9ee5e3c8f68df2a4a4f754bdc3a21da3.ppt

- Количество слайдов: 32

Capital Structure I: Basic Concepts

The Capital-Structure Question and The Pie Theory l l The value of a firm is defined to be the sum of the value of the firm’s debt and the firm’s equity. V=B+S If the goal of the management of the firm is to make the firm as valuable as possible, the firm should pick the debt-equity ratio that makes the pie as big as possible. S B Value of the Firm

The Capital-Structure Question There are really two important questions: 1. Why should the stockholders care about maximizing firm value? Perhaps they should be interested in strategies that maximize shareholder value. 2. What is the ratio of debt-to-equity that maximizes the shareholder’s value? As it turns out, changes in capital structure benefit the stockholders if and only if the value of the firm increases.

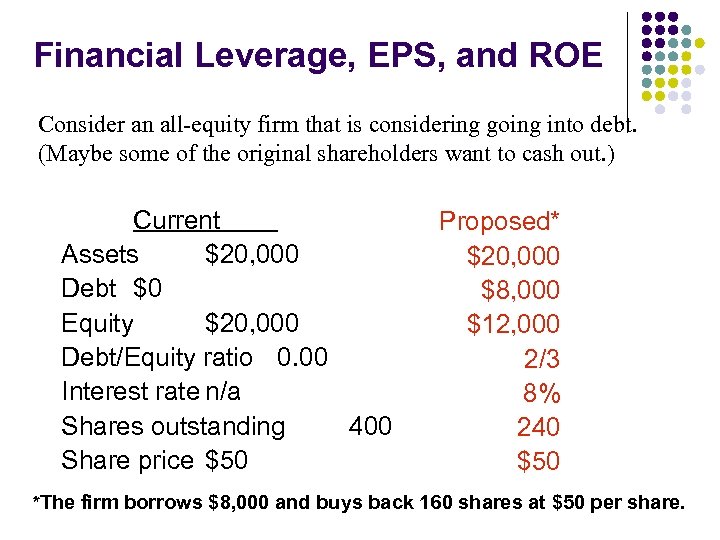

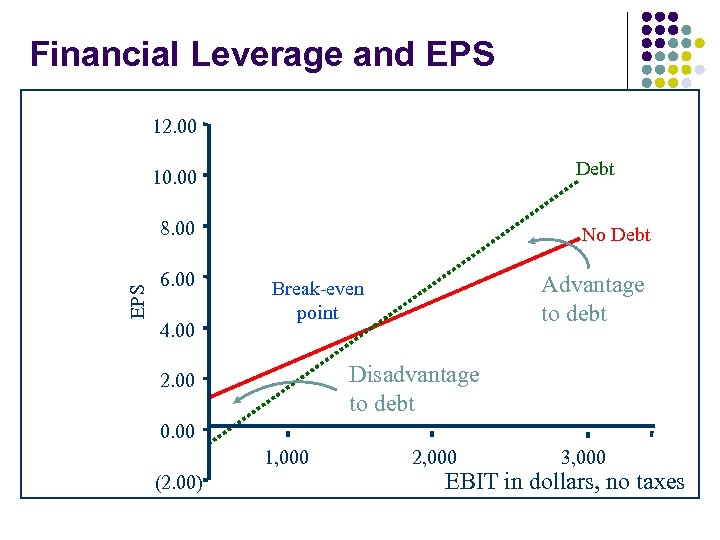

Financial Leverage, EPS, and ROE Consider an all-equity firm that is considering going into debt. (Maybe some of the original shareholders want to cash out. ) Current Assets $20, 000 Debt $0 Equity $20, 000 Debt/Equity ratio 0. 00 Interest rate n/a Shares outstanding 400 Share price $50 Proposed* $20, 000 $8, 000 $12, 000 2/3 8% 240 $50 *The firm borrows $8, 000 and buys back 160 shares at $50 per share.

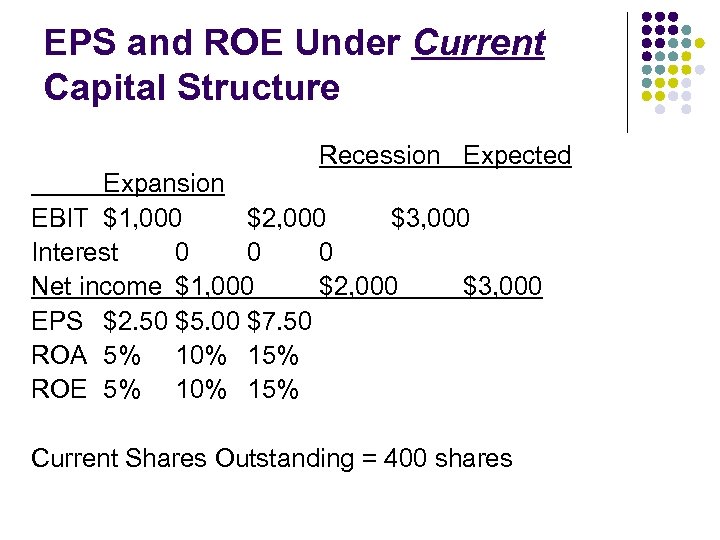

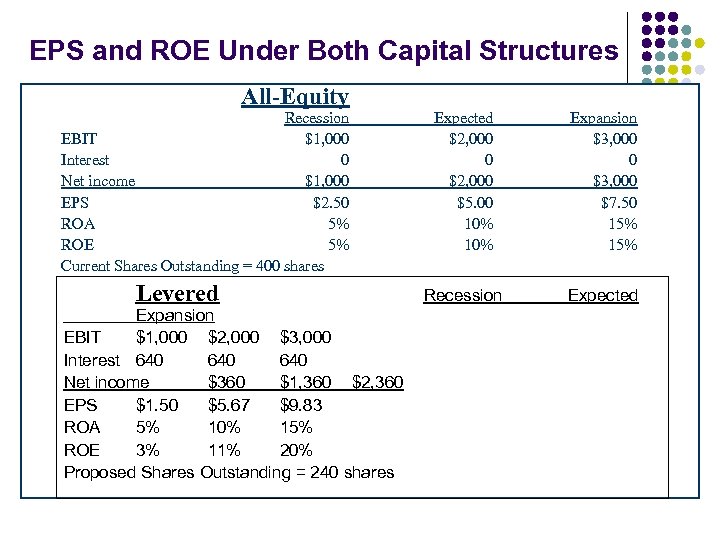

EPS and ROE Under Current Capital Structure Recession Expected Expansion EBIT $1, 000 $2, 000 $3, 000 Interest 0 0 0 Net income $1, 000 $2, 000 $3, 000 EPS $2. 50 $5. 00 $7. 50 ROA 5% 10% 15% ROE 5% 10% 15% Current Shares Outstanding = 400 shares

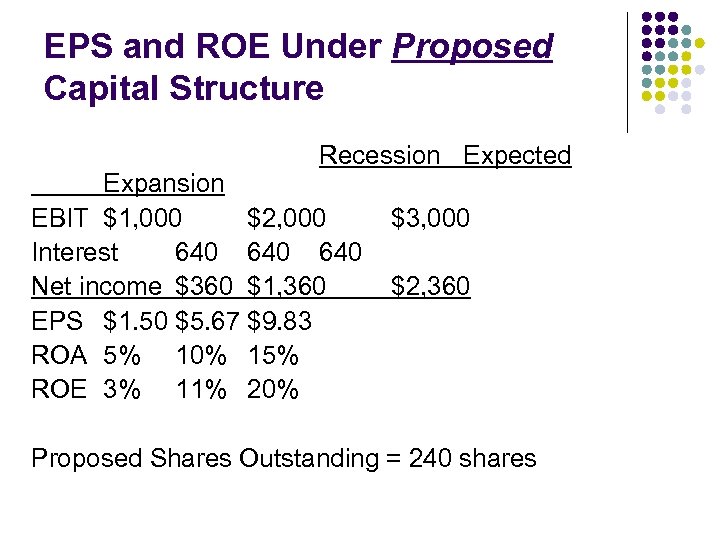

EPS and ROE Under Proposed Capital Structure Recession Expected Expansion EBIT $1, 000 $2, 000 Interest 640 640 Net income $360 $1, 360 EPS $1. 50 $5. 67 $9. 83 ROA 5% 10% 15% ROE 3% 11% 20% $3, 000 $2, 360 Proposed Shares Outstanding = 240 shares

EPS and ROE Under Both Capital Structures All-Equity Recession EBIT $1, 000 Interest 0 Net income $1, 000 EPS $2. 50 ROA 5% ROE 5% Current Shares Outstanding = 400 shares Levered Expansion EBIT $1, 000 $2, 000 $3, 000 Interest 640 640 Net income $360 $1, 360 $2, 360 EPS $1. 50 $5. 67 $9. 83 ROA 5% 10% 15% ROE 3% 11% 20% Proposed Shares Outstanding = 240 shares Expected $2, 000 0 $2, 000 $5. 00 10% Expansion $3, 000 0 $3, 000 $7. 50 15% Recession Expected

Financial Leverage and EPS 12. 00 Debt 10. 00 EPS 8. 00 6. 00 4. 00 No Debt Advantage to debt Break-even point Disadvantage to debt 2. 00 0. 00 1, 000 (2. 00) 2, 000 3, 000 EBIT in dollars, no taxes

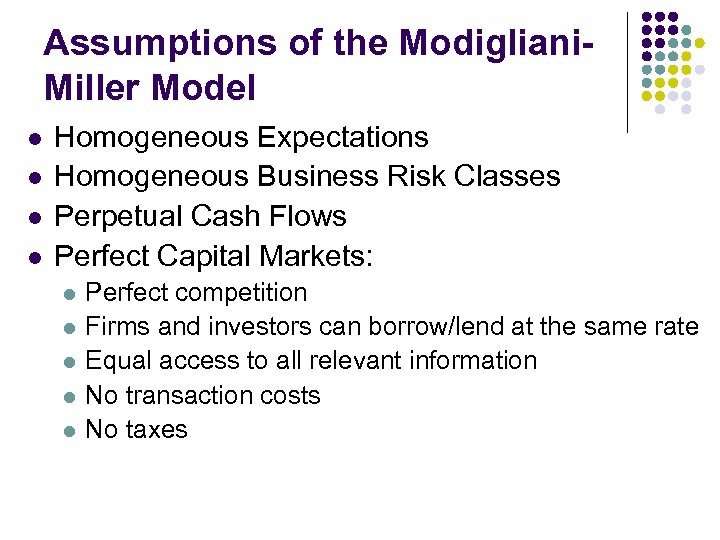

Assumptions of the Modigliani. Miller Model l l Homogeneous Expectations Homogeneous Business Risk Classes Perpetual Cash Flows Perfect Capital Markets: l l l Perfect competition Firms and investors can borrow/lend at the same rate Equal access to all relevant information No transaction costs No taxes

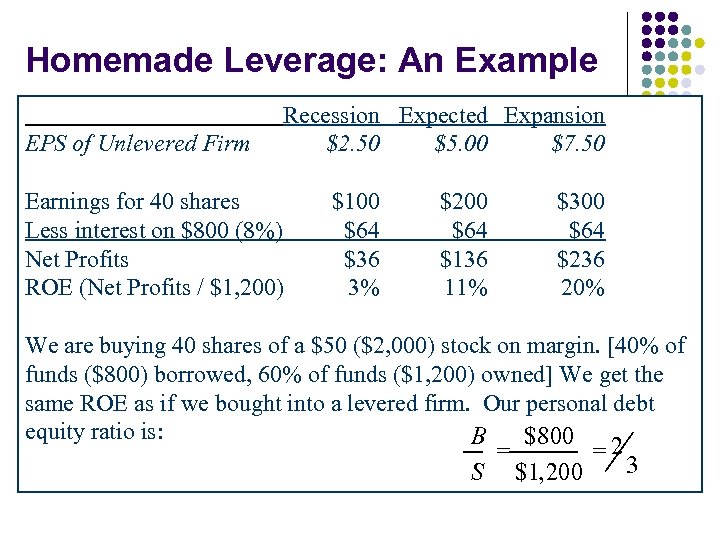

Homemade Leverage: An Example EPS of Unlevered Firm Recession Expected Expansion $2. 50 $5. 00 $7. 50 Earnings for 40 shares Less interest on $800 (8%) Net Profits ROE (Net Profits / $1, 200) $100 $64 $36 3% $200 $64 $136 11% $300 $64 $236 20% We are buying 40 shares of a $50 ($2, 000) stock on margin. [40% of funds ($800) borrowed, 60% of funds ($1, 200) owned] We get the same ROE as if we bought into a levered firm. Our personal debt equity ratio is: B $800 2 = = 3 S $1, 200

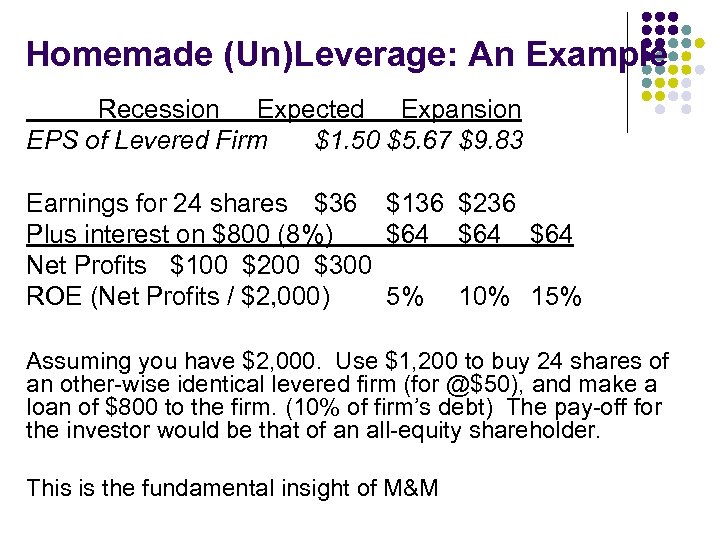

Homemade (Un)Leverage: An Example Recession Expected Expansion EPS of Levered Firm $1. 50 $5. 67 $9. 83 Earnings for 24 shares $36 $136 $236 Plus interest on $800 (8%) $64 $64 Net Profits $100 $200 $300 ROE (Net Profits / $2, 000) 5% 10% 15% Assuming you have $2, 000. Use $1, 200 to buy 24 shares of an other-wise identical levered firm (for @$50), and make a loan of $800 to the firm. (10% of firm’s debt) The pay-off for the investor would be that of an all-equity shareholder. This is the fundamental insight of M&M

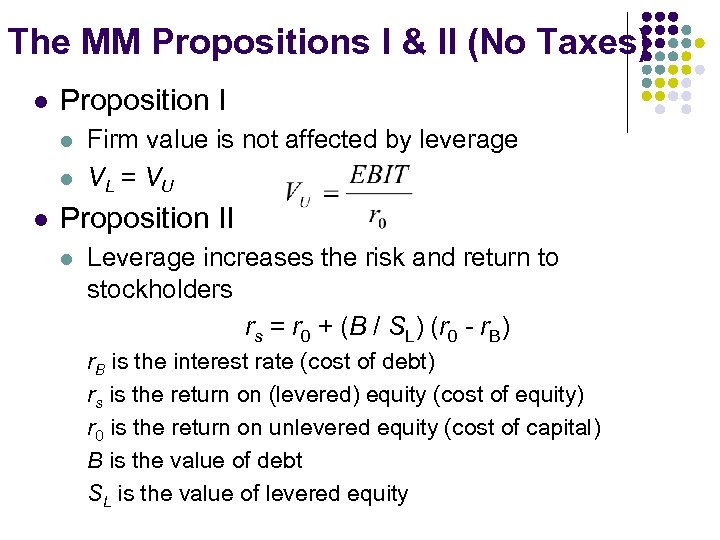

The MM Propositions I & II (No Taxes) l Proposition I l l l Firm value is not affected by leverage VL = VU Proposition II l Leverage increases the risk and return to stockholders rs = r 0 + (B / SL) (r 0 - r. B) r. B is the interest rate (cost of debt) rs is the return on (levered) equity (cost of equity) r 0 is the return on unlevered equity (cost of capital) B is the value of debt SL is the value of levered equity

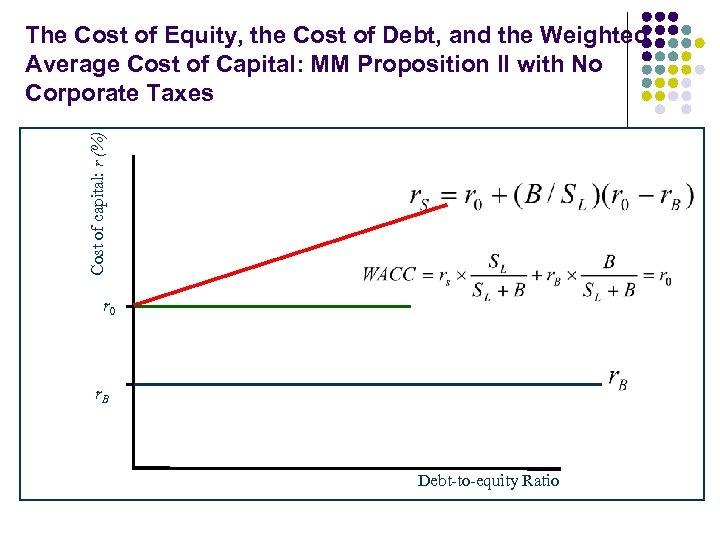

Cost of capital: r (%) The Cost of Equity, the Cost of Debt, and the Weighted Average Cost of Capital: MM Proposition II with No Corporate Taxes r 0 r. B Debt-to-equity Ratio

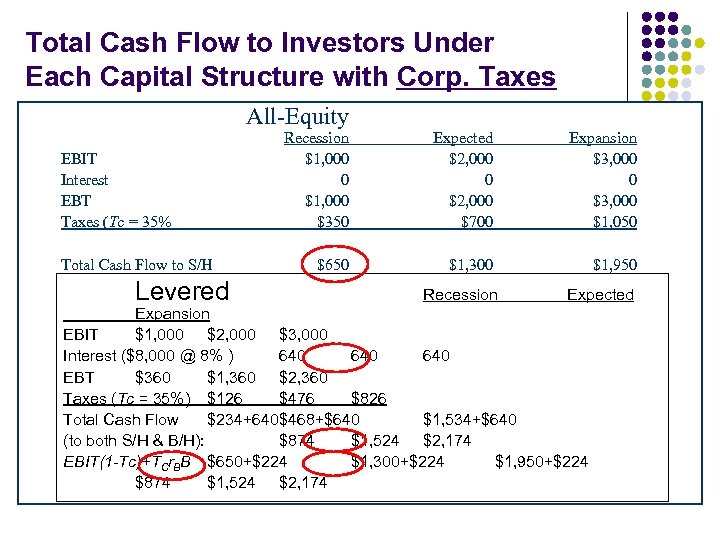

Total Cash Flow to Investors Under Each Capital Structure with Corp. Taxes All-Equity EBIT Interest EBT Taxes (Tc = 35% Total Cash Flow to S/H Levered Recession $1, 000 0 $1, 000 $350 Expected $2, 000 0 $2, 000 $700 Expansion $3, 000 0 $3, 000 $1, 050 $650 $1, 300 $1, 950 Recession Expected Expansion EBIT $1, 000 $2, 000 $3, 000 Interest ($8, 000 @ 8% ) 640 640 EBT $360 $1, 360 $2, 360 Taxes (Tc = 35%) $126 $476 $826 Total Cash Flow $234+640$468+$640 $1, 534+$640 (to both S/H & B/H): $874 $1, 524 $2, 174 EBIT(1 -Tc)+TCr. BB $650+$224 $1, 300+$224 $1, 950+$224 $874 $1, 524 $2, 174

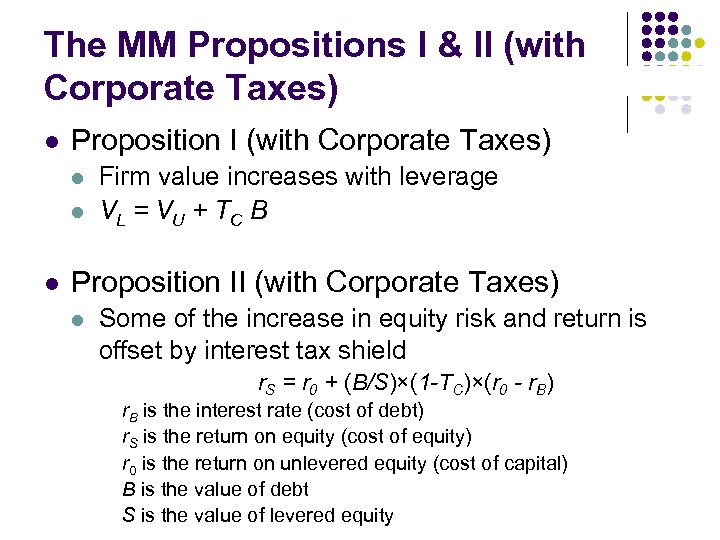

The MM Propositions I & II (with Corporate Taxes) l Proposition I (with Corporate Taxes) l l l Firm value increases with leverage VL = V U + T C B Proposition II (with Corporate Taxes) l Some of the increase in equity risk and return is offset by interest tax shield r. S = r 0 + (B/S)×(1 -TC)×(r 0 - r. B) r. B is the interest rate (cost of debt) r. S is the return on equity (cost of equity) r 0 is the return on unlevered equity (cost of capital) B is the value of debt S is the value of levered equity

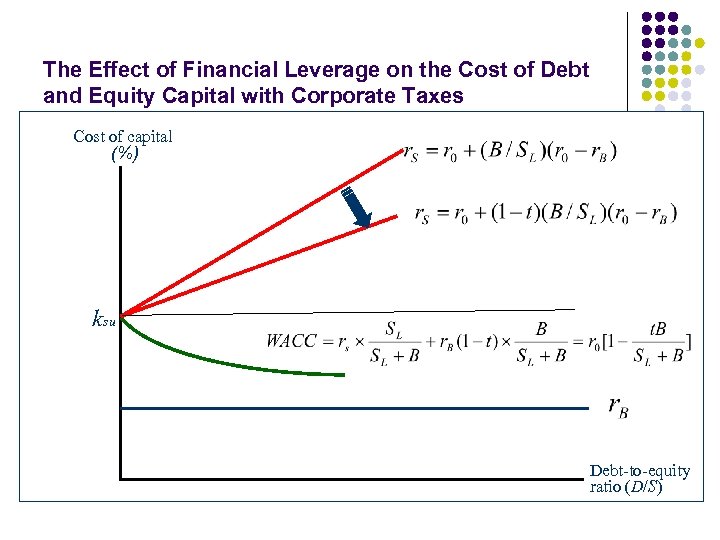

The Effect of Financial Leverage on the Cost of Debt and Equity Capital with Corporate Taxes Cost of capital (%) ksu Debt-to-equity ratio (D/S)

Capital Structure II: Limits to the Use of Debt

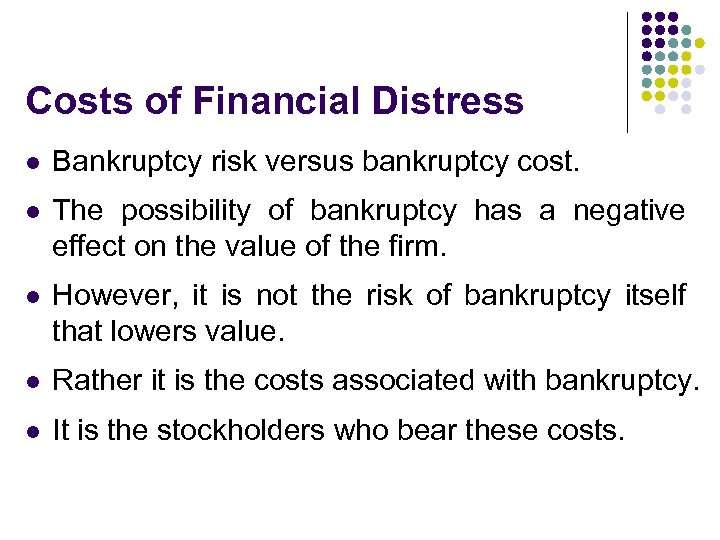

Costs of Financial Distress l Bankruptcy risk versus bankruptcy cost. l The possibility of bankruptcy has a negative effect on the value of the firm. l However, it is not the risk of bankruptcy itself that lowers value. l Rather it is the costs associated with bankruptcy. l It is the stockholders who bear these costs.

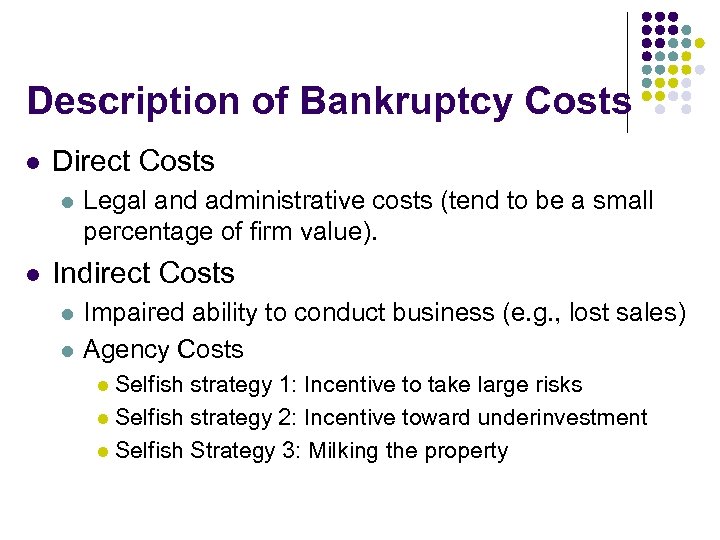

Description of Bankruptcy Costs l Direct Costs l l Legal and administrative costs (tend to be a small percentage of firm value). Indirect Costs l l Impaired ability to conduct business (e. g. , lost sales) Agency Costs Selfish strategy 1: Incentive to take large risks l Selfish strategy 2: Incentive toward underinvestment l Selfish Strategy 3: Milking the property l

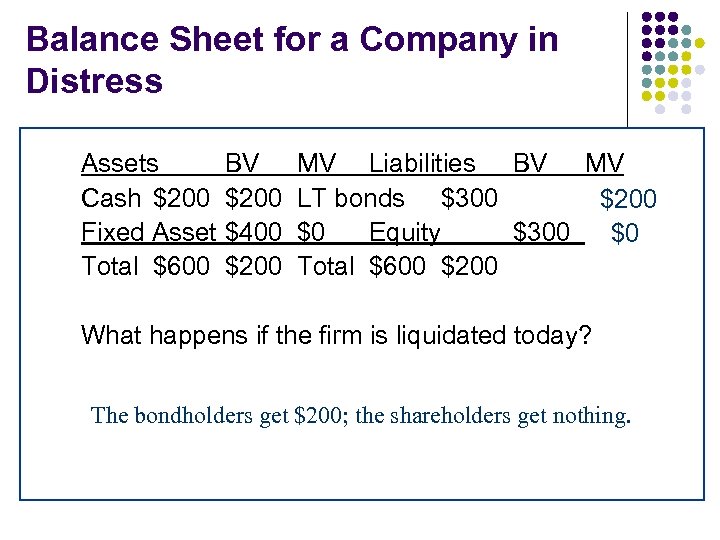

Balance Sheet for a Company in Distress Assets Cash $200 Fixed Asset Total $600 BV $200 $400 $200 MV Liabilities BV MV LT bonds $300 $200 $0 Equity $300 $0 Total $600 $200 What happens if the firm is liquidated today? The bondholders get $200; the shareholders get nothing.

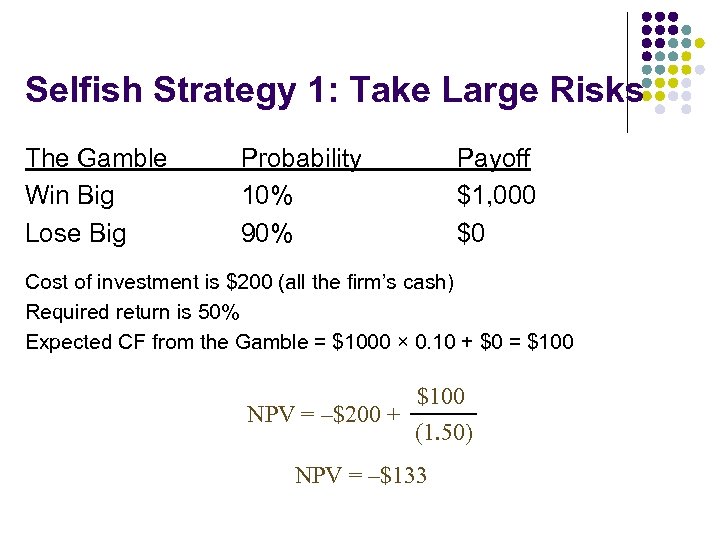

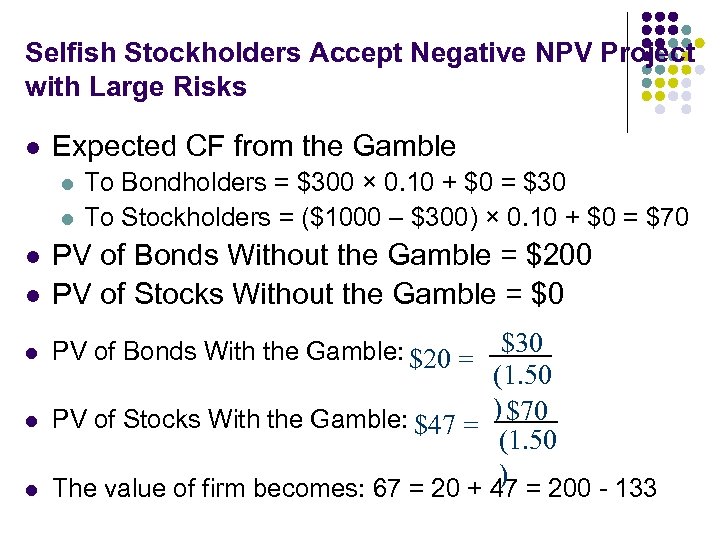

Selfish Strategy 1: Take Large Risks The Gamble Win Big Lose Big Probability 10% 90% Payoff $1, 000 $0 Cost of investment is $200 (all the firm’s cash) Required return is 50% Expected CF from the Gamble = $1000 × 0. 10 + $0 = $100 NPV = –$200 + $100 (1. 50) NPV = –$133

Selfish Stockholders Accept Negative NPV Project with Large Risks l Expected CF from the Gamble l l l l To Bondholders = $300 × 0. 10 + $0 = $30 To Stockholders = ($1000 – $300) × 0. 10 + $0 = $70 PV of Bonds Without the Gamble = $200 PV of Stocks Without the Gamble = $0 $30 (1. 50 PV of Stocks With the Gamble: $47 = ) $70 (1. 50 ) PV of Bonds With the Gamble: $20 = The value of firm becomes: 67 = 20 + 47 = 200 - 133

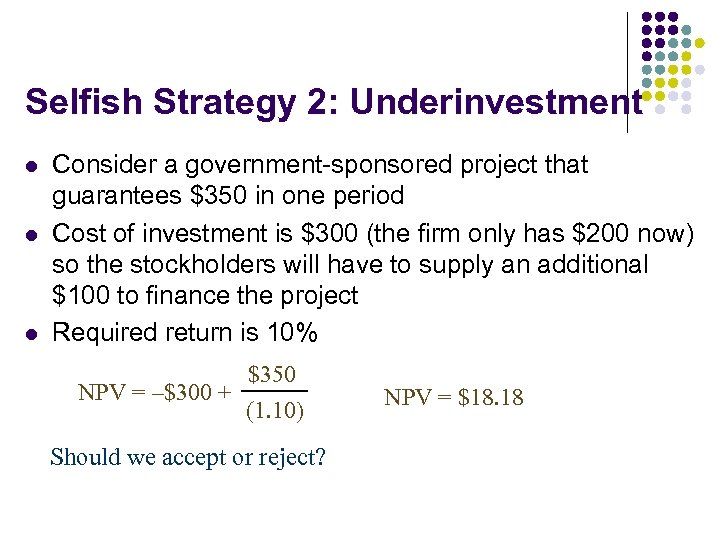

Selfish Strategy 2: Underinvestment l l l Consider a government-sponsored project that guarantees $350 in one period Cost of investment is $300 (the firm only has $200 now) so the stockholders will have to supply an additional $100 to finance the project Required return is 10% NPV = –$300 + $350 (1. 10) Should we accept or reject? NPV = $18. 18

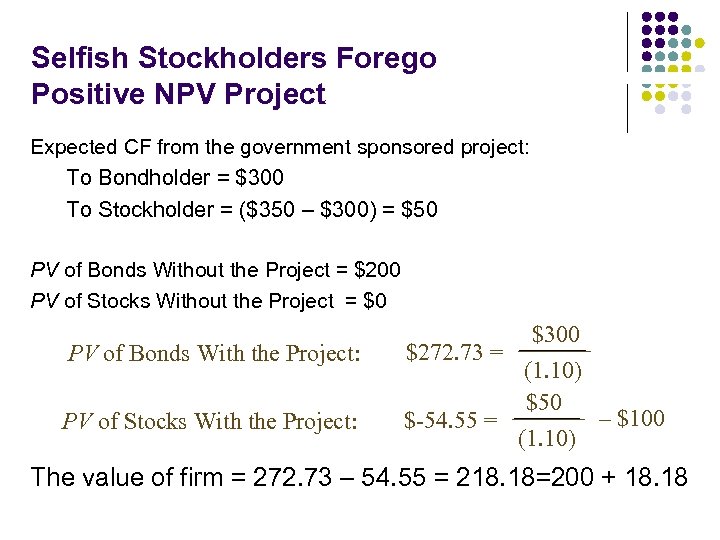

Selfish Stockholders Forego Positive NPV Project Expected CF from the government sponsored project: To Bondholder = $300 To Stockholder = ($350 – $300) = $50 PV of Bonds Without the Project = $200 PV of Stocks Without the Project = $0 PV of Bonds With the Project: $272. 73 = PV of Stocks With the Project: $-54. 55 = $300 (1. 10) $50 (1. 10) – $100 The value of firm = 272. 73 – 54. 55 = 218. 18=200 + 18. 18

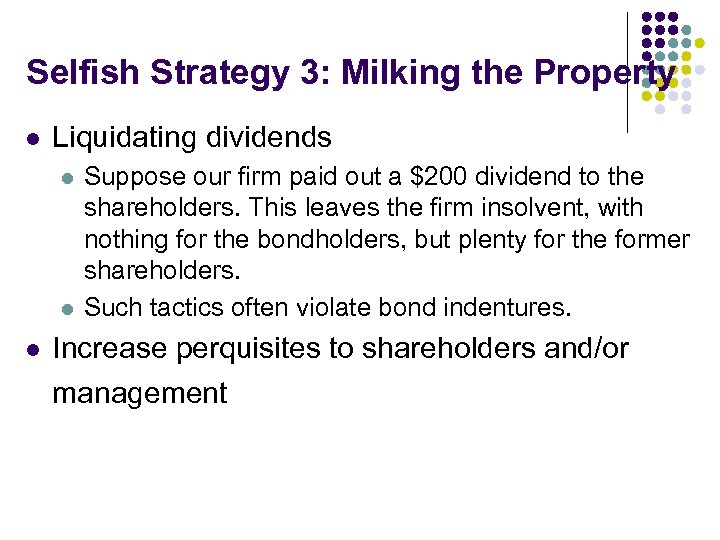

Selfish Strategy 3: Milking the Property l Liquidating dividends l l l Suppose our firm paid out a $200 dividend to the shareholders. This leaves the firm insolvent, with nothing for the bondholders, but plenty for the former shareholders. Such tactics often violate bond indentures. Increase perquisites to shareholders and/or management

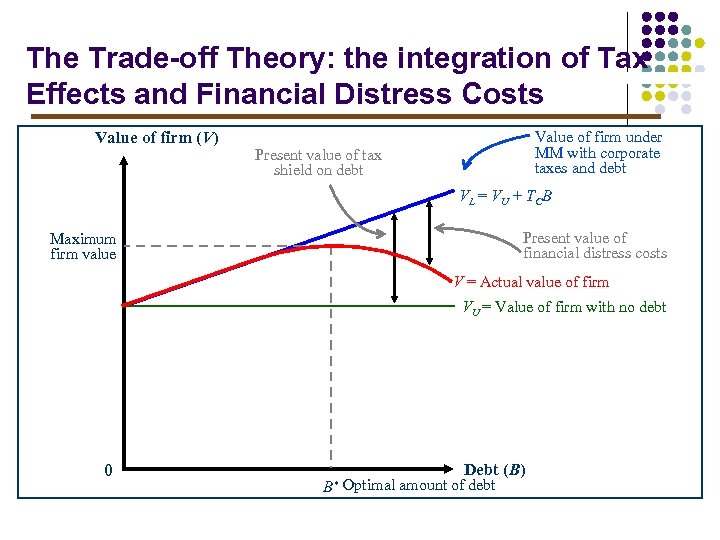

The Trade-off Theory: the integration of Tax Effects and Financial Distress Costs l There is a trade-off between the tax advantage of debt and the costs of financial distress. l The optimum capital structure occurs when a firm’s positive tax advantage equals the negative cost of financial distress.

The Trade-off Theory: the integration of Tax Effects and Financial Distress Costs Value of firm (V) Value of firm under MM with corporate taxes and debt Present value of tax shield on debt VL = VU + TCB Present value of financial distress costs Maximum firm value V = Actual value of firm VU = Value of firm with no debt 0 B* Debt (B) Optimal amount of debt

Signaling l l The firm’s capital structure is optimized where the marginal subsidy to debt equals the marginal cost. Investors view debt as a signal of firm value. l l l Firms with low anticipated profits will take on a low level of debt. Firms with high anticipated profits will take on high levels of debt. A manager that takes on more debt than is optimal in order to fool investors will pay the cost in the long run.

Shirking, Perquisites, and Bad Investments: The Agency Cost of Equity l l l An individual will work harder for a firm if he is one of the owners than if he is one of the “hired help”. While managers may have motive to partake in perquisites, they also need opportunity. Free cash flow provides this opportunity. l The free cash flow hypothesis says that an increase in dividends should benefit the stockholders by reducing the ability of managers to pursue wasteful activities. l The free cash flow hypothesis also argues that an increase in debt will reduce the ability of managers to pursue wasteful activities more effectively than dividend increases. The managers may decide to pursue a capital structure which is less levered than that implied by maximized value, trying to reduce the risk in bankruptcy, thus the risk in losing his own job.

The Pecking-Order Theory l Theory stating that firms prefer to issue debt rather than equity if internal finance is insufficient. l Rule 1 l Use l internal financing first. Rule 2 l Issue l debt next, equity last. The pecking-order Theory is at odds with the trade -off theory: l l l There is no target D/E ratio. Profitable firms use less debt. Companies like financial slack

Growth and the Debt-Equity Ratio l High growth firms face high operating risk; so they adopt less risky financial strategy. l Growth implies significant equity financing, even in a world with low bankruptcy costs. l Thus, high-growth firms will have lower debt ratios than low-growth firms. l Growth is an essential feature of the real world; as a result, 100% debt financing is sub-optimal.

Integrate operating and financial risk with financing alternatives l l l Firms try to manage total risk (financial and operating) to an acceptable level. Firms with high operating risk, tend to adopt less financial risk financing (equity financing dominant) alternatives, to avoid high interest payment. Firms with low operating risk, tend to adopt more financial risk financing (debt financing dominant) alternatives, to increase ROE.

9ee5e3c8f68df2a4a4f754bdc3a21da3.ppt