cc1c9cac94613ef8546afde2bd147bfa.ppt

- Количество слайдов: 36

Capital Markets Focus Public Finance Banking Since 1895. Member SIPC and NYSE.

Public Finance Services Investment Banking Overview ® ® ® ® A highly effective business model Expertise in specialty and regional niches Emphasis within Piper Jaffray to grow public finance A recognized leader in the market sectors we serve Middle market focused with a broad spectrum of clients Strong market presence and brand Full product capabilities Consultative approach 2

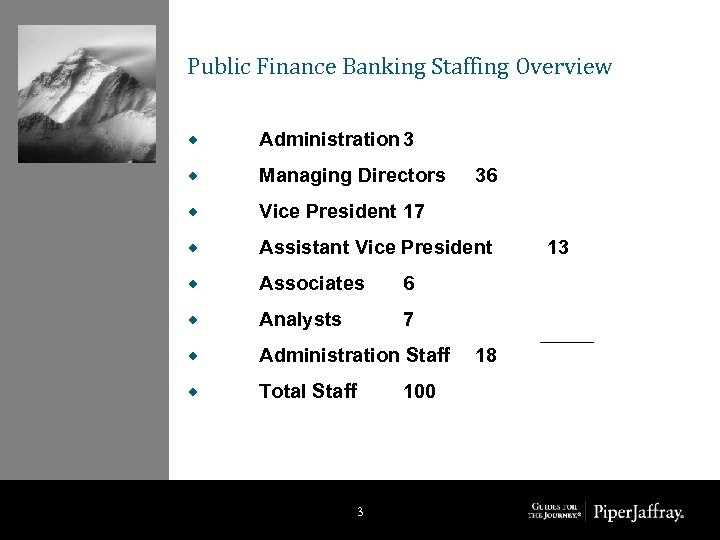

Public Finance Banking Staffing Overview ® Administration 3 ® Managing Directors ® Vice President 17 ® Assistant Vice President ® Associates 6 ® Analysts 7 ® Administration Staff ® Total Staff 3 100 36 18 13

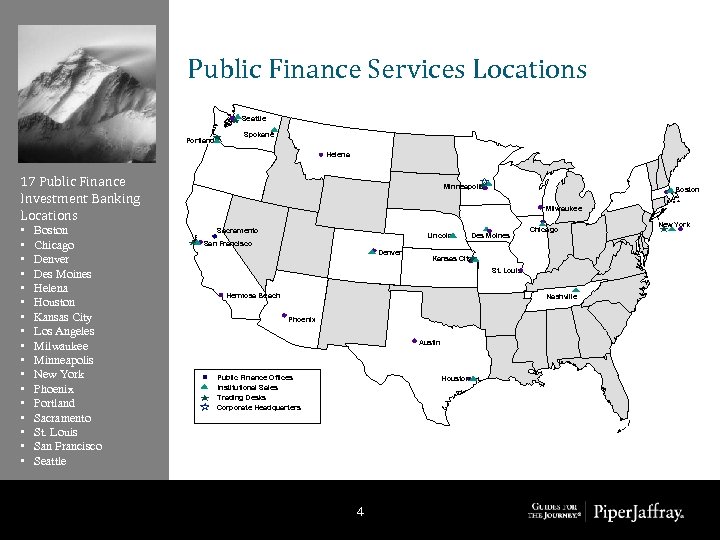

Public Finance Services Locations Seattle Portland Spokane Helena 17 Public Finance Investment Banking Locations • • • • • Boston Chicago Denver Des Moines Helena Houston Kansas City Los Angeles Milwaukee Minneapolis New York Phoenix Portland Sacramento St. Louis San Francisco Seattle Minneapolis Boston Milwaukee Sacramento Lincoln San Francisco Denver Des Moines Chicago Kansas City St. Louis Hermosa Beach Nashville Phoenix Austin Public Finance Offices Institutional Sales Trading Desks Corporate Headquarters Houston 4 New York

Public Finance Business Segments 11 Regional Market Areas for Government Business Office/Market § • • School Bonding Roads/Bridges Sewer/Water Tax Financed Development § § § § § Minneapolis (Minnesota and Dakotas) Des Moines (Iowa) Kansas City/St. Louis (Missouri and Kansas) Milwaukee (Wisconsin) Houston (Texas and New Mexico) Denver (Colorado, Montana) Seattle/Portland (Pacific Northwest) Phoenix (Arizona) San Francisco (California Cities and RDAs) Los Angeles (California Schools) New York (New York and New Jersey) 5

Public Finance Business Segments Five Specialty Business Areas ® Real Estate § ® Single Family Housing § ® A leading practice in working with non-profit hospitals and health care systems Higher Education § ® An underwriter or advisor to 14 state Housing Finance Agencies Health Care § ® A broad-based real estate business including the Multi-Family Housing/Senior Living industries as well as other real estate sectors A significant practice in working with private and public colleges and universities Hospitality/Project Finance § A leader in convention center hotel transactions and other hospitality and project finance areas 6

Public Finance A Full Range of Products and Services ® Negotiated Underwritings Fixed-Rate (High Grade, Bank-Qualified, and High-Yield) § Variable Rate/Auction Rate § Financial Advisory ® Remarketing and Dealer Services for Variable/Auction Issues ® Derivative Products ® SWAPs/Rate Locks § Forward Bond Purchases § Loan Origination and Servicing ® Tender Option Bonds ® 7

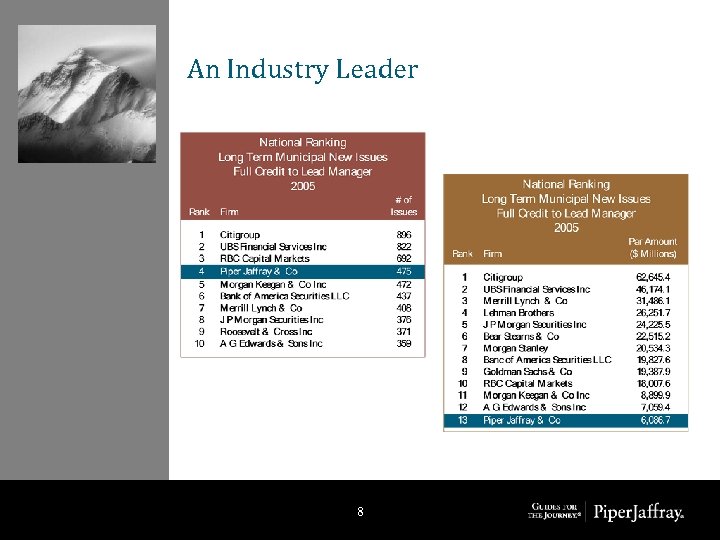

An Industry Leader 8

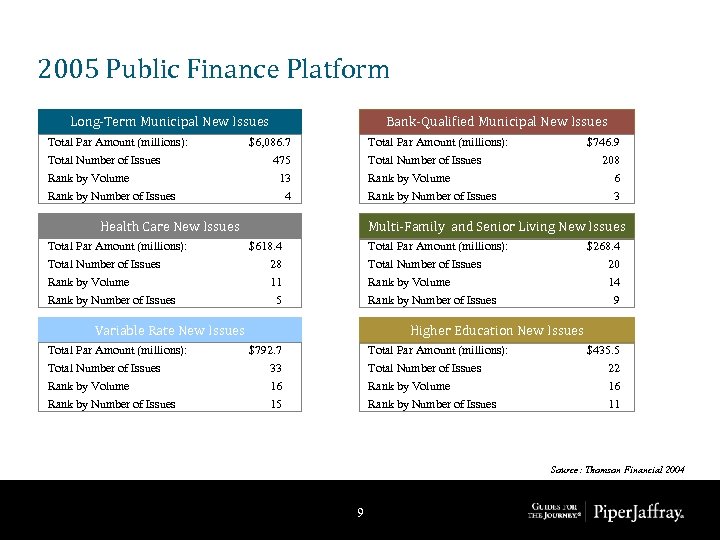

2005 Public Finance Platform Long-Term Municipal New Issues Total Par Amount (millions): Total Number of Issues Rank by Volume Rank by Number of Issues Bank-Qualified Municipal New Issues $6, 086. 7 Total Par Amount (millions): 475 13 4 Total Number of Issues Rank by Volume Rank by Number of Issues Health Care New Issues Total Par Amount (millions): Total Number of Issues Rank by Volume Rank by Number of Issues 208 6 3 Multi-Family and Senior Living New Issues $618. 4 Total Par Amount (millions): 28 11 $268. 4 Total Number of Issues Rank by Volume 5 20 14 Rank by Number of Issues Variable Rate New Issues Total Par Amount (millions): $746. 9 9 Higher Education New Issues $792. 7 Total Par Amount (millions): $435. 5 Total Number of Issues Rank by Volume 33 16 Total Number of Issues Rank by Volume 22 16 Rank by Number of Issues 15 Rank by Number of Issues 11 Source: Thomson Financial 2004 9

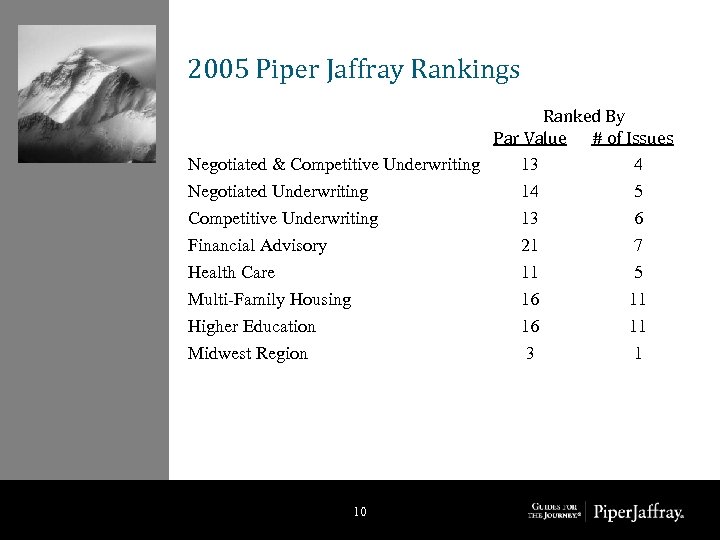

2005 Piper Jaffray Rankings Ranked By Par Value # of Issues Negotiated & Competitive Underwriting 13 4 Negotiated Underwriting 14 5 Competitive Underwriting 13 6 Financial Advisory 21 7 Health Care 11 5 Multi-Family Housing 16 11 Higher Education 16 11 Midwest Region 3 1 10

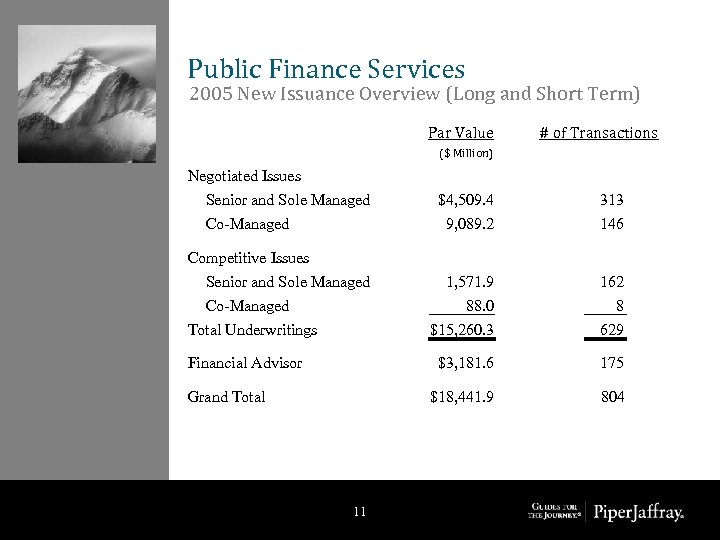

Public Finance Services 2005 New Issuance Overview (Long and Short Term) Par Value # of Transactions ($ Million) Negotiated Issues Senior and Sole Managed Grand Total 11 1, 571. 9 88. 0 $15, 260. 3 162 8 629 175 $18, 441. 9 Financial Advisor 146 $3, 181. 6 Competitive Issues Senior and Sole Managed Co-Managed Total Underwritings 313 9, 089. 2 Co-Managed $4, 509. 4 804

Public Finance Approach to the Business ® Put Client Interests First § ® Focus on Value Added From Expertise and Relationships § ® Underwriting, advisory, remarketing, reinvestment, derivatives, loans Work Together as a Team § ® Follow a well developed business plan to build long-term clients Maximize Revenues by Providing Multiple Services § ® Work with clients as a lead manager or a financial advisor Be Strategic in Allocating our Resources § ® Create solutions through expertise and avoid business based exclusively on price Build Primary Relationships with Clients § ® Be ethical and think long-term Bring multiple specialties together as needed to serve clients Develop Talent within our Firm § Be successful at developing junior staff 12

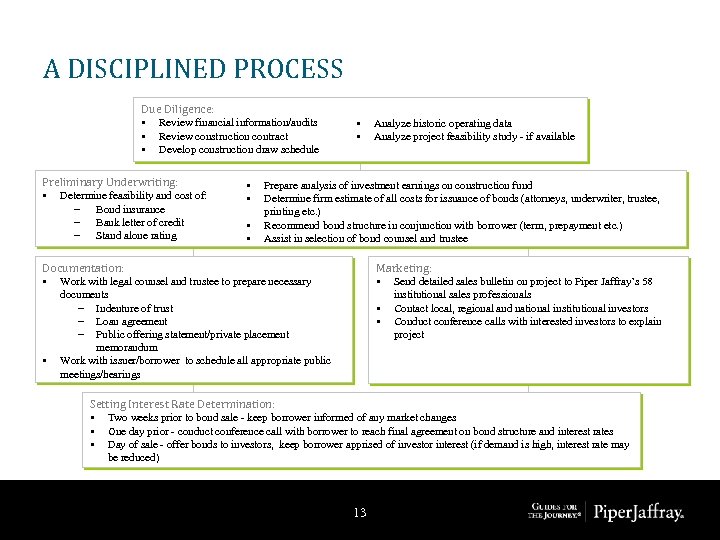

A DISCIPLINED PROCESS Due Diligence: • Review financial information/audits • Review construction contract • Develop construction draw schedule Preliminary Underwriting: • Determine feasibility and cost of: – Bond insurance – Bank letter of credit – Stand alone rating • • • Prepare analysis of investment earnings on construction fund Determine firm estimate of all costs for issuance of bonds (attorneys, underwriter, trustee, printing etc. ) Recommend bond structure in conjunction with borrower (term, prepayment etc. ) Assist in selection of bond counsel and trustee Documentation: • Work with legal counsel and trustee to prepare necessary • Analyze historic operating data Analyze project feasibility study - if available Marketing: • Send detailed sales bulletin on project to Piper Jaffray’s 58 documents – Indenture of trust – Loan agreement – Public offering statement/private placement memorandum Work with issuer/borrower to schedule all appropriate public meetings/hearings • • institutional sales professionals Contact local, regional and national institutional investors Conduct conference calls with interested investors to explain project Setting Interest Rate Determination: • Two weeks prior to bond sale - keep borrower informed of any market changes • One day prior - conduct conference call with borrower to reach final agreement on bond structure and interest rates • Day of sale - offer bonds to investors, keep borrower apprised of investor interest (if demand is high, interest rate may be reduced) 13

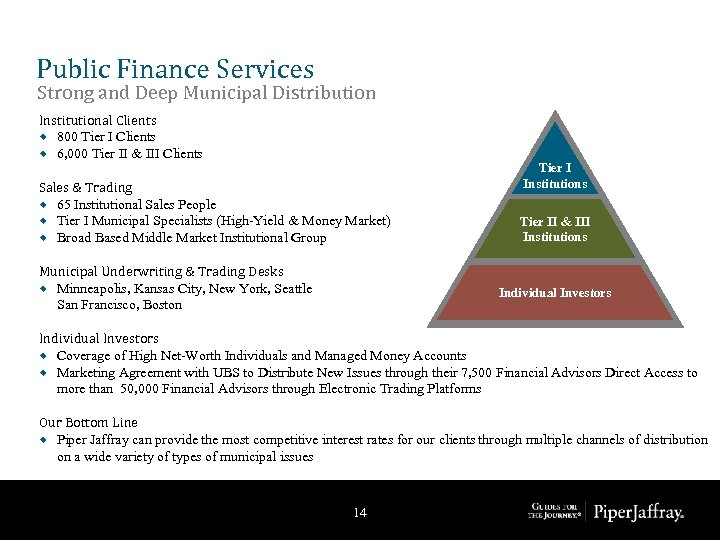

Public Finance Services Strong and Deep Municipal Distribution Institutional Clients ® 800 Tier I Clients ® 6, 000 Tier II & III Clients Sales & Trading ® 65 Institutional Sales People ® Tier I Municipal Specialists (High-Yield & Money Market) ® Broad Based Middle Market Institutional Group Municipal Underwriting & Trading Desks ® Minneapolis, Kansas City, New York, Seattle San Francisco, Boston Tier I Institutions Tier II & III Institutions Individual Investors ® Coverage of High Net-Worth Individuals and Managed Money Accounts ® Marketing Agreement with UBS to Distribute New Issues through their 7, 500 Financial Advisors Direct Access to more than 50, 000 Financial Advisors through Electronic Trading Platforms Our Bottom Line ® Piper Jaffray can provide the most competitive interest rates for our clients through multiple channels of distribution on a wide variety of types of municipal issues 14

Loan Participation Business ® Created by our Public Finance group as an additional product capability for developers and other clients ® We § § originate and service loans through Piper Jaffray Lending LLC To date, we have completed 31 loans totaling more than $500 MM Project types include senior living, commercial real estate, hotels, medical office buildings and condominiums ® We distribute loan participations through our fixed income salesforce to middle market banks and other lenders ® This capability complements our real estate group and other areas of our Public Finance effort 15

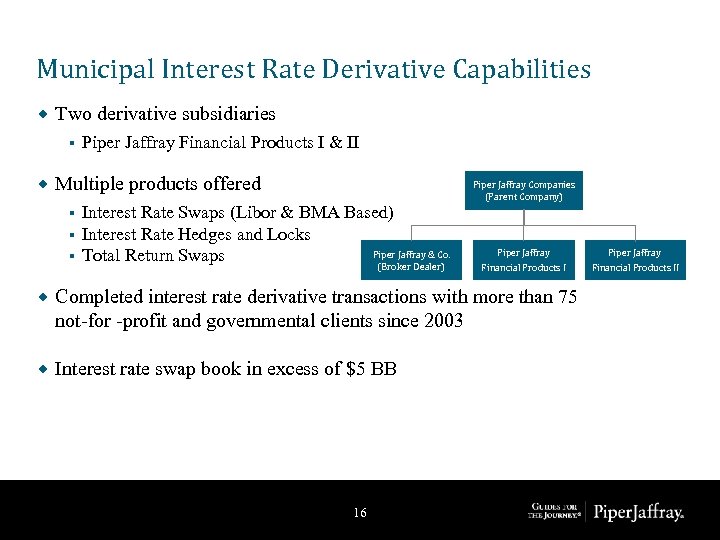

Municipal Interest Rate Derivative Capabilities ® Two derivative subsidiaries § ® Piper Jaffray Financial Products I & II Multiple products offered § § § Interest Rate Swaps (Libor & BMA Based) Interest Rate Hedges and Locks Piper Jaffray & Co. Total Return Swaps (Broker Dealer) Piper Jaffray Companies (Parent Company) Piper Jaffray Financial Products I ® Completed interest rate derivative transactions with more than 75 not-for -profit and governmental clients since 2003 ® Interest rate swap book in excess of $5 BB 16 Piper Jaffray Financial Products II

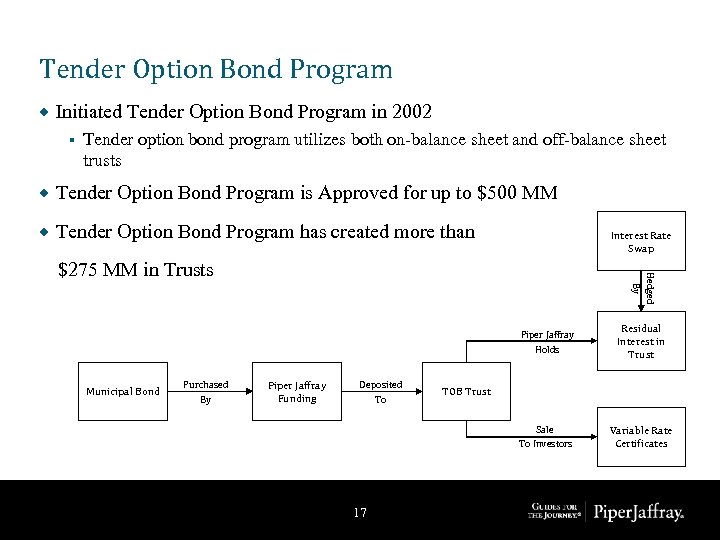

Tender Option Bond Program ® Initiated Tender Option Bond Program in 2002 § Tender option bond program utilizes both on-balance sheet and off-balance sheet trusts ® Tender Option Bond Program is Approved for up to $500 MM ® Tender Option Bond Program has created more than Interest Rate Swap Hedged By $275 MM in Trusts Piper Jaffray Holds Municipal Bond Purchased By Piper Jaffray Funding Sale To Investors Deposited To 17 Residual Interest in Trust Variable Rate Certificates TOB Trust

Public Finance Services Key Directional Strategies ® Expand extend our Public Finance platform Build out existing specialties and geographies § Expand into new geographies § Maintain our current approach and middle market focus § Continue to expand our base of clients § ® Build our loan business Expand our loan origination capabilities § Increase our secondary trading of loans § ® Enhance our taxable fixed-income business Maintain a core capability in traditional products § Expand our business in structured products § Focus on client types where we can add value § Upgrade and expand our sales force as opportunities arise § 18

Public Finance Growth Strategy & Landscape Piper’s Competitive Pluses & Minuses Position Business Area (1) Non-Profit Business ®Health Care Solid Middle Market niche Strategic Direction (+) Use of multiple products Grow toward a national franchise Solid niches in several areas (+) Attractive spreads (+) Solid expertise Grow to add scale & additional capabilities Solid niches in certain states (+) Attractive spreads (+) Solid expertise (-) State laws Grow in states where opportunities exist ®Higher Education ®Cultural Non-Profits (2) Real Estate Business ®Multi-Family Housing ®Senior Living ®Hospitality ®Commercial Real Estate (3) Development Finance ®Tax Increment ®Assessment Bonds ®Special Districts 19

Public Finance Growth Strategy & Landscape Piper’s Competitive Position Business Area (4) Strategic Direction Solid in several states Local Government Finance Pluses & Minuses (-) FA Penetration Grow but pay attention to dynamics for each state Moderate Penetration with many competitors (-) Compete with Wall Street (-) Spread compression (+) High issuance volume ®Cities (-) Spread compression (+) Many Issuers ®School District (5) Large Governmental Issuers ®State & State agencies ®Large cities ®Transportation 20 Grow selectively and consider FA vs. V/W strategy

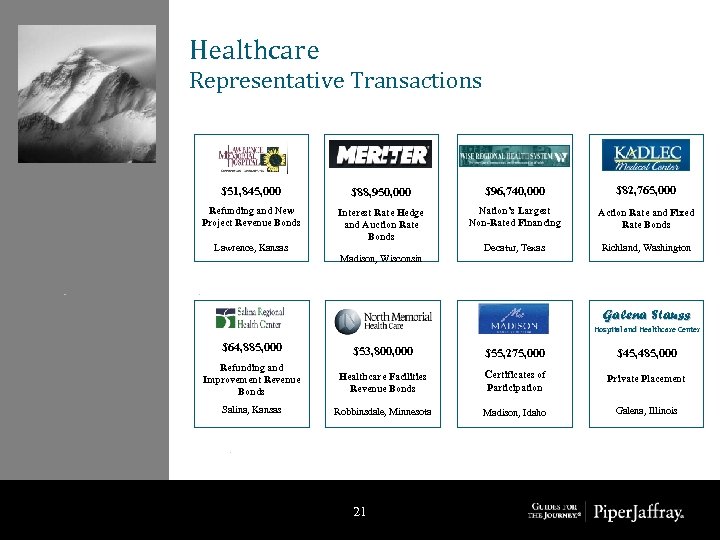

Healthcare Representative Transactions $51, 845, 000 $88, 950, 000 $96, 740, 000 $82, 765, 000 Refunding and New Project Revenue Bonds Interest Rate Hedge and Auction Rate Bonds Nation’s Largest Non-Rated Financing Action Rate and Fixed Rate Bonds Decatur, Texas Richland, Washington Lawrence, Kansas Madison, Wisconsin Galena Stauss Hospital and Healthcare Center $64, 885, 000 $53, 800, 000 $55, 275, 000 $45, 485, 000 Refunding and Improvement Revenue Bonds Healthcare Facilities Revenue Bonds Certificates of Private Placement Salina, Kansas Robbinsdale, Minnesota Madison, Idaho 21 Participation Galena, Illinois

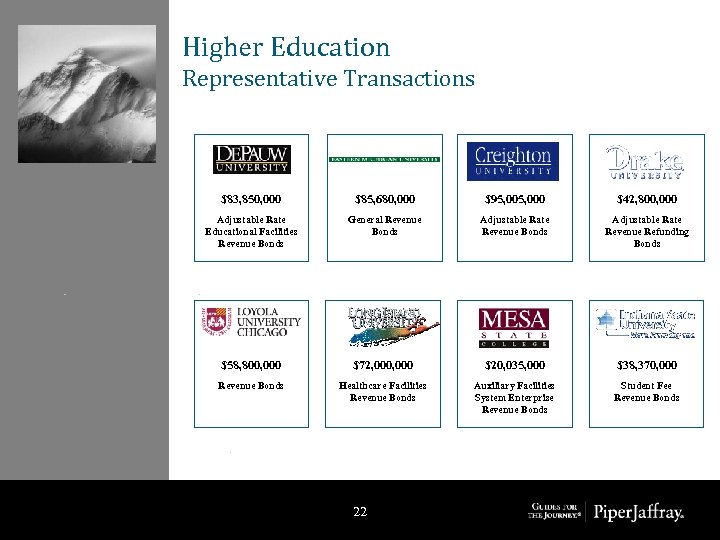

Higher Education Representative Transactions $83, 850, 000 $85, 680, 000 $95, 000 $42, 800, 000 Adjustable Rate Educational Facilities Revenue Bonds General Revenue Bonds Adjustable Rate Revenue Refunding Bonds $58, 800, 000 $72, 000 $20, 035, 000 $38, 370, 000 Revenue Bonds Healthcare Facilities Revenue Bonds Auxiliary Facilities System Enterprise Revenue Bonds Student Fee Revenue Bonds 22

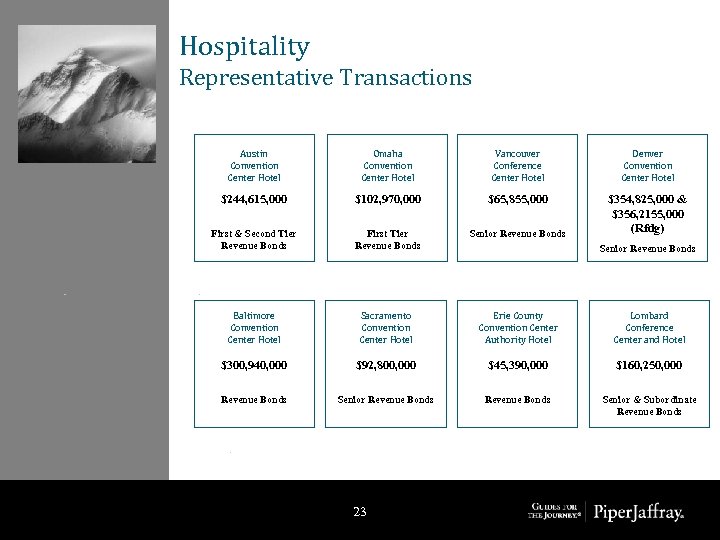

Hospitality Representative Transactions Austin Convention Center Hotel Omaha Convention Center Hotel Vancouver Conference Center Hotel Denver Convention Center Hotel $244, 615, 000 $102, 970, 000 $65, 855, 000 First & Second Tier Revenue Bonds First Tier Revenue Bonds Senior Revenue Bonds $354, 825, 000 & $356, 2155, 000 (Rfdg) Baltimore Convention Center Hotel Sacramento Convention Center Hotel Erie County Convention Center Authority Hotel Lombard Conference Center and Hotel $300, 940, 000 $92, 800, 000 $45, 390, 000 $160, 250, 000 Revenue Bonds Senior & Subordinate Revenue Bonds 23 Senior Revenue Bonds

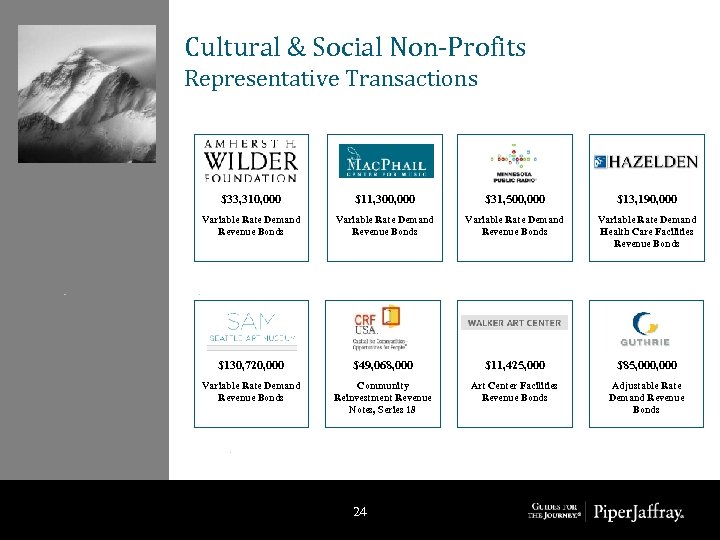

Cultural & Social Non-Profits Representative Transactions $33, 310, 000 $11, 300, 000 $31, 500, 000 $13, 190, 000 Variable Rate Demand Revenue Bonds Variable Rate Demand Health Care Facilities Revenue Bonds $130, 720, 000 $49, 068, 000 $11, 425, 000 $85, 000 Variable Rate Demand Revenue Bonds Community Reinvestment Revenue Notes, Series 18 Art Center Facilities Revenue Bonds Adjustable Rate Demand Revenue Bonds 24

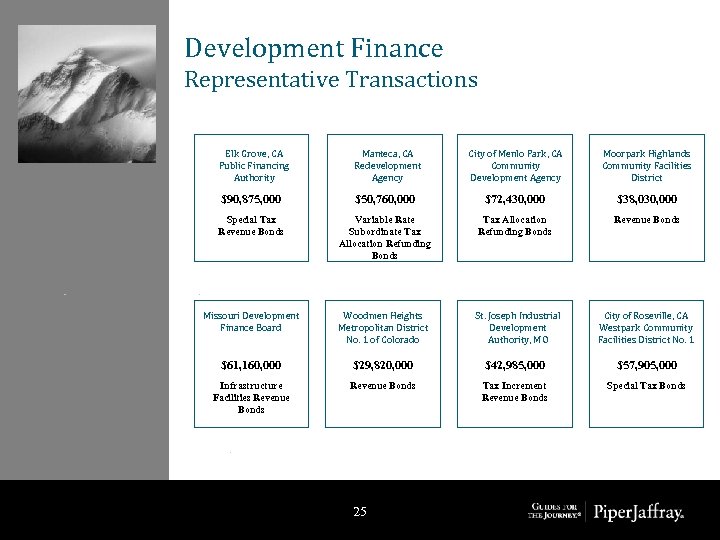

Development Finance Representative Transactions Elk Grove, CA Public Financing Authority Manteca, CA Redevelopment Agency City of Menlo Park, CA Community Development Agency Moorpark Highlands Community Facilities District $90, 875, 000 $50, 760, 000 $72, 430, 000 $38, 030, 000 Special Tax Revenue Bonds Variable Rate Subordinate Tax Allocation Refunding Bonds Revenue Bonds Missouri Development Finance Board Woodmen Heights Metropolitan District No. 1 of Colorado St. Joseph Industrial Development Authority, MO $61, 160, 000 $29, 820, 000 $42, 985, 000 $57, 905, 000 Infrastructure Facilities Revenue Bonds Tax Increment Revenue Bonds Special Tax Bonds 25 City of Roseville, CA Westpark Community Facilities District No. 1

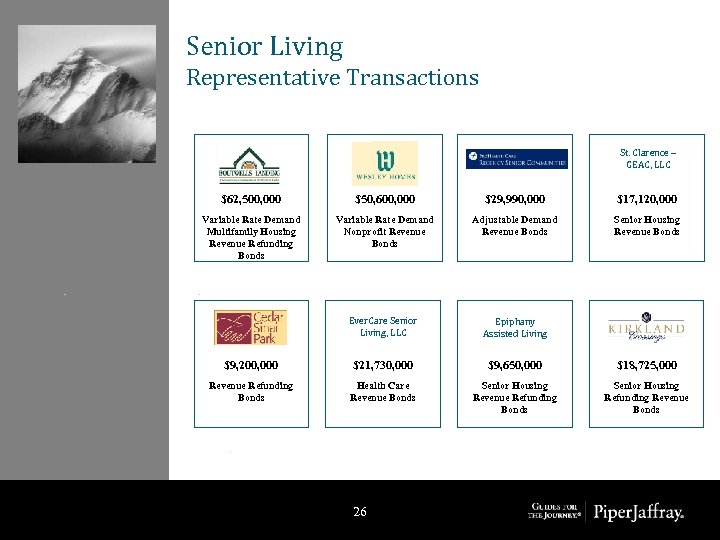

Senior Living Representative Transactions St. Clarence – GEAC, LLC $62, 500, 000 $50, 600, 000 $29, 990, 000 $17, 120, 000 Variable Rate Demand Multifamily Housing Revenue Refunding Bonds Variable Rate Demand Nonprofit Revenue Bonds Adjustable Demand Revenue Bonds Senior Housing Revenue Bonds Ever. Care Senior Living, LLC Epiphany Assisted Living $9, 200, 000 $21, 730, 000 $9, 650, 000 $18, 725, 000 Revenue Refunding Bonds Health Care Revenue Bonds Senior Housing Revenue Refunding Bonds Senior Housing Refunding Revenue Bonds 26

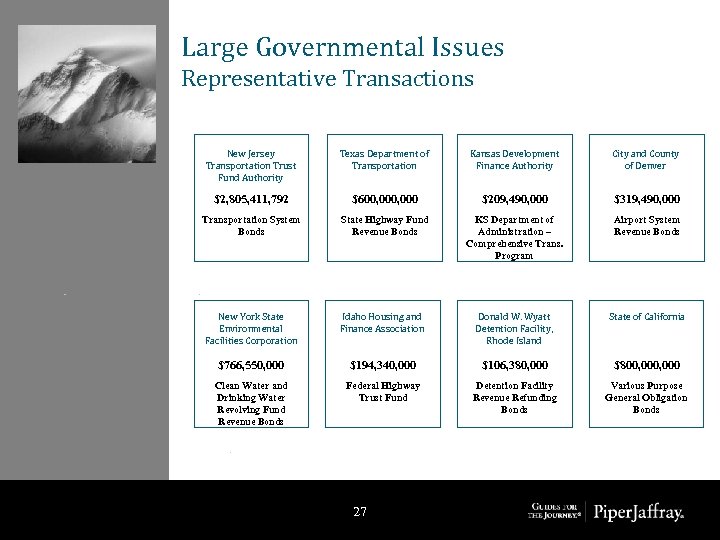

Large Governmental Issues Representative Transactions New Jersey Transportation Trust Fund Authority Texas Department of Transportation Kansas Development Finance Authority City and County of Denver $2, 805, 411, 792 $600, 000 $209, 490, 000 $319, 490, 000 Transportation System Bonds State Highway Fund Revenue Bonds KS Department of Administration – Comprehensive Trans. Program Airport System Revenue Bonds New York State Environmental Facilities Corporation Idaho Housing and Finance Association Donald W. Wyatt Detention Facility, Rhode Island State of California $766, 550, 000 $194, 340, 000 $106, 380, 000 $800, 000 Clean Water and Drinking Water Revolving Fund Revenue Bonds Federal Highway Trust Fund Detention Facility Revenue Refunding Bonds Various Purpose General Obligation Bonds 27

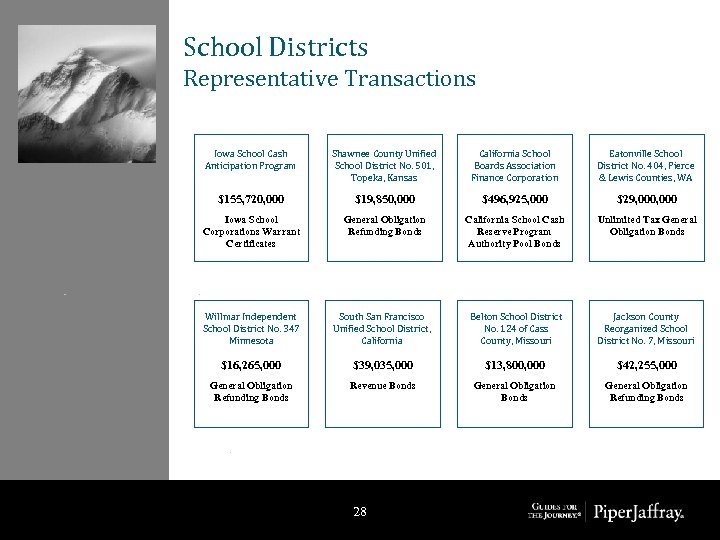

School Districts Representative Transactions Iowa School Cash Anticipation Program Shawnee County Unified School District No. 501, Topeka, Kansas California School Boards Association Finance Corporation Eatonville School District No. 404, Pierce & Lewis Counties, WA $155, 720, 000 $19, 850, 000 $496, 925, 000 $29, 000 Iowa School Corporations Warrant Certificates General Obligation Refunding Bonds California School Cash Reserve Program Authority Pool Bonds Unlimited Tax General Obligation Bonds Willmar Independent School District No. 347 Minnesota South San Francisco Unified School District, California Belton School District No. 124 of Cass County, Missouri Jackson County Reorganized School District No. 7, Missouri $16, 265, 000 $39, 035, 000 $13, 800, 000 $42, 255, 000 General Obligation Refunding Bonds Revenue Bonds General Obligation Refunding Bonds 28

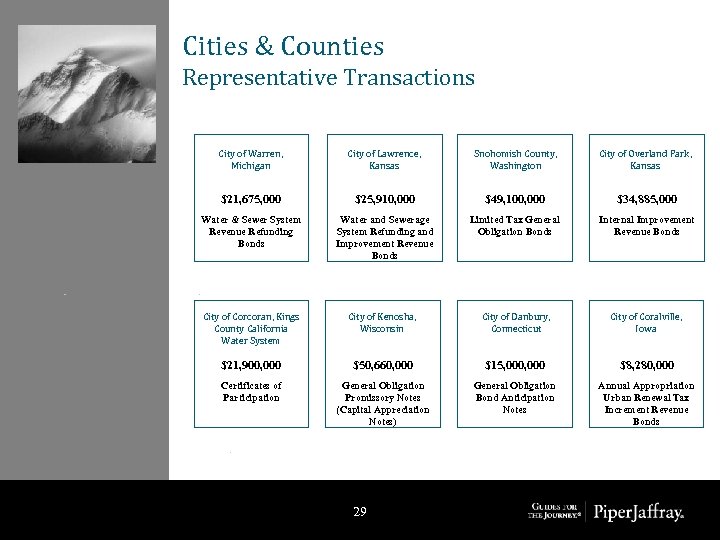

Cities & Counties Representative Transactions City of Warren, Michigan City of Lawrence, Kansas Snohomish County, Washington City of Overland Park, Kansas $21, 675, 000 $25, 910, 000 $49, 100, 000 $34, 885, 000 Water & Sewer System Revenue Refunding Bonds Water and Sewerage System Refunding and Improvement Revenue Bonds Limited Tax General Obligation Bonds Internal Improvement Revenue Bonds City of Corcoran, Kings County California Water System City of Kenosha, Wisconsin City of Danbury, Connecticut City of Coralville, Iowa $21, 900, 000 $50, 660, 000 $15, 000 $8, 280, 000 Certificates of Participation General Obligation Promissory Notes (Capital Appreciation Notes) General Obligation Bond Anticipation Notes Annual Appropriation Urban Renewal Tax Increment Revenue Bonds 29

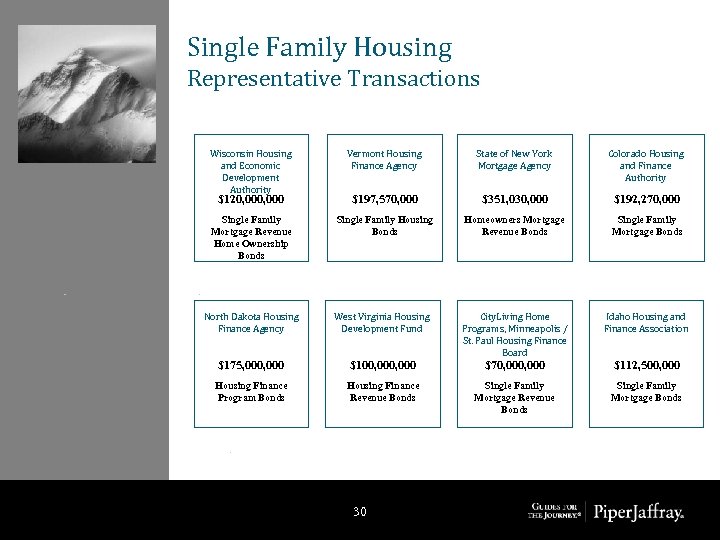

Single Family Housing Representative Transactions Wisconsin Housing and Economic Development Authority Vermont Housing Finance Agency State of New York Mortgage Agency Colorado Housing and Finance Authority $120, 000 $197, 570, 000 $351, 030, 000 $192, 270, 000 Single Family Mortgage Revenue Home Ownership Bonds Single Family Housing Bonds Homeowners Mortgage Revenue Bonds Single Family Mortgage Bonds North Dakota Housing Finance Agency West Virginia Housing Development Fund City. Living Home Programs, Minneapolis / St. Paul Housing Finance Board Idaho Housing and Finance Association $175, 000 $100, 000 $70, 000 $112, 500, 000 Housing Finance Program Bonds Housing Finance Revenue Bonds Single Family Mortgage Bonds 30

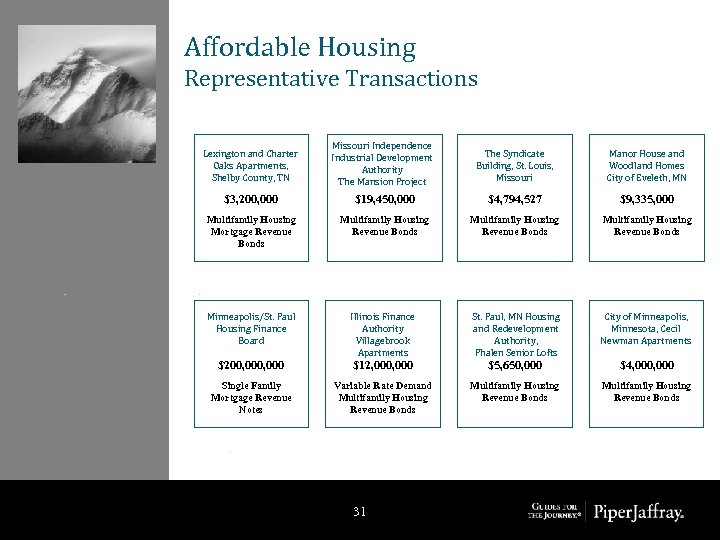

Affordable Housing Representative Transactions Lexington and Charter Oaks Apartments, Shelby County, TN Missouri Independence Industrial Development Authority The Mansion Project The Syndicate Building, St. Louis, Missouri Manor House and Woodland Homes City of Eveleth, MN $3, 200, 000 $19, 450, 000 $4, 794, 527 $9, 335, 000 Multifamily Housing Mortgage Revenue Bonds Multifamily Housing Revenue Bonds Minneapolis/St. Paul Housing Finance Board Illinois Finance Authority Villagebrook Apartments St. Paul, MN Housing and Redevelopment Authority, Phalen Senior Lofts City of Minneapolis, Minnesota, Cecil Newman Apartments $200, 000 $12, 000 $5, 650, 000 $4, 000 Single Family Mortgage Revenue Notes Variable Rate Demand Multifamily Housing Revenue Bonds 31

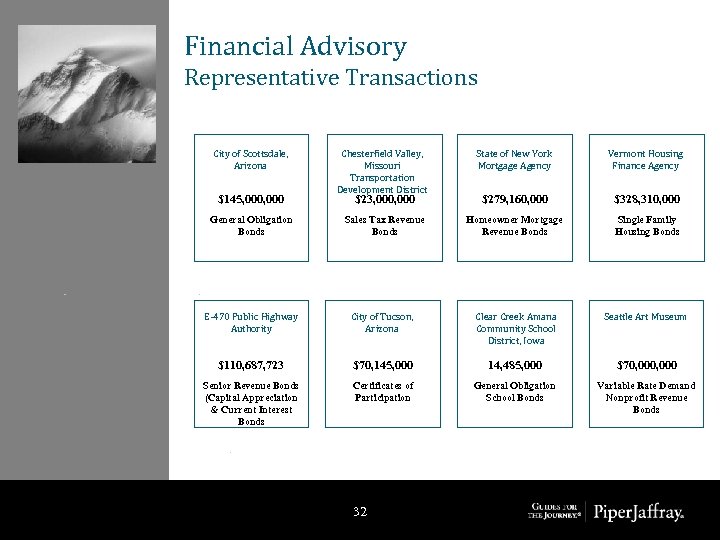

Financial Advisory Representative Transactions City of Scottsdale, Arizona Chesterfield Valley, Missouri Transportation Development District State of New York Mortgage Agency Vermont Housing Finance Agency $23, 000 $279, 160, 000 $328, 310, 000 General Obligation Bonds Sales Tax Revenue Bonds Homeowner Mortgage Revenue Bonds Single Family Housing Bonds E-470 Public Highway Authority City of Tucson, Arizona Clear Creek Amana Community School District, Iowa Seattle Art Museum $110, 687, 723 $70, 145, 000 14, 485, 000 $70, 000 Senior Revenue Bonds (Capital Appreciation & Current Interest Bonds Certificates of Participation General Obligation School Bonds Variable Rate Demand Nonprofit Revenue Bonds $145, 000 32

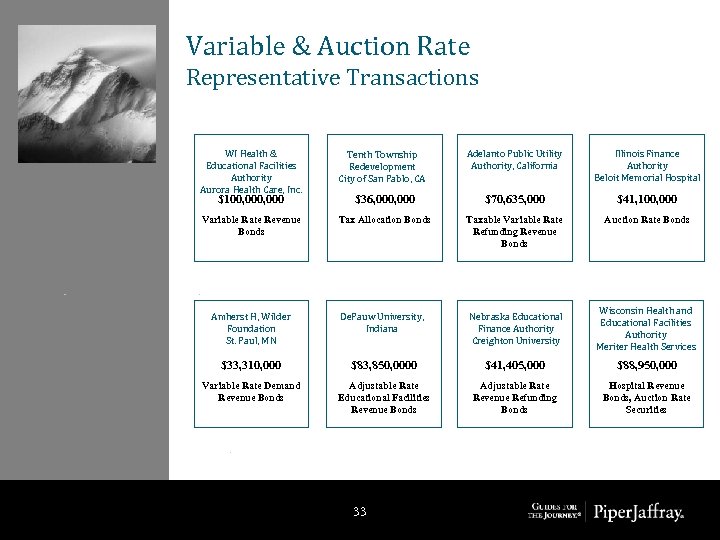

Variable & Auction Rate Representative Transactions WI Health & Educational Facilities Authority Aurora Health Care, Inc. Tenth Township Redevelopment City of San Pablo, CA Adelanto Public Utility Authority, California Illinois Finance Authority Beloit Memorial Hospital $100, 000 $36, 000 $70, 635, 000 $41, 100, 000 Variable Rate Revenue Bonds Tax Allocation Bonds Taxable Variable Rate Refunding Revenue Bonds Auction Rate Bonds Amherst H, Wilder Foundation St. Paul, MN De. Pauw University, Indiana Nebraska Educational Finance Authority Creighton University Wisconsin Health and Educational Facilities Authority Meriter Health Services $33, 310, 000 $83, 850, 0000 $41, 405, 000 $88, 950, 000 Variable Rate Demand Revenue Bonds Adjustable Rate Educational Facilities Revenue Bonds Adjustable Rate Revenue Refunding Bonds Hospital Revenue Bonds, Auction Rate Securities 33

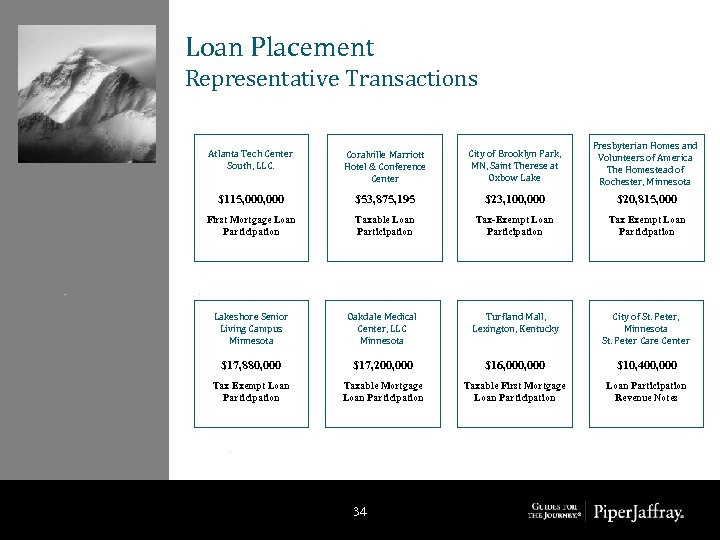

Loan Placement Representative Transactions Atlanta Tech Center South, LLC. Coralville Marriott Hotel & Conference Center City of Brooklyn Park, MN, Saint Therese at Oxbow Lake Presbyterian Homes and Volunteers of America The Homestead of Rochester, Minnesota $115, 000 $53, 875, 195 $23, 100, 000 $20, 815, 000 First Mortgage Loan Participation Taxable Loan Participation Tax-Exempt Loan Participation Tax Exempt Loan Participation Lakeshore Senior Living Campus Minnesota Oakdale Medical Center, LLC Minnesota Turfland Mall, Lexington, Kentucky City of St. Peter, Minnesota St. Peter Care Center $17, 880, 000 $17, 200, 000 $16, 000 $10, 400, 000 Tax Exempt Loan Participation Taxable Mortgage Loan Participation Taxable First Mortgage Loan Participation Revenue Notes 34

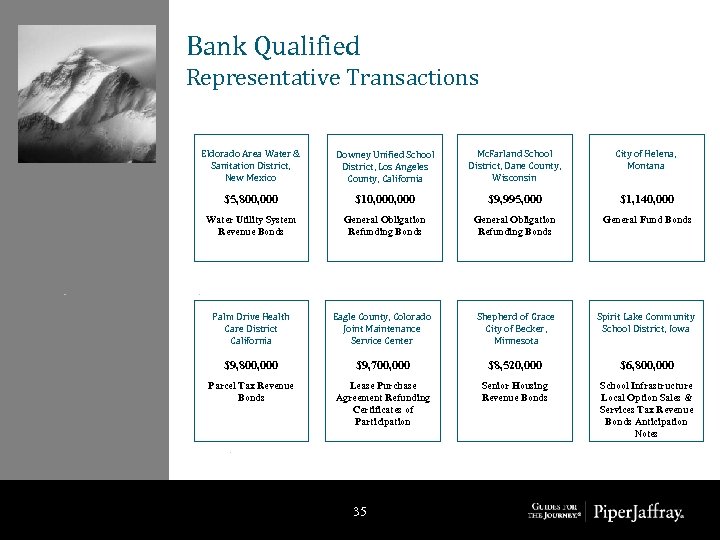

Bank Qualified Representative Transactions Eldorado Area Water & Sanitation District, New Mexico Downey Unified School District, Los Angeles County, California Mc. Farland School District, Dane County, Wisconsin City of Helena, Montana $5, 800, 000 $10, 000 $9, 995, 000 $1, 140, 000 Water Utility System Revenue Bonds General Obligation Refunding Bonds General Fund Bonds Palm Drive Health Care District California Eagle County, Colorado Joint Maintenance Service Center Shepherd of Grace City of Becker, Minnesota Spirit Lake Community School District, Iowa $9, 800, 000 $9, 700, 000 $8, 520, 000 $6, 800, 000 Parcel Tax Revenue Bonds Lease Purchase Agreement Refunding Certificates of Participation Senior Housing Revenue Bonds School Infrastructure Local Option Sales & Services Tax Revenue Bonds Anticipation Notes 35

Questions 36

cc1c9cac94613ef8546afde2bd147bfa.ppt