bcc8368da1d4bd024542ddcccff83931.ppt

- Количество слайдов: 27

Capacity Planning in a General Supply Chain with Multiple Contract Types Stephen C. Graves and Xin Huang May 2008 1

Capacity Planning in a General Supply Chain with Multiple Contract Types Stephen C. Graves and Xin Huang May 2008 1

Motivation • Prior research has developed algorithms and software for modeling and optimizing the inventory across a supply chain – “strategic inventory placement model” • Impetus for current research – develop and deploy a tactical model to provide decision support for determining capacity levels across a supply chain Copyright Stephen C. Graves 2008 All Rights Reserved 2

Motivation • Prior research has developed algorithms and software for modeling and optimizing the inventory across a supply chain – “strategic inventory placement model” • Impetus for current research – develop and deploy a tactical model to provide decision support for determining capacity levels across a supply chain Copyright Stephen C. Graves 2008 All Rights Reserved 2

Intent • Develop a framework to support capacity planning decisions in a supply chain with − Multiple products − Each product requires multiple processes components) (or − Each resource provides capacity for one or more processes • Need to determine the right level and type of capacity investments • Need to account for network interrelationships , demand uncertainty , multiple time periods , & different capacity contracts. Copyright Stephen C. Graves 2008 All Rights Reserved 3

Intent • Develop a framework to support capacity planning decisions in a supply chain with − Multiple products − Each product requires multiple processes components) (or − Each resource provides capacity for one or more processes • Need to determine the right level and type of capacity investments • Need to account for network interrelationships , demand uncertainty , multiple time periods , & different capacity contracts. Copyright Stephen C. Graves 2008 All Rights Reserved 3

Work to Date • Developed framework for structuring models • Developed and tested algorithms for determining the amount, type and timing of capacity investments across a complex multi-product supply chain • Implementation of user-friendly software is underway Copyright Stephen C. Graves 2008 All Rights Reserved 4

Work to Date • Developed framework for structuring models • Developed and tested algorithms for determining the amount, type and timing of capacity investments across a complex multi-product supply chain • Implementation of user-friendly software is underway Copyright Stephen C. Graves 2008 All Rights Reserved 4

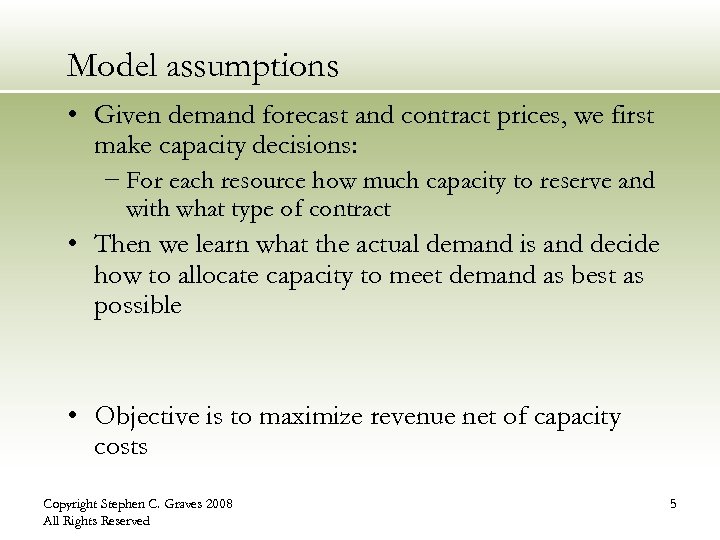

Model assumptions • Given demand forecast and contract prices, we first make capacity decisions: − For each resource how much capacity to reserve and with what type of contract • Then we learn what the actual demand is and decide how to allocate capacity to meet demand as best as possible • Objective is to maximize revenue net of capacity costs Copyright Stephen C. Graves 2008 All Rights Reserved 5

Model assumptions • Given demand forecast and contract prices, we first make capacity decisions: − For each resource how much capacity to reserve and with what type of contract • Then we learn what the actual demand is and decide how to allocate capacity to meet demand as best as possible • Objective is to maximize revenue net of capacity costs Copyright Stephen C. Graves 2008 All Rights Reserved 5

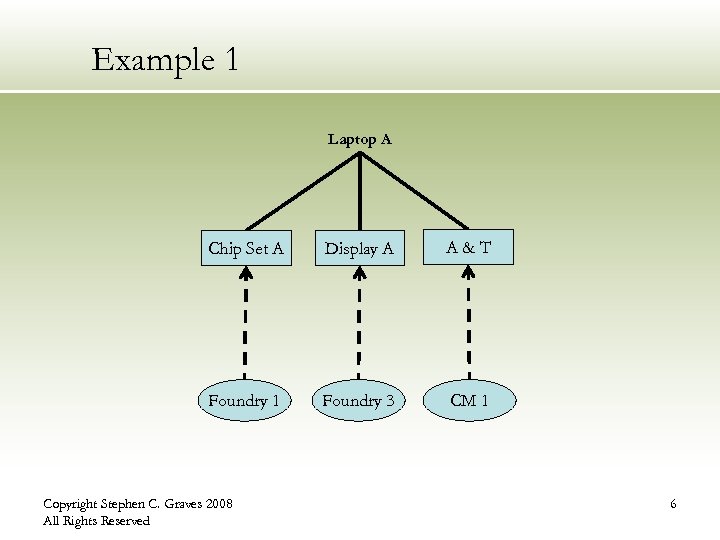

Example 1 Laptop A Chip Set A Display A A&T Foundry 1 Foundry 3 CM 1 Copyright Stephen C. Graves 2008 All Rights Reserved 6

Example 1 Laptop A Chip Set A Display A A&T Foundry 1 Foundry 3 CM 1 Copyright Stephen C. Graves 2008 All Rights Reserved 6

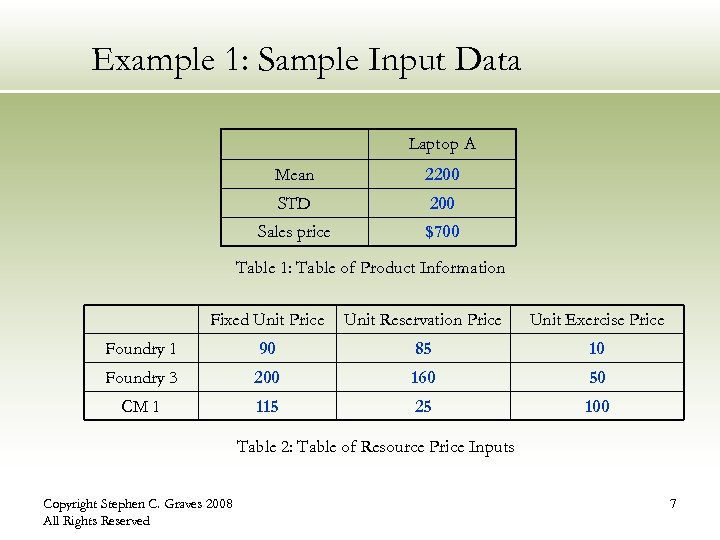

Example 1: Sample Input Data Laptop A Mean 2200 STD 200 Sales price $700 Table 1: Table of Product Information Fixed Unit Price Unit Reservation Price Unit Exercise Price Foundry 1 90 85 10 Foundry 3 200 160 50 CM 1 115 25 100 Table 2: Table of Resource Price Inputs Copyright Stephen C. Graves 2008 All Rights Reserved 7

Example 1: Sample Input Data Laptop A Mean 2200 STD 200 Sales price $700 Table 1: Table of Product Information Fixed Unit Price Unit Reservation Price Unit Exercise Price Foundry 1 90 85 10 Foundry 3 200 160 50 CM 1 115 25 100 Table 2: Table of Resource Price Inputs Copyright Stephen C. Graves 2008 All Rights Reserved 7

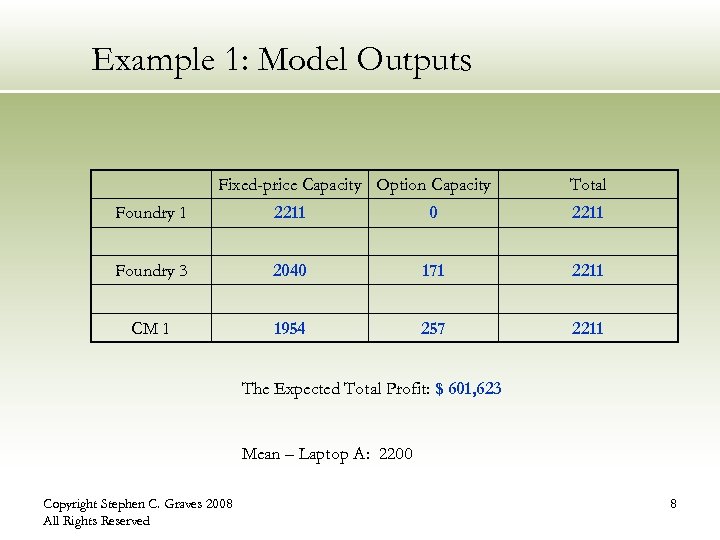

Example 1: Model Outputs Fixed-price Capacity Option Capacity Total Foundry 1 2211 0 2211 Foundry 3 2040 171 2211 CM 1 1954 257 2211 The Expected Total Profit: $ 601, 623 Mean – Laptop A: 2200 Copyright Stephen C. Graves 2008 All Rights Reserved 8

Example 1: Model Outputs Fixed-price Capacity Option Capacity Total Foundry 1 2211 0 2211 Foundry 3 2040 171 2211 CM 1 1954 257 2211 The Expected Total Profit: $ 601, 623 Mean – Laptop A: 2200 Copyright Stephen C. Graves 2008 All Rights Reserved 8

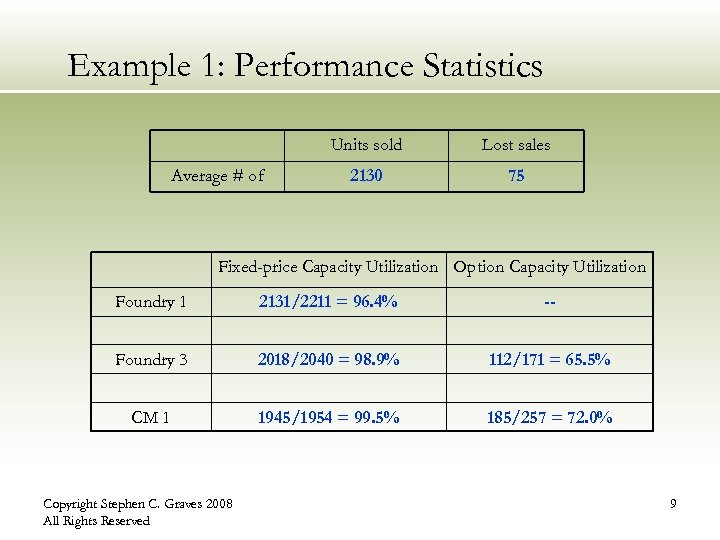

Example 1: Performance Statistics Units sold Average # of Lost sales 2130 75 Fixed-price Capacity Utilization Option Capacity Utilization Foundry 1 2131/2211 = 96. 4% -- Foundry 3 2018/2040 = 98. 9% 112/171 = 65. 5% CM 1 1945/1954 = 99. 5% 185/257 = 72. 0% Copyright Stephen C. Graves 2008 All Rights Reserved 9

Example 1: Performance Statistics Units sold Average # of Lost sales 2130 75 Fixed-price Capacity Utilization Option Capacity Utilization Foundry 1 2131/2211 = 96. 4% -- Foundry 3 2018/2040 = 98. 9% 112/171 = 65. 5% CM 1 1945/1954 = 99. 5% 185/257 = 72. 0% Copyright Stephen C. Graves 2008 All Rights Reserved 9

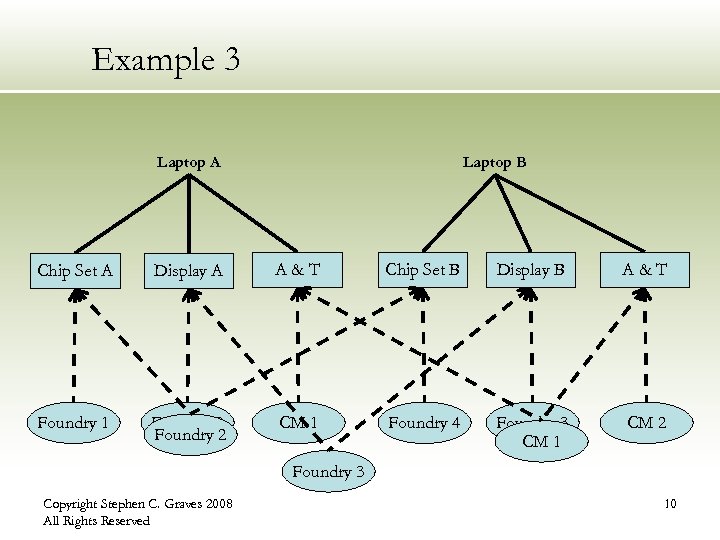

Example 3 Laptop A Laptop B Chip Set A Display A A&T Chip Set B Display B A&T Foundry 1 Foundry 3 Foundry 2 CM 1 Foundry 4 Foundry 3 CM 1 CM 2 Foundry 3 Copyright Stephen C. Graves 2008 All Rights Reserved 10

Example 3 Laptop A Laptop B Chip Set A Display A A&T Chip Set B Display B A&T Foundry 1 Foundry 3 Foundry 2 CM 1 Foundry 4 Foundry 3 CM 1 CM 2 Foundry 3 Copyright Stephen C. Graves 2008 All Rights Reserved 10

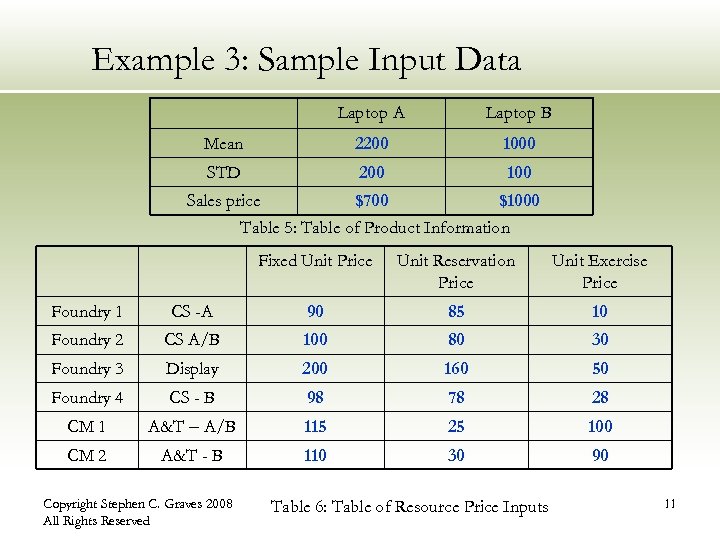

Example 3: Sample Input Data Laptop A Laptop B Mean 2200 1000 STD 200 100 Sales price $700 $1000 Table 5: Table of Product Information Fixed Unit Price Unit Reservation Price Unit Exercise Price Foundry 1 CS -A 90 85 10 Foundry 2 CS A/B 100 80 30 Foundry 3 Display 200 160 50 Foundry 4 CS - B 98 78 28 CM 1 A&T – A/B 115 25 100 CM 2 A&T - B 110 30 90 Copyright Stephen C. Graves 2008 All Rights Reserved Table 6: Table of Resource Price Inputs 11

Example 3: Sample Input Data Laptop A Laptop B Mean 2200 1000 STD 200 100 Sales price $700 $1000 Table 5: Table of Product Information Fixed Unit Price Unit Reservation Price Unit Exercise Price Foundry 1 CS -A 90 85 10 Foundry 2 CS A/B 100 80 30 Foundry 3 Display 200 160 50 Foundry 4 CS - B 98 78 28 CM 1 A&T – A/B 115 25 100 CM 2 A&T - B 110 30 90 Copyright Stephen C. Graves 2008 All Rights Reserved Table 6: Table of Resource Price Inputs 11

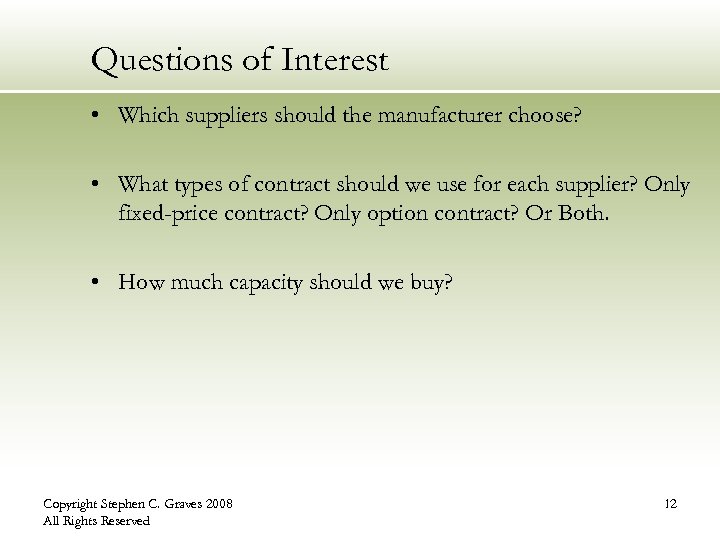

Questions of Interest • Which suppliers should the manufacturer choose? • What types of contract should we use for each supplier? Only fixed-price contract? Only option contract? Or Both. • How much capacity should we buy? Copyright Stephen C. Graves 2008 All Rights Reserved 12

Questions of Interest • Which suppliers should the manufacturer choose? • What types of contract should we use for each supplier? Only fixed-price contract? Only option contract? Or Both. • How much capacity should we buy? Copyright Stephen C. Graves 2008 All Rights Reserved 12

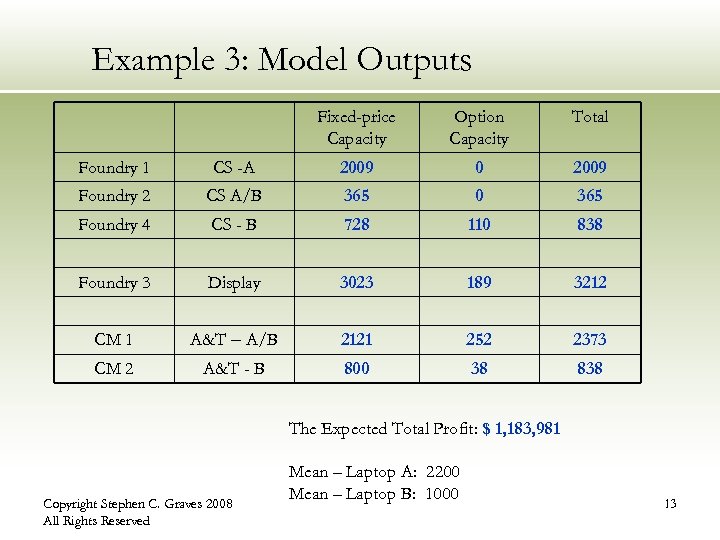

Example 3: Model Outputs Fixed-price Capacity Option Capacity Total Foundry 1 CS -A 2009 0 2009 Foundry 2 CS A/B 365 0 365 Foundry 4 CS - B 728 110 838 Foundry 3 Display 3023 189 3212 CM 1 A&T – A/B 2121 252 2373 CM 2 A&T - B 800 38 838 The Expected Total Profit: $ 1, 183, 981 Copyright Stephen C. Graves 2008 All Rights Reserved Mean – Laptop A: 2200 Mean – Laptop B: 1000 13

Example 3: Model Outputs Fixed-price Capacity Option Capacity Total Foundry 1 CS -A 2009 0 2009 Foundry 2 CS A/B 365 0 365 Foundry 4 CS - B 728 110 838 Foundry 3 Display 3023 189 3212 CM 1 A&T – A/B 2121 252 2373 CM 2 A&T - B 800 38 838 The Expected Total Profit: $ 1, 183, 981 Copyright Stephen C. Graves 2008 All Rights Reserved Mean – Laptop A: 2200 Mean – Laptop B: 1000 13

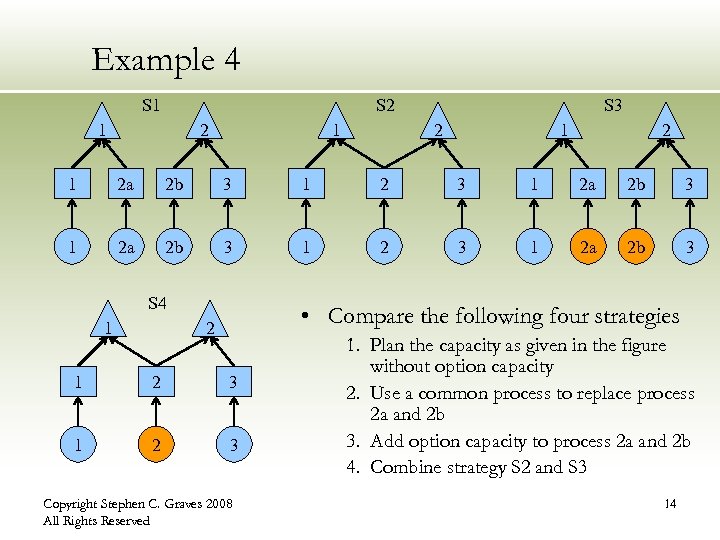

Example 4 S 1 S 2 1 S 3 2 1 2 a 2 b 3 1 2 3 1 2 a 2 b 3 S 4 1 • Compare the following four strategies 2 1 2 3 Copyright Stephen C. Graves 2008 All Rights Reserved 1. Plan the capacity as given in the figure without option capacity 2. Use a common process to replace process 2 a and 2 b 3. Add option capacity to process 2 a and 2 b 4. Combine strategy S 2 and S 3 14

Example 4 S 1 S 2 1 S 3 2 1 2 a 2 b 3 1 2 3 1 2 a 2 b 3 S 4 1 • Compare the following four strategies 2 1 2 3 Copyright Stephen C. Graves 2008 All Rights Reserved 1. Plan the capacity as given in the figure without option capacity 2. Use a common process to replace process 2 a and 2 b 3. Add option capacity to process 2 a and 2 b 4. Combine strategy S 2 and S 3 14

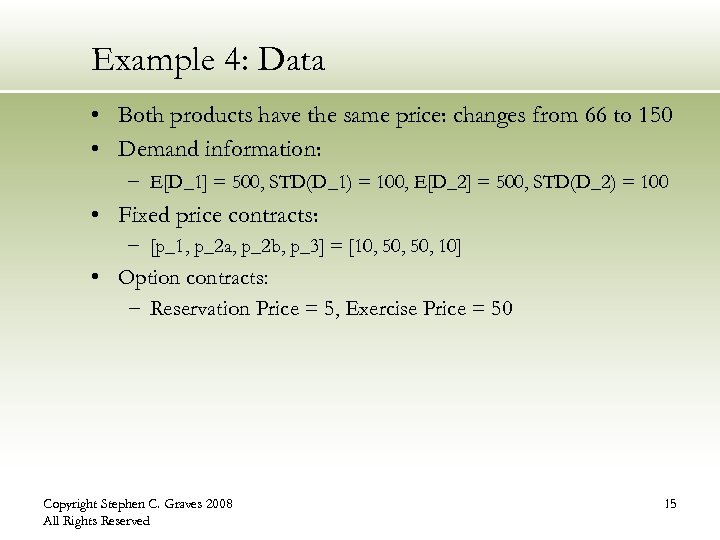

Example 4: Data • Both products have the same price: changes from 66 to 150 • Demand information: − E[D_1] = 500, STD(D_1) = 100, E[D_2] = 500, STD(D_2) = 100 • Fixed price contracts: − [p_1, p_2 a, p_2 b, p_3] = [10, 50, 10] • Option contracts: − Reservation Price = 5, Exercise Price = 50 Copyright Stephen C. Graves 2008 All Rights Reserved 15

Example 4: Data • Both products have the same price: changes from 66 to 150 • Demand information: − E[D_1] = 500, STD(D_1) = 100, E[D_2] = 500, STD(D_2) = 100 • Fixed price contracts: − [p_1, p_2 a, p_2 b, p_3] = [10, 50, 10] • Option contracts: − Reservation Price = 5, Exercise Price = 50 Copyright Stephen C. Graves 2008 All Rights Reserved 15

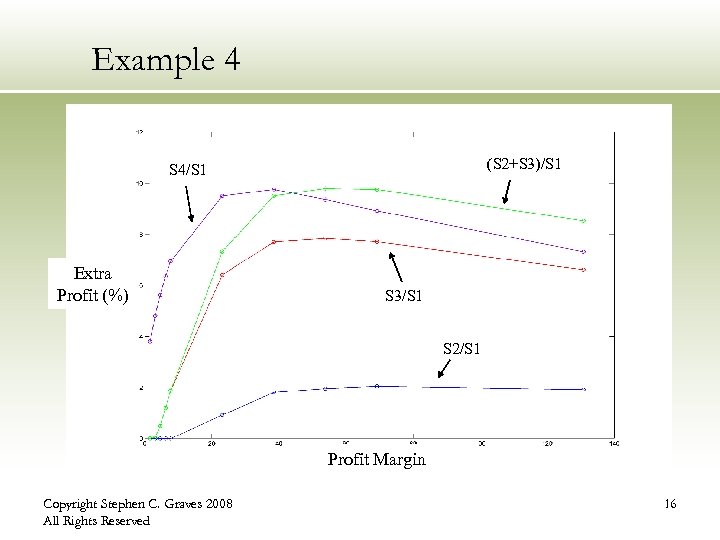

Example 4 (S 2+S 3)/S 1 S 4/S 1 Extra Profit (%) S 3/S 1 S 2/S 1 Profit Margin Copyright Stephen C. Graves 2008 All Rights Reserved 16

Example 4 (S 2+S 3)/S 1 S 4/S 1 Extra Profit (%) S 3/S 1 S 2/S 1 Profit Margin Copyright Stephen C. Graves 2008 All Rights Reserved 16

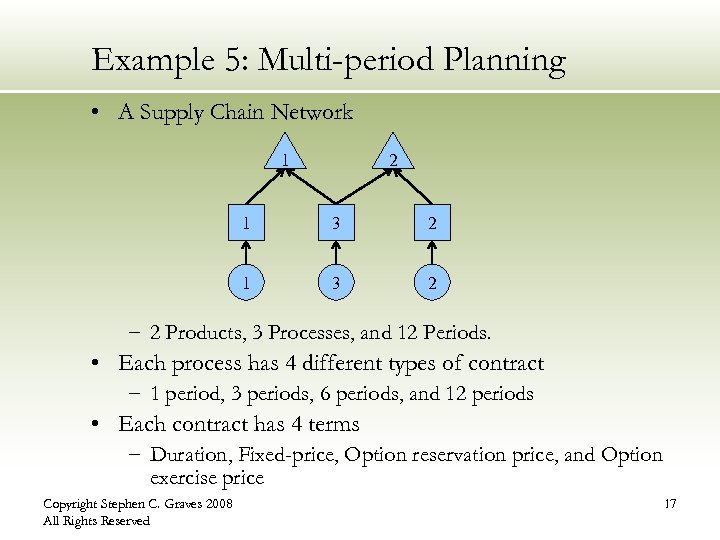

Example 5: Multi-period Planning • A Supply Chain Network 1 2 1 3 2 − 2 Products, 3 Processes, and 12 Periods. • Each process has 4 different types of contract − 1 period, 3 periods, 6 periods, and 12 periods • Each contract has 4 terms − Duration, Fixed-price, Option reservation price, and Option exercise price Copyright Stephen C. Graves 2008 All Rights Reserved 17

Example 5: Multi-period Planning • A Supply Chain Network 1 2 1 3 2 − 2 Products, 3 Processes, and 12 Periods. • Each process has 4 different types of contract − 1 period, 3 periods, 6 periods, and 12 periods • Each contract has 4 terms − Duration, Fixed-price, Option reservation price, and Option exercise price Copyright Stephen C. Graves 2008 All Rights Reserved 17

![Sample Demands 1 E [D 1 ] E [D 2 ] 2 3 4 Sample Demands 1 E [D 1 ] E [D 2 ] 2 3 4](https://present5.com/presentation/bcc8368da1d4bd024542ddcccff83931/image-18.jpg) Sample Demands 1 E [D 1 ] E [D 2 ] 2 3 4 5 6 7 8 9 10 11 12 70 100 180 210 240 230 180 100 70 60 50 70 100 180 210 240 Copyright Stephen C. Graves 2008 All Rights Reserved 18

Sample Demands 1 E [D 1 ] E [D 2 ] 2 3 4 5 6 7 8 9 10 11 12 70 100 180 210 240 230 180 100 70 60 50 70 100 180 210 240 Copyright Stephen C. Graves 2008 All Rights Reserved 18

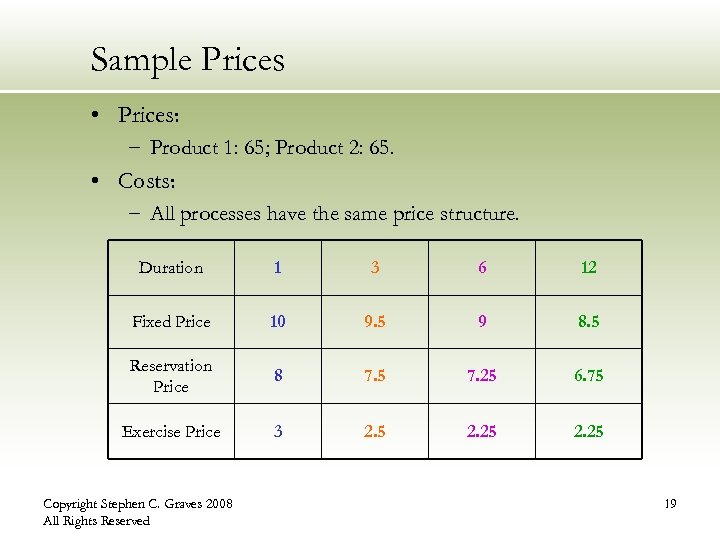

Sample Prices • Prices: − Product 1: 65; Product 2: 65. • Costs: − All processes have the same price structure. Duration 1 3 6 12 Fixed Price 10 9. 5 9 8. 5 Reservation Price 8 7. 5 7. 25 6. 75 Exercise Price 3 2. 5 2. 25 Copyright Stephen C. Graves 2008 All Rights Reserved 19

Sample Prices • Prices: − Product 1: 65; Product 2: 65. • Costs: − All processes have the same price structure. Duration 1 3 6 12 Fixed Price 10 9. 5 9 8. 5 Reservation Price 8 7. 5 7. 25 6. 75 Exercise Price 3 2. 5 2. 25 Copyright Stephen C. Graves 2008 All Rights Reserved 19

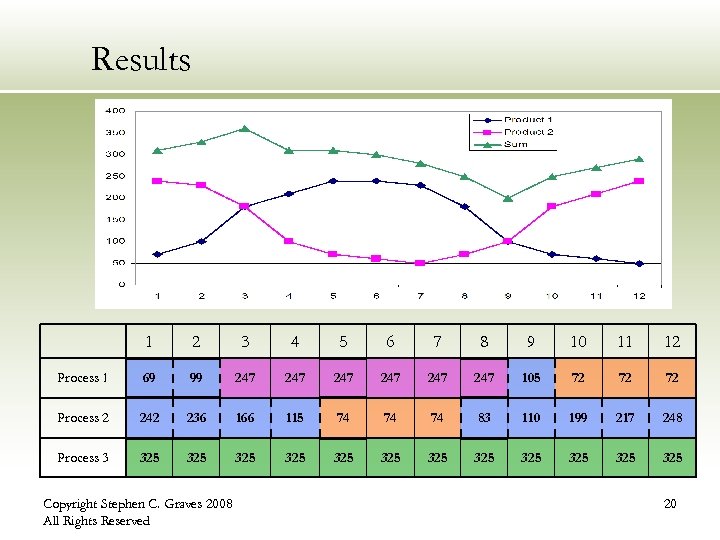

Results 1 2 3 4 5 6 7 8 9 10 11 12 Process 1 69 99 247 247 247 105 72 72 72 Process 2 242 236 166 115 74 74 74 83 110 199 217 248 Process 3 325 325 325 Copyright Stephen C. Graves 2008 All Rights Reserved 20

Results 1 2 3 4 5 6 7 8 9 10 11 12 Process 1 69 99 247 247 247 105 72 72 72 Process 2 242 236 166 115 74 74 74 83 110 199 217 248 Process 3 325 325 325 Copyright Stephen C. Graves 2008 All Rights Reserved 20

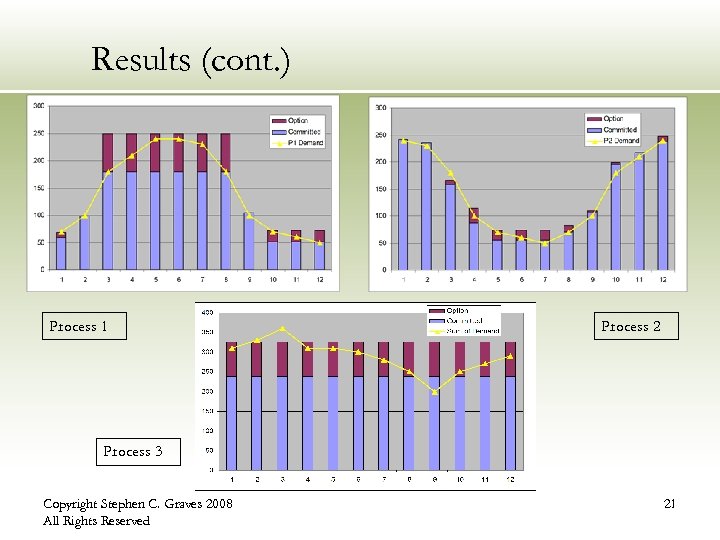

Results (cont. ) Process 1 Process 2 Process 3 Copyright Stephen C. Graves 2008 All Rights Reserved 21

Results (cont. ) Process 1 Process 2 Process 3 Copyright Stephen C. Graves 2008 All Rights Reserved 21

Summary • Have developed a framework to support capacity planning decisions for supply chain • Have developed solution algorithms for single period and multi-period problems • To do − develop a case study to test and validate approach − finalize prototype software with user friendly interface Copyright Stephen C. Graves 2008 All Rights Reserved 22

Summary • Have developed a framework to support capacity planning decisions for supply chain • Have developed solution algorithms for single period and multi-period problems • To do − develop a case study to test and validate approach − finalize prototype software with user friendly interface Copyright Stephen C. Graves 2008 All Rights Reserved 22

Collaboration Opportunities • Need a test case(s) to validate and refine framework − Are we looking at problem in right way? − Does the data exist to test model? − Can our algorithms result in better decisions? − What’s critical/non-critical in how we are viewing problem? • Interest in internships for LFM or SDM students for “beta testing” • Contact Steve Graves (sgraves@mit. edu) or Xin Huang (xinhuang@mit. edu) Copyright Stephen C. Graves 2008 All Rights Reserved 23

Collaboration Opportunities • Need a test case(s) to validate and refine framework − Are we looking at problem in right way? − Does the data exist to test model? − Can our algorithms result in better decisions? − What’s critical/non-critical in how we are viewing problem? • Interest in internships for LFM or SDM students for “beta testing” • Contact Steve Graves (sgraves@mit. edu) or Xin Huang (xinhuang@mit. edu) Copyright Stephen C. Graves 2008 All Rights Reserved 23

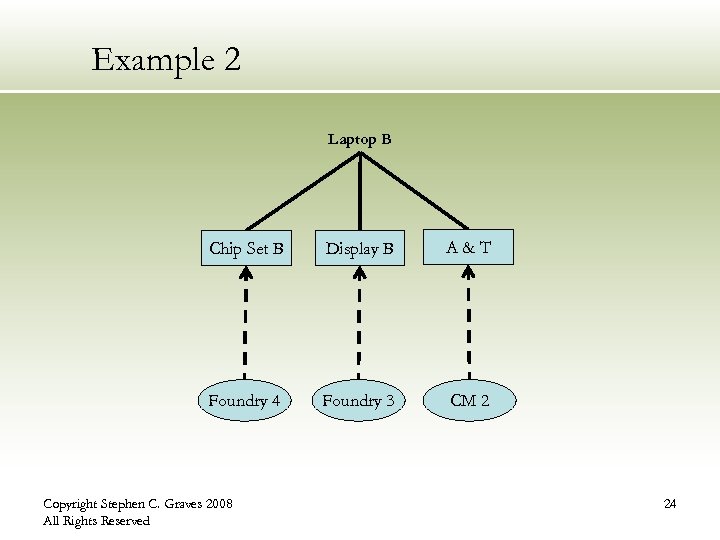

Example 2 Laptop B Chip Set B Display B A&T Foundry 4 Foundry 3 CM 2 Copyright Stephen C. Graves 2008 All Rights Reserved 24

Example 2 Laptop B Chip Set B Display B A&T Foundry 4 Foundry 3 CM 2 Copyright Stephen C. Graves 2008 All Rights Reserved 24

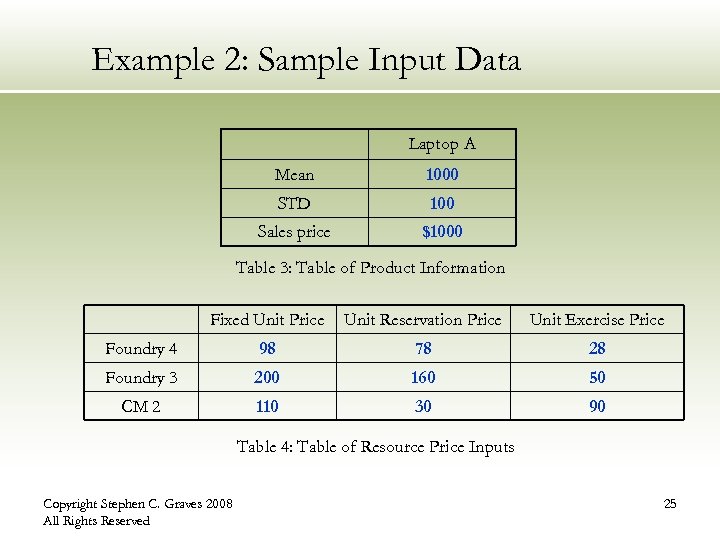

Example 2: Sample Input Data Laptop A Mean 1000 STD 100 Sales price $1000 Table 3: Table of Product Information Fixed Unit Price Unit Reservation Price Unit Exercise Price Foundry 4 98 78 28 Foundry 3 200 160 50 CM 2 110 30 90 Table 4: Table of Resource Price Inputs Copyright Stephen C. Graves 2008 All Rights Reserved 25

Example 2: Sample Input Data Laptop A Mean 1000 STD 100 Sales price $1000 Table 3: Table of Product Information Fixed Unit Price Unit Reservation Price Unit Exercise Price Foundry 4 98 78 28 Foundry 3 200 160 50 CM 2 110 30 90 Table 4: Table of Resource Price Inputs Copyright Stephen C. Graves 2008 All Rights Reserved 25

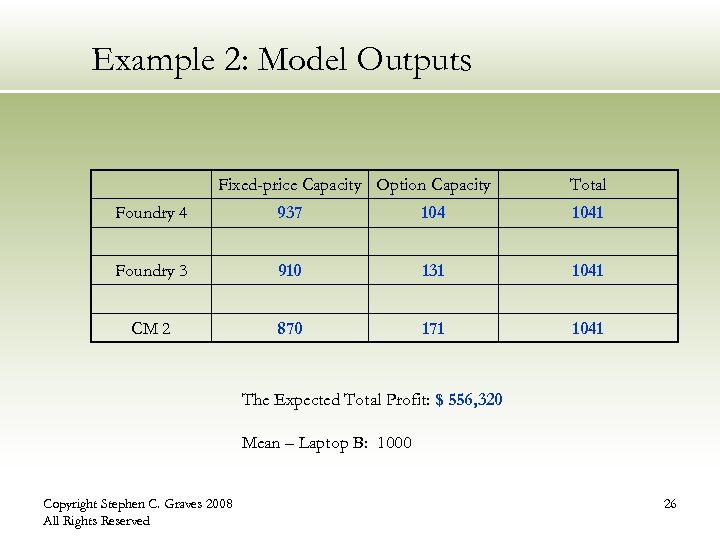

Example 2: Model Outputs Fixed-price Capacity Option Capacity Total Foundry 4 937 1041 Foundry 3 910 131 1041 CM 2 870 171 1041 The Expected Total Profit: $ 556, 320 Mean – Laptop B: 1000 Copyright Stephen C. Graves 2008 All Rights Reserved 26

Example 2: Model Outputs Fixed-price Capacity Option Capacity Total Foundry 4 937 1041 Foundry 3 910 131 1041 CM 2 870 171 1041 The Expected Total Profit: $ 556, 320 Mean – Laptop B: 1000 Copyright Stephen C. Graves 2008 All Rights Reserved 26

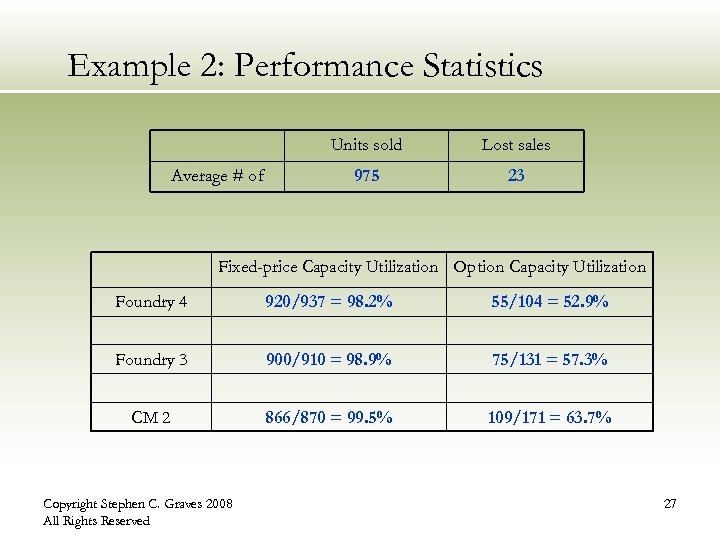

Example 2: Performance Statistics Units sold Average # of Lost sales 975 23 Fixed-price Capacity Utilization Option Capacity Utilization Foundry 4 920/937 = 98. 2% 55/104 = 52. 9% Foundry 3 900/910 = 98. 9% 75/131 = 57. 3% CM 2 866/870 = 99. 5% 109/171 = 63. 7% Copyright Stephen C. Graves 2008 All Rights Reserved 27

Example 2: Performance Statistics Units sold Average # of Lost sales 975 23 Fixed-price Capacity Utilization Option Capacity Utilization Foundry 4 920/937 = 98. 2% 55/104 = 52. 9% Foundry 3 900/910 = 98. 9% 75/131 = 57. 3% CM 2 866/870 = 99. 5% 109/171 = 63. 7% Copyright Stephen C. Graves 2008 All Rights Reserved 27