a557e89b4f0b8f9f283c10b350ee9217.ppt

- Количество слайдов: 9

Capital-flows view n Intertemporal trade (international borrowing and lending) See Chp. 1 Obstfeld and Rogoff n See class notes n n Bottom line: Countries can gain from intertemporal trade

Global Saving Glut n n See Ben Bernanke (2005) “The Global Saving Glut and the U. S. Current Account Deficit” Diverse forces increase in the global supply of saving increase in U. S. current account deficit and low long-term real interest rates

Industrial countries n n Aging populations high saving rates to help support future retirees High K/L ratios low prospective returns on investment

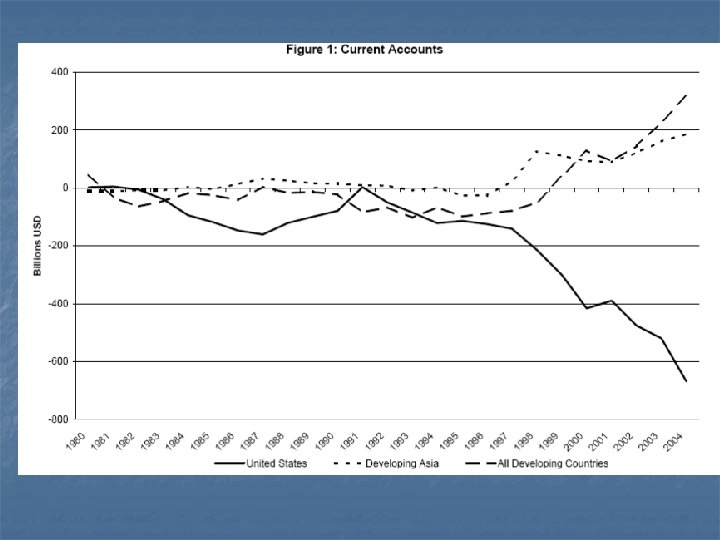

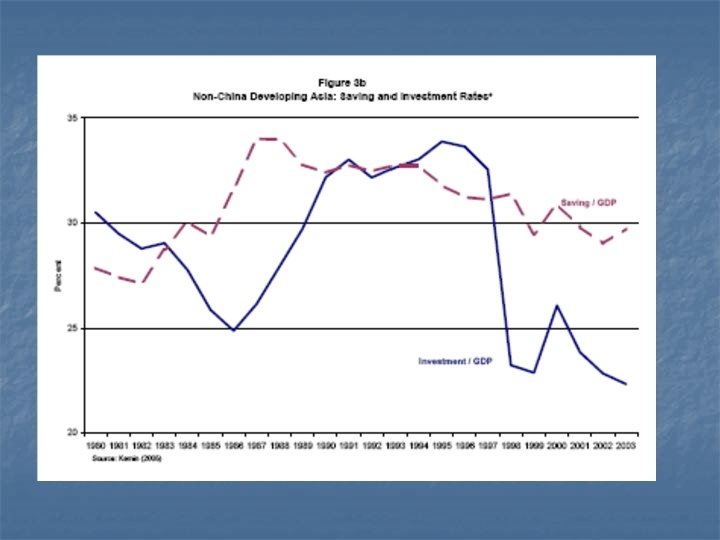

Developing countries n n n Big swing in current account positions since mid 1990 s (see Table 1) Developing countries switch from international borrowers to international lenders Financial crises n n Desire to build up FX reserves Export led-growth strategies Depressed investment High oil prices

United States n 1996 -2000: Inflows to U. S. stock markets n n n Wealth effect higher consumer spending Stronger dollar boosted imports and hurt exports Post-2000: Global investment weakened low real interest rates boost U. S. house prices wealth effect n Recovery in BFI and strong residential investment

Concerns n n n Capital is flowing the “wrong” way Capital may not be flowing into productive investment in the US Adjustment costs related to moving resources across sectors

Policy Implications n n n “Capital flows” view: no reason why “imbalances” can persist for long time “Trade flows” view: no reason why ROW will finance US deficit for extended period Under both views: dollar must drop Resource reallocation n Demand management n

a557e89b4f0b8f9f283c10b350ee9217.ppt