d634517671a3d0542239c66f0ba26467.ppt

- Количество слайдов: 22

CAP 2015 Conference Innovative Approaches for Financial and Economic Empowerment August 29, 2015

CAP 2015 Conference Innovative Approaches for Financial and Economic Empowerment August 29, 2015

LISC Overview q Sustainable Communities are good places to live, raise families, work and do business Ø Expanding Investment in Housing and Other Real Estate Ø Increasing Family Income and Wealth Ø Stimulating Economic Development Ø Improving Access to Quality Education Ø Supporting Healthy Environments and Lifestyles

LISC Overview q Sustainable Communities are good places to live, raise families, work and do business Ø Expanding Investment in Housing and Other Real Estate Ø Increasing Family Income and Wealth Ø Stimulating Economic Development Ø Improving Access to Quality Education Ø Supporting Healthy Environments and Lifestyles

What is the FOC Model? Marsha Murrington, Senior Program Officer – LISC Bay Area

What is the FOC Model? Marsha Murrington, Senior Program Officer – LISC Bay Area

Family Income & Wealth Building Goals q Sufficient family income q Transferable job skills q Manageable expenses q Smart debt q Post-secondary education plan q Real opportunity for retirement @ 65

Family Income & Wealth Building Goals q Sufficient family income q Transferable job skills q Manageable expenses q Smart debt q Post-secondary education plan q Real opportunity for retirement @ 65

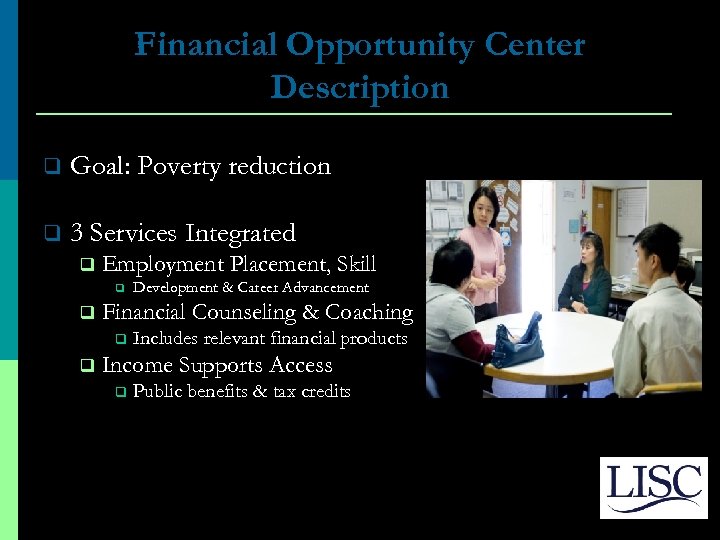

Financial Opportunity Center Description q Goal: Poverty reduction q 3 Services Integrated q Employment Placement, Skill q q Financial Counseling & Coaching q q Development & Career Advancement Includes relevant financial products Income Supports Access q Public benefits & tax credits

Financial Opportunity Center Description q Goal: Poverty reduction q 3 Services Integrated q Employment Placement, Skill q q Financial Counseling & Coaching q q Development & Career Advancement Includes relevant financial products Income Supports Access q Public benefits & tax credits

Financial Opportunity Center Key Operational Elements On-site employment services (job placement, retention, reattachment, and advancement) q On-site one-on-one financial coaching tailored to the needs of the working poor q On-site access to income supports (public benefits, tax credits, tax return preparation) q Intentional/well-planned integration of the three cores services q Data tracking to improve program performance q Center is built off existing services q

Financial Opportunity Center Key Operational Elements On-site employment services (job placement, retention, reattachment, and advancement) q On-site one-on-one financial coaching tailored to the needs of the working poor q On-site access to income supports (public benefits, tax credits, tax return preparation) q Intentional/well-planned integration of the three cores services q Data tracking to improve program performance q Center is built off existing services q

Financial Opportunity Centers Basics Asset building occurs over 40 yrs q Single transaction services inadequate q Focus on improving financial capability of the client and asset building behavior q Client success is defined as: q Ø q Income increase & improvement in ability to obtain assets Work with client for 3 years

Financial Opportunity Centers Basics Asset building occurs over 40 yrs q Single transaction services inadequate q Focus on improving financial capability of the client and asset building behavior q Client success is defined as: q Ø q Income increase & improvement in ability to obtain assets Work with client for 3 years

FOC Model Integration Sacred Heart Community Service Christian Luna, Manager, Joblink Employment Program– Sacred Heart Community Service, San Jose, CA

FOC Model Integration Sacred Heart Community Service Christian Luna, Manager, Joblink Employment Program– Sacred Heart Community Service, San Jose, CA

Phases of Integration Organizational buy-in: leadership and staff, volunteers ETO integration, compatibility with existing processes, HMIS database Integrate volunteers to build FOC capacity and sustainability Other initiatives: Fresh Carts Silicon Valley, Financial Opportunity Corps, MOOVE (Massive Open Online Volunteer Engagement)

Phases of Integration Organizational buy-in: leadership and staff, volunteers ETO integration, compatibility with existing processes, HMIS database Integrate volunteers to build FOC capacity and sustainability Other initiatives: Fresh Carts Silicon Valley, Financial Opportunity Corps, MOOVE (Massive Open Online Volunteer Engagement)

Ongoing Organizational Impacts Compelling data illustrating our FOC’s story of moving people out of poverty Detailed demographics of FOC client base Evidence-based approach to grant strategies which place FOC at competitive advatange Monthly and quarterly monitoring of program effectiveness and impacts with tools like ETO.

Ongoing Organizational Impacts Compelling data illustrating our FOC’s story of moving people out of poverty Detailed demographics of FOC client base Evidence-based approach to grant strategies which place FOC at competitive advatange Monthly and quarterly monitoring of program effectiveness and impacts with tools like ETO.

Impact of Integrated Service Delivery Vicky Rodriguez, Program Officer – LISC National

Impact of Integrated Service Delivery Vicky Rodriguez, Program Officer – LISC National

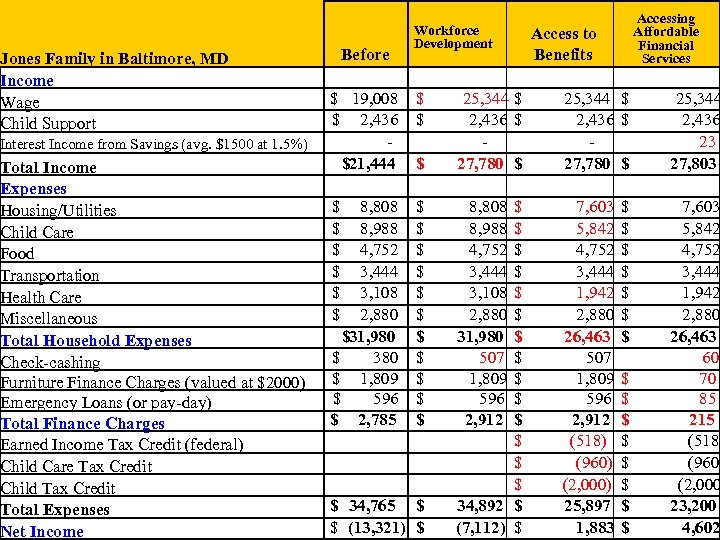

Jones Family in Baltimore, MD Income Wage Child Support Interest Income from Savings (avg. $1500 at 1. 5%) Total Income Expenses Housing/Utilities Child Care Food Transportation Health Care Miscellaneous Total Household Expenses Check-cashing Furniture Finance Charges (valued at $2000) Emergency Loans (or pay-day) Total Finance Charges Earned Income Tax Credit (federal) Child Care Tax Credit Child Tax Credit Total Expenses Net Income Before Workforce Development $ 19, 008 $ 2, 436 $21, 444 $ $ $ $ 8, 808 8, 988 4, 752 3, 444 3, 108 2, 880 $31, 980 $ 380 $ 1, 809 $ 596 $ 2, 785 Accessing Affordable Financial Services Access to Benefits $ 25, 344 $ 2, 436 $ 27, 780 $ 25, 344 2, 436 23 27, 803 $ $ $ 8, 808 8, 988 4, 752 3, 444 3, 108 2, 880 31, 980 507 1, 809 596 2, 912 7, 603 5, 842 4, 752 3, 444 1, 942 2, 880 26, 463 507 1, 809 596 2, 912 (518) (960) (2, 000) 25, 897 1, 883 7, 603 5, 842 4, 752 3, 444 1, 942 2, 880 26, 463 60 70 85 215 (518) (960) (2, 000 23, 200 4, 602 $ 34, 765 $ $ (13, 321) $ $ $ $ 34, 892 $ (7, 112) $ $ $ $

Jones Family in Baltimore, MD Income Wage Child Support Interest Income from Savings (avg. $1500 at 1. 5%) Total Income Expenses Housing/Utilities Child Care Food Transportation Health Care Miscellaneous Total Household Expenses Check-cashing Furniture Finance Charges (valued at $2000) Emergency Loans (or pay-day) Total Finance Charges Earned Income Tax Credit (federal) Child Care Tax Credit Child Tax Credit Total Expenses Net Income Before Workforce Development $ 19, 008 $ 2, 436 $21, 444 $ $ $ $ 8, 808 8, 988 4, 752 3, 444 3, 108 2, 880 $31, 980 $ 380 $ 1, 809 $ 596 $ 2, 785 Accessing Affordable Financial Services Access to Benefits $ 25, 344 $ 2, 436 $ 27, 780 $ 25, 344 2, 436 23 27, 803 $ $ $ 8, 808 8, 988 4, 752 3, 444 3, 108 2, 880 31, 980 507 1, 809 596 2, 912 7, 603 5, 842 4, 752 3, 444 1, 942 2, 880 26, 463 507 1, 809 596 2, 912 (518) (960) (2, 000) 25, 897 1, 883 7, 603 5, 842 4, 752 3, 444 1, 942 2, 880 26, 463 60 70 85 215 (518) (960) (2, 000 23, 200 4, 602 $ 34, 765 $ $ (13, 321) $ $ $ $ 34, 892 $ (7, 112) $ $ $ $

Outcomes Tracked p p p p Changes in net income n Wages, public benefits, Changes in net worth n Assets - liabilities Employment retention n 6 months and longer Career/wage advancement Debt reduction Budget development/implementation Credit report/score improvement Bundling of the three core services

Outcomes Tracked p p p p Changes in net income n Wages, public benefits, Changes in net worth n Assets - liabilities Employment retention n 6 months and longer Career/wage advancement Debt reduction Budget development/implementation Credit report/score improvement Bundling of the three core services

Improving Financial Outcomes for Low-Income Households

Improving Financial Outcomes for Low-Income Households

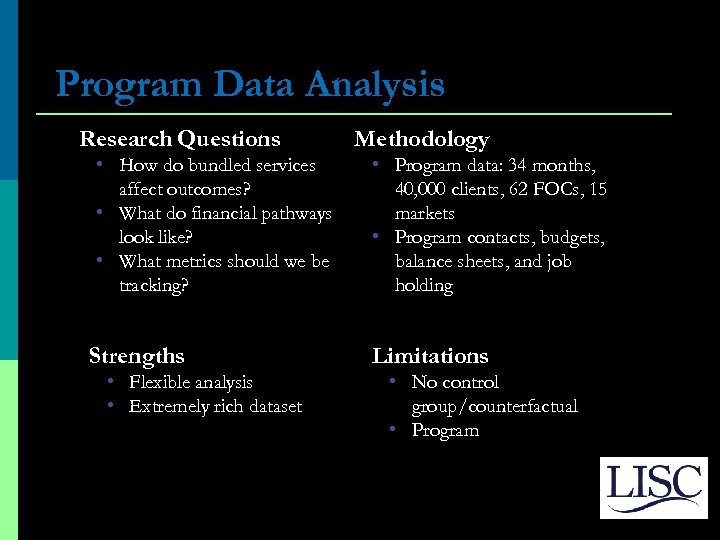

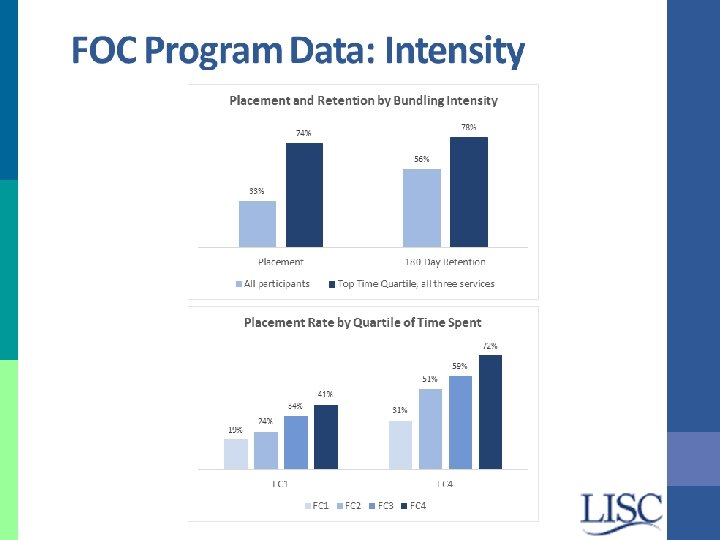

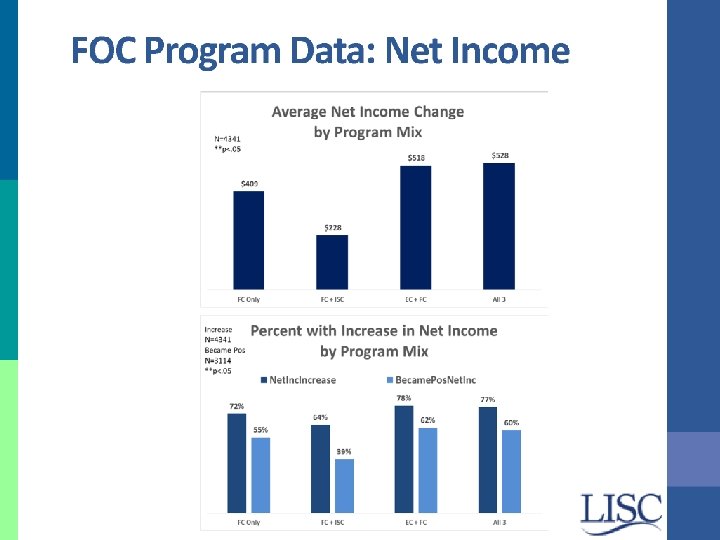

Program Data Analysis Research Questions • How do bundled services affect outcomes? • What do financial pathways look like? • What metrics should we be tracking? Strengths • Flexible analysis • Extremely rich dataset Methodology • Program data: 34 months, 40, 000 clients, 62 FOCs, 15 markets • Program contacts, budgets, balance sheets, and job holding Limitations • No control group/counterfactual • Program data limitations

Program Data Analysis Research Questions • How do bundled services affect outcomes? • What do financial pathways look like? • What metrics should we be tracking? Strengths • Flexible analysis • Extremely rich dataset Methodology • Program data: 34 months, 40, 000 clients, 62 FOCs, 15 markets • Program contacts, budgets, balance sheets, and job holding Limitations • No control group/counterfactual • Program data limitations

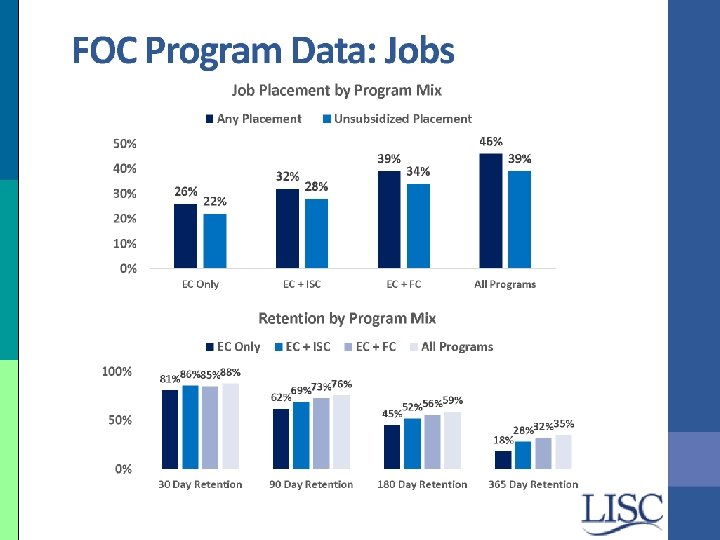

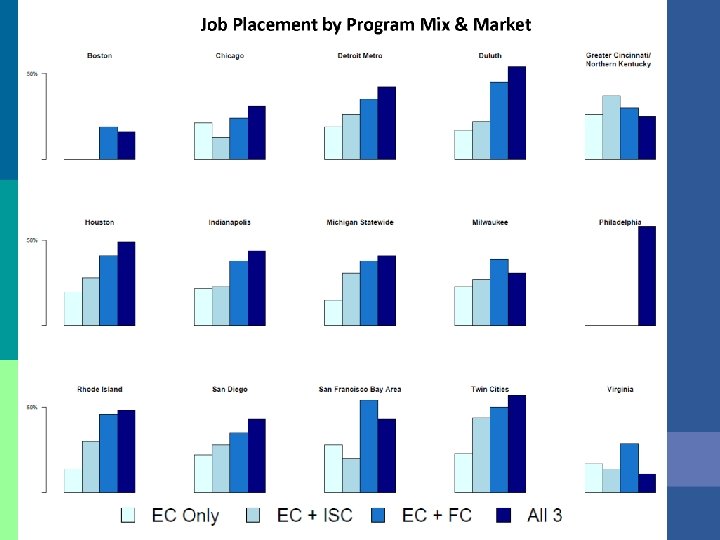

Lessons Learned q q q Employment must be secure for lasting economic improvements Solid employment is not sufficient for economic success High levels of debt, high expenses undermine the value of work When work feels like it ‘pays”, people stay employed 3 core services mutually reinforcing Economic achievement is a culmination of a series of smaller victories and changes in behaviors/habits

Lessons Learned q q q Employment must be secure for lasting economic improvements Solid employment is not sufficient for economic success High levels of debt, high expenses undermine the value of work When work feels like it ‘pays”, people stay employed 3 core services mutually reinforcing Economic achievement is a culmination of a series of smaller victories and changes in behaviors/habits

Lessons Learned: Client-Staff Interaction p Single transaction services inadequate p From the beginning of relationship address: n n n p Increasing income Reducing expenses Building assets Focus on asset building behavior

Lessons Learned: Client-Staff Interaction p Single transaction services inadequate p From the beginning of relationship address: n n n p Increasing income Reducing expenses Building assets Focus on asset building behavior

? Questions? Christian Luna – Sacred Heart cluna@sacredheartcs. org Marsha Murrington – LISC Bay Area mmurrington@lisc. org Vicky Rodriguez – LISC National vrodriguez@lisc. org

? Questions? Christian Luna – Sacred Heart cluna@sacredheartcs. org Marsha Murrington – LISC Bay Area mmurrington@lisc. org Vicky Rodriguez – LISC National vrodriguez@lisc. org