CHAPTER 8_03 III.ppt

- Количество слайдов: 15

CASE STUDY EMERALD ISLE KNITTERS

CASE STUDY EMERALD ISLE KNITTERS

Mary O’Meara is the owner and manager of Emerald Isle Knitters, Ltd. , of Irvington, New Jersey. The company is very small, with only 10 employees. Mary started the company three years ago with cash loaned to her by a local bank. The company manufactures a traditional wool fisherman’s sweater from a pattern Mary learned from her grandmother. Like most apparel manufacturers, Emerald Isle Knitters sells its product to department stores and clothing store chains rather than to retail customers. The sweater was an immediate success, and all of the first year’s production was sold out. However, in the second year of operations, one of the company’s major customers cancelled its order due to bankruptcy, and the company ended the year with large stocks of unsold sweaters. The third year of operations was a great year in contrast to that disastrous second year. Sales rebounded dramatically, and all of the unsold production carried over from the second year was sold by the end of the third year. Shortly after the close of the third year, Mary met with her accountant Sean Mac. Lafferty to discuss the results for the year. Mary: Sean, the results of this year look a lot better than for last year, but I’m frankly puzzled why this year’s results aren’t even better than this income statement shows. Sean: I know what you mean. The net income for this year is just $90’ 000. Last year it was $30’ 000. That is a huge improvement, but it seems that profits this year should have been even higher and profits last year should have been much less. We were in big trouble last year. I was afraid that we might not even break even – yet we showed a healthy $30’ 000 profit. Somehow, it doesn’t seem quite right. Mary: I wondered about that $30’ 000 profit last year, but I didn’t question it since it was the only good news I had gotten for quite some time. Sean: In case you’re wondering, I didn’t invent that profit last year just to make you feel better. Our auditor required that I follow certain accounting rules in preparing those reports for the bank. This may sound heretical, but we could use different rules for our own internal reports. Mary: Wait a minute; rules are rules – especially in accounting. Sean: Yes and no. For our internal reports, it might be better to use different rules than we use in the reports we send to the bank. Mary: As I said, rules are rules. Still, I’m willing to listen if you want to show me what you have in mind. Sean: It’s a deal.

Mary O’Meara is the owner and manager of Emerald Isle Knitters, Ltd. , of Irvington, New Jersey. The company is very small, with only 10 employees. Mary started the company three years ago with cash loaned to her by a local bank. The company manufactures a traditional wool fisherman’s sweater from a pattern Mary learned from her grandmother. Like most apparel manufacturers, Emerald Isle Knitters sells its product to department stores and clothing store chains rather than to retail customers. The sweater was an immediate success, and all of the first year’s production was sold out. However, in the second year of operations, one of the company’s major customers cancelled its order due to bankruptcy, and the company ended the year with large stocks of unsold sweaters. The third year of operations was a great year in contrast to that disastrous second year. Sales rebounded dramatically, and all of the unsold production carried over from the second year was sold by the end of the third year. Shortly after the close of the third year, Mary met with her accountant Sean Mac. Lafferty to discuss the results for the year. Mary: Sean, the results of this year look a lot better than for last year, but I’m frankly puzzled why this year’s results aren’t even better than this income statement shows. Sean: I know what you mean. The net income for this year is just $90’ 000. Last year it was $30’ 000. That is a huge improvement, but it seems that profits this year should have been even higher and profits last year should have been much less. We were in big trouble last year. I was afraid that we might not even break even – yet we showed a healthy $30’ 000 profit. Somehow, it doesn’t seem quite right. Mary: I wondered about that $30’ 000 profit last year, but I didn’t question it since it was the only good news I had gotten for quite some time. Sean: In case you’re wondering, I didn’t invent that profit last year just to make you feel better. Our auditor required that I follow certain accounting rules in preparing those reports for the bank. This may sound heretical, but we could use different rules for our own internal reports. Mary: Wait a minute; rules are rules – especially in accounting. Sean: Yes and no. For our internal reports, it might be better to use different rules than we use in the reports we send to the bank. Mary: As I said, rules are rules. Still, I’m willing to listen if you want to show me what you have in mind. Sean: It’s a deal.

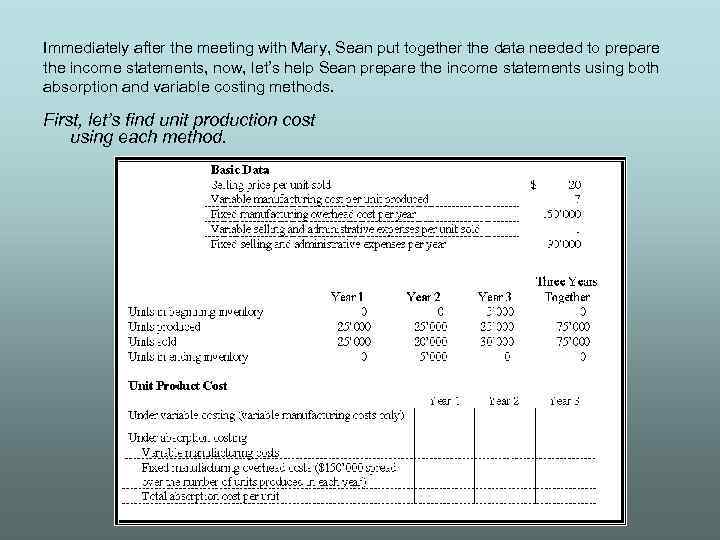

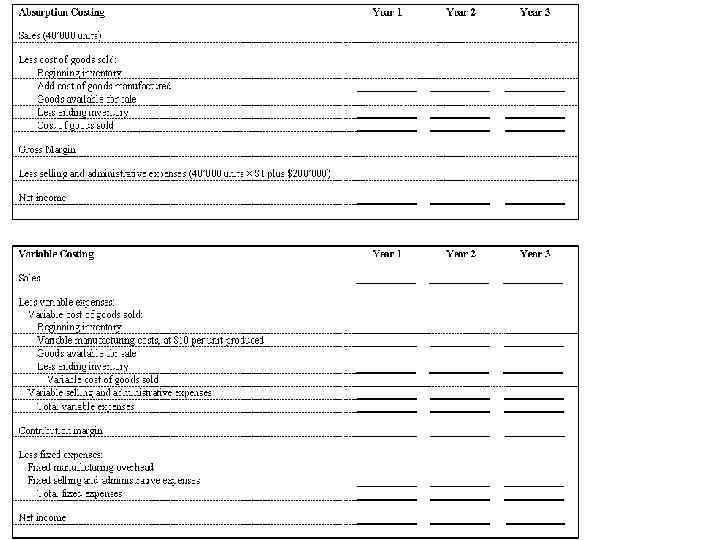

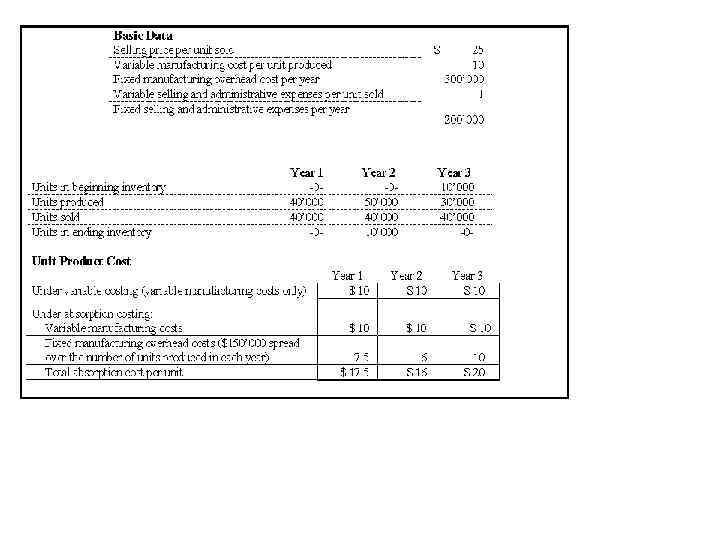

Immediately after the meeting with Mary, Sean put together the data needed to prepare the income statements, now, let’s help Sean prepare the income statements using both absorption and variable costing methods. First, let’s find unit production cost using each method.

Immediately after the meeting with Mary, Sean put together the data needed to prepare the income statements, now, let’s help Sean prepare the income statements using both absorption and variable costing methods. First, let’s find unit production cost using each method.

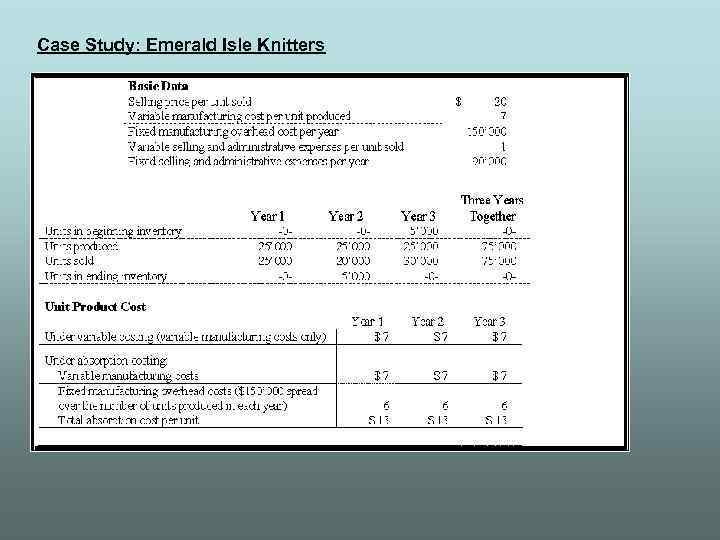

Case Study: Emerald Isle Knitters

Case Study: Emerald Isle Knitters

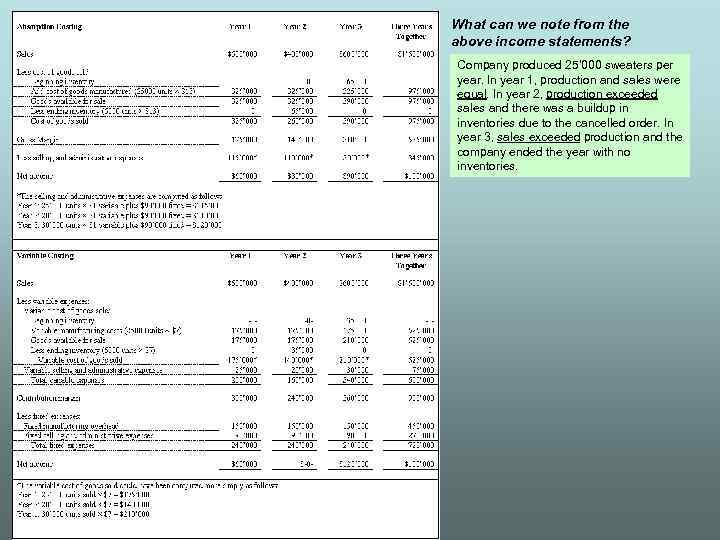

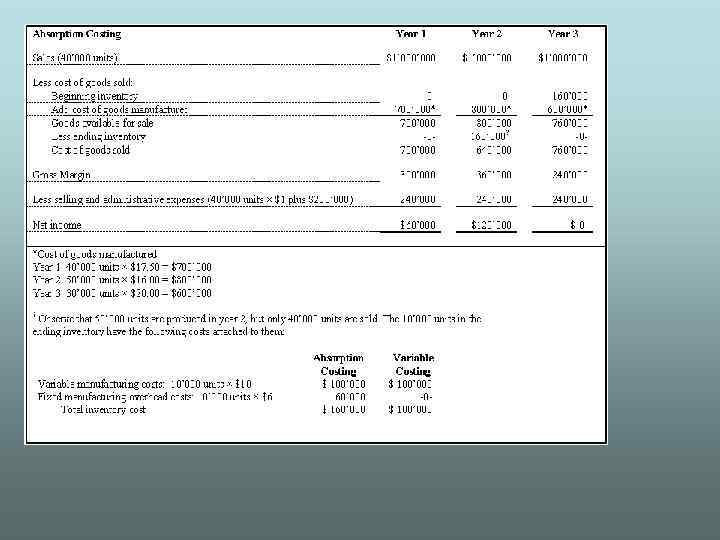

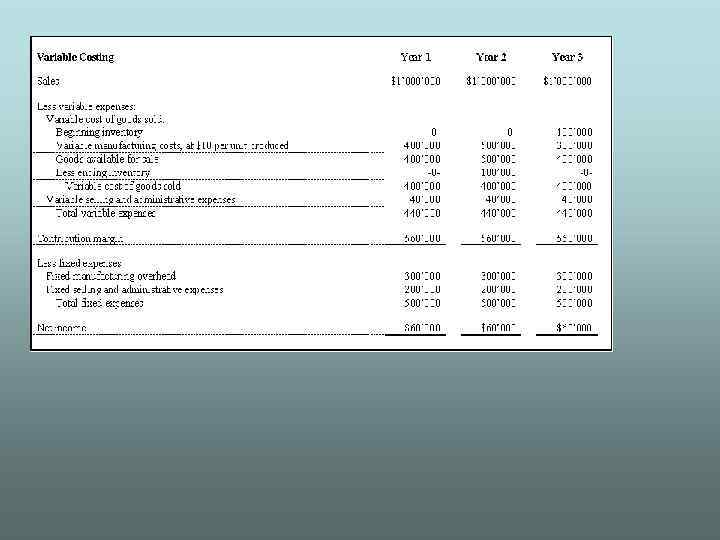

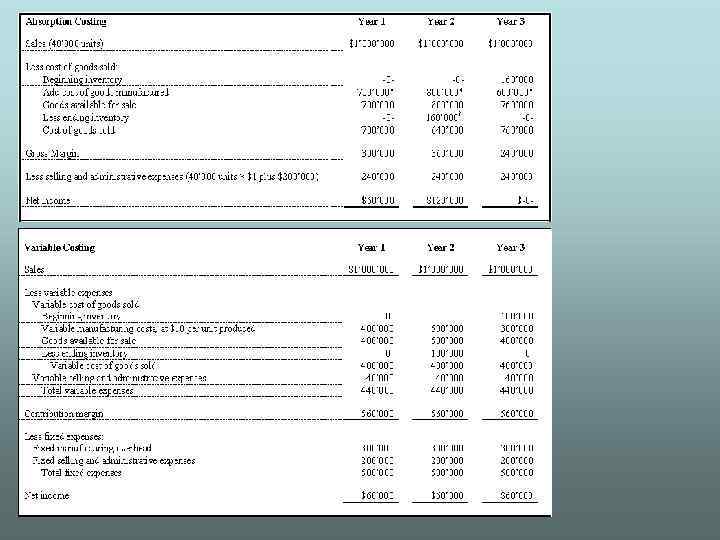

What can we note from the above income statements? Company produced 25’ 000 sweaters per year. In year 1, production and sales were equal. In year 2, production exceeded sales and there was a buildup in inventories due to the cancelled order. In year 3, sales exceeded production and the company ended the year with no inventories.

What can we note from the above income statements? Company produced 25’ 000 sweaters per year. In year 1, production and sales were equal. In year 2, production exceeded sales and there was a buildup in inventories due to the cancelled order. In year 3, sales exceeded production and the company ended the year with no inventories.

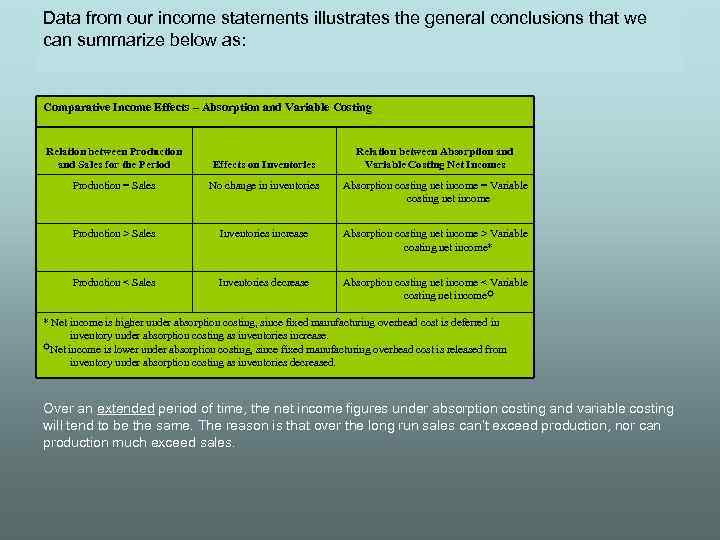

Data from our income statements illustrates the general conclusions that we can summarize below as: Comparative Income Effects – Absorption and Variable Costing Relation between Production and Sales for the Period Relation between Absorption and Variable Costing Net Incomes Effects on Inventories Production = Sales No change in inventories Absorption costing net income = Variable costing net income Production > Sales Inventories increase Absorption costing net income > Variable costing net income* Production < Sales Inventories decrease Absorption costing net income < Variable costing net income☼ * Net income is higher under absorption costing, since fixed manufacturing overhead cost is deferred in inventory under absorption costing as inventories increase. ☼Net income is lower under absorption costing, since fixed manufacturing overhead cost is released from inventory under absorption costing as inventories decreased. Over an extended period of time, the net income figures under absorption costing and variable costing will tend to be the same. The reason is that over the long run sales can’t exceed production, nor can production much exceed sales.

Data from our income statements illustrates the general conclusions that we can summarize below as: Comparative Income Effects – Absorption and Variable Costing Relation between Production and Sales for the Period Relation between Absorption and Variable Costing Net Incomes Effects on Inventories Production = Sales No change in inventories Absorption costing net income = Variable costing net income Production > Sales Inventories increase Absorption costing net income > Variable costing net income* Production < Sales Inventories decrease Absorption costing net income < Variable costing net income☼ * Net income is higher under absorption costing, since fixed manufacturing overhead cost is deferred in inventory under absorption costing as inventories increase. ☼Net income is lower under absorption costing, since fixed manufacturing overhead cost is released from inventory under absorption costing as inventories decreased. Over an extended period of time, the net income figures under absorption costing and variable costing will tend to be the same. The reason is that over the long run sales can’t exceed production, nor can production much exceed sales.

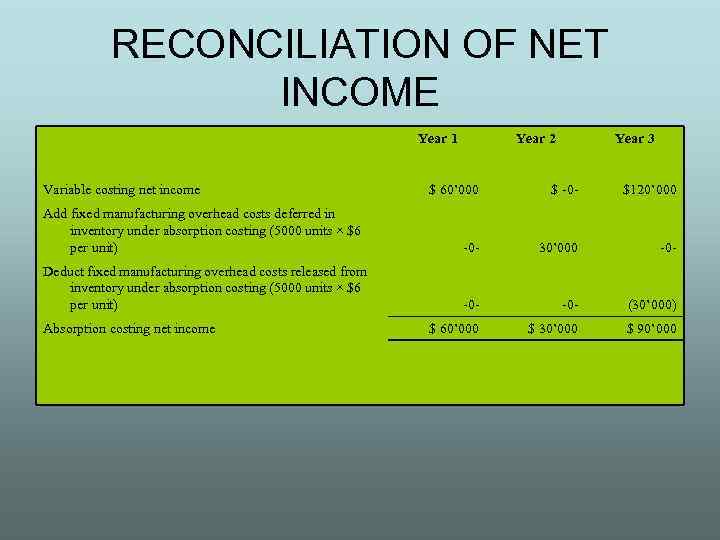

RECONCILIATION OF NET INCOME Year 1 Variable costing net income Year 2 Year 3 $ 60’ 000 $ -0 - $120’ 000 Add fixed manufacturing overhead costs deferred in inventory under absorption costing (5000 units × $6 per unit) -0 - 30’ 000 -0 - Deduct fixed manufacturing overhead costs released from inventory under absorption costing (5000 units × $6 per unit) -0 - (30’ 000) $ 60’ 000 $ 30’ 000 $ 90’ 000 Absorption costing net income

RECONCILIATION OF NET INCOME Year 1 Variable costing net income Year 2 Year 3 $ 60’ 000 $ -0 - $120’ 000 Add fixed manufacturing overhead costs deferred in inventory under absorption costing (5000 units × $6 per unit) -0 - 30’ 000 -0 - Deduct fixed manufacturing overhead costs released from inventory under absorption costing (5000 units × $6 per unit) -0 - (30’ 000) $ 60’ 000 $ 30’ 000 $ 90’ 000 Absorption costing net income

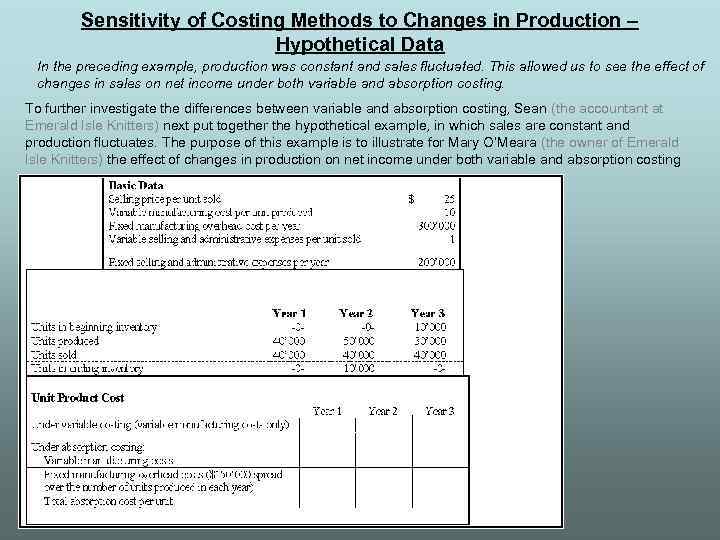

Sensitivity of Costing Methods to Changes in Production – Hypothetical Data In the preceding example, production was constant and sales fluctuated. This allowed us to see the effect of changes in sales on net income under both variable and absorption costing. To further investigate the differences between variable and absorption costing, Sean (the accountant at Emerald Isle Knitters) next put together the hypothetical example, in which sales are constant and production fluctuates. The purpose of this example is to illustrate for Mary O’Meara (the owner of Emerald Isle Knitters) the effect of changes in production on net income under both variable and absorption costing

Sensitivity of Costing Methods to Changes in Production – Hypothetical Data In the preceding example, production was constant and sales fluctuated. This allowed us to see the effect of changes in sales on net income under both variable and absorption costing. To further investigate the differences between variable and absorption costing, Sean (the accountant at Emerald Isle Knitters) next put together the hypothetical example, in which sales are constant and production fluctuates. The purpose of this example is to illustrate for Mary O’Meara (the owner of Emerald Isle Knitters) the effect of changes in production on net income under both variable and absorption costing

What to note: • • A change in production has no impact on net income when variable costing is in use. Note, when absorption costing is in use, net income goes up and down in years 2 and 3 even though the same number of units is sold in each year. Reason is shifting fixed manufacturing overhead cost between periods under the absorption costing method. If we use absorption costing we may not need to sell more of the products to report a profit!!!!!! As the number of units produced in year 2 is higher than the amount sold fixed manufacturing overhead cost is deferred in inventory decreasing COGS and thus total expenses of the period thus net income figure is higher. As the number of units produced in year 3 is lower than amount sold we may see that fixed manufacturing overhead cost previously deferred in inventory is released out in year 3 through the sale of goods As cost are higher under absorption costing in this case Net income is less on the amount of fixed manufacturing overhead cost released from inventory.

What to note: • • A change in production has no impact on net income when variable costing is in use. Note, when absorption costing is in use, net income goes up and down in years 2 and 3 even though the same number of units is sold in each year. Reason is shifting fixed manufacturing overhead cost between periods under the absorption costing method. If we use absorption costing we may not need to sell more of the products to report a profit!!!!!! As the number of units produced in year 2 is higher than the amount sold fixed manufacturing overhead cost is deferred in inventory decreasing COGS and thus total expenses of the period thus net income figure is higher. As the number of units produced in year 3 is lower than amount sold we may see that fixed manufacturing overhead cost previously deferred in inventory is released out in year 3 through the sale of goods As cost are higher under absorption costing in this case Net income is less on the amount of fixed manufacturing overhead cost released from inventory.

Homework: • Reading material: pages 331 -343 • Exercises: E 8 -3, E 8 -4, E 8 -5, E 8 -6; pages 346 -348 • Problems: P 8 -8, P 8 -9, P 8 -10, P 8 -11, P 8 -12, P 8 -13, • Cases: C 8 -16

Homework: • Reading material: pages 331 -343 • Exercises: E 8 -3, E 8 -4, E 8 -5, E 8 -6; pages 346 -348 • Problems: P 8 -8, P 8 -9, P 8 -10, P 8 -11, P 8 -12, P 8 -13, • Cases: C 8 -16