679b82cb14a89c9143c16c1a6feeaba1.ppt

- Количество слайдов: 10

Capital Markets Update Rob Stiles EVP & Principal Head of Western Region Cushman & Wakefield Sonnenblick Goldman

1 Property & Finance Update Capital Drought or Capital Bubble – Depends on Where You Stand? ■ Post Triage – Two Worlds Emerge ■ Changing Equity Markets ■ Changing Debt is Back – Really? ■ Resultant Imbalance of Equity Capital Raised to Investment Opportunities ■ So What Will it Take Looking Forward?

2 Post Triage – Two Worlds Emerge ■ Enter REITVILLE – Better Asset Pricing – Cheaper & Higher Leverage Debt – Ability to Price on 3 – 4 Year Forward 7 – 10% returns on Cost – Hard to Get Visas ■ Enter Realityville – Buyers Want Distress – Lenders Want Coverage!? – People Know How to Spell Recourse – Fewer Optimists

3 Changing Equity Markets ■ Plenty of Capital – But Why the Increasing Appetite for Hotels? Ø No Good Alternatives Outside Real Estate Ø Within Real Estate – Only Hotel NOI Has Bottomed Ø Public REITS, Private REITS, PE Funds, Domestic and International HNWs ■ Two Minds of Buyers: Ø Cycle Buyers Who Believe We Have Bottomed Out Ø Buyers Focused on Deep Discounts

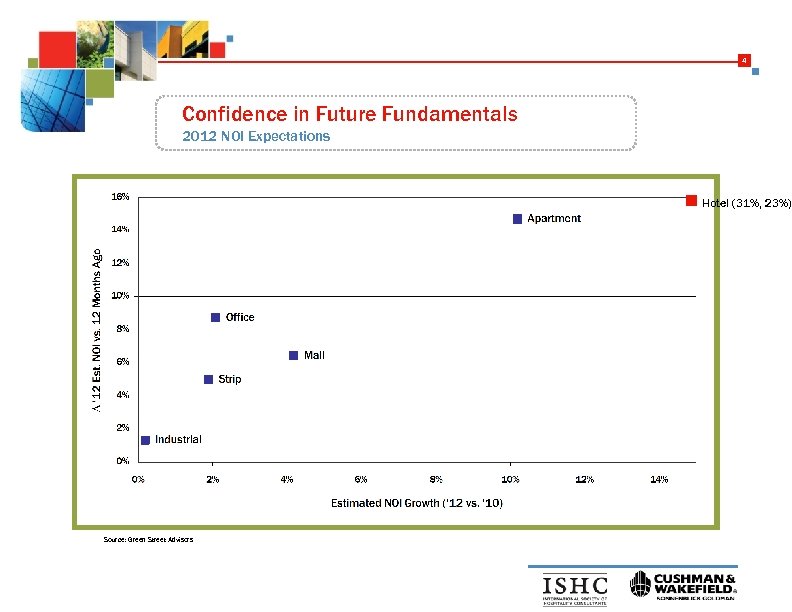

4 Confidence in Future Fundamentals 2012 NOI Expectations n Hotel (31%, 23%) Source: Green Street Advisors

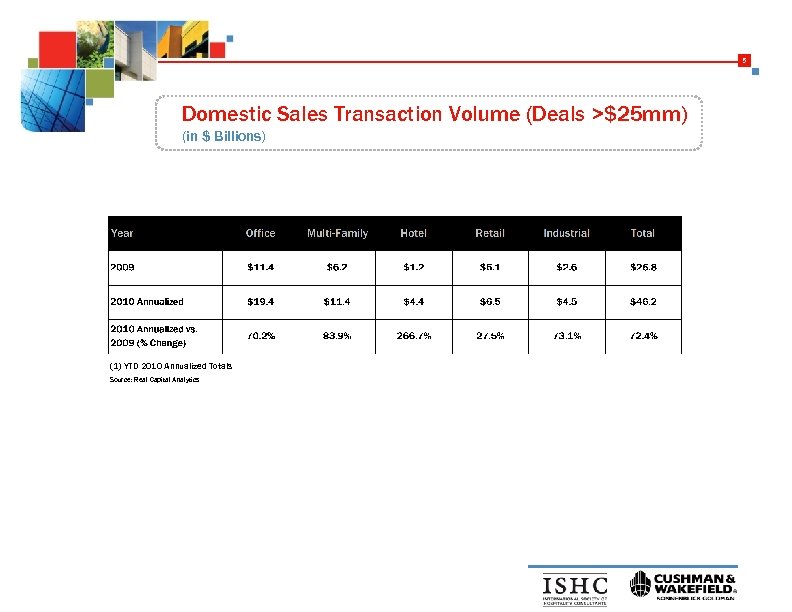

5 Domestic Sales Transaction Volume (Deals >$25 mm) (in $ Billions) (1) YTD 2010 Annualized Totals Source: Real Capital Analytics

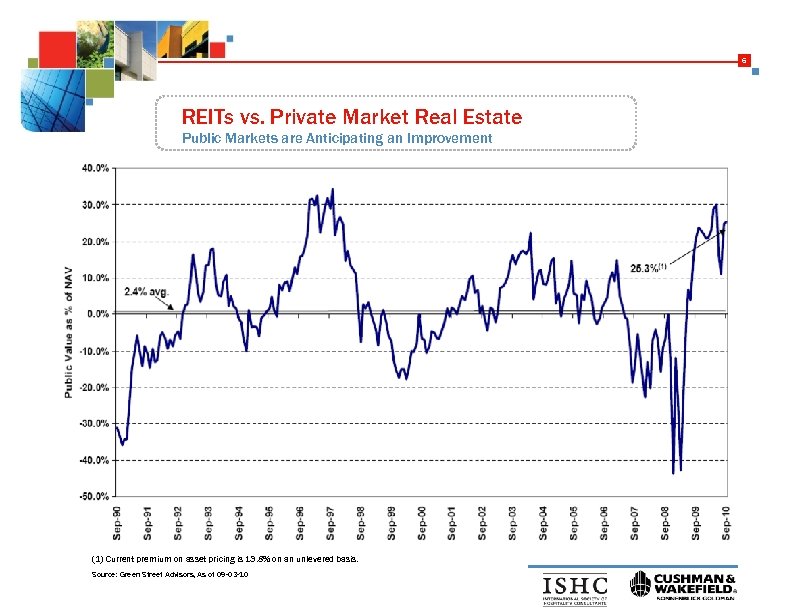

6 REITs vs. Private Market Real Estate Public Markets are Anticipating an Improvement Maximize Value (1) Current premium on asset pricing is 13. 8% on an unlevered basis. Source: Green Street Advisors, As of 09 -03 -10

7 Debt is Back – Really? In One of the Two Worlds Anyway ■ Lack of Debt or Lack of Cash Flow ■ Starting to Look Forward Again! ■ Data is Supportive ■ Yield is Delicious Relative to Options Ø (3. 75 – 4. 25%/Year Fixed for Core Office) ■ CMBS 2. 0 or 1. 2? $6. 3 Billion 4 th Qtr Pipeline ■ General Debt Parameters – Leverage – Coverage / Debt Yield – Pricing – Term

8 Will Resultant Imbalance of Equity Capital Raised Make Sales Happen? ■ Voluntary Opportunistic Sellers Come Out of the Woods – The Surge is Visible (Off a Terribly Low Base) – Suddenly, underwater Owners Have Equity! (But they still can’t refinance their debt) ■ Surging Confidence Among Lenders Leads to Action – Recovery Values move above Marked Loan Values – Lenders are in a Better Position to Get Aggressive

9 So What Will it Take Looking Forward? ■ Debt Costs to Remain Low and Begin to Tighten on the Borders ■ Prospects of Sustained Lower Debt Costs to Push Valuations ■ Lack of Alternatives Will Continue to Attract Capital - $60 Billion of Capital Raised by REITS in 2009 and YTD 2010 ■ Hotels to Become Increasingly Favorable Class (In Reitville) ■ Ability to Compete – Buy on Forward Stabilized Return on Cost ■ Nerves to Play in the Other World (Realityville): Ø DPOs Ø Structured Transactions Ø Note Sales ■ In the End – Its All About the Loathing of Writing Checks ■ Think Long Term –- or Duck

679b82cb14a89c9143c16c1a6feeaba1.ppt