cd08f2a835fe750b9c56ecff1d7bcf42.ppt

- Количество слайдов: 27

Capital Structure Joseph V. Rizzi Amsterdam Institute of Finance October, 2014

Capital Structure Joseph V. Rizzi Amsterdam Institute of Finance October, 2014

Approaches To Credit Analysis • Cash Flow n Impacts default risk • Balance Sheet n Determines Loss in Event of Default (LIED) n Liquidity Valuation Amsterdam Institute of Finance October, 2014 2

Approaches To Credit Analysis • Cash Flow n Impacts default risk • Balance Sheet n Determines Loss in Event of Default (LIED) n Liquidity Valuation Amsterdam Institute of Finance October, 2014 2

Credit Analysis • • • Business Risk: EBITDA Volatility ◦ Industry Characteristics ◦ Firm Characteristics Financial Risk: EBITDA Relative to Debt Structural Risk ◦ Issues Priority of claim on assets and income Control ◦ Focus Covenants, Seniority, Security Amsterdam Institute of Finance October, 2014 3

Credit Analysis • • • Business Risk: EBITDA Volatility ◦ Industry Characteristics ◦ Firm Characteristics Financial Risk: EBITDA Relative to Debt Structural Risk ◦ Issues Priority of claim on assets and income Control ◦ Focus Covenants, Seniority, Security Amsterdam Institute of Finance October, 2014 3

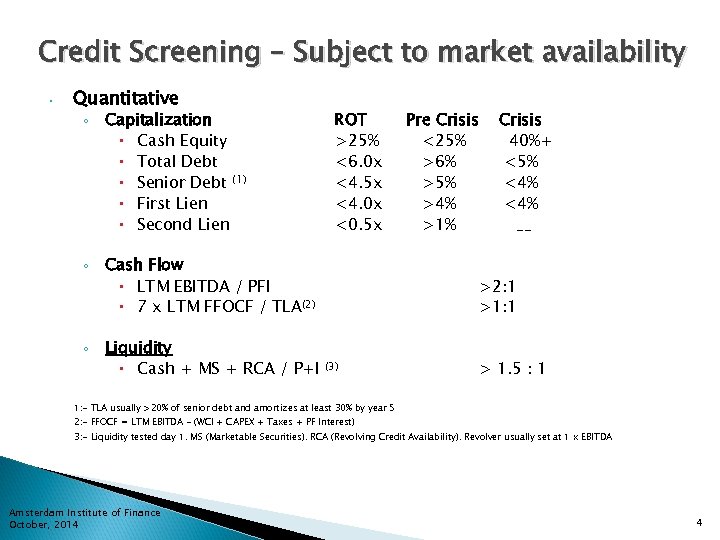

Credit Screening – Subject to market availability • Quantitative ◦ Capitalization Cash Equity Total Debt Senior Debt (1) First Lien Second Lien ◦ Cash Flow LTM EBITDA / PFI 7 x LTM FFOCF / TLA(2) ◦ Liquidity Cash + MS + RCA / P+I ROT >25% <6. 0 x <4. 5 x <4. 0 x <0. 5 x Pre Crisis <25% >6% >5% >4% >1% Crisis 40%+ <5% <4% __ >2: 1 >1: 1 (3) > 1. 5 : 1 1: - TLA usually >20% of senior debt and amortizes at least 30% by year 5 2: - FFOCF = LTM EBITDA - (WCI + CAPEX + Taxes + PF Interest) 3: - Liquidity tested day 1. MS (Marketable Securities). RCA (Revolving Credit Availability). Revolver usually set at 1 x EBITDA Amsterdam Institute of Finance October, 2014 4

Credit Screening – Subject to market availability • Quantitative ◦ Capitalization Cash Equity Total Debt Senior Debt (1) First Lien Second Lien ◦ Cash Flow LTM EBITDA / PFI 7 x LTM FFOCF / TLA(2) ◦ Liquidity Cash + MS + RCA / P+I ROT >25% <6. 0 x <4. 5 x <4. 0 x <0. 5 x Pre Crisis <25% >6% >5% >4% >1% Crisis 40%+ <5% <4% __ >2: 1 >1: 1 (3) > 1. 5 : 1 1: - TLA usually >20% of senior debt and amortizes at least 30% by year 5 2: - FFOCF = LTM EBITDA - (WCI + CAPEX + Taxes + PF Interest) 3: - Liquidity tested day 1. MS (Marketable Securities). RCA (Revolving Credit Availability). Revolver usually set at 1 x EBITDA Amsterdam Institute of Finance October, 2014 4

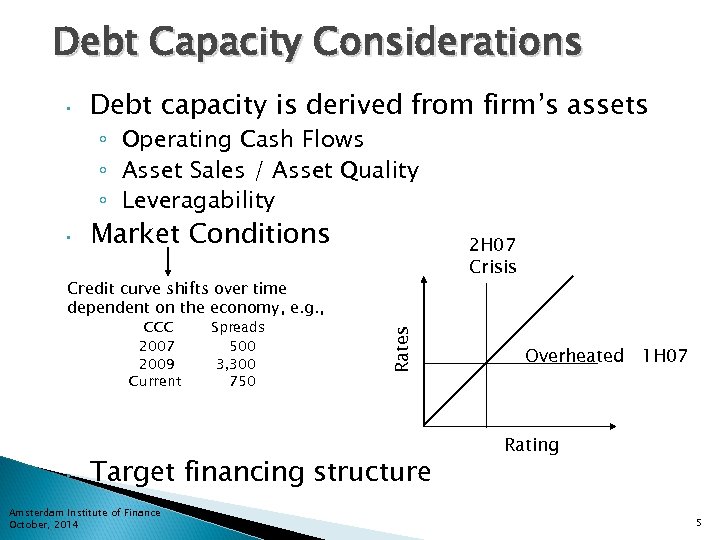

Debt Capacity Considerations • Debt capacity is derived from firm’s assets • Market Conditions ◦ Operating Cash Flows ◦ Asset Sales / Asset Quality ◦ Leveragability 2 H 07 Crisis CCC 2007 2009 Current • Spreads 500 3, 300 750 Rates Credit curve shifts over time dependent on the economy, e. g. , Target financing structure Amsterdam Institute of Finance October, 2014 Overheated 1 H 07 Rating 5

Debt Capacity Considerations • Debt capacity is derived from firm’s assets • Market Conditions ◦ Operating Cash Flows ◦ Asset Sales / Asset Quality ◦ Leveragability 2 H 07 Crisis CCC 2007 2009 Current • Spreads 500 3, 300 750 Rates Credit curve shifts over time dependent on the economy, e. g. , Target financing structure Amsterdam Institute of Finance October, 2014 Overheated 1 H 07 Rating 5

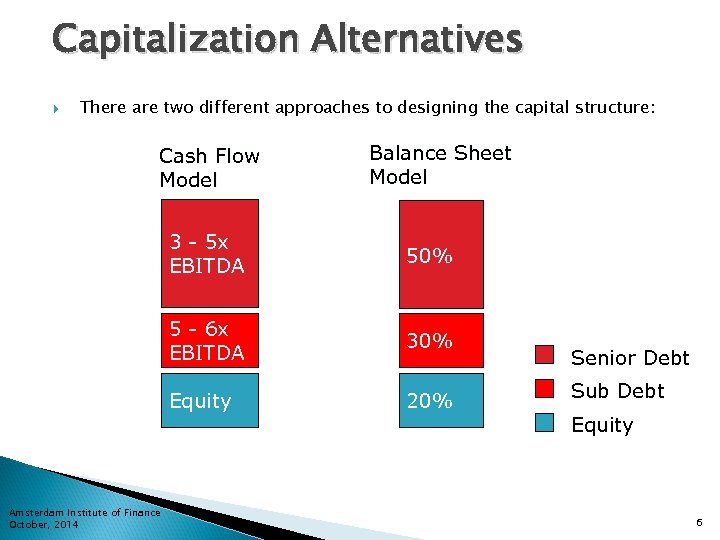

Capitalization Alternatives There are two different approaches to designing the capital structure: Cash Flow Model Balance Sheet Model 3 - 5 x EBITDA 5 - 6 x EBITDA 30% Equity Amsterdam Institute of Finance October, 2014 50% 20% Senior Debt Sub Debt Equity 6

Capitalization Alternatives There are two different approaches to designing the capital structure: Cash Flow Model Balance Sheet Model 3 - 5 x EBITDA 5 - 6 x EBITDA 30% Equity Amsterdam Institute of Finance October, 2014 50% 20% Senior Debt Sub Debt Equity 6

Approaches to Determining Debt Capacity • Ratio Approach • Cash Flow • Advance Rate Amsterdam Institute of Finance October, 2014 7

Approaches to Determining Debt Capacity • Ratio Approach • Cash Flow • Advance Rate Amsterdam Institute of Finance October, 2014 7

Ratio Approach Market ◦ Maximum senior debt and total debt ratios ◦ Vary over cycle Peers ◦ Identify ◦ Rating Classification ◦ Key Ratios Rating Agencies ◦ Credit Statistics Amsterdam Institute of Finance October, 2014 8

Ratio Approach Market ◦ Maximum senior debt and total debt ratios ◦ Vary over cycle Peers ◦ Identify ◦ Rating Classification ◦ Key Ratios Rating Agencies ◦ Credit Statistics Amsterdam Institute of Finance October, 2014 8

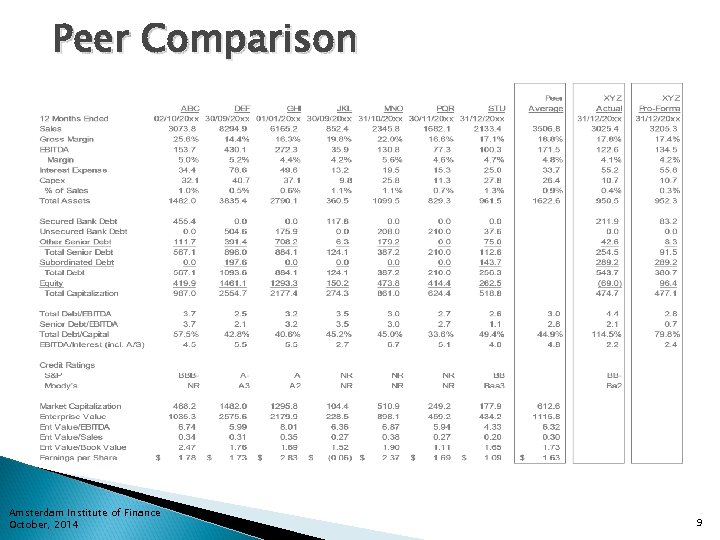

Peer Comparison Amsterdam Institute of Finance October, 2014 9

Peer Comparison Amsterdam Institute of Finance October, 2014 9

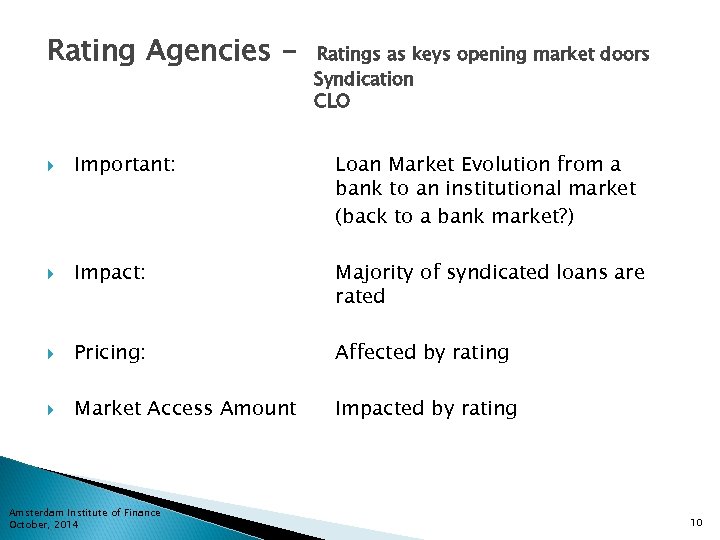

Rating Agencies - Ratings as keys opening market doors Syndication CLO Important: Loan Market Evolution from a bank to an institutional market (back to a bank market? ) Impact: Majority of syndicated loans are rated Pricing: Affected by rating Market Access Amount Impacted by rating Amsterdam Institute of Finance October, 2014 10

Rating Agencies - Ratings as keys opening market doors Syndication CLO Important: Loan Market Evolution from a bank to an institutional market (back to a bank market? ) Impact: Majority of syndicated loans are rated Pricing: Affected by rating Market Access Amount Impacted by rating Amsterdam Institute of Finance October, 2014 10

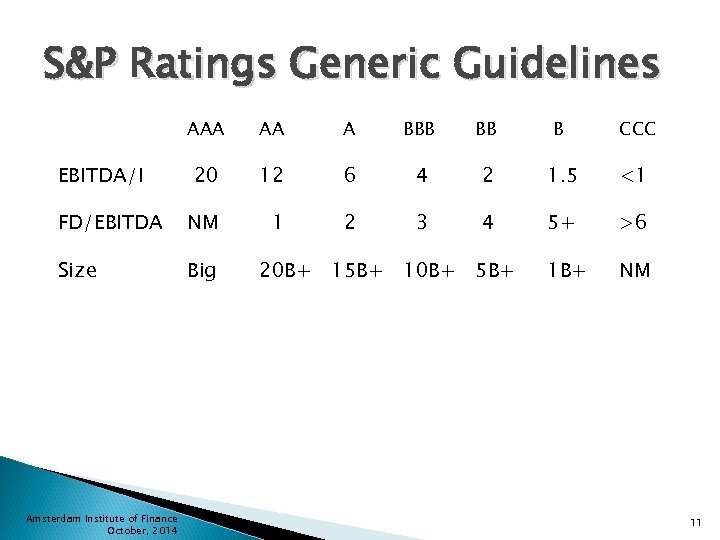

S&P Ratings Generic Guidelines AAA AA A BBB BB B CCC 20 12 6 4 2 1. 5 <1 FD/EBITDA NM 1 2 3 4 5+ >6 Size Big 1 B+ NM EBITDA/I Amsterdam Institute of Finance October, 2014 20 B+ 15 B+ 10 B+ 5 B+ 11

S&P Ratings Generic Guidelines AAA AA A BBB BB B CCC 20 12 6 4 2 1. 5 <1 FD/EBITDA NM 1 2 3 4 5+ >6 Size Big 1 B+ NM EBITDA/I Amsterdam Institute of Finance October, 2014 20 B+ 15 B+ 10 B+ 5 B+ 11

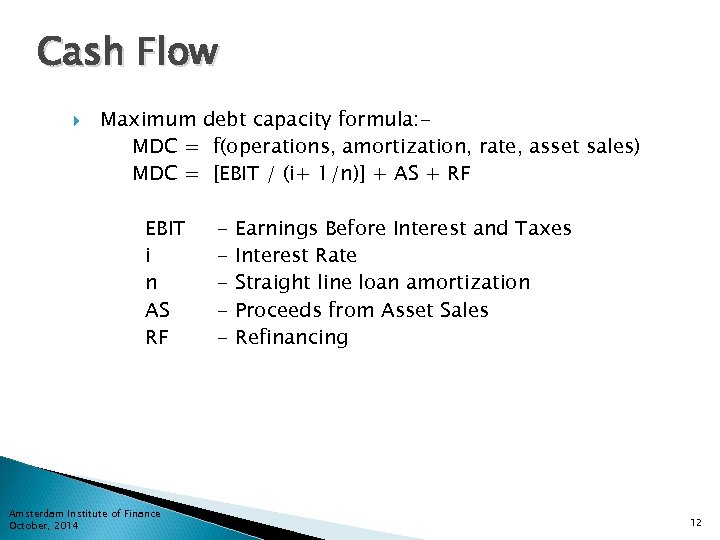

Cash Flow Maximum debt capacity formula: MDC = f(operations, amortization, rate, asset sales) MDC = [EBIT / (i+ 1/n)] + AS + RF EBIT i n AS RF Amsterdam Institute of Finance October, 2014 - Earnings Before Interest and Taxes Interest Rate Straight line loan amortization Proceeds from Asset Sales Refinancing 12

Cash Flow Maximum debt capacity formula: MDC = f(operations, amortization, rate, asset sales) MDC = [EBIT / (i+ 1/n)] + AS + RF EBIT i n AS RF Amsterdam Institute of Finance October, 2014 - Earnings Before Interest and Taxes Interest Rate Straight line loan amortization Proceeds from Asset Sales Refinancing 12

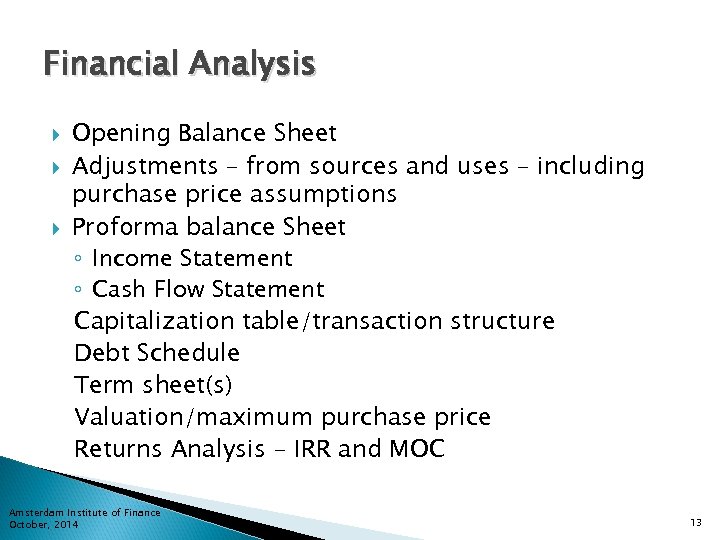

Financial Analysis Opening Balance Sheet Adjustments – from sources and uses – including purchase price assumptions Proforma balance Sheet ◦ Income Statement ◦ Cash Flow Statement Capitalization table/transaction structure Debt Schedule Term sheet(s) Valuation/maximum purchase price Returns Analysis – IRR and MOC Amsterdam Institute of Finance October, 2014 13

Financial Analysis Opening Balance Sheet Adjustments – from sources and uses – including purchase price assumptions Proforma balance Sheet ◦ Income Statement ◦ Cash Flow Statement Capitalization table/transaction structure Debt Schedule Term sheet(s) Valuation/maximum purchase price Returns Analysis – IRR and MOC Amsterdam Institute of Finance October, 2014 13

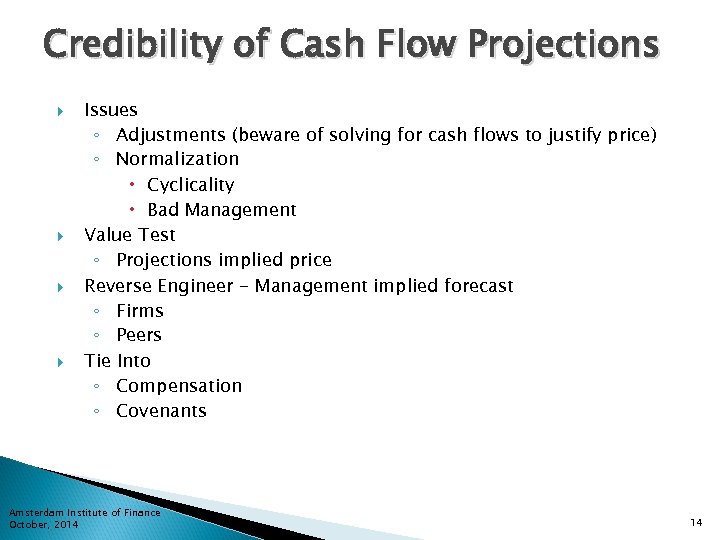

Credibility of Cash Flow Projections Issues ◦ Adjustments (beware of solving for cash flows to justify price) ◦ Normalization Cyclicality Bad Management Value Test ◦ Projections implied price Reverse Engineer - Management implied forecast ◦ Firms ◦ Peers Tie Into ◦ Compensation ◦ Covenants Amsterdam Institute of Finance October, 2014 14

Credibility of Cash Flow Projections Issues ◦ Adjustments (beware of solving for cash flows to justify price) ◦ Normalization Cyclicality Bad Management Value Test ◦ Projections implied price Reverse Engineer - Management implied forecast ◦ Firms ◦ Peers Tie Into ◦ Compensation ◦ Covenants Amsterdam Institute of Finance October, 2014 14

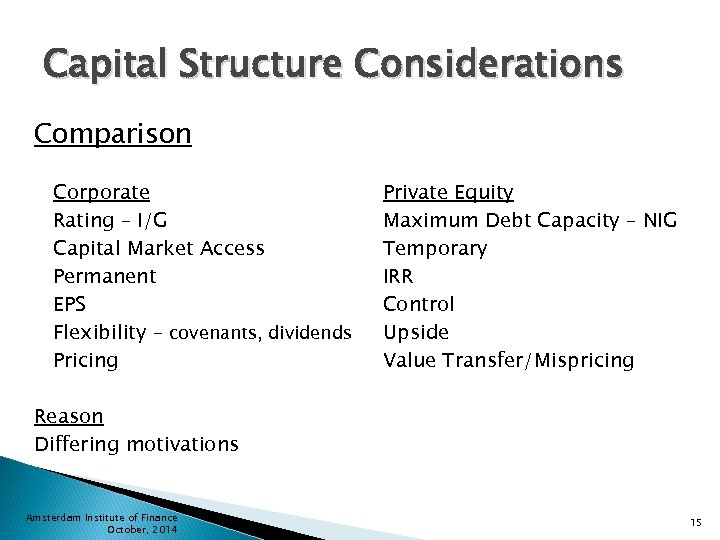

Capital Structure Considerations Comparison Corporate Rating – I/G Capital Market Access Permanent EPS Flexibility – covenants, dividends Pricing Private Equity Maximum Debt Capacity – NIG Temporary IRR Control Upside Value Transfer/Mispricing Reason Differing motivations Amsterdam Institute of Finance October, 2014 15

Capital Structure Considerations Comparison Corporate Rating – I/G Capital Market Access Permanent EPS Flexibility – covenants, dividends Pricing Private Equity Maximum Debt Capacity – NIG Temporary IRR Control Upside Value Transfer/Mispricing Reason Differing motivations Amsterdam Institute of Finance October, 2014 15

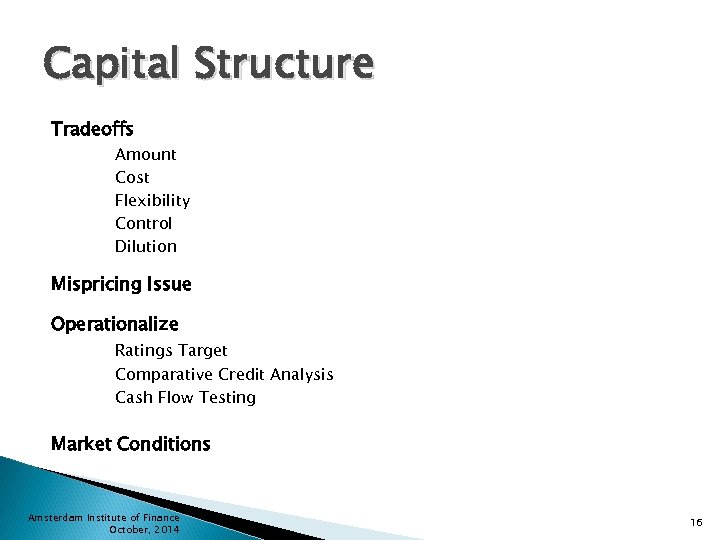

Capital Structure Tradeoffs Amount Cost Flexibility Control Dilution Mispricing Issue Operationalize Ratings Target Comparative Credit Analysis Cash Flow Testing Market Conditions Amsterdam Institute of Finance October, 2014 16

Capital Structure Tradeoffs Amount Cost Flexibility Control Dilution Mispricing Issue Operationalize Ratings Target Comparative Credit Analysis Cash Flow Testing Market Conditions Amsterdam Institute of Finance October, 2014 16

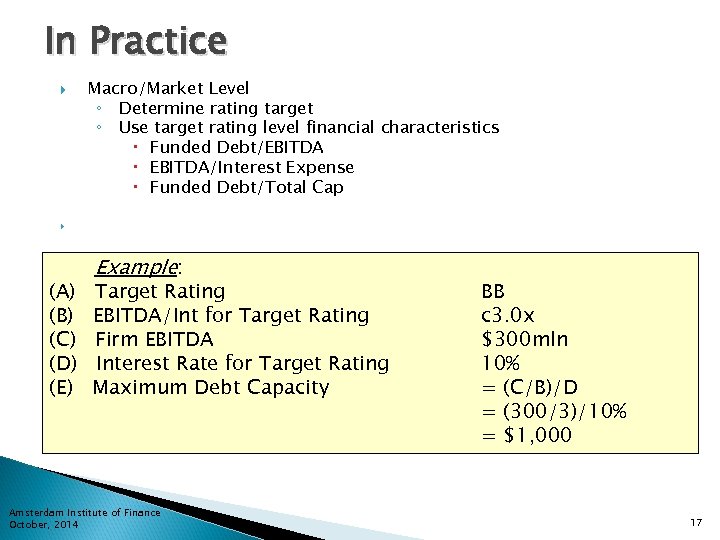

In Practice Macro/Market Level ◦ Determine rating target ◦ Use target rating level financial characteristics Funded Debt/EBITDA EBITDA/Interest Expense Funded Debt/Total Cap (A) (B) (C) (D) (E) Example: Target Rating EBITDA/Int for Target Rating Firm EBITDA Interest Rate for Target Rating Maximum Debt Capacity Amsterdam Institute of Finance October, 2014 BB c 3. 0 x $300 mln 10% = (C/B)/D = (300/3)/10% = $1, 000 17

In Practice Macro/Market Level ◦ Determine rating target ◦ Use target rating level financial characteristics Funded Debt/EBITDA EBITDA/Interest Expense Funded Debt/Total Cap (A) (B) (C) (D) (E) Example: Target Rating EBITDA/Int for Target Rating Firm EBITDA Interest Rate for Target Rating Maximum Debt Capacity Amsterdam Institute of Finance October, 2014 BB c 3. 0 x $300 mln 10% = (C/B)/D = (300/3)/10% = $1, 000 17

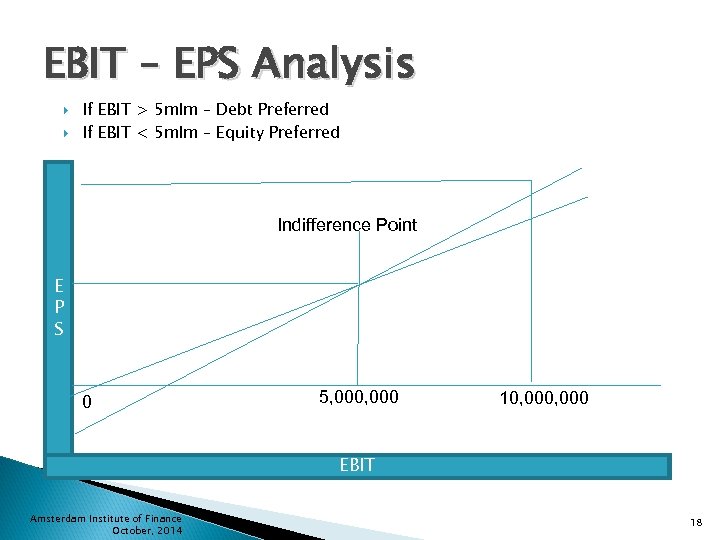

EBIT – EPS Analysis If EBIT > 5 mlm – Debt Preferred If EBIT < 5 mlm – Equity Preferred Indifference Point E P S 0 5, 000 10, 000 EBIT Amsterdam Institute of Finance October, 2014 18

EBIT – EPS Analysis If EBIT > 5 mlm – Debt Preferred If EBIT < 5 mlm – Equity Preferred Indifference Point E P S 0 5, 000 10, 000 EBIT Amsterdam Institute of Finance October, 2014 18

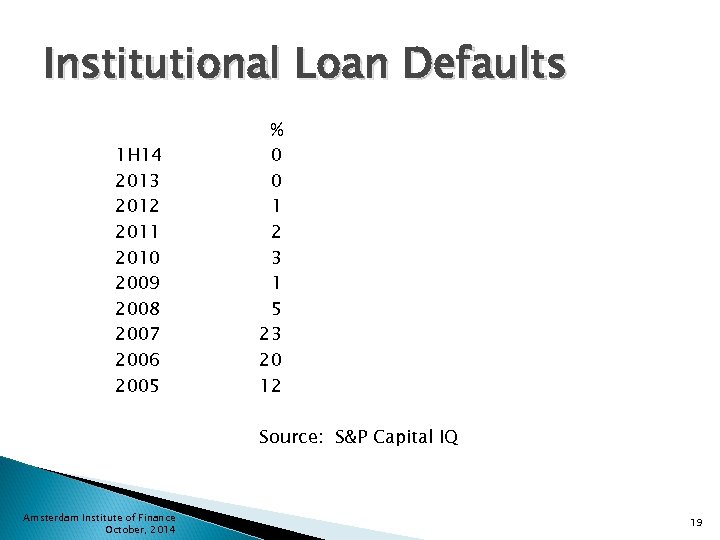

Institutional Loan Defaults 1 H 14 2013 2012 2011 2010 2009 2008 2007 2006 2005 % 0 0 1 2 3 1 5 23 20 12 Source: S&P Capital IQ Amsterdam Institute of Finance October, 2014 19

Institutional Loan Defaults 1 H 14 2013 2012 2011 2010 2009 2008 2007 2006 2005 % 0 0 1 2 3 1 5 23 20 12 Source: S&P Capital IQ Amsterdam Institute of Finance October, 2014 19

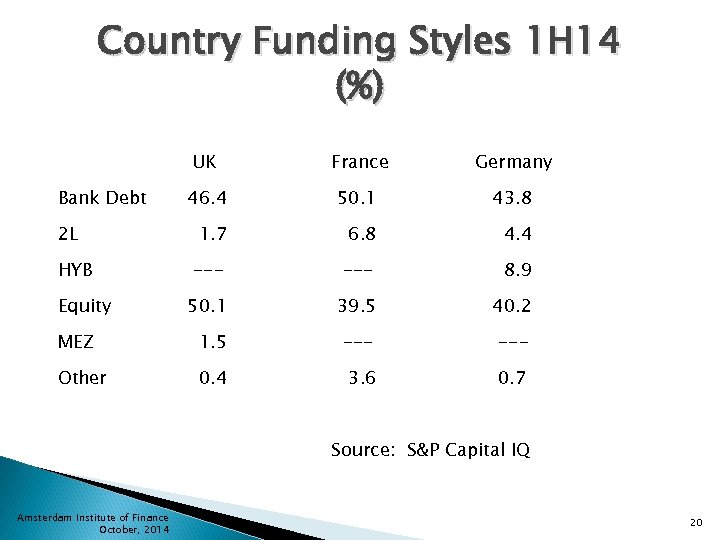

Country Funding Styles 1 H 14 (%) UK France Germany 46. 4 50. 1 43. 8 1. 7 6. 8 4. 4 --- 8. 9 50. 1 39. 5 40. 2 MEZ 1. 5 --- Other 0. 4 3. 6 0. 7 Bank Debt 2 L HYB Equity Source: S&P Capital IQ Amsterdam Institute of Finance October, 2014 20

Country Funding Styles 1 H 14 (%) UK France Germany 46. 4 50. 1 43. 8 1. 7 6. 8 4. 4 --- 8. 9 50. 1 39. 5 40. 2 MEZ 1. 5 --- Other 0. 4 3. 6 0. 7 Bank Debt 2 L HYB Equity Source: S&P Capital IQ Amsterdam Institute of Finance October, 2014 20

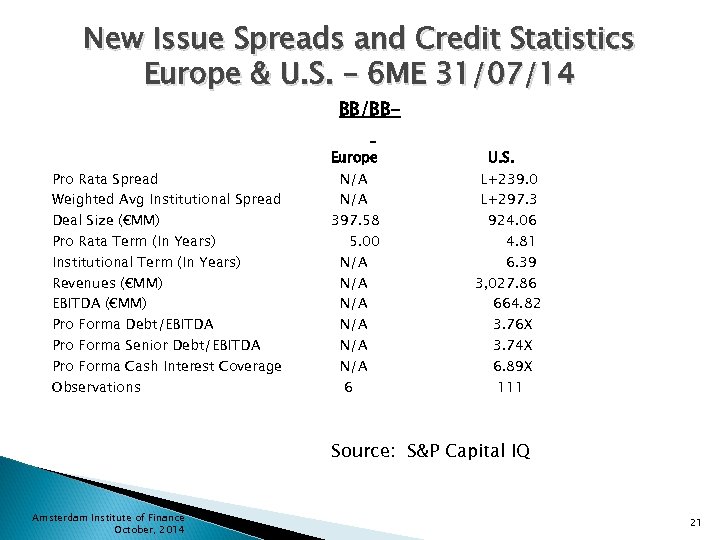

New Issue Spreads and Credit Statistics Europe & U. S. – 6 ME 31/07/14 BB/BB- Pro Rata Spread Weighted Avg Institutional Spread Deal Size (€MM) Pro Rata Term (In Years) Institutional Term (In Years) Revenues (€MM) EBITDA (€MM) Pro Forma Debt/EBITDA Pro Forma Senior Debt/EBITDA Pro Forma Cash Interest Coverage Observations Europe N/A 397. 58 5. 00 N/A N/A N/A 6 U. S. L+239. 0 L+297. 3 924. 06 4. 81 6. 39 3, 027. 86 664. 82 3. 76 X 3. 74 X 6. 89 X 111 Source: S&P Capital IQ Amsterdam Institute of Finance October, 2014 21

New Issue Spreads and Credit Statistics Europe & U. S. – 6 ME 31/07/14 BB/BB- Pro Rata Spread Weighted Avg Institutional Spread Deal Size (€MM) Pro Rata Term (In Years) Institutional Term (In Years) Revenues (€MM) EBITDA (€MM) Pro Forma Debt/EBITDA Pro Forma Senior Debt/EBITDA Pro Forma Cash Interest Coverage Observations Europe N/A 397. 58 5. 00 N/A N/A N/A 6 U. S. L+239. 0 L+297. 3 924. 06 4. 81 6. 39 3, 027. 86 664. 82 3. 76 X 3. 74 X 6. 89 X 111 Source: S&P Capital IQ Amsterdam Institute of Finance October, 2014 21

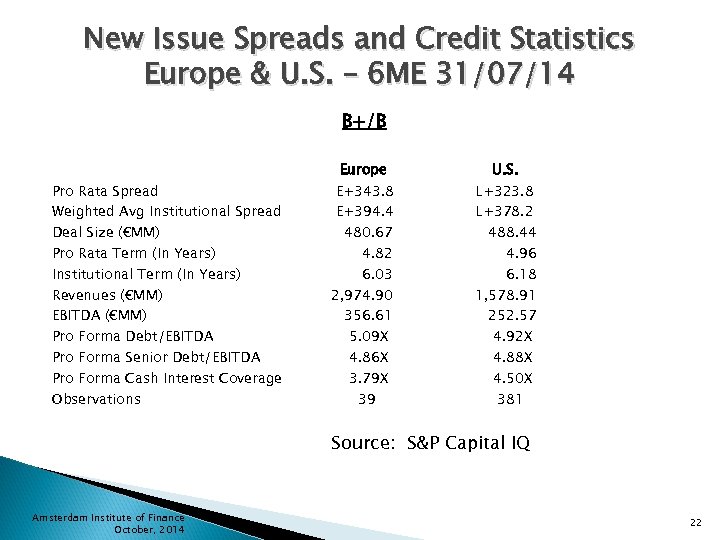

New Issue Spreads and Credit Statistics Europe & U. S. – 6 ME 31/07/14 B+/B Pro Rata Spread Weighted Avg Institutional Spread Deal Size (€MM) Pro Rata Term (In Years) Institutional Term (In Years) Revenues (€MM) EBITDA (€MM) Pro Forma Debt/EBITDA Pro Forma Senior Debt/EBITDA Pro Forma Cash Interest Coverage Observations Europe E+343. 8 E+394. 4 480. 67 4. 82 6. 03 2, 974. 90 356. 61 5. 09 X 4. 86 X 3. 79 X 39 U. S. L+323. 8 L+378. 2 488. 44 4. 96 6. 18 1, 578. 91 252. 57 4. 92 X 4. 88 X 4. 50 X 381 Source: S&P Capital IQ Amsterdam Institute of Finance October, 2014 22

New Issue Spreads and Credit Statistics Europe & U. S. – 6 ME 31/07/14 B+/B Pro Rata Spread Weighted Avg Institutional Spread Deal Size (€MM) Pro Rata Term (In Years) Institutional Term (In Years) Revenues (€MM) EBITDA (€MM) Pro Forma Debt/EBITDA Pro Forma Senior Debt/EBITDA Pro Forma Cash Interest Coverage Observations Europe E+343. 8 E+394. 4 480. 67 4. 82 6. 03 2, 974. 90 356. 61 5. 09 X 4. 86 X 3. 79 X 39 U. S. L+323. 8 L+378. 2 488. 44 4. 96 6. 18 1, 578. 91 252. 57 4. 92 X 4. 88 X 4. 50 X 381 Source: S&P Capital IQ Amsterdam Institute of Finance October, 2014 22

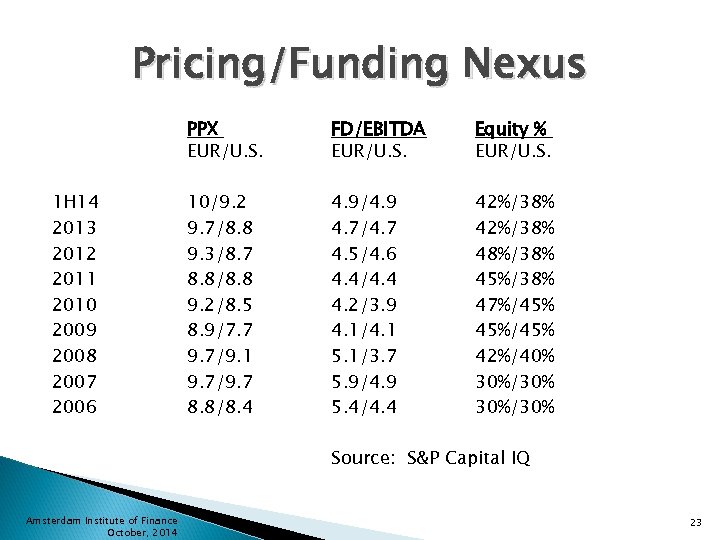

Pricing/Funding Nexus PPX EUR/U. S. 1 H 14 2013 2012 2011 2010 2009 2008 2007 2006 FD/EBITDA EUR/U. S. Equity % EUR/U. S. 10/9. 2 9. 7/8. 8 9. 3/8. 7 8. 8/8. 8 9. 2/8. 5 8. 9/7. 7 9. 7/9. 1 9. 7/9. 7 8. 8/8. 4 4. 9/4. 9 4. 7/4. 7 4. 5/4. 6 4. 4/4. 4 4. 2/3. 9 4. 1/4. 1 5. 1/3. 7 5. 9/4. 9 5. 4/4. 4 42%/38% 48%/38% 45%/38% 47%/45% 45%/45% 42%/40% 30%/30% Source: S&P Capital IQ Amsterdam Institute of Finance October, 2014 23

Pricing/Funding Nexus PPX EUR/U. S. 1 H 14 2013 2012 2011 2010 2009 2008 2007 2006 FD/EBITDA EUR/U. S. Equity % EUR/U. S. 10/9. 2 9. 7/8. 8 9. 3/8. 7 8. 8/8. 8 9. 2/8. 5 8. 9/7. 7 9. 7/9. 1 9. 7/9. 7 8. 8/8. 4 4. 9/4. 9 4. 7/4. 7 4. 5/4. 6 4. 4/4. 4 4. 2/3. 9 4. 1/4. 1 5. 1/3. 7 5. 9/4. 9 5. 4/4. 4 42%/38% 48%/38% 45%/38% 47%/45% 45%/45% 42%/40% 30%/30% Source: S&P Capital IQ Amsterdam Institute of Finance October, 2014 23

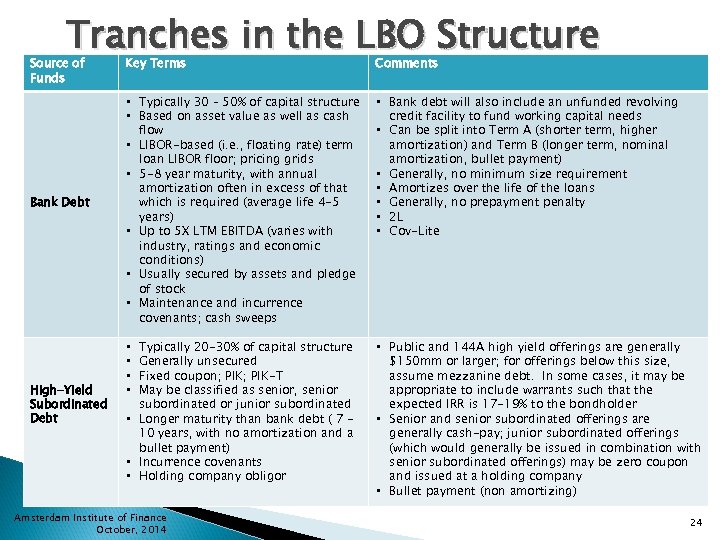

Tranches in the LBO Structure Source of Funds Bank Debt High-Yield Subordinated Debt Key Terms Comments • Typically 30 – 50% of capital structure • Based on asset value as well as cash flow • LIBOR-based (i. e. , floating rate) term loan LIBOR floor; pricing grids • 5 -8 year maturity, with annual amortization often in excess of that which is required (average life 4 -5 years) • Up to 5 X LTM EBITDA (varies with industry, ratings and economic conditions) • Usually secured by assets and pledge of stock • Maintenance and incurrence covenants; cash sweeps • Bank debt will also include an unfunded revolving credit facility to fund working capital needs • Can be split into Term A (shorter term, higher amortization) and Term B (longer term, nominal amortization, bullet payment) • Generally, no minimum size requirement • Amortizes over the life of the loans • Generally, no prepayment penalty • 2 L • Cov-Lite Typically 20 -30% of capital structure Generally unsecured Fixed coupon; PIK-T May be classified as senior, senior subordinated or junior subordinated • Longer maturity than bank debt ( 7 10 years, with no amortization and a bullet payment) • Incurrence covenants • Holding company obligor • Public and 144 A high yield offerings are generally $150 mm or larger; for offerings below this size, assume mezzanine debt. In some cases, it may be appropriate to include warrants such that the expected IRR is 17 -19% to the bondholder • Senior and senior subordinated offerings are generally cash-pay; junior subordinated offerings (which would generally be issued in combination with senior subordinated offerings) may be zero coupon and issued at a holding company • Bullet payment (non amortizing) • • Amsterdam Institute of Finance October, 2014 24

Tranches in the LBO Structure Source of Funds Bank Debt High-Yield Subordinated Debt Key Terms Comments • Typically 30 – 50% of capital structure • Based on asset value as well as cash flow • LIBOR-based (i. e. , floating rate) term loan LIBOR floor; pricing grids • 5 -8 year maturity, with annual amortization often in excess of that which is required (average life 4 -5 years) • Up to 5 X LTM EBITDA (varies with industry, ratings and economic conditions) • Usually secured by assets and pledge of stock • Maintenance and incurrence covenants; cash sweeps • Bank debt will also include an unfunded revolving credit facility to fund working capital needs • Can be split into Term A (shorter term, higher amortization) and Term B (longer term, nominal amortization, bullet payment) • Generally, no minimum size requirement • Amortizes over the life of the loans • Generally, no prepayment penalty • 2 L • Cov-Lite Typically 20 -30% of capital structure Generally unsecured Fixed coupon; PIK-T May be classified as senior, senior subordinated or junior subordinated • Longer maturity than bank debt ( 7 10 years, with no amortization and a bullet payment) • Incurrence covenants • Holding company obligor • Public and 144 A high yield offerings are generally $150 mm or larger; for offerings below this size, assume mezzanine debt. In some cases, it may be appropriate to include warrants such that the expected IRR is 17 -19% to the bondholder • Senior and senior subordinated offerings are generally cash-pay; junior subordinated offerings (which would generally be issued in combination with senior subordinated offerings) may be zero coupon and issued at a holding company • Bullet payment (non amortizing) • • Amsterdam Institute of Finance October, 2014 24

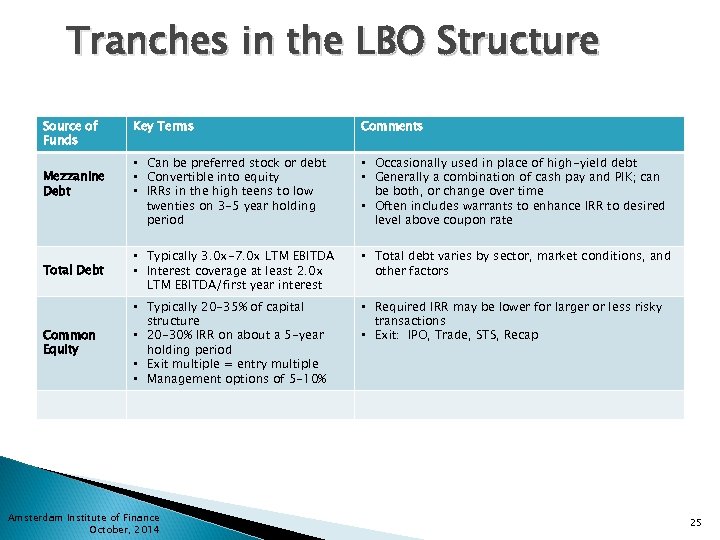

Tranches in the LBO Structure Source of Funds Key Terms Comments • Can be preferred stock or debt • Convertible into equity • IRRs in the high teens to low twenties on 3 -5 year holding period • Occasionally used in place of high-yield debt • Generally a combination of cash pay and PIK; can be both, or change over time • Often includes warrants to enhance IRR to desired level above coupon rate Total Debt • Typically 3. 0 x-7. 0 x LTM EBITDA • Interest coverage at least 2. 0 x LTM EBITDA/first year interest • Total debt varies by sector, market conditions, and other factors Common Equity • Typically 20 -35% of capital structure • 20 -30% IRR on about a 5 -year holding period • Exit multiple = entry multiple • Management options of 5 -10% • Required IRR may be lower for larger or less risky transactions • Exit: IPO, Trade, STS, Recap Mezzanine Debt Amsterdam Institute of Finance October, 2014 25

Tranches in the LBO Structure Source of Funds Key Terms Comments • Can be preferred stock or debt • Convertible into equity • IRRs in the high teens to low twenties on 3 -5 year holding period • Occasionally used in place of high-yield debt • Generally a combination of cash pay and PIK; can be both, or change over time • Often includes warrants to enhance IRR to desired level above coupon rate Total Debt • Typically 3. 0 x-7. 0 x LTM EBITDA • Interest coverage at least 2. 0 x LTM EBITDA/first year interest • Total debt varies by sector, market conditions, and other factors Common Equity • Typically 20 -35% of capital structure • 20 -30% IRR on about a 5 -year holding period • Exit multiple = entry multiple • Management options of 5 -10% • Required IRR may be lower for larger or less risky transactions • Exit: IPO, Trade, STS, Recap Mezzanine Debt Amsterdam Institute of Finance October, 2014 25

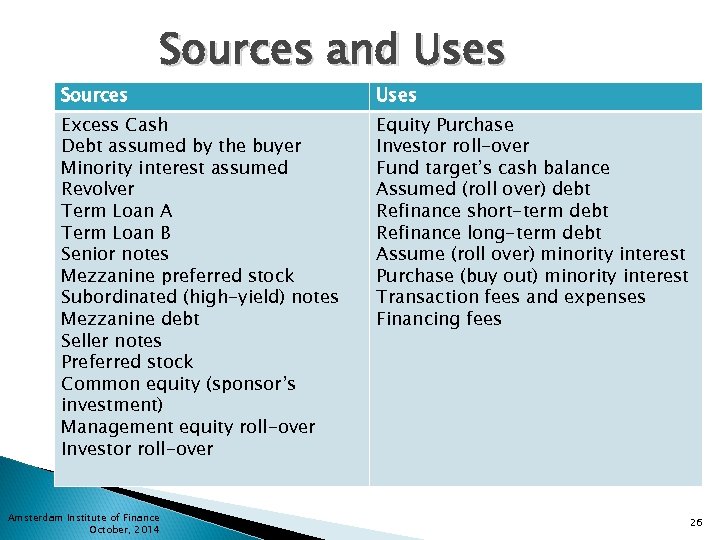

Sources and Uses Excess Cash Debt assumed by the buyer Minority interest assumed Revolver Term Loan A Term Loan B Senior notes Mezzanine preferred stock Subordinated (high-yield) notes Mezzanine debt Seller notes Preferred stock Common equity (sponsor’s investment) Management equity roll-over Investor roll-over Amsterdam Institute of Finance October, 2014 Uses Equity Purchase Investor roll-over Fund target’s cash balance Assumed (roll over) debt Refinance short-term debt Refinance long-term debt Assume (roll over) minority interest Purchase (buy out) minority interest Transaction fees and expenses Financing fees 26

Sources and Uses Excess Cash Debt assumed by the buyer Minority interest assumed Revolver Term Loan A Term Loan B Senior notes Mezzanine preferred stock Subordinated (high-yield) notes Mezzanine debt Seller notes Preferred stock Common equity (sponsor’s investment) Management equity roll-over Investor roll-over Amsterdam Institute of Finance October, 2014 Uses Equity Purchase Investor roll-over Fund target’s cash balance Assumed (roll over) debt Refinance short-term debt Refinance long-term debt Assume (roll over) minority interest Purchase (buy out) minority interest Transaction fees and expenses Financing fees 26

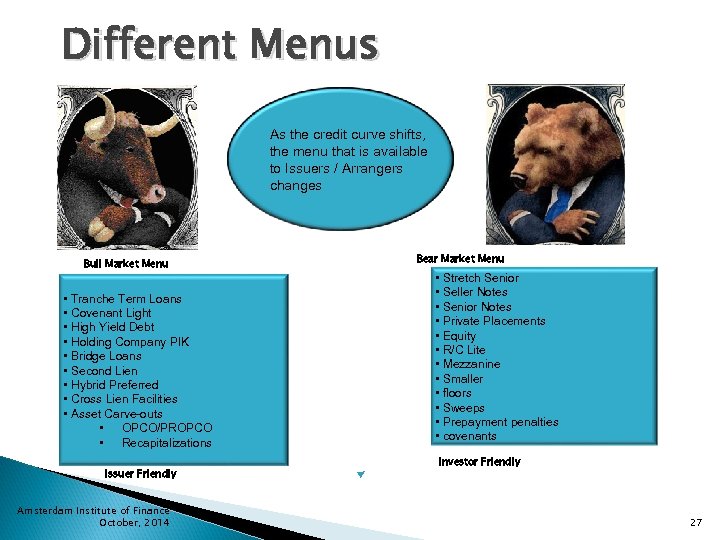

Different Menus As the credit curve shifts, the menu that is available to Issuers / Arrangers changes Bull Market Menu • Tranche Term Loans • Covenant Light • High Yield Debt • Holding Company PIK • Bridge Loans • Second Lien • Hybrid Preferred • Cross Lien Facilities • Asset Carve-outs • OPCO/PROPCO • Recapitalizations Issuer Friendly Amsterdam Institute of Finance October, 2014 Bear Market Menu • Stretch Senior • Seller Notes • Senior Notes • Private Placements • Equity • R/C Lite • Mezzanine • Smaller • floors • Sweeps • Prepayment penalties • covenants Investor Friendly 27

Different Menus As the credit curve shifts, the menu that is available to Issuers / Arrangers changes Bull Market Menu • Tranche Term Loans • Covenant Light • High Yield Debt • Holding Company PIK • Bridge Loans • Second Lien • Hybrid Preferred • Cross Lien Facilities • Asset Carve-outs • OPCO/PROPCO • Recapitalizations Issuer Friendly Amsterdam Institute of Finance October, 2014 Bear Market Menu • Stretch Senior • Seller Notes • Senior Notes • Private Placements • Equity • R/C Lite • Mezzanine • Smaller • floors • Sweeps • Prepayment penalties • covenants Investor Friendly 27