Capital Market Course 5

Capital Market Course 5

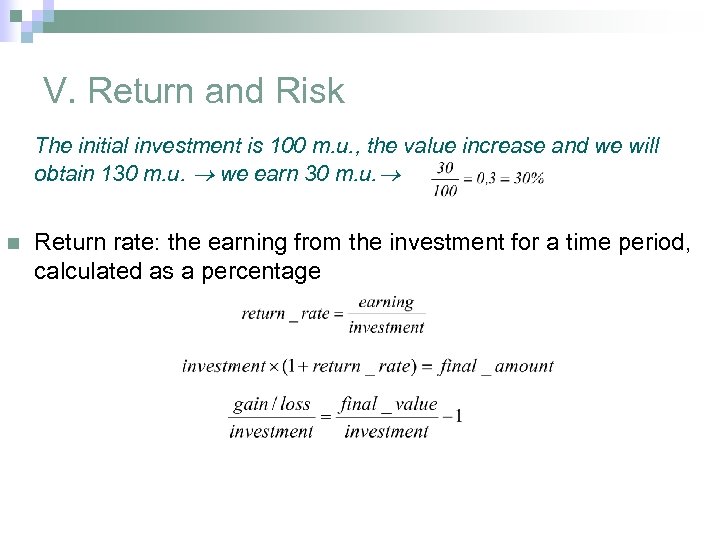

V. Return and Risk The initial investment is 100 m. u. , the value increase and we will obtain 130 m. u. we earn 30 m. u. n Return rate: the earning from the investment for a time period, calculated as a percentage

V. Return and Risk The initial investment is 100 m. u. , the value increase and we will obtain 130 m. u. we earn 30 m. u. n Return rate: the earning from the investment for a time period, calculated as a percentage

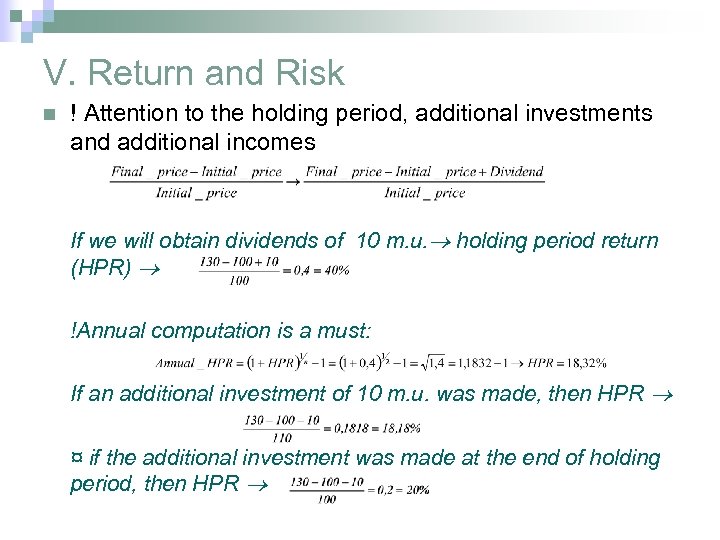

V. Return and Risk n ! Attention to the holding period, additional investments and additional incomes If we will obtain dividends of 10 m. u. holding period return (HPR) !Annual computation is a must: If an additional investment of 10 m. u. was made, then HPR ¤ if the additional investment was made at the end of holding period, then HPR

V. Return and Risk n ! Attention to the holding period, additional investments and additional incomes If we will obtain dividends of 10 m. u. holding period return (HPR) !Annual computation is a must: If an additional investment of 10 m. u. was made, then HPR ¤ if the additional investment was made at the end of holding period, then HPR

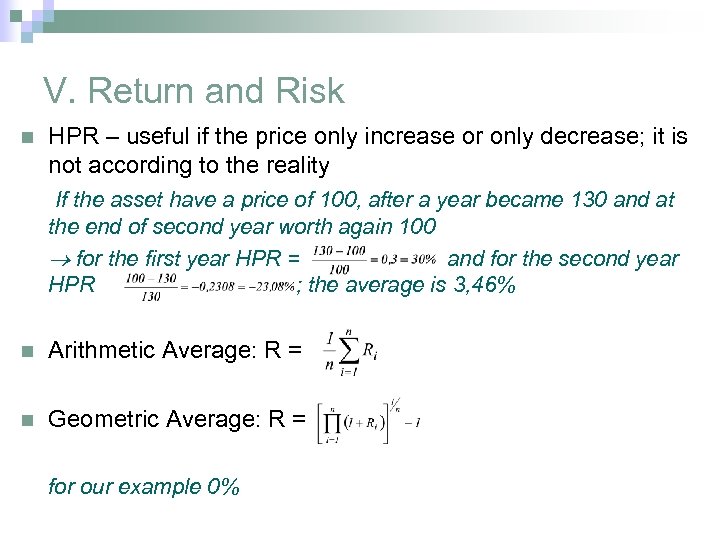

V. Return and Risk n HPR – useful if the price only increase or only decrease; it is not according to the reality If the asset have a price of 100, after a year became 130 and at the end of second year worth again 100 for the first year HPR = and for the second year HPR ; the average is 3, 46% n Arithmetic Average: R = n Geometric Average: R = for our example 0%

V. Return and Risk n HPR – useful if the price only increase or only decrease; it is not according to the reality If the asset have a price of 100, after a year became 130 and at the end of second year worth again 100 for the first year HPR = and for the second year HPR ; the average is 3, 46% n Arithmetic Average: R = n Geometric Average: R = for our example 0%

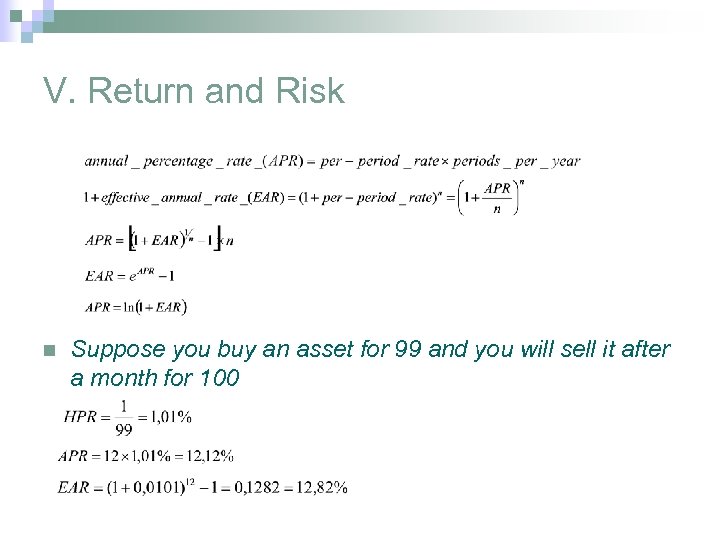

V. Return and Risk n Suppose you buy an asset for 99 and you will sell it after a month for 100

V. Return and Risk n Suppose you buy an asset for 99 and you will sell it after a month for 100

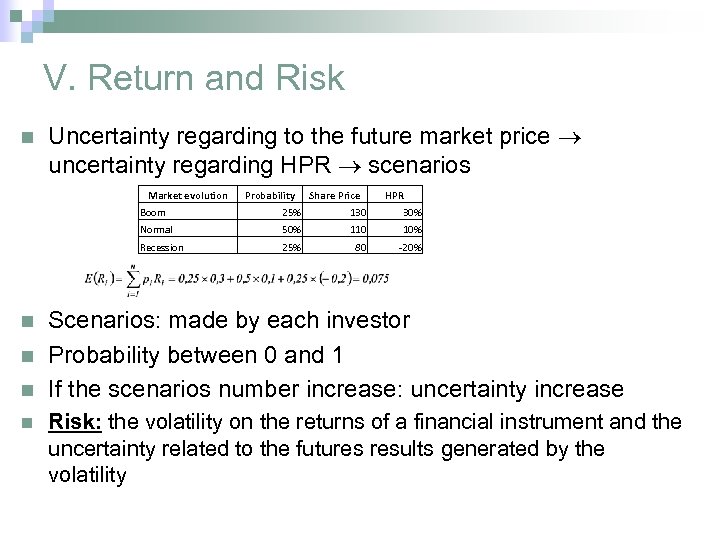

V. Return and Risk n Uncertainty regarding to the future market price uncertainty regarding HPR scenarios Market evolution Probability Share Price HPR Boom n n 30% 50% 110 10% Recession n 130 Normal n 25% 80 -20% Scenarios: made by each investor Probability between 0 and 1 If the scenarios number increase: uncertainty increase Risk: the volatility on the returns of a financial instrument and the uncertainty related to the futures results generated by the volatility

V. Return and Risk n Uncertainty regarding to the future market price uncertainty regarding HPR scenarios Market evolution Probability Share Price HPR Boom n n 30% 50% 110 10% Recession n 130 Normal n 25% 80 -20% Scenarios: made by each investor Probability between 0 and 1 If the scenarios number increase: uncertainty increase Risk: the volatility on the returns of a financial instrument and the uncertainty related to the futures results generated by the volatility

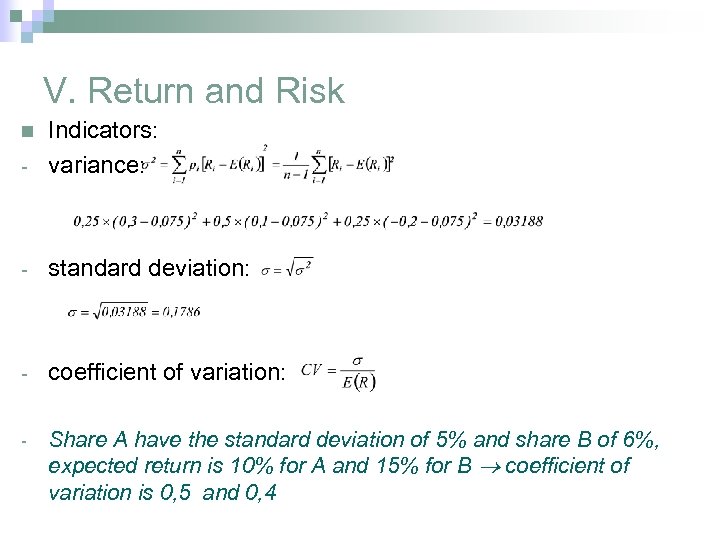

V. Return and Risk - Indicators: variance: - standard deviation: - coefficient of variation: - Share A have the standard deviation of 5% and share B of 6%, expected return is 10% for A and 15% for B coefficient of variation is 0, 5 and 0, 4 n

V. Return and Risk - Indicators: variance: - standard deviation: - coefficient of variation: - Share A have the standard deviation of 5% and share B of 6%, expected return is 10% for A and 15% for B coefficient of variation is 0, 5 and 0, 4 n

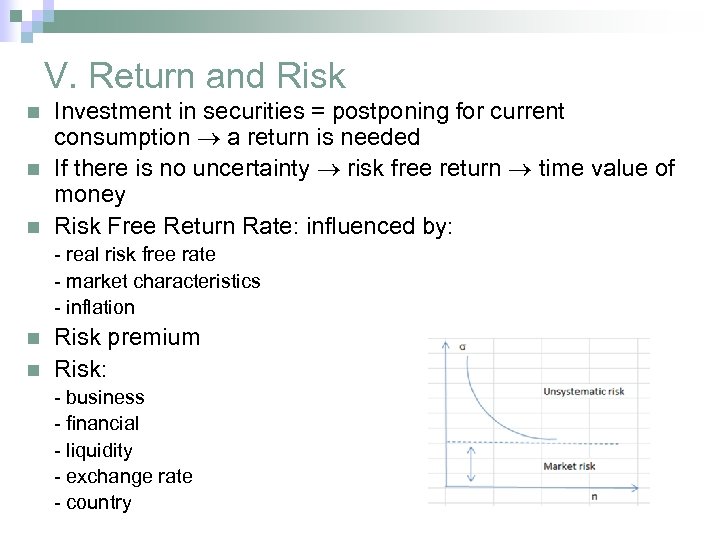

V. Return and Risk n n n Investment in securities = postponing for current consumption a return is needed If there is no uncertainty risk free return time value of money Risk Free Return Rate: influenced by: - real risk free rate - market characteristics - inflation n n Risk premium Risk: - business - financial - liquidity - exchange rate - country

V. Return and Risk n n n Investment in securities = postponing for current consumption a return is needed If there is no uncertainty risk free return time value of money Risk Free Return Rate: influenced by: - real risk free rate - market characteristics - inflation n n Risk premium Risk: - business - financial - liquidity - exchange rate - country

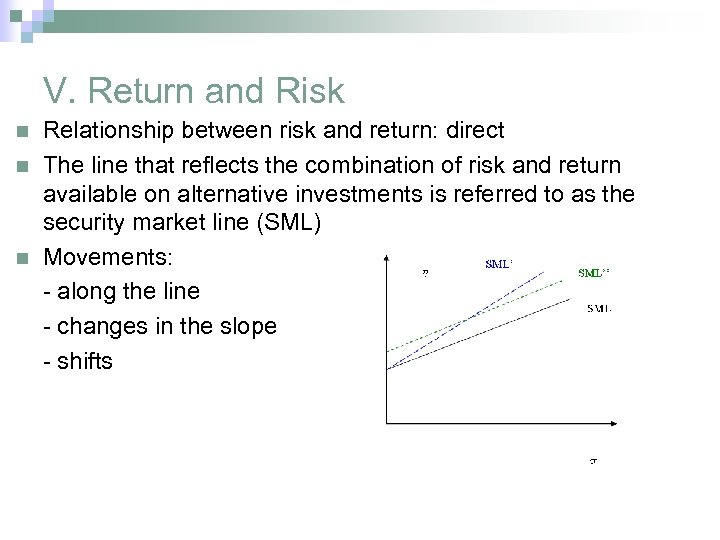

V. Return and Risk n n n Relationship between risk and return: direct The line that reflects the combination of risk and return available on alternative investments is referred to as the security market line (SML) Movements: - along the line - changes in the slope - shifts

V. Return and Risk n n n Relationship between risk and return: direct The line that reflects the combination of risk and return available on alternative investments is referred to as the security market line (SML) Movements: - along the line - changes in the slope - shifts

Bibliography n n Bodie, Z. , A. Kane, and A. J. Marcus (2007): Essentials of Investments, 6 th edition, Mc. Graw Hill International Edition Reilly, F. , and K. Brown (2006): Investments Analysis and Portfolio Management, 8 th edition, South-Western, Div of Thomson Learning; International Ed.

Bibliography n n Bodie, Z. , A. Kane, and A. J. Marcus (2007): Essentials of Investments, 6 th edition, Mc. Graw Hill International Edition Reilly, F. , and K. Brown (2006): Investments Analysis and Portfolio Management, 8 th edition, South-Western, Div of Thomson Learning; International Ed.