fd00595b1ebdecd5ce1e0b498bc2505f.ppt

- Количество слайдов: 18

Carboncredits. nl Baseline Methodologies Dispatch Analysis Gerhard Mulder Project Officer

Senter Internationaal · Agency of the Dutch Ministry of Economic Affairs · Programme implementation, for example: – CO 2 -reductionplan (domestic) – Emerging markets – Export Finance · Staff of approximately 760 · Annual budget: EUR 1. 000 million

Senter Internationaal: Carboncredits. nl team within Senter · Carboncredits. nl is the that executes the JI/CDM mechanism for the Dutch government – 6 project officers, one programme manager – Supported by a group of technical and financial experts · 3 ERUPT tenders: (total 70 projects - JI) · 1 CERUPT tender: (total of 80 projects CDM) · Look at www. carboncredits. nl

Senter Internationaal: Procurement rules · Carboncredits. nl implements the programme conform EU procurement rules. Public tender with two phases: – selection phase: focus on the supplier – contract awarding phase: focus on the proposal · There is no negotiation, and there is no preference for companies · Procurement rules are published in the Terms of Reference (To. R) · Advantage: one rules are published, they stand firm · Disadvantage: limited flexibility,

Introduction: History of JI/CDM · Dutch Government started with first AIJ projects in 1997 · First ERU-Procurement Tender (ERUPT) for Joint Implementation in 2000 – Describe baseline methodology in To. R – Input from national and international experts · Today: ERUPT- 2 and 3, plus CERUPT-1 have resulted in over 150 PINs, and approximately 50 Baseline studies

Introduction: Goals Baseline studyis the goal of a baseline study? · What – Article 44: the baseline for a CDM project activity is the scenario that reasonably represents the anthropogenic emissions by sources of GHG that would occur in the absence of the proposed project activity · Baseline emissions -/- project emissions +/leakage = emissions reductions

Introduction: Elements of the Baseline Control · Principle of – Project boundary – Account for Leakage · Fixed period – For 7 -year renewable or 10 -year non-renewable – Provides confidence to investors · Marrakech Accords criteria: Conservative, Transparent, Reasonable · Not one-size-fits-all – Reality is very complex – Scenario Analysis

The Dutch Baseline Methodology on using conservative · Strong emphasis assumptions · The To. R allows for more than one baseline methodology: – Scenario Analysis – Investment Analysis – Simplified Baselines for Small Scale CDM

Scenario Analysis · Definition: “A future emissions scenario (baseline) is constructed by identifying barriers and risks in a key-factor analysis, using currently delivery system as a starting point” · Which MA approach is umbrella for scenario analysis methodology (art. 48)? – A. Existing or historical emissions – B. Barriers-to-investment approach – C. Build Margin/Benchmarking

Scenario Analysis: Steps · Step 1: Describe current delivery system to develop baseline emissions – E. g. how many MWs of what type is installed, fuel use, etc · Step 2: Establish which emissions can be controlled or influenced by the project participants – One step upstream, one step downstream · Step 3: Develop Key Factor Analysis – Sectoral reform initiatives, local fuel availability, power sector expansion plans, and the economic situation in the project sector · Step 4: Determine CEF

Scenario Analysis: Take your pick Scenario Analysis is guiding · While principle, it can be implemented in more than one way – Depending on the sector/project – Depending on the preference of the project participant · Of the approximately 25 PDDs we received for CERUPT, we identified several different ways to implement our baseline guidelines: – Dispatch Analysis – Alternative Investment Analysis – Ex-ante calculation of CEF of existing plants · All methodologies are conform MA:

Dispatch Analysis: An Overview · Dispatch Analysis simulates the electricity sector for a period of time · It calculates generating costs per plant in each hour, and then optimises the dispatch for the system · The model calculates the electricity generated for each power plant for the whole crediting period · Knowing the carbon content of the fuels, you can calculate the emissions generated · You run the model with and without the proposed CDM project, and you can

Dispatch Analysis: Advantages · Approximates reality closest – Uses reality as starting point – Combines short term and long term effects · Works best if National Expansion Plans exist – But has element of Alternative Investment Analysis · Data input can be evaluated easily and objectively – DOE must evaluate input · Focus is on displacing electricity rather than capacity – CEF is based on how much electricity the

Dispatch Analysis: Disadvantages not always be available · Dispatch Model may – Models are often used by National Grid Operator · Data may not always be available – Some data may be proprietary

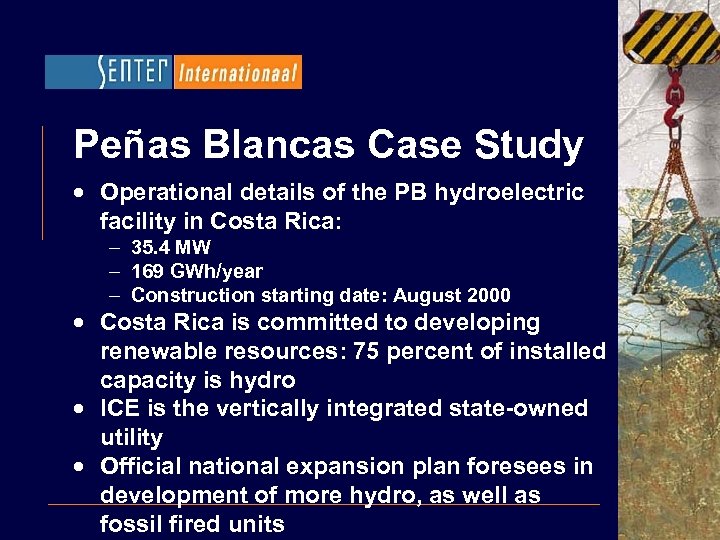

Peñas Blancas Case Study · Operational details of the PB hydroelectric facility in Costa Rica: – 35. 4 MW – 169 GWh/year – Construction starting date: August 2000 · Costa Rica is committed to developing renewable resources: 75 percent of installed capacity is hydro · ICE is the vertically integrated state-owned utility · Official national expansion plan foresees in development of more hydro, as well as fossil fired units

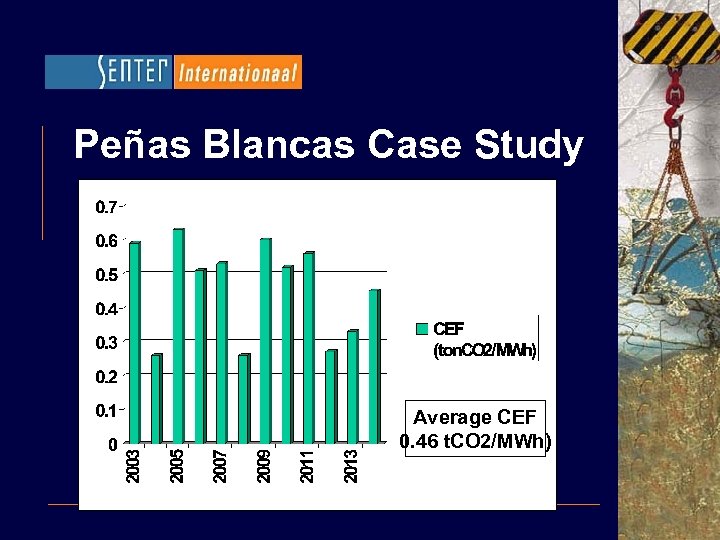

Peñas Blancas Case Study Average CEF 0. 46 t. CO 2/MWh)

Peñas Blancas Case Study · How was Costa Rica conservative in establishing the baseline? – – – Assumes no imports Did not include scenario of regional integration Average fuel prices Heat rates of existing fossil plants Demand projections Used National Expansion Plan · Furthermore, all assumptions meet the criteria that the baseline must be ‘transparent and reasonable’

Next Steps · Meth Panel rejected 14 of 15 New Methodologies – Could not reach consensus on Dispatch Analysis · Investment additionality appears to be back as the most important criteria for project eligibility · Executive Board must provide guidance on how to move the CDM ahead

fd00595b1ebdecd5ce1e0b498bc2505f.ppt