d475ad38e22ff2190f40c6a1f07b3369.ppt

- Количество слайдов: 22

Capital Pool Company™ An alternative source of growth capital for business in your community Delilah Panio, Director, Business Development & Strategy Mark Lawrence, Managing Director – North. Crest Partners Inc. Los Angeles, Sept. 30 th, 2009

Capital Pool Company™ An alternative source of growth capital for business in your community Delilah Panio, Director, Business Development & Strategy Mark Lawrence, Managing Director – North. Crest Partners Inc. Los Angeles, Sept. 30 th, 2009

Disclaimer This document is for information purposes only and is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group Inc. and its affiliates do not endorse or recommend any securities referenced in this document. Please seek professional advice to evaluate specific securities. While the information herein is collected and compiled with care, neither TMX Group Inc. nor any of its affiliated companies represents, warrants or guarantees the accuracy or the completeness of the information. You agree not to rely on the information contained herein for any trading, business or financial purpose. This information is provided with the express condition, to which by making use thereof you expressly consent, that no liability shall be incurred by TMX Group Inc. and/or any of its affiliates as a result of any errors, omissions or inaccuracies herein or any use or reliance upon this information. The views, opinions and advice of the presenters reflect those of the individual presenters. TMX Group Inc. and its affiliates do not endorse and are not responsible for any information provided by third party presenters. © 2009 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify without TSX Inc. ’s prior written consent. TMX Group, Toronto Stock Exchange, TSX Venture Exchange, TMX, TSXV and Capital Pool Company are trademarks of TSX Inc.

Disclaimer This document is for information purposes only and is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group Inc. and its affiliates do not endorse or recommend any securities referenced in this document. Please seek professional advice to evaluate specific securities. While the information herein is collected and compiled with care, neither TMX Group Inc. nor any of its affiliated companies represents, warrants or guarantees the accuracy or the completeness of the information. You agree not to rely on the information contained herein for any trading, business or financial purpose. This information is provided with the express condition, to which by making use thereof you expressly consent, that no liability shall be incurred by TMX Group Inc. and/or any of its affiliates as a result of any errors, omissions or inaccuracies herein or any use or reliance upon this information. The views, opinions and advice of the presenters reflect those of the individual presenters. TMX Group Inc. and its affiliates do not endorse and are not responsible for any information provided by third party presenters. © 2009 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify without TSX Inc. ’s prior written consent. TMX Group, Toronto Stock Exchange, TSX Venture Exchange, TMX, TSXV and Capital Pool Company are trademarks of TSX Inc.

CPC Founders Mark Lawrence Managing Director, Northcrest Partners

CPC Founders Mark Lawrence Managing Director, Northcrest Partners

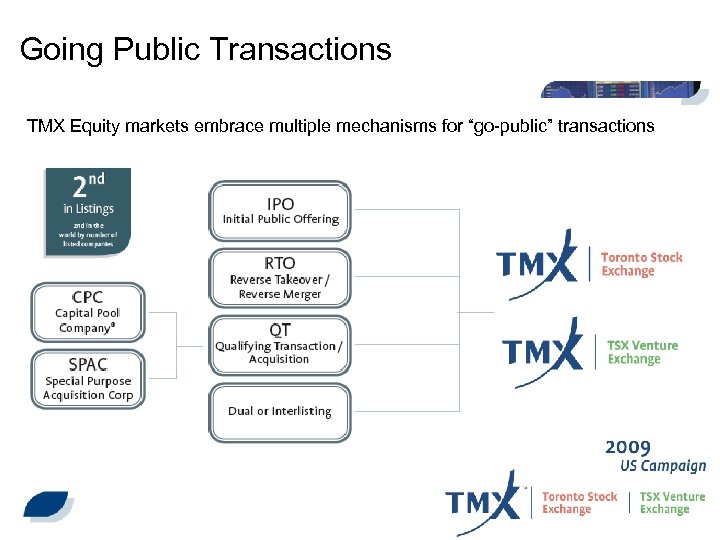

Going Public Transactions TMX Equity markets embrace multiple mechanisms for “go-public” transactions

Going Public Transactions TMX Equity markets embrace multiple mechanisms for “go-public” transactions

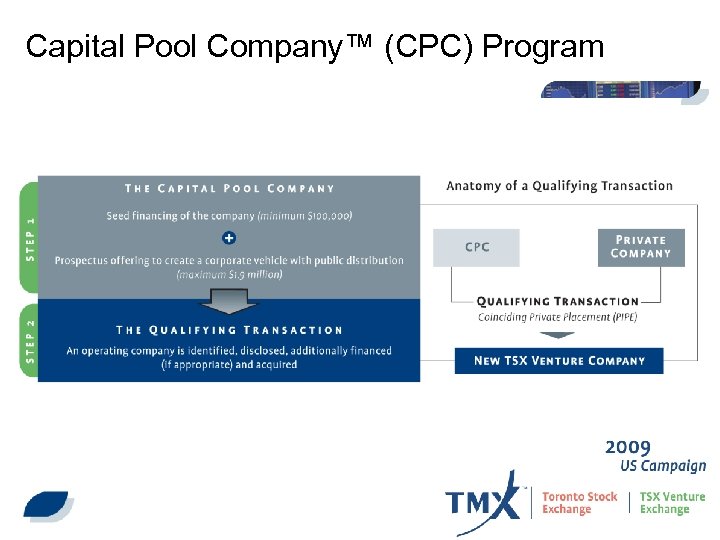

Capital Pool Company™ (CPC) Program

Capital Pool Company™ (CPC) Program

A successful track record Capital Pool Company (CPC): • Unique listing vehicle on TSXV • Reverse merger into a newly formed listed company • 2, 021 listed since program inception in 1987 • 80% have completed their QT • 247 former CPCs currently trade on TSX • 86 QTs 2008 • A new clean CPC company has none of the hidden costs and liability of a “shell” with previous operating history

A successful track record Capital Pool Company (CPC): • Unique listing vehicle on TSXV • Reverse merger into a newly formed listed company • 2, 021 listed since program inception in 1987 • 80% have completed their QT • 247 former CPCs currently trade on TSX • 86 QTs 2008 • A new clean CPC company has none of the hidden costs and liability of a “shell” with previous operating history

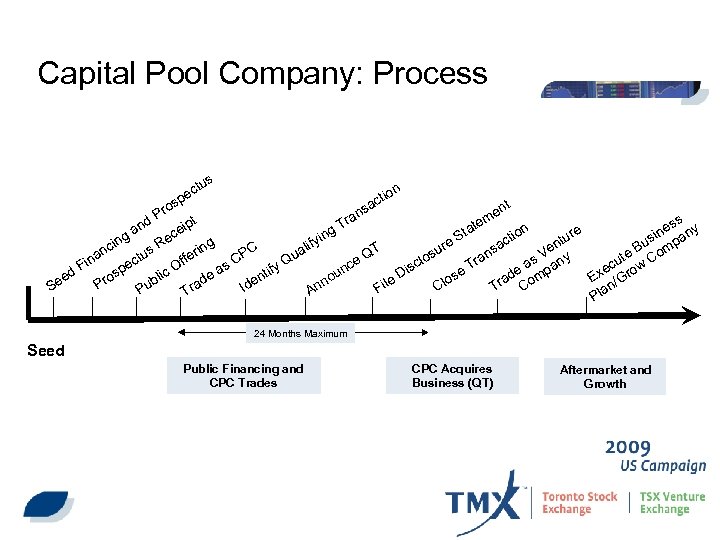

Capital Pool Company: Process tus ec on cti sa p ros nt me t s es ny n ate an eip e r in St g tio in ec us mpa g ntu ac re R lify cin e s T u B o s n rin PC ua los s V any ffe ran ctu ute w C e Q ina C Q s a T F O isc fy nc ec o pe de omp se lic e a D nti ed ou os Ex /Gr a o b e n ad Pr n Tr C Se Cl Ide Fil Pu An Tr Pla an Tr g d P 24 Months Maximum Seed Public Financing and CPC Trades CPC Acquires Business (QT) Aftermarket and Growth

Capital Pool Company: Process tus ec on cti sa p ros nt me t s es ny n ate an eip e r in St g tio in ec us mpa g ntu ac re R lify cin e s T u B o s n rin PC ua los s V any ffe ran ctu ute w C e Q ina C Q s a T F O isc fy nc ec o pe de omp se lic e a D nti ed ou os Ex /Gr a o b e n ad Pr n Tr C Se Cl Ide Fil Pu An Tr Pla an Tr g d P 24 Months Maximum Seed Public Financing and CPC Trades CPC Acquires Business (QT) Aftermarket and Growth

Capital Pool Company: Milestones 1. Seed Financing – $100, 000 to $1. 8 M seed financing of the company by 3 -5 Founders/Directors – Up to $500, 000 can be discount seed 2. CPC IPO – a prospectus offering to create a corporate vehicle with public distribution 3. Qualifying Transaction (QT) – a target business is identified, disclosed and acquired 4. Aftermarket and Growth – company trades and executes its business plan

Capital Pool Company: Milestones 1. Seed Financing – $100, 000 to $1. 8 M seed financing of the company by 3 -5 Founders/Directors – Up to $500, 000 can be discount seed 2. CPC IPO – a prospectus offering to create a corporate vehicle with public distribution 3. Qualifying Transaction (QT) – a target business is identified, disclosed and acquired 4. Aftermarket and Growth – company trades and executes its business plan

Keys to CPC Success l l Understanding the Process Knowing the Market Sponsoring Firm Professional Advisors l l BOD with Pubco Exp. Mgt. Industry Expertise High Growth Business Ability to create Shareholder Value

Keys to CPC Success l l Understanding the Process Knowing the Market Sponsoring Firm Professional Advisors l l BOD with Pubco Exp. Mgt. Industry Expertise High Growth Business Ability to create Shareholder Value

Why Create a CPC? l l World-class financing vehicle Vibrant, well regulated financial market (TSX. V) Numerous success stories – multiple sectors Access to Growth Capital l l Great financial leverage for Principals Low cost means of creating a Public Company High rates of return Ease of access to listing on U. S. markets

Why Create a CPC? l l World-class financing vehicle Vibrant, well regulated financial market (TSX. V) Numerous success stories – multiple sectors Access to Growth Capital l l Great financial leverage for Principals Low cost means of creating a Public Company High rates of return Ease of access to listing on U. S. markets

Invigorating Company Growth ™ Lessons Learned About CPCs LA - TMX Group September 30, 2009 Copyright 2009

Invigorating Company Growth ™ Lessons Learned About CPCs LA - TMX Group September 30, 2009 Copyright 2009

What We Do • North. Crest Partners provides advisory services to small and mid-sized companies to achieve growth and meet restructuring objectives. • Our main services include: – – 1. 2. 3. 4. Consulting (Strategic and Operational) Mergers, Acquisitions and Restructuring Capital Pool Company (CPC) Creation and Operation Capital Sourcing (for private and public companies) • We uniquely bring to our clients extensive investment banking and operational experience. • Former Analyst Pru-Bache, Midland Walwyn (Merrill), LOM. • Chair – Toronto MIT Enterprise Forum. Copyright 2009

What We Do • North. Crest Partners provides advisory services to small and mid-sized companies to achieve growth and meet restructuring objectives. • Our main services include: – – 1. 2. 3. 4. Consulting (Strategic and Operational) Mergers, Acquisitions and Restructuring Capital Pool Company (CPC) Creation and Operation Capital Sourcing (for private and public companies) • We uniquely bring to our clients extensive investment banking and operational experience. • Former Analyst Pru-Bache, Midland Walwyn (Merrill), LOM. • Chair – Toronto MIT Enterprise Forum. Copyright 2009

Lessons Learned About CPCs Target Company Criteria for a Good CPC - Institutional Grade Potential – Get Feedback Early On. - Coachable Management Team. - Commercial Stage – more revenue the better. - Concurrent Financing of $0 to $millions required is okay. - Reason to be public. - Acquisition candidates possible with share currency. - Realistic valuation – Road to Liquidity, not cashing out – escrow? . CPC Structure – Does it Matter? - Personally like smaller ones – manageable float. - Raise cash at 1 x value at QT. - Recent Deals suggested larger CPC vs concurrent financing. - Merging several CPCs doable but personalities and lead a question? Copyright 2009

Lessons Learned About CPCs Target Company Criteria for a Good CPC - Institutional Grade Potential – Get Feedback Early On. - Coachable Management Team. - Commercial Stage – more revenue the better. - Concurrent Financing of $0 to $millions required is okay. - Reason to be public. - Acquisition candidates possible with share currency. - Realistic valuation – Road to Liquidity, not cashing out – escrow? . CPC Structure – Does it Matter? - Personally like smaller ones – manageable float. - Raise cash at 1 x value at QT. - Recent Deals suggested larger CPC vs concurrent financing. - Merging several CPCs doable but personalities and lead a question? Copyright 2009

Lessons Learned About CPCs CPC Process - Find a Champion in Canada. - Lawyers/ Accountants do not fill Champion’s role. - Try to work out most details up front before signing LOI. - Make all parties aware of budget. - Set reasonable schedule of timelines early on. TSX V Interface Important - TSX V manages CPC process for OSC. - TSX V very approachable vs OSC, NASDAQ, AIM etc. - TSX V Listing department different than Compliance department. Copyright 2009

Lessons Learned About CPCs CPC Process - Find a Champion in Canada. - Lawyers/ Accountants do not fill Champion’s role. - Try to work out most details up front before signing LOI. - Make all parties aware of budget. - Set reasonable schedule of timelines early on. TSX V Interface Important - TSX V manages CPC process for OSC. - TSX V very approachable vs OSC, NASDAQ, AIM etc. - TSX V Listing department different than Compliance department. Copyright 2009

Lessons Learned About CPCs Audit – Always The Gating Factor - Determine requirements early on and time required. - Canadian or US$, but reconcile to Cdn GAAP. - Select firm that will continue, does not need to be BIG firm. Minimum Listing Requirements - Determine requirements immediately – don’t leave to end. - Determine amount of concurrent financing if any required. - Start with working capital deficit, cash flow for time until QT, next 12 months and add costs of being public ( plus $100 K for good measure). - Does short term debt need to be converted, ideally yes. - Make sure business plan supports cash flow forecasts. Copyright 2009

Lessons Learned About CPCs Audit – Always The Gating Factor - Determine requirements early on and time required. - Canadian or US$, but reconcile to Cdn GAAP. - Select firm that will continue, does not need to be BIG firm. Minimum Listing Requirements - Determine requirements immediately – don’t leave to end. - Determine amount of concurrent financing if any required. - Start with working capital deficit, cash flow for time until QT, next 12 months and add costs of being public ( plus $100 K for good measure). - Does short term debt need to be converted, ideally yes. - Make sure business plan supports cash flow forecasts. Copyright 2009

Lessons Learned About CPCs Lawyers - Target. Co, CPC and Sponsor has one (some cross border too). - Select lead lawyer with CPC experience, not just a securities guy. - Lead lawyer on Target. Co or CPC side ideally ongoing firm after QT. - Must all work in same sandbox. - US firms needed for US issues for Target. Co. - Target. Co lawyer will review Filing Statement info from Target. Co, don’t make them create it! Cross Border Tax Advice - Plan ahead with everyone’s eyes open can let you deal with cross border share exchange issues in prudent manner. - Make sure Target. Co investors sign off in writing method employed. Copyright 2009

Lessons Learned About CPCs Lawyers - Target. Co, CPC and Sponsor has one (some cross border too). - Select lead lawyer with CPC experience, not just a securities guy. - Lead lawyer on Target. Co or CPC side ideally ongoing firm after QT. - Must all work in same sandbox. - US firms needed for US issues for Target. Co. - Target. Co lawyer will review Filing Statement info from Target. Co, don’t make them create it! Cross Border Tax Advice - Plan ahead with everyone’s eyes open can let you deal with cross border share exchange issues in prudent manner. - Make sure Target. Co investors sign off in writing method employed. Copyright 2009

Lessons Learned About CPCs SEC Registration Issues - Enjoy TSXV without complete SOX issues. - Plan ahead and know the issues (everyone). - Pre migration to Canada? - Conversion of common to preferred? - Special Warrants? - Number of US shareholders? - Migrate CPC to Delaware? Educate Target. Co Investor Base - Make sure all investors know the CPC process to avoid surprises. - VC investors need to be educated. - Institutional funds need to be educated. - Get sign off in writing of 100% buyin early on. (small or large investor base) Copyright 2009

Lessons Learned About CPCs SEC Registration Issues - Enjoy TSXV without complete SOX issues. - Plan ahead and know the issues (everyone). - Pre migration to Canada? - Conversion of common to preferred? - Special Warrants? - Number of US shareholders? - Migrate CPC to Delaware? Educate Target. Co Investor Base - Make sure all investors know the CPC process to avoid surprises. - VC investors need to be educated. - Institutional funds need to be educated. - Get sign off in writing of 100% buyin early on. (small or large investor base) Copyright 2009

Lessons Learned About CPCs After Market Support - Get Target. Co buy in of post QT IR program. - Have Canadian team members on board with Capital Markets contacts. - Interview IR firms in US and Canada and short list early on. - Credible board and advisory board members in relevant industry. Broker and Sponsor - Need a sponsor even if money not raised (can be broker raising $) - Reasonable QT raise needed to attract corporate finance. - CPC Seed investors cannot collect fees or commissions. - Pre LOI is time to meet analysts and corporate finance teams, use the opportunity wisely. (Make sure Champion has the contacts). - Watch for CPCs that have ROFRs with their IPO brokers. Copyright 2009 - Have ability to pick best broker for Target. Co Concurrent

Lessons Learned About CPCs After Market Support - Get Target. Co buy in of post QT IR program. - Have Canadian team members on board with Capital Markets contacts. - Interview IR firms in US and Canada and short list early on. - Credible board and advisory board members in relevant industry. Broker and Sponsor - Need a sponsor even if money not raised (can be broker raising $) - Reasonable QT raise needed to attract corporate finance. - CPC Seed investors cannot collect fees or commissions. - Pre LOI is time to meet analysts and corporate finance teams, use the opportunity wisely. (Make sure Champion has the contacts). - Watch for CPCs that have ROFRs with their IPO brokers. Copyright 2009 - Have ability to pick best broker for Target. Co Concurrent

Lessons Learned About CPCs Other Issues • Set reasonable time lines and have regular meetings. • Identify PIF candidates early on to get searches underway. • Make sure CPC has concurrent meeting schedule if required re name change, share split, extra directors added beyond 1/3 in Ontario company. • Make sure Targetco can obtain bridge loan to fund period to closing. • Don’t count on CPC loans. • Bridge loan can be a debenture with a discount conversion to QT price. Copyright 2009

Lessons Learned About CPCs Other Issues • Set reasonable time lines and have regular meetings. • Identify PIF candidates early on to get searches underway. • Make sure CPC has concurrent meeting schedule if required re name change, share split, extra directors added beyond 1/3 in Ontario company. • Make sure Targetco can obtain bridge loan to fund period to closing. • Don’t count on CPC loans. • Bridge loan can be a debenture with a discount conversion to QT price. Copyright 2009

Discussion Mark Lawrence 416 707 6630 Mark@northcrestpartners. com www. northcrestpartners. com Copyright 2009

Discussion Mark Lawrence 416 707 6630 Mark@northcrestpartners. com www. northcrestpartners. com Copyright 2009

Mark Lawrence, P. Eng. , MBA, CFA Managing Partner - North. Crest Partners Inc. Mark received his designation as a Chartered Financial Analyst in 1990 and has been a registered Professional Engineer since 1985. Mr. Lawrence previously worked in leading North American retail and institutional brokerage firms between 1987 and 1997, including being a Director of Loewen, Ondaatje, Mc. Cutcheon Ltd, a VP of Midland Walwyn Capital Inc. , and the Senior Technology Analyst at Prudential-Bache Securities Inc. Mr. Lawrence became an industry leading software and hardware analyst in Canada. He has worked on cross-border public transactions, equity issues in excess of $2 billion, and on private financings. Since 1997, through CML Capital Ventures Inc. , he has invested in, founded and operated several technology firms, and assisted many others. Some of these include Investors Source (wealth management software), Zacks Canada Inc. , (consensus earnings database service), Classwave Wireless (Bluetooth software), USA. CA Corp. , (investment research portal), Cables. Edge Software (remote desktop access by voice), and Linmor Inc. , (remote network management). In addition, he is a founder of CPCs Blue. Fyre One Inc, Software Growth Inc. , and York Ridge Lifetech Inc. He is Chairman of Axiotron Corp. (TSXV), director of Soltoro Ltd. (TSXV) and director of Mutual Fund Company Stone Investment Group. Mr. Lawrence was until mid 2009 a Director of One. World Energy Inc. , a private diversified renewable energy company. Mr. Lawrence has a Bachelor of Science in Mechanical Engineering from Queens University and a Masters in Business Administration from the Ivey School of Business. He is also a Chairman of the MIT Enterprise Forum in Toronto. 21

Mark Lawrence, P. Eng. , MBA, CFA Managing Partner - North. Crest Partners Inc. Mark received his designation as a Chartered Financial Analyst in 1990 and has been a registered Professional Engineer since 1985. Mr. Lawrence previously worked in leading North American retail and institutional brokerage firms between 1987 and 1997, including being a Director of Loewen, Ondaatje, Mc. Cutcheon Ltd, a VP of Midland Walwyn Capital Inc. , and the Senior Technology Analyst at Prudential-Bache Securities Inc. Mr. Lawrence became an industry leading software and hardware analyst in Canada. He has worked on cross-border public transactions, equity issues in excess of $2 billion, and on private financings. Since 1997, through CML Capital Ventures Inc. , he has invested in, founded and operated several technology firms, and assisted many others. Some of these include Investors Source (wealth management software), Zacks Canada Inc. , (consensus earnings database service), Classwave Wireless (Bluetooth software), USA. CA Corp. , (investment research portal), Cables. Edge Software (remote desktop access by voice), and Linmor Inc. , (remote network management). In addition, he is a founder of CPCs Blue. Fyre One Inc, Software Growth Inc. , and York Ridge Lifetech Inc. He is Chairman of Axiotron Corp. (TSXV), director of Soltoro Ltd. (TSXV) and director of Mutual Fund Company Stone Investment Group. Mr. Lawrence was until mid 2009 a Director of One. World Energy Inc. , a private diversified renewable energy company. Mr. Lawrence has a Bachelor of Science in Mechanical Engineering from Queens University and a Masters in Business Administration from the Ivey School of Business. He is also a Chairman of the MIT Enterprise Forum in Toronto. 21