fd6bc8b9e555369e3e14bd54e9372133.ppt

- Количество слайдов: 13

Cards and e. Payments Brian Hartzer Managing Director Australia and New Zealand Banking Group Limited 24 August 2001

Building the leading cards business in Australasia • Strong financial performance • Growing market share • Leveraging our core capabilities into new areas • Attractive growth opportunities and goals Page 2

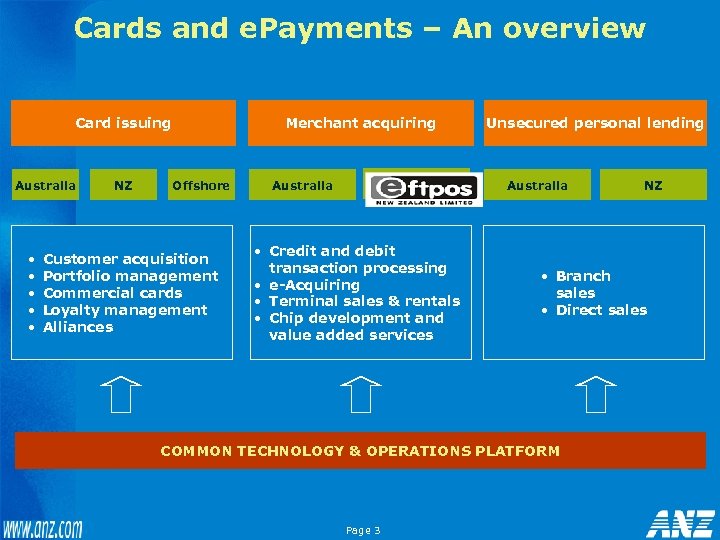

Cards and e. Payments – An overview Card issuing Australia • • • NZ Merchant acquiring Offshore Customer acquisition Portfolio management Commercial cards Loyalty management Alliances Australia Unsecured personal lending Australia • Credit and debit transaction processing • e-Acquiring • Terminal sales & rentals • Chip development and value added services • Branch sales • Direct sales COMMON TECHNOLOGY & OPERATIONS PLATFORM Page 3 NZ

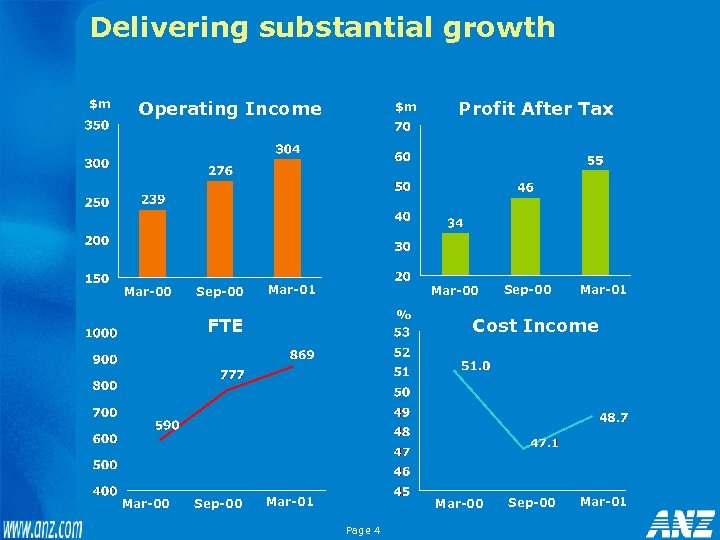

Delivering substantial growth $m Operating Income Mar-00 Sep-00 $m Mar-01 Mar-00 % FTE Mar-00 Sep-00 Profit After Tax Mar-01 Cost Income Mar-00 Page 4 Sep-00 Mar-01

Co-branded cards drive customer numbers and scale Relative profitability of Australian issuing & acquiring* Note: Co-brand accounts increased 70% between Sep-98 and Mar-01 Page 5

Growing share in both issuing and acquiring Share of Issuing Outstandings Share of Acquiring* * Excludes $1 billion+ p. a. in Coles Myer volume, commenced this month Page 6

… with a strong risk management focus Credit losses Fraud losses - credit cards – credit cards Bp of turnover Industry average (7 bp) Rolling 12 mth loss rate 90/210 days delinquent • Application and behavioural scorecards in use • Vision Plus and Triad to further enhance capabilities (3/02) Page 7 • Falcon and Eagle systems installed (neural networking tools) • 24 hour analysis and detection team

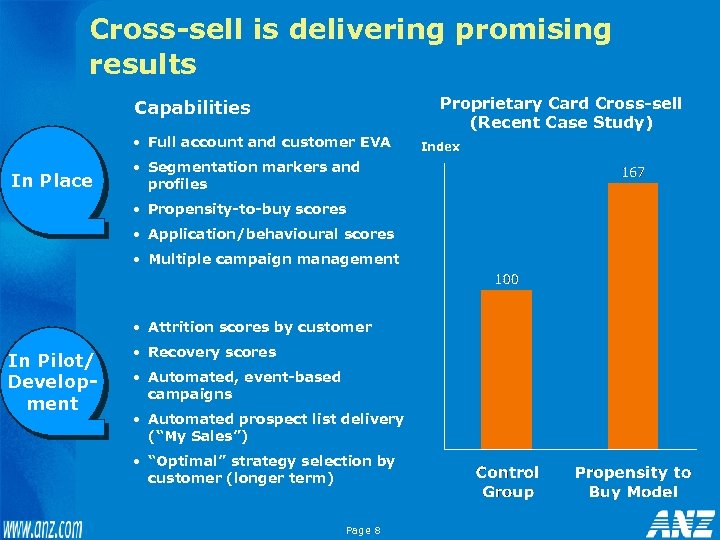

Cross-sell is delivering promising results Proprietary Card Cross-sell (Recent Case Study) Capabilities • Full account and customer EVA In Place • Segmentation markers and profiles • Propensity-to-buy scores • Application/behavioural scores • Multiple campaign management • Attrition scores by customer In Pilot/ Development • Recovery scores • Automated, event-based campaigns • Automated prospect list delivery (“My Sales”) • “Optimal” strategy selection by customer (longer term) Page 8 Index

Despite 27% share of card spend, we still have significant potential for profitable growth Share of total Personal Consumer Expenditure Share of Consumer Non-Mortgage Debt* ANZ cards 6. 5% ANZ cards 7. 9% Other banks cards ~17. 5% Total Consumer Non-Mortgage Debt = $50. 6 bn Total Personal Consumer Expenditure = $360 bn * includes personal loans Page 9

The merchant business offers significant growth: • Multi. POS terminal will lead market in functionality and price • Chip capabilities open up new opportunities for merchants • Offshore banks are expressing interest in our capabilities Page 10

Leveraging our distinctive capabilities internationally “Best Frequent Traveller Credit or Charge Card (International)”* First Place: Qantas Telstra Visa Card • Target: Hong Kong platinum market • Niche product with unique features to attract profitable segment • Proof of concept for marketing and operational capabilities in the region * source: Inside. Flyer Magazine, 2001 Page 11

Execution will be key to our success • Specialisation and “monoline” focus • High quality people and dynamic culture • Strong team experience in – Loyalty management: QTV, Westfield – Terminal/chip: Eftpos New Zealand – International markets: India, Asia • Investment in technology: – Platform of the future: Vision Plus, Falcon/Eagle, Triad – CRM – Chip Page 12 Staff Satisfaction

Summary • Focus & specialisation has driven strong financial performance • We will continue to grow market share • We are leveraging our distinctive capabilities into new growth opportunities • Cultural change has been significant, and will continue Page 13 Goals • 20%+ pa earnings growth to 2005 • Consolidate position as the leading cards business in Australasia • Become a meaningful player in Asia

fd6bc8b9e555369e3e14bd54e9372133.ppt