2c7184d393ba810dda1ccaeeab4c6b14.ppt

- Количество слайдов: 58

Capital Structure Debt versus Equity

Advantages of Debt • Interest is tax deductible (lowers the effective cost of debt) • Debt-holders are limited to a fixed return – so stockholders do not have to share profits if the business does exceptionally well • Debt holders do not have voting rights

Disadvantages of Debt • Higher debt ratios lead to greater risk and higher required interest rates (to compensate for the additional risk)

What is the optimal debt-equity ratio? • Need to consider two kinds of risk: – Business risk – Financial risk

Business Risk • Standard measure is beta (controlling for financial risk) • Factors: – Demand variability – Sales price variability – Input cost variability – Ability to develop new products – Foreign exchange exposure – Operating leverage (fixed vs variable costs)

Financial Risk • The additional risk placed on the common stockholders as a result of the decision to finance with debt

Example of Business Risk • Suppose 10 people decide to form a corporation to manufacture disk drives. • If the firm is capitalized only with common stock – and if each person buys 10% -each investor shares equally in business risk

Example of Relationship Between Financial and Business Risk • If the same firm is now capitalized with 50% debt and 50% equity – with five people investing in debt and five investing in equity • The 5 who put up the equity will have to bear all the business risk, so the common stock will be twice as risky as it would have been had the firm been all-equity (unlevered).

Business and Financial Risk • Financial leverage concentrates the firm’s business risk on the shareholders because debt-holders, who receive fixed interest payments, bear none of the business risk.

Financial Risk • Leverage increases shareholder risk • Leverage also increases the return on equity (to compensate for the higher risk)

Question? • Is the increase in expected return due to financial leverage sufficient to compensate stockholders for the increase in risk?

Modigliani and Miller • YES • Assuming no taxes, the increase in return to shock-holders resulting from the use of leverage is exactly offset by the increase in risk – hence no benefit to using financial leverage (and no cost).

Topics To Be Covered • Leverage in a Tax Free Environment • How Leverage Affects Returns • The Traditional Position

Capital Structure • When a firm issues debt and equity securities it splits cash flows into two streams: – Safe stream to bondholders – Risky stream to stockholders

Capital Structure • Modigliani and Miller (1958) show that financing decisions don’t matter in perfect capital markets • M&M Proposition 1: – Firms cannot change the total value of their securities by splitting cash flows into two different streams – Firm value is determined by real assets – Capital structure is irrelevant

M&M (Debt Policy Doesn’t Matter) • Modigliani & Miller – When there are no taxes and capital markets function well, it makes no difference whether the firm borrows or individual shareholders borrow. Therefore, the market value of a company does not depend on its capital structure.

M&M (Debt Policy Doesn’t Matter) Assumptions • By issuing 1 security rather than 2, company diminishes investor choice. This does not reduce value if: – Investors do not need choice, OR – There are sufficient alternative securities • Capital structure does not affect cash flows e. g. . . – No taxes – No bankruptcy costs – No effect on management incentives

An Example of the Effects of Leverage • D and E are market values of debt and equity of Wapshot Marketing Company. Wapshot has issued 1000 shares and these are currently selling at $50 a share. Wapshot has borrowed $25, 000 so Wapshot’s stock is “levered equity”. • E = 1000 x $50 = $50, 000 • D= $25, 000 • V = E + D = $75, 000

Effects of Leverage • What happens if WPS “levers up” again by borrowing an additional $10, 000 and at the same time paying out a special dividend of $10 per share, thereby substituting debt for equity? • This should have no impact on WPS assets or total cash flows: – V is unchanged – D= $35, 000 – E= $75, 000 - $35, 000 = $40, 000 • Stockholders will suffer a $10, 000 capital loss which is exactly offset by the $10, 000 special dividend.

Effects of Leverage • What if instead of assuming V is unchanged we allow V it rise to $80, 000 as a result of the change in capital structure? • Then E = $80, 000 - $35, 000 = $45, 000 • Any increase or decrease in V as a result of the change in capital structure accrues to the shareholders

Effects of Leverage • What if the new borrowing increases the risk of bankruptcy? • This would suggest that the risk of the “old debt” is higher (and the value of the old debt is lower) • If this is the case, then shareholders would gain from the increase in leverage at the expense of the original bondholders.

Modigliani and Miller • Any combination of securities is as good as any other. • Example: – Two Firms with the same operating income who differ only in capital structure • Firm U is unlevered: VU=EU • Firm L is levered: EL= VL-DL

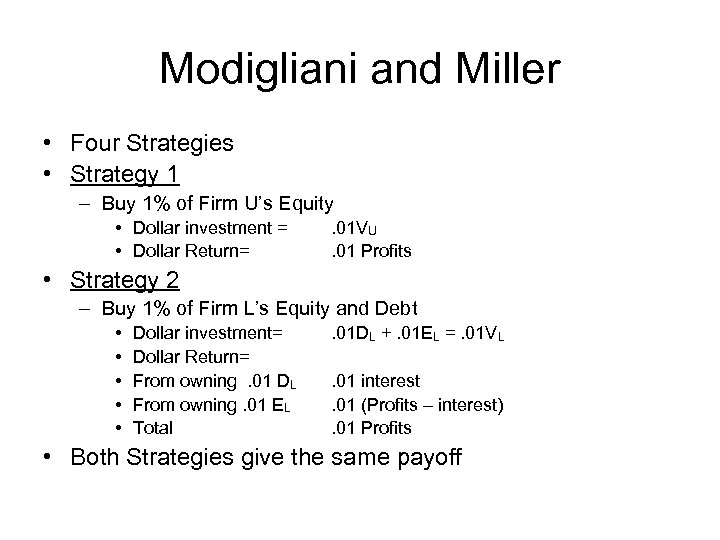

Modigliani and Miller • Four Strategies • Strategy 1 – Buy 1% of Firm U’s Equity • Dollar investment = • Dollar Return= . 01 VU. 01 Profits • Strategy 2 – Buy 1% of Firm L’s Equity and Debt • • • Dollar investment= Dollar Return= From owning. 01 DL From owning. 01 EL Total . 01 DL +. 01 EL =. 01 VL. 01 interest. 01 (Profits – interest). 01 Profits • Both Strategies give the same payoff

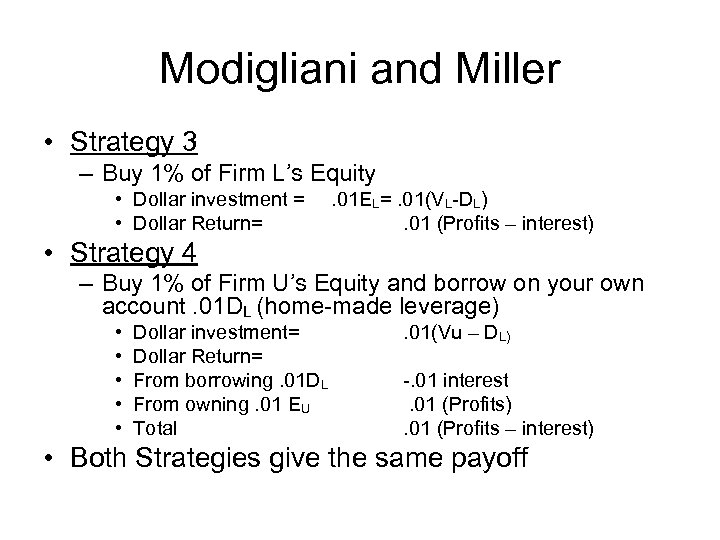

Modigliani and Miller • Strategy 3 – Buy 1% of Firm L’s Equity • Dollar investment = • Dollar Return= . 01 EL=. 01(VL-DL). 01 (Profits – interest) • Strategy 4 – Buy 1% of Firm U’s Equity and borrow on your own account. 01 DL (home-made leverage) • • • Dollar investment= Dollar Return= From borrowing. 01 DL From owning. 01 EU Total . 01(Vu – DL) -. 01 interest. 01 (Profits). 01 (Profits – interest) • Both Strategies give the same payoff

Modigliani and Miller • It does not matter what risk preferences are for investors. • Just need that investors have the ability to borrow and lend for their own account (and at the same rate as firms) so that they can “undo” any changes in firm’s capital structure • M&M Proposition 1: the value of a firm is independent of its capital structure.

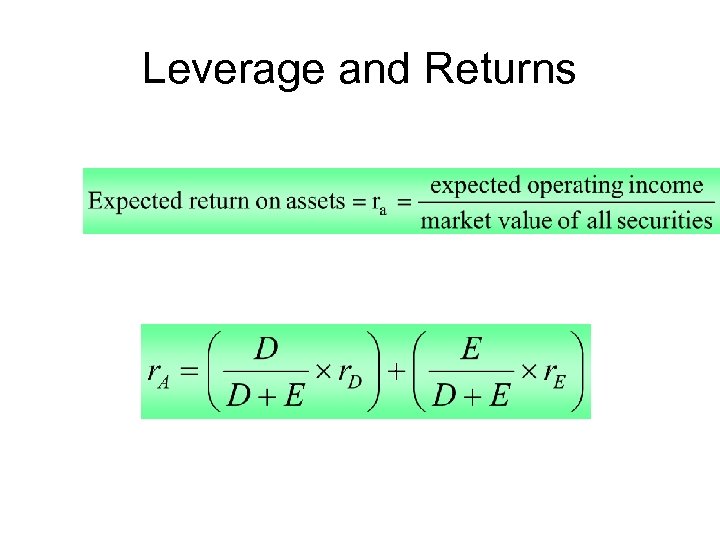

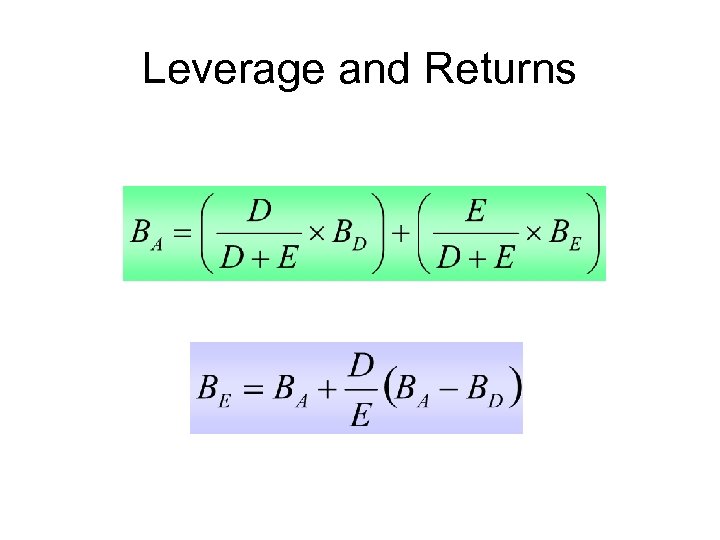

Leverage and Returns

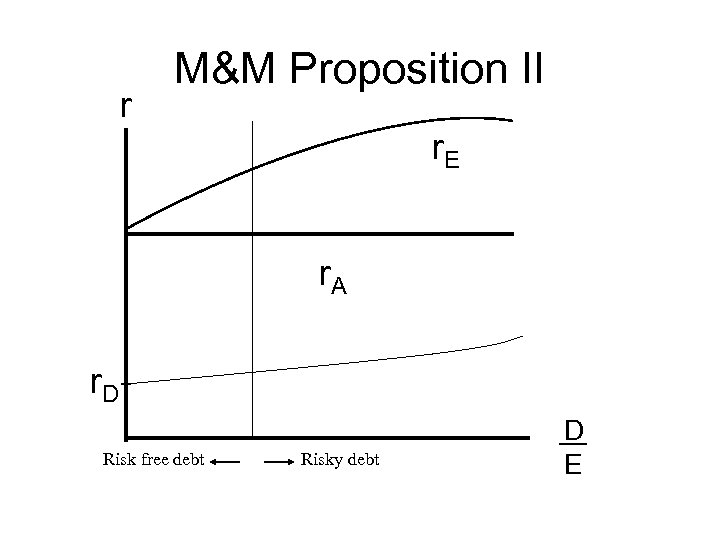

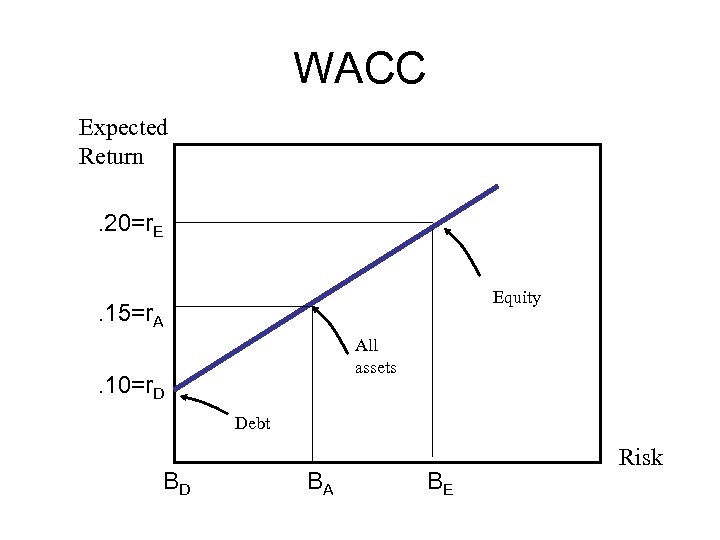

r M&M Proposition II r. E r. A r. D Risk free debt Risky debt D E

M&M Proposition 2 • Bonds are almost risk-free at low debt levels – r. D is independent of leverage – r. E increases linearly with debt-equity ratios and the increase in expected return reflects increased risk • As firms borrow more, the risk of default rises – r. D starts to increase – r. E increases more slowly (because the holders of risky debt bear some of the firm’s business risk)

The Return on Equity • The increase in expected equity return reflects increased risk • The increase in leverage increases the amplitude of variation in cash flows available to share-holders (the same change in operating income is now distributed among fewer shares) • We can understand the increase in risk in terms of Betas

Leverage and Returns

The Traditional Position • What did financial experts think before M&M? • They used the concept of WACC (weighted average cost of capital) – WACC is the expected return on the portfolio of all the company’s securities

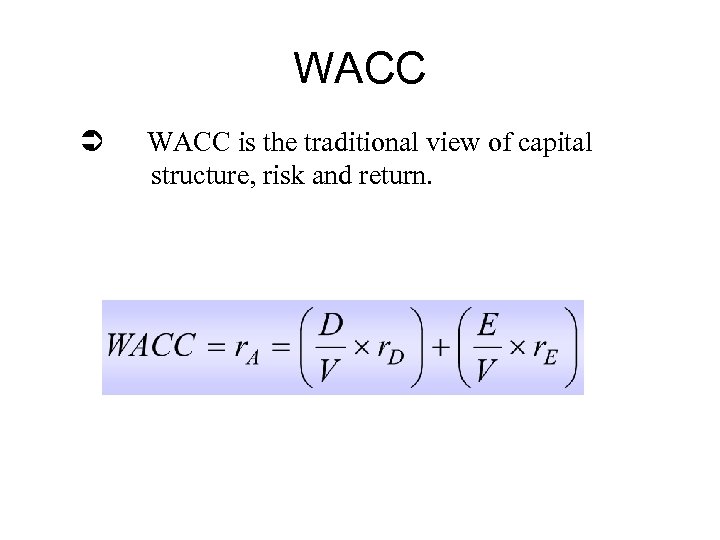

WACC Ü WACC is the traditional view of capital structure, risk and return.

WACC Expected Return. 20=r. E Equity . 15=r. A All assets . 10=r. D Debt BD BA BE Risk

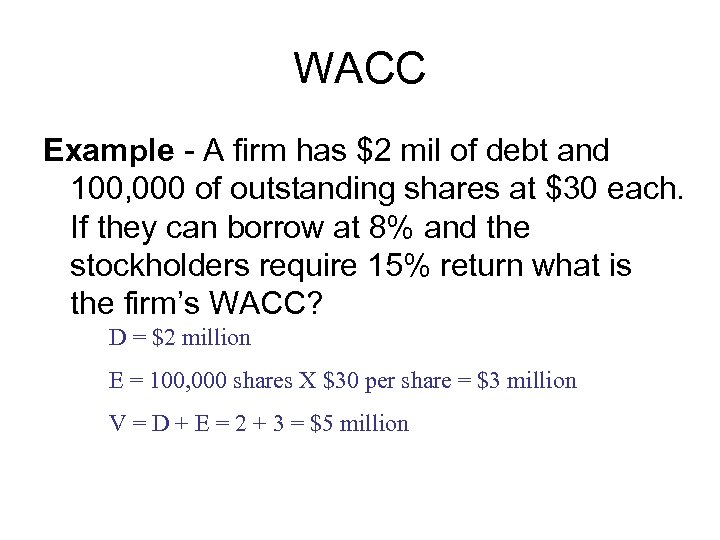

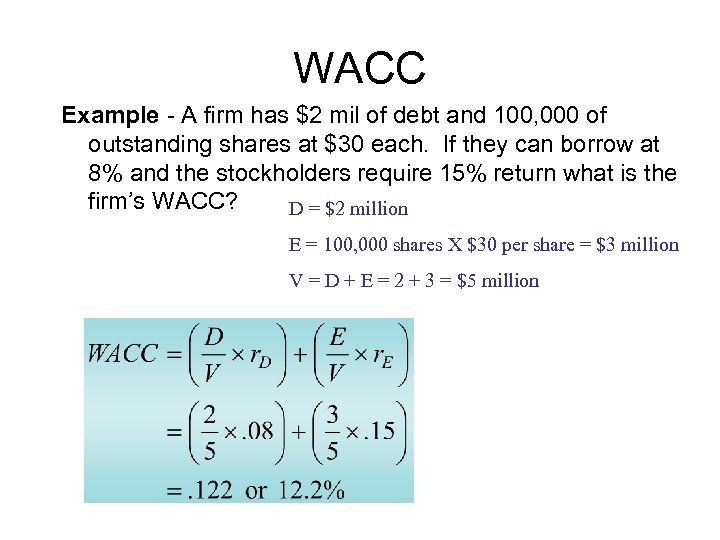

WACC Example - A firm has $2 mil of debt and 100, 000 of outstanding shares at $30 each. If they can borrow at 8% and the stockholders require 15% return what is the firm’s WACC? D = $2 million E = 100, 000 shares X $30 per share = $3 million V = D + E = 2 + 3 = $5 million

WACC Example - A firm has $2 mil of debt and 100, 000 of outstanding shares at $30 each. If they can borrow at 8% and the stockholders require 15% return what is the firm’s WACC? D = $2 million E = 100, 000 shares X $30 per share = $3 million V = D + E = 2 + 3 = $5 million

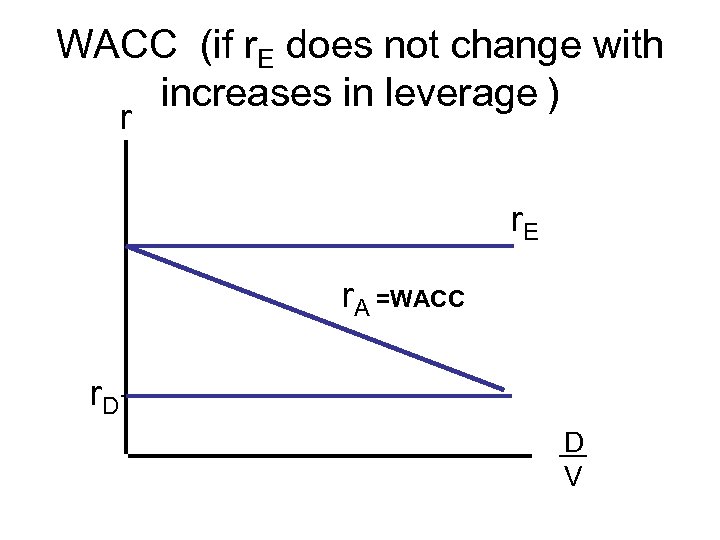

The Traditional Position • The return on equity (r. E) is constant • WACC declines with increasing leverage because r. D<r. E • Given the two assumptions above, a firm will minimize the cost of capital by issuing almost 100% debt • This can’t be correct!

WACC (if r. E does not change with increases in leverage ) r r. E r. A =WACC r. D D V

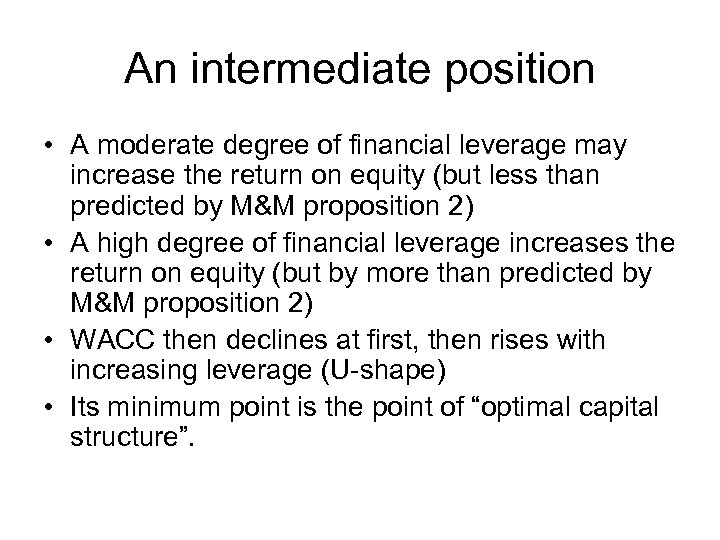

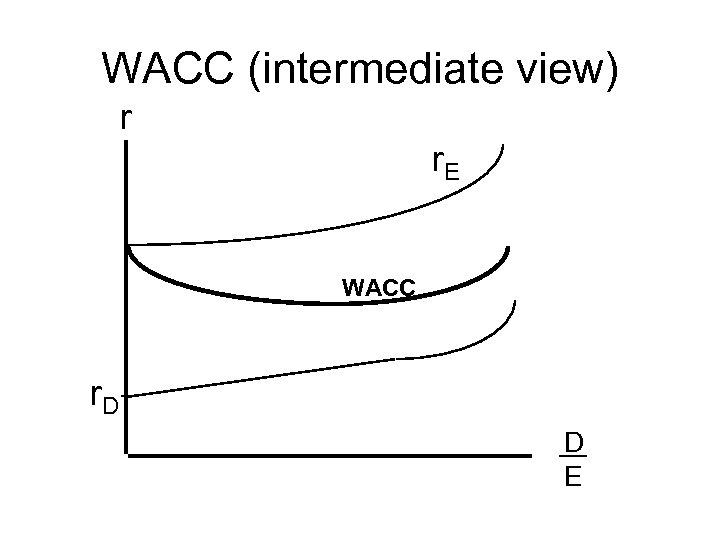

An intermediate position • A moderate degree of financial leverage may increase the return on equity (but less than predicted by M&M proposition 2) • A high degree of financial leverage increases the return on equity (but by more than predicted by M&M proposition 2) • WACC then declines at first, then rises with increasing leverage (U-shape) • Its minimum point is the point of “optimal capital structure”.

WACC (intermediate view) r r. E WACC r. D D E

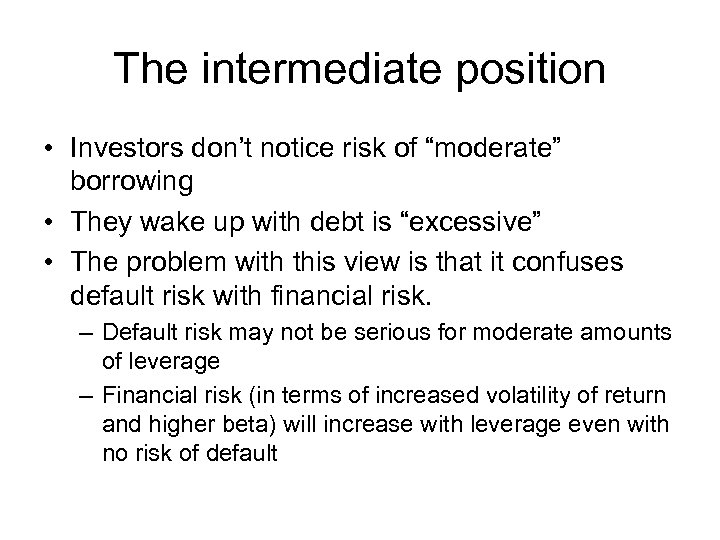

The intermediate position • Investors don’t notice risk of “moderate” borrowing • They wake up with debt is “excessive” • The problem with this view is that it confuses default risk with financial risk. – Default risk may not be serious for moderate amounts of leverage – Financial risk (in terms of increased volatility of return and higher beta) will increase with leverage even with no risk of default

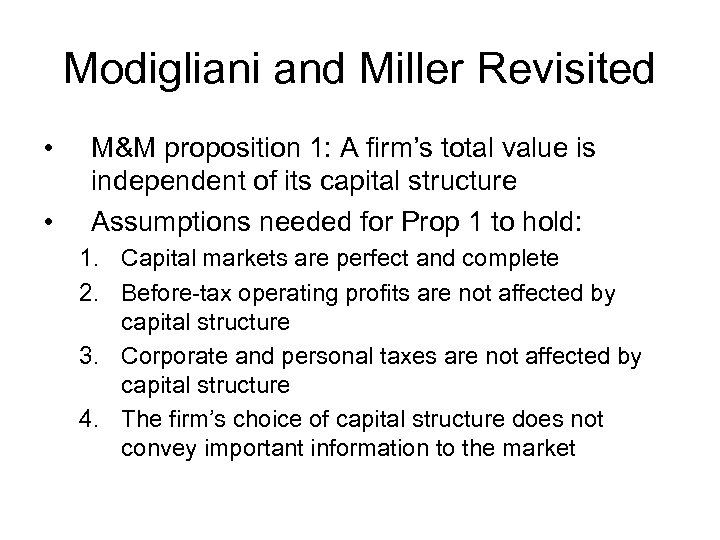

Modigliani and Miller Revisited • • M&M proposition 1: A firm’s total value is independent of its capital structure Assumptions needed for Prop 1 to hold: 1. Capital markets are perfect and complete 2. Before-tax operating profits are not affected by capital structure 3. Corporate and personal taxes are not affected by capital structure 4. The firm’s choice of capital structure does not convey important information to the market

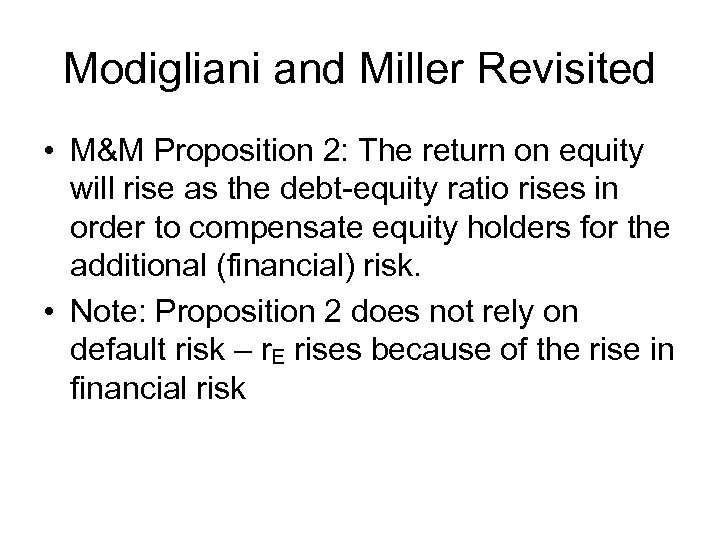

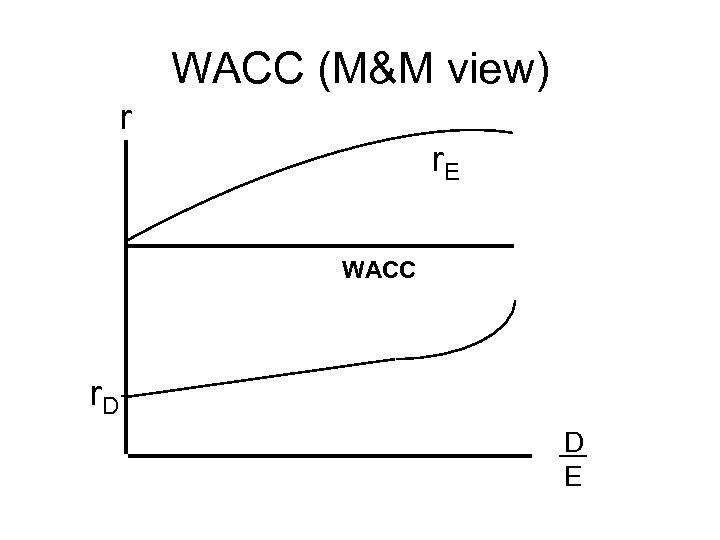

Modigliani and Miller Revisited • M&M Proposition 2: The return on equity will rise as the debt-equity ratio rises in order to compensate equity holders for the additional (financial) risk. • Note: Proposition 2 does not rely on default risk – r. E rises because of the rise in financial risk

WACC (M&M view) r r. E WACC r. D D E

Capital Structure and Corporate Taxes Financial Risk - Risk to shareholders resulting from the use of debt. Financial Leverage - Increase in the variability of shareholder returns that comes from the use of debt. Interest Tax Shield- Tax savings resulting from deductibility of interest payments.

Capital Structure and Corporate Taxes Example - You own all the equity in a company. The company has no debt. The company’s annual cash flow is $1, 000, before interest and taxes. The corporate tax rate is 40%. You have the option to exchange 1/2 of your equity position for 10% bonds with a face value of $1, 000. Should you do this and why?

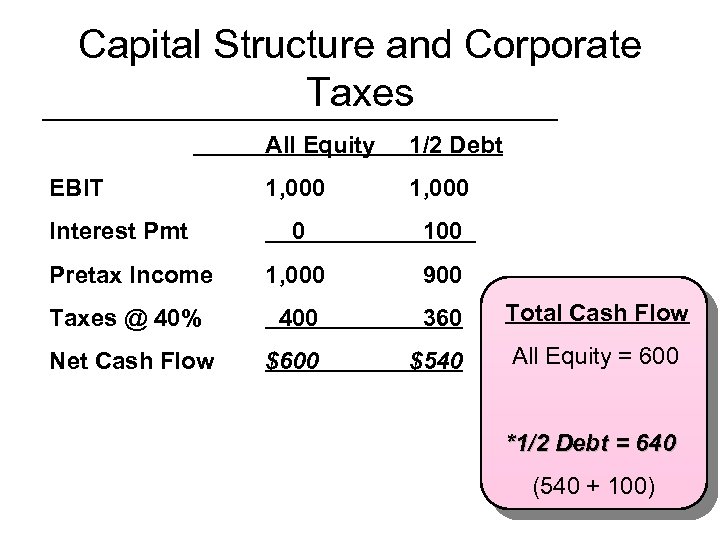

Capital Structure and Corporate Taxes All Equity 1/2 Debt 1, 000 0 100 Pretax Income 1, 000 900 Taxes @ 40% 400 360 Total Cash Flow Net Cash Flow $600 $540 All Equity = 600 EBIT Interest Pmt *1/2 Debt = 640 (540 + 100)

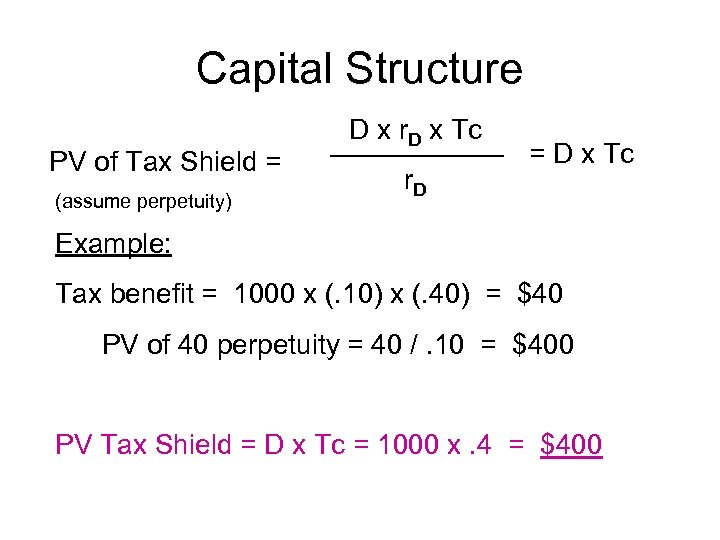

Capital Structure PV of Tax Shield = (assume perpetuity) D x r. D x Tc r. D = D x Tc Example: Tax benefit = 1000 x (. 10) x (. 40) = $40 PV of 40 perpetuity = 40 /. 10 = $400 PV Tax Shield = D x Tc = 1000 x. 4 = $400

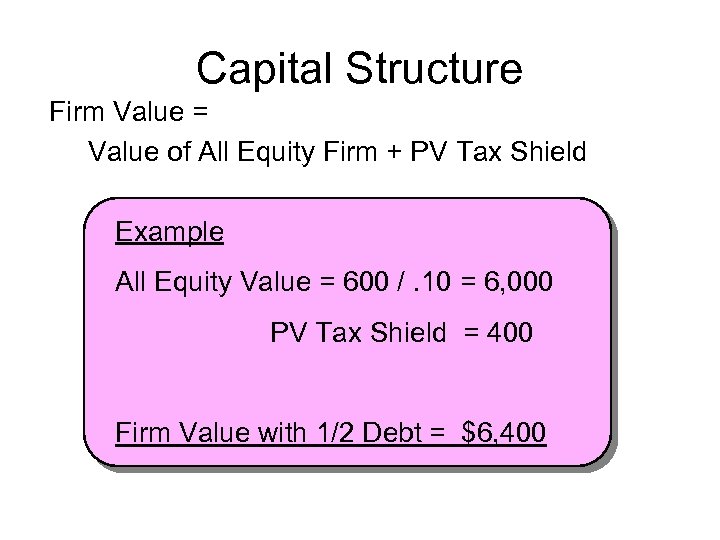

Capital Structure Firm Value = Value of All Equity Firm + PV Tax Shield Example All Equity Value = 600 /. 10 = 6, 000 PV Tax Shield = 400 Firm Value with 1/2 Debt = $6, 400

U. S. Tax Code • Allows corporations to deduct interest payments on debt as an expense • Dividend payments to stockholders are not deductible • Differential treatment results in a net benefit to financial leverage (debt)

U. S. Tax Code • Personal taxes bias the other way (toward equity) • Income from bonds generally comes as interest and is taxed at the personal income tax rate • Income from equity comes partly from dividends and partly from capital gains • Capital gains are often taxed at a lower rate and the tax is deferred until the stock is sold and the gain realized. • If the owner of the stock dies – no capital gain tax is paid • On balance, common stock returns are taxed at lower rates than debt returns

U. S. Tax Rates • Top bracket (over $250, 000 for a married couple) – Personal rates: 35% – Capital gains: 18% (holding period of 18 mos) • If stock is held for less than 1 year capital gain is taxed at the personal rate • If stock is held for over 1 year but less than 18 mos the capital gains tax is between 18 -35%

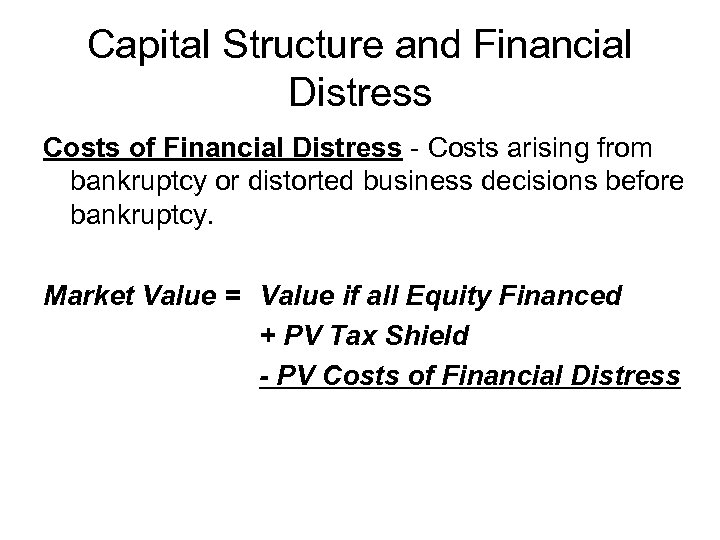

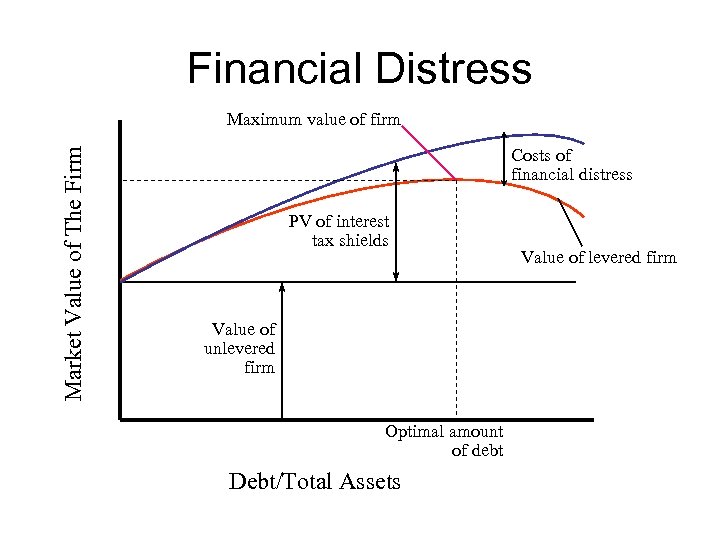

Capital Structure and Financial Distress Costs of Financial Distress - Costs arising from bankruptcy or distorted business decisions before bankruptcy. Market Value = Value if all Equity Financed + PV Tax Shield - PV Costs of Financial Distress

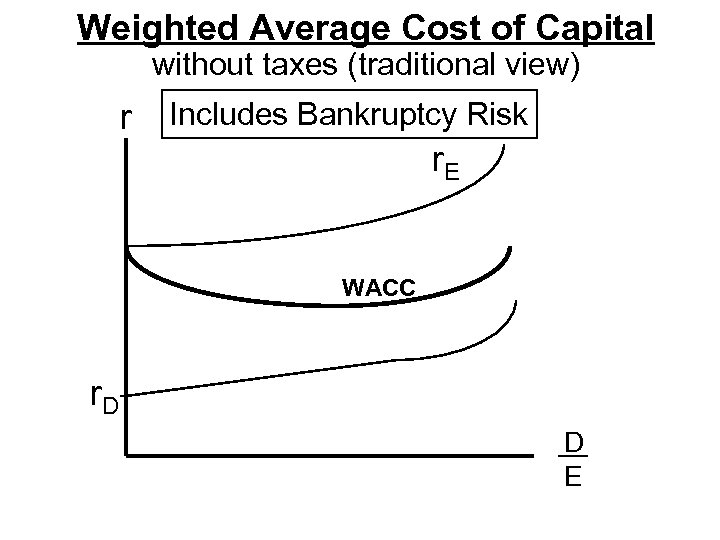

Weighted Average Cost of Capital without taxes (traditional view) r Includes Bankruptcy Risk r. E WACC r. D D E

Financial Distress Market Value of The Firm Maximum value of firm Costs of financial distress PV of interest tax shields Value of unlevered firm Optimal amount of debt Debt/Total Assets Value of levered firm

M&M with taxes and bankruptcy • WACC now is more hump-shaped (similar to the traditional view – though for different reasons). • The minimum WACC occurs where the stock price is maximized. • Thus, the same capital structure that maximizes stock price also minimizes the WACC.

Financial Choices Trade-off Theory - Theory that capital structure is based on a trade-off between tax savings and distress costs of debt. Pecking Order Theory - Theory stating that firms prefer to issue debt rather than equity if internal finance is insufficient.

Pecking Order Theory The announcement of a stock issue drives down the stock price because investors believe managers are more likely to issue when shares are overpriced. Therefore firms prefer internal finance since funds can be raised without sending adverse signals. If external finance is required, firms issue debt first and equity as a last resort. The most profitable firms borrow less not because they have lower target debt ratios but because they don't need external finance.

Pecking Order Theory Some Implications: Ü Internal equity may be better than external equity. Ü Financial slack is valuable. Ü If external capital is required, debt is better. (There is less room for difference in opinions about what debt is worth).

2c7184d393ba810dda1ccaeeab4c6b14.ppt