fa9201d667d8e59c88dca196550a2f54.ppt

- Количество слайдов: 28

Capital Markets Development in Bangladesh: The Status of Dhaka Stock Exchange www. Assignment. Point. com

Meaning of Capital Market The capital market is market for securities, where companies and Governments can raise long-term funds. It is a market in which money is lent for periods longer than a year. The capital market includes the stock market and the bond market. Capital market is the group of interrelated markets, in which capital in financial form is lend or borrowed for medium and long term and, in cases such as equities, for unspecified periods. www. Assignment. Point. com

Sub-Markets of Capital Market Primary Market Capital Market Secondary Market www. Assignment. Point. com

Sub-Markets of Capital Market The Primary Market The primary market deals with newly issued securities and is responsible for generating new long-term capital. The secondary market handles the trading of previouslyissued securities, and must remain highly liquid in nature because most of the securities are sold by investors. www. Assignment. Point. com

ROLE OF CAPITAL MARKET The primary role of the capital market is to raise long-term funds for governments, banks, and corporations while providing a platform for the trading of securities. This fund rising is regulated by the performance of the stock and bond markets within the capital market. www. Assignment. Point. com

Capital Market of Bangladesh capital market is one of the smallest in Asia but the third largest in the south Asia region. It has two full-fledged automated stock exchanges namely - Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange(CSE). It also consists of a dedicated regulator, the Securities and Exchange Commission (SEC), since, it implements rules and regulations, monitors their implications to operate and develop the capita market. www. Assignment. Point. com

SEC Regulating the CSE and DSE CSE DSE SEC www. Assignment. Point. com

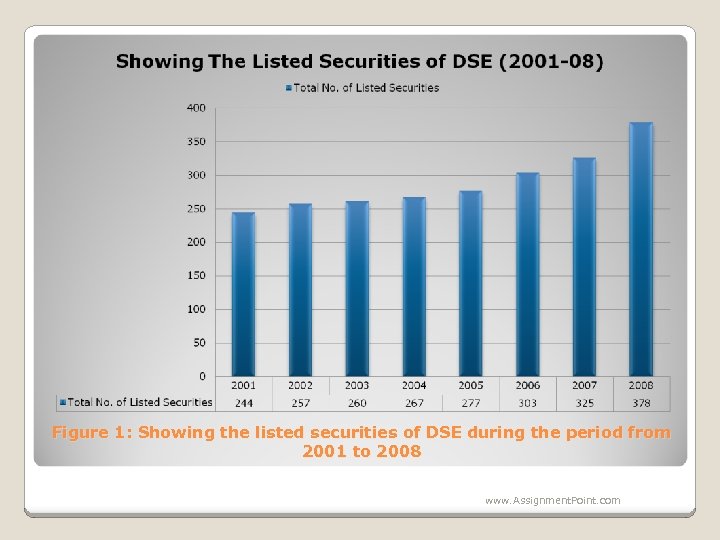

Background of Dhaka Stock Exchange East Pakistan Stock Exchange Ltd was finally named as Dhaka Stock Exchange (DSE) on 14 May 1964. Although incorporated in 1954, formal trading started in 1956. Prior to independence in 1971, the number of listed companies in DSE was 196 with a total paid up capital of Tk. 4 billion. The total number of listed securities is now 378. www. Assignment. Point. com

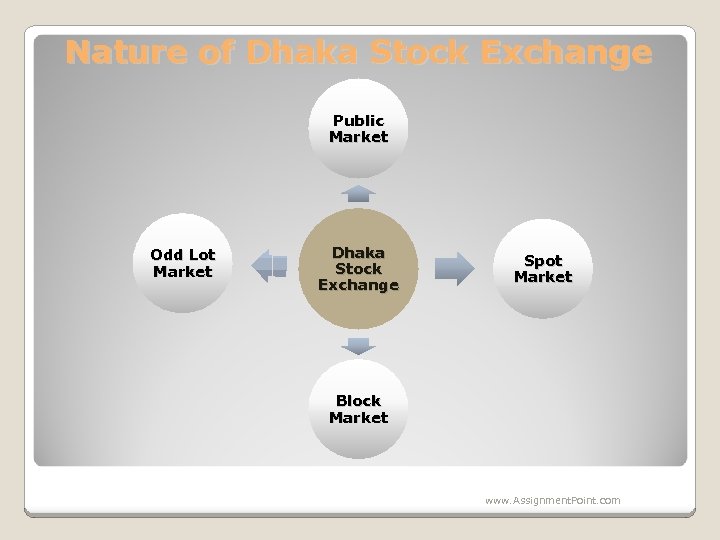

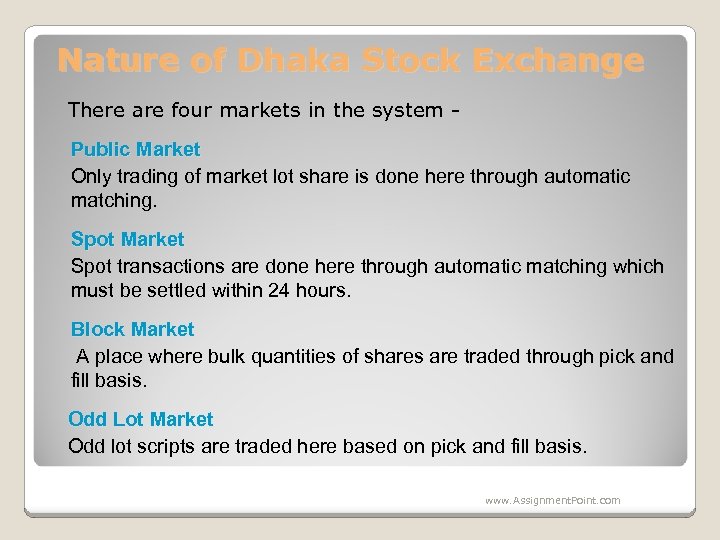

Nature of Dhaka Stock Exchange Public Market Odd Lot Market Dhaka Stock Exchange Spot Market Block Market www. Assignment. Point. com

Nature of Dhaka Stock Exchange There are four markets in the system Public Market Only trading of market lot share is done here through automatic matching. Spot Market Spot transactions are done here through automatic matching which must be settled within 24 hours. Block Market A place where bulk quantities of shares are traded through pick and fill basis. Odd Lot Market Odd lot scripts are traded here based on pick and fill basis. www. Assignment. Point. com

Figure 1: Showing the listed securities of DSE during the period from 2001 to 2008 www. Assignment. Point. com

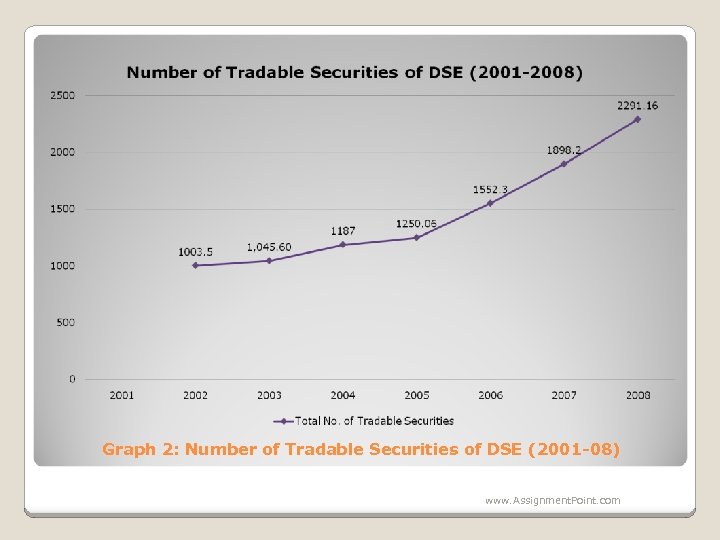

Graph 2: Number of Tradable Securities of DSE (2001 -08) www. Assignment. Point. com

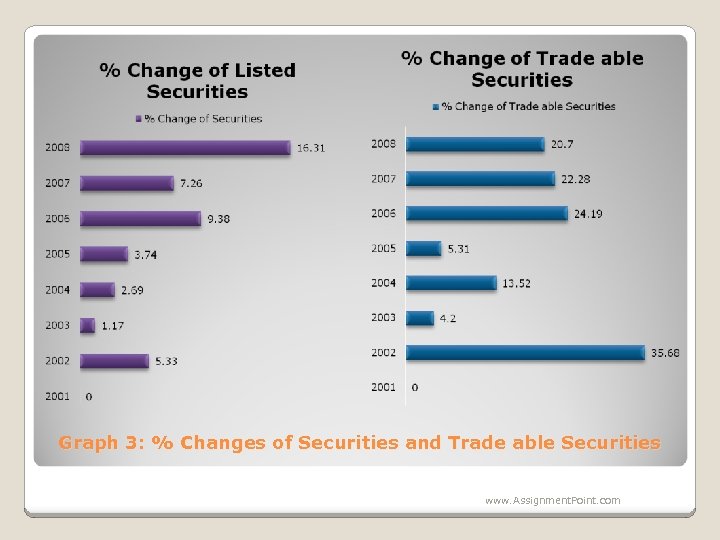

Graph 3: % Changes of Securities and Trade able Securities www. Assignment. Point. com

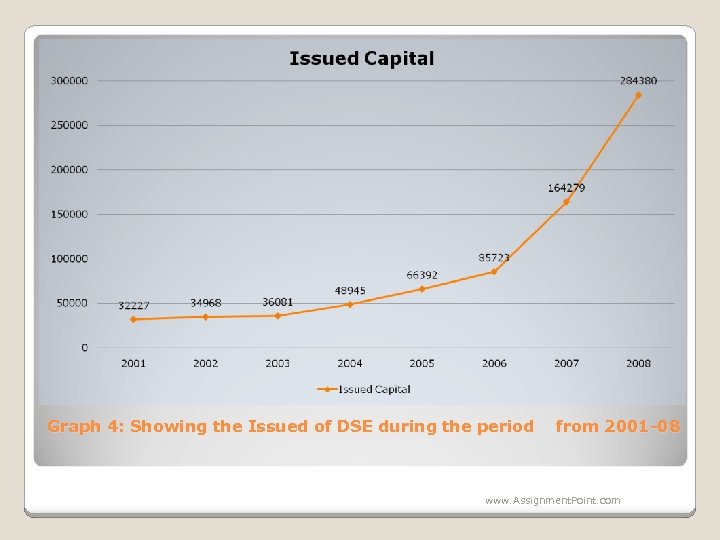

Graph 4: Showing the Issued of DSE during the period from 2001 -08 www. Assignment. Point. com

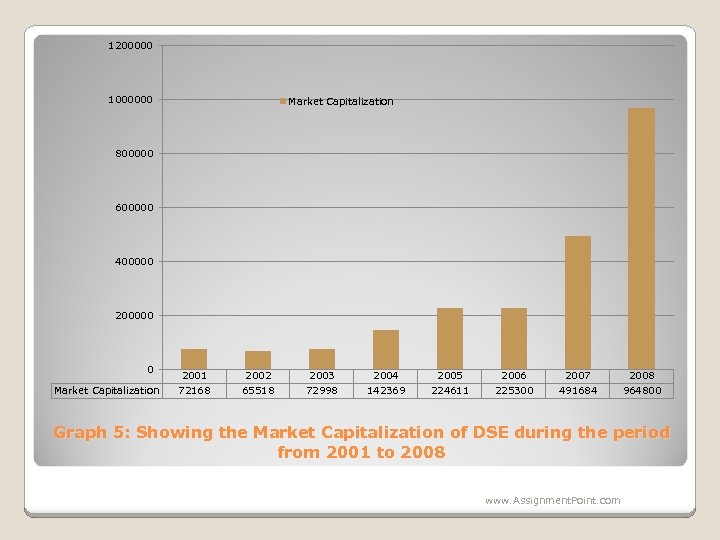

1200000 1000000 Market Capitalization 800000 600000 400000 200000 0 Market Capitalization 2001 72168 2002 65518 2003 72998 2004 142369 2005 224611 2006 225300 2007 491684 2008 964800 Graph 5: Showing the Market Capitalization of DSE during the period from 2001 to 2008 www. Assignment. Point. com

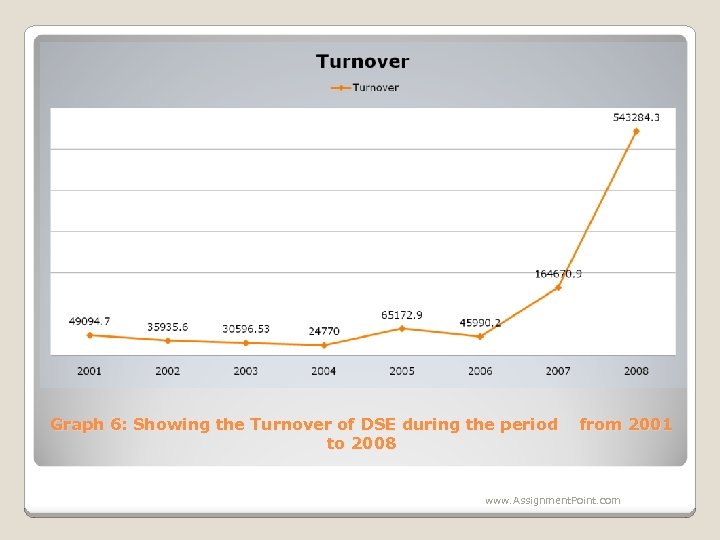

Graph 6: Showing the Turnover of DSE during the period to 2008 from 2001 www. Assignment. Point. com

POLICIES OF DSE can introduce automate monitoring systems that may control price manipulation, malpractices and inside trading. It can make sure all the listed companies publish their annual reports with actual and proper information that can ensure the interest of the investors. To force the listed companies to declare and pay regular dividends through conducting Annual General Meeting. To make arrangement to set up merchant banks, investment banks and floatation of more mutual funds particularly in the private sectors. www. Assignment. Point. com

POLICIES OF DSE (Continued) More banks, insurance companies and other financial institutions should be encouraged to deal in share business directly The management of DSE should be vested with professionals and should not in any way be linked with the ownership of stock exchange and other firms. To train the investors about fundamentals to deal in share transactions. To punish the member brokers for breaching of contract. www. Assignment. Point. com

FUNCTION OF DSE Listing of Companies Providing the screen based automated trading of listed Securities Settlement of trading Granting approval to the transaction Market Administration & Control Market Surveillance www. Assignment. Point. com

FUNCTION OF DSE (Continued) Publication of Monthly Review Monitoring the activities of listed companies Investor’s grievance Cell Investors Protection Fund Announcement of Price sensitive or other information about listed companies through online. www. Assignment. Point. com

PROBLEMS AND LIMITATIONS OF DSE Price Manipulation It has been observed that the share values of some profitable companies have been increased fictitiously some times that hampers the smooth operation of DSE. Delays of settlement Financing procedures and delivery of securities sometimes take an unusual long time for which the money is blocked for nothing. Irregular payment dividends Some companies do not hold Annual General Meeting and eventually declare dividends that do not reflect the real or actual financial positions of the company and ultimately shareholders become confused. www. Assignment. Point. com

PROBLEMS AND LIMITATIONS (continued) Selection of membership Some members being the directors of listed companies of DSE look for their own interest using the internal information of share market. Improper Financial Statement Many companies of DSE do not focus real position of the company as some audit firms involve in corruption while preparing financial statements. As a result the shareholders as well as investors do not have any idea about position of the company. Technical problems and political infighting The concept of centralization of securities market has not been implemented that arises technical problems and political infighting. www. Assignment. Point. com

PROBLEMS AND LIMITATIONS (continued) Lack of skilled manpower in DSE as well as financial and non financial institutions involved in the securities market. The lack of proper policy Absence on framework that provides incentives and protection to investors. www. Assignment. Point. com

SUGGESTIONS TO IMPROVE THE ACTIVITIES OF DSE To force the listed companies to publish their annual reports with actual and proper information that can ensure the interests of investors. To introduce automated monitoring system that may control price manipulation, malpractices and inside trading. To introduce full computerized settlement of transactions. system www. Assignment. Point. com for

SUGGESTIONS TO IMPROVE THE ACTIVITIES OF DSE To force the listed companies to declare and pay regular dividends through conducting Annual General Meeting. To take remedial action against the issues of fake certificates. Banks, insurance companies and other financial institutions should be encouraged deal in share business directly. To punish the member brokers for breaching of contract. www. Assignment. Point. com

Capital Market Development Program in Bangladesh Strengthening market regulation and supervision Developing the capital market infrastructure Modernizing capital market support facilities Increasing the limited supply of securities in the market Developing institutional sources of demand for securities in the market and Improving policy coordination. www. Assignment. Point. com

2010 AS A BRIGHT YEAR IF WE CAN ENSURE To ensure an adequate supply of quality shares of telecommunications, energy and pharmaceutical firms, which are attractive sectors foreign funds. Surrounding easy access to information and coordination among regulatory bodies that needed attention. Better coordination among the government and relevant agencies. Efforts among policy-makers and regulators like the central bank, tax authority, stock market watchdog and investment board which is needed to sustain the present inflow of portfolio investment in the country's stock market. www. Assignment. Point. com

Thank You All The End www. Assignment. Point. com

fa9201d667d8e59c88dca196550a2f54.ppt