b6dde82baed808f9f3c6794a1548abd7.ppt

- Количество слайдов: 14

Case Study The Rise and Fall of Global Trust Bank By: Dhiraj Agarwal (01) Rajat Agarwal (03) Hersh Inder Lulla (26) Mrigendra Singh Parihar (32)

GTB’s Ramesh Gelli

GTB bank- A High Flying Entity Promoted by Jayant Madhab, Ramesh Gelli and Sridhar Subasri who together raised Rs. 400 mn International Finance Corporation and Asian Development Bank other major shareholders First Indian private sector bank to attract equity participation from international investment banks GTB offered its clients an array of services like retail banking, investment banking, treasury management, NRI products etc. Portrayed its image as extremely tech-savvy with delivery of world class services to its customers

Immediate Landmarks Rs 1 bn worth of deposits on Day One of operations and 10 bn by the end of first year Subscription worth Rs 62. 40 bn against original size of Rs 1. 04 bn. (oversubscribed 60 times) In three years of operation, business exceeded Rs 43. 02 bn By July 2004, 104 branches in 34 cities, 275 ATMs and 1400 employees From the very beginning GTB concentrated on midmarket corporates involved in software, textiles, energy, gems and jewellery (known as Diamond Merchants Banker) and exports

GTB collapse reasons High NPAs due to indiscriminate lending and gross underprovisioning for NPAs Bank’s direct exposure to capital markets was around 24% of advances in fiscal year 2000 -01, whilst the cap is 5% according to SEBI guidelines Loans against shares as security; turned into bad debts with the fall in the stock market Not monitoring end use of lent funds, many found way to few specific companies False auditing of Financial statements (Window Dressing)

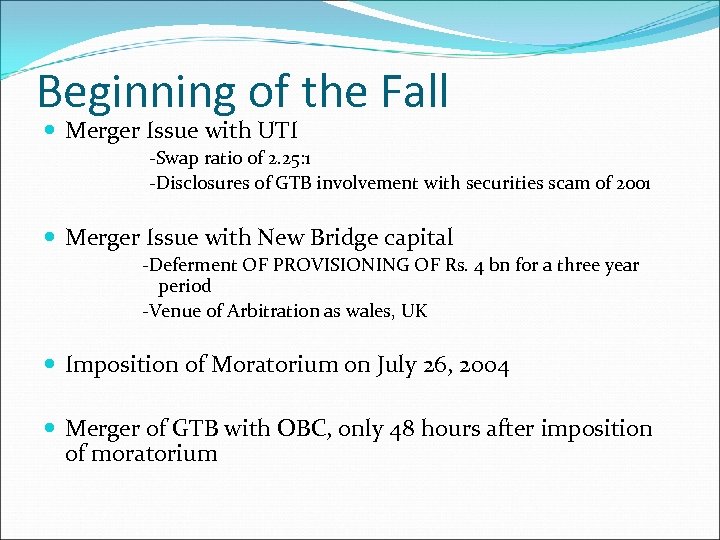

Beginning of the Fall Merger Issue with UTI -Swap ratio of 2. 25: 1 -Disclosures of GTB involvement with securities scam of 2001 Merger Issue with New Bridge capital -Deferment OF PROVISIONING OF Rs. 4 bn for a three year period -Venue of Arbitration as wales, UK Imposition of Moratorium on July 26, 2004 Merger of GTB with OBC, only 48 hours after imposition of moratorium

Relationship with Ketan Parekh and role in Stock Market Scam Either a high stakes reckless gamble by GTB Or Fulcrum for Ketan Parekh’s transactions in market Parekh’s corporate associates, investment companies, network of numerous investment firms had accounts with GTB JPC(Joint Parliamentary Committee) revealed the tremendous velocity with which funds were transferred among these entities GTB’s lending was dictated by the stock market, not by business potential

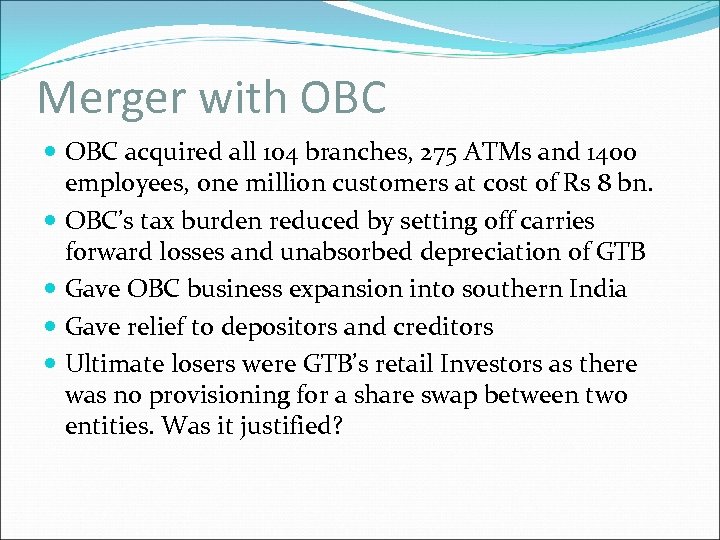

Merger with OBC acquired all 104 branches, 275 ATMs and 1400 employees, one million customers at cost of Rs 8 bn. OBC’s tax burden reduced by setting off carries forward losses and unabsorbed depreciation of GTB Gave OBC business expansion into southern India Gave relief to depositors and creditors Ultimate losers were GTB’s retail Investors as there was no provisioning for a share swap between two entities. Was it justified?

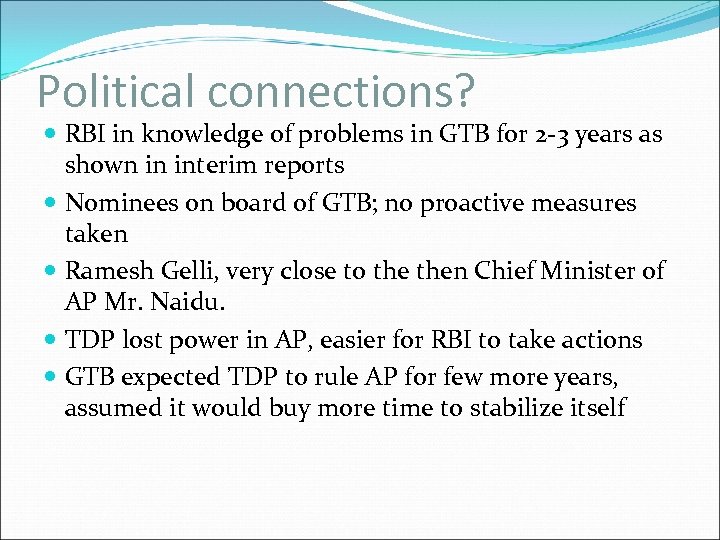

Political connections? RBI in knowledge of problems in GTB for 2 -3 years as shown in interim reports Nominees on board of GTB; no proactive measures taken Ramesh Gelli, very close to then Chief Minister of AP Mr. Naidu. TDP lost power in AP, easier for RBI to take actions GTB expected TDP to rule AP for few more years, assumed it would buy more time to stabilize itself

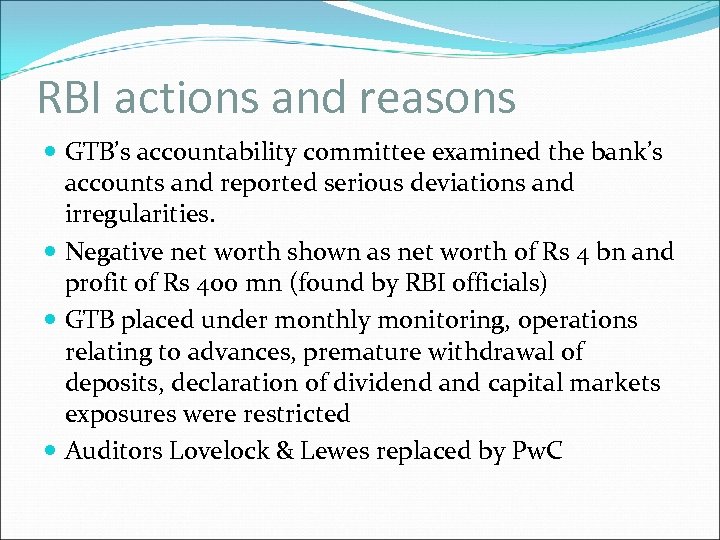

RBI actions and reasons GTB’s accountability committee examined the bank’s accounts and reported serious deviations and irregularities. Negative net worth shown as net worth of Rs 4 bn and profit of Rs 400 mn (found by RBI officials) GTB placed under monthly monitoring, operations relating to advances, premature withdrawal of deposits, declaration of dividend and capital markets exposures were restricted Auditors Lovelock & Lewes replaced by Pw. C

Learnings RBI should publicise the directions given to the bank Should publicly announce the broad confines of actions taken under Prompt Corrective Actions regime RBI owes it to depositors, borrowers and investors RBI should direct banks to publicise such incidents in their annual reports

Questions to Ponder Should a bank’s operations be determined by the sole objective of generating returns to its promoters? Why was requisite vigilance not maintained in the past by RBI to ensure that the bank is following all the norms? Why did RBI refuse the infusion of fresh capital through new Bridge Capital? Who was a bigger defaulter - GTB or RBI?

Who should absorb risks in the future – Investors, Company or RBI? What necessary changes should be made to prevent similar cases in the future? Why did RBI and SEBI allow trading of shares when the bank was under critical inspection?

b6dde82baed808f9f3c6794a1548abd7.ppt