69fd0745992156a29fad760ba2e24a5d.ppt

- Количество слайдов: 26

Captivate and Estate Planning The Do’s Don’ts and What The !? $!? By: Douglas W. Stein Strategic Law, LLC (770) 804 -4888

Captivate and Estate Planning The Do’s Don’ts and What The !? $!? By: Douglas W. Stein Strategic Law, LLC (770) 804 -4888

Objectives of Captives The recurring theme with captives is that they offer businesses significant benefits in: A. Controlling risk 1. Insure against commercially unavailable or unaffordable risks 2. Access to reinsurance markets B. Controlling premium costs C. Create an off-balance sheet “rainy day” fund

Objectives of Captives The recurring theme with captives is that they offer businesses significant benefits in: A. Controlling risk 1. Insure against commercially unavailable or unaffordable risks 2. Access to reinsurance markets B. Controlling premium costs C. Create an off-balance sheet “rainy day” fund

Ancillary Objectives of A Captive Program • • • Creating a New Profit Center Diversification of Investments Favorable Income Tax Treatment • • Asset Protection Wealth Accumulation Wealth Transfer Estate Tax

Ancillary Objectives of A Captive Program • • • Creating a New Profit Center Diversification of Investments Favorable Income Tax Treatment • • Asset Protection Wealth Accumulation Wealth Transfer Estate Tax

What is a Captive? • A licensed insurance company formed to insure the risks of related or affiliated businesses • A captive permits a business to manage its risks and control its premium costs • Captives provide an opportunity to insure against liabilities that are generally uninsurable or hard to insure • Over 50% of the Fortune 1500 have captives

What is a Captive? • A licensed insurance company formed to insure the risks of related or affiliated businesses • A captive permits a business to manage its risks and control its premium costs • Captives provide an opportunity to insure against liabilities that are generally uninsurable or hard to insure • Over 50% of the Fortune 1500 have captives

What is Insurance? • • There is no statutory definition A contractual relationship that exists when one party (the insurer) for consideration (the premium) agrees to reimburse another party (the insured) for loss to a specified subject (the risk) caused by designated contingencies (hazards or perils)

What is Insurance? • • There is no statutory definition A contractual relationship that exists when one party (the insurer) for consideration (the premium) agrees to reimburse another party (the insured) for loss to a specified subject (the risk) caused by designated contingencies (hazards or perils)

Code Section 831(b) • Captives generally fall into one of three basic categories: (a) “micro” captives, (b) “small” captives, and (c) “large” captives • Today we focus on “small” captives, which are captives that make an election under Code Section 831(b) • “Small” captives can write up to $1. 2 million dollars of premium per year, and are not taxed on premium income. This creates an arbitrage opportunity (which will be discussed) • “Large” captives, which generally includes captives writing more than $1. 2 million in premiums annually, are best suited for companies with significant operating revenues. While “large” captives are taxed on premium income, they offer significant advantages in controlling risk, controlling premium costs, asset management, and credit enhancement

Code Section 831(b) • Captives generally fall into one of three basic categories: (a) “micro” captives, (b) “small” captives, and (c) “large” captives • Today we focus on “small” captives, which are captives that make an election under Code Section 831(b) • “Small” captives can write up to $1. 2 million dollars of premium per year, and are not taxed on premium income. This creates an arbitrage opportunity (which will be discussed) • “Large” captives, which generally includes captives writing more than $1. 2 million in premiums annually, are best suited for companies with significant operating revenues. While “large” captives are taxed on premium income, they offer significant advantages in controlling risk, controlling premium costs, asset management, and credit enhancement

Overview of How A Captive Works • A captive insurance program involves forming a fully licensed insurance company either onshore or offshore • The captive is owned by the owner (or members of the owner’s family) and qualifies as an insurance company under the U. S. Tax Code • The owner or the owner’s business deducts premiums paid to the captive. These amounts would otherwise be taxed at personal or corporate tax rates • Since the captive does not recognize any taxable premium income, this sets up a tax arbitrage that permits the owner to accumulate investment assets at an accelerated rate, resulting in wealth accumulation and giving rise to numerous opportunities

Overview of How A Captive Works • A captive insurance program involves forming a fully licensed insurance company either onshore or offshore • The captive is owned by the owner (or members of the owner’s family) and qualifies as an insurance company under the U. S. Tax Code • The owner or the owner’s business deducts premiums paid to the captive. These amounts would otherwise be taxed at personal or corporate tax rates • Since the captive does not recognize any taxable premium income, this sets up a tax arbitrage that permits the owner to accumulate investment assets at an accelerated rate, resulting in wealth accumulation and giving rise to numerous opportunities

The Captive’s Operations • Insure risks not presently insured, lower limits (insuring last dollars out), or increasing deductibles (insuring first dollars out) creating a contingency fund for future catastrophic losses • Captives do not usually insure all P&C risks of the client’s operating company • The captive focuses on investing the underwriting profits from premiums to meet future claims and uses tax arbitrage to create wealth

The Captive’s Operations • Insure risks not presently insured, lower limits (insuring last dollars out), or increasing deductibles (insuring first dollars out) creating a contingency fund for future catastrophic losses • Captives do not usually insure all P&C risks of the client’s operating company • The captive focuses on investing the underwriting profits from premiums to meet future claims and uses tax arbitrage to create wealth

Onshore Captives • • Onshore captives offer a variety of choices (50 states plus DC) Many states require that you hold annual meetings within the state Regulators tend to be very strict Capitalization requirements are relatively high (e. g. , $250, 000)

Onshore Captives • • Onshore captives offer a variety of choices (50 states plus DC) Many states require that you hold annual meetings within the state Regulators tend to be very strict Capitalization requirements are relatively high (e. g. , $250, 000)

Offshore Captives • • • Almost every country has captive legislation You can forum shop Annual meetings need not be held in the same jurisdiction that the captive is formed Some regulators are strict some are not Be very wary that the jurisdiction you choose has a regulator who understands captives

Offshore Captives • • • Almost every country has captive legislation You can forum shop Annual meetings need not be held in the same jurisdiction that the captive is formed Some regulators are strict some are not Be very wary that the jurisdiction you choose has a regulator who understands captives

Offshore Captives • • • They are taxed as US corporations (you do not “hide the ball”) No foreign income tax Much lower capitalization requirements ($50, 000 -$100, 000) Offers more choices in types you can form then most US jurisdictions IRS has explicitly approved them

Offshore Captives • • • They are taxed as US corporations (you do not “hide the ball”) No foreign income tax Much lower capitalization requirements ($50, 000 -$100, 000) Offers more choices in types you can form then most US jurisdictions IRS has explicitly approved them

Potential Drawbacks Captives are great tools for clients who fit the profile. Nevertheless, there are certain shortfalls to be wary of: • • • This is a real insurance company. Once the captive is formed there is little opportunity to get “too cute” Captives can be complicated to form or unwind Captives are expensive to form and maintain (usually at least $150, 000 to capitalize, and $45, 000 annually to maintain)

Potential Drawbacks Captives are great tools for clients who fit the profile. Nevertheless, there are certain shortfalls to be wary of: • • • This is a real insurance company. Once the captive is formed there is little opportunity to get “too cute” Captives can be complicated to form or unwind Captives are expensive to form and maintain (usually at least $150, 000 to capitalize, and $45, 000 annually to maintain)

Who Is a Candidate for A Captive? Any profitable business

Who Is a Candidate for A Captive? Any profitable business

Captive Insurance Owner Profile • • • Family-owned, nonpublic business High profitability - more than $750, 000 of income before income taxes P&C insurance costs for existing business insurance is at least $20, 000 § § § Motivated to: Control insurance costs in hard markets Access to reinsurance markets Control terms of policies Quick claim payment Eliminate risk that coverage will be dropped

Captive Insurance Owner Profile • • • Family-owned, nonpublic business High profitability - more than $750, 000 of income before income taxes P&C insurance costs for existing business insurance is at least $20, 000 § § § Motivated to: Control insurance costs in hard markets Access to reinsurance markets Control terms of policies Quick claim payment Eliminate risk that coverage will be dropped

Captive Insurance Owner Profile Cont’d § § § Accumulate tax deductible savings account Accumulate asset base outside the operating company Accumulate pre-tax assets for gifting • • • Shift wealth to next generation Provide additional options for financing business Other reasons

Captive Insurance Owner Profile Cont’d § § § Accumulate tax deductible savings account Accumulate asset base outside the operating company Accumulate pre-tax assets for gifting • • • Shift wealth to next generation Provide additional options for financing business Other reasons

Tax Filings • Even though some jurisdictions may allow a captive to be formed as a partnership or LLC, captives are taxed as C-corps for federal tax purposes • Captives file Form 1120 -PC, U. S. Property and Casualty Insurance Company Income Tax Return • The Code Sec. 831(b) election is filed with the captive’s first tax return • Offshore captives wishing to be taxed as U. S. captives (meaning they can make an 831(b) election) must make an election under Code Sec. 953(d) to be treated as a domestic corporation and apply for an EIN • Captives do not file on a consolidated basis

Tax Filings • Even though some jurisdictions may allow a captive to be formed as a partnership or LLC, captives are taxed as C-corps for federal tax purposes • Captives file Form 1120 -PC, U. S. Property and Casualty Insurance Company Income Tax Return • The Code Sec. 831(b) election is filed with the captive’s first tax return • Offshore captives wishing to be taxed as U. S. captives (meaning they can make an 831(b) election) must make an election under Code Sec. 953(d) to be treated as a domestic corporation and apply for an EIN • Captives do not file on a consolidated basis

Important Principles for Tax Arbitrage found only in Captives • 1. Premiums are deductible expenses • 2. Significant tax arbitrage may be available from the operating company to the Captive through the payment of tax deductible P&C insurance premiums • 3. Taxpayers not only achieve deferral on taxable income, but can also reduce the ultimate tax rate from ordinary rates to the preferred dividend or capital gain rate

Important Principles for Tax Arbitrage found only in Captives • 1. Premiums are deductible expenses • 2. Significant tax arbitrage may be available from the operating company to the Captive through the payment of tax deductible P&C insurance premiums • 3. Taxpayers not only achieve deferral on taxable income, but can also reduce the ultimate tax rate from ordinary rates to the preferred dividend or capital gain rate

Managing Money in the Captive What will the Client do with all this money accumulated inside the captive? • Withdraw as dividends – this is the arbitrage opportunity The qualified dividend rate is currently 15%, meaning the taxpayer has deferred income taxes and cut the tax rate by more than half (35% 15%) • • • Sale or liquidation of the captive (creating capital gains) Hold until death (may trigger estate taxes) Loan back to the company

Managing Money in the Captive What will the Client do with all this money accumulated inside the captive? • Withdraw as dividends – this is the arbitrage opportunity The qualified dividend rate is currently 15%, meaning the taxpayer has deferred income taxes and cut the tax rate by more than half (35% 15%) • • • Sale or liquidation of the captive (creating capital gains) Hold until death (may trigger estate taxes) Loan back to the company

Managing Money in the Captive Cont’d • Offer credit enhancement A. Extend loan guarantees B. Issue letters of credit C. Cash collateral account • Others as needed

Managing Money in the Captive Cont’d • Offer credit enhancement A. Extend loan guarantees B. Issue letters of credit C. Cash collateral account • Others as needed

Examples of actual captives

Examples of actual captives

Examples • Medical practice – surgery § § § HIPAA violations Tax audit/defense Medicare/ Medicaid Billing errors Deductible buy down Procedures redone

Examples • Medical practice – surgery § § § HIPAA violations Tax audit/defense Medicare/ Medicaid Billing errors Deductible buy down Procedures redone

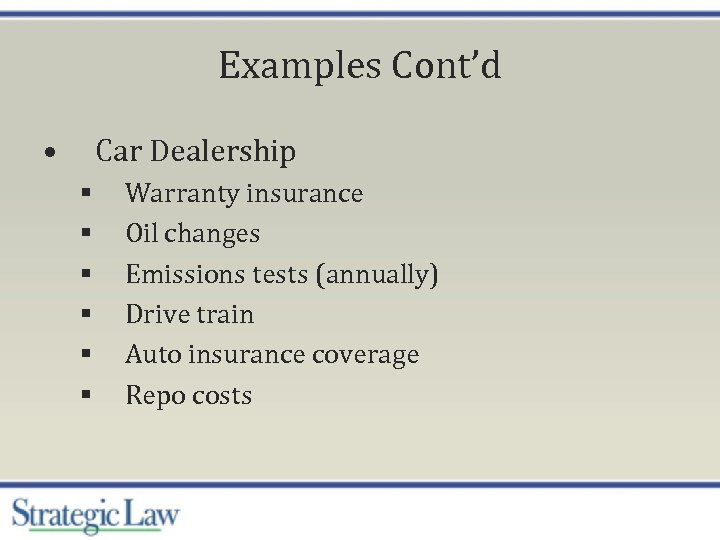

Examples Cont’d • Car Dealership § § § Warranty insurance Oil changes Emissions tests (annually) Drive train Auto insurance coverage Repo costs

Examples Cont’d • Car Dealership § § § Warranty insurance Oil changes Emissions tests (annually) Drive train Auto insurance coverage Repo costs

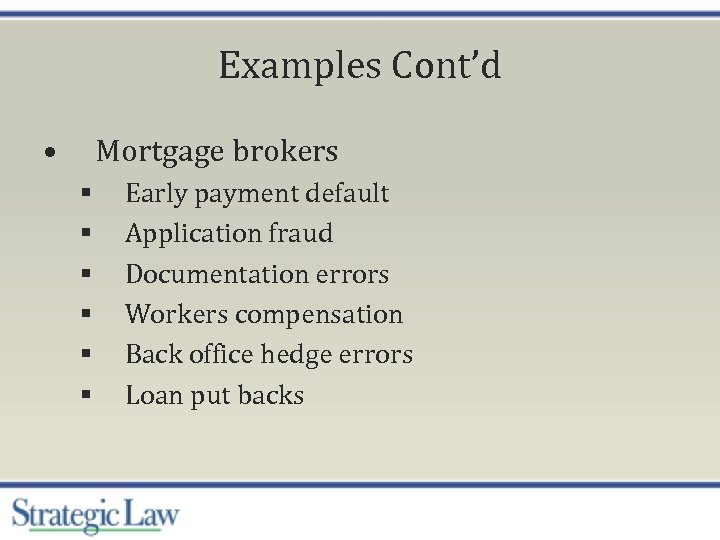

Examples Cont’d • Mortgage brokers § § § Early payment default Application fraud Documentation errors Workers compensation Back office hedge errors Loan put backs

Examples Cont’d • Mortgage brokers § § § Early payment default Application fraud Documentation errors Workers compensation Back office hedge errors Loan put backs

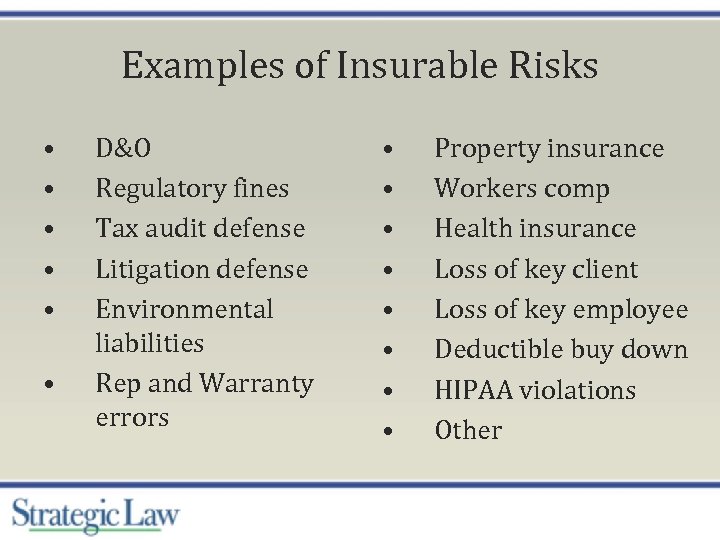

Examples of Insurable Risks • • • D&O Regulatory fines Tax audit defense Litigation defense Environmental liabilities Rep and Warranty errors • • Property insurance Workers comp Health insurance Loss of key client Loss of key employee Deductible buy down HIPAA violations Other

Examples of Insurable Risks • • • D&O Regulatory fines Tax audit defense Litigation defense Environmental liabilities Rep and Warranty errors • • Property insurance Workers comp Health insurance Loss of key client Loss of key employee Deductible buy down HIPAA violations Other

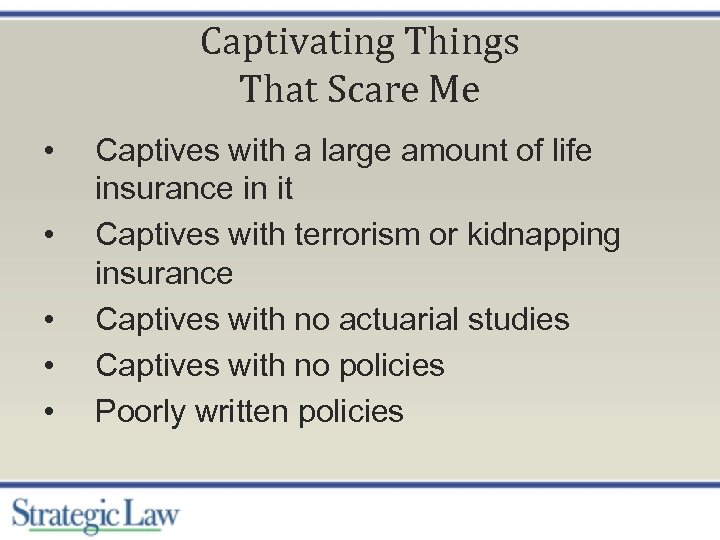

Captivating Things That Scare Me • • • Captives with a large amount of life insurance in it Captives with terrorism or kidnapping insurance Captives with no actuarial studies Captives with no policies Poorly written policies

Captivating Things That Scare Me • • • Captives with a large amount of life insurance in it Captives with terrorism or kidnapping insurance Captives with no actuarial studies Captives with no policies Poorly written policies

QUESTIONS? ? ? IRS Circular 230 Disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any U. S. federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein.

QUESTIONS? ? ? IRS Circular 230 Disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any U. S. federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein.