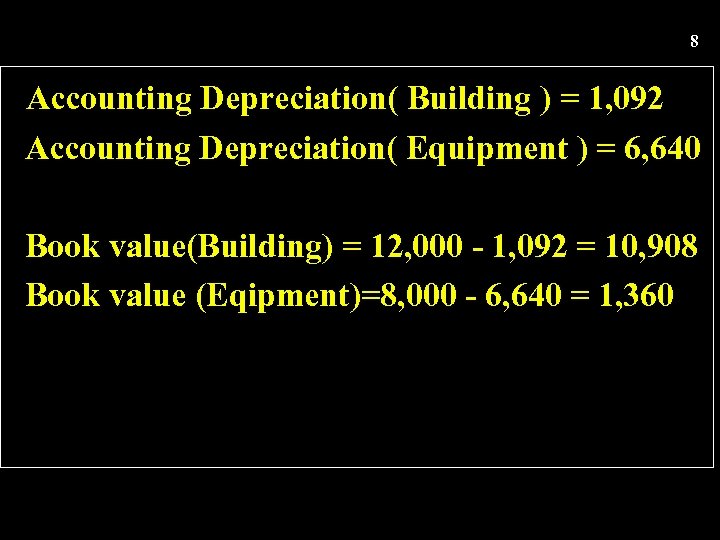

8 Accounting Depreciation( Building ) = 1, 092 Accounting Depreciation( Equipment ) = 6, 640 Book value(Building) = 12, 000 - 1, 092 = 10, 908 Book value (Eqipment)=8, 000 - 6, 640 = 1, 360

8 Accounting Depreciation( Building ) = 1, 092 Accounting Depreciation( Equipment ) = 6, 640 Book value(Building) = 12, 000 - 1, 092 = 10, 908 Book value (Eqipment)=8, 000 - 6, 640 = 1, 360

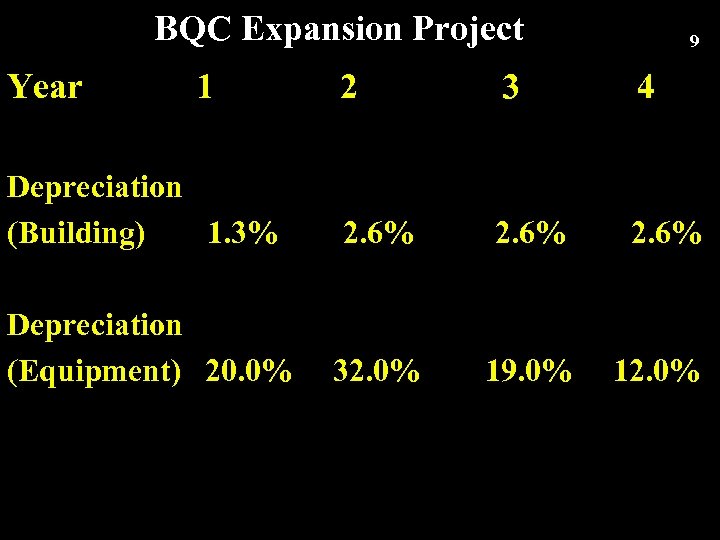

BQC Expansion Project Year 1 9 2 3 4 Depreciation (Building) 1. 3% 2. 6% Depreciation (Equipment) 20. 0% 32. 0% 19. 0% 12. 0%

BQC Expansion Project Year 1 9 2 3 4 Depreciation (Building) 1. 3% 2. 6% Depreciation (Equipment) 20. 0% 32. 0% 19. 0% 12. 0%

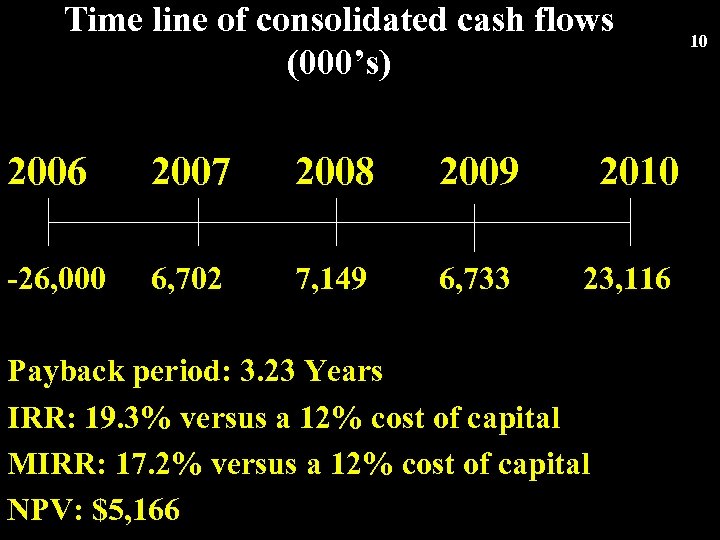

Time line of consolidated cash flows (000’s) 2006 2007 2008 2009 2010 -26, 000 6, 702 7, 149 6, 733 23, 116 Payback period: 3. 23 Years IRR: 19. 3% versus a 12% cost of capital MIRR: 17. 2% versus a 12% cost of capital NPV: $5, 166 10

Time line of consolidated cash flows (000’s) 2006 2007 2008 2009 2010 -26, 000 6, 702 7, 149 6, 733 23, 116 Payback period: 3. 23 Years IRR: 19. 3% versus a 12% cost of capital MIRR: 17. 2% versus a 12% cost of capital NPV: $5, 166 10

Net Salvage Values 11 + - Total cash flow from salvage value = $8, 863, 200 + $1, 744, 000 = $10, 607, 200

Net Salvage Values 11 + - Total cash flow from salvage value = $8, 863, 200 + $1, 744, 000 = $10, 607, 200

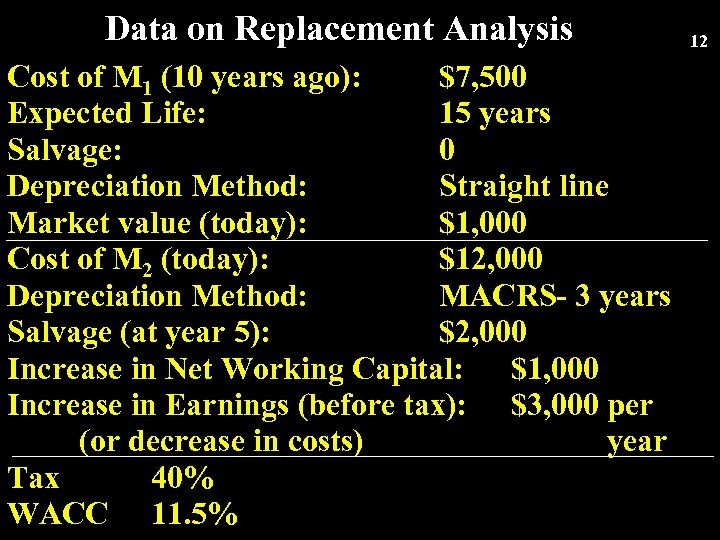

Data on Replacement Analysis Cost of M 1 (10 years ago): $7, 500 Expected Life: 15 years Salvage: 0 Depreciation Method: Straight line Market value (today): $1, 000 Cost of M 2 (today): $12, 000 Depreciation Method: MACRS- 3 years Salvage (at year 5): $2, 000 Increase in Net Working Capital: $1, 000 Increase in Earnings (before tax): $3, 000 per (or decrease in costs) year Tax 40% WACC 11. 5% 12

Data on Replacement Analysis Cost of M 1 (10 years ago): $7, 500 Expected Life: 15 years Salvage: 0 Depreciation Method: Straight line Market value (today): $1, 000 Cost of M 2 (today): $12, 000 Depreciation Method: MACRS- 3 years Salvage (at year 5): $2, 000 Increase in Net Working Capital: $1, 000 Increase in Earnings (before tax): $3, 000 per (or decrease in costs) year Tax 40% WACC 11. 5% 12

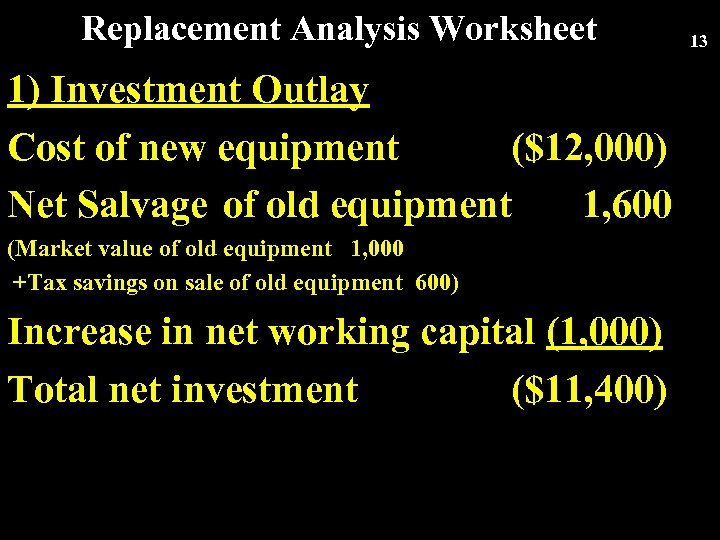

Replacement Analysis Worksheet 1) Investment Outlay Cost of new equipment ($12, 000) Net Salvage of old equipment 1, 600 (Market value of old equipment 1, 000 +Tax savings on sale of old equipment 600) Increase in net working capital (1, 000) Total net investment ($11, 400) 13

Replacement Analysis Worksheet 1) Investment Outlay Cost of new equipment ($12, 000) Net Salvage of old equipment 1, 600 (Market value of old equipment 1, 000 +Tax savings on sale of old equipment 600) Increase in net working capital (1, 000) Total net investment ($11, 400) 13

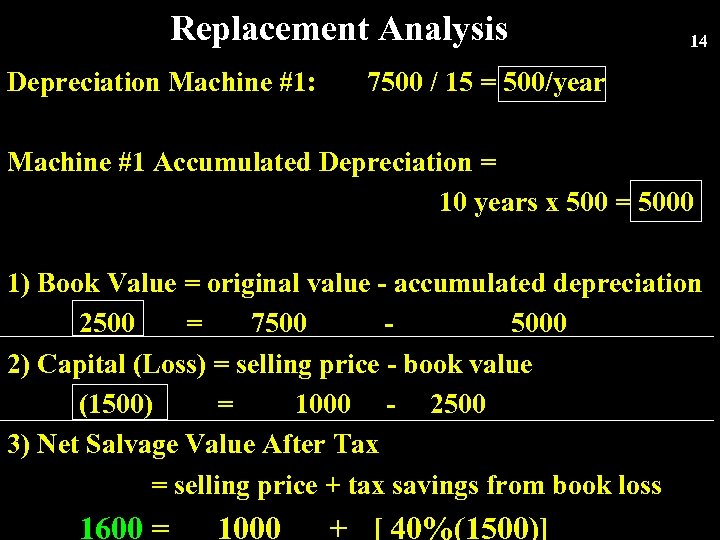

Replacement Analysis Depreciation Machine #1: 14 7500 / 15 = 500/year Machine #1 Accumulated Depreciation = 10 years x 500 = 5000 1) Book Value = original value - accumulated depreciation 2500 = 7500 5000 2) Capital (Loss) = selling price - book value (1500) = 1000 - 2500 3) Net Salvage Value After Tax = selling price + tax savings from book loss 1600 = 1000 + [ 40%(1500)]

Replacement Analysis Depreciation Machine #1: 14 7500 / 15 = 500/year Machine #1 Accumulated Depreciation = 10 years x 500 = 5000 1) Book Value = original value - accumulated depreciation 2500 = 7500 5000 2) Capital (Loss) = selling price - book value (1500) = 1000 - 2500 3) Net Salvage Value After Tax = selling price + tax savings from book loss 1600 = 1000 + [ 40%(1500)]

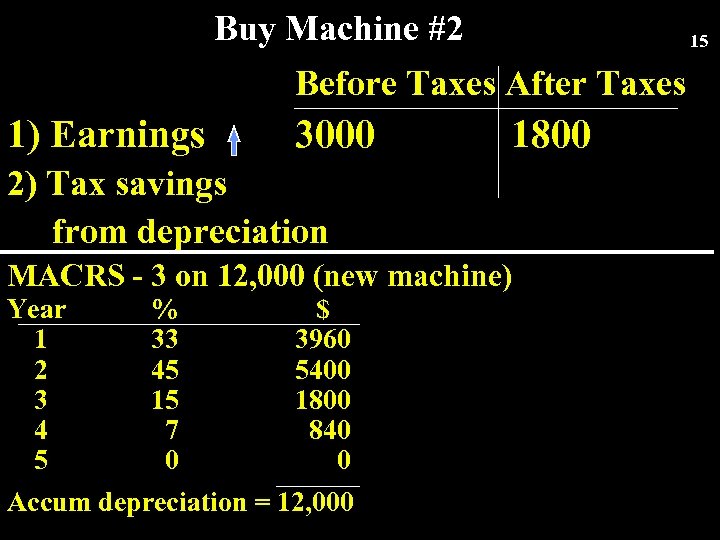

Buy Machine #2 15 Before Taxes After Taxes 1) Earnings 3000 1800 2) Tax savings from depreciation MACRS - 3 on 12, 000 (new machine) Year % $ 1 33 3960 2 45 5400 3 15 1800 4 7 840 5 0 0 Accum depreciation = 12, 000

Buy Machine #2 15 Before Taxes After Taxes 1) Earnings 3000 1800 2) Tax savings from depreciation MACRS - 3 on 12, 000 (new machine) Year % $ 1 33 3960 2 45 5400 3 15 1800 4 7 840 5 0 0 Accum depreciation = 12, 000

Replacement Analysis Worksheet + 16

Replacement Analysis Worksheet + 16

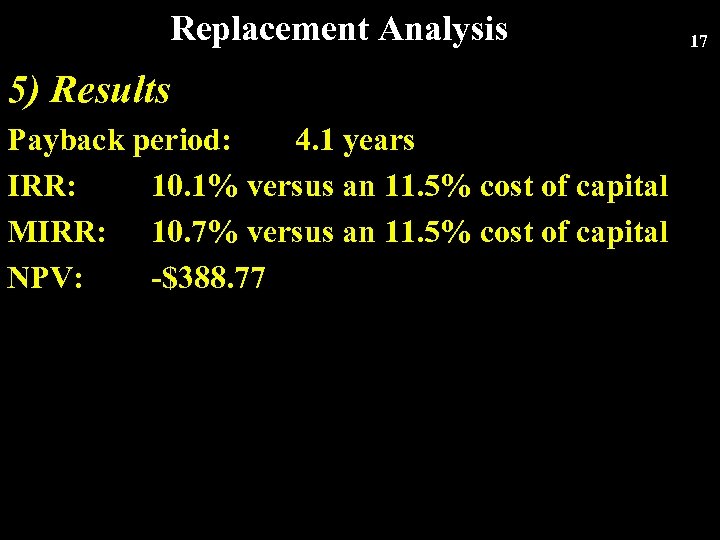

Replacement Analysis 5) Results Payback period: 4. 1 years IRR: 10. 1% versus an 11. 5% cost of capital MIRR: 10. 7% versus an 11. 5% cost of capital NPV: -$388. 77 17

Replacement Analysis 5) Results Payback period: 4. 1 years IRR: 10. 1% versus an 11. 5% cost of capital MIRR: 10. 7% versus an 11. 5% cost of capital NPV: -$388. 77 17

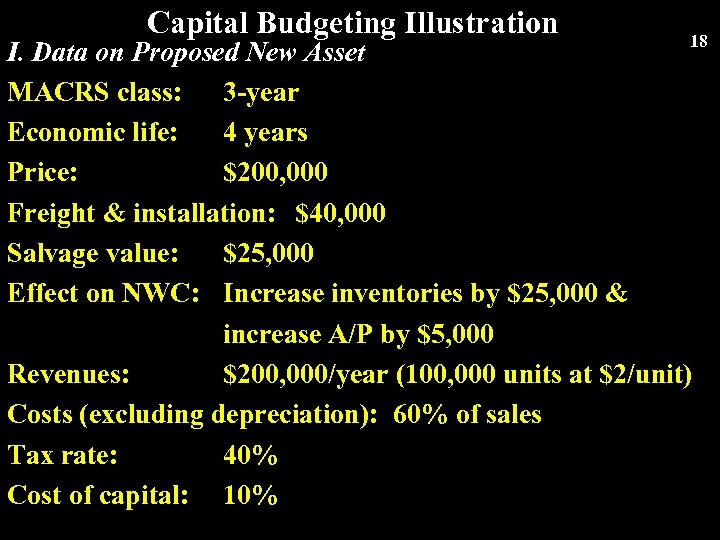

Capital Budgeting Illustration 18 I. Data on Proposed New Asset MACRS class: 3 -year Economic life: 4 years Price: $200, 000 Freight & installation: $40, 000 Salvage value: $25, 000 Effect on NWC: Increase inventories by $25, 000 & increase A/P by $5, 000 Revenues: $200, 000/year (100, 000 units at $2/unit) Costs (excluding depreciation): 60% of sales Tax rate: 40% Cost of capital: 10%

Capital Budgeting Illustration 18 I. Data on Proposed New Asset MACRS class: 3 -year Economic life: 4 years Price: $200, 000 Freight & installation: $40, 000 Salvage value: $25, 000 Effect on NWC: Increase inventories by $25, 000 & increase A/P by $5, 000 Revenues: $200, 000/year (100, 000 units at $2/unit) Costs (excluding depreciation): 60% of sales Tax rate: 40% Cost of capital: 10%

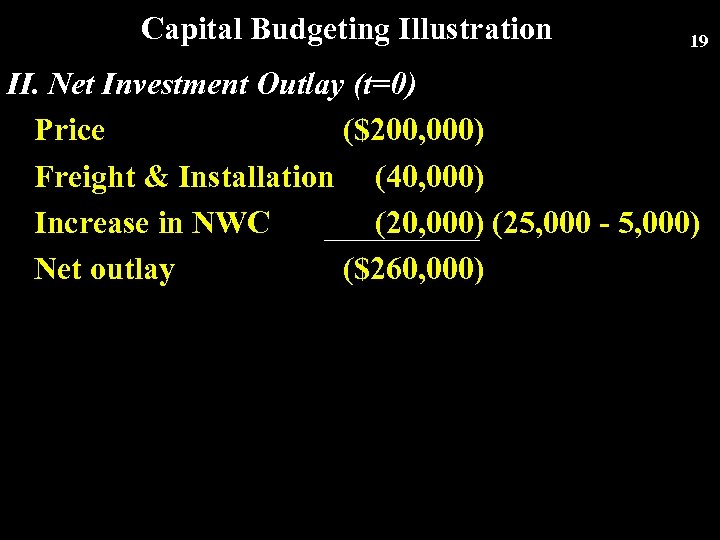

Capital Budgeting Illustration 19 II. Net Investment Outlay (t=0) Price ($200, 000) Freight & Installation (40, 000) Increase in NWC (20, 000) (25, 000 - 5, 000) Net outlay ($260, 000)

Capital Budgeting Illustration 19 II. Net Investment Outlay (t=0) Price ($200, 000) Freight & Installation (40, 000) Increase in NWC (20, 000) (25, 000 - 5, 000) Net outlay ($260, 000)

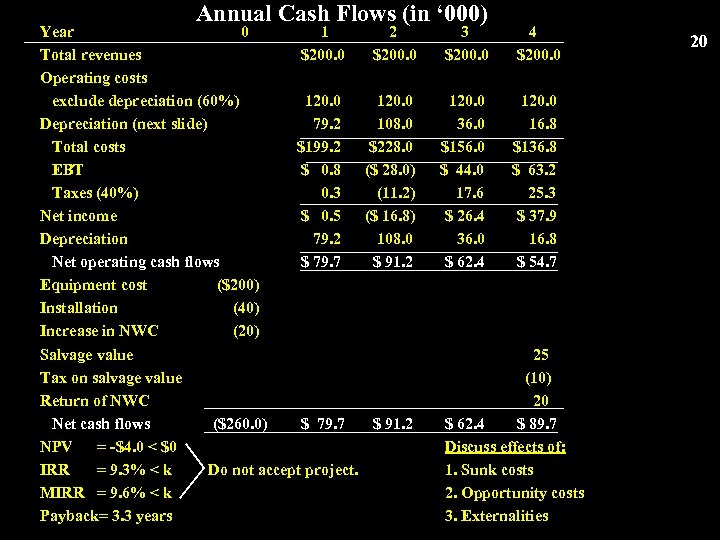

Annual Cash Flows (in ‘ 000) Year 0 1 Total revenues $200. 0 Operating costs exclude depreciation (60%) 120. 0 Depreciation (next slide) 79. 2 Total costs $199. 2 EBT $ 0. 8 Taxes (40%) 0. 3 Net income $ 0. 5 Depreciation 79. 2 Net operating cash flows $ 79. 7 Equipment cost ($200) Installation (40) Increase in NWC (20) Salvage value Tax on salvage value Return of NWC Net cash flows ($260. 0) $ 79. 7 NPV = -$4. 0 < $0 IRR = 9. 3% < k Do not accept project. MIRR = 9. 6% < k Payback= 3. 3 years 2 $200. 0 3 $200. 0 4 $200. 0 120. 0 108. 0 $228. 0 ($ 28. 0) (11. 2) ($ 16. 8) 108. 0 $ 91. 2 120. 0 36. 0 $156. 0 $ 44. 0 17. 6 $ 26. 4 36. 0 $ 62. 4 120. 0 16. 8 $136. 8 $ 63. 2 25. 3 $ 37. 9 16. 8 $ 54. 7 $ 91. 2 25 (10) 20 $ 62. 4 $ 89. 7 Discuss effects of: 1. Sunk costs 2. Opportunity costs 3. Externalities 20

Annual Cash Flows (in ‘ 000) Year 0 1 Total revenues $200. 0 Operating costs exclude depreciation (60%) 120. 0 Depreciation (next slide) 79. 2 Total costs $199. 2 EBT $ 0. 8 Taxes (40%) 0. 3 Net income $ 0. 5 Depreciation 79. 2 Net operating cash flows $ 79. 7 Equipment cost ($200) Installation (40) Increase in NWC (20) Salvage value Tax on salvage value Return of NWC Net cash flows ($260. 0) $ 79. 7 NPV = -$4. 0 < $0 IRR = 9. 3% < k Do not accept project. MIRR = 9. 6% < k Payback= 3. 3 years 2 $200. 0 3 $200. 0 4 $200. 0 120. 0 108. 0 $228. 0 ($ 28. 0) (11. 2) ($ 16. 8) 108. 0 $ 91. 2 120. 0 36. 0 $156. 0 $ 44. 0 17. 6 $ 26. 4 36. 0 $ 62. 4 120. 0 16. 8 $136. 8 $ 63. 2 25. 3 $ 37. 9 16. 8 $ 54. 7 $ 91. 2 25 (10) 20 $ 62. 4 $ 89. 7 Discuss effects of: 1. Sunk costs 2. Opportunity costs 3. Externalities 20