287b1f338f5076ee3c08406467c6fc71.ppt

- Количество слайдов: 19

CAPITAL MARKETS PRESENTED BY ANWAR MISBAH SOUBRA, Phd.

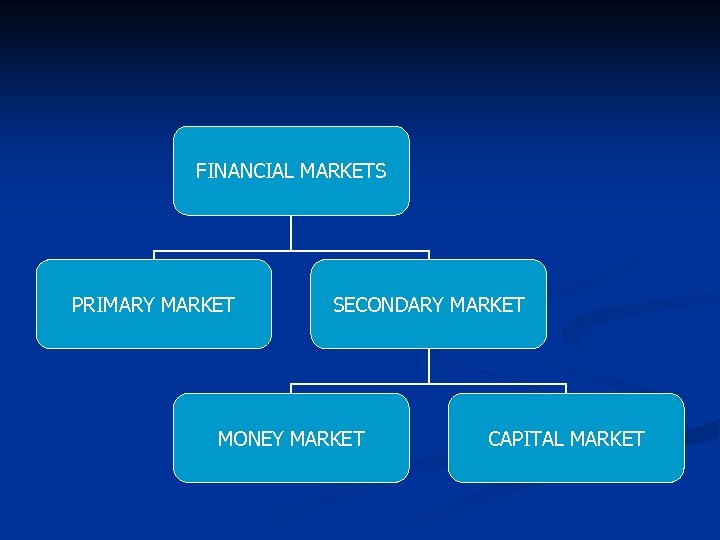

FINANCIAL MARKETS • THE PLACE WHERE FINANCIAL CLAIMS AND SERVICES ARE TRADED. • THE MEETING PLACE AMONG BUYERS AND SELLERS.

MONEY MARKET • THE FINANCIAL INSTITUTION WHERE MONEY IS CHANNELED FROM EXCESS LIQUIDITY ENTITIES TO ENTITIES SHORT IN LIQUIDITY ON A SHORT TERM BASIS.

CAPITAL MARKET • THE INSTITIUTION WHERE LONG TERM FINANCING AND CHANNELING OF FUNDS IS CONCLUDED.

MONEY • WHAT ARE THE FUNCTIONS OF MONEY?

FUNCTIONS OF MONEY 1. STANDARD OF VALUE FOR GOODS AND SERVICES. 2. MEDIUM OF EXCHANGE. 3. STORE OF VALUE.

MONEY ITSELF IS NOT A COMMODITY AND CANNOT BE BOUGHT OR SOLD.

MAJOR SUPPLIERS OF FUNDS IN THE CAPITAL MARKET. 1. 2. 3. 4. COMMERCIAL BANKS. INSURANCE COMPANIES. BUSINESS CORPORATIONS. RETREMENT FUNDS.

MAJOR BORROWERS IN THE CAPITAL MARKET. 1. TREASURY DEPARTMENTS. 2. CORPORATIONS. 3. SECURITIES DEALERS.

CAPITAL MARKET INSTRUMENTS 1. 2. 3. 4. 5. 6. STOCKS. CORPORATE BONDS. MORTGAGES. GOVERNMENT NOTES AND BONDS. MUNICIPAL BONDS. CONSUMER LOANS.

FINANCIAL MARKETS PRIMARY MARKET SECONDARY MARKET MONEY MARKET CAPITAL MARKET

MARKET TYPES 1. SPOT MARKET: FINANCIAL SERVICES ARE TRADED WITH IMMEDIATE DELIVERY. 2. FUTURE MARKET: FUTURE DELIVERY TRADING. (1) 3. FORWARD MARKET: FUTURE DELIVERY TRADING. (2) 4. OPTION MARKET: EXERCISE THE RIGHT TO BUY OR SELL IN EXCHANGE FOR AN OPTION PRICE.

ASSETS TRADED SECURITIES. METALS. COMMODITIES. CURRENCIES. INDEXES.

COMMON CHARACTERISTICS 1. 2. 3. CREDIT. SPECULATION. SHORT SALE.

SHARIA’ VIEW

SHARIA’ DISCUSSIONS: § SPECULATION VS. INVESTMENT. § SHARES: REPRESENT ASSETS AND LIABILITIES (DEBTS). § MARGIN PURCHASES AND LOANS. § COMMON STOCKS: NON-VOTING (MUDARABA), WARRANTS. § PREFERRED STOCKS: GUARANTEE THE PRINCIPAL, FIXED RETURN, CUMULATIVE, CALLABLE, CONVERTIBLE.

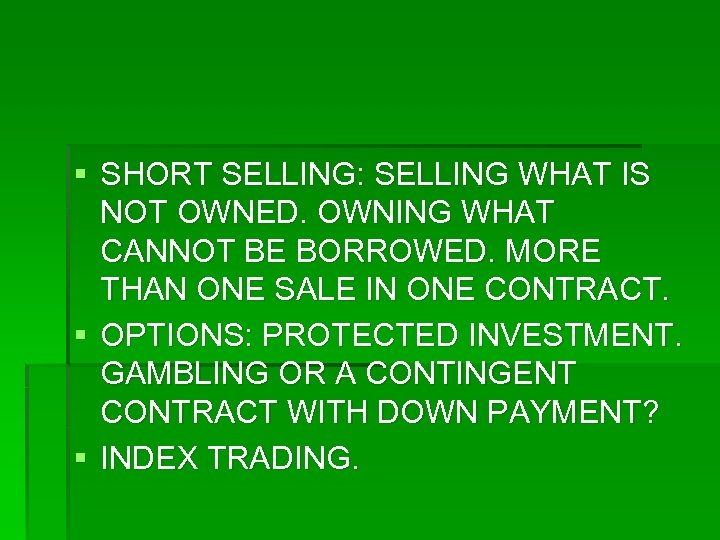

§ SHORT SELLING: SELLING WHAT IS NOT OWNED. OWNING WHAT CANNOT BE BORROWED. MORE THAN ONE SALE IN ONE CONTRACT. § OPTIONS: PROTECTED INVESTMENT. GAMBLING OR A CONTINGENT CONTRACT WITH DOWN PAYMENT? § INDEX TRADING.

§ § § FUTURE TRADING VS. DELIVERY. 97% NON DELIVERY CONTRACTS. CURRENCIES, PRECIOUS METALS.

REVISIT AND REASSURE THE REAL OBJECTIVE OF THE CAPITAL MARKET: CHANNEL SURPLUS LIQUIDITY TO REAL INVESTMENT WITH AN ECONOMIC VALUE ADDED.

287b1f338f5076ee3c08406467c6fc71.ppt