0c55bb7d506b65a7f38666ee6f1d2294.ppt

- Количество слайдов: 25

Caribbean Commercial Banking: Myths, Realities and the Way Forward by Ronald Ramkissoon Ph. D. Senior Economist, Republic Bank Ltd. 3 rd International Conference on Business, Banking and Finance, May 27 -29, 2009 UWI, St Augustine, Trinidad

Outline n Background to Paper n Attempt to clear up misunderstandings n Myths n Realities n Way Forward n Conclusions

Caveats n Paper done in 2007 n World’s financial system has changed radically since then n Major focus on banking system

Myth #1: Banks Lend More for Consumption n Data proves otherwise n Is consumption lending bad? n Note urging of advanced economies n Is the problem re- “productive” loans, on the supply side or on the demand side? n Is the Caribbean open for business?

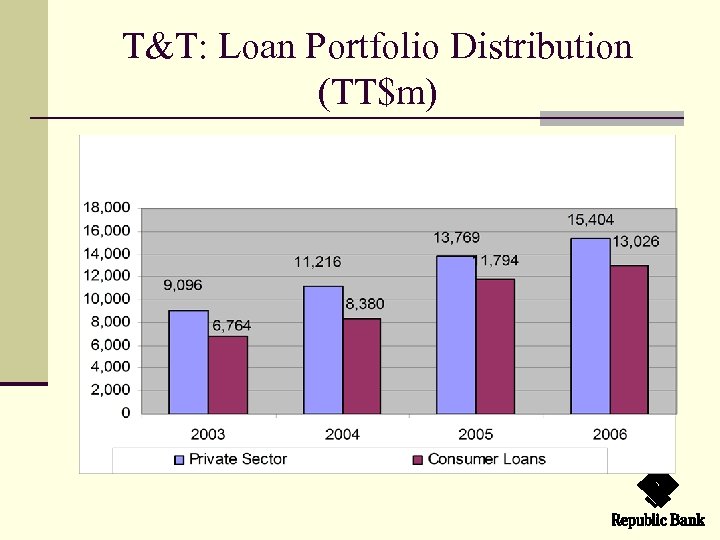

T&T: Loan Portfolio Distribution (TT$m)

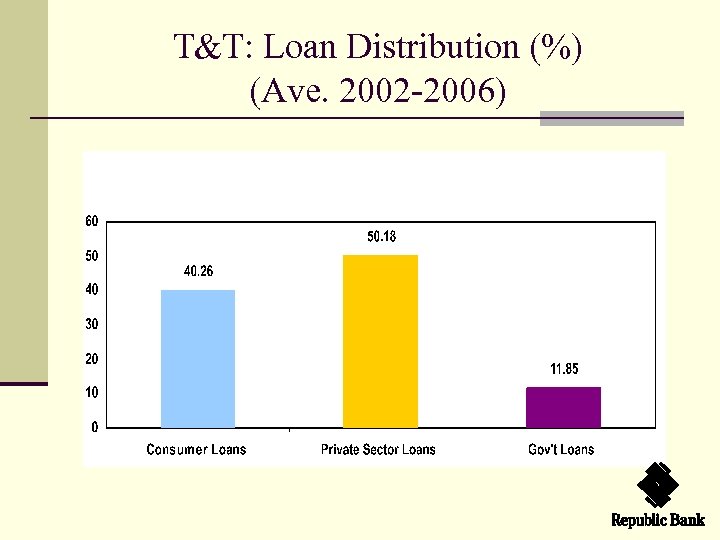

T&T: Loan Distribution (%) (Ave. 2002 -2006)

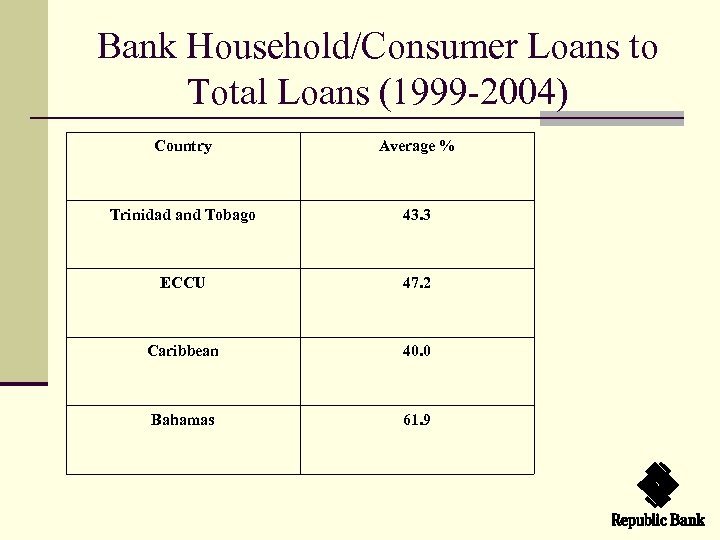

Bank Household/Consumer Loans to Total Loans (1999 -2004) Country Average % Trinidad and Tobago 43. 3 ECCU 47. 2 Caribbean 40. 0 Bahamas 61. 9

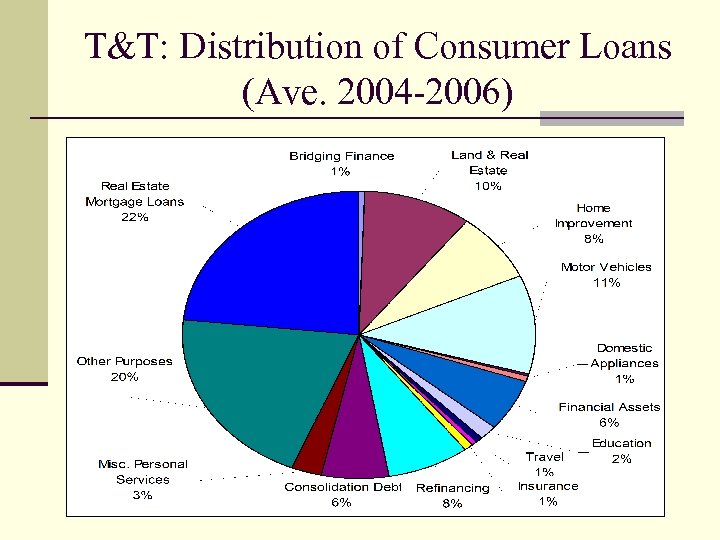

T&T: Distribution of Consumer Loans (Ave. 2004 -2006)

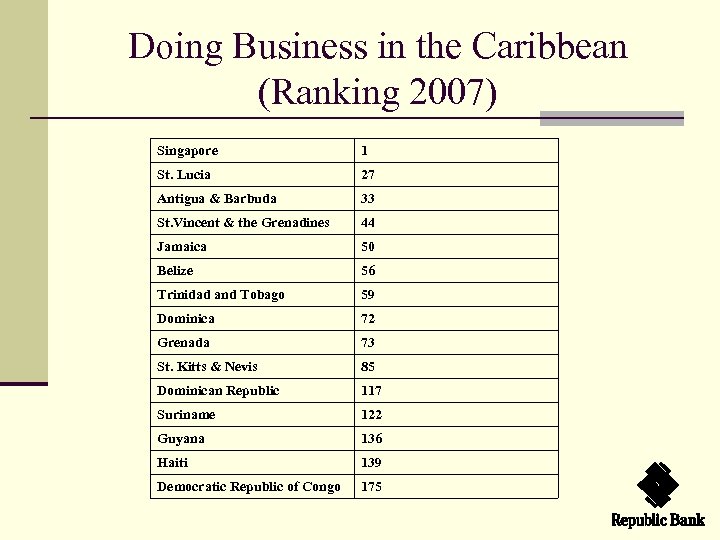

Doing Business in the Caribbean (Ranking 2007) Singapore 1 St. Lucia 27 Antigua & Barbuda 33 St. Vincent & the Grenadines 44 Jamaica 50 Belize 56 Trinidad and Tobago 59 Dominica 72 Grenada 73 St. Kitts & Nevis 85 Dominican Republic 117 Suriname 122 Guyana 136 Haiti 139 Democratic Republic of Congo 175

Way Forward n Address business environment n Address capital market development etc.

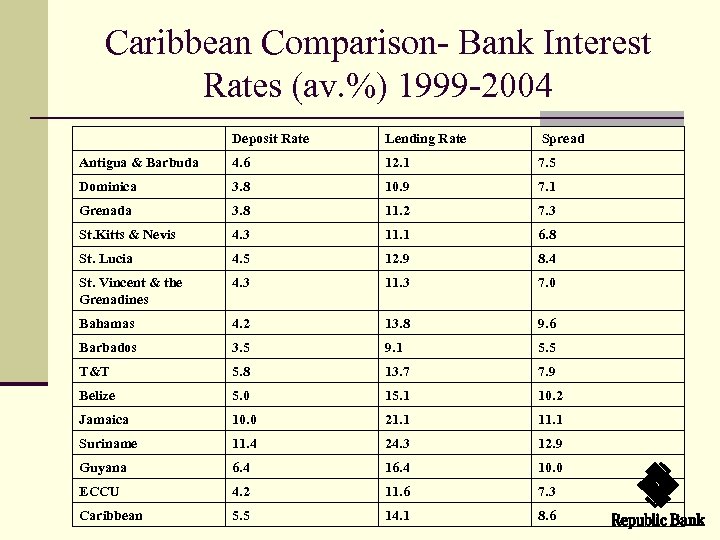

Myth #2: Bank Spreads are Too High n Spreads are highest for more risky performers. The n n reverse is also true. On the deposit side deposit rates are higher in Jamaica and Suriname compared to Barbados-no surprise here Lending rates are higher in the same countries with higher deposit rates Risk free rates are higher in developing countries If deposit and loan rates are consistent then spreads must be

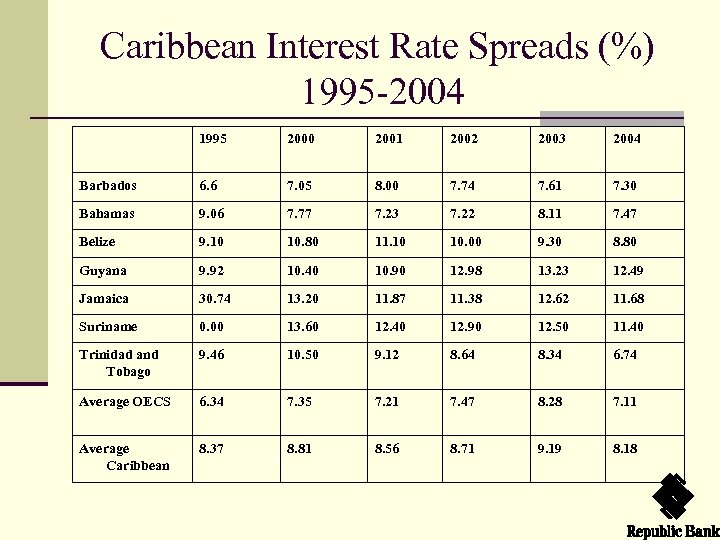

Caribbean Interest Rate Spreads (%) 1995 -2004 1995 2000 2001 2002 2003 2004 Barbados 6. 6 7. 05 8. 00 7. 74 7. 61 7. 30 Bahamas 9. 06 7. 77 7. 23 7. 22 8. 11 7. 47 Belize 9. 10 10. 80 11. 10 10. 00 9. 30 8. 80 Guyana 9. 92 10. 40 10. 90 12. 98 13. 23 12. 49 Jamaica 30. 74 13. 20 11. 87 11. 38 12. 62 11. 68 Suriname 0. 00 13. 60 12. 40 12. 90 12. 50 11. 40 Trinidad and Tobago 9. 46 10. 50 9. 12 8. 64 8. 34 6. 74 Average OECS 6. 34 7. 35 7. 21 7. 47 8. 28 7. 11 Average Caribbean 8. 37 8. 81 8. 56 8. 71 9. 19 8. 18

Caribbean Comparison- Bank Interest Rates (av. %) 1999 -2004 Deposit Rate Lending Rate Spread Antigua & Barbuda 4. 6 12. 1 7. 5 Dominica 3. 8 10. 9 7. 1 Grenada 3. 8 11. 2 7. 3 St. Kitts & Nevis 4. 3 11. 1 6. 8 St. Lucia 4. 5 12. 9 8. 4 St. Vincent & the Grenadines 4. 3 11. 3 7. 0 Bahamas 4. 2 13. 8 9. 6 Barbados 3. 5 9. 1 5. 5 T&T 5. 8 13. 7 7. 9 Belize 5. 0 15. 1 10. 2 Jamaica 10. 0 21. 1 11. 1 Suriname 11. 4 24. 3 12. 9 Guyana 6. 4 10. 0 ECCU 4. 2 11. 6 7. 3 Caribbean 5. 5 14. 1 8. 6

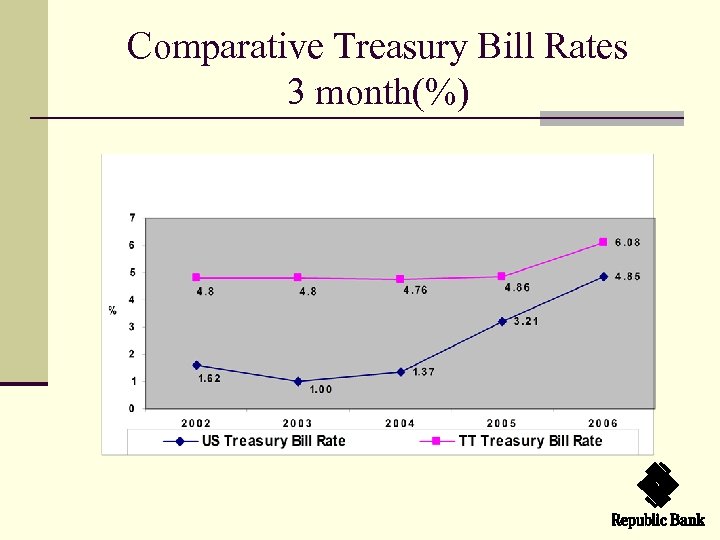

Comparative Treasury Bill Rates 3 month(%)

Way Forward n Reduce/mitigate risks in Caribbean countries n Be careful about the level of reserve requirements- these represent costs which are reflected in deposit rates

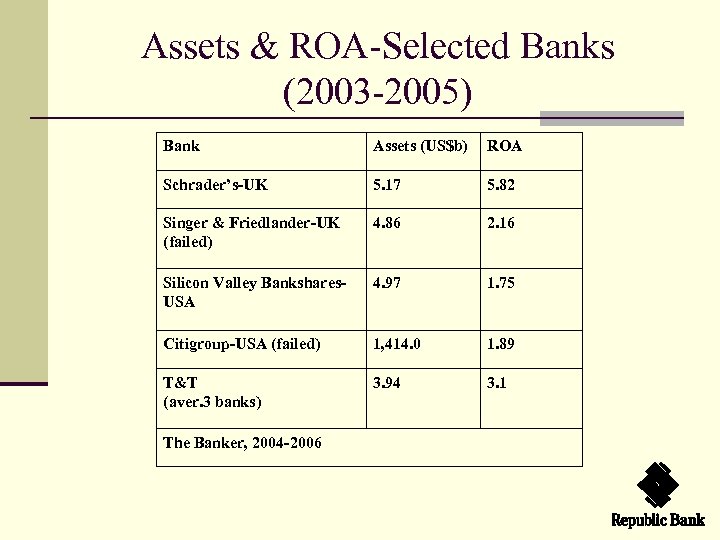

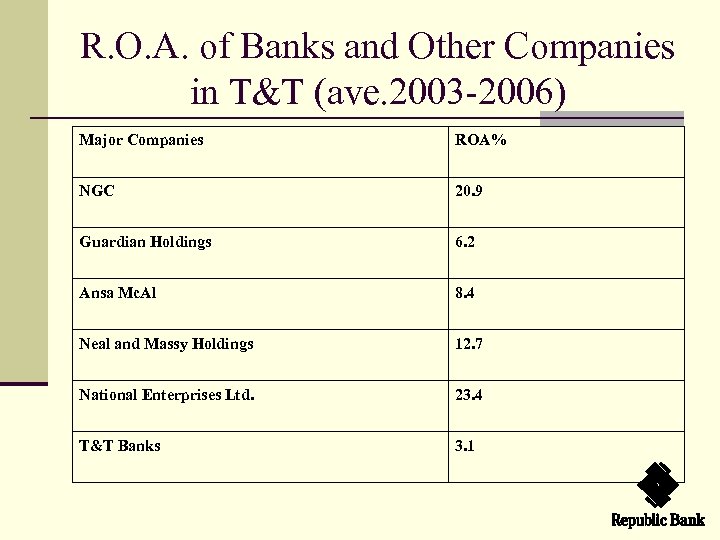

Myth #3: Bank Profits are too High n Absolute dollar values are not as meaningful n ROA’s in the Caribbean are generally on par with those in other jurisdictions n Banks in more risky environments with higher intermediation costs should have higher profits n “…banks stand a better chance of surviving the vagaries of banking and risk mitigation if their margins are larger than is the case in more developed environments where banking structure is presumably superior and shocks are likely to be weaker. ”

Assets & ROA-Selected Banks (2003 -2005) Bank Assets (US$b) ROA Schrader’s-UK 5. 17 5. 82 Singer & Friedlander-UK (failed) 4. 86 2. 16 Silicon Valley Bankshares. USA 4. 97 1. 75 Citigroup-USA (failed) 1, 414. 0 1. 89 T&T (aver. 3 banks) 3. 94 3. 1 The Banker, 2004 -2006

R. O. A. of Banks and Other Companies in T&T (ave. 2003 -2006) Major Companies ROA% NGC 20. 9 Guardian Holdings 6. 2 Ansa Mc. Al 8. 4 Neal and Massy Holdings 12. 7 National Enterprises Ltd. 23. 4 T&T Banks 3. 1

Myth #4: Banks do not Compete n T&T banking system comprises Central Bank, 5 foreign-owned banks, 1 government-owned bank and 1 privately-owned local bank n A wide range of non-banks n Caribbean has always been host to a range of international banks n Way forward: continue to ensure competition n Be aware that there is something as “unhealthy competition” i. e. non-bank institutions that compete with banks without being properly regulated

Myth #5: Banks do not Take Enough Risks n That banks look for “opportunities of lowest risks” in the economy is positive not negative n Banks should not be encouraged to take risks for which there balance sheets are not suited n Central banking regulation typically plays an important role here n Indeed higher risks typically generate higher returns which is one of the criticisms!

Myth # 6: Banks not Interested in Extending “Development Loans” n Be careful about what might be defined as “development” loans n Such longer term loans tend to be made by the longer term lending arm of banks i. e. merchant banks etc.

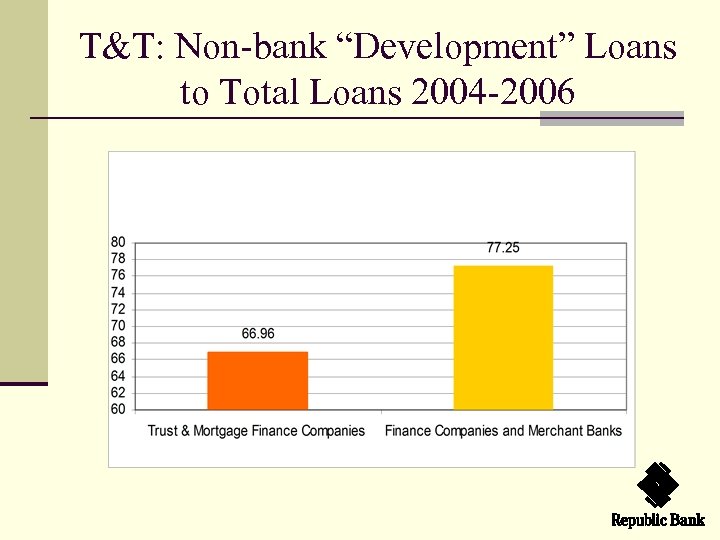

T&T: Non-bank “Development” Loans to Total Loans 2004 -2006

Conclusions n Caribbean commercial banks plead “not guilty” to the n n charges Banks ought not to be asked to do what they are not equipped to do To the extent that there is a gap for additional longerterm funding, cheaper funding and venture capital funding more remains to be done. “When your neighbour’s house is on fire…. ” While Caribbean banks have remained largely unscathed by the global financial meltdown we nevertheless have work to do

Conclusions n Make improvement to the Caribbean business environment the # 1 priority by Addressing limitations of the business environment (demand side) n Developing/providing the appropriate financial institutions/products (supply side) n

Thank You For Listening

0c55bb7d506b65a7f38666ee6f1d2294.ppt